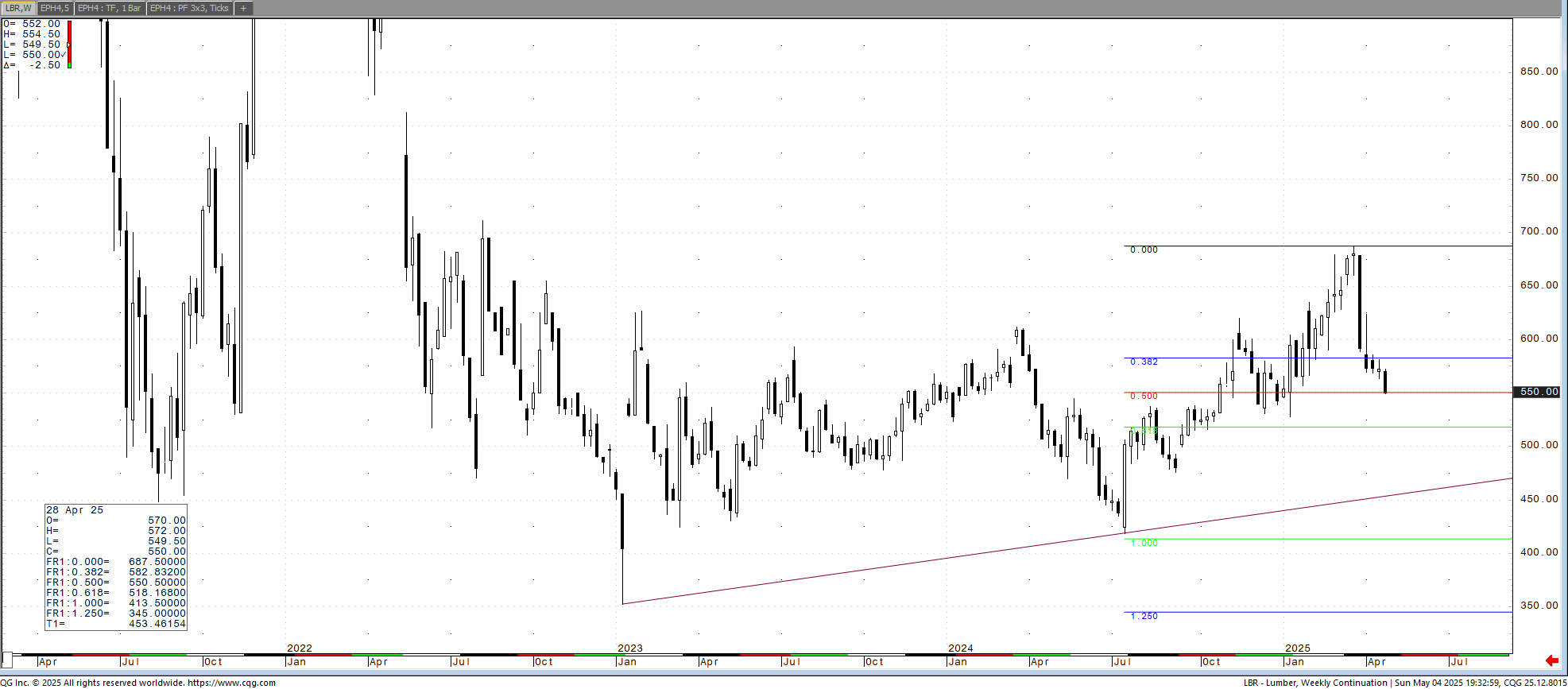

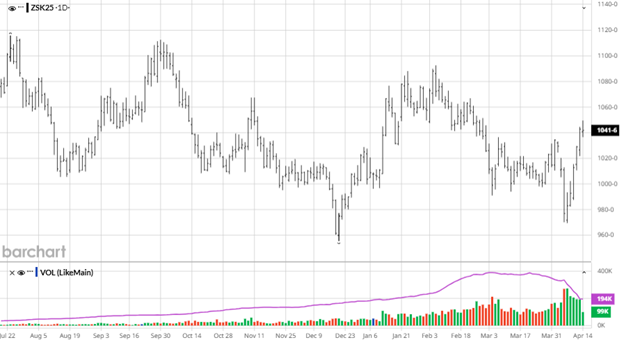

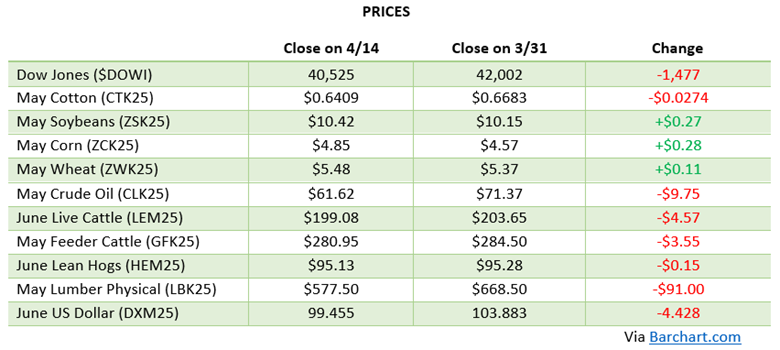

The Lumber Market:

