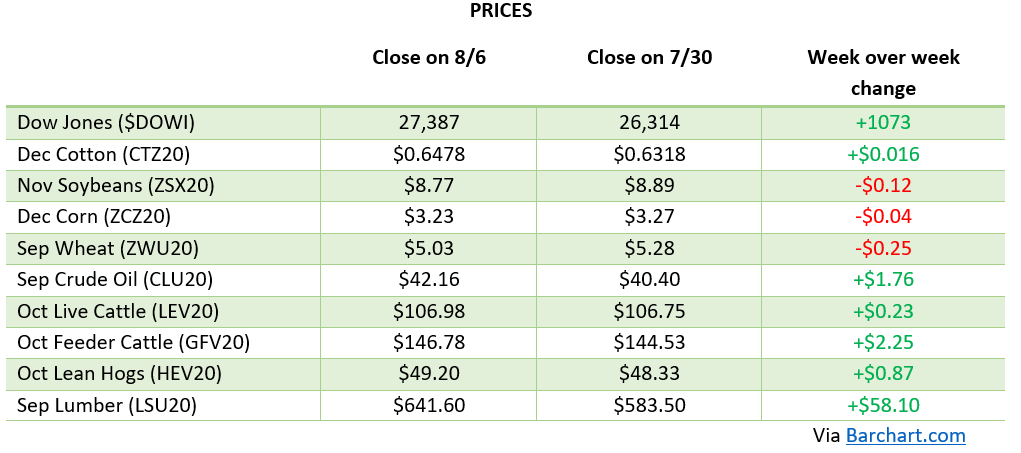

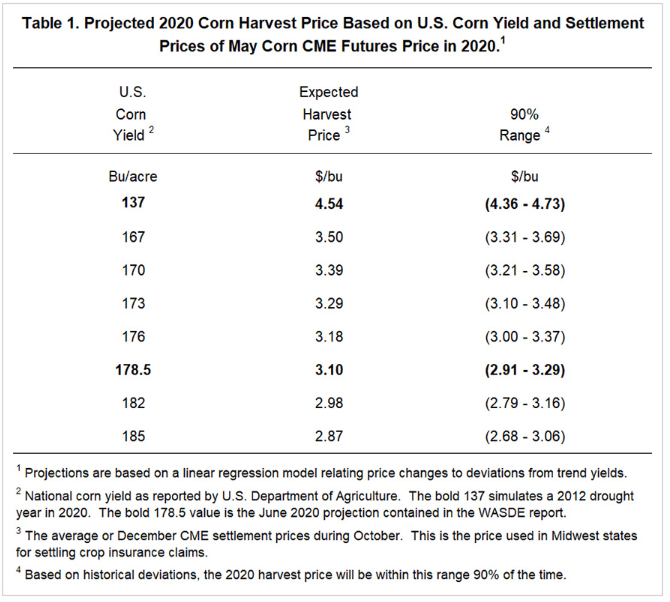

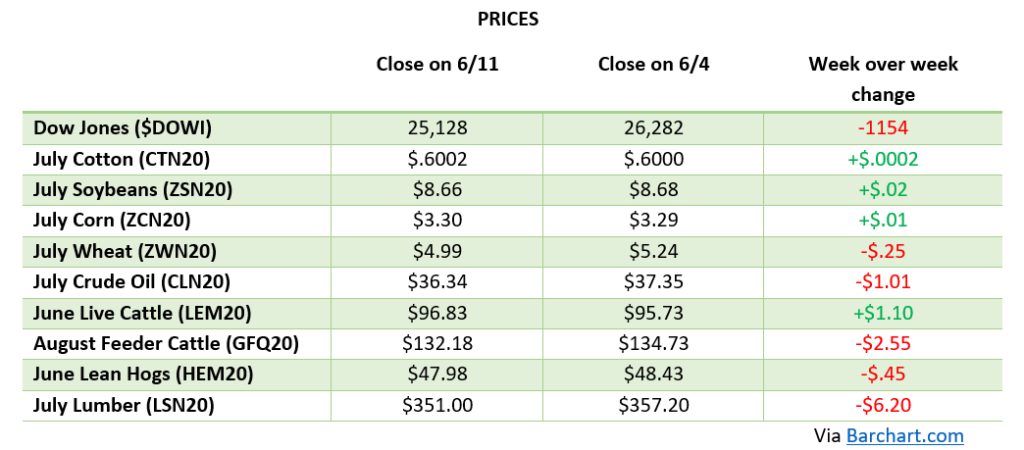

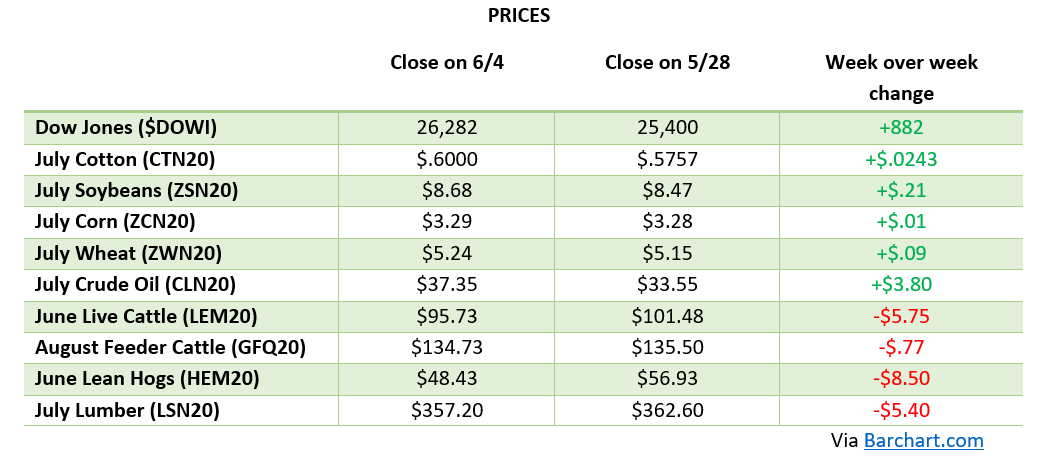

Corn took it on the chin this week, again, as crop conditions and weather forecasts continue to point toward the potential of a record yield. With strong conditions and weather moving forward, most of the corn belt, with the exception of parts of Iowa suffering from severe drought, are running out of time for many weather factors to effect the crop. Keeping an eye on forecasts for Ohio and Michigan will be important to farmers as they could use some rain in those areas but are not desperate, yet. If the forecast continues to look promising there is not much bullish news out there to help find support with a 180 bpa crop still in play. Keep an eye on exports as we continue to see strong export numbers but little positive price reaction as a product of it. Yield estimates range from 178-183 bpa from what we have seen from across the spectrum, showing that many top experts believe a record yield could be seen this year.

Soybeans had a tough week like corn because high yields are still very much in play on top of already strong stocks. Without China ramping up their purchases to try and at least act like they are trying to reach the Phase 1 Trade Agreement; beans are running into a demand problem. Bean yields are looking to potentially be 52+ bpa with a 73% G/E rating this week saw prices take a hit. Beans and corn have been moving lower over the last few weeks as few weather issues and no large surprises in demand have come to fruition. Any problem that China has with the Three Gorges Dam area could lead to more purchases but a total failure of the dam would be a disaster as it could cause a massive loss of life along with flooding of large areas of farmland.

Cotton has seen a boost this week as it, like other raw materials have seen a boost as demand around the world starts to come back. Another supportive factor for cotton has been the continued decline in the value of the US Dollar. The threat of Hurricane Isaias effecting the crop in the SE helped give a boost early in the week but how much damage it actually did to the crop remains to be seen. If prices can breach and stay above 65 cents that would be a good level of support.

Phase 1 Trade Agreement Meeting

The US and China are set to have their first check-in meeting to assess how Phase 1 is going (spoiler alert: not great). This is on top of recent tensions over the closing of embassies and spying allegations. Not sure that anything good can actually come out of these talks but they will be worth keeping an eye on August 15th. Hopefully we see a commitment to ramp up and get a boost to start that week following.

