Summary:

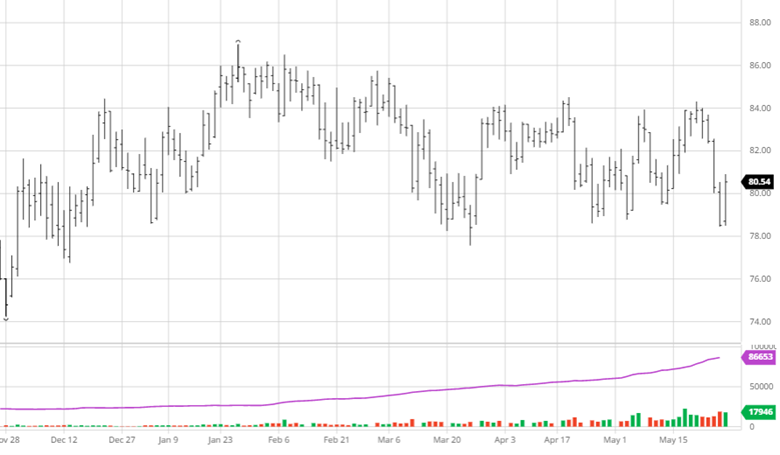

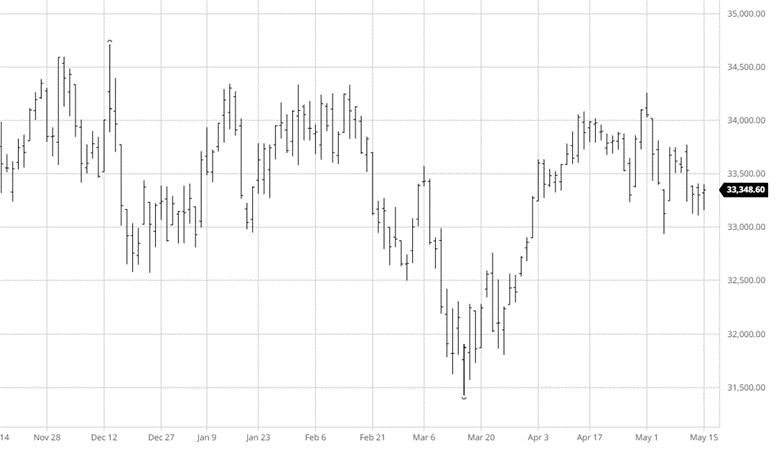

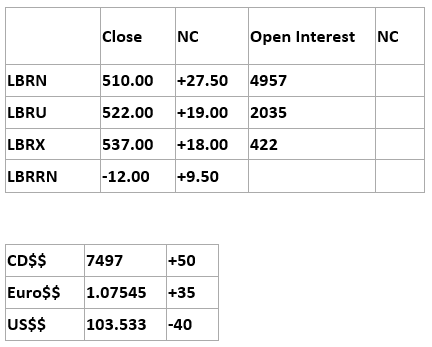

The futures and cash market saw a much needed buy round last week. July futures finished up $27.50 while cash was up $7. I would categorize it as not explosive, but positive. The fires in eastern Canada set the rally off. The lack of inventories kept it going. It is not a runaway market. It is one that needs continuous reassurance. The current trader psyche should cause a pause early next week unless more issues arise. $350 cash isn’t the issue. Getting long is. Let’s dig down into that thought process.

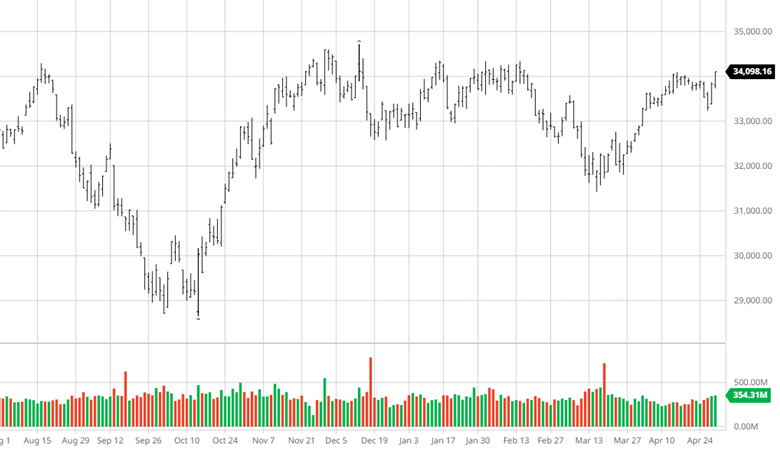

There is a big divergence in confidence between the buyers and the builders. The builders have been living off old orders this year but then began gearing up for more building with no one noticing. Economics showed they could still build and sell. Wallstreet saw while distribution didn’t care. The buy side was suffering through an oversupplied marketplace. That is still around but having a much less impact. Last week we saw a slight wake-up call on the supply side. This summer wood won’t be as available and weed was at Woodstock.

