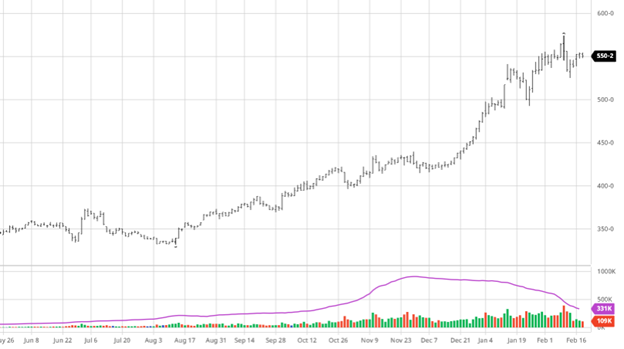

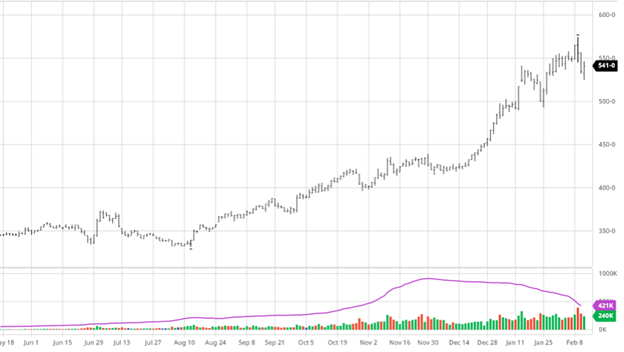

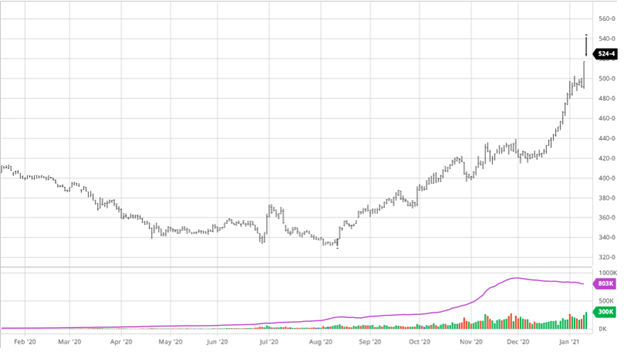

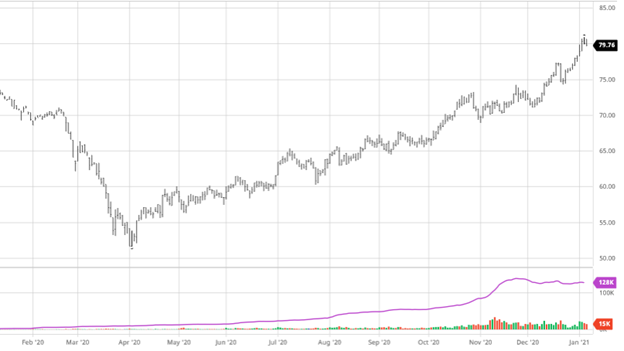

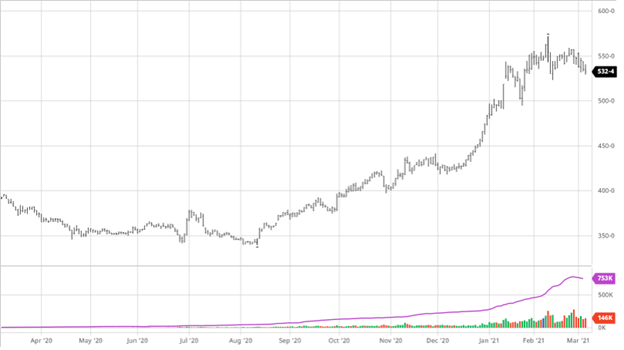

Corn had noticeable losses this week after volatility in the markets picked back up. A disappointing, but not surprising, export report helped to keep pressure on markets. Thursday was off to a good start until about midday when the selling began to finish, well off the highs for a mixed close. Rain has crept into the northern Argentina forecast which will help a hurting corn crop. The continued wetness of northern Brazil keeps the regions harvest behind with no clear window for them to catch up/make serious progress. The May contract closed below the 20 day moving average at the close of Thursday’s trading. There has been support below these levels the last few times markets tested this level. How Friday’s trade finishes will be important to maintain the technical uptrend.

