2023 Lumber Market Outlook & Affect on Housing

The following report summarizes today’s lumber industry and housing. I use past data to project future scenarios. What can’t be measured is the buyer attitude, cultural norms, and trends. The data is going to paint a troubling picture while in fact the housing market has tremendous underlying strength because of the cultural shift to homeownership. There is a whole generation out there of new home buyers. Today they are just waiting for it to be affordable again. Hopefully by the end of this report we have some type of idea whether that will happen in 2023 or not.

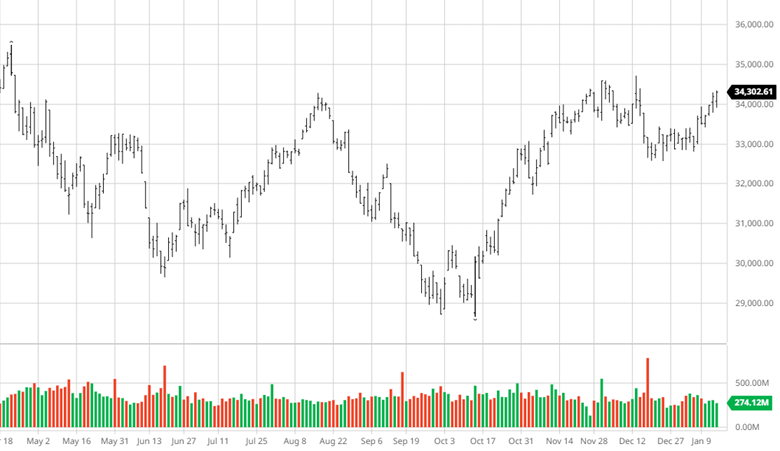

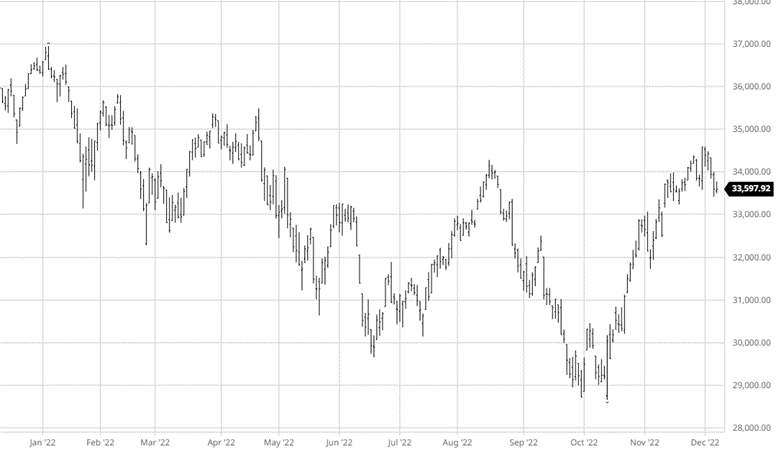

Interest Rates:

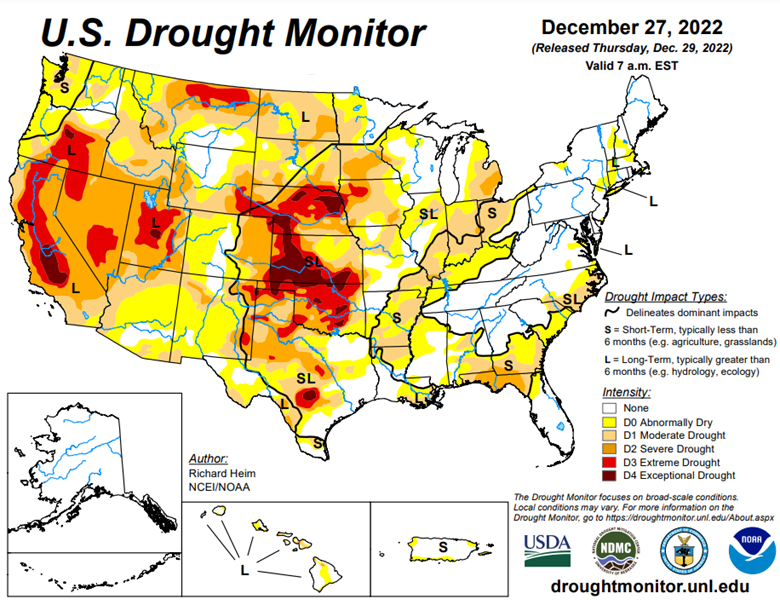

“The Fed wants housing dead.” If you want to curb inflation you attack the largest segment of the growth wheel. Powell is laser focused on our sector. The is no reason to enter into the debate of whether it will be a “50 or 25” move. Our focus should be on the ratio of wages, home prices and rates to get a better read of trajectory. The average mortgage rate over the last 50 years is 7.76% according to mortgagerates.com. The current rate of 6.30% seems manageable. Weekly wages jumped 6.20% last year. The is the highest rise in wages since the early 1980’s. The dominant factor is home prices. The explosion of prices post covid has taken many out of the game. Home prices and the CPI tend to track well together. A cooling CPI will not necessarily cause a fall in home prices but will lead to home value erosion. It will be purely a mathematical change. The prices will be forced to relate to the marketplace. Today the math adds up to a marketplace will accept rates close to 5.5%, median home values are under $400K and wages that are consistent with inflation. Those points are closer than most think. The issue, as always, in 2023 is if the Fed overshoots. This is the key factor for housing in 2023. A stagflation model will keep demand and construction underwhelmed.

