Futures trading has been around for hundreds of years with the first exchange, Dojima Rice Exchange, starting in Japan in 1730.

The United States got its first official commodity trading exchange in 1848 when the Chicago Board of Trade (CBOT) was created. Chicago was the ideal location for the exchange with rail lines and proximity to the heartland of American agriculture and an already booming metropolis. As one would expect, corn, soybeans, and wheat were among the first futures contracts traded with corn leading the way.

Eventually the CBOT merged with the CME (Chicago Mercantile Exchange) to form the CME Group that exists today as the world’s largest financial derivatives exchange. While futures and options are used to trade several asset classes through the CME, we will focus on the agriculture sector and the uses there.

What are Futures and Options?

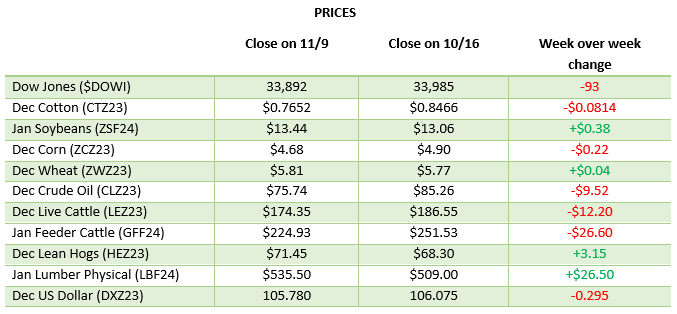

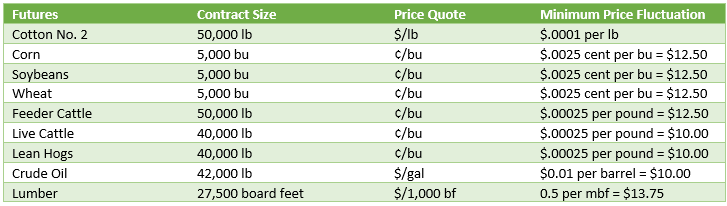

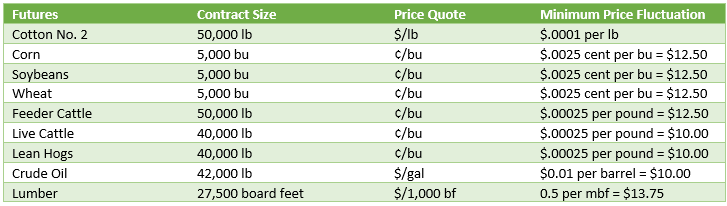

Futures and options are tools that traders use to both speculate and hedge. A futures contract is a legally binding financial instrument that allows someone to buy or sell a standardized asset for delivery at a set future time for a set price. Futures are different from forward contracts because of the standardized contracts, and they are traded on exchanges. While a forward may be customized with the point of delivery the contracts traded on exchange have defined contract amounts (see chart below).

An options contract is the right but NOT the obligation between two parties to make a potential transaction of an underlying security at a preset price before or on the expiration date.

As we go through all the uses and potential ways futures and options can be used here are some questions you should be able to answer at the end.

- What are the basic uses of futures and options?

- What advantages and disadvantages does using futures and options have?

- How can I use these as risk management tools?

- How to calculate the profit or loss from a trade?

Hedging with Futures

Hedging in the futures world can best be thought of as a type of insurance. It is used to manage the risk that prices could move adversely to your interests. Hedging is used in all markets to manage positions and reduce exposure to various risks including but not limited to dramatic increases or decrease in price.

Hedging is used in the production agriculture industry to help protect downward price movements and for buyers/ end users to lock in prices for goods that will be sold/bought in the future. Whether you are a farmer selling your crop or an end user buying the grain there are hedge strategies that are available for your operation.

While futures are the most straight forward method of hedging, options are also very popular as they provide some flexibility. Let’s look at a couple examples:

Ex. You are a producer and want to hedge the risk of prices moving lower:

A farmer believes the basis, currently -$0.20, will improve over the next couple months but is happy with a $6.50 futures price. They sell $6.50 March futures while storing the grain. They were right and basis is flat come February, but the price fell to $6.40. This would result in a final price of $6.50 for the farmer minus fees and commissions ($0.10 trade profit + $0.00 basis + $6.40 cash price – fees and commissions). If they had just made the sale at the time when basis was -$0.20 they would have only received a price of $6.30.