The March USDA Report be out on Tuesday the March 9th and will be the next big market mover. Traders are in need of some bullish news to hold off the bears. Consider covering a portion of your new crop with some downside protection and or forward sales ahead of the report.

Via Barchart.com

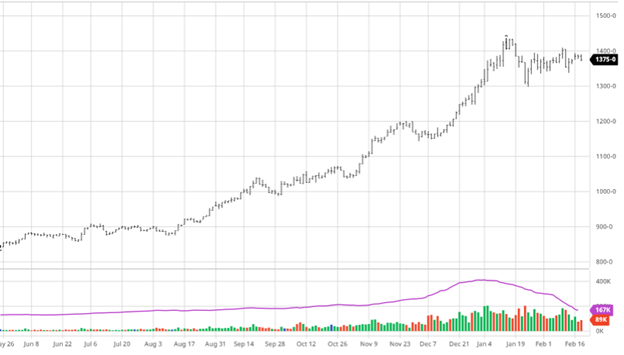

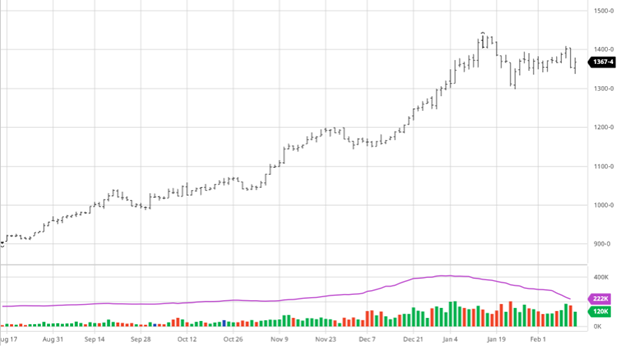

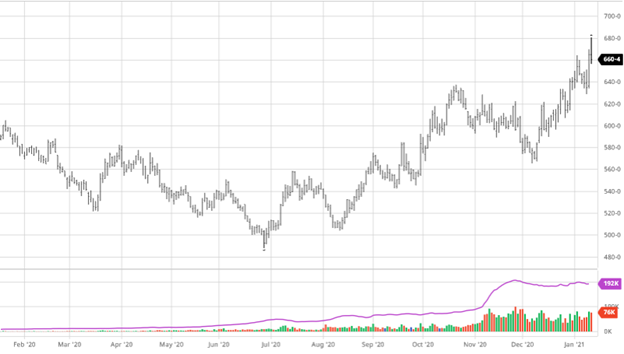

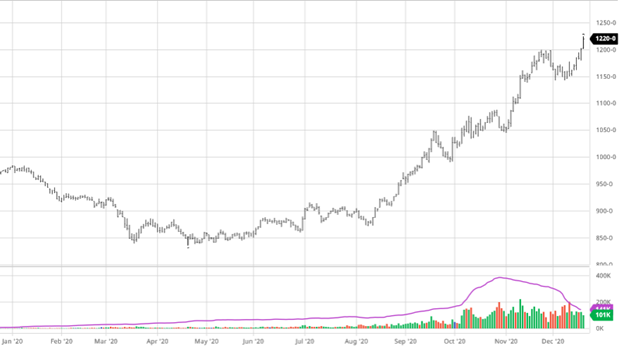

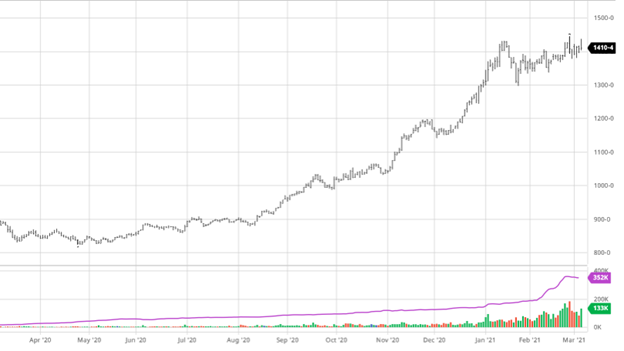

Soybeans made small gains on the week as the continued struggles with the Brazilian harvest has continued to be supportive for the past/many months. The problem hanging over the market right now is the confirmation of ASF in China AGAIN (will it ever end?). After all the talk of China’s improved process of feeding pigs = driving soybean exports, if ASF gets out of hand (i.e 2018) it could pull the rug out from under the demand story. Despite this news, soybean oil prices continue to climb supporting beans and slowing the blow from the ASF scare. Exports, like corn, were not great but that was expected as sales remain strong and well ahead of this time last year. The weather issues in South America will continue to support US beans as they struggle to finish harvest and will push back any double crop area planting. Another note about the quality of the South American crop- the Buenos Ares Grains Exchange rated the Argentinian crop 10% good to excellent down from 15% the previous week. South America’s troubles are the US bean prices gains.