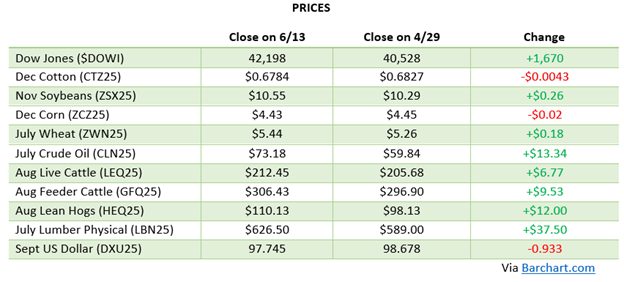

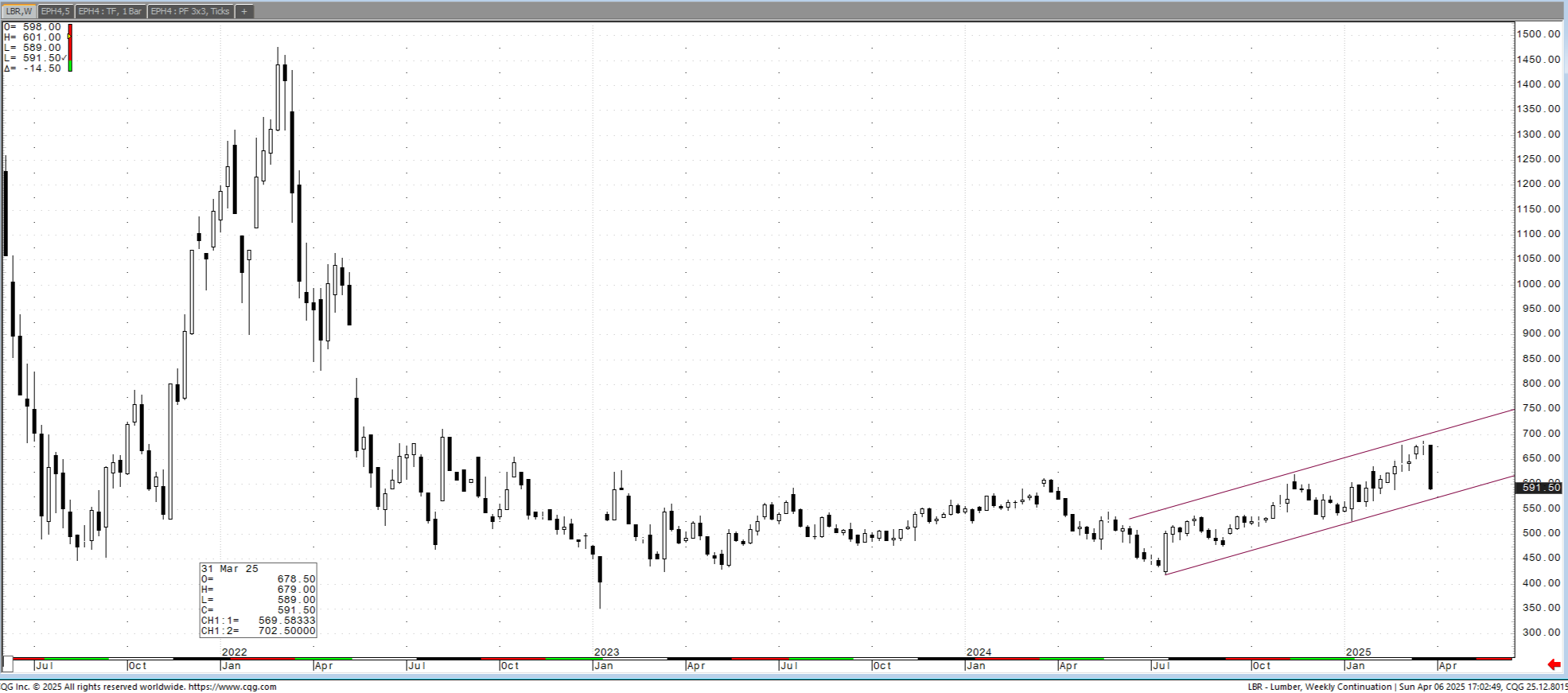

Futures were up $20 for the week. It is a market doing a good job in developing price discovery in a chaos environment. Saturday, I was asked to be on a call with an equities team who wanted to know what was causing the uptick. These guys a very inflation sensitive. I explained that between the CVD, AD and, tariffs prices from Canada will be going up. To what level remains to be seen. They were quick to point out that the US and European capacity could be increased. I pointed out that the quarters it would take to be a factor is too far off to put into a 2025 equation. What about demand? We are here because demand has been flat for 3 years. A macro look shows that we are fighting for every dollar higher as usual. July hit 710.00 back in early March. The futures market is actually near its low end of the range. We are flat. The trade today is