Futures Were Off $35.70 for the Week

The weeks are starting to look the same. Each one has numerous undefined potential threats. Unlike most commodities, this industry has so many working parts that it is hard to rank them from least to most. Let’s look at a few.

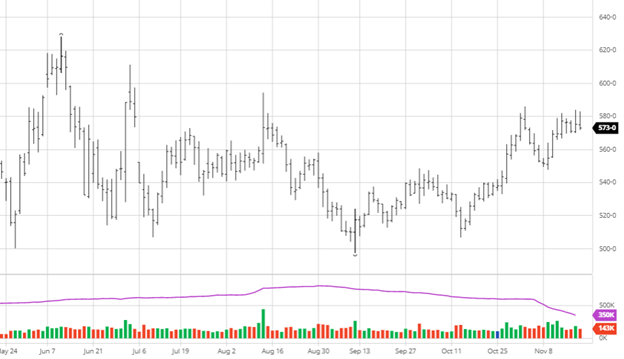

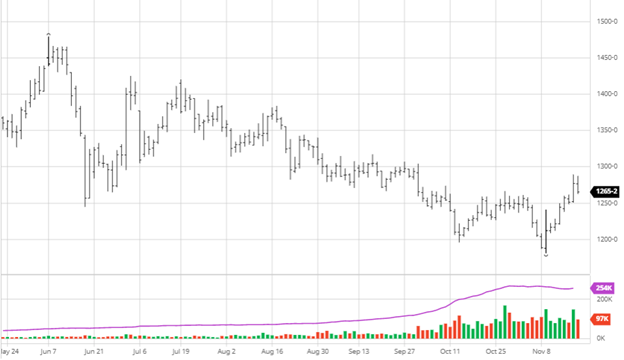

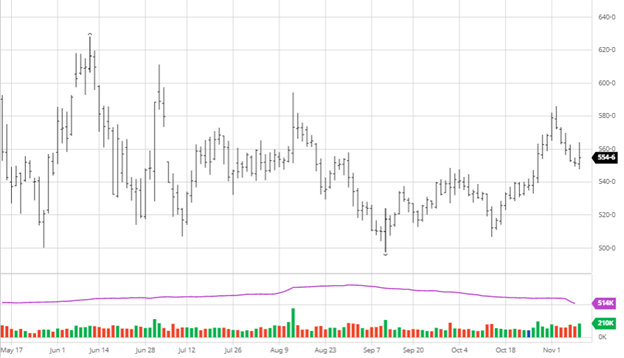

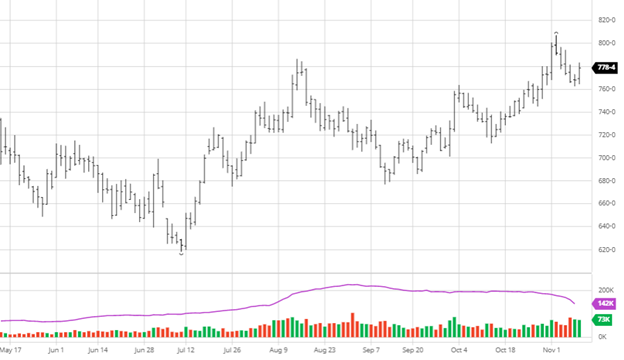

The futures market continues to act top heavy every time it breaks through the $800 mark. A combination of speculative profit-taking and basis trades weigh on the run. Most of last week saw a positive market as the BC shipping issues grew. But the COVID talk on Friday changed the focus from worries of undersupplied to concerns of being oversupplied. Unlike most other commodities, housing is affected more by stock market moves, so Friday was tough.

The Facts are in Front of Us

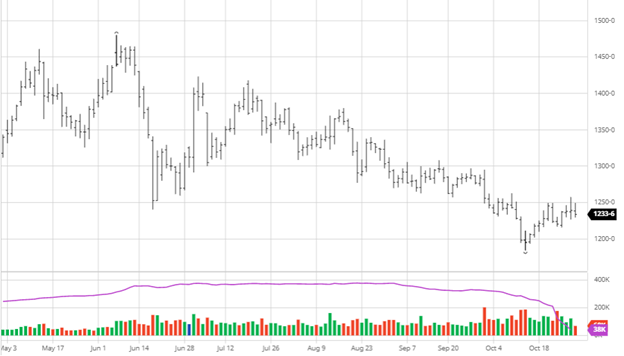

The facts in front of us are that business is excellent, but shipping has slowed. What we are having an issue with is the value of the commodity. If the marketplace stays at 1.6 and shipping remains at a slower pace, then most would agree that the high end of the cash trade is around the $700 mark, and with a typical $100 premium, the futures will be sitting at $800. If supply starts to move freely, cash could rest around $550 and futures closer to $600. This is a fair analysis and would challenge others to set it up differently.

The Sleeper Out There is the Industry’s Psyche

In the futures market, 70% of the industry was bearish back at $500. Today 80 to 90% are bearish at $800. That big negative push keeps the market underbought. Monday, the focus will be on any potential COVID disruptions. Tuesday, we should be back to transportation issues.

