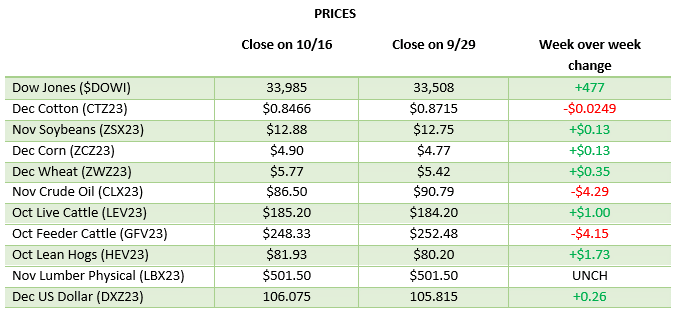

Recap:

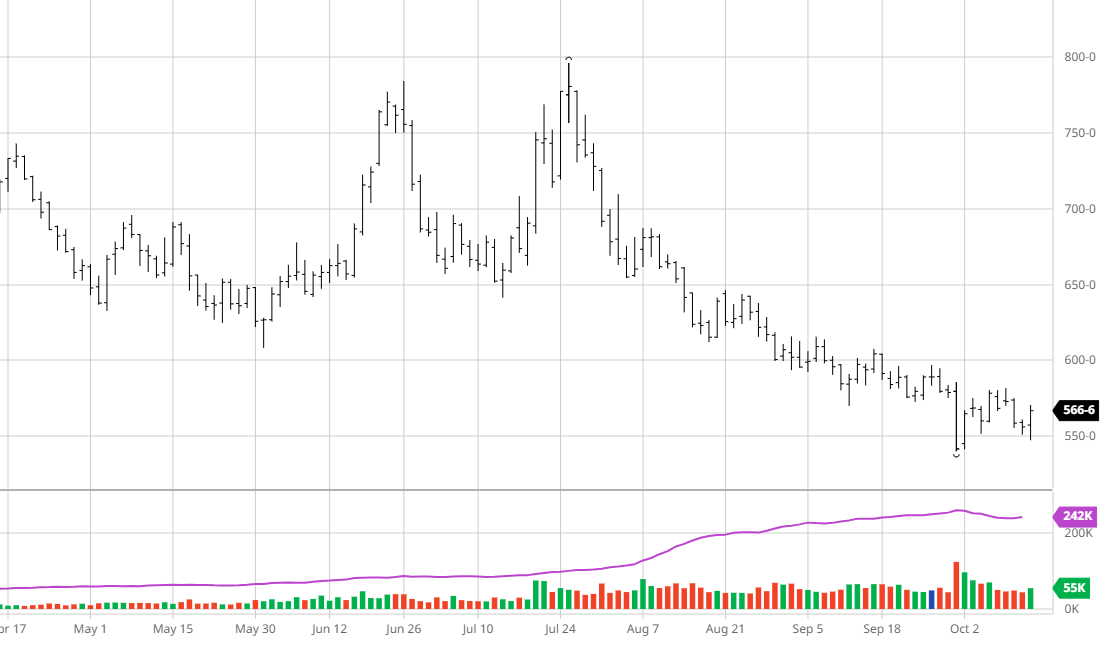

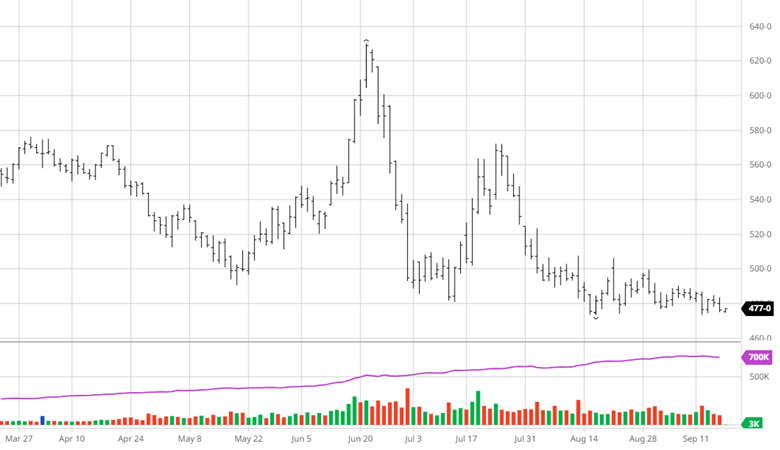

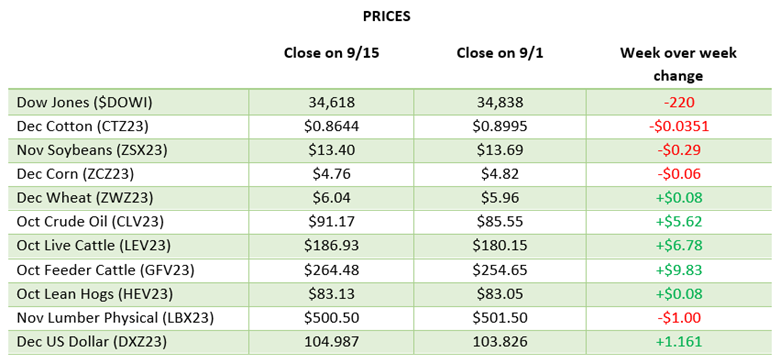

We are all trying to shape this market not with clay but with wet sand. Each negative seems to overwhelm the positive. While the housing pace continues on its post-COVID run, there are signs of fatigue. As we measure ongoing business, we continue to get hit with bad news. The 8% mortgage was expected. The fact that it went from 8 to 8.10 in less than 24 hours wasn’t. We are seeing the fatigue factor mixing in with lousy economics. The next six months will be a street fight. The good news is this industry will stop buying, leading to higher prices. The question is when we will get back down to dirt. Friday was a significant volume roll day. The roll has been orderly. The pressure came from accelerated liquidation. No spec long is a winner.

