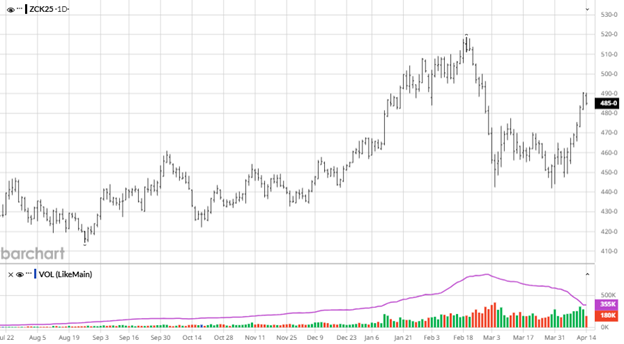

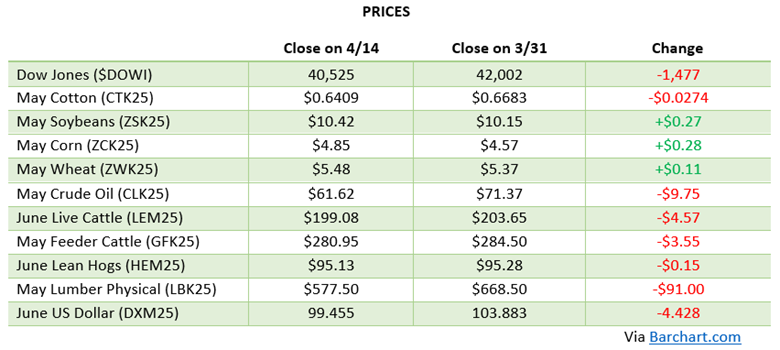

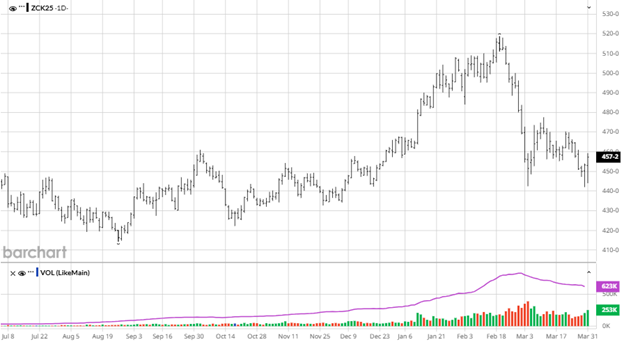

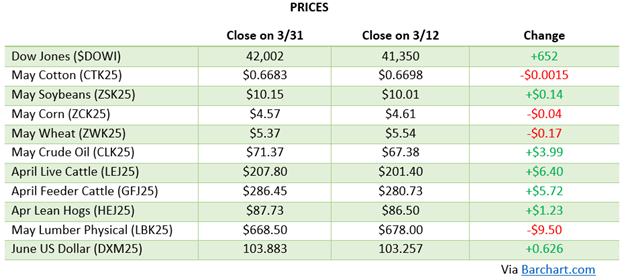

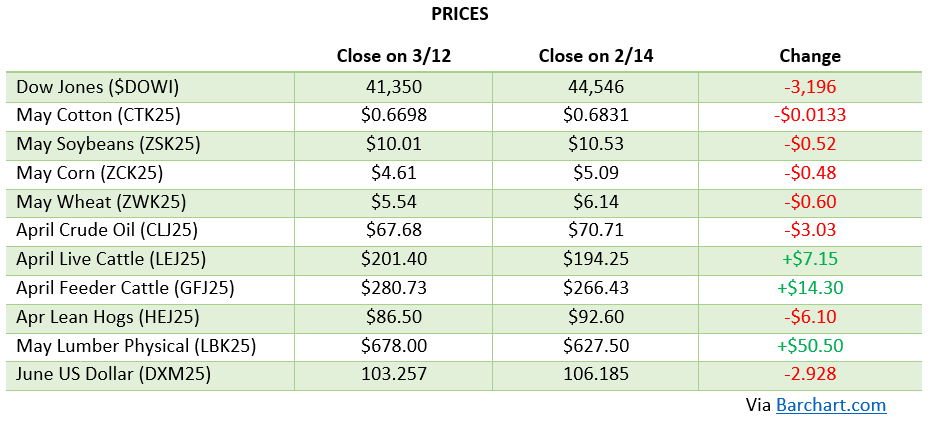

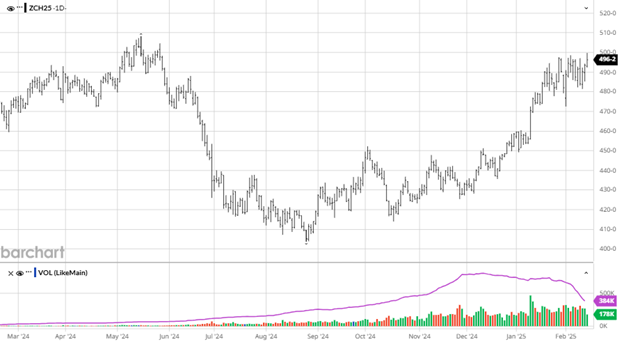

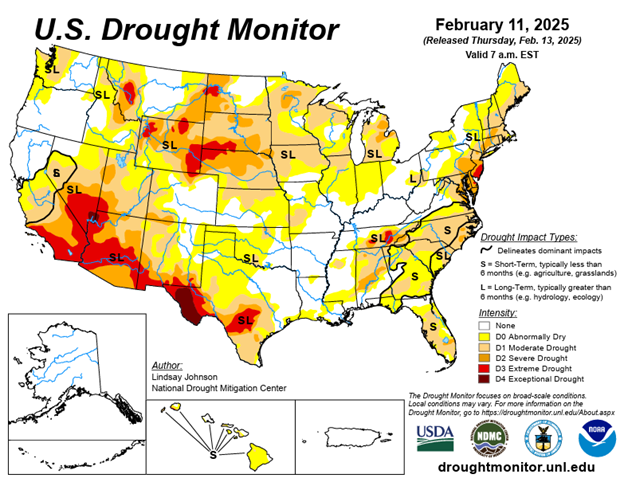

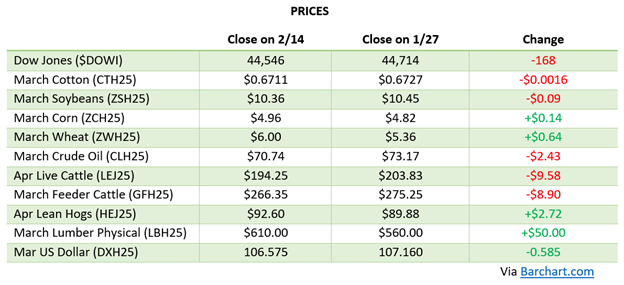

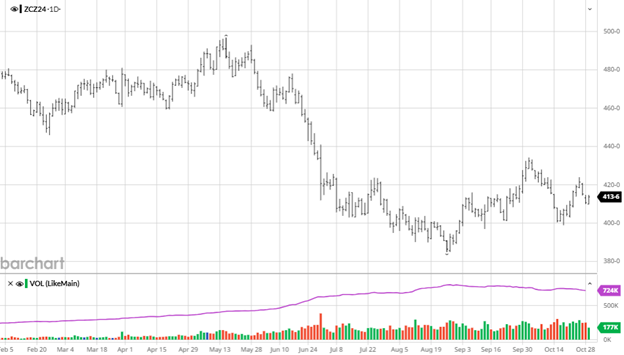

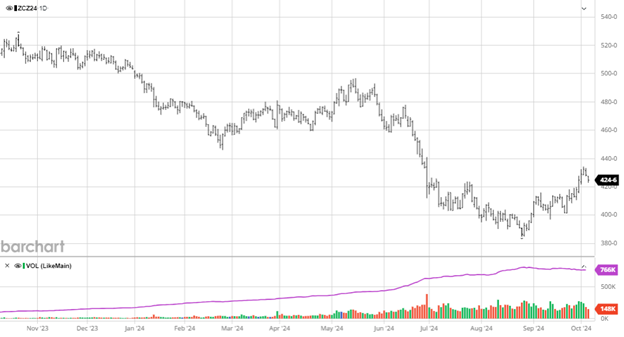

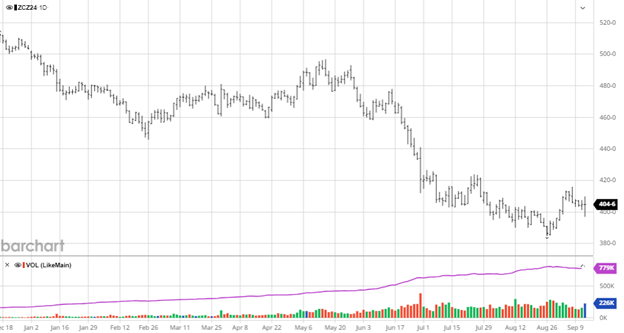

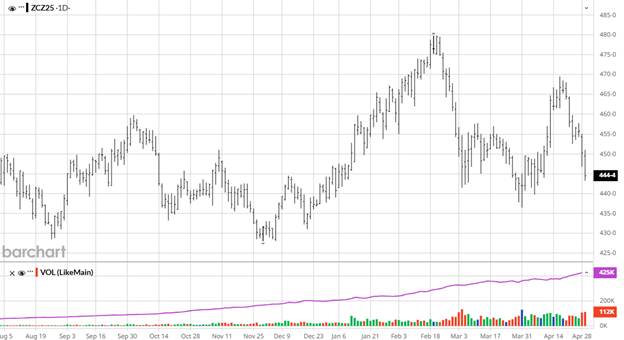

