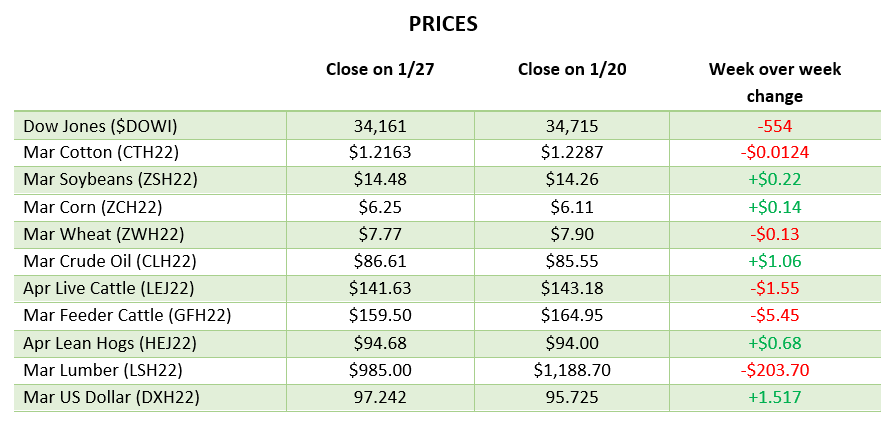

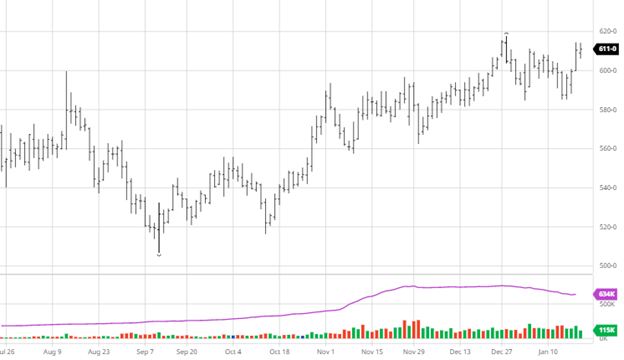

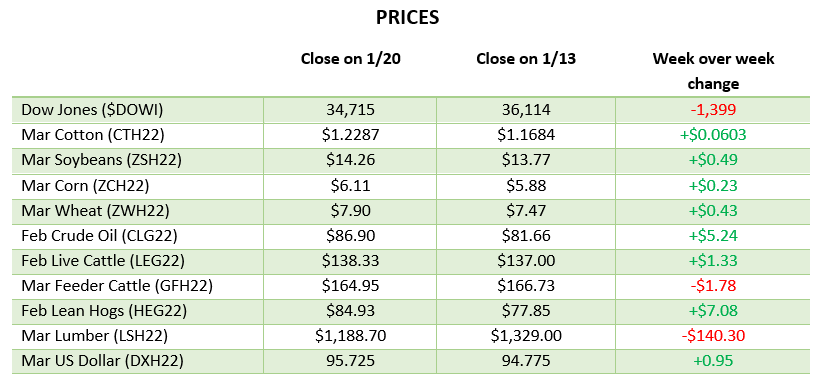

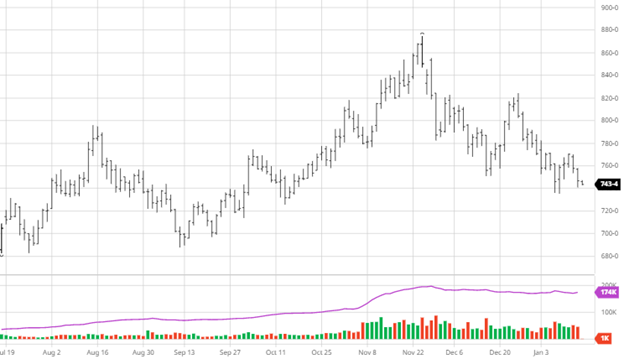

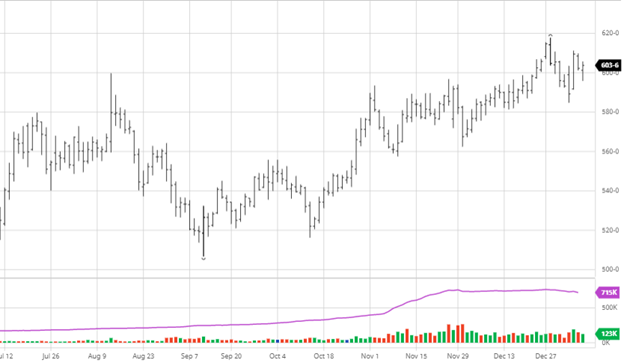

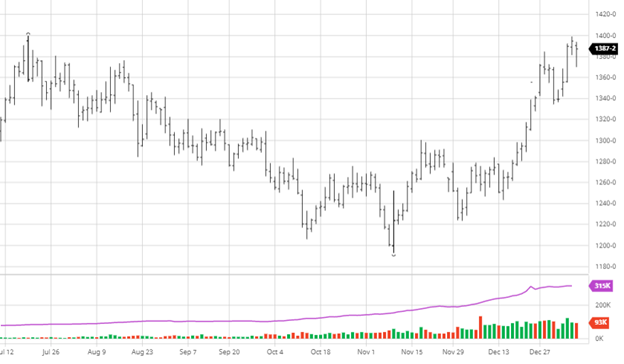

We entered 2022 looking for a more tempered and defined market but instead have seen some of the most violent swings in lumber history. The market ran up $230 in 8 sessions and then fell $375 in 8 sessions. That is in an industry that thinks making $10 on a car is good. This $11 tick market has always been clearly defined, with extremes in the $20 range. What has changed? The economics of the industry. The producing side has left its historic role as customer service orientated and now turned into profit-only speculators. The buy-side contraction has turned into a massive party of 4 with models built for much smaller structures. That is our all-in-all-out