Via Barchart.com

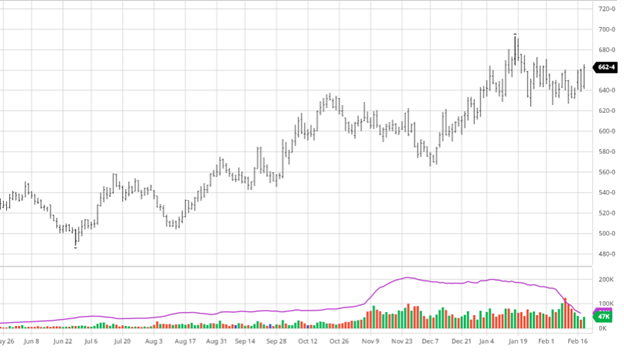

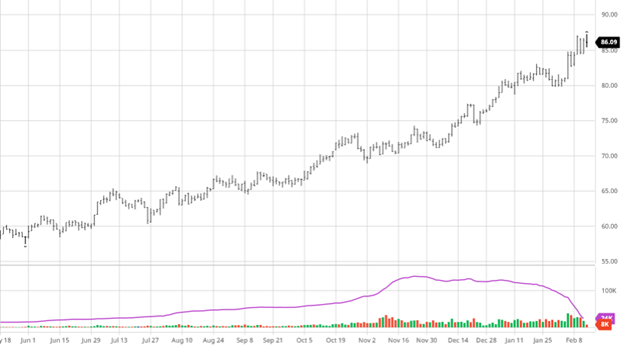

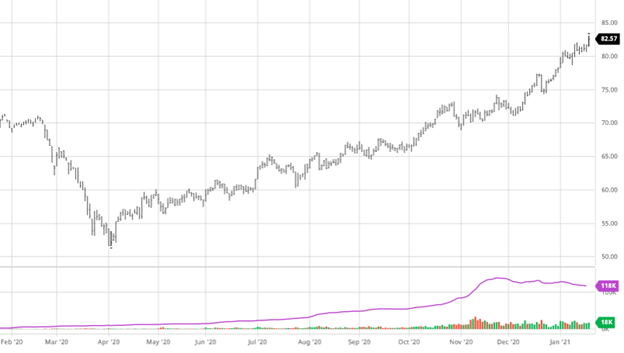

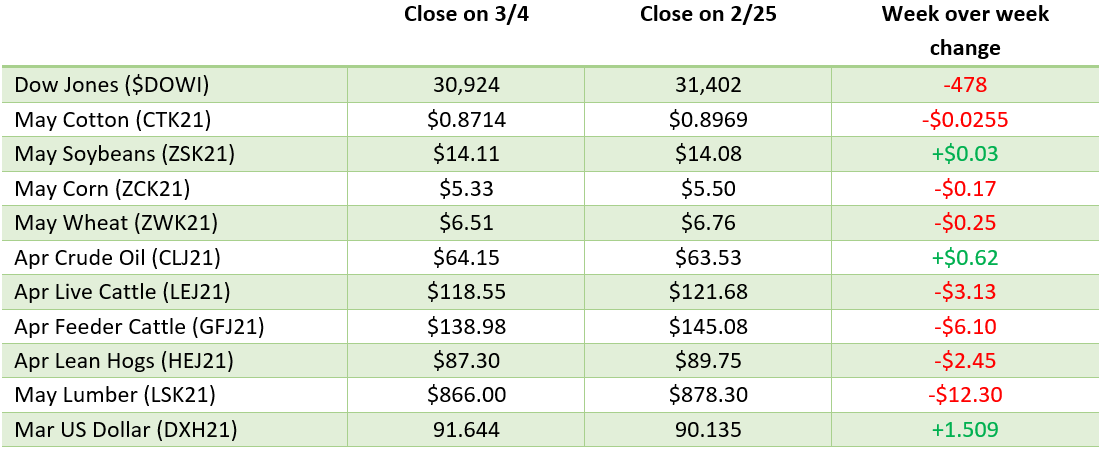

Dow Jones

The Dow had a tough week along with the other major indexes as the prospects of interest rate pressure threw cold water on stock prices. The 10 year US Treasury Note closed Thursday over 1.5% for the first time since the pandemic began. This has brought caution to the markets as tech has gotten hammered and the Fed may be losing its grip on its direction for interest rates.

Insurance

February was important for revenue-based insurance averages. At the end of the month the price for corn is $4.5848 and soybeans are $11.8665.

