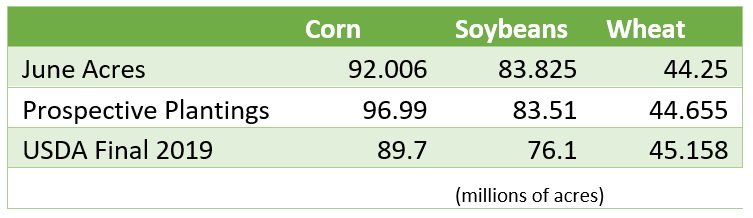

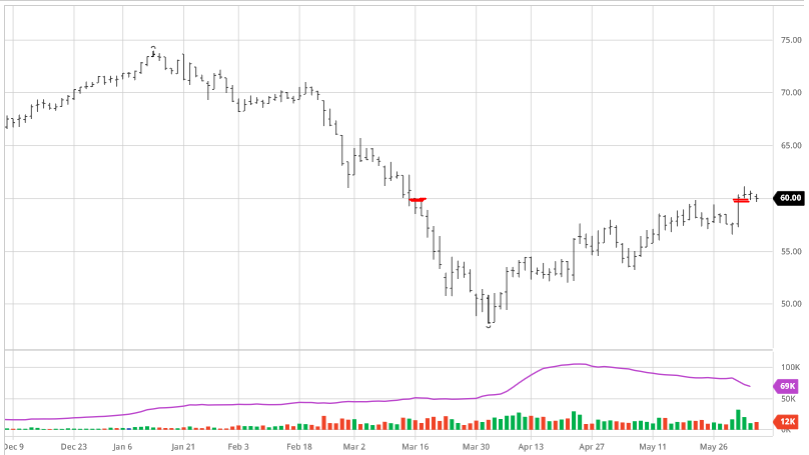

Corn stayed level on the week after last week’s rally from the storm damage. Pro Farmer Tour is on the road this week looking at several areas across the midwest. The markets will be keeping an eye on them as they try and assess the damage of the storm and how many bushels were lost as well as the potential yields in areas not affected by the storm. So far the PFT has shown better than expected yield potential for Ohio, Indiana, Nebraska and the Dakotas. The parts of Iowa and Illinois to miss the storm look strong as well but storm damage is ultimately what people are holding their breathe for. Parts of western Iowa that were not affected by the storm have had another problem of their own, a severe drought that is going to cost the area bushels as well. All eyes and ears will be on the PFT as they try and estimate how many acres/bushels were lost to the derecho; more than expected expect another small rally, less than expected we could see another retreat as we head into harvest season.

Soybeans saw a small boost this week as China continues to be a major buyer. PFT is also looking at beans and making estimates based off pod counts so that has been a market mover this week as well. Bean pod count numbers are running well ahead of last year and historical averages, which indicates the bean crop still has above trend line potential which is bearish at these levels after the recent 54-cent rally. Several areas are in need of rain as well in the next 10-14 day window that look relatively dry for most areas continuing the trend of the past couple of weeks. At this stage beans still have plenty of ways to go to get to harvest ready so keeping an eye on them as August comes to a close will be important as well as always keeping an eye on export numbers.