industry today. Once you mentally prepare for the swings, you will start to recognize the many opportunities that become available.

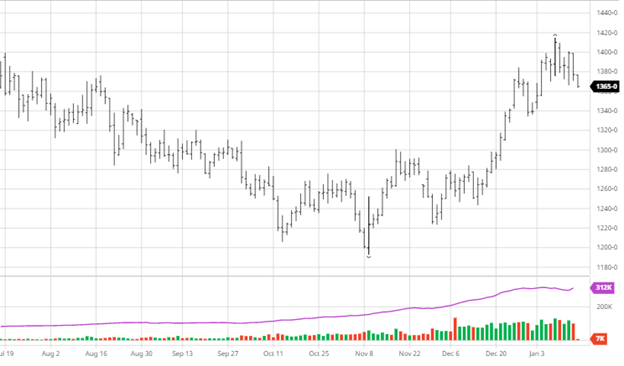

The market finished limit up on Friday after a straight down week. On Thursday, we started seeing the forward sale community showing up, which was even more aggressive on Friday. The key takeaway from the new buy interest is that prices have fallen enough to show value. That also means that the cycle isn’t over but just hit a pause. Between the constant demand, the 30-day inventory rule, and a $375 drop, one would have expected a bottom at some point. Was an 8 session down cycle enough? That is too hard to gauge, but this massive volatility could signal a market trying to find a balance. That doesn’t indicate the top is in, but if you’re long at $1,300, you could be sitting around for some time waiting to scratch it.

