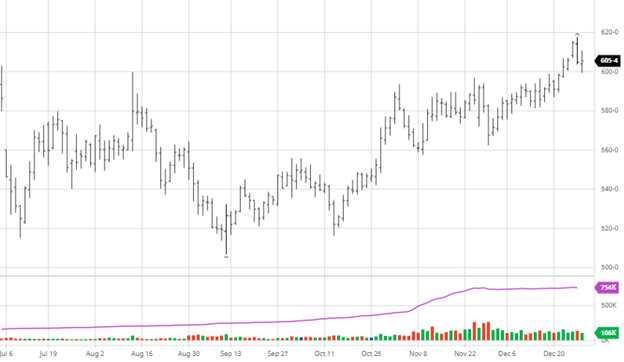

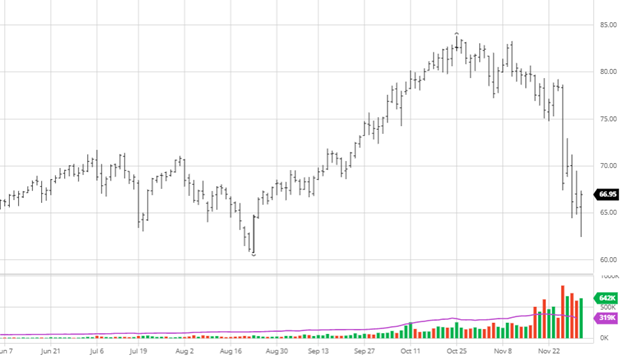

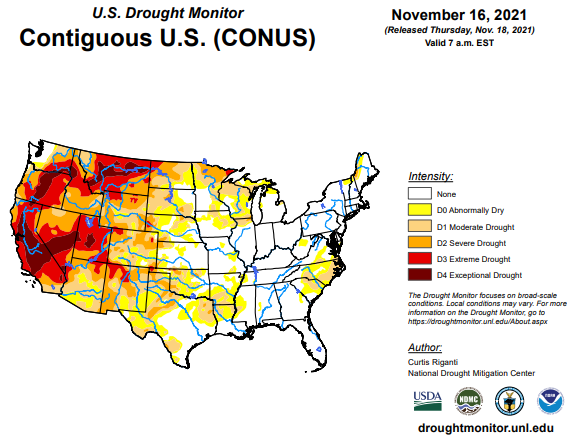

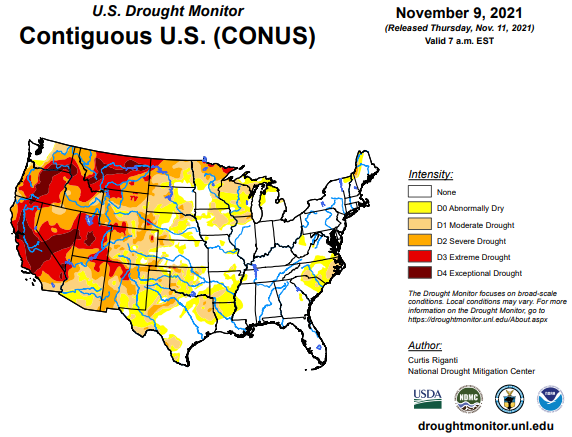

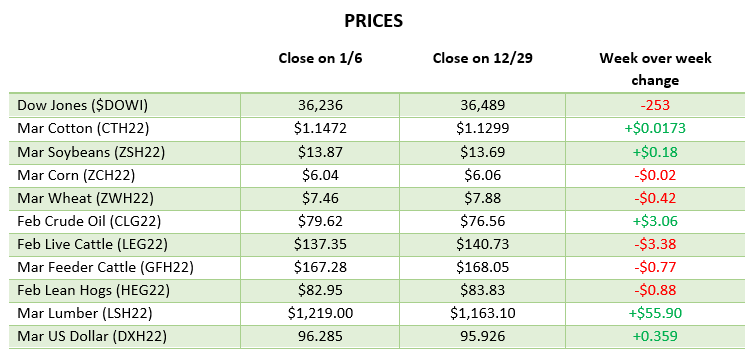

Happy New Year! Volatility has been the main storyline in the first week of 2022. There was enough surprise rainfall in the dry areas of South America to spook the markets right before the New Year before a slight bounce. This week’s ethanol production numbers were slightly below last week. Compared to the previous year, monthly ethanol production is running 9% over last year, but ethanol stocks are 8.3% below last year. Ethanol margins are still profitable as gas has rallied since Thanksgiving. The dryness and heat in Southern Brazil and Argentina remain in the forecast while northern Brazil continues to get too much rain. For reference, this time of the year in Argentina is the equivalent to June. If the forecasts prove true in the next couple of weeks, they will continue to stress the crop. Exports this week were nothing to write home about as the USDA described them as the “Marketing year low.” If South America’s crops continue to struggle, we could see an increase in exports, but the opposite could be true if the weather improves.