trying to find a new equilibrium trading range. This is not a supply driven rally, at least not yet. It isn’t a demand push either. The rally is spec shorts covering and short funds covering via the roll. Nothing more, nothing less. I do see and uptick in the industry hedging up here. Good move.

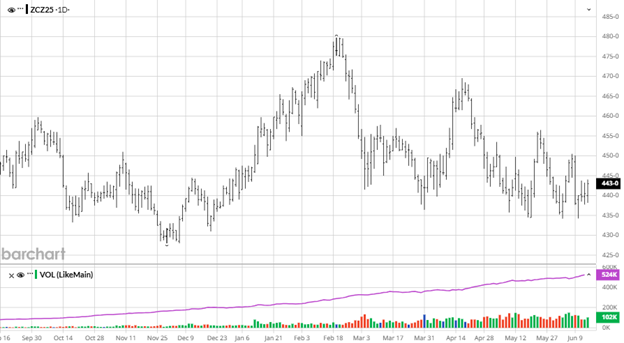

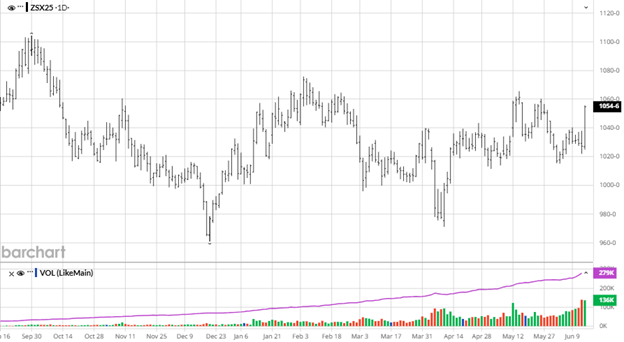

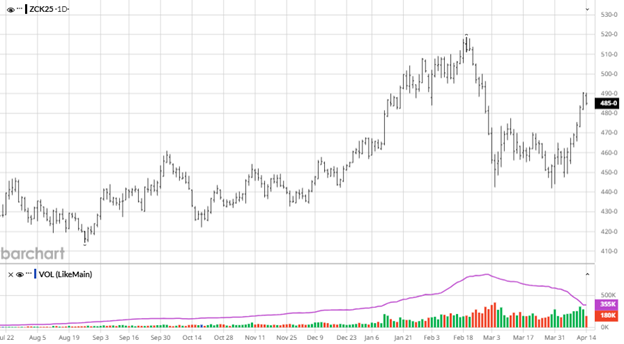

Technical:

The RSI is 75.60. A grind to the next points of 642 and then 655 are in reach. Once we hit the gap we may have to take a closer look. The 200 day is at 618.50. History has shown us that this ends in a quick thud, so a risk management plans need to be in place. Just stair step in higher. There is no need to rush into it. The marketplace should drag the cash marginally higher.

Daily Bulletin:

Southern Yellow Pine:

The Commitment of Traders:

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636