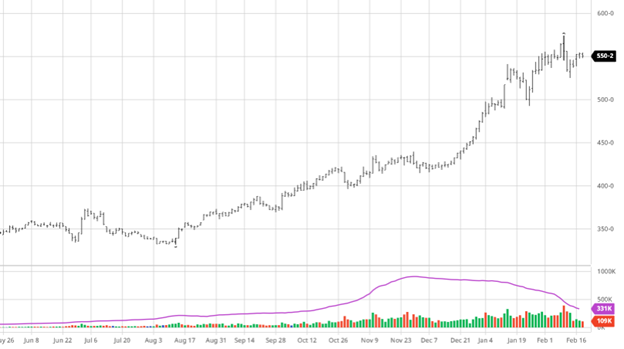

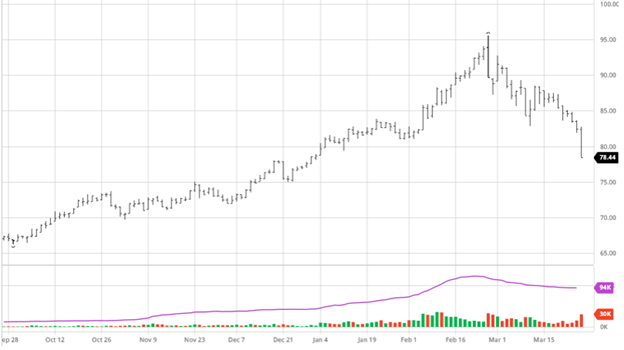

Corn struggled to get any momentum going this week, despite having better than expected exports. Corn, like other commodities, has struggled as funds begin to reposition in a “rising interest rates” environment and a strengthening US dollar. There has not been any news out of South America that is either bullish or bearish for corn and it is likely to stay that way into next week. The prospective plantings report on Wednesday is major and we expect the market news to be relatively calm as everyone holds their breath for next week. This report always has the potential to pull the rug out from under the market, so positioning yourself ahead of it will be important as well as considering some new crop sales as prices are still very good in case the report is bearish.