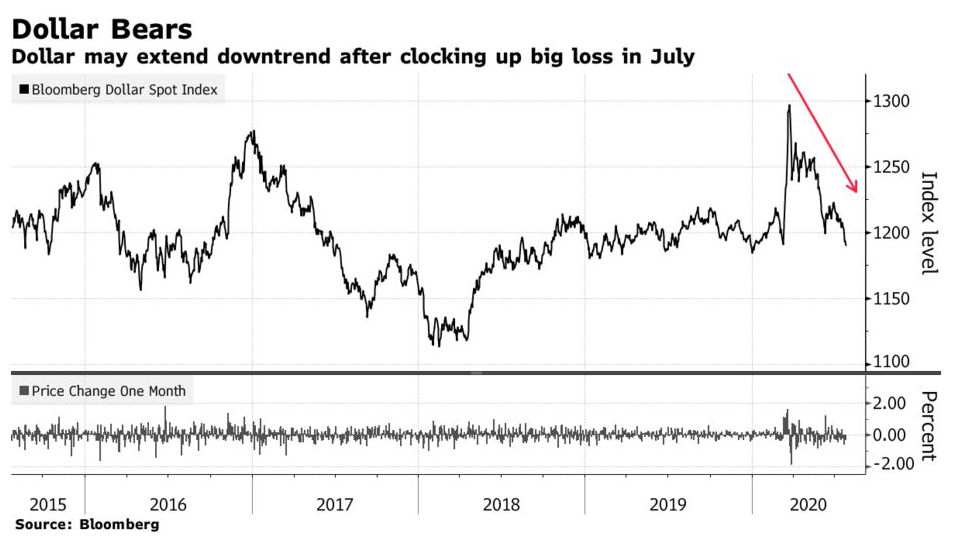

Cotton prices gained on the week as strong exports and the concern of the possibility of a tropical storm in the gulf grew. West Texas has already had many weather issues, but the south has had a good year so far for growing but a storm with strong winds could change that. China was the biggest buyer of cotton on this weeks export report with 13 total buyers. This is promising as it would appear that other countries demand is beginning to come back after a summer of shutdowns has kept exports low. The US dollar continues to struggle providing some support for US commodities on the world stage. Continue keeping an eye on China as more rains continue to affect the Yangtze River as it reached new record water levels this week. The US and PRC look to continue trade talks in the coming days so expect any news, positive or negative, to affect the market.

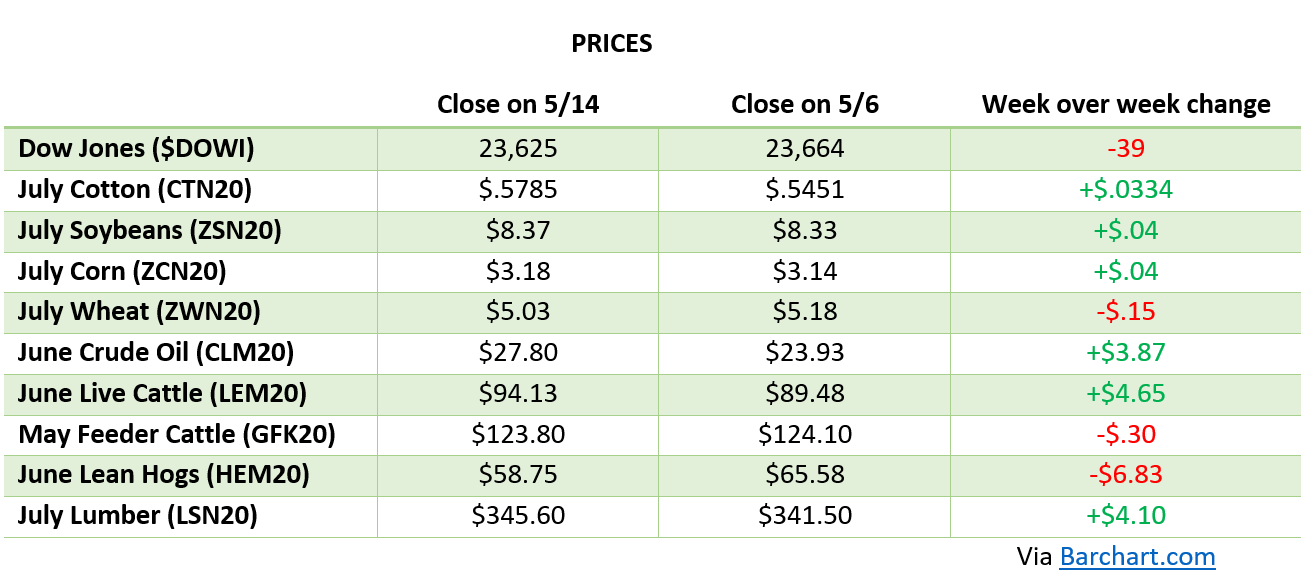

Via Barchart.com