Recap:

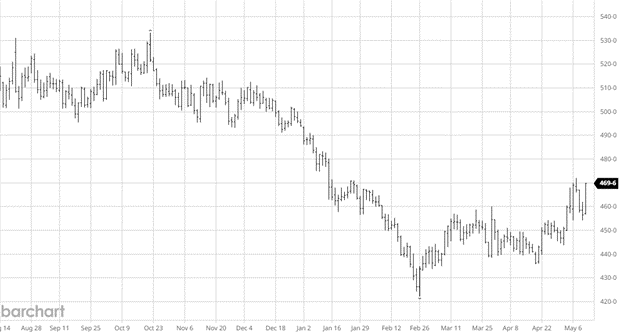

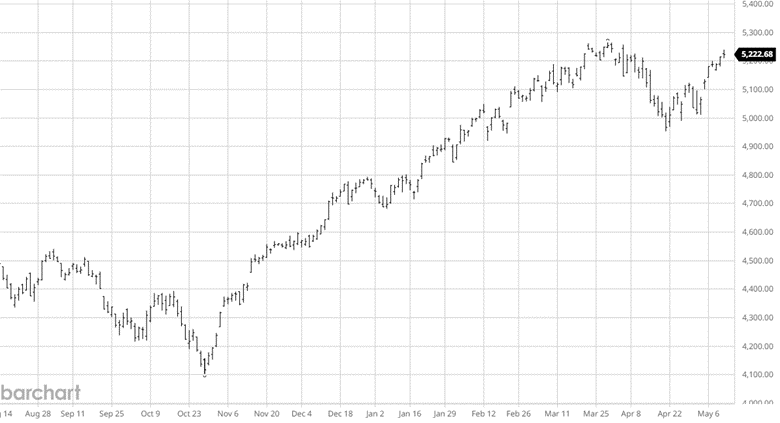

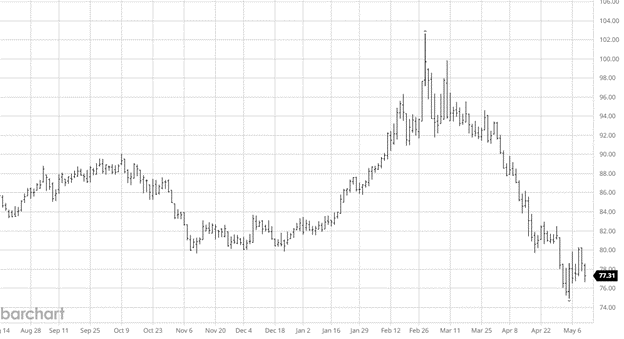

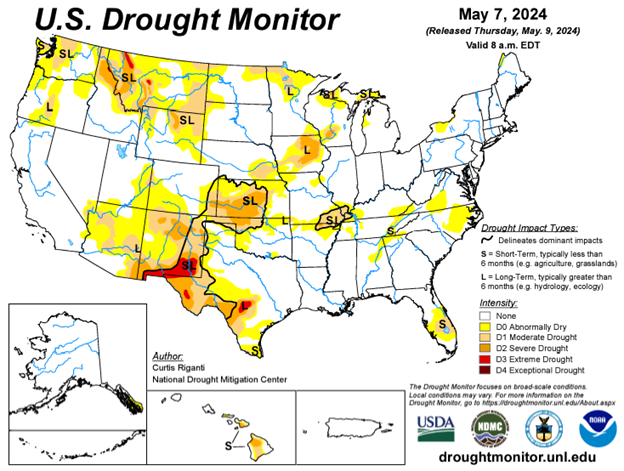

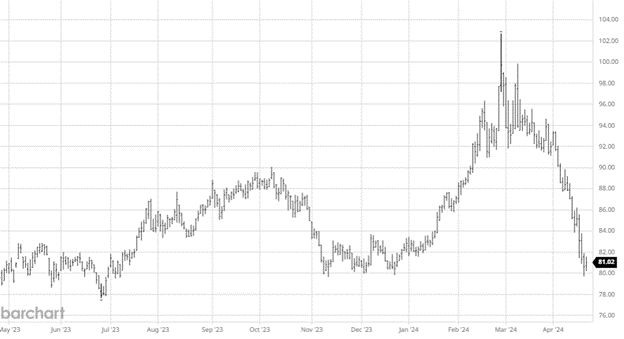

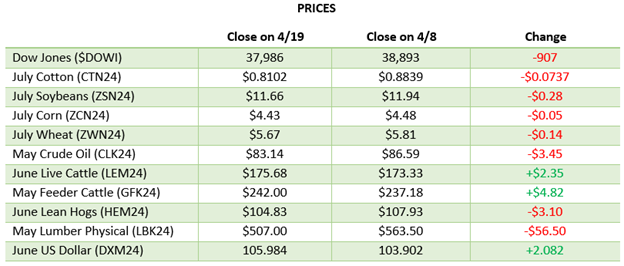

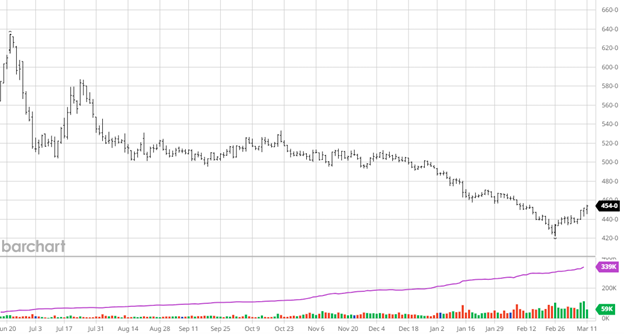

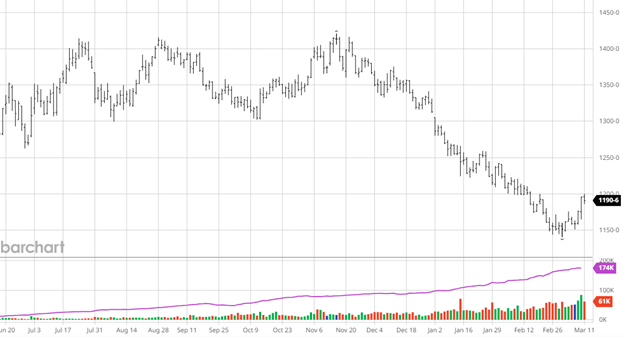

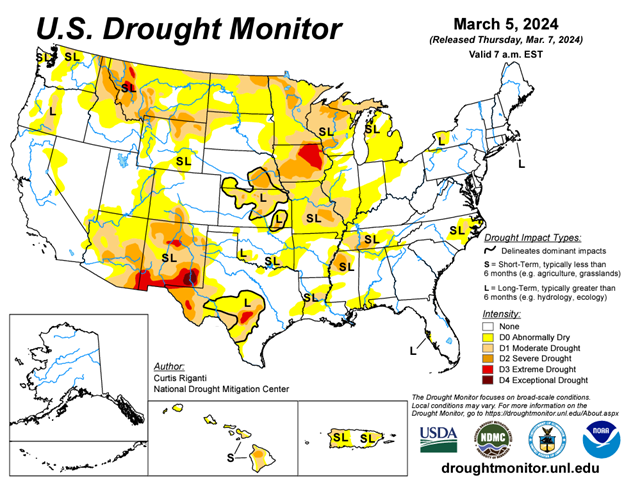

It was a tough week for cash and futures as the quiet market pushed prices lower. Before we sound the alarm, the market is $22 off its high and $18 off the low. After 20 sessions, the market sits in the middle. At this time of year, the market tends to put in a seasonal low. This battle with a $35 range is mildly friendly. This marketplace is not heading for the exits. The industry and speculators are firmly committed to the long side, while the funds are firmly committed to the short side. If you are long waiting for the funds to react, it will be a long 30 days. Last