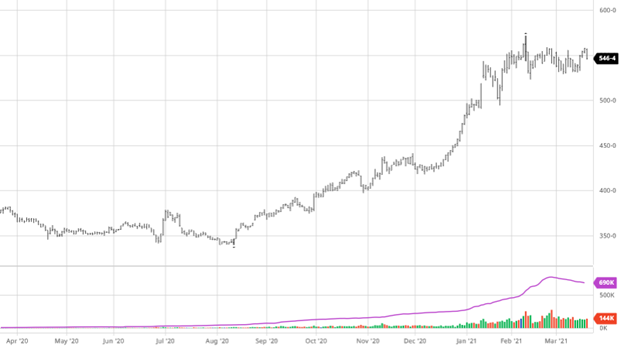

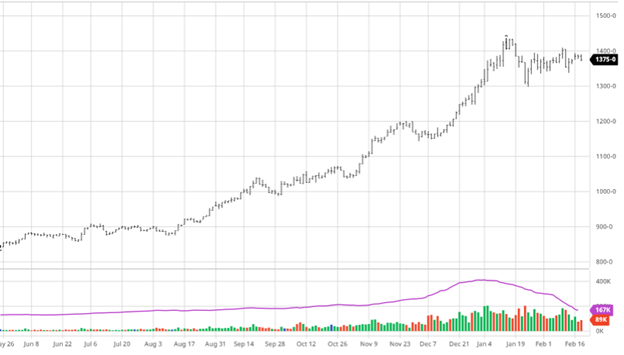

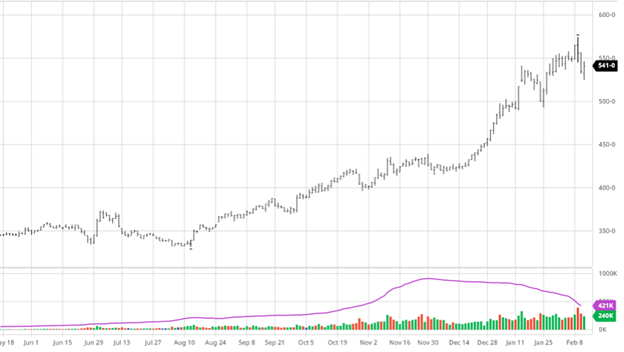

Soybeans had slight gains on the week as they continue to trade in the same range of the last few weeks. Even though it looks like beans have flattened out on the chart, we are still about 50 cents better than we were on Feb 1st . So even though beans have slowed down compared to Aug-Jan, we still have seen a good last 2 months even if it looks like the momentum is slowing down. Exports were good again this week and there was little changed in the world weather outlook, so beans have been at the mercy of traders and not the fundamental news moving the markets. Wednesday’s report, like with all markets, will be an important measuring stick on beans as we see the acres as well. As it is expected, the USDA will lower ending stocks as exports continue to be strong and ahead of the USDA predicted pace. As always, the USDA can surprise everyone so be prepared for the unexpected and plan accordingly.

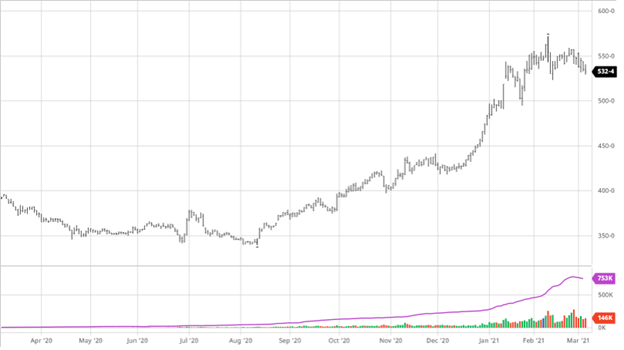

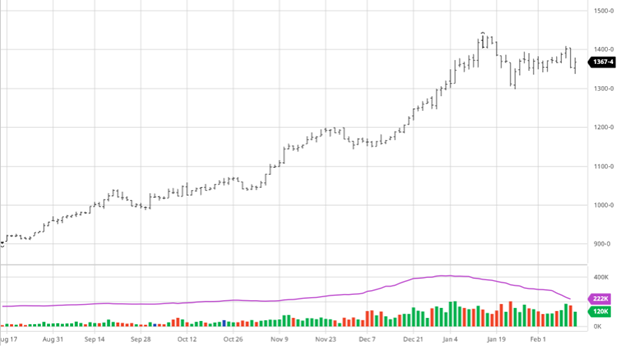

The cotton market got hammered this week capped off by a limit-down movement on Thursday. The cotton market is being moved by the funds and quants as what we are seeing in all other markets is affecting cotton. The fundamental news about cotton is rather bullish as pressure continues to be put on the CCP and cotton coming out of Xinjiang. The exports this week were higher than anticipated as well as large sales going to Vietnam, China, and Turkey pushing cotton higher. With the acreage report next week it is expected that about 40% of the US cotton crop will be planted in West Texas (which is suffering from very bad drought conditions) which will affect planting unless there is a major shift in weather. Cotton will also likely lose some acres to other crops in areas that can grow variety as December soybean and corn prices are much more attractive. The increase in demand coming to the US market along with what could be a very challenging growing season for many areas could lead to a high demand low supply environment.