On the other side if prices had gone up to $7.00 and basis had remained at -$0.20 the farmer would receive that $6.30 price minus fees and commissions ($7.00 price at time of sale to elevator -$0.50 loss from trade – $0.20 basis – fees and commissions = $6.30). If they were right about basis and it did improve to $0.00, then the price they would receive is $6.50 minus fees and commissions ($7.00 price from elevator – $0.50 loss from trade + $0.00 basis – fees and commissions)

*Fees and commissions vary by broker

Ex. You are an end user that buys grain to feed cattle.

The feeder is comfortable paying current prices because they believe they can make a profit locking in part of the input costs at current levels but is worried prices will move higher. They buy 25,000 bushels for a future month (let’s use July) for $6.00. If prices go up to $6.50 when it is time to buy the corn in July, basis remains the same, they will save themselves $.50 cents a bushel or a total of $12,500 – minus any fees and commissions* ($6.50 x 25,000 = $162,500; $6.00 x 25,000 = $150,000). In this scenario they were right and were able to protect against adverse price movements and save themselves money.

If they had been wrong and prices moved lower by 50 cents, then they would have cost themselves $12,500. The payoff of hedging comes with knowing you have certain prices locked in and help set ceilings and floors to help you budget and manage risk.

While these are some straightforward ways in which futures can be used to hedge, there are other strategies that traders employ that may be specific to the customer. For more information on hedging grains check out the education courses on the CME Group website.

