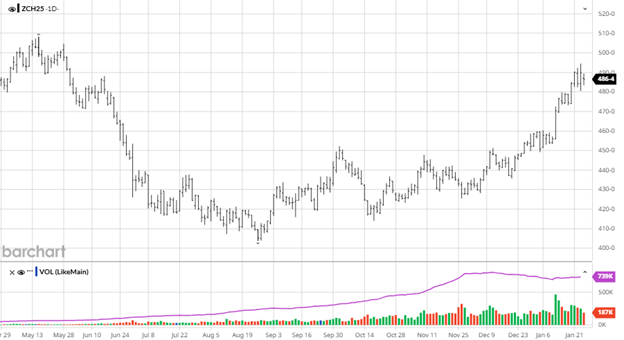

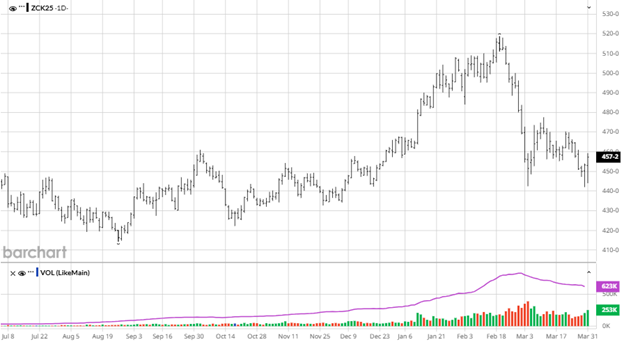

The March 31 Stocks and Acreage Report did not provide any fireworks as there were no major surprises in the report with the USDA saying there will be 95.326 million acres planted. While this is a large acreage number the trade and talk the last couple weeks was about the likelihood of the USDA coming out with a 95 number. While the report could have been worse, stocks coming in exactly in line with the estimate did not pile on with bad news. As we head toward planting, weather, South America and tariff wars will be the main movers now.