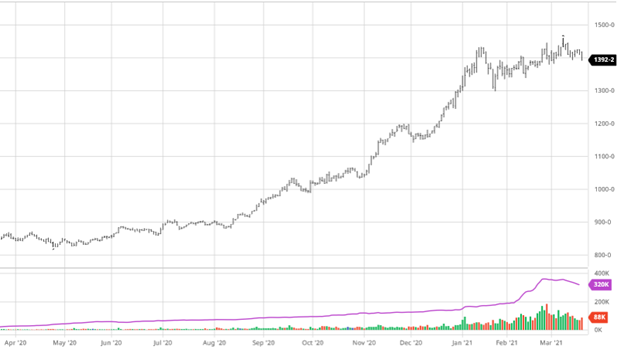

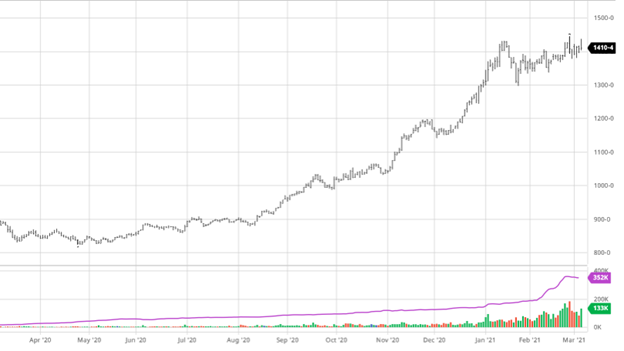

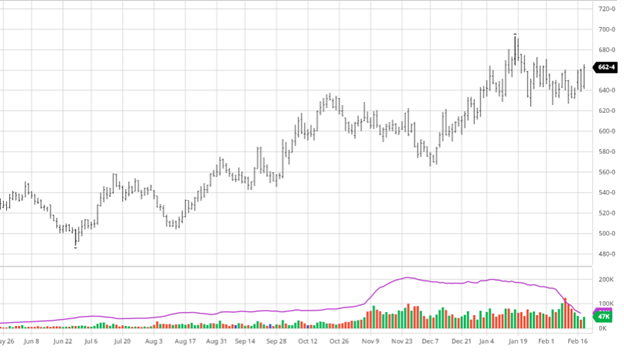

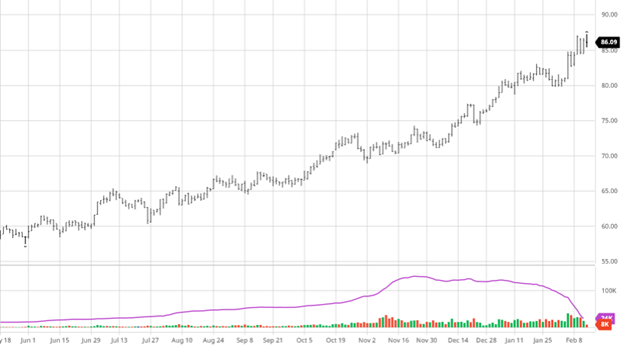

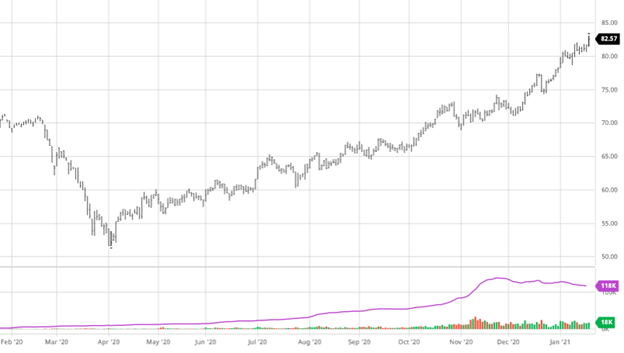

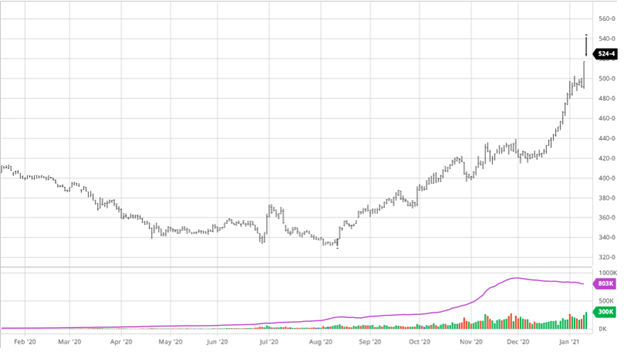

Dow Jones

The Dow suffered some losses on the week as the markets leaked lower after a couple of weeks of gains. The vaccination problems in Europe mixed with uncertainty about rates continue to hover over the market. All major indexes were down this week with the Dow as all eyes turn to what the Biden administration has planned in their infrastructure and tax plan.