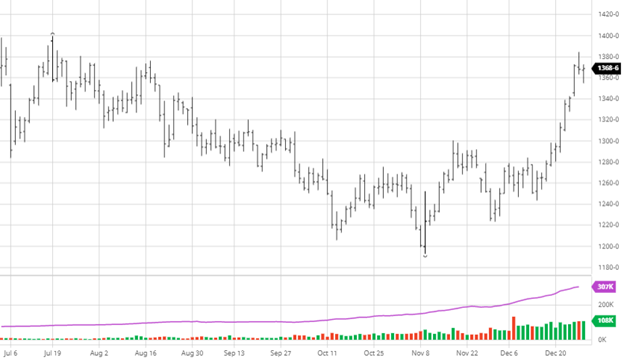

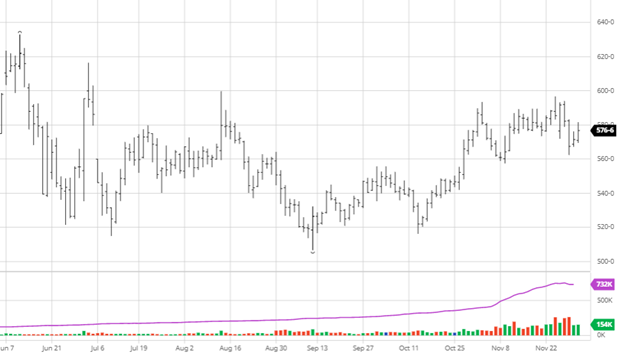

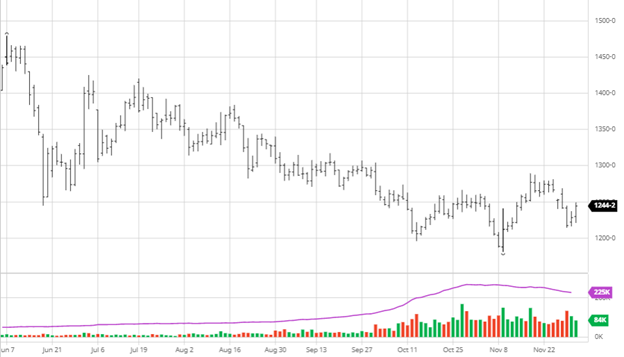

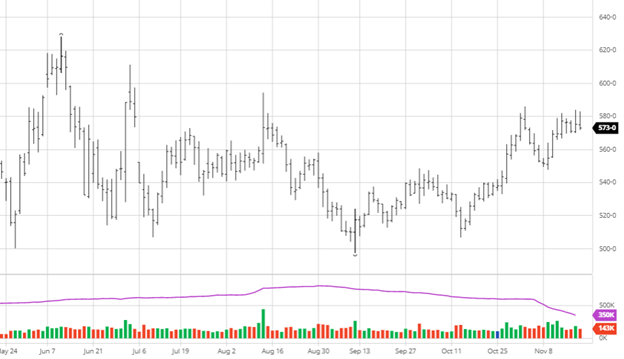

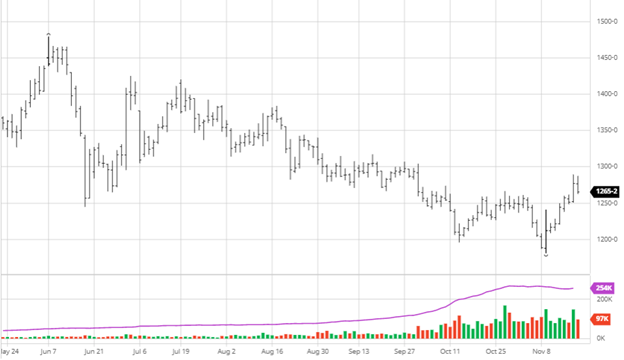

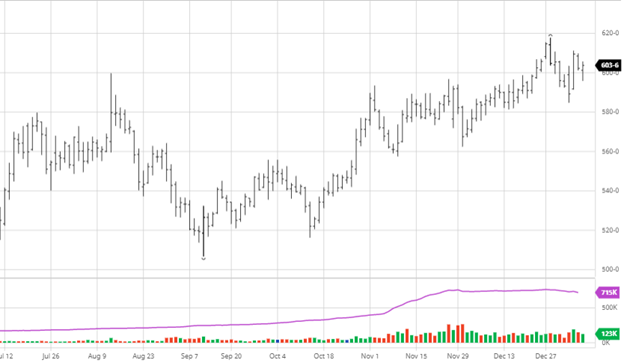

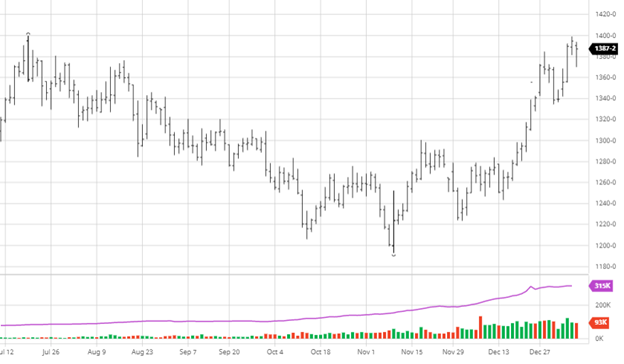

Soybeans have experienced the same volatility as corn but remain at its highs, as seen in the chart below. The story is the same as corn being driven by weather problems in South America. Barchart estimated Brazilian soybean production at 137 million tonnes, with Argentina production at 45 million tonnes. The last USDA projection had 144 million tonnes in Brazil and 49.5 million tonnes in Argentina, showing that the private sector believes the crop has gotten worse and is trending in the wrong direction. The chart below is interesting because you can see the top at $14 this week and back in July. That will be an important number to close above to keep the momentum going.

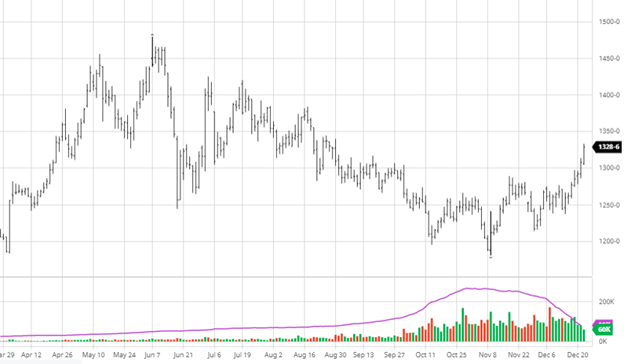

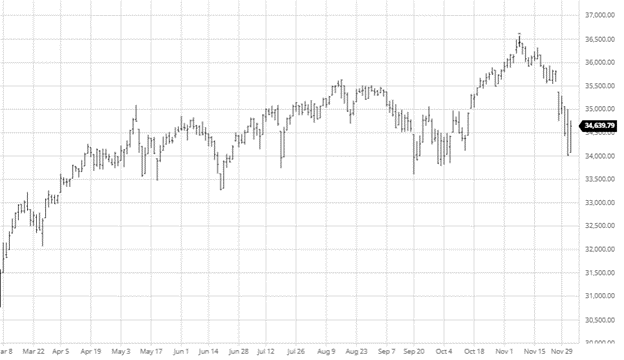

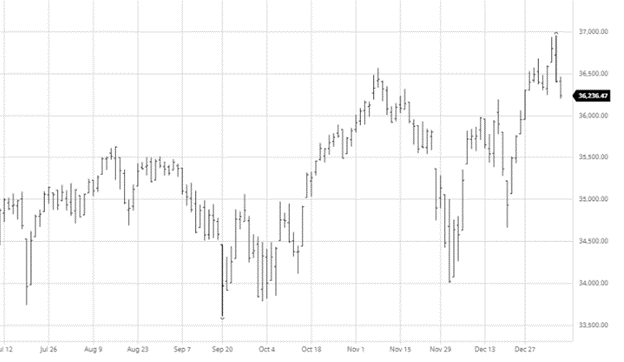

Dow Jones

The Dow has had quite a volatile week following a week of the Santa Claus rally. The Fed may increase the rate at which they raise rates which worries some investors, but at this point with the Fed, many investors are waiting until they see the plan. As a new year starts, especially following the impressive year that was 2021, many investors try to predict the story for the year ahead. If we have learned to expect anything while Covid is in the markets, we can’t predict much for the year ahead.

January USDA Report

The January USDA Report is Tuesday and should be a market mover. All eyes will be on the report as everyone positions themselves ahead. If the volatility of late shows up, it could be a big market mover.

Podcast

The 2021 U.S. grain crop has the potential to be one of the largest on record. Where did all the yield come from, what areas were the hardest hit, and why on God’s green earth are grain prices still so high?

Today, we are joined by several RCM Ag Services grain markets experts from around the country to catch up on a post-harvest update and share an outlook for production and marketing in each of their respective regions for the remainder of the 2021 marketing season and the upcoming 22 crops.

Via Barchart.com