First Glance:

Quiet report with no real changes made in production. The dark cloud over the market of tariffs was not addressed in a major way in this report as the demand picture remains blurred by how long the trade war could last. Nothing from the report changes the trade in a meaningful way for corn, soybeans or wheat.

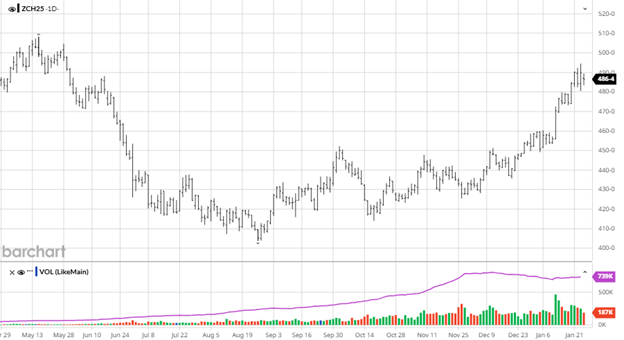

Corn 24/25 US Corn Stocks: 1.540 BBU (1.516 BBU Estimate)

24/25 World Corn Stocks: 288.94 MMT (289.93 MMT Estimate)

24/25 Brazil Corn Prod: 126 MMT (126.07 Estimate)

24/25 Argentina Corn Prod: 50 MMT (49 Estimate)

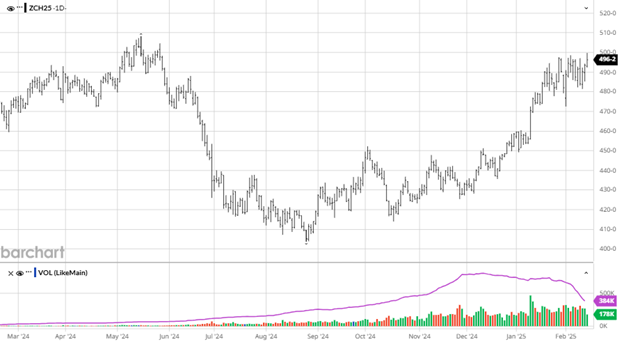

- Corn had a boring report with balance sheets remaining unchanged across the board. Global corn stocks were slightly lower and China imports were 2 mmt lower. Corn needs to get through technical resistance at the 50 day moving average ($4.59 ½) to see a move higher, it is currently trading at $4.55.

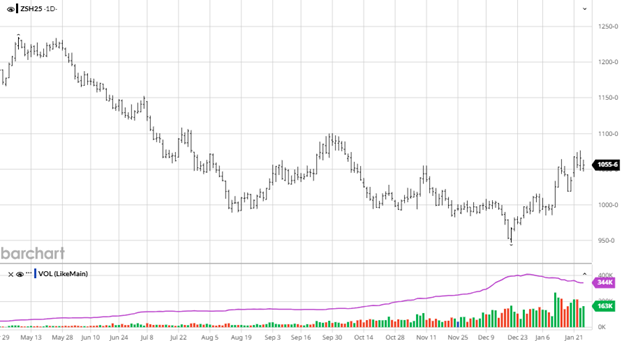

Beans 24/25 US Bean Stocks: 380 MBU (379 MBU Estimate)

24/25 World Bean Stocks: 121.41 MMT (124.56 MMT Estimate)

24/25 Brazil Bean Prod: 169 MMT (169.18 Estimate)

24/25 Argentina Bean Prod: 49 MMT (48.88 Estimate)

- Beans did not receive much news as US bean stocks remained the same while lowering world ending stocks 2.93 mmt. The one item of note is that the USDA lowering the seed usage 3 mbu, potentially hinting at a lower bean acre number.

Wheat 24/25 US Wheat Stocks: 819 MBU (797 MBU Estimate)

24/25 World Wheat Stocks: 260.08 MMT (257.62 MMT Estimate)

- Wheat was slightly changed this month with larger supplies, higher consumption, reduced exports and an increase in ending stocks. Exports were lowered for the EU, Russia and the United States. While not by large amounts (0.9 million tonnes) it was enough to move the market slightly lower with no big news in corn or beans.

Overview:

