Ag Market Updates: March 27 – April 1

Watch our corn and grain experts talk through this new report in our podcast The Hedged Edge. Or you can continue on below and read our analysis on the corn, soybean, and wheat markets.

The USDA coming out with a bullish report? 2021 is due to have some crazy things happen after how 2020 went. The Prospective Plantings Report that came out this week pegged the US corn crop at 91.144 million acres when the average trade estimate was 93.208 million acres. The USDA lowered their numbers from the USDA Ag Forum earlier in the year that projected 92 million acres. Along with the acreage coming in below expectations, the Stocks report was lowered from the March 1 number of 7.952 billion bushels to 7.701 billion. So, what does all this mean? It means that an already tight world supply has to meet the needs of a world coming out of a year of lockdowns where demand is expected to ramp back up to pre-pandemic levels. The US crop is always important in the world supply but any major weather issues in the US with this acreage could cause major issues in the world supply while also boosting prices. These numbers could still change as farmers can always decide to plant more but until the summer report of actual acres planted these will be the numbers to go off of.

Soybeans, like corn, had a bullish report with prospective plantings coming in at 87.600 million acres. The average trade estimate was 89.996 million acres and the USDA Ag Forum had estimated it at 90 million acres. This led to a limit-up day following the report as the demand for beans is expected to continue to be strong as the world reopens and the US will need to meet that demand as South America did not blow their growing season out of the water. As we have continued to see the problems with ASF in China that is the current cloud still over this market even with the report. Even with the limit up move you can see in the chart below that it came after a long losing streak to get it back in the higher side of the range of the last 2 months. Thursday beans gave back a good chunk of their gains following the report as the market digests the report and all other information in the market right now. If this acreage number is accurate for the year and the crop isn’t trend line or better then prices should continue to be strong and go up from here. If there is a great growing season and the ASF outbreak in China gets out of control it could put some pressure on this market.

The report for wheat came out bearish but was pulled up after the report by corn and beans. All wheat acres came in at 46.358 million acres when the average trade estimate had it at 44.971 million acres and the USDA Ag Forum had it at 45 million acres. Wheat appears to have taken some of the 1.4 million acres from corn and soybean estimates. The stocks came in above estimates to pushing more bearish news into the market. It will be interesting to see if this weekend’s freeze for the winter wheat areas changes some minds on abandoning acres. As you can see from the chart below wheat has had a more volatile run but is still much higher than it was over last summer despite the last few weeks of losses.

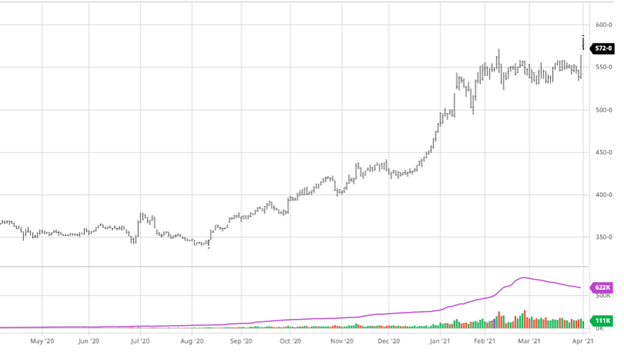

Dow Jones

The Dow gained on the week as markets calm down following the spike in interest rates as their rise has slowed. President Biden rolled out his plan for over $2 trillion in infrastructure improvements this week and still has more spending plans to go. With the money that has been pumped into the economy through stimulus and reopening continuing in the US, there are many questions ahead but one thing we know is that Biden plans to raise taxes to help pay for these plans which will be important to pay attention to.

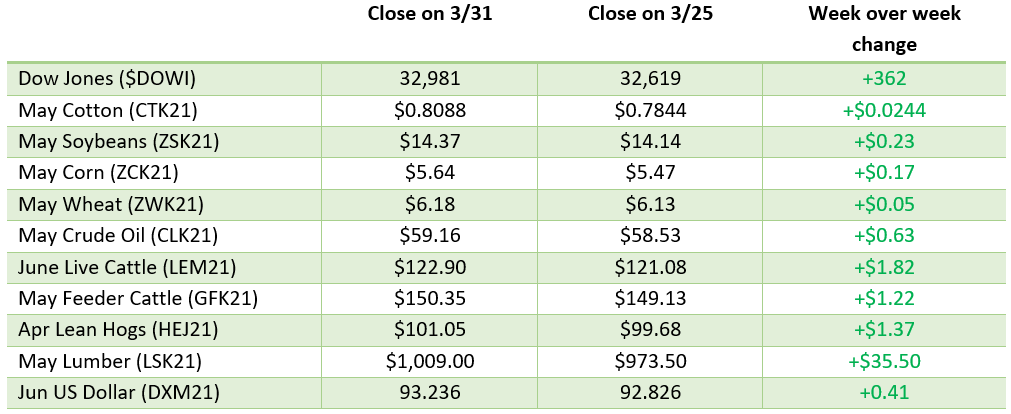

Weekly Prices

Via Barchart.com