year, we saw the same dynamics of less traffic, falling builders’ sentiment, and less construction than projected. What happened was a grind higher market. I want to make a call for the same, but this year, we are just now confirming more negatives and fewer positives. More brown shoots don’t necessarily equal sharply lower prices. It will just be a continued drag on this market. I would be mildly friendly to the market if it weren’t for the fact that the industry is long-future and cash-playing Texas Holdem with a Texas hedge. Those long cash should be selling the pops in futures.

Technical:

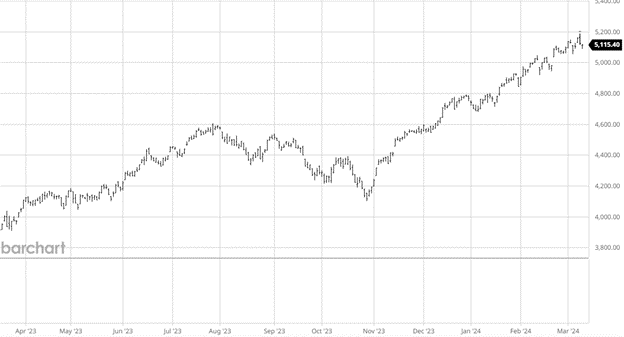

The tech read hasn’t been effective this year due to the tight range between swings. Today, there is a mildly friendly candlestick. The market is building a new value area about $20 higher than last year at this time. I’m looking for a lower RSI up here to confirm.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636