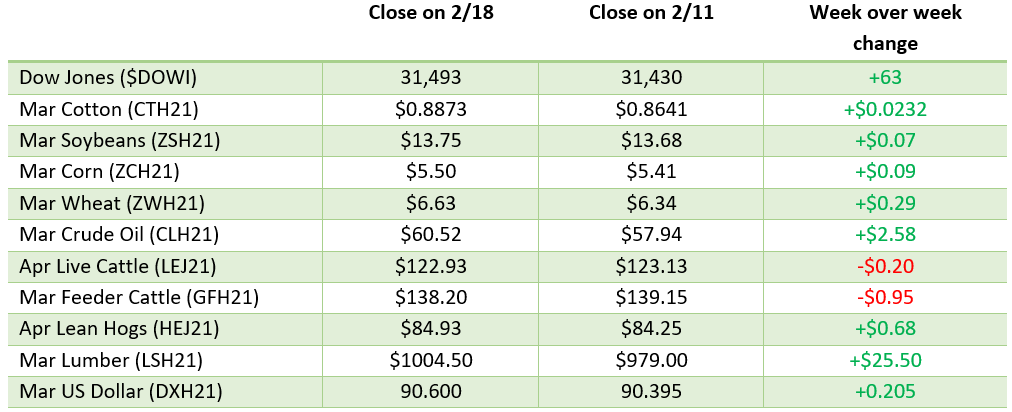

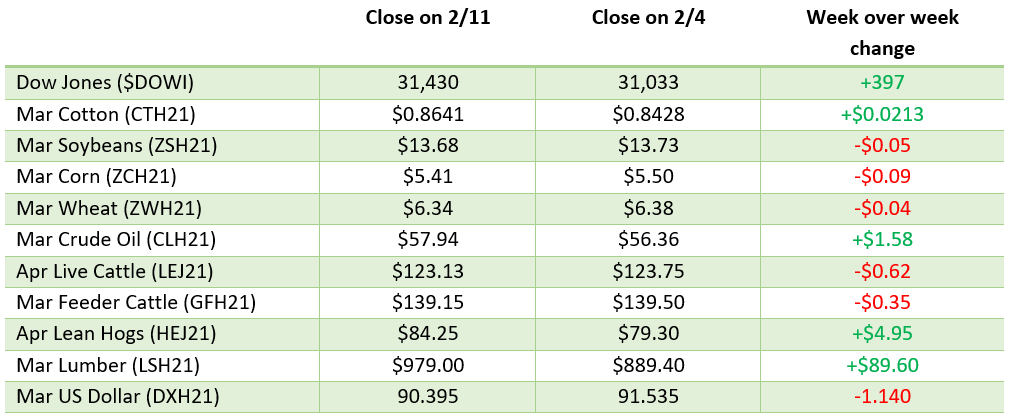

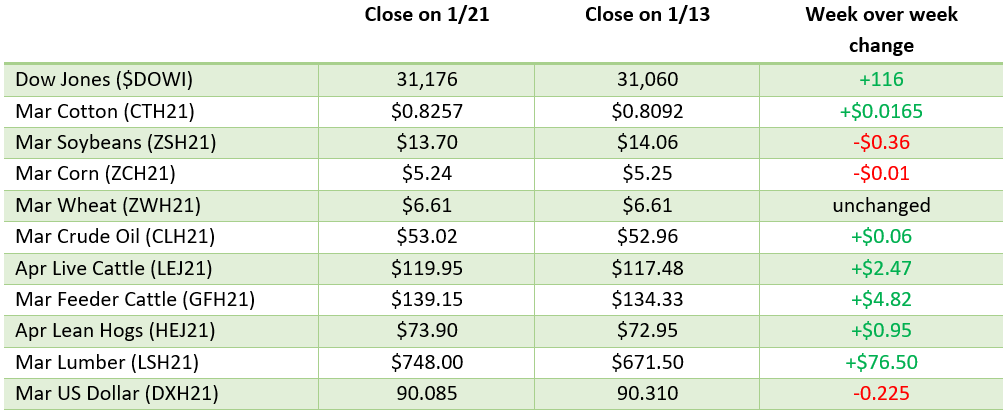