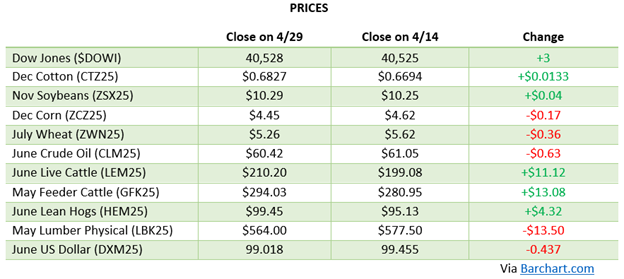

Over the past two weeks, corn futures have experienced significant volatility, primarily from trade policy developments and supply and demand dynamics. In early April, the market faced pressure as the U.S. implemented tariffs on imports from Canada, Mexico, and China, prompting retaliatory measures, including a 15% tariff on U.S. corn by China. This escalation raised concerns about reduced export demand, leading to a sell-off in corn futures. However, the market rebounded when President Trump announced a delay in the implementation of tariffs on Mexican goods, alleviating fears of diminished demand from Mexico, the largest importer of U.S. corn. The market has tight US and global supplies with the recent USDA revisions resulting in a stocks-to-use ratio of 9.6%, the lowest in 3 years. South American weather remains non-threatening and US planting continues to make progress with many areas ready to get rolling in May.

