AG MARKET UPDATE: SEPTEMBER 2 – 16

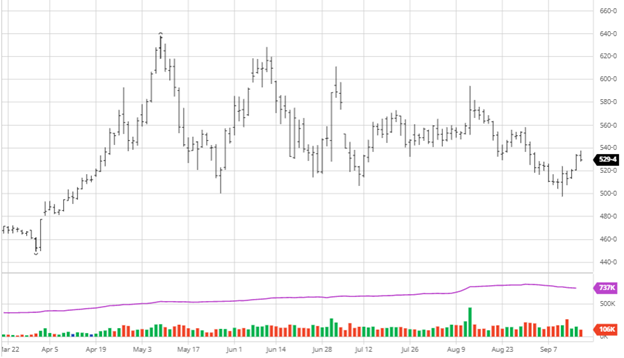

Corn was struggling heading into the USDA report last week but has seen a good 30+ cent bounce from the sub $5.00 lows. The USDA raised their expected yield for corn to 176.3 bu/acre and added 600,000 acres. They also raised the ending stocks with higher yield for what some would consider a bearish report, but the reaction was neutral to bullish following it. As harvest gets going, yield estimates cover a wide range, but it appears that a mid 170s is more and more likely. With no significant weather concerns in the coming weeks, harvest should get off to a fast start. As strong as prices currently are, it is always essential to have a marketing strategy to avoid missing out on other opportunities. As you debate how much to store in the bins or go ahead and sell, make sure it is what makes the most sense for your farm. If you want to sell now to get the cash, consider what can be done on paper to not miss out in case of higher prices in the future. As harvest gets rolling expect yield updates to change as well while the markets keep an eye on them.

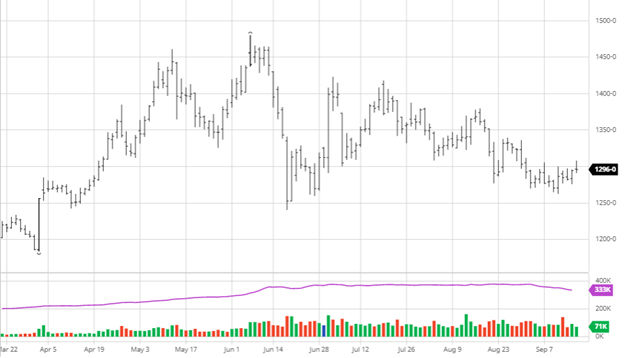

Soybeans have had a similar reaction the past couple of weeks as corn. The USDA slightly raised their bean yield to 50.6 bu/acre from 50 and lowered harvested acres by 300,000. China continues to show up in the export report which is both needed and welcome to see after this summer’s lack.. As the ports in New Orleans and the other grain terminals along the Mississippi River reopen following the hurricane, export disruption worry has slowed. Harvest (like corn) should get off to a great start in the coming weeks, and it is crucial to have your marketing plan ready and execute it. Keep an eye on yield reports as they come out in the weeks ahead and the cash market as it will help give an idea of how much people are willing to sell now or store.

Soybeans have had a similar reaction the past couple of weeks as corn. The USDA slightly raised their bean yield to 50.6 bu/acre from 50 and lowered harvested acres by 300,000. China continues to show up in the export report which is both needed and welcome to see after this summer’s lack.. As the ports in New Orleans and the other grain terminals along the Mississippi River reopen following the hurricane, export disruption worry has slowed. Harvest (like corn) should get off to a great start in the coming weeks, and it is crucial to have your marketing plan ready and execute it. Keep an eye on yield reports as they come out in the weeks ahead and the cash market as it will help give an idea of how much people are willing to sell now or store.

Dow Jones

The Dow has struggled so far in September like the other indexes. This is not uncommon to see this time of the year but does give investors heartburn when you see back-to-back weeks of struggles.

Wheat

The insurance price was set for the red wheat varieties yesterday at $7.16 and $7.08, a multi-year high. High prices cure high prices so expect corn to lose acres in the Wheat Belt as the guarantees will motivate additional wheat acres.

Podcast

Check out our recent podcast where we’ve brought on one of our real-life firefighters from RCM Ag – Jody Lawrence, along with Tim Andriesen from the CME Group to provide us with some inside baseball knowledge of the current state of agriculture markets. They discuss the real-world application of short-dated options to fight the recent blaze of volatility surrounding agriculture markets potentially. https://rcmagservices.com/the-hedged-edge/

