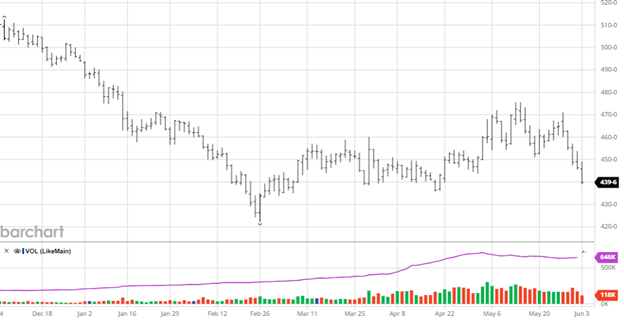

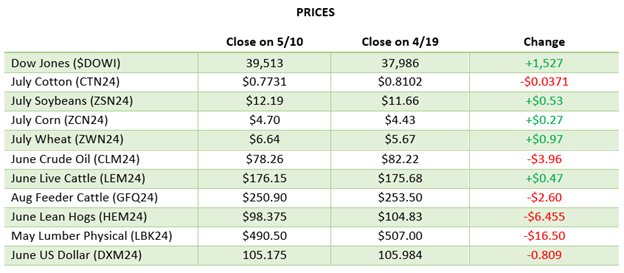

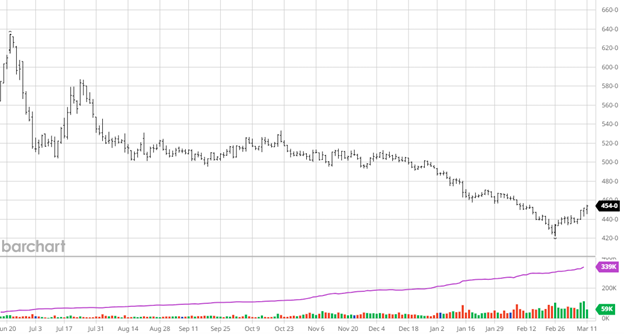

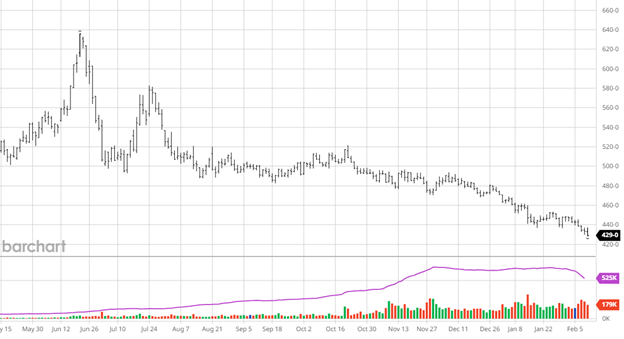

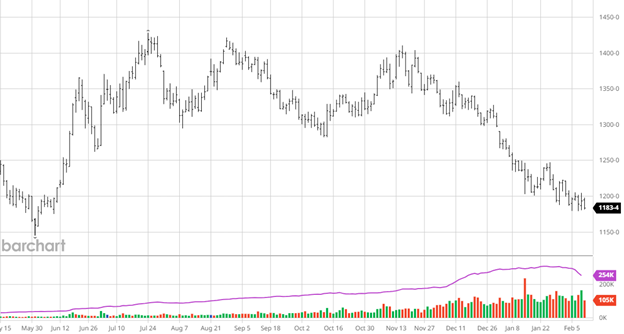

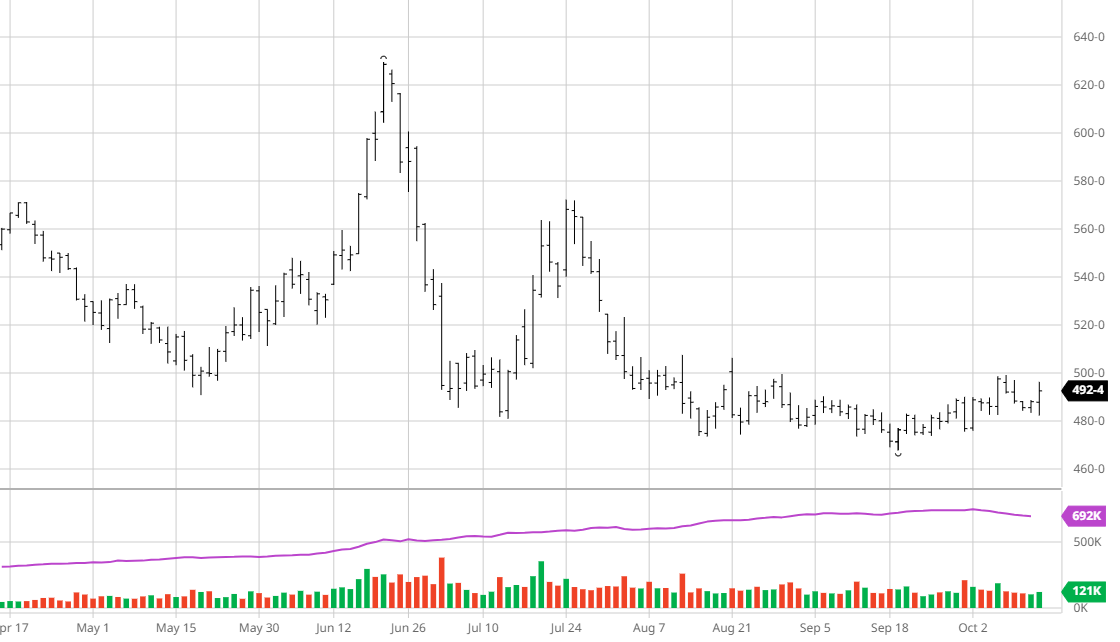

Corn’s small 18 cent rally off recent lows for new crop corn has been very welcome after 6 down days in a 7-day period to end May and start June. This week’s USDA Report was a non-event with the USDA making no changes to South Americas production from last month despite the trade expecting production well below the USDA’s estimate of 175 mmt (171.82 estimated). CONAB released their estimates on Thursday, increasing their estimates for Brazil’s corn crop but still 310 million bushels below what the USDA is saying. The heat over the next couple of weeks is not expected to be a major problem but if this level of heat with a lack of rain goes into July the markets would take notice and begin to worry a bit.