Hedging with Options

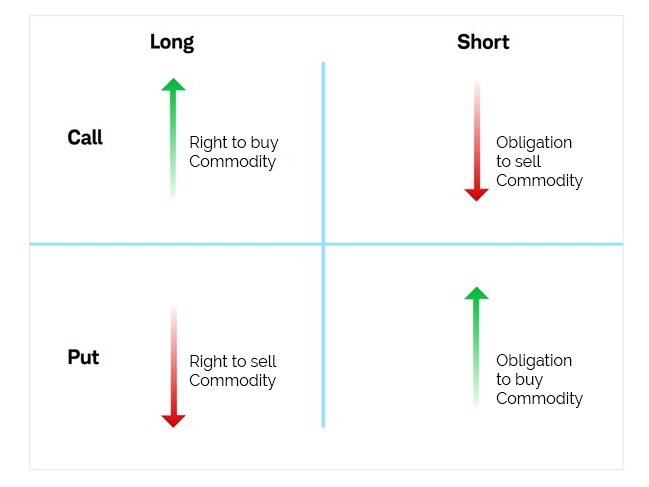

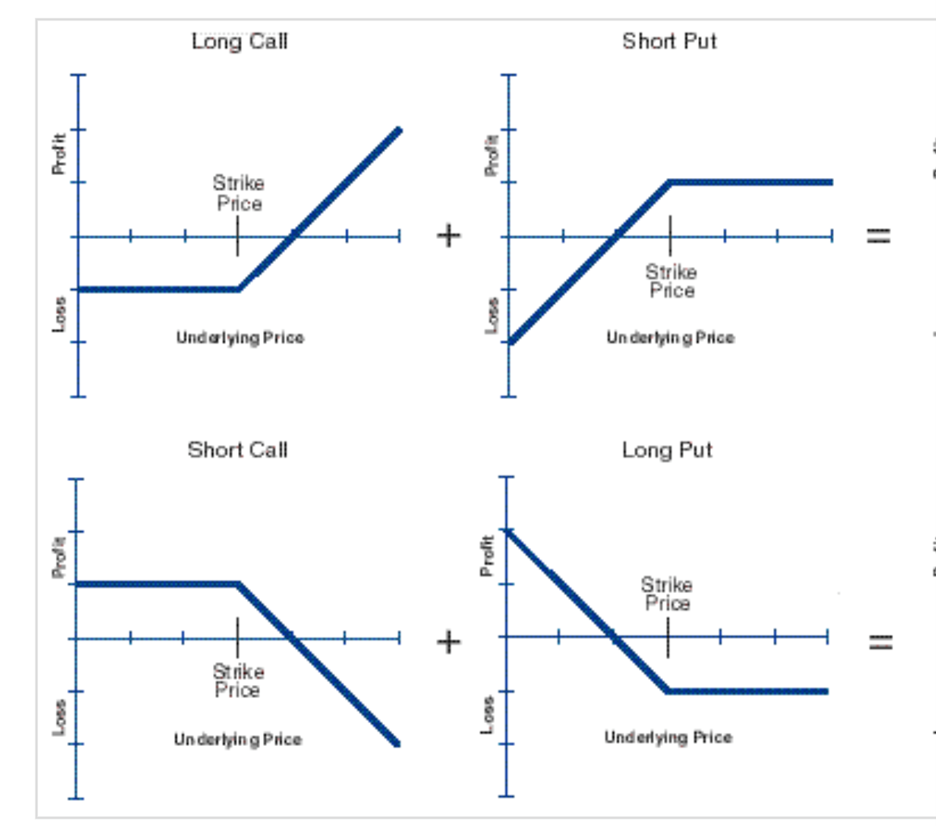

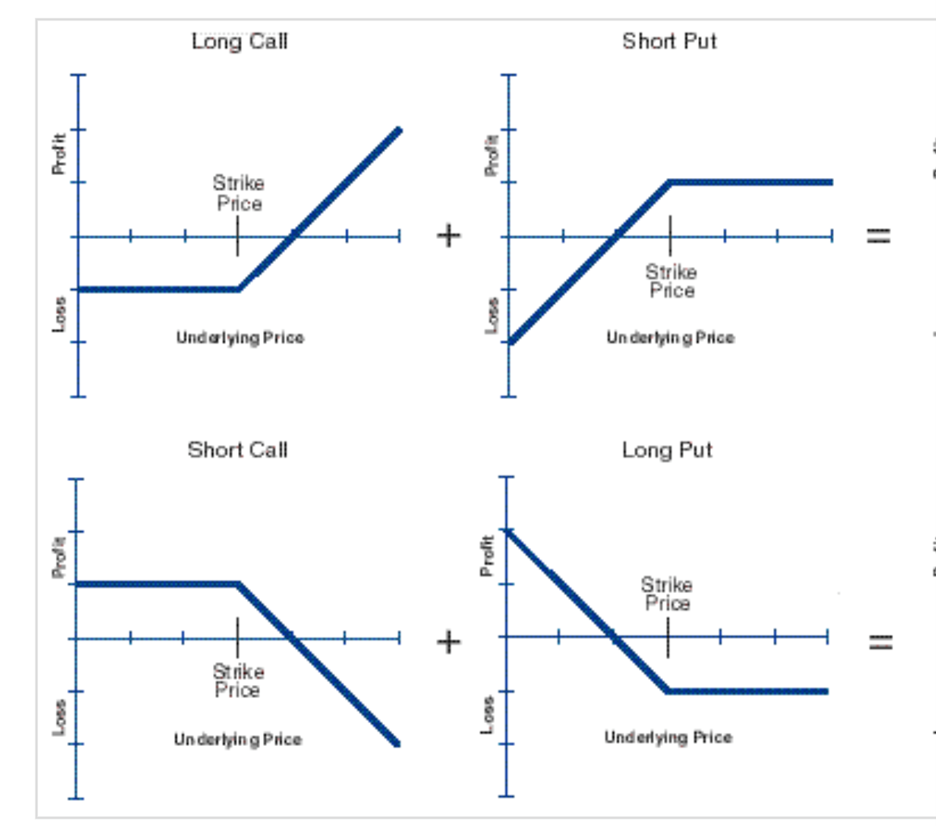

Being long an options contract is the right, but not the obligation, to buy or sell the underlying futures contract at a predetermined price on or before a given date in the future. Many customers like these because they require less capital up front, but that does not eliminate risk. Below the charts show the difference in movement.