Prospective Plantings Report March 31st

This report will be a big market mover as it will set the tone for what we have to plan for in the year ahead. This report contains the expected plantings and last year’s harvest for principal crops and tobacco presented on a state basis. Principal crops are as follows: corn, all wheat, winter wheat, durum wheat, other spring wheat, oats, barley, flaxseed, cotton, rice, all sorghum, sweet potatoes, dry edible beans, soybeans, sunflower, peanuts, sugarbeets, canola, and proso millet.

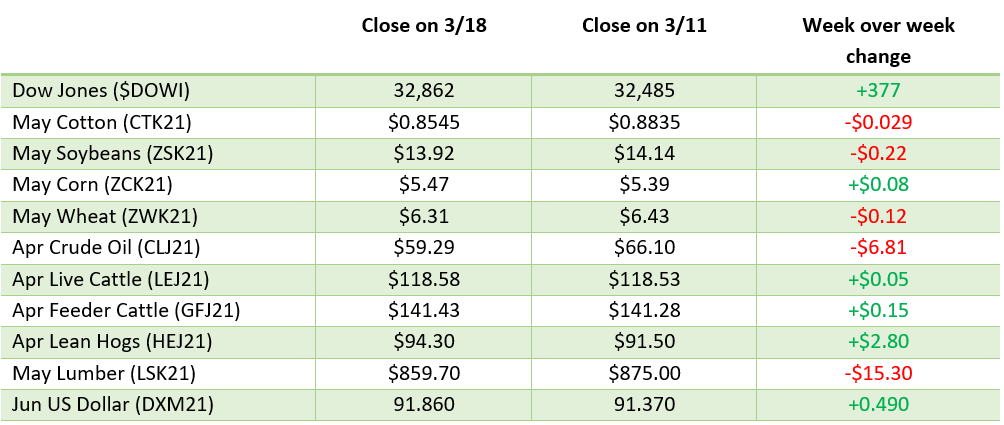

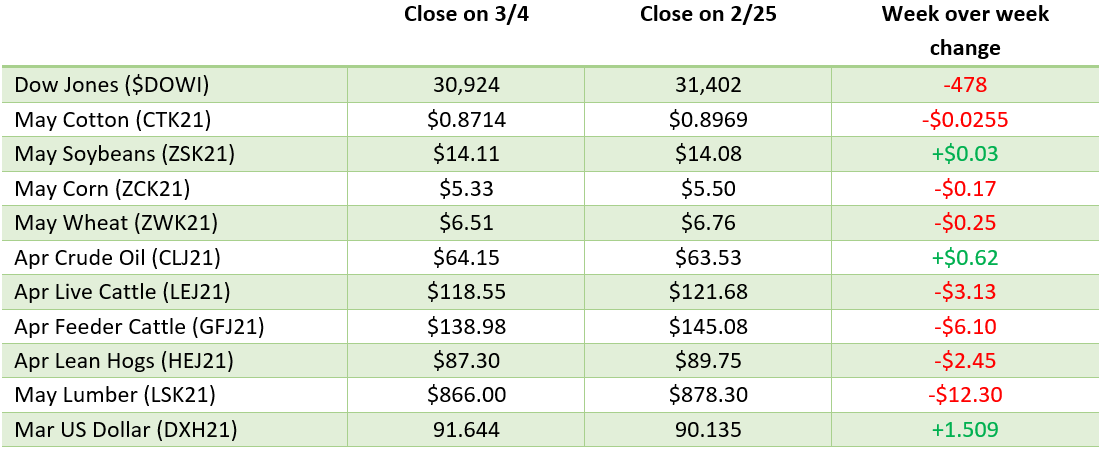