Flash Crash:

At about 12:30 on Friday, the futures market experienced a flash crash. In a matter of seconds, the market fell $20 to the first circuit breaker of $25. There is a circuit breaker at the 50% mark of a limit move. It stops trading for two minutes and then resumes. It was put in place to keep computer programs from running the market limit on one order. Coming off of a market that ran $60 in a few seconds this was nothing.

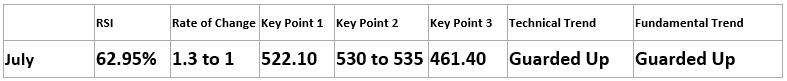

Technical:

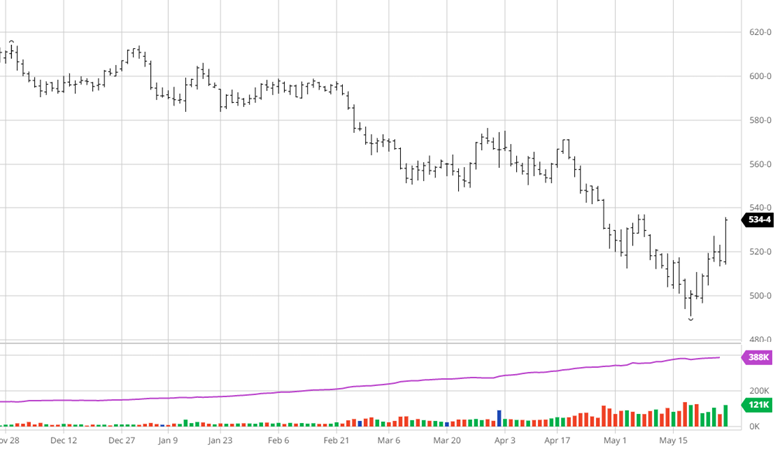

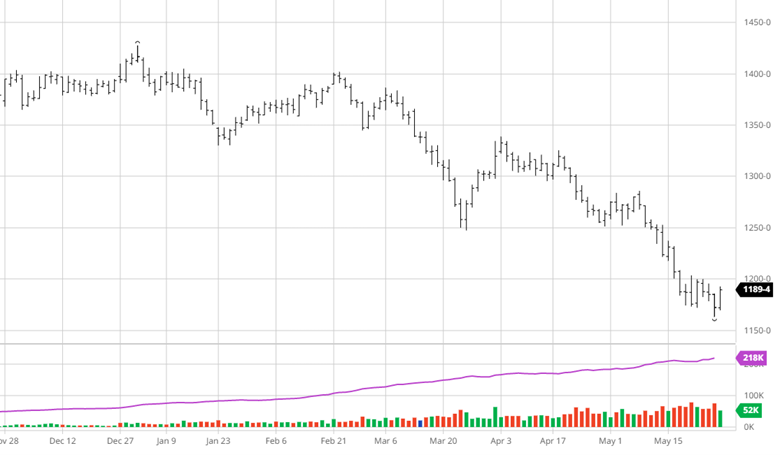

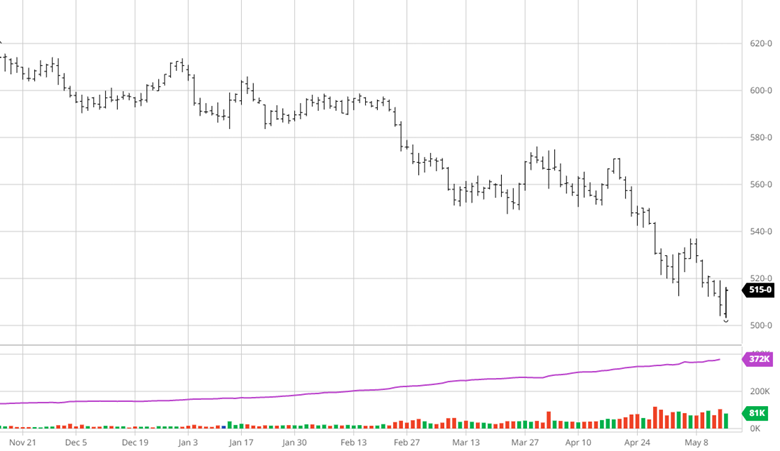

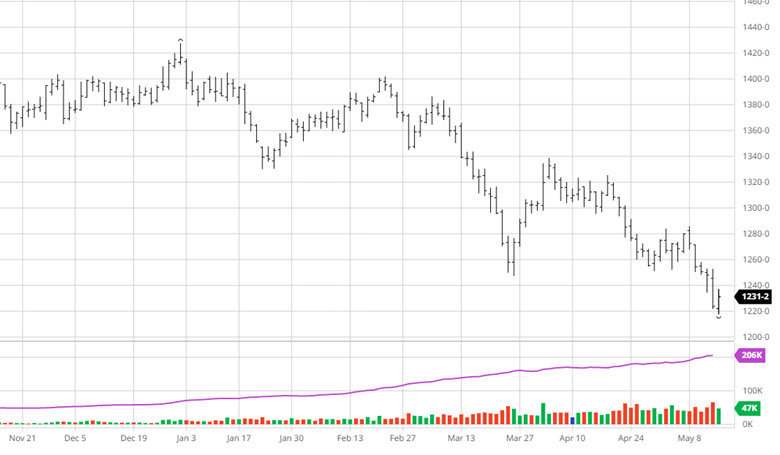

The futures market did a good job of breaking out from the sideways trade. That move turned some overdone oscillators to neutral or positive. The run also caused a rapid increase in the RSI. It hit 71% intraday. 80% is getting too rich. This is a norm for a market that was trending sideways for so long. What to watch for is a 70% RSI when July futures get into the $520s. That type of divergence is positive.

