AG MARKET UPDATE: NOVEMBER 9 – 18

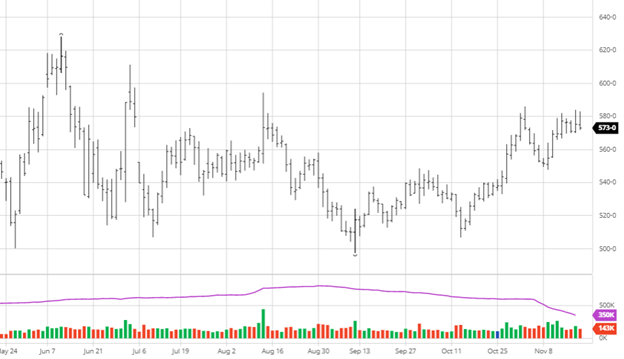

Corn has seen a good bounce since the Nov 9 USDA report and has traded relatively flat the past few days despite some intraday volatility. There was no specific market-moving news to fuel this rally but tidbits here and there to help fuel overall positive sentiment. IHS Markit updated their acreage for 2022 planted acres estimate with corn coming in at 90.8 million acres, 2.5 million lower than 2020. Ethanol production stays hot as the weekly grind rose to 312 mbu, up 7 from the previous week and well ahead of the USDA estimate for the year. With increased input costs going into 2022, the decrease in acreage makes sense, as balance sheets will be tighter. As harvest nears the end, eyes turn to South American growing conditions for the months ahead.

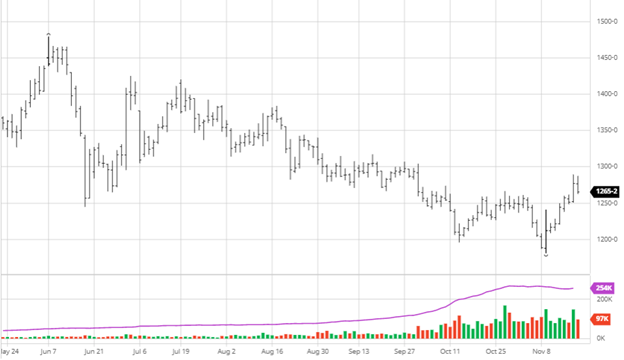

Soybeans, like corn, have seen a solid rally since the USDA report. Soybeans continued their rally on Thursday until the EPA announced they would release their renewable fuel mandates by the end of the week. As the Biden administration has not been much of an ally for the ag sector, the decline on the coming news makes sense. Soybeans had decent exports this week as buyers keep showing up in the market even as prices trek higher. Continued demand from exports will help support beans, and it will be interesting to see how many beans get stored and who took advantage of higher prices with forward pricing. We will see this play out in the cash & basis market come the spring, but we expect most farmers to store corn for now. IHS Markit estimated the 2022 bean acreage to be 87.9 million acres, 700,000 acres less than 2020.

Dow Jones

The Dow struggled this week as earnings continue to come in, but market volatility seems to be expected with the holiday season coming up. The Fed can still raise rates this year, and the Biden administration has not yet announced their nominee to head the Fed (either keeping Powell or someone new).

Cotton

Cotton has had life in the $1.10+ range for a while now as demand overseas is high for U.S. cotton. Growers have seen mixed yields across the country but nothing too surprising to the market. Cotton demand does not seem to be slowing down anytime soon as the world still is coming out of the pandemic, and some countries still have major restrictions.

Podcast

For the past year, commodity prices have perpetually soared and continue to trend higher. We’re diving into the fertilizer forecast with a unique guest, Billy Dale Strader, a branch manager for Helena Agri-Enterprises in Russellville, KY., who is truly at the epicenter of the rising fertilizer prices.

Billy Dale planted his agriculture roots on his family-owned farm and has managed regional seed and chemical sales at Helena for the past decade. In this week’s pod, we tackle the big question for farmers and ultimately end-users — is the impact of higher-priced inputs, like seeds, chemicals, and fertilizer, on the supply and demand for the major U.S. crops? Listen or watch to find out!

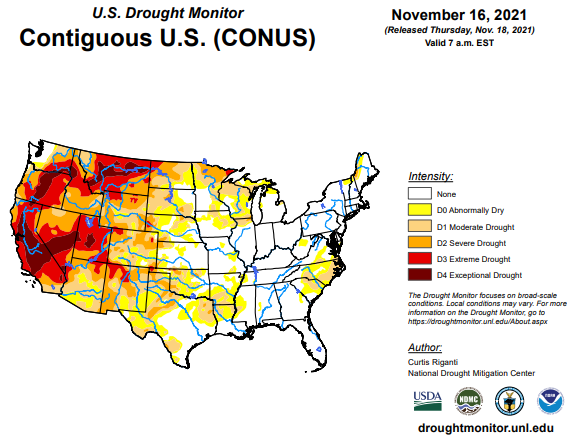

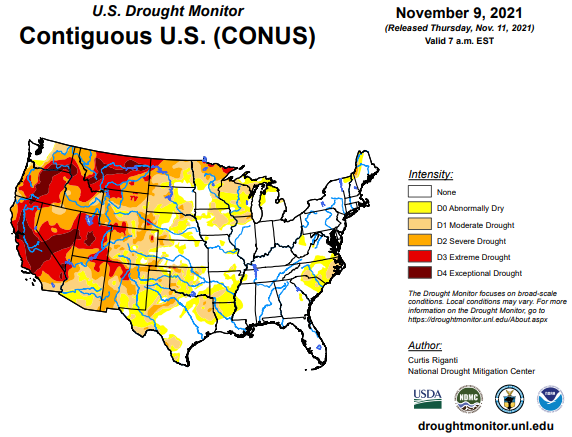

U.S. Drought Monitor

The maps below show the U.S. drought monitor and the comparison to it from a week ago. The outlined areas in black are areas that the drought will have a dominant impact.

Via Barchart.com