AG MARKET UPDATE: SEPTEMBER 16 – 23

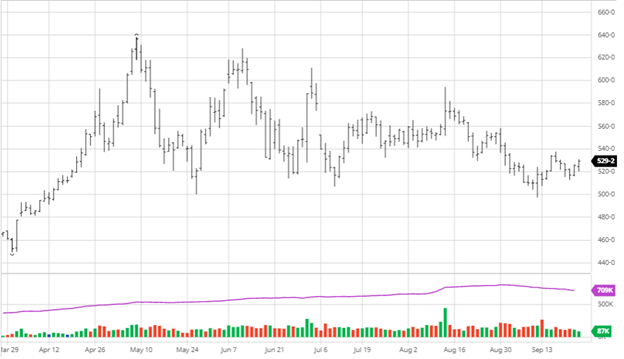

Corn was pretty even on the week, only losing 1 cent as overall market weakness to start the week pulled it lower, followed by a rebound the last few days. Harvest continues to roll on as there has been great weather the last week in most parts of the country. Inconsistent yield reports coming out of the eastern corn belt have raised an eyebrow, but with a long way to go before the end of harvest, it is not a market mover. As always, when harvest comes, we will begin to get an idea of how many bushels are going straight to market and how much will go into storage. The late rally in 2020 and into this year may have some farmers trigger shy along with a La Nina year in South America. The exports were steady but nothing major to move the markets one way or another. Look for the shipping/export problems to continue until all the issues caused by Hurricane Ida are fixed. The next USDA report on the 30th will be what the market and traders position themselves for over the next week.

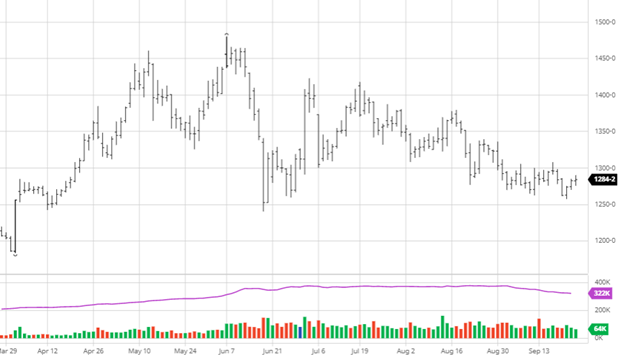

Via Barchart  Soybeans have had a similar bounce back after the start of the week but still fell slightly. Exports have been strong recently as China continues to be a buyer as US beans have become competitive in the world market. Harvest for beans has gotten going as well and will continue in the coming weeks. Dozens of crush plants in China have been forced to close while the government looks to reduce electricity use to meet energy-saving goals. There has been a lot of confusion around the biofuel mandates but, until we get a final answer from the Biden administration, the market does not seem to be interested in rumors.

Soybeans have had a similar bounce back after the start of the week but still fell slightly. Exports have been strong recently as China continues to be a buyer as US beans have become competitive in the world market. Harvest for beans has gotten going as well and will continue in the coming weeks. Dozens of crush plants in China have been forced to close while the government looks to reduce electricity use to meet energy-saving goals. There has been a lot of confusion around the biofuel mandates but, until we get a final answer from the Biden administration, the market does not seem to be interested in rumors.

Dow Jones

The Dow has gotten its losses back following the Evergrande driven collapse to start the week. The quick bounce back after the worst day in several months is good to see for the bulls, while the bears do not think that is the only issue in the market and a correction is still due. Despite the bounce back, the Evergrande news will be followed for a while.The Fed did not make any major changes this week but may be looking to towards the end of the year.

Podcast

Check out our recent podcast where we’ve brought on one of our real-life firefighters from RCM Ag – Jody Lawrence, along with Tim Andriesen from the CME Group to provide us with some inside baseball knowledge of the current state of agriculture markets. They discuss the real-world application of short-dated options to potentially fight the recent blaze of volatility surrounding agriculture markets.

https://rcmagservices.com/the-hedged-edge/

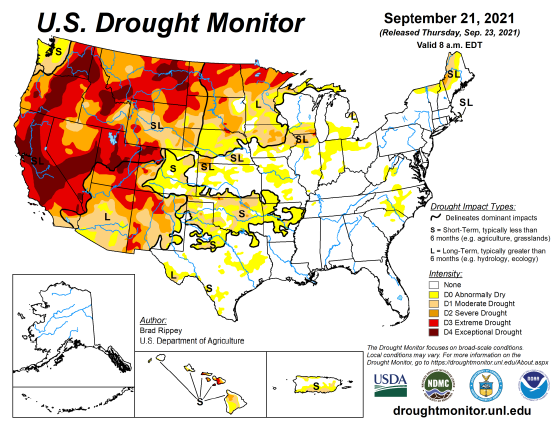

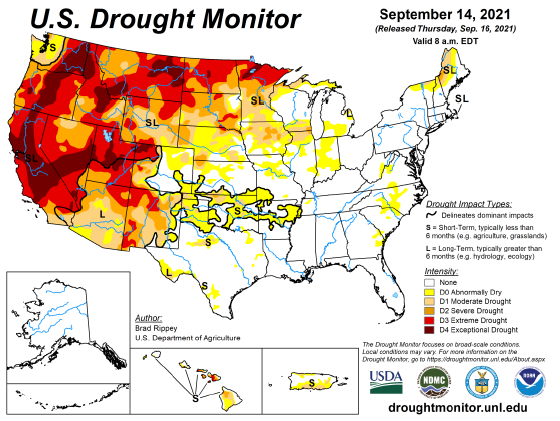

US Drought Monitor

The maps below show the US drought monitor and the comparison to it from a week ago. The outlined areas in black are areas that the drought will have a dominant impact.

Via Barchart.com