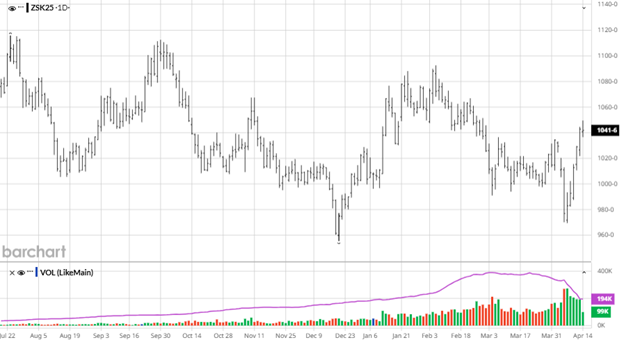

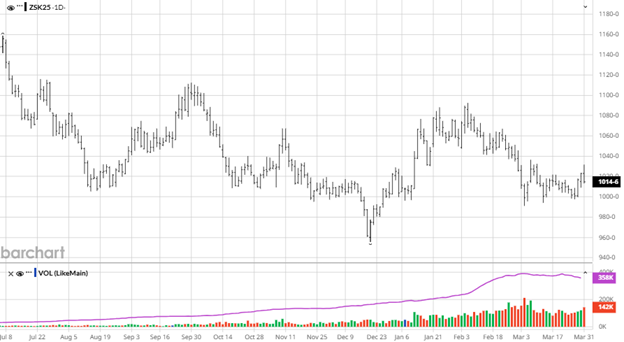

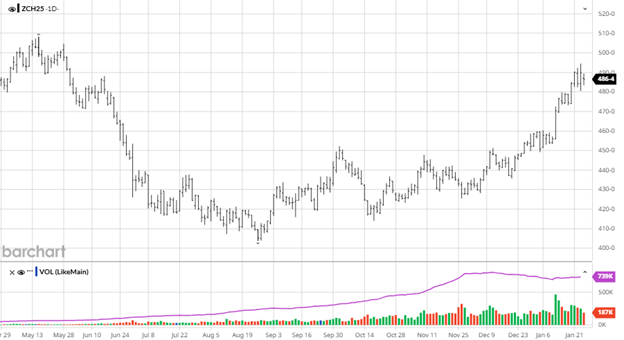

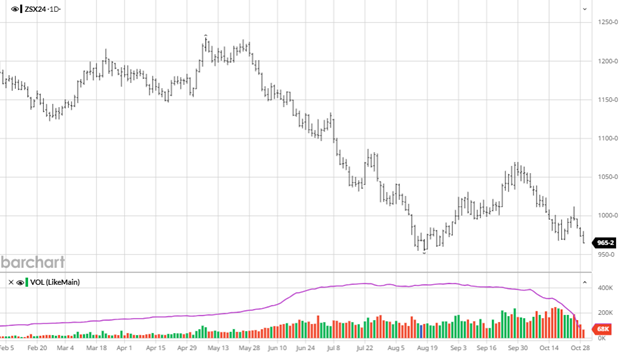

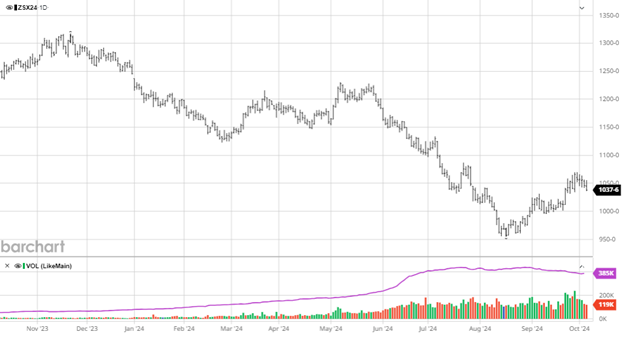

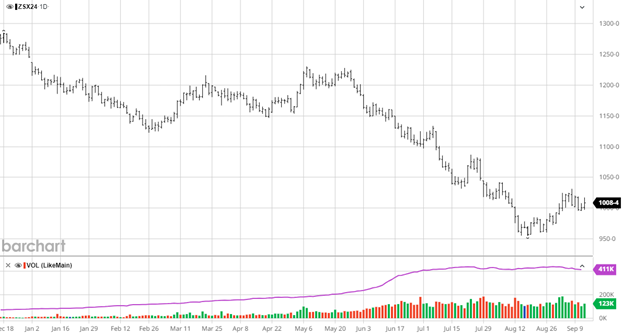

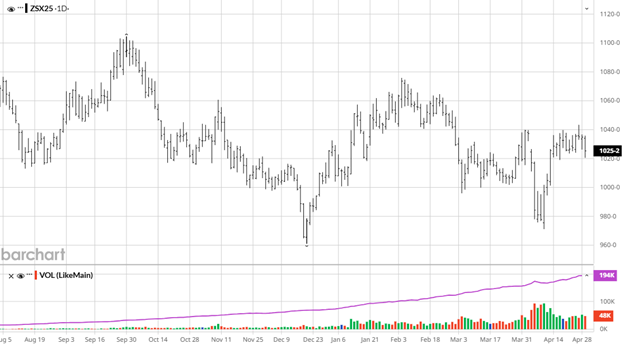

Soybeans have also faced sharp swings in the past two weeks, driven by global trade tensions, weather and repositioning. China’s retaliatory tariffs on US beans lead to a big drop in US exports, at the same time Brazil’s exports to China surged. Weather in some areas of Brazil has raised some concerns about a potential dip in yield but another record crop is still expected. Spec traders have started positioning a small long position after it has been beaten down so much they are hoping for a rally that could come with any US issues with planting or lower planted acres.

Soybeans have also faced sharp swings in the past two weeks, driven by global trade tensions, weather and repositioning. China’s retaliatory tariffs on US beans lead to a big drop in US exports, at the same time