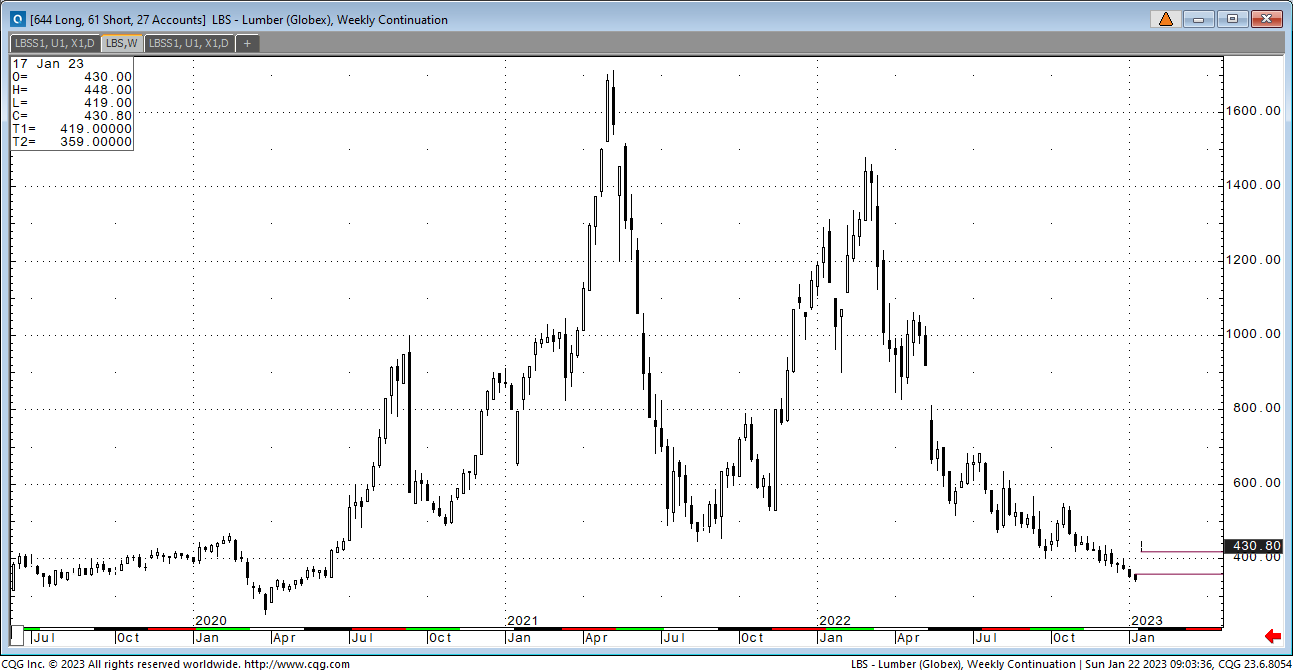

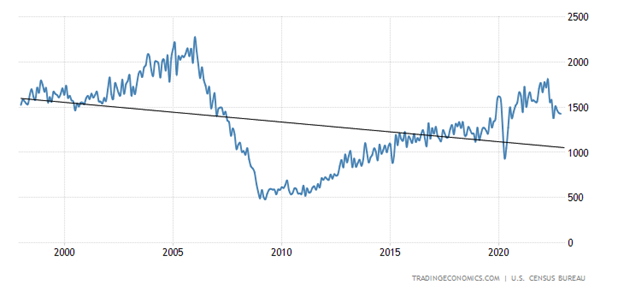

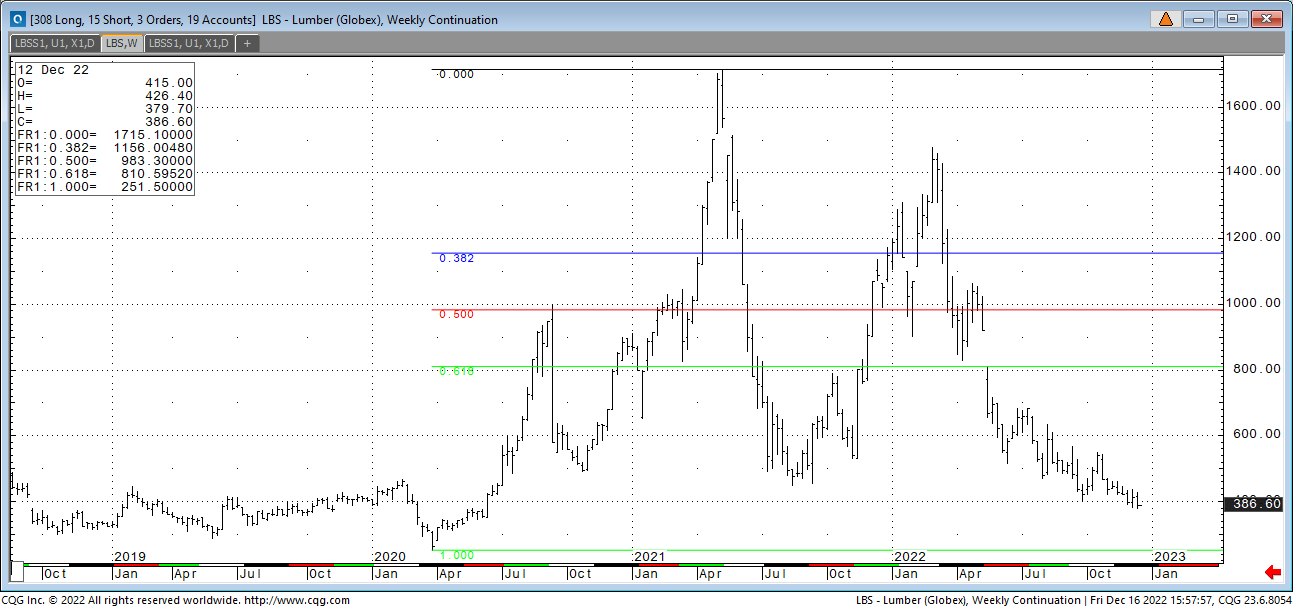

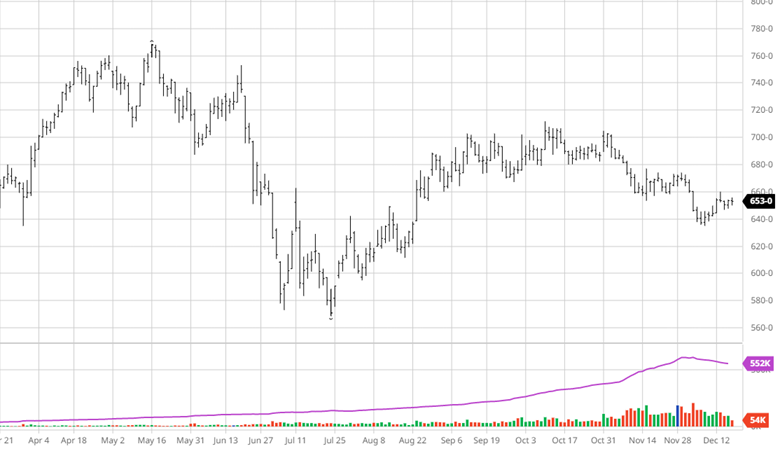

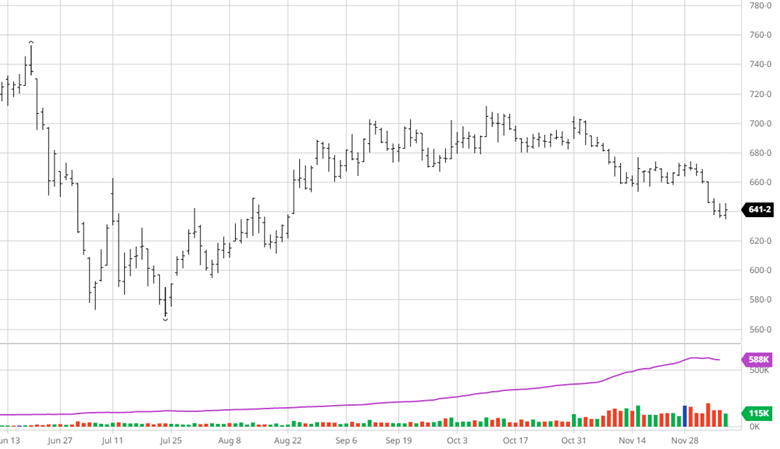

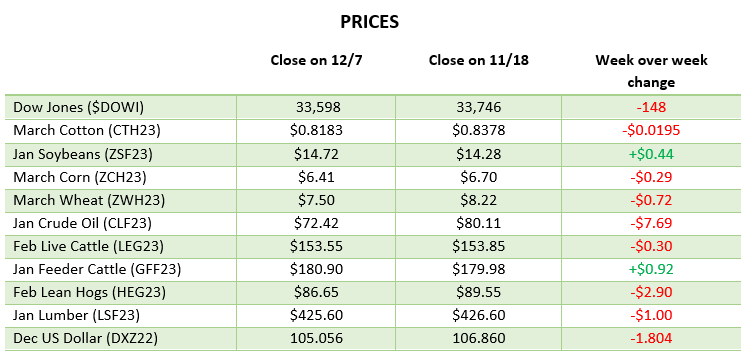

Cost of Production:

The cost to produce, from logs to transportation and also wages has gone up substantially over the past few years. What we have experienced in other commodities after their spike was a return to a level about 35% over their 30-year average. There is a strong correlation here. Those markets found costs higher after the fact. Doing the math that puts the low end of lumber prices to be near $420. Over time that number will be a feature and should be factored into your business plan. Our all-in and all-out cycles make it hard to buy value.