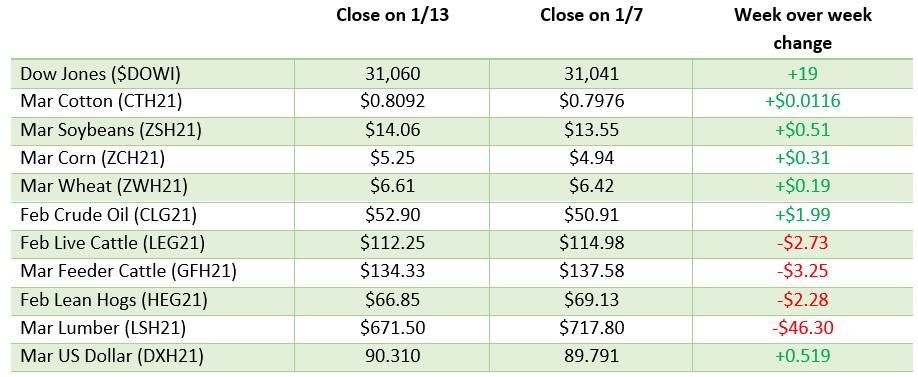

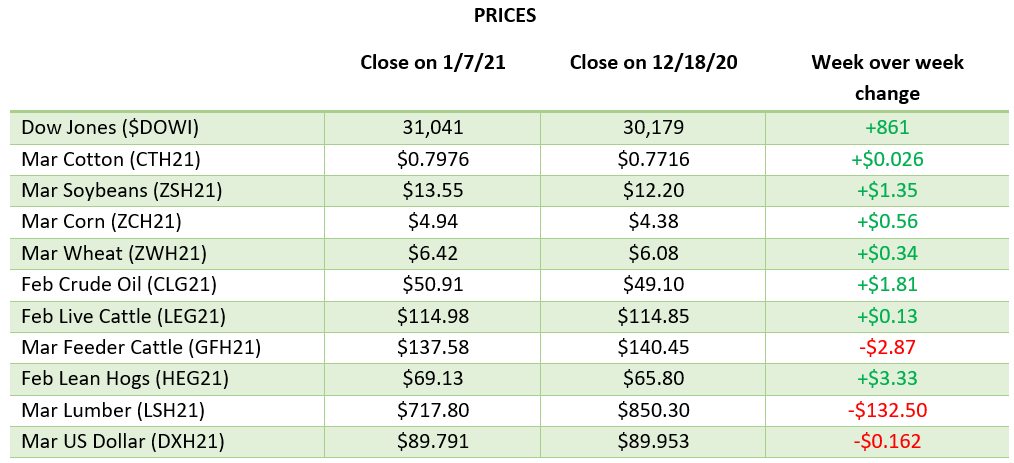

Weekly Prices

Via Barchart.com