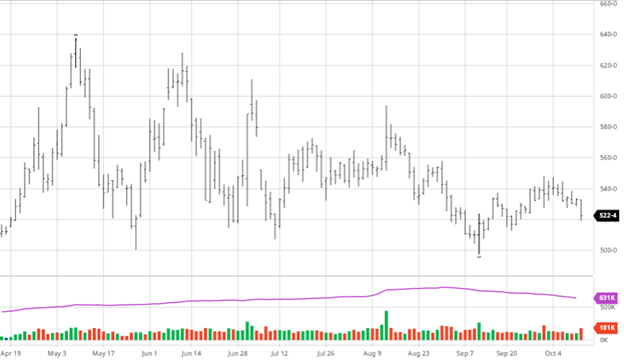

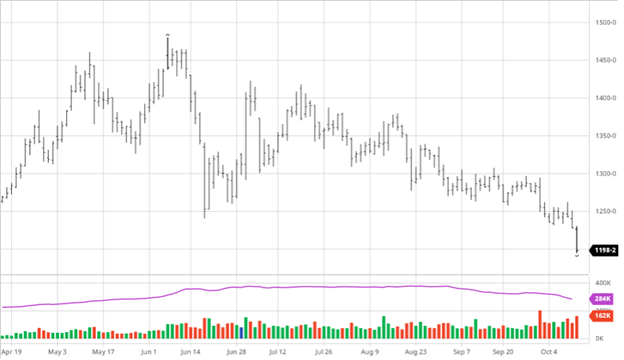

Let’s Get Technical:

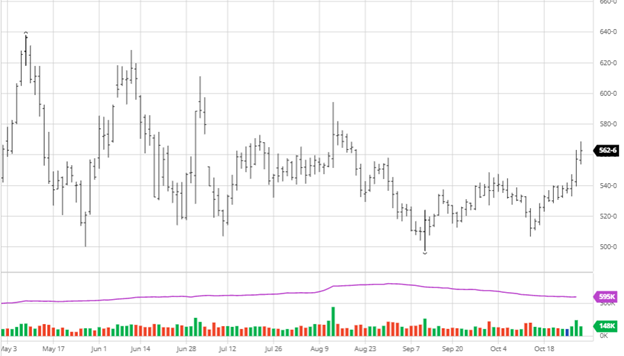

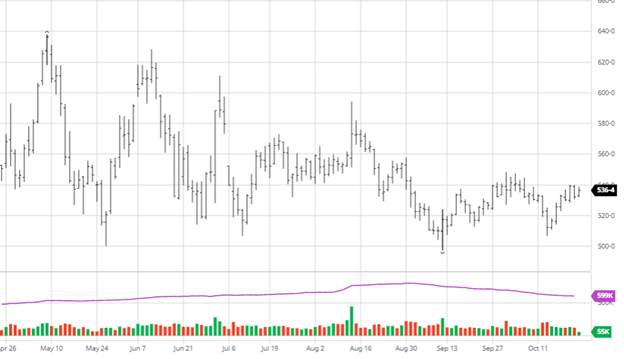

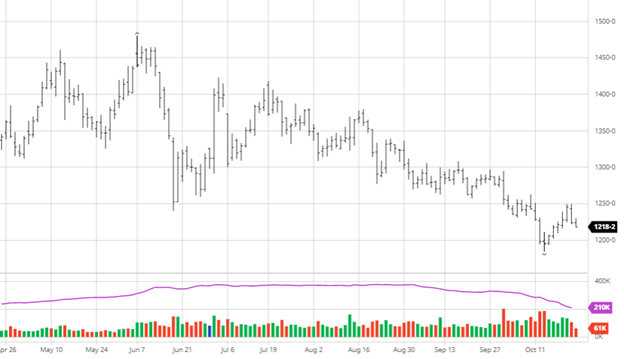

The futures market is forming a volume area in the mid $ 700’s. If the market starts to rerun upside, that volume area measures up to the 38% retracement point of $924.85. If the market can get to the 38% mark — a good enough base was built, and the futures are on their way to the 61% mark of $1,225. That should be food for thought when developing a basis or general hedging strategy. Using calls would be prudent. On the other side, generally, if a market builds a volume area without a follow-through push, it is a very defined top to focus on. The overall structure of the recent trade in both cash and futures leads me to believe that the chart pattern is trying to build the top end of the trading range.

Weekly Round-Up:

The smartest strategy for those who need a product is to stay in front of it. Owning enough wood or having a derivative positioned for a run-up will keep you out of the middle of the noise. There is no way to navigate the issues thrown at us daily. The only way is to be proactive for those who like all the noise trade the spread. It’s a good buy -20 and a good sell +20. What I do see happening is that those in the middle will have a much harder time staying out of those whips back and forth.

Open Interest and Commitment of Traders

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

https://www.cftc.gov/dea/futures/other_lf.htm

About The Leonard Report

The Leonard Lumber Report is a new column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Before You Go…

For the past year, commodity prices have perpetually soared and continue to trend higher. We’re diving into the fertilizer forecast with a unique guest, Billy Dale Strader, a branch manager for Helena Agri-Enterprises in Russellville, KY., who is truly at the epicenter of the rising fertilizer prices.