Via Schwab

Via StackExchange

Options can be used to reduce uncertainty and limit loss without significantly reducing the potential returns from the other side. There are put and call options that each have different uses and strategies around. Here is an example with each.

Ex. You are a farmer looking to limit downside risk.

1 Dec corn put option is bought for 20 cents per bushel with a strike of $6.50 expiring in Nov. The 1 contract represents 5,000 bushels. The farmer is risking the $1,000 + commissions and fees he paid up front (5,000 bu x $0.20) to protect a move lower. If the price when the option approaches maturity of Dec corn is $6.00 then the farmer successfully protected that $6.50 price while risking the $0.20 (the option would cost around $0.50 then and you would sell it to get out of it or exercise it and get assigned a short position from $6.50). The total profit on the trade would be $0.30 less commissions (Option strike price of $6.50 – Market settlement $6.00 – cost of the option $0.20).

If the price had moved higher to $7.00 you would benefit from the higher price to make your sale but the $0.20 you paid for the option would be worth close to $0.00, making your actual price $6.80.

Ex. You are an end user looking to limit the upside price risk.

1 Dec corn call option is bought for 20 cents with a strike of $6.50 expiring in Nov. The end user is risking the $1,000 + commissions and fees he paid up front to protect against a move higher. If the price when the option approaches maturity of Dec corn is $7.00 then you are protected against that move while risking the $0.20. The option would be worth close to 50 cents ($2,500-commissions and fees – the cost of the option $1,000 for a total profit of $1,500 per contract).

If the price had moved lower to $6.00 then you would benefit from buying at a lower price but would lose the 20 cents with the price of the option being close to $0.00, making your real purchase price closer to $6.20.

There are advantages and disadvantages to using either hedging strategy, so it is important to think about what you are trying to accomplish when taking a position. The advantages include ease of pricing, liquidity, and price risk hedging. By actively hedging you can work to limit the price risk or lock in prices that you like or believe can lock in a profit margin for your business. The disadvantages are the risk of being wrong and adverse price movements against your position. As shown above, while these tools can be very helpful it is important to understand their limitations and risks.

Speculation

Futures and options are also used in the markets every day for speculative purposes allowing for additional volume and liquidity to support the hedging side of the market. That said, with additional volume comes increased volatility and price movement forcing all market participants (hedgers and speculators) to be highly focused on managing risk and profit margins. Practically, the examples above work the same way for someone trading these contracts that do not deal with the physical side.

For more on how hedge funds are utilizing commodity markets, check out the RCM Alternatives Guide to Commodity Trend Following: https://info.rcmalternatives.com/trend-following-guide.

Margin

Futures initial margin is the amount of money that you must deposit in advance of entering a futures position with the FCM (Futures Clearing Merchant). Unlike the margin in a stock account, there is no money being borrowed or an interest rate to be paid for using house funds. Rather, margin is cold / hard cash deposited by the customer in their account at the FCM that acts like a partial downpayment to hold the position. If the market moves against the initial trade, traders can expect that additional funds will need to be deposited.

Similar to futures margin, option margins are an important factor when using options strategies. Margin is the cash an investor must have on deposit as collateral before purchasing (buying) or writing (selling) options. Often times, the initial margin requirement for an option is low; however, there are more factors to consider with option margin pricing – including but not limited to changes in volatility or the proximity to option expiration.

In the case of both futures and options, margin requirements are set by the exchanges and change from time to time at the sole discretion of either the exchange or FCM.

Maintenance margin is the minimum equity an investor must hold in the account after the purchase to continue to hold the position.

Expiration and Settlement

Expiration dates vary based on the derivative being traded but is the last day that derivatives contracts are valid. Most option contracts are closed or rolled before expiration to avoid assignment.

If the futures contract is held too long, then the customer could risk being assigned delivery. Over 95% of the derivatives are exited early but there are options to take delivery should that be desired.

A link to the expiration calendar can be found here.

