To keep it simple the sharp selloff on Monday rattled some cages and woke up a marketplace. All of a sudden, the trade looked up and saw low inventories with a cash market very close to $300. The round of cash was enough to bring in short covering in futures. To sum it up we finally are getting a cash buy. The question now is it one of the new 2024 tepid buys or a good old fashion fill in?

Early in the year, we expected shutdowns, fires, or rail to hold prices up. Most of those factors are still here. As a matter of fact, we are in the thick of the shutdowns, so that can become a feature. Nothing has changed with demand. We had run inventories to very low levels with fall coming soon. The market bottomed out in cash, and if it is going to go much higher, the futures have to become the driver.

Some could buy early in the week and sell most of it by Friday. The next buy will be higher, so they have to decide on building inventory. With the futures at such a premium, there is a way to protect it, but for now, buyers want to book a few profitable cars, noting that it’s been a few months. Market psychology always has the last word.

A higher futures trade will bring in more cash buying. The focus from here will be on the ability to manage the risk of the next cash buy. I bet everyone is putting the futures app back on their phones this weekend.

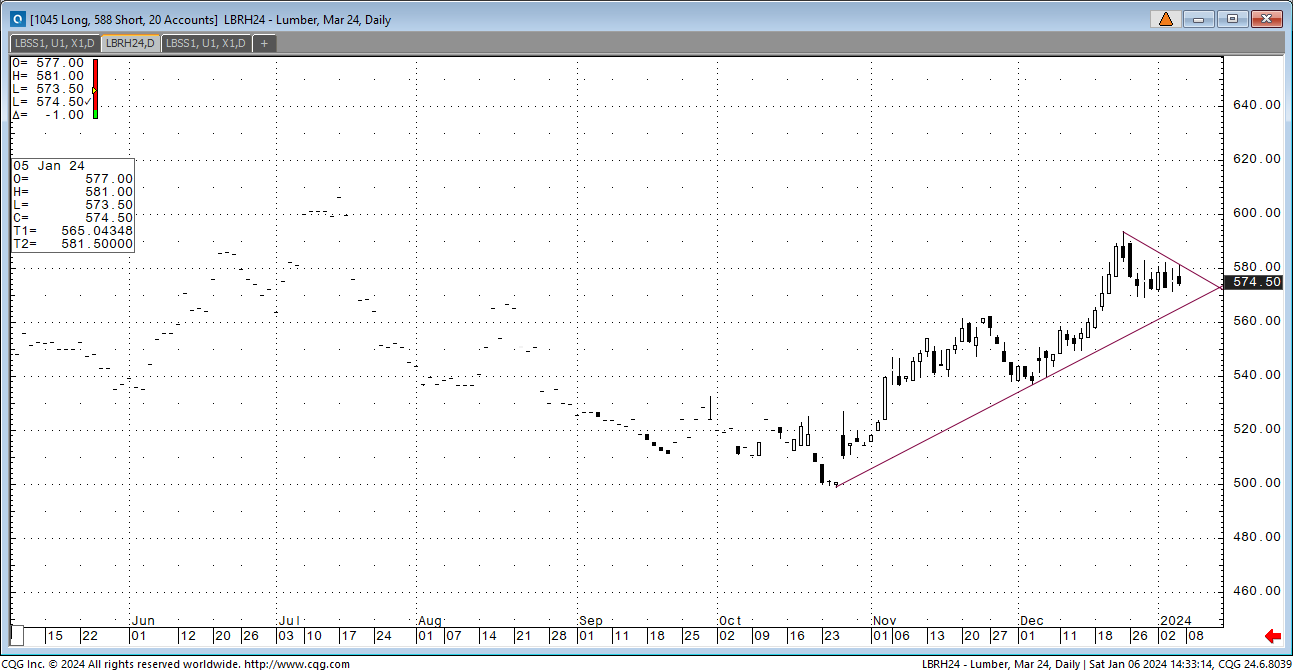

Technical:

The futures offer two major focal points. The first is a bottoming of the market with real upside potential. I’ll add to that in a moment. The other fact is that July futures expired at 418.50. With all the headwinds facing the economy and this industry, you can’t call it a low. But today, we are.

I have talked about the noise above the market for months now. Last week’s action tells me that the market can grind through those areas. The problem with the grind is that you have to deal with more fund selling each day. The data shows that it would take a trade over $518 to slow or stop that. A close over it gains momentum to the $528 area. The next level is $550. I’m not calling for anything like that, but if you are short and sitting on your hands, pay attention.

The gap left Tuesday adds a little “generative” confidence to futures. This rally was needed. It’s healthy and should stay intact until the funds say that’s enough.

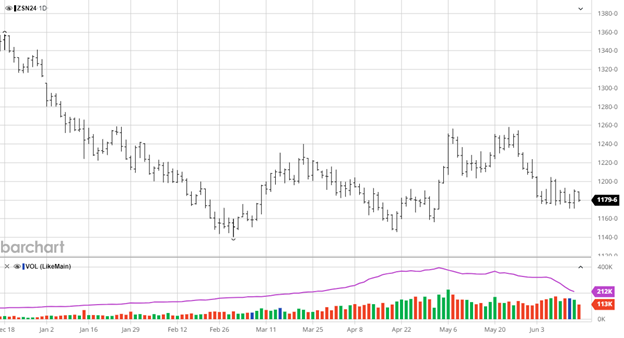

Beans are lower over the last 2 weeks with them settling into a flat trade this week. The USDA report was uneventful despite the USDA cutting another 1 mmt from Brazil’s bean crop. US exports were revised lower and ending stocks rose as the slow pace of exports continued. With no major surprises and no major weather/production issues yet there is not much bullish news outside of CONAB’s Brazil production estimate which is 207 million bushels below this week’s USDA update.

Beans are lower over the last 2 weeks with them settling into a flat trade this week. The USDA report was uneventful despite the USDA cutting another 1 mmt from Brazil’s bean crop. US exports were revised lower and ending stocks rose as the slow pace of exports continued. With no major surprises and no major weather/production issues yet there is not much bullish news outside of CONAB’s Brazil production estimate which is 207 million bushels below this week’s USDA update.