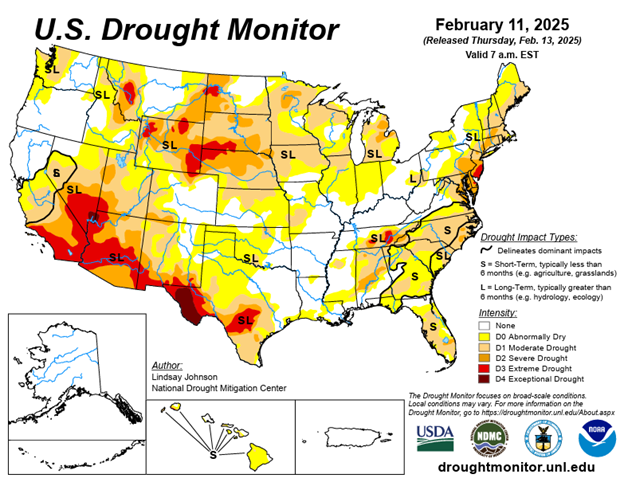

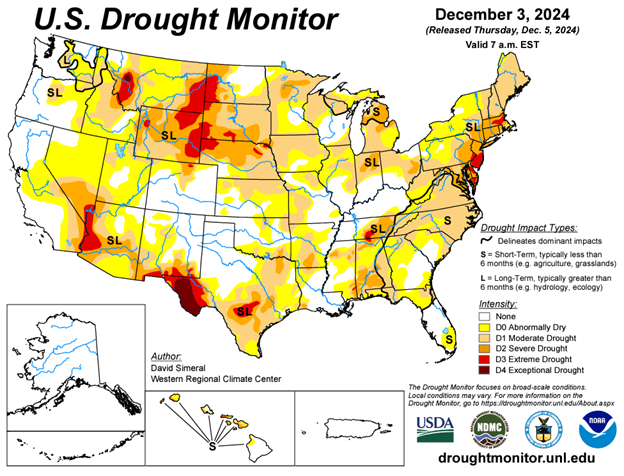

A quiet report as the market looks elsewhere for news to dictate trade. As China gets involved in the tariff war with Canada and Trump steps up tariffs on some imports while delaying others, there remains more questions than answers. News from the White House will be the main market mover moving forward until the planting intentions report at the end of the month. While South American weather is not a problem currently that is always a variable to keep an eye on as their second crop begins to take shape.

Note from the report: “The WASDE report only considers trade policies that are in effect at the time of publication. Further, unless a formal end date is specified, the report also assumes that these policies remain in place.” This is important because US tariffs on Canada and Mexico were delayed until April 2 on all products covered by the USMCA meaning theses numbers are estimates if this is resolved before then.

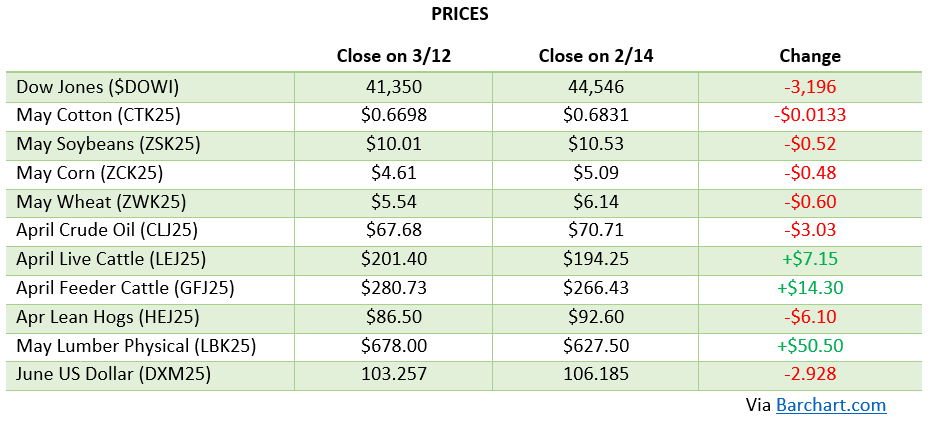

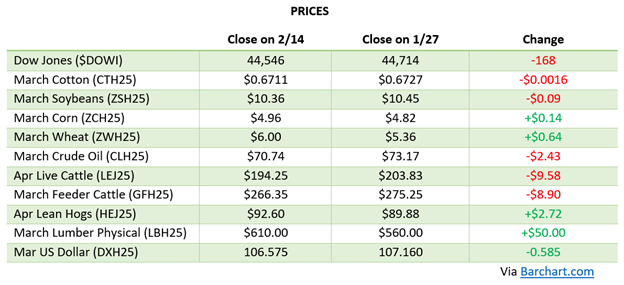

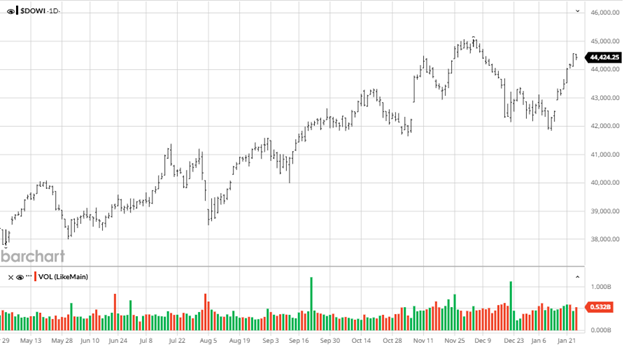

Equity Markets

The equity markets have given up all gains since the election in November as trade wars and tariffs dominate the headlines with the chip stocks and market leader Nvidia getting hit hard as recession fears ramp up. The global markets, after lagging the US markets for several years coming out of Covid, have ramped up recently, having a better start to 2025.

Other News

- The tariff war is up and running as everybody tries to out tariff each other. How long this lasts will ultimately decide how much economic damage is done.

- Canada has a new Prime Minister after Trudeau stepped down and Mark Carney from the liberal party took the position.