Recap:

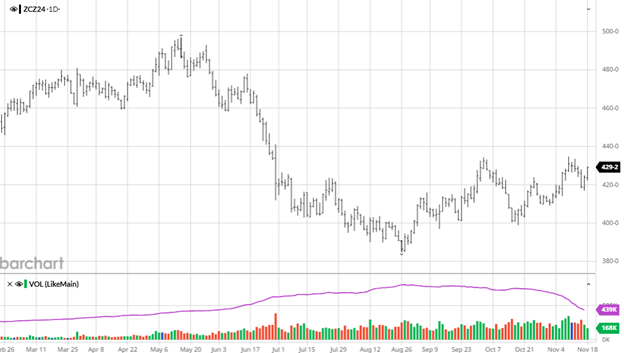

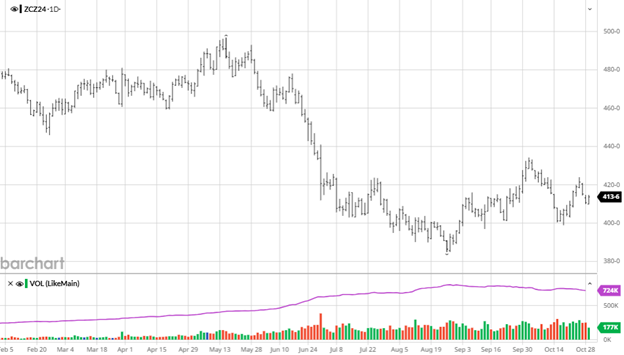

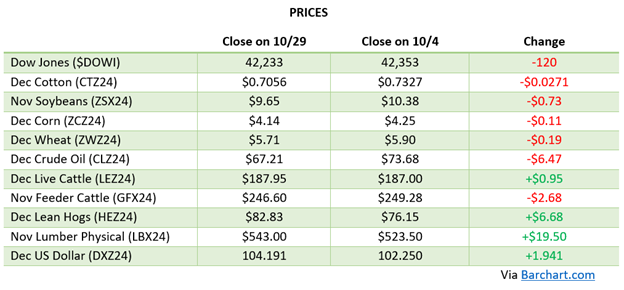

” A flare for the dramatics.” That’s how the market was described last week. It was meant for futures but can be easily fit the cash trade most of the year. Here all in or all out mentality drives prices more than supply and demand. The fact that this commodity has been in a range now for over 2 years, but the trade can get chopped up, shows us just how difficult this market is to navigate. At the end of the day, the price always represents value. The main takeaway from last week was that this market is working to redefine the trading range higher. If you look back over the past few weeks, many cash items were back near their lows. That’s not a consolidation higher, but it’s not a confirmation of value. The futures market better defines the overall market as it is a broader indicator of prices and attitudes. Last week we saw a rally of about $40. Yes, it was all in one day and actually all in a matter of minutes, but the fact that it didn’t give it all back tells us that the value area is higher. If all economics remain the same the market has suggested the new value area to be $560 up from $520. The buy zone has moved up. The sell is the premium offered when out of line.

Technical:

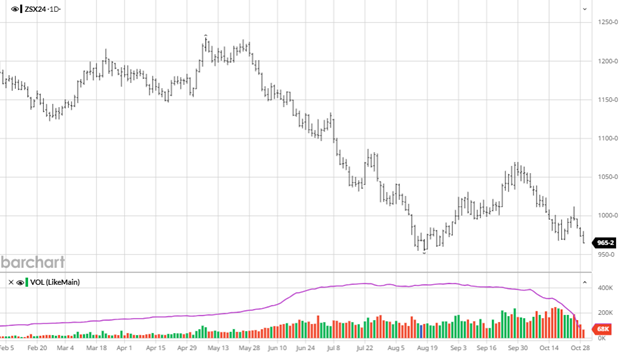

It’s hard to find a mirror today’s chart pattern in any markets. The looming gap down to $540 will keep most technicians out of the market. The idea mentioned above of a new value area and how this market trades technically are opposites this week.

The roll has allowed a long algo to trade again. That will be the key to direction this week. That said, with rising open interest in the commercial longs and in the fund shorts, I’m worried more about the downside more than the upside during the holidays. Again, the roll will bring in buying. The best trade of the week is to shut off the computer and come back on January 6th.

Brian Leonard

bleonard@rcmam.com

312-761-2636