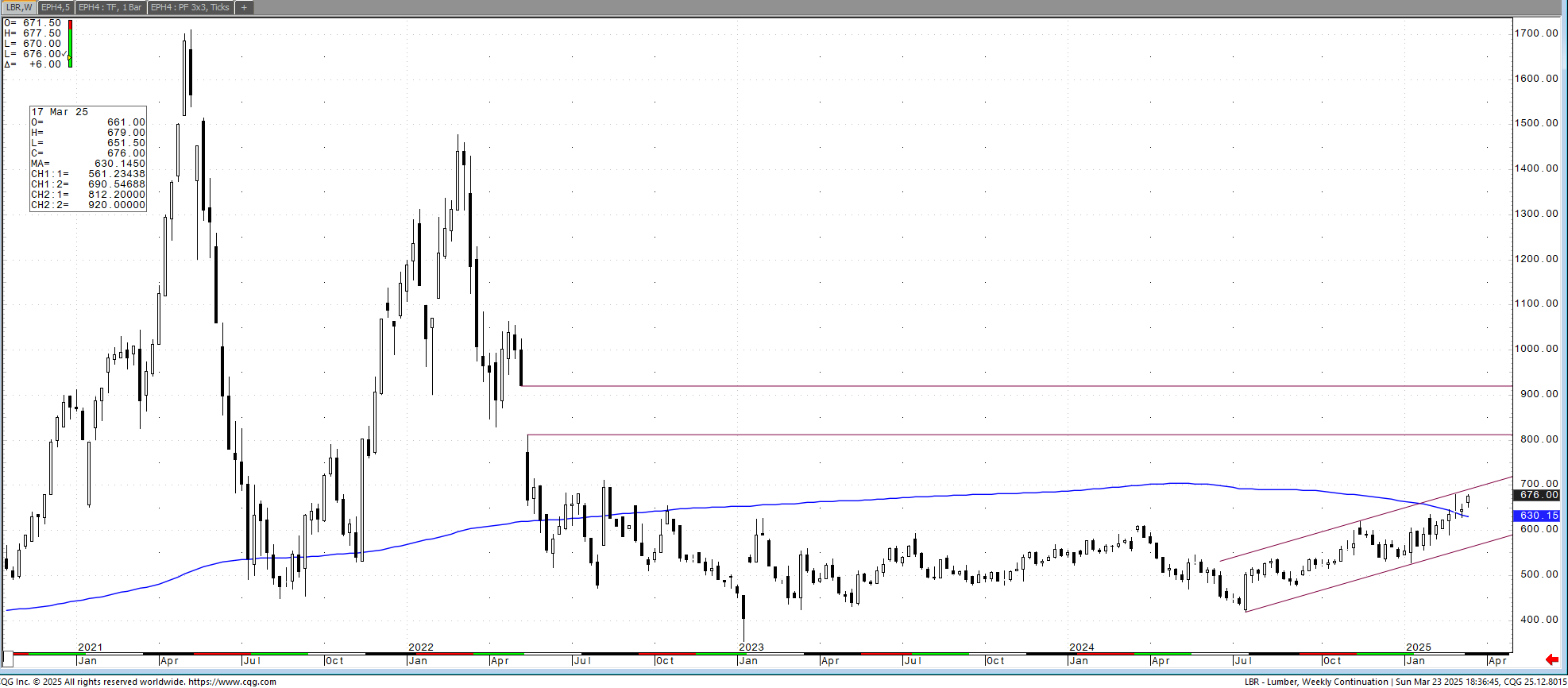

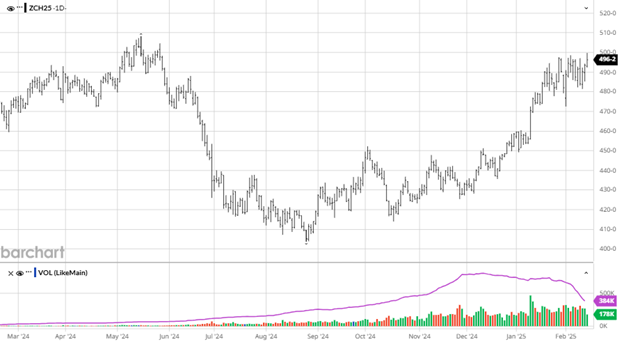

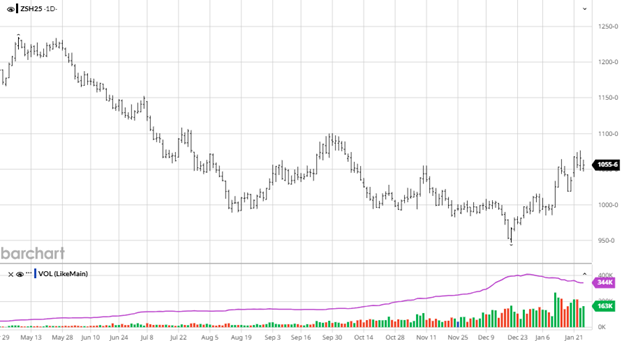

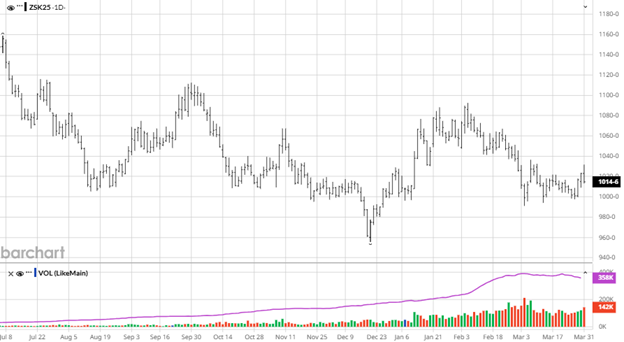

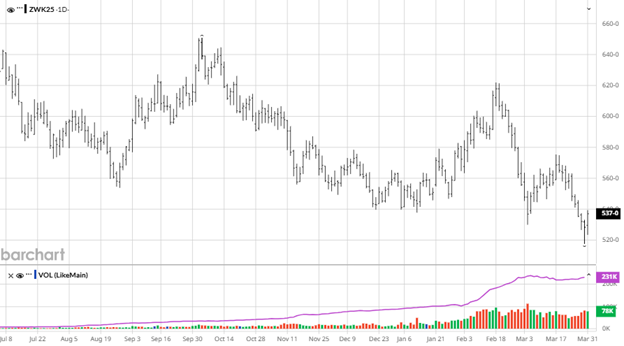

Soybeans came in at 83.495 million acres as their lack of profitability at current prices is making farmers switch some acres to corn. As you can see from the chart below there have not been much help for beans but if this acreage number is close to what we see, it is hard to think they would dip much below $10. The post report action was disappointing as beans continued lower.

Wheat had bullish news from the report as acreage came in 1.125 million below estimates. Wheat has some bullish world news for price with emergence concerns in the Black Sea and US Plains, despite recent price action. News out of the Black Sea and any issues with the US crop will be market movers for now.

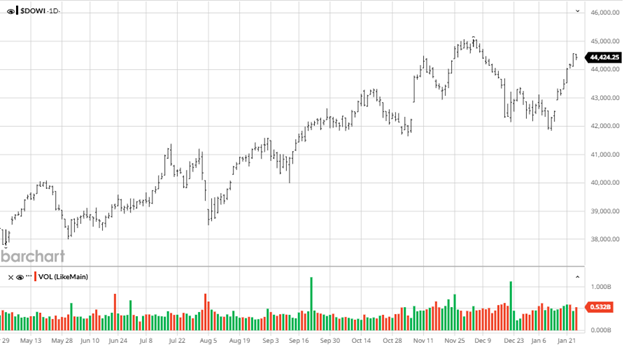

Equity Markets

The equity markets continue their volatile swings while President Trump’s “day of liberation” approaches on April 2 when tariffs are supposed to be going in place. Volatility will be the name of the game as many unknowns remain in the trade wars.

Other News

- Cotton acres came in at 9.867 million. This is 1.315 million acres less than last year. Cotton needs to see demand pick up to get back and stay over 70 cents/lb.

