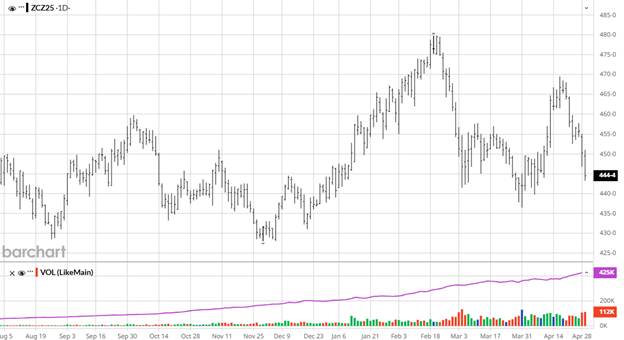

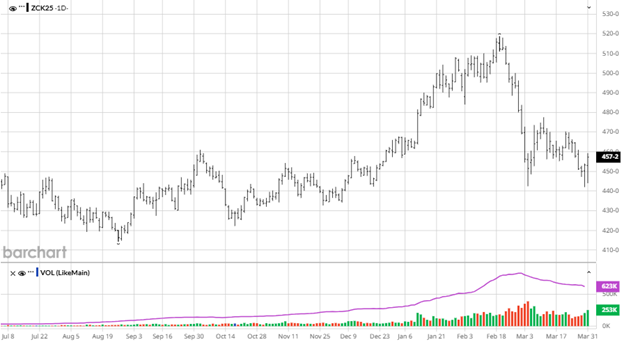

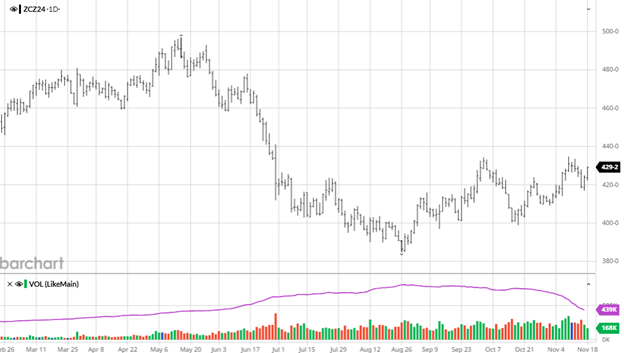

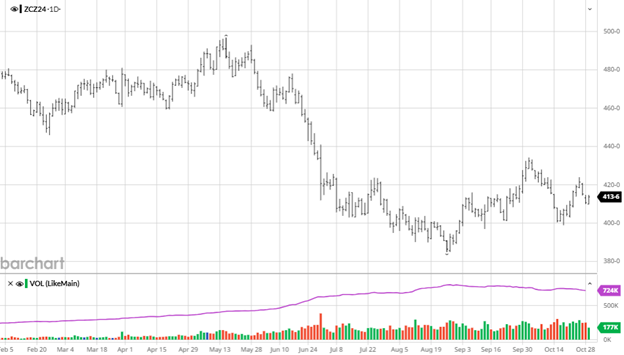

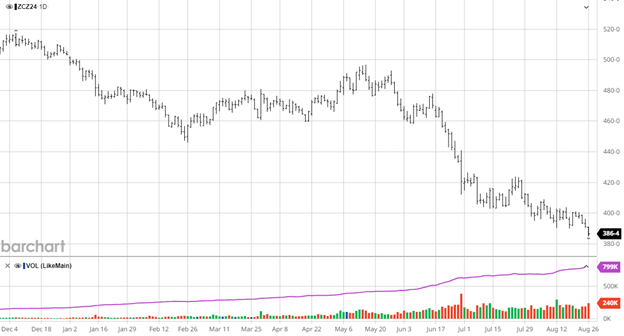

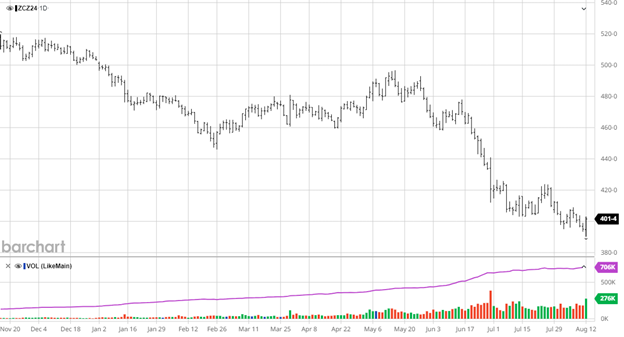

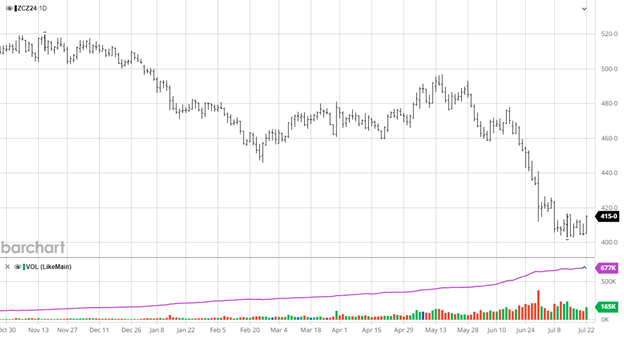

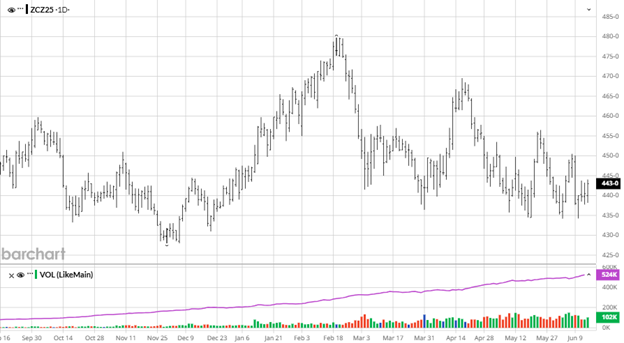

Corn continues to struggle with any rallies as you can see in the chart below every recent high is lower than the previous. The June 12th USDA report was lackluster with no real changes and not enough good news to give the bulls help. With the crop planted, 75% good/excellent, and non-threatening growing weather ahead, the bulls need a weather issue and/or positive trade news to change the direction of the market. The next major report is the June 30th Stocks and Acreage Report that tends to cause some volatility.