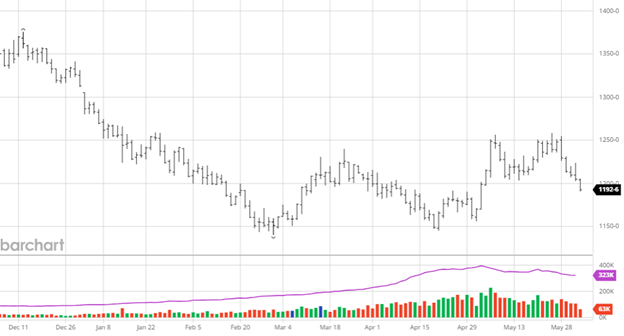

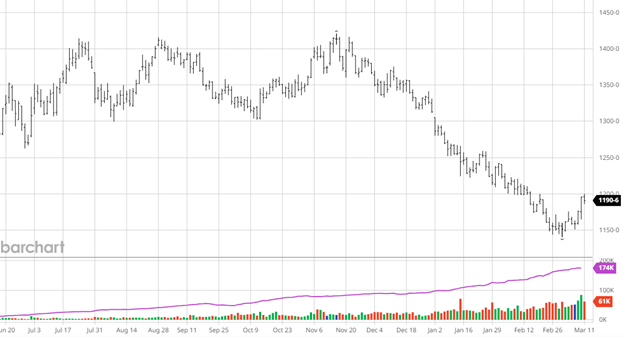

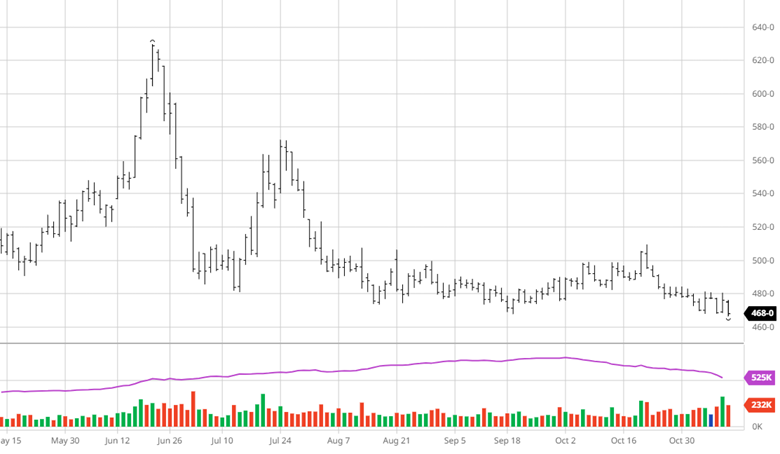

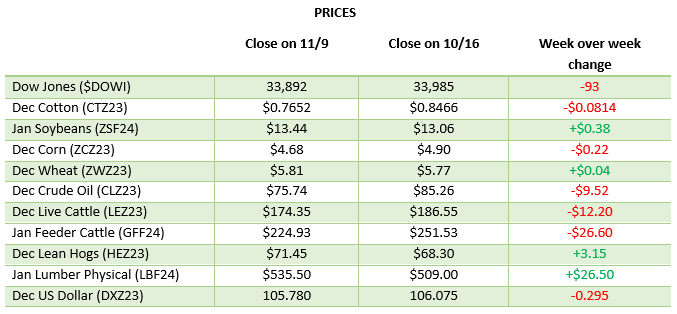

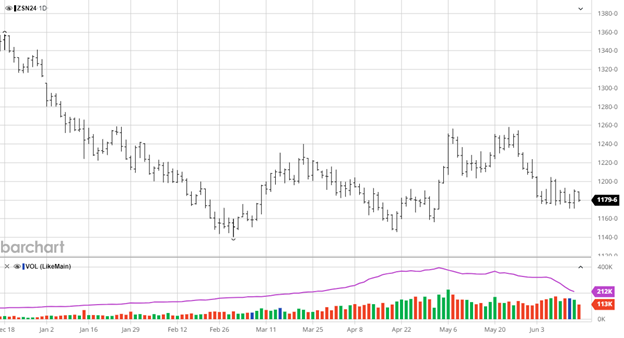

Beans are lower over the last 2 weeks with them settling into a flat trade this week. The USDA report was uneventful despite the USDA cutting another 1 mmt from Brazil’s bean crop. US exports were revised lower and ending stocks rose as the slow pace of exports continued. With no major surprises and no major weather/production issues yet there is not much bullish news outside of CONAB’s Brazil production estimate which is 207 million bushels below this week’s USDA update.

Beans are lower over the last 2 weeks with them settling into a flat trade this week. The USDA report was uneventful despite the USDA cutting another 1 mmt from Brazil’s bean crop. US exports were revised lower and ending stocks rose as the slow pace of exports continued. With no major surprises and no major weather/production issues yet there is not much bullish news outside of CONAB’s Brazil production estimate which is 207 million bushels below this week’s USDA update.