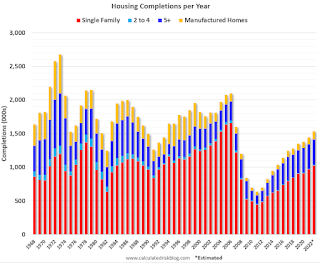

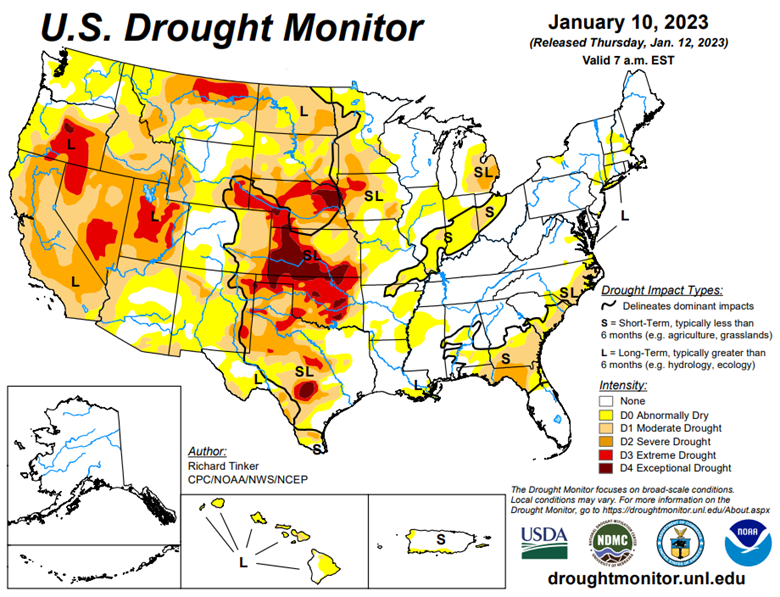

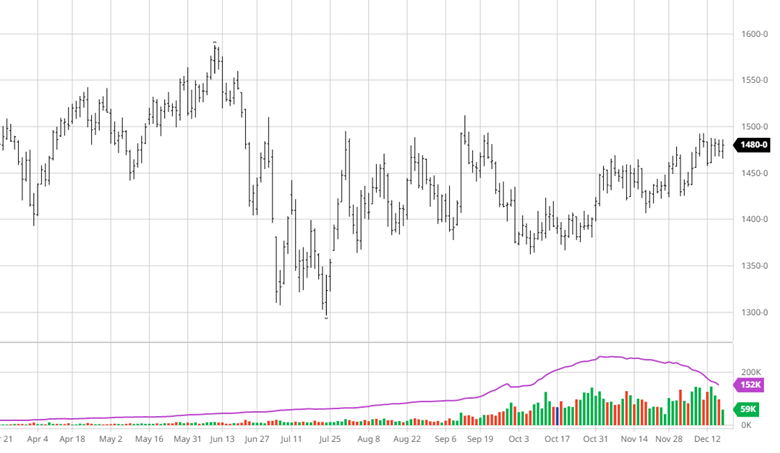

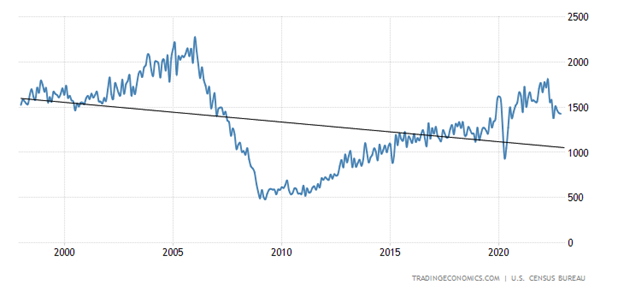

Starts:

Home construction is slowing with expectations of it continuing. From the forward-looking statement coming out of the builders to the reports from those who feed the home builders, things are going to get slower. If you look at the chart below the analysis shows the starts number to close in on the 1.1 mark. The defined business plans in 2023 from the home builders is fluid. It is going to be developed quarter by quarter. The structural decade plan was for a 1.4 pace. Covid accelerated that number and now it is pulling back but construction can be turned on in a short time period given many plans are already in place. In this scenario the longer the pullback the quicker the rebound.

