Planting is almost complete across the country as the final reported number was 88% planted this week. The weather outlook into early June is promising for many areas that were delayed in planting to still be able to get their crop in the ground in early June with the exception of parts of North Dakota that will be hard to catch up. With little news in the markets this month, trade has been pretty stagnant. July corn did trade at $3.30 in the July contract for the first time in over a month on Thursday before falling back to $3.27 ½ at the close. If July corn could close above $3.30 for the month of May it would be a very welcome sight after a month of very limited trading range.

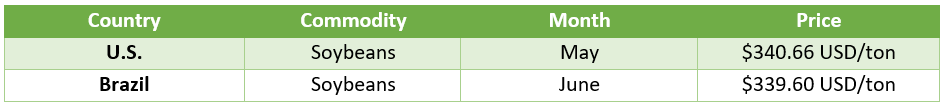

Soybean planting was estimated to be 65% complete this week, still well ahead of the average for this time of year. Like corn, the weather for the next week is promising for planting progress across most of the country. Purchases from China gave beans a boost early in the week but no follow up purchases have kept the news slow and prices steady. Any purchases from China, as has been the trend, would be helpful to prices along with an easing in political tensions. ASF news has been quiet as Covid-19 has been the big news story, but as China continues to replenish its hog populations that should help purchases in the future. November beans have been trading between $8.30 and $8.55 for most of the last month with $8.50 the current landing spot. While the bulls have been hopeful of size-able Chinese purchases, the reality has been small purchases with much of their purchases coming from Brazil.

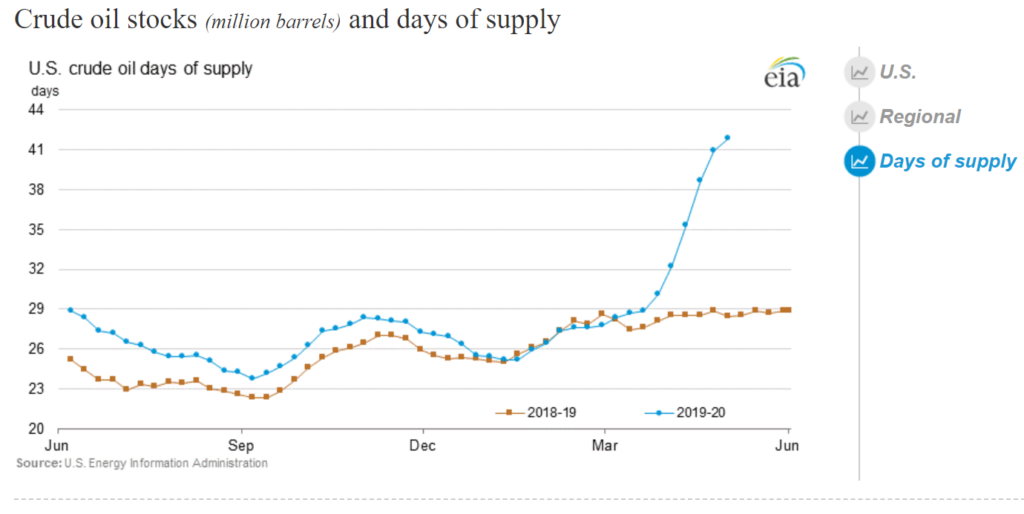

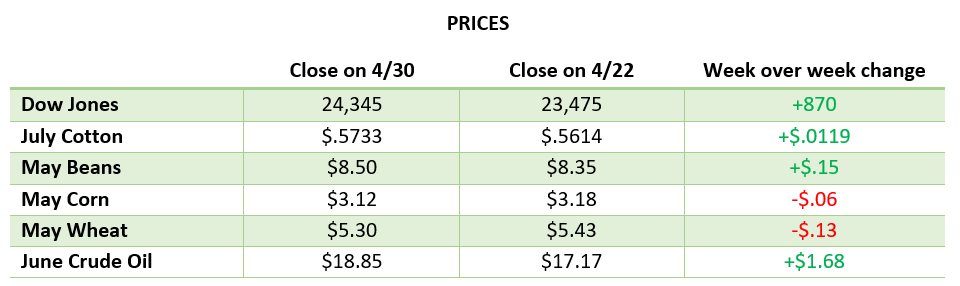

Crude Oil prices have had a great rally despite early worries that we would have another bottleneck problem like we did with the May crude contracts for July. As people around the country are going back to their daily lives, in some capacity they are driving again. The rest of this year should see increasing travel by car as people will look to drive to vacations rather than hoping on a plane. See the chart below to see the impressive rebound for the month of May.

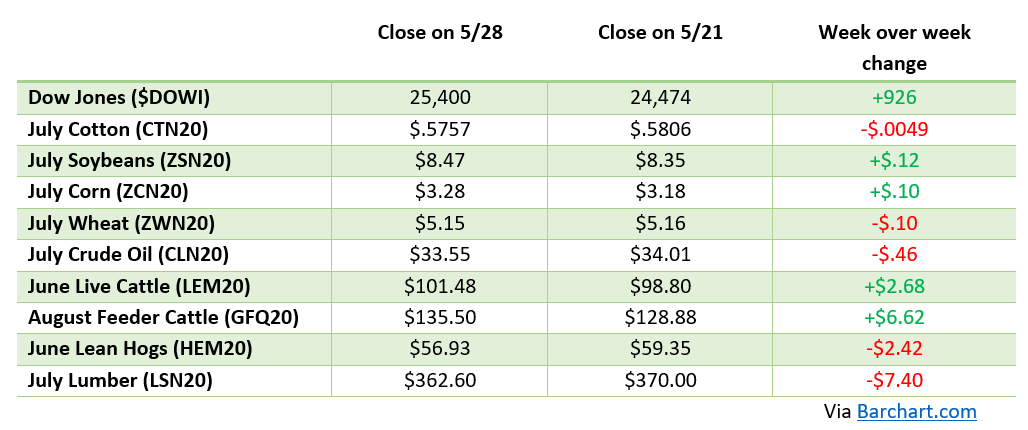

DOW Jones

The Dow Jones has continued its surge up as May will post another large gain despite record unemployment numbers. As states have begun reopening, traders are seeing this as promising for the markets as people will hopefully be returning to work. People continue to work from home in many major cities, or have the option to work from home, and will probably continue doing this as the summer goes on until the public feels safe to return to close to normal.

CFAP Relief Package

Enrollment for the CFAP Relief Package began this week on the 26th. If you have not already, reach out to your local FSA office to begin this process to make sure you do not miss out on any opportunity. The CFAP had scheduled payment of 32 cents per bushel from the original CARES Act and a CCC payment of 35 cents per bushel on the lower of 50% of last year’s production or 50% of your unpriced corn on January 15th. That works out to potentially receiving 67 cents on half of last year’s corn crop. The soybeans payment works the same with payments of 45 cents and 50 cents for a potential payment of 95 cents per bushel on 50% of last year’s bean crop. The math is not clear nor why January 15th was chosen, but those are the guidelines. Livestock is also covered in the payment and information on that from the USDA website can be found here. For more information on how to sign up for the CFAP Relief Package, check out this video.