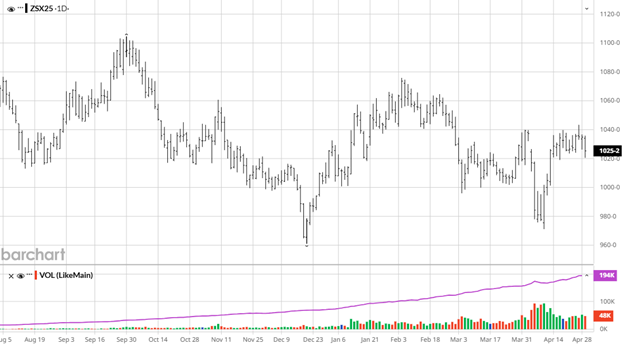

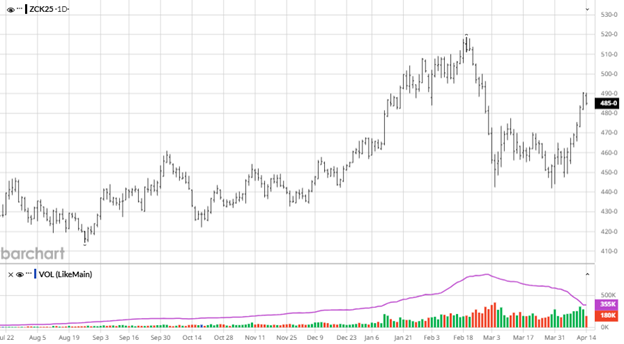

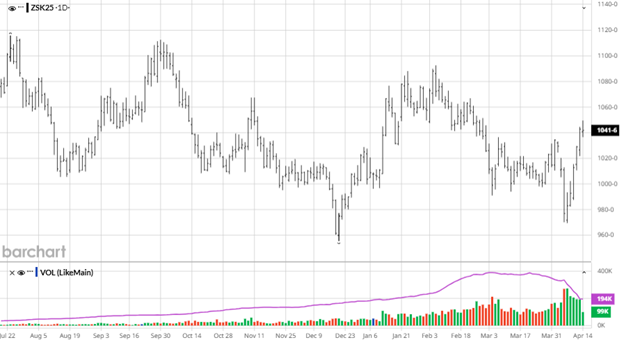

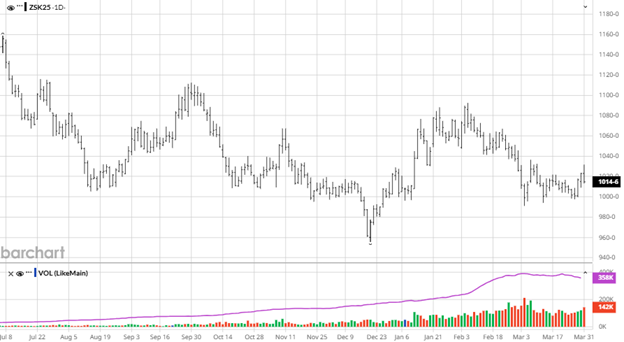

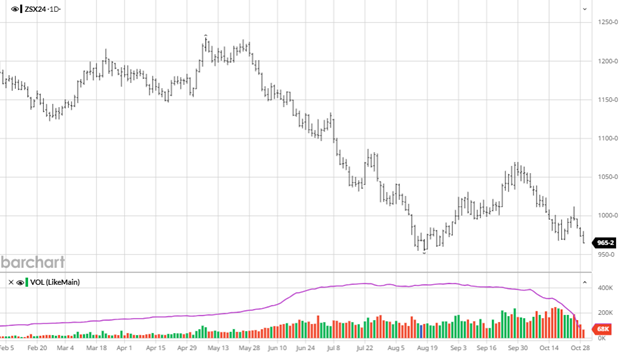

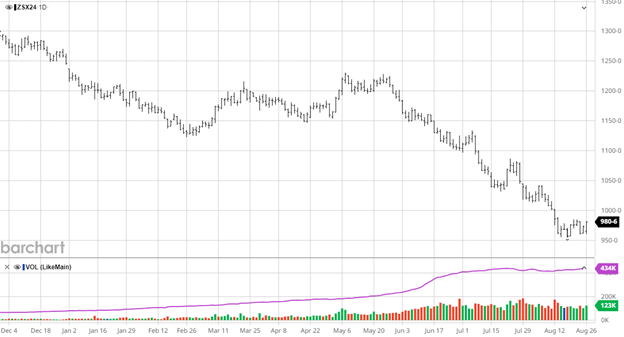

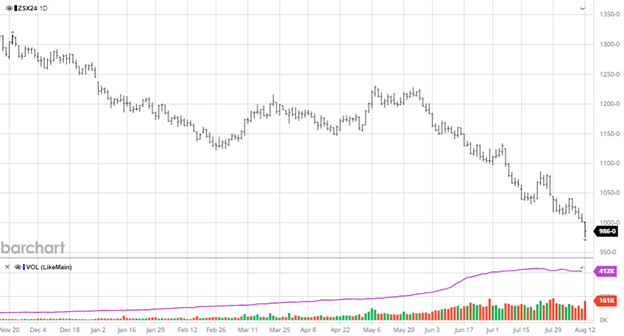

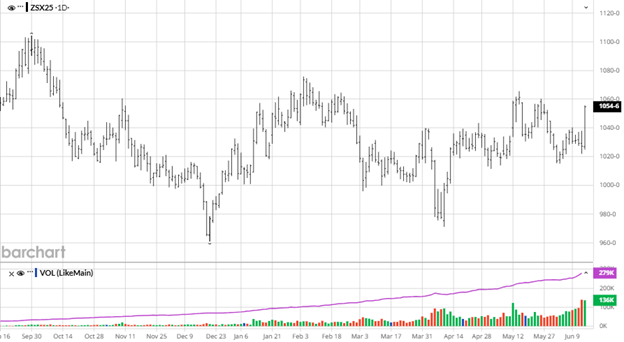

Soybeans received great news to end the week with better-than-expected biofuel mandates from the Trump administration. You can see how the news was received after a lackluster USDA report earlier in the week in the chart below. Beans will need to breakthrough recent highs or at least stay above the moving averages they broke through to keep some positive momentum as they are where they were back in February which is at least better than corn’s price movement. Planting should wrap up soon and good growing weather will move this crop along. Beans received one piece of good news in the biofuel mandates as they await news on any deal with China to help push higher.

