September futures settled at $20 under print, the first recorded discounted expiration in almost 12 months. Was it a one-off trade or a change in market dynamics? It’s too early to tell, but we must remember that it doesn’t necessarily indicate a bull or bear market, only a change. If it holds, it is a shift from basis trading strategies to forward pricing. I don’t expect to see much forward selling from the industry. They didn’t touch the basis, so why do forwards? I expect the industry to continue to trade extremely guarded through the end of the year. We saw an almost 30% reduction in the commercial short position after the Canfor announcement. That massive bail is a result of the guardedness of the trade. Most took hedges off above $520 and are naked under $500. Is this a dynamic shift or a fluke?

Production is getting cut. When will the supply cut be a factor? Someday, but not tomorrow? The struggle now is to continue to navigate a balanced marketplace. Can value be brought back into play in housing after a few rate cuts and increasing existing home supplies? We are starting that process based on the futures trade, but it could take another year. If you look back, in 2012, there was a fear of a fiber shortage that shot prices higher. It took five years to get our next spike to new highs in 2017. And finally, our covid 2021 debacle. My point is it takes years to create the undersupplied pocket. If we are there, our lows will be higher and highs sharply higher. Today, all the pressure is from the funds or the algo selling. That’s where the work needs to be done. The mills should start with the funds if they want to curtail something.

Technical:

The November contract low is 473.00. September’s low was 455, and July’s was 418. The market is already stair-stepping higher, making these lows significant points. As we head into October and the traditional lows, 473 is key. A trade under 473 indicates a more aggressive fund-selling program, knocking all fundamentals out of the equation.

The technical picture is negative for the short term. To change the trend, we need to reach an oversold condition. The problem with the RSI today is that it holds long-term bearish divergence. It remains high every time the market breaks. Walk that down into the low 20s, and the momentum can change. I could bring in almost every other oscillator and show the same results. The selloffs are not hurting the market.

The key upside point is 518. This area has been key for months and could be the top for now. The computers will target the low of 473. It could be a $10 market until the next announcement comes out.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636