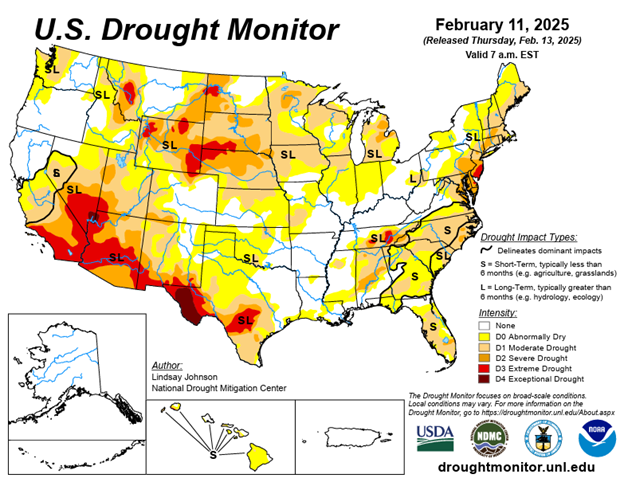

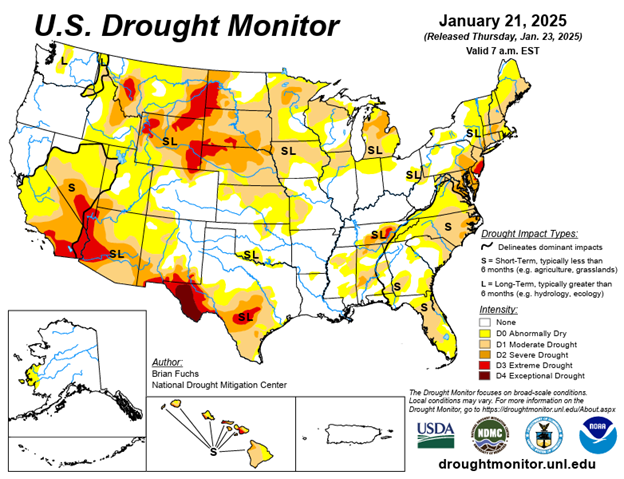

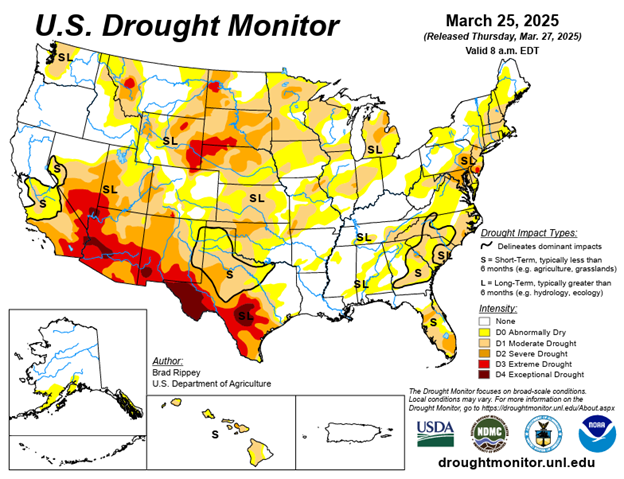

Drought Monitor

As planting approaches the drought monitor begins to become important again as subsoil moisture always seems to be a problem somewhere.

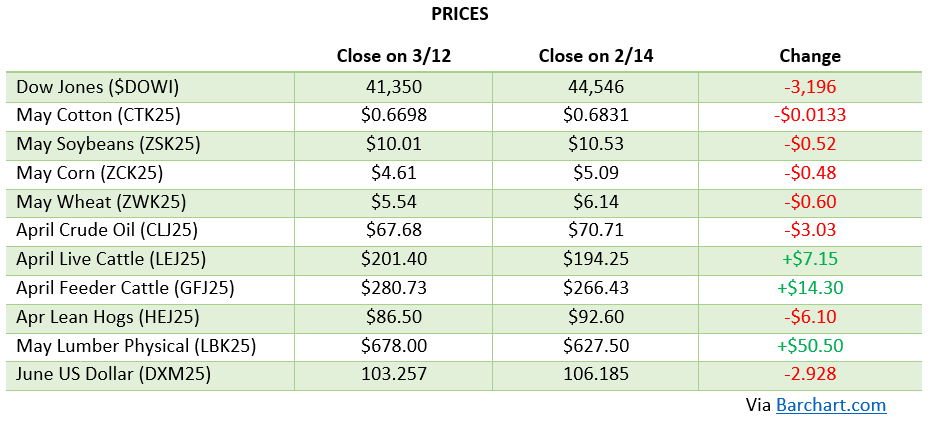

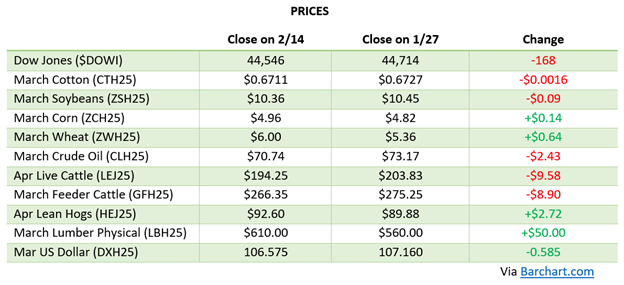

PRICES

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.