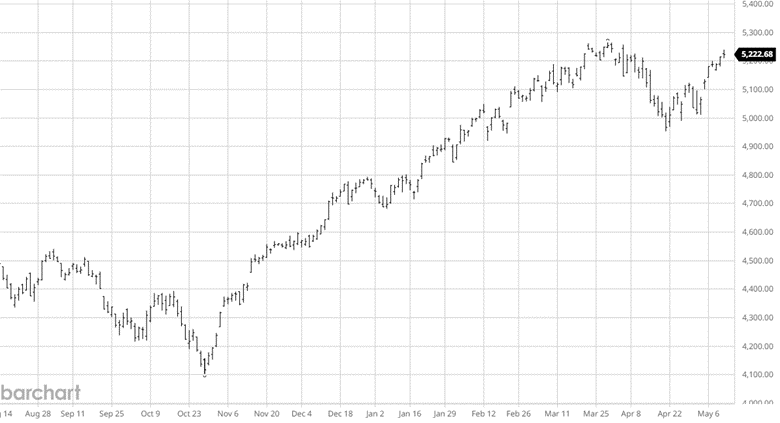

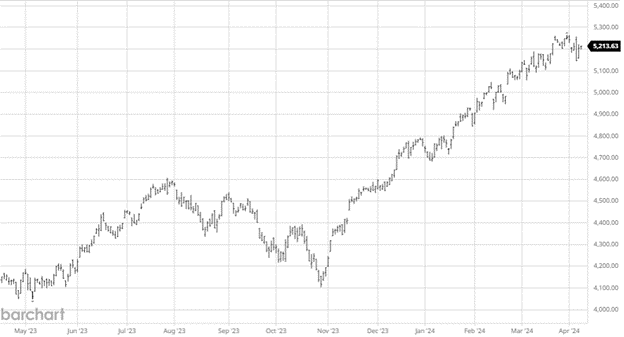

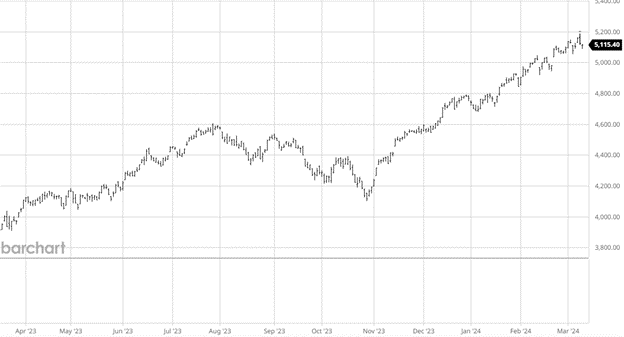

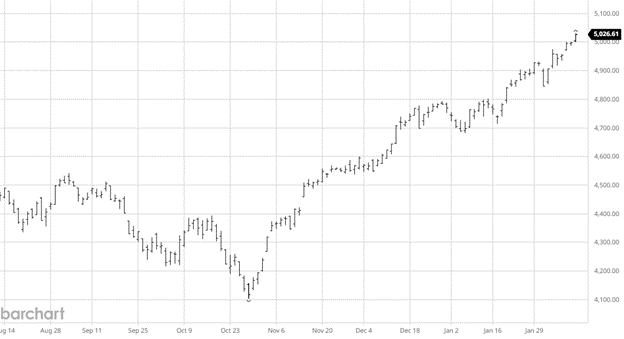

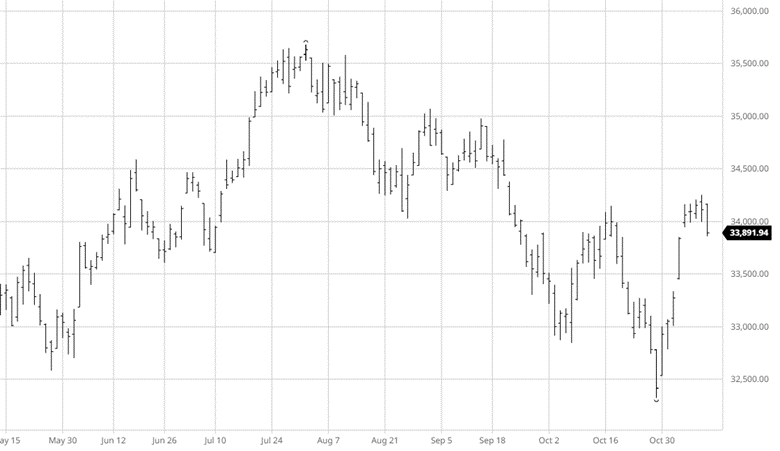

Equity Markets

The S&P 500 and NASQDAQ continue to move higher setting new all-time highs as several large tech companies beat on earnings. The AI movement is continuing its dominance, but some other areas are starting to find strength as funds are forced to reposition.

Other News

- The cotton market continues lower as there is nothing bullish in the news cycle for it other than the potential for up to 25 named hurricanes this year.