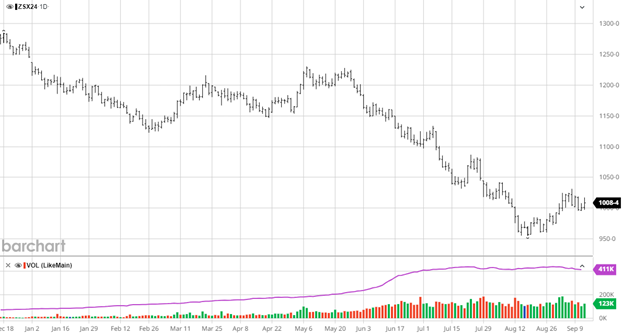

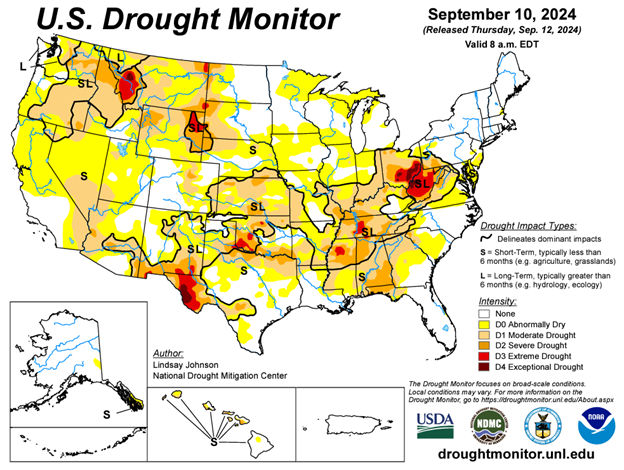

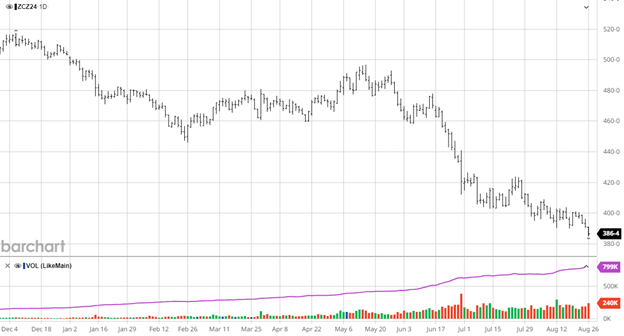

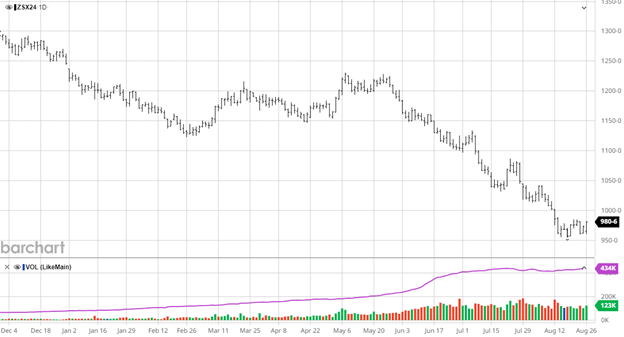

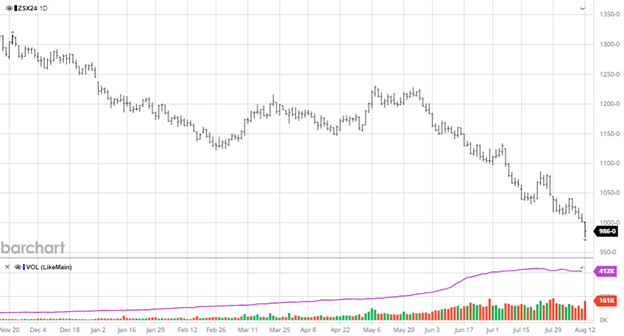

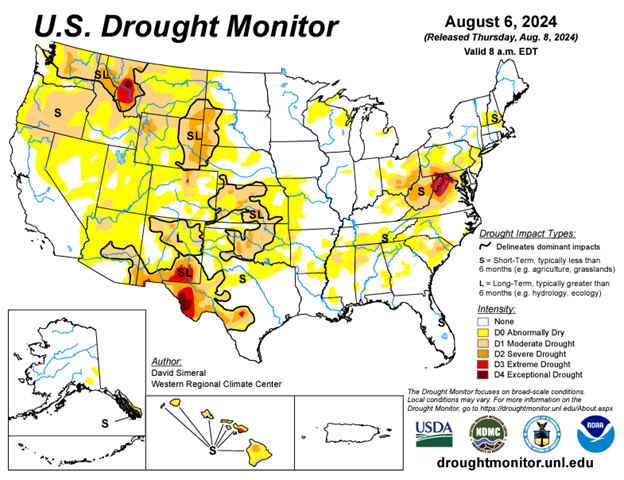

Soybeans have seen a nice 50+ cent rally off recent lows with dryness in areas causing a little concern with pod fill and some pickup in demand. The USDA kept yield the same at 53.2 bu/ac as they agree with Pro Farmer tour that a massive crop is out there. Like corn, this recent bounce off lows is encouraging but may setup a range bound trade until harvest gets rolling and we have a better idea on the true yield. The USDA did slightly lower US ending stocks in both 23/24 and 24/25. Continued exports and any issues to South American planting are needed to drive beans higher in the current market.

Soybeans have seen a nice 50+ cent rally off recent lows with dryness in areas causing a little concern with pod fill and some pickup in demand. The USDA kept yield the same at 53.2 bu/ac as they agree with Pro Farmer tour that a massive crop is out there. Like corn, this recent bounce off lows is encouraging but may setup a range bound trade until harvest gets rolling and we have a better idea on the true yield. The USDA did slightly lower US ending stocks in both 23/24 and 24/25. Continued exports and any issues to South American planting are needed to drive beans higher in the current market.