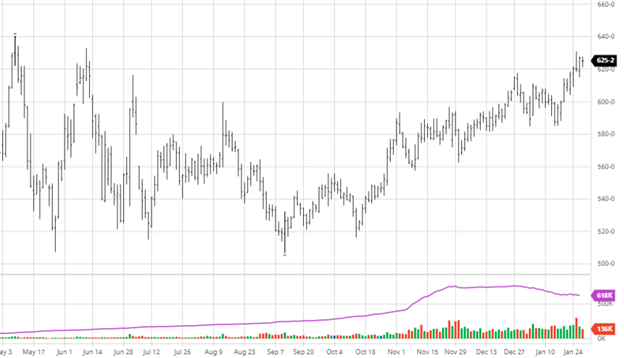

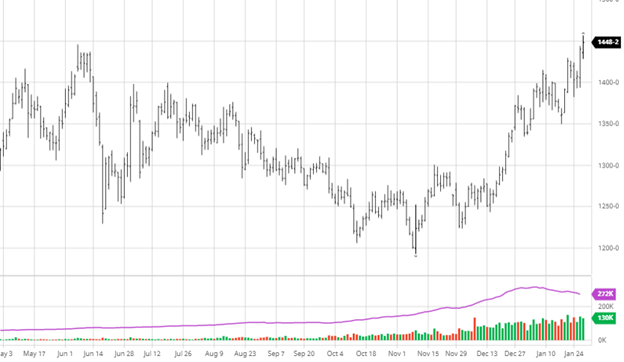

Let’s Get Technical:

With all the gaps above the market, any positive trade on Monday should be used to buy futures. Those stops are prominent and noticeable. With a 32% RSI, the spec trade is up. The technical focus is still on the 1059 fib area, which could be where the market finds some trade. A return to the 963 area would indicate a long cold summer ahead.

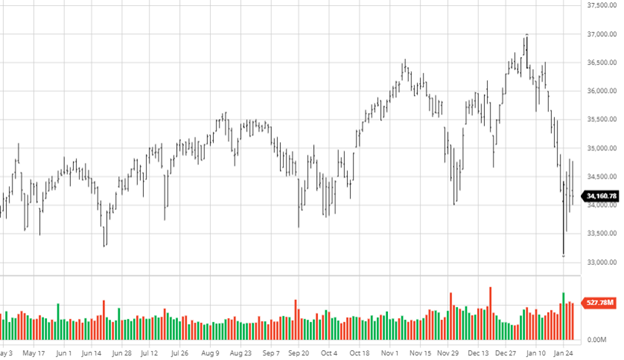

Weekly Round-Up:

At $1,000, we can comfortably say that those buying it are either doing a forward price for a customer, need it today, or enjoys speculating. I keep saying that over $1,000 is unsustainable, and these levels aren’t a norm and will continue to fail. That said, there might be a day that it will indicate a value. As for Monday morning, it is cheap.

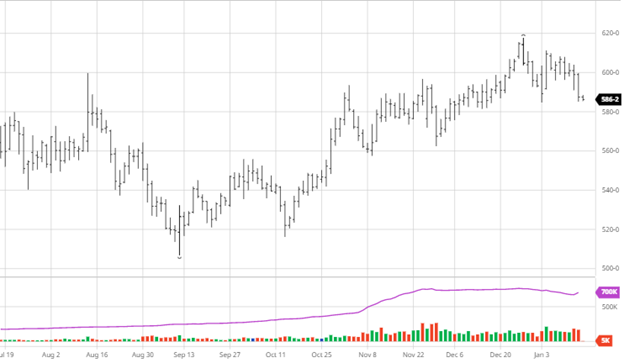

Open Interest and Commitment of Traders

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

https://www.cftc.gov/dea/futures/other_lf.htm

About The Leonard Report

The Leonard Lumber Report is a new column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Before You Go…

A special guest joins us for this episode of The Hedged Edge, who is well known for his many titles, which include Doctor, Editor-in-Chief, Dean, and Chief Academic Officer, just to name a few. Dr. Channa S. Prakash, Dean of the College of Arts and Sciences (CAS) at Tuskegee University, has served as faculty since 1989 and is a professor of crop genetics, biotechnology, and genomics. He is also well recognized for mentoring underrepresented minority students.

Tune in as biotech guru Dr. Prakash discusses everything from Alabama football, genetics as one of the most extensive agricultural advancements, the most significant risk factors to feeding the world over the next 30-50 years, plus everything in between. And as a bonus, we find out what sport he would be interested in playing if he went professional.