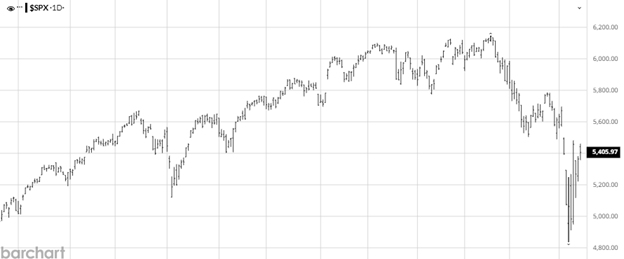

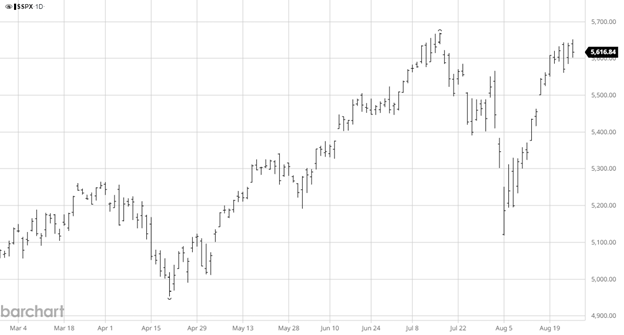

Equity Markets

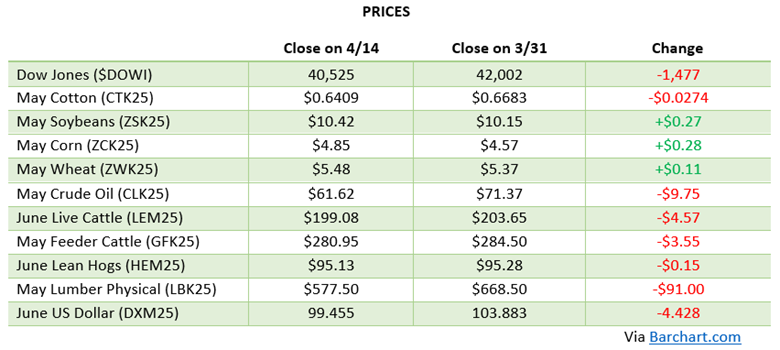

Markets have settled down after another V shape recovery following the tariff driven dip at the beginning of April. The leveling off slightly below all-time highs shows that the market is hesitant in what to expect moving forward but acknowledges that the initial reaction to tariffs with negotiations ongoing were an overreaction. While the market could fail here and move lower with negative trade news the biggest domino the market is watching is China while also keeping an eye on developments in the Middle East.

Other News

- Israel and Iran’s conflict appears to be getting worse with more attacks while the US tries to position itself to lower tensions. Crude Oil prices will watch the news as a global economic slowdown vs lower production due to war would face off.

- Cotton has been quiet with a lack of foreign demand with global economic uncertainty.