Brazil’s exports to China surged. Weather in some areas of Brazil has raised some concerns about a potential dip in yield but another record crop is still expected. Spec traders have started positioning a small long position after it has been beaten down so much they are hoping for a rally that could come with any US issues with planting or lower planted acres.

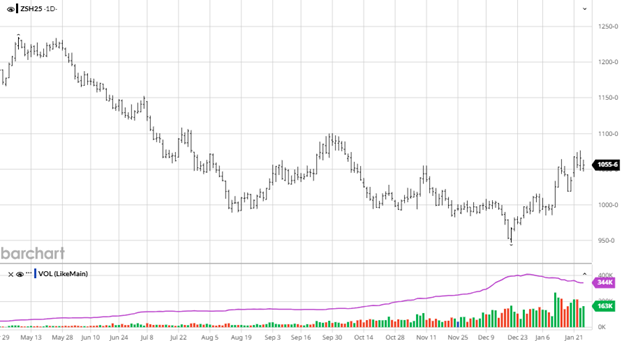

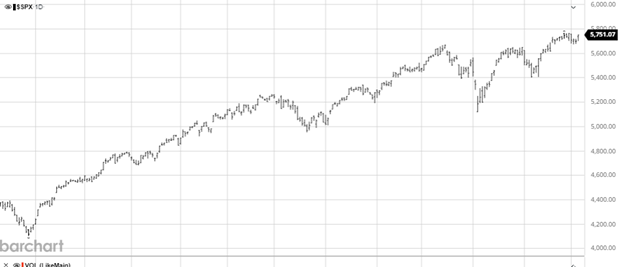

Equity Markets

Markets have seen wild volatility this month but have calmed lately as the S&P 500 tries to hold above 5,500, a point many saw as resistance. While trade negotiations on tariffs continue with the world the market needs a stream of announcements that progress is being made as the 90-day delay will get here very quickly.

Other News

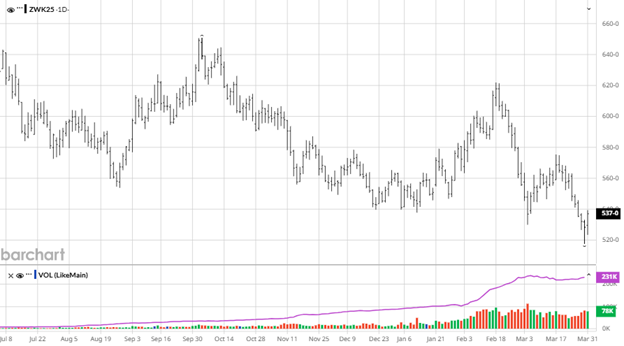

- Global wheat supplies face potential tightening through next year due to lower production in the Black Sea as the Russia Ukraine war continues on.

- Cattle prices continue to record highs as the US headcount is the lowest level since 1951.

