Leonard Lumber Update: I Will Continue to focus on the technical side of this market

Recap:

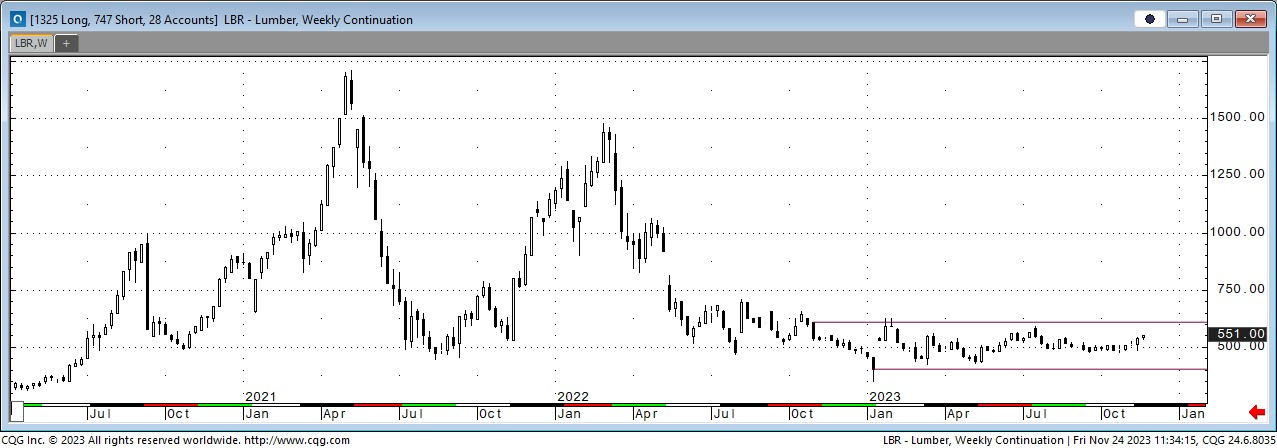

I will continue to focus on the technical side of this market. There are two takeaways from the weekly chart below.

The first read is that when a market goes through an extreme volatility event, there tends to be a corrective phase. You can see just how flat the market has become. In 2021 and 2022, the market experienced record prices and volatility. In 2023, the market has been flat. I wonder if the excess volatility has been sufficiently drained yet. The chart shows that futures can run another $50 higher and still be in the flat range. That brings me to read number two. This is a flat market working along its bottom. Rarely does a market break out down from this type of trade. The breakout is usually a retracement of the last move. So, this market has some room to run higher. I made a case in March, more than once, that the potential distance up is far greater than down. That math has stayed the same, but the timeline is in doubt.

The fundamentals are getting better as time goes on. The market is getting used to higher rates and higher home prices. A slight downtick in either stimulates more activity. I expect a continued start and lag with the buyers for another year, but the good news is the actual decline was marginal at best. My other soapbox rant continues to be the excess capital in the system. Massive capital injections are still coming into the market. There is also enormous capital sitting on the sidelines. And finally, 2024 is an election year. Enough said there.

Last week’s futures trade was a good read of the market. The recent Sept-Oct trend to new lows was more a sign of frustration than weakness. The bounce off those lows is a rebalancing, but last week’s positive trade showed underlying strength. The breakthrough of the 100-day average and the 200-day average indicated new strength. Two other keys are that Elliot Wave is calling the excess volatility gone. This is not a bottom call. It is a warning not to discount the possibility of some large spikes higher. If true, the other key factor could be a market exiting the focus of the 2020 to 2022 data and reverting to pre-2020 data and fundamentals. As we remember, that was an underbuilt sector with lessening production.

This week’s focus remains on the algo buying versus the premium. This is a very disciplined premium/discount trading market. It will have to meet somewhere in the middle. A good indicator of potential January weakness will be if the spread goes further. The upcoming roll might be enough to bring January closer to the cash market.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636