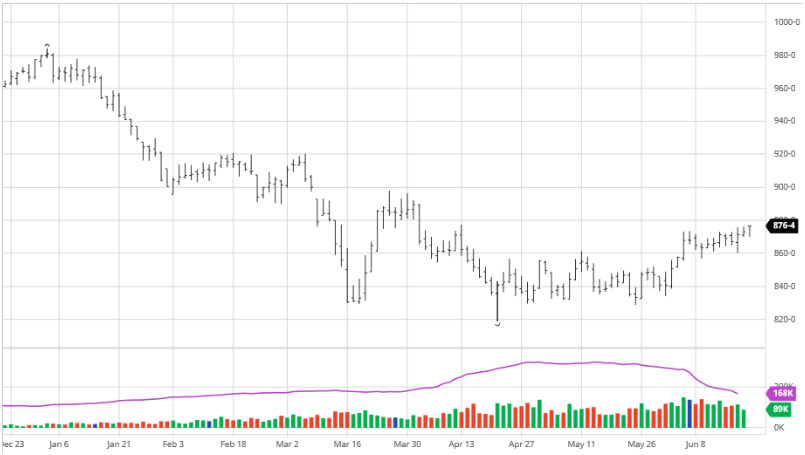

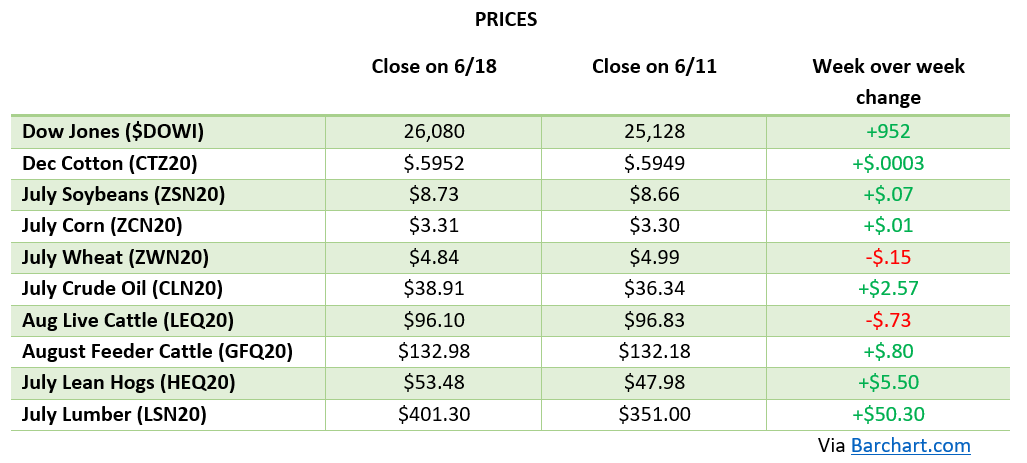

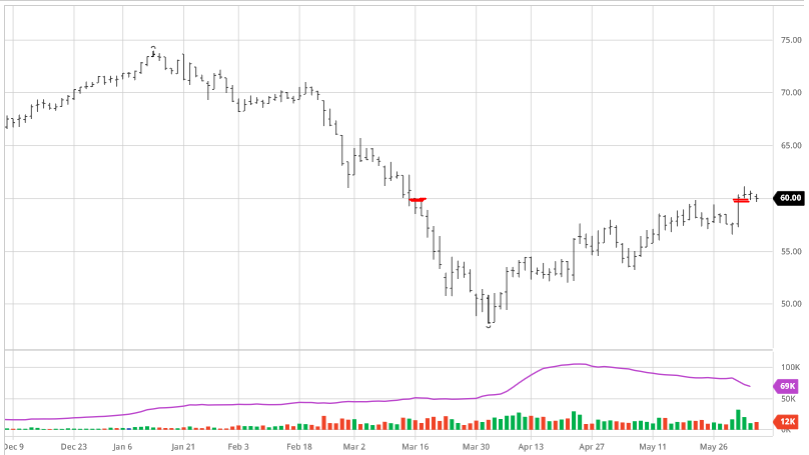

Lumber

Lumber continues its upward trend to price levels we have not seen since 2018. Lumber is a commodity the is easily produced because of the sheer quantity of it available supply is not an issue to slow down consumption. As many purchases and contracts are done well in advance the demand has not wavered as much as the pipeline of getting it from A-Z has. In a volatile market like this, especially during this kind of positive run for price, nobody ever wants to call the top so looks like everyone may want to ride it out and see what happens.