Summary

In summary, futures and options trading offer a dynamic landscape for both hedging and speculative purposes. Whether you’re a farmer safeguarding against price fluctuations or a trader seeking to capitalize on market movements, understanding these financial instruments is crucial.

The advantages of ease of pricing and liquidity come hand in hand with the responsibility to manage risks diligently. As we’ve explored the intricacies of hedging with futures and options, delving into the significance of margin requirements and the nuances of expiration and settlement, it’s evident that these tools wield immense potential when managed properly.

RCM Ag Services

Farmers, producers and end users have special needs that our experienced hedging/ag trading team have been working through with clients for years. Improve your hedging strategy by making use of RCM’s market analysis and discussing hedge solutions with our local experienced agricultural advisors. Contact us Here: https://rcmagservices.com/contact/

To dive even deeper into the world of futures and options, explore the education materials on the CME Group website here.

Happy trading!

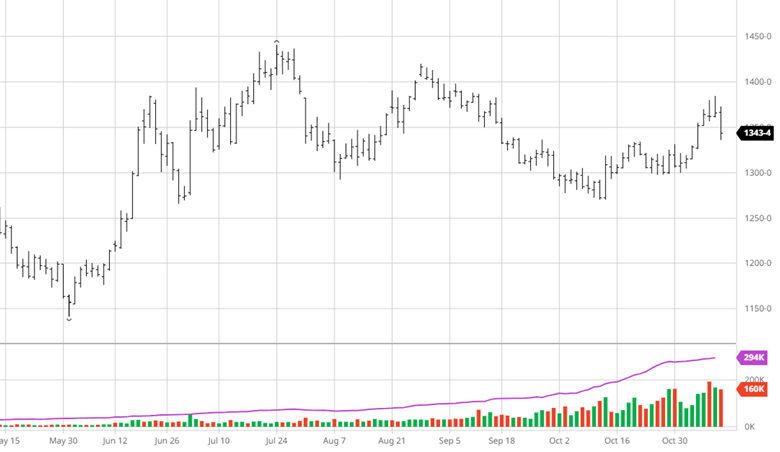

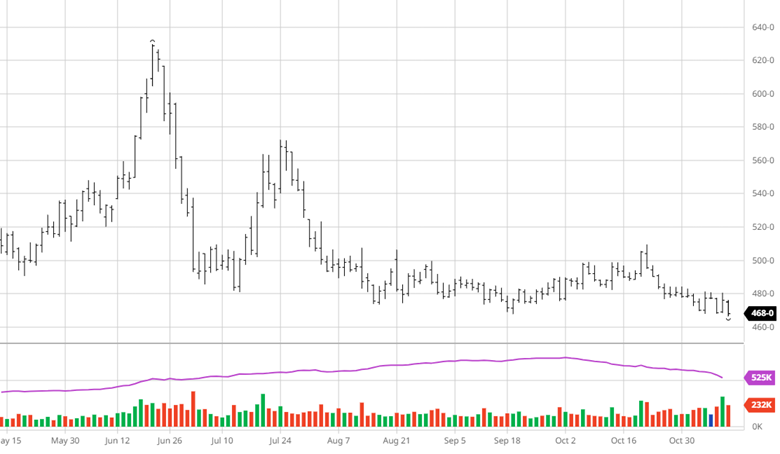

Soybeans had seen a good run over the last couple of weeks until the USDA report took a hit. While beans are still well off their lows the report’s reaction saw beans lose 20 cents. Like corn, soybeans saw their yield increased to 49.9 bu/ac. The Chinese demand situation and northern Brazil’s dry weather have been bullish for beans and will be a bullish talking point if they last and the main news moving forward. US soybean yield 49.9 bu/ac. US soybean production 4.129 billion bushels.

Soybeans had seen a good run over the last couple of weeks until the USDA report took a hit. While beans are still well off their lows the report’s reaction saw beans lose 20 cents. Like corn, soybeans saw their yield increased to 49.9 bu/ac. The Chinese demand situation and northern Brazil’s dry weather have been bullish for beans and will be a bullish talking point if they last and the main news moving forward. US soybean yield 49.9 bu/ac. US soybean production 4.129 billion bushels.