Roll/Spread:

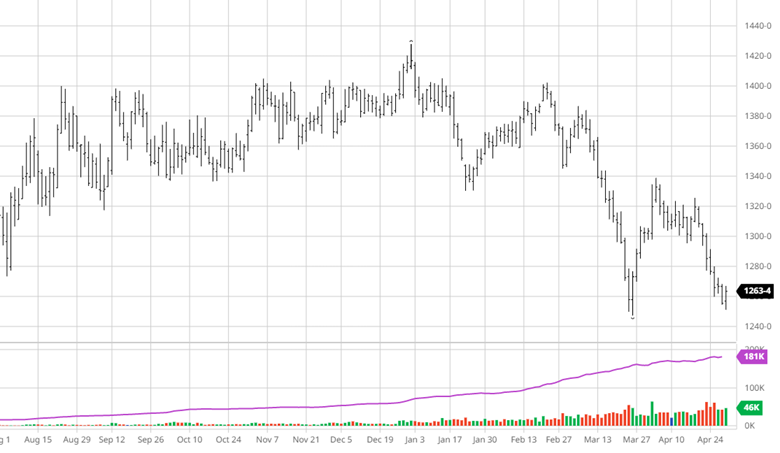

The first takeaway is the fact that there are funds in this contract to roll. That mechanism is key for liquidity. They are holding roughly 2500 shorts. The percentage to open interest is consistent with the fund’s way of trading for years. The spreading on Wednesday and Thursday was very robust. The buying of July and selling of September helped keep July higher than the rest of the market. More rolling will keep July positive if that is the only trading.

Lumber Futures Volume & Open Interest

CFTC Commitments of Traders Long Report

https://www.cftc.gov/dea/futures/other_lf.htm

Lumber & Wood Pulp Options

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636

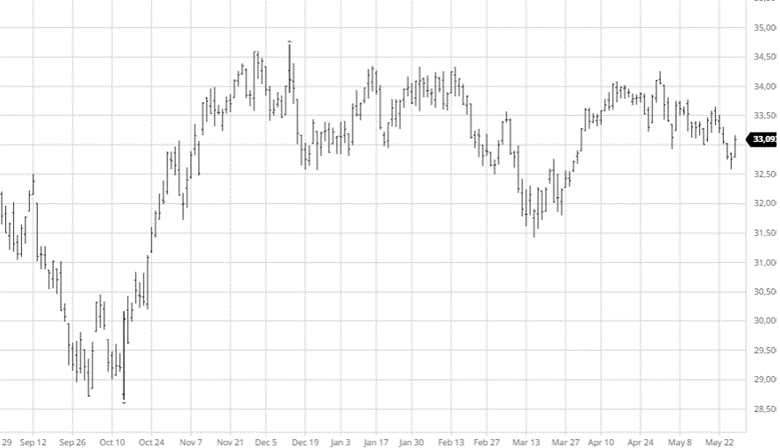

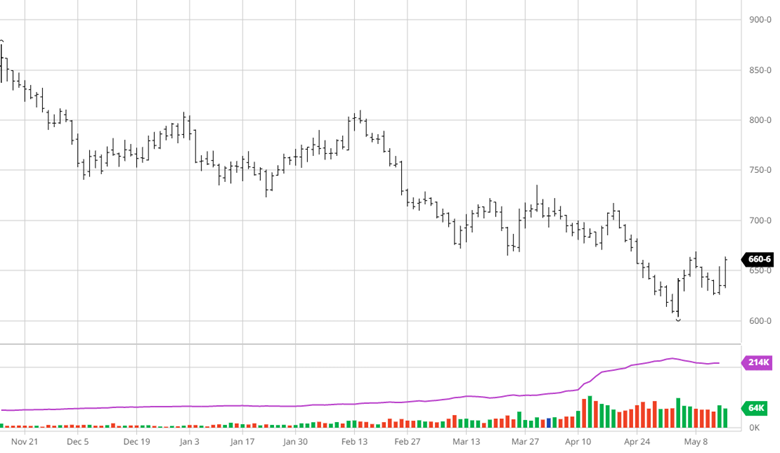

22/23 US Corn Stocks: 1.452 BBU (1.449 BBU Est)

22/23 US Corn Stocks: 1.452 BBU (1.449 BBU Est) 22/23 US Bean Stocks: 230 MBU (223 MBU Est)

22/23 US Bean Stocks: 230 MBU (223 MBU Est) 22/23 US Wheat Stocks: 598 MBU (606 MBU Est)

22/23 US Wheat Stocks: 598 MBU (606 MBU Est)