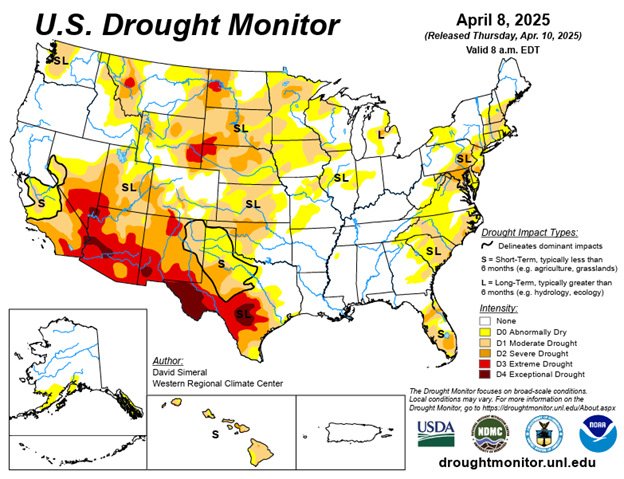

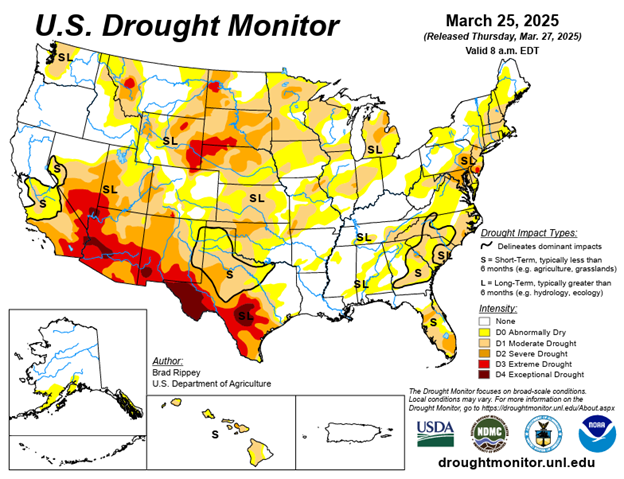

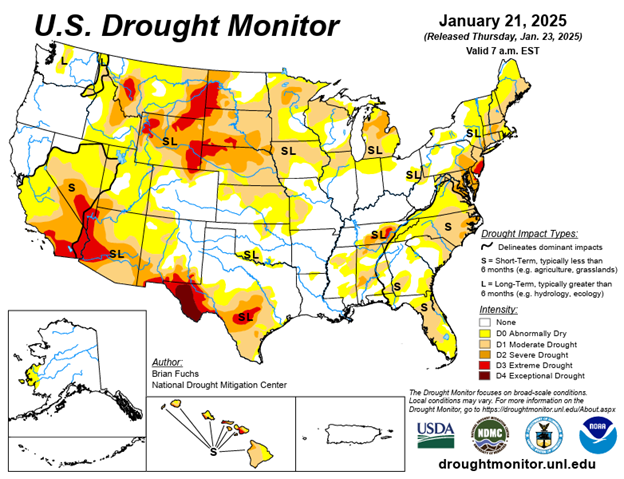

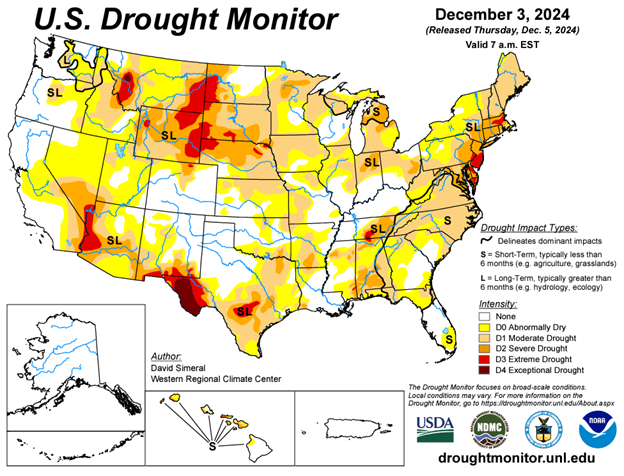

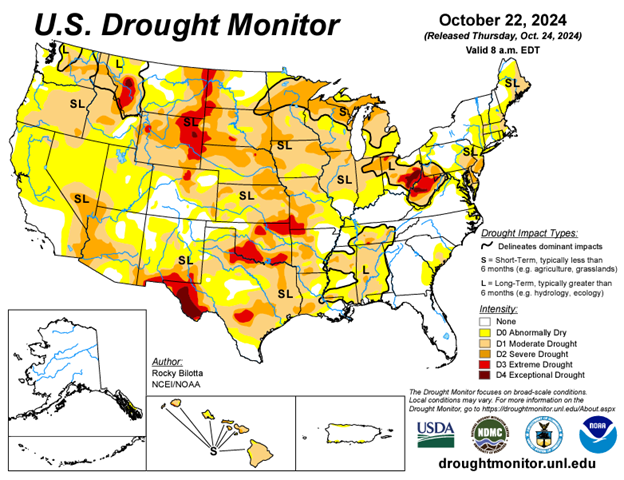

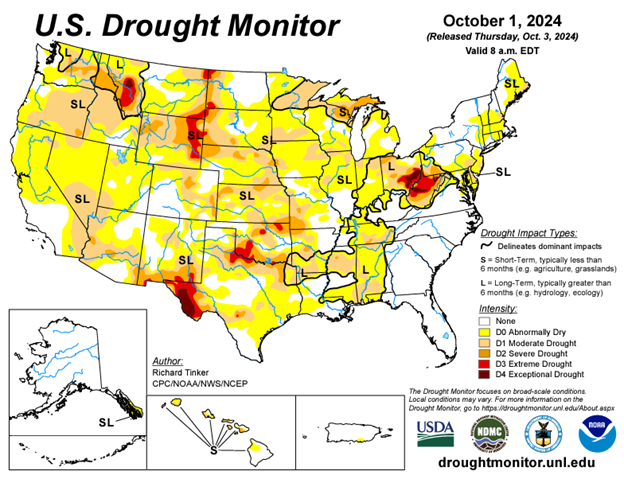