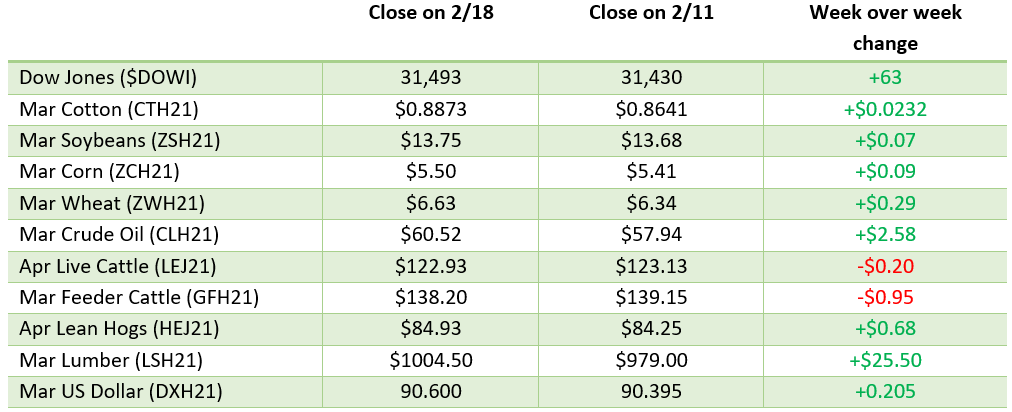

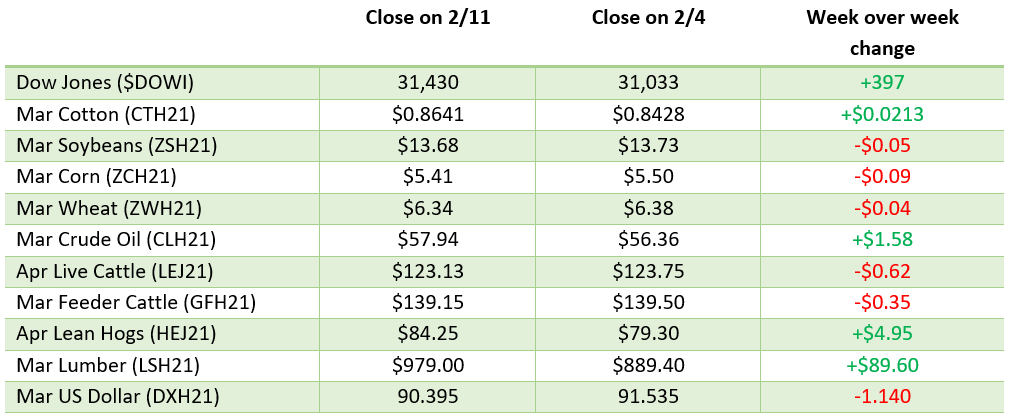

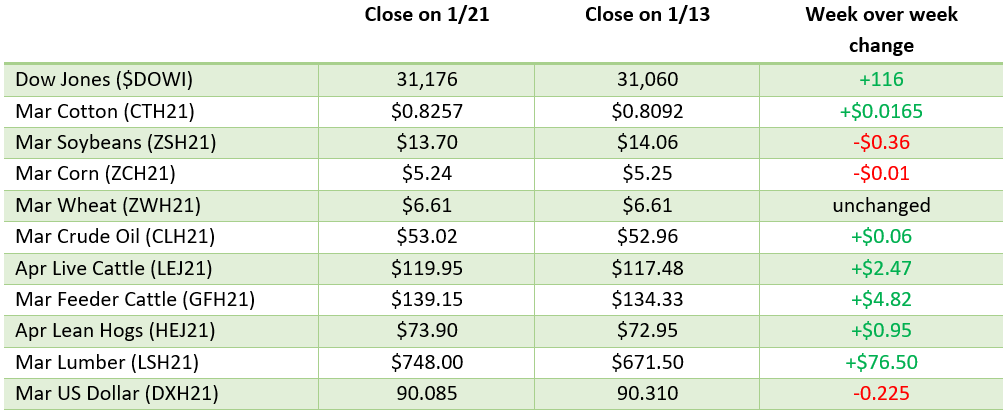

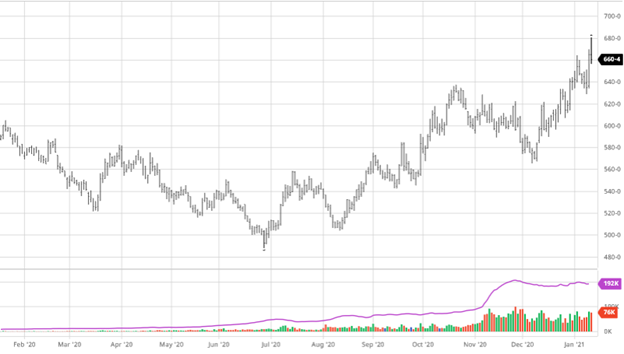

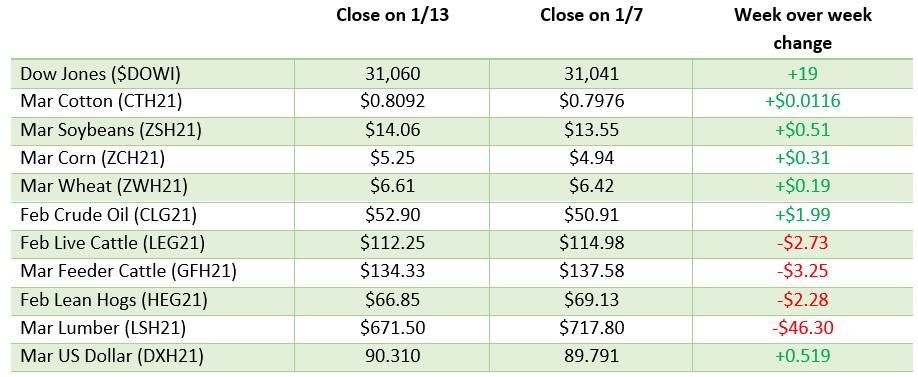

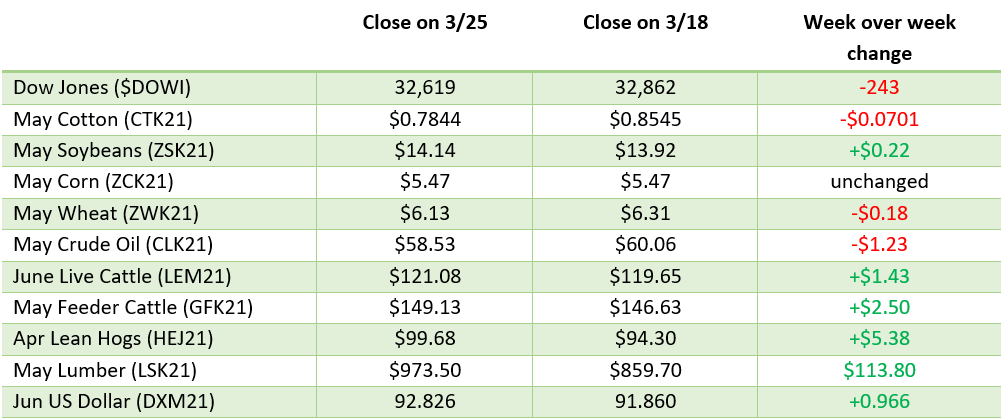

Weekly Prices

Via Barchart.com