Macro:

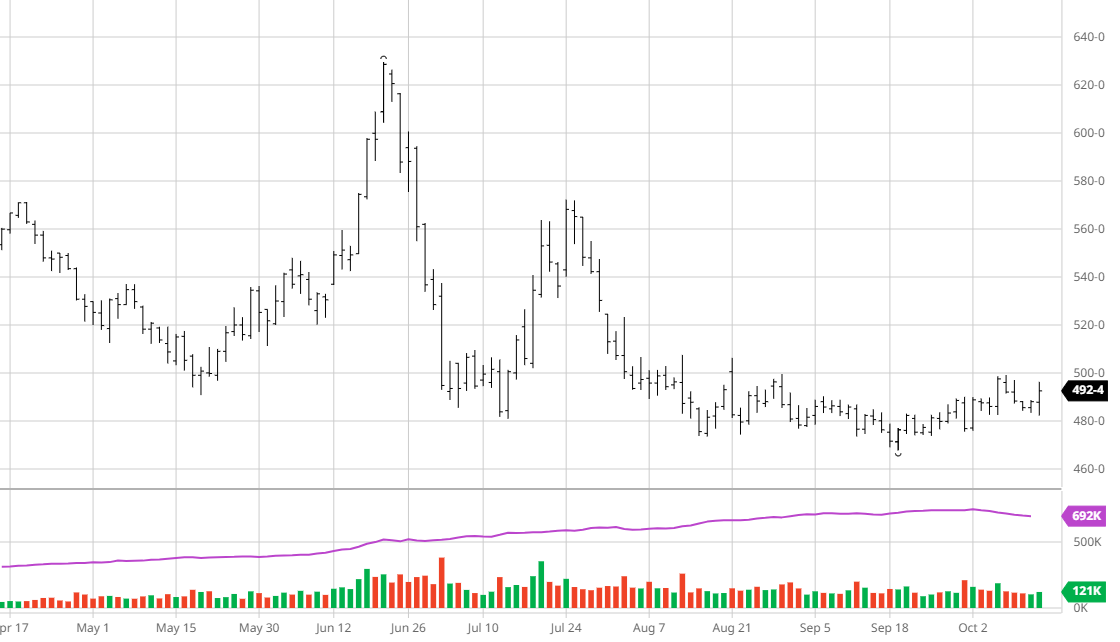

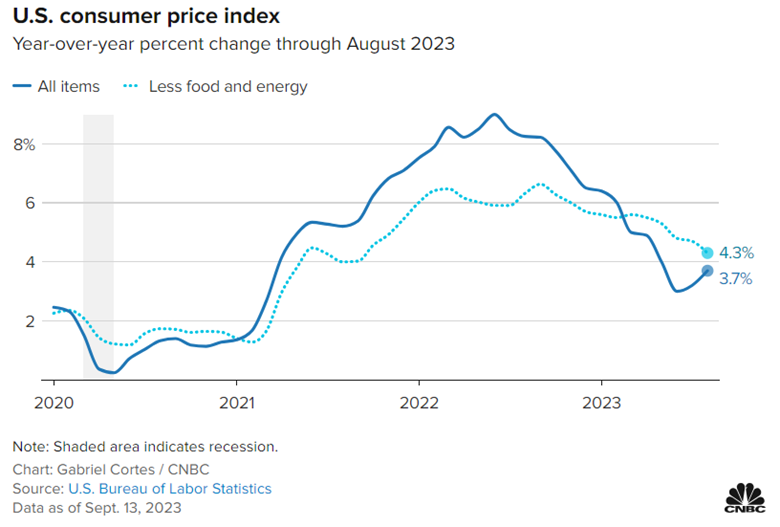

We’ve been talking about how rising rates will break something. It is going to be housing. Now, the extent of the slowdown will lessen as time goes on and the marketplace adapts. Going back to January, construction was expected to be lower heading into the fourth quarter, but production and supply would also be down. That is where we sit and why the futures are stuck at $500. The challenge will be the short-term pressure the market will feel for the next few months as rates find a level. Core inflation is stuck at 4.1%. That won’t be to 3% anytime soon. In 2024, it is estimated that the US will spend $800 million to finance the debt. The Fed needs to sell a record amount of bonds. The hope is for the market to absorb all the bad news over time and not overnight hysterics.

Technical:

Technically, the market broke out to the downside and is now a sell with a 36.90 RSI. The market has seen these sell signals this year but with a very low RSI. This one has some room to go lower, and with all the under-the-table deals offered out there, it just may.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636