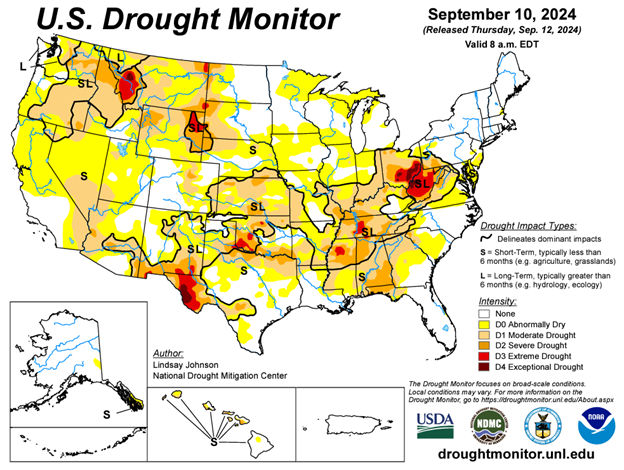

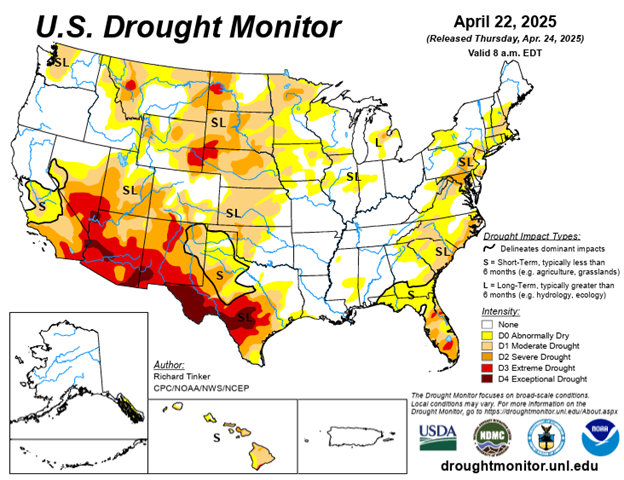

Drought Monitor

As planting approaches here is the most recent drought monitor.

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.