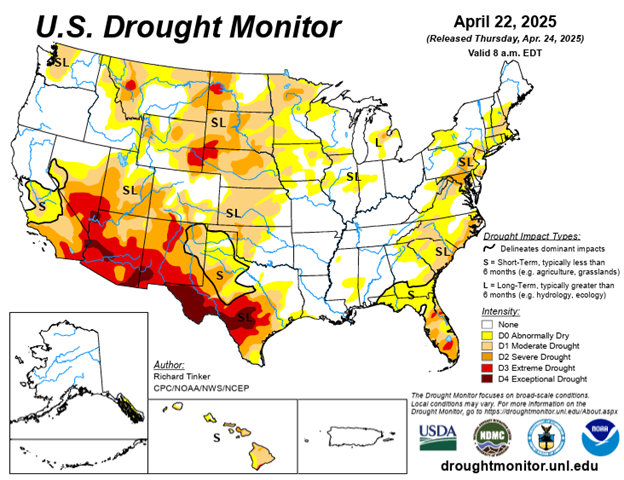

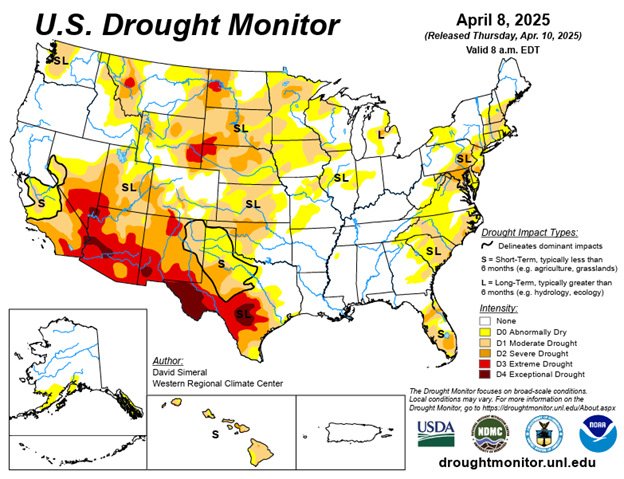

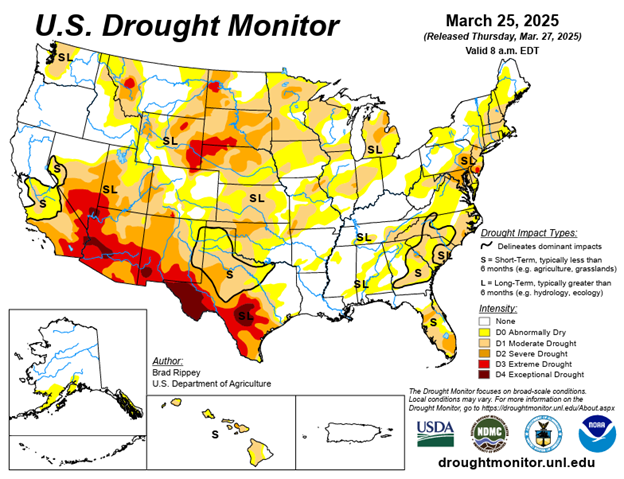

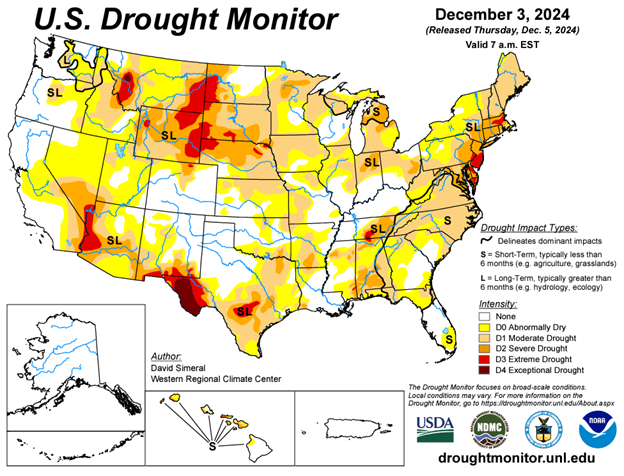

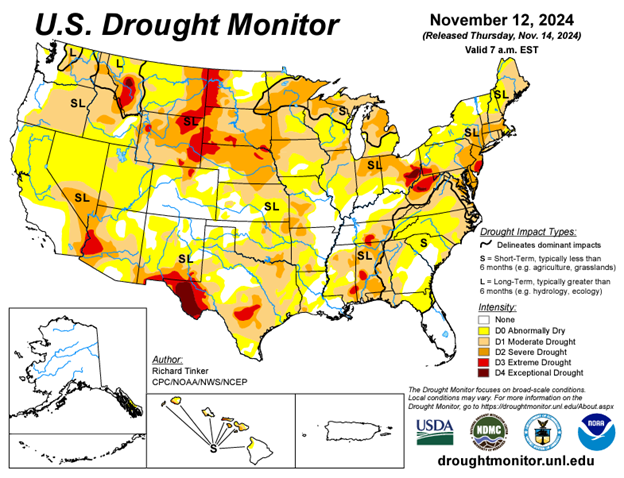

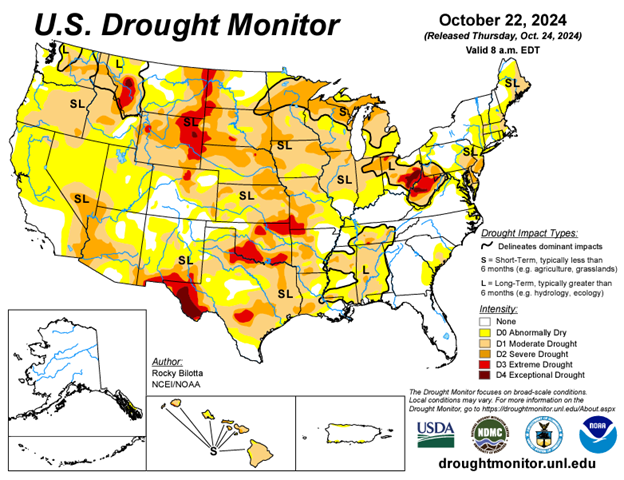