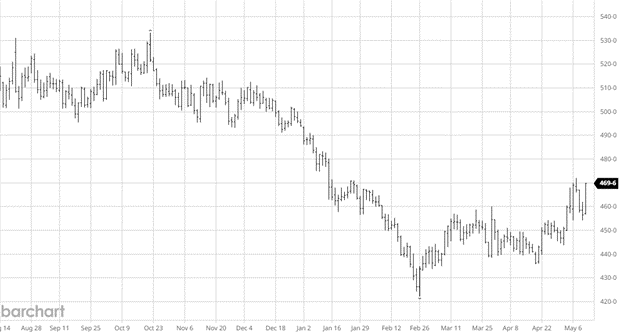

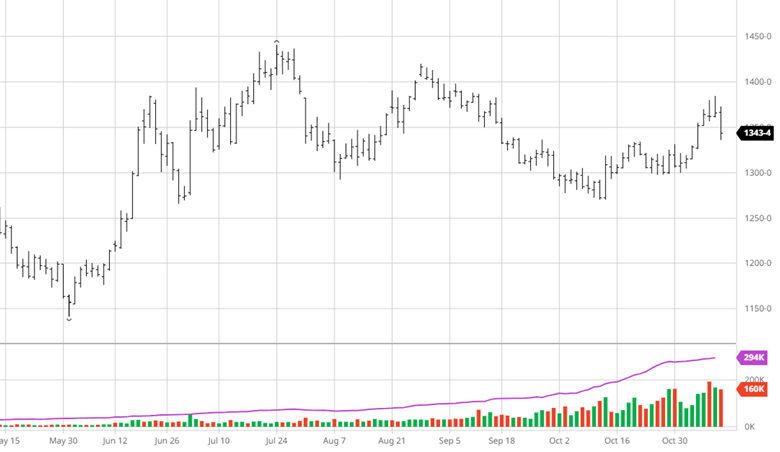

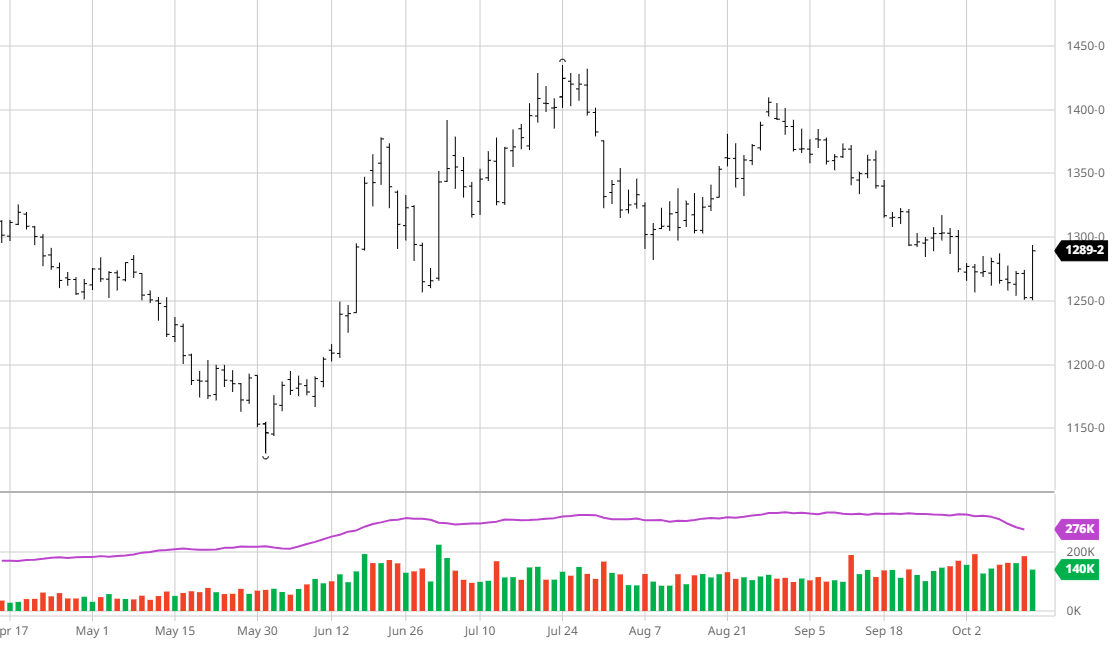

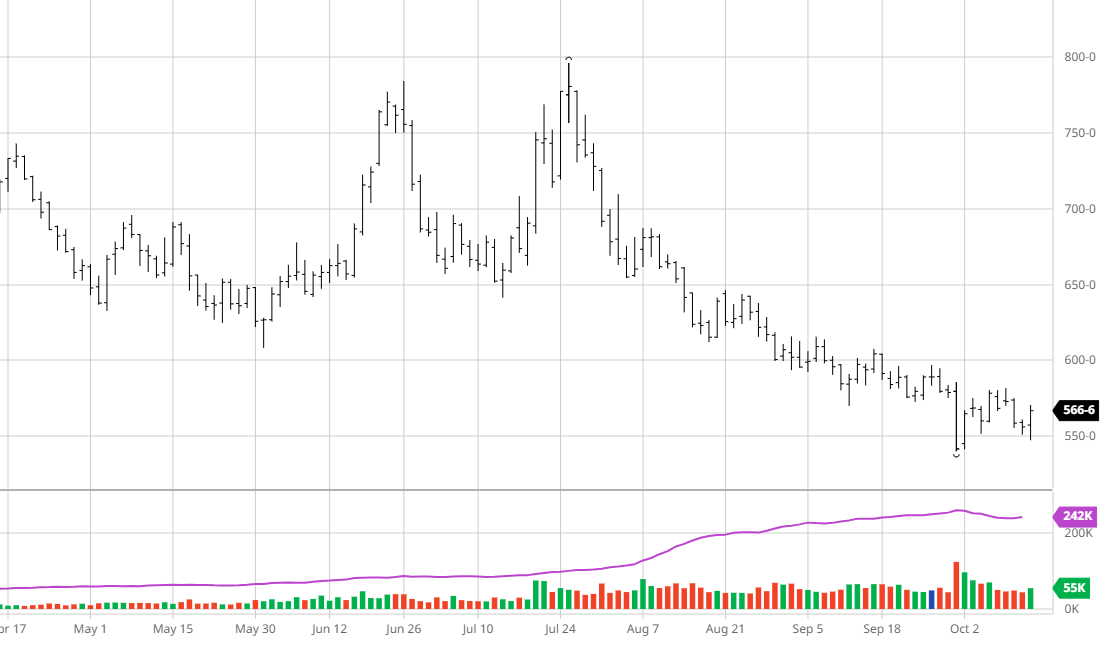

- Wheat’s roller coaster ride continues with potential for lower Black Sea production still a possibility after the $1.50+ rally follows by a $1 fall with 10 down days in a row.