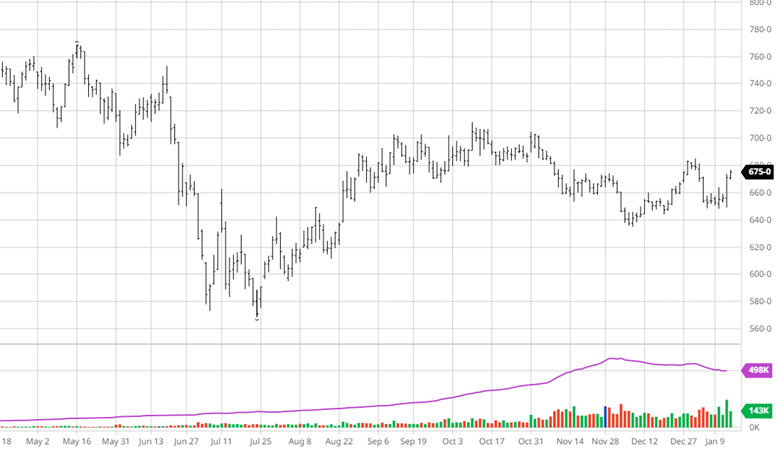

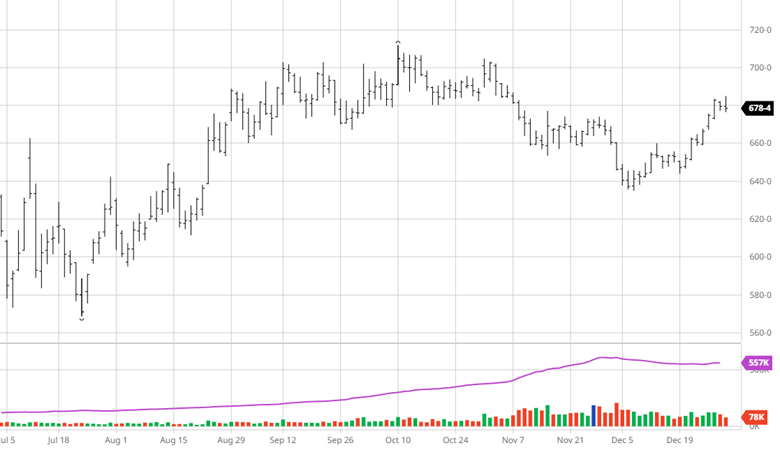

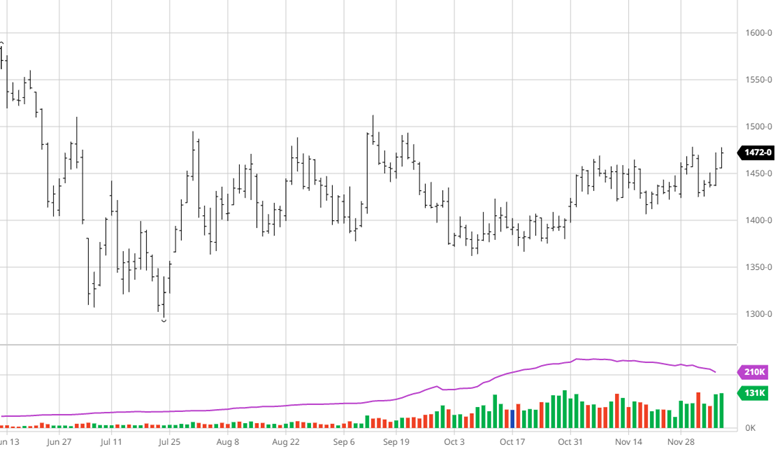

Import/Export:

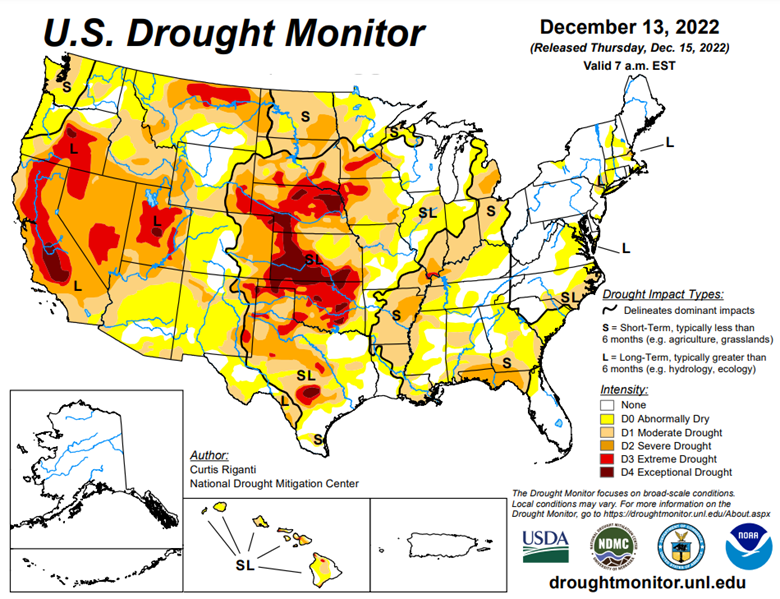

Here is a component of pricing that has never had as much an impact as it does today. The sheer number of traders in the Euro space is a factor in overall pricing today. They can drive the market. That has never been the case before. We are currently seeing how much downside pressure it is putting on the market. The question now becomes as we move into 2023 and shipment are curtailed will that boost prices? The other positive is the fact that Asia exports are off substantially. There is a lot of capital available to build in China. The increase in exports overseas will at a minimum tighten up certain markets. There are some possible green shoots for the market in this sector.

Wages/Employment/ Money:

Wage growth is currently sitting at 6%. As we try to compare that growth to years back, we must recognize that most families are dual income today so 6% is a big number. The buyer isn’t too far off affordability. There is that natural drift away from buying after such a spike, but incomes will allow home buying. It will take time to accept the higher level. Employment is the key to all this analysis. If unemployment takes off the housing market will go into a freeze mode that takes months to thaw. My analysis calls for a continued rise in unemployment but leveling off at some point in the 3rd quarter. Most will be comfortable with their employment status. And finally, with have a very large amount of excess capital out there. From infrastructure to chip building the dollar amount is enormous. That capital spending will trickle into housing.

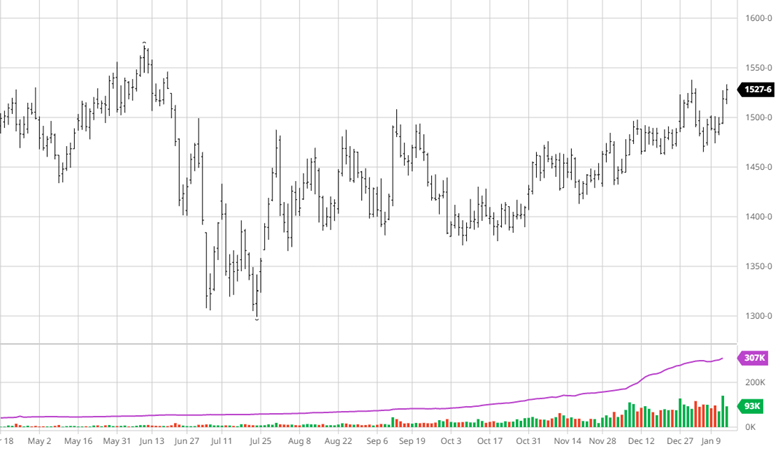

Summary:

A drag across the bottom could be unsettling in 2023 to all who haven’t lived it. Not just in the lumber industry but in most others. There will not be an all-good signal until the cycle plays out and that won’t be for many months. That said, any signs of a turn in the market will bring in a robust buying environment that will fail. What is needed is a guarded deliberate buy program to build a value area. Inventory will become an investment not a liability. There won’t be a perfectly timed buy. It must be ongoing. There also won’t be the volatility we are used to. This will be a grind year with spikes higher. Grind is good.

