Recap:

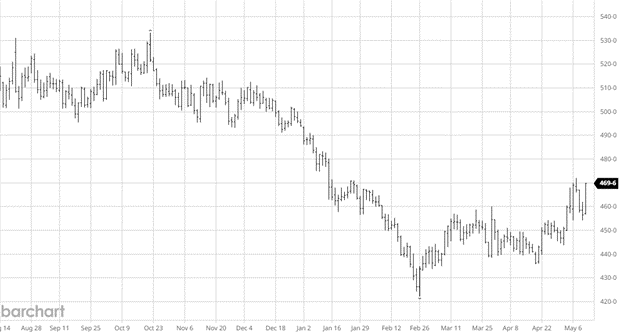

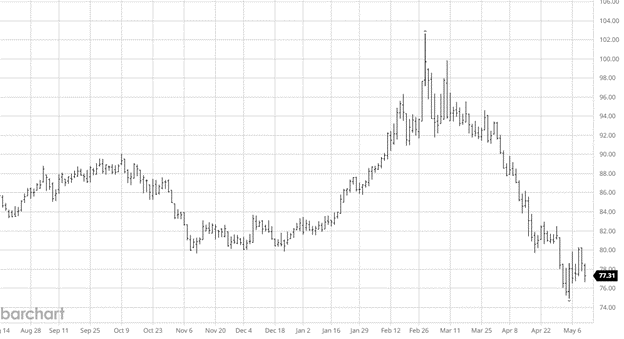

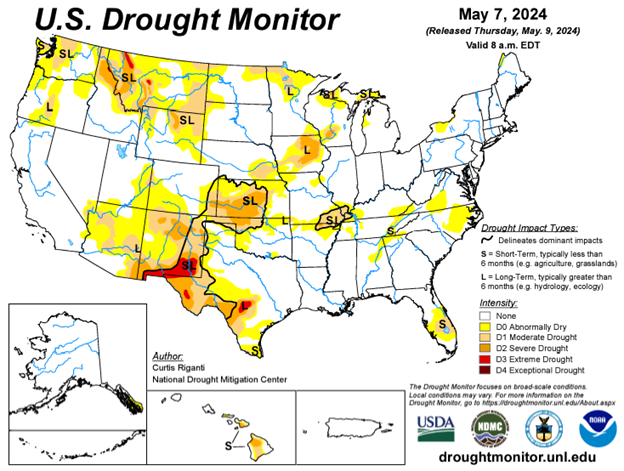

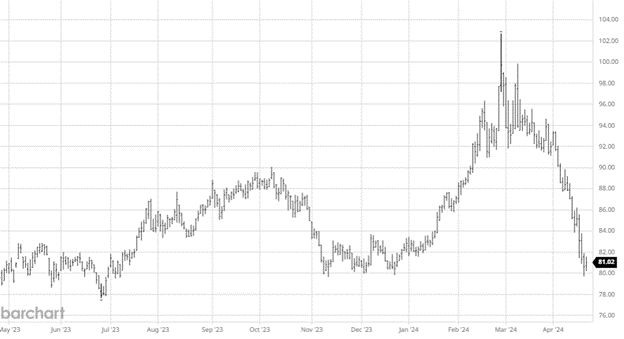

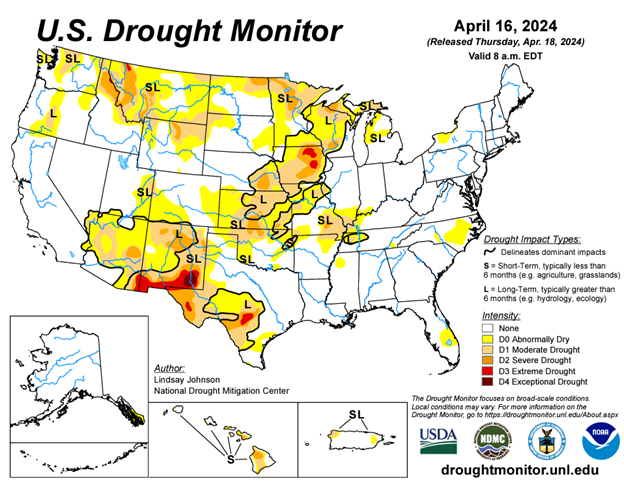

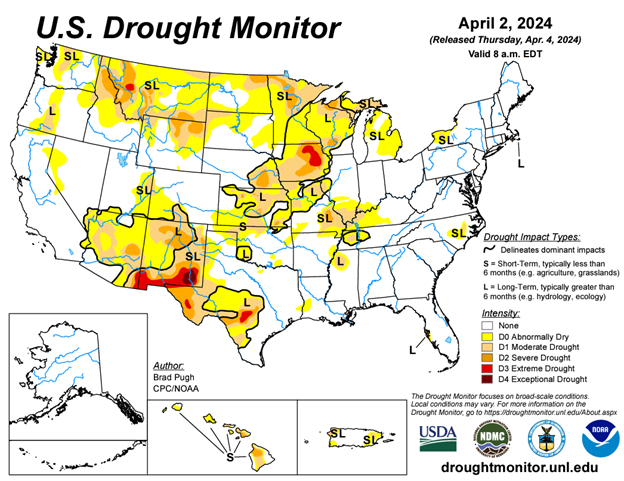

Headwinds, brown shoots, interest rates—whatever data we look at is not good. The question is whether we have to start worrying about the housing market. We were looking for more but didn’t get it. What we have is the same market we have had for 17 months now. It has pockets of positives followed by a long bleed. That has been the lumber market for over 40 years now. It is tradable and profitable when one adapts to the trade mode. So what does that look like?

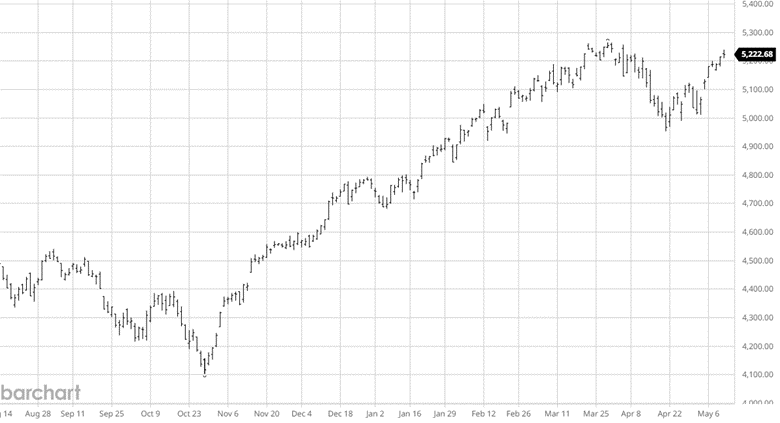

Buying into a falling market has always been a challenge for most. For a few years, you could buy into strength and make money. That is no longer the case. There isn’t enough time between cycles. What this indicates is a flat demand curve. What has finally hit the market is the higher rate uncertainty. For a year, the builders worked around the higher rates. That worked for the aggressive buy side. We now have returned to the “average Joe” buyer. This was expected but came early. The builders are reacting by pulling back. This knee-jerk reaction will take time to work itself out, but for now, it adds pressure.

This is an environment where you need to dust off that 10-year-old playbook. How do you take advantage of a flat market that offers a pop every so often? Today, the industry is offside, being long futures when there is a $40 or more basis opportunity available. Lower prices will rebalance that.

The fear of a strike, fires, or another shutdown has kept the marketplace off balance. At the end of the day the wood continues to show up.

Technical:

The trading range is very narrow. The focus today is on the outer bands. On the upside, the 38% retrace sits at 556.90, and the 200-day moving average sits at 564.98. This market can gain momentum with a move over the 200 day. On the downside, 511.00 is the key support point, followed by 497.00 and 486.00. This area has been support for months. There isn’t a technical point that would increase the downside momentum. Breaking back into the 400’s would indicate an economic turn in housing. The funds seem to be leaning towards a slowdown and could help it lower. That conversation is not for today.

For today, 540 is too high and 520 is too low. Enjoy.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636