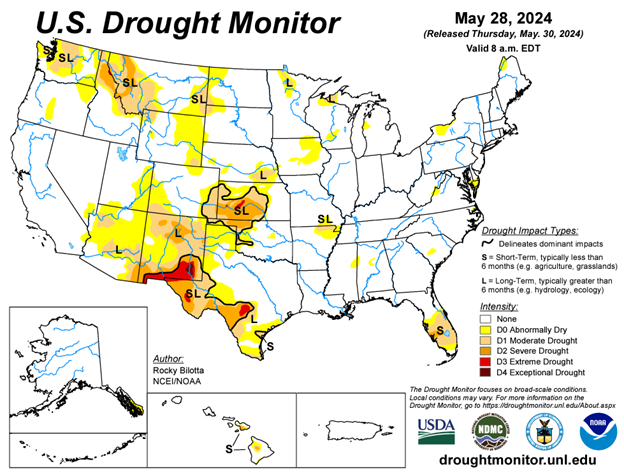

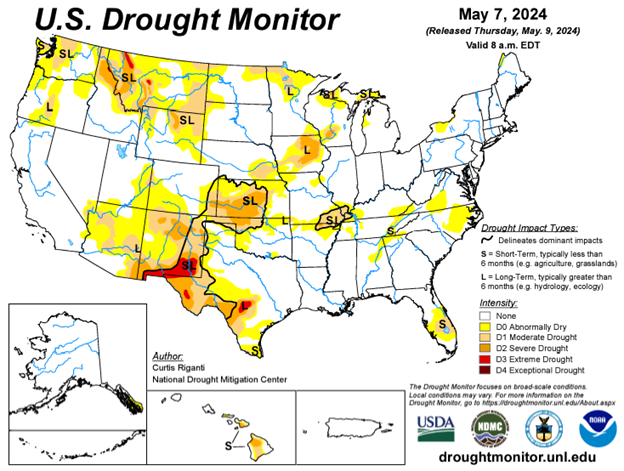

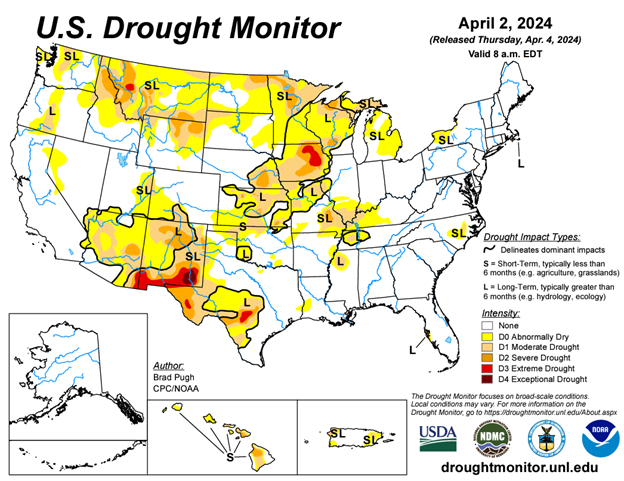

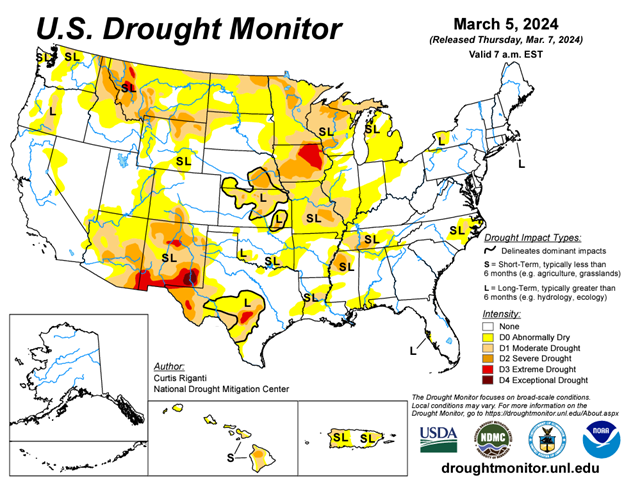

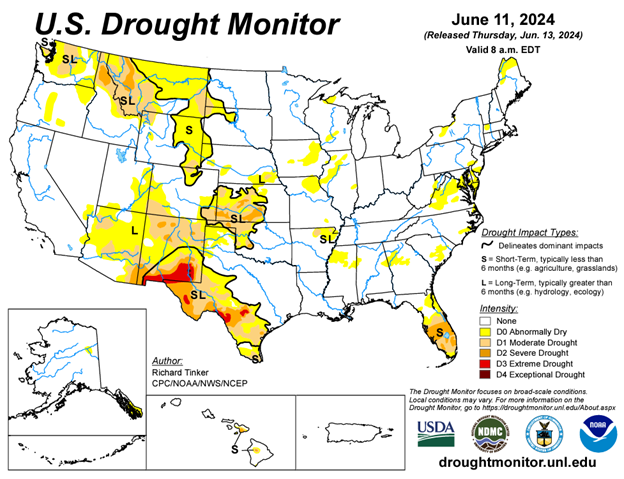

Drought Monitor

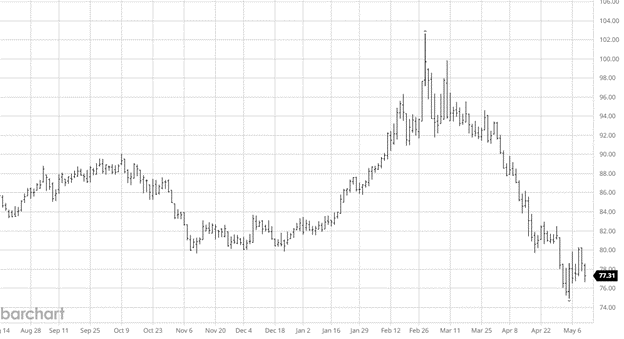

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.