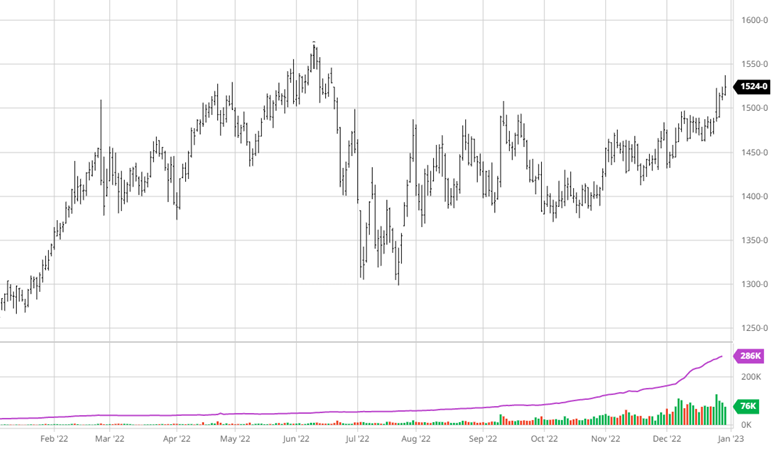

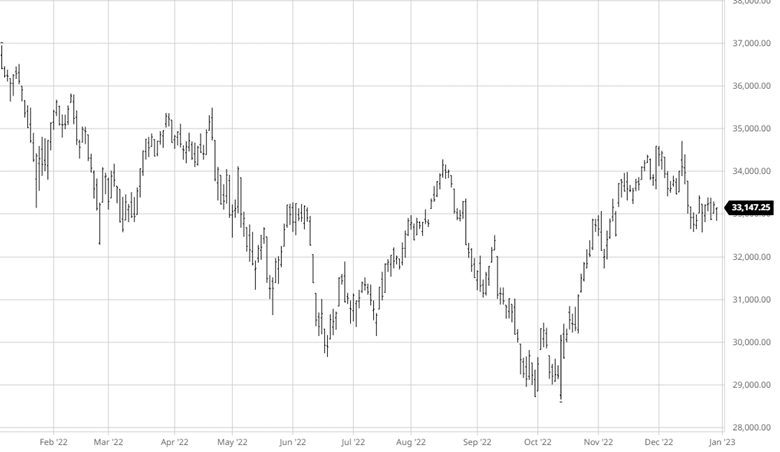

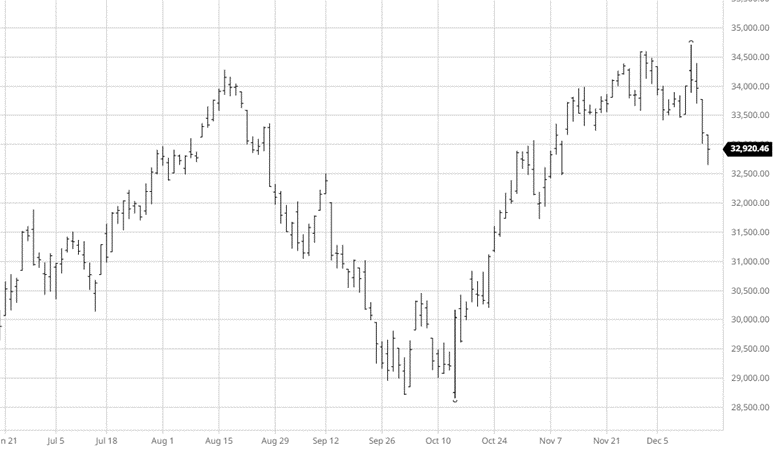

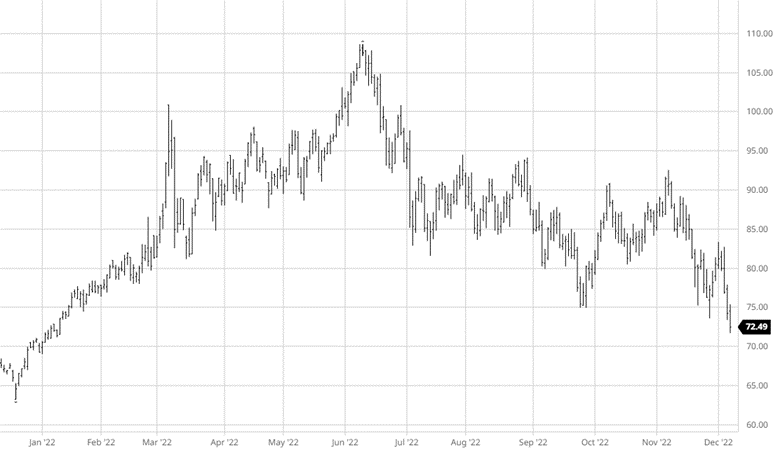

The recession is the key to the 2023 housing market. Gold and silver, yes those old men investments, are showing a inclination to a heavier recession than what is projected out there. The other side is talking about copper and its positive tone indicating no recession. None of this will help our current issue of liquidity but could project the distance of the problem.

Happy New Year!

Brian Leonard

[email protected]

312-761-2636