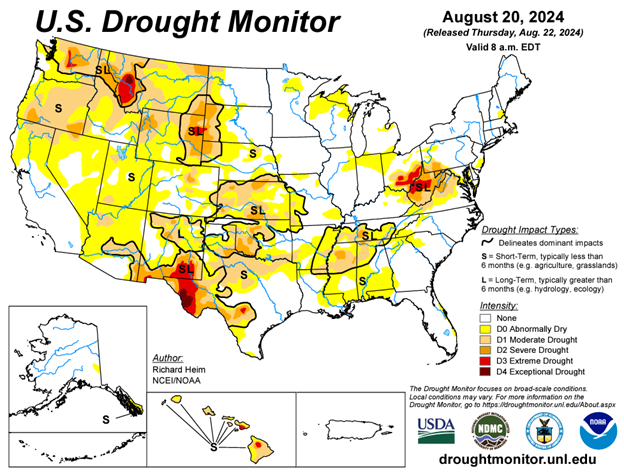

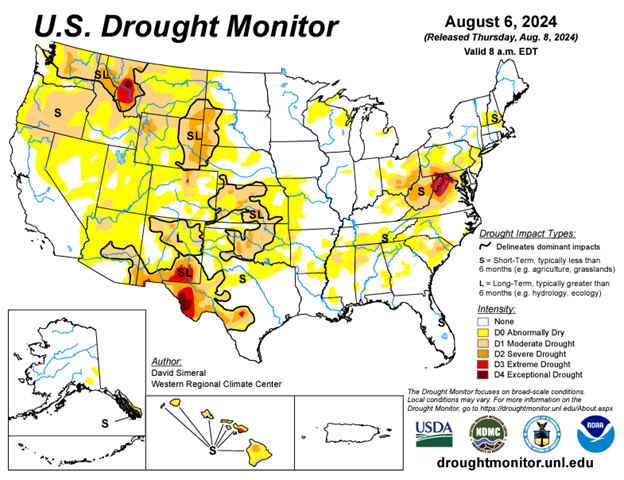

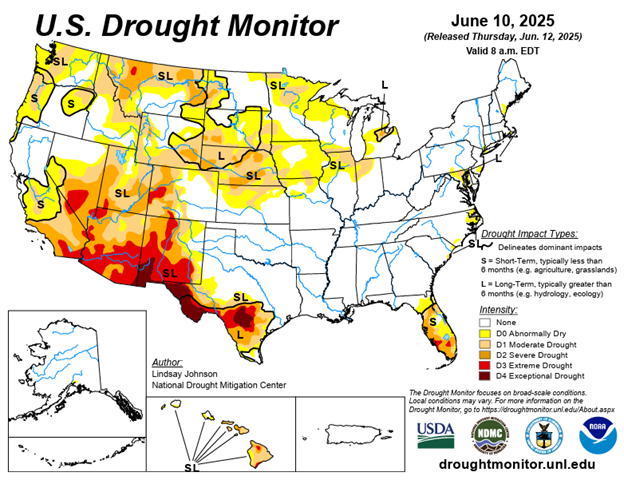

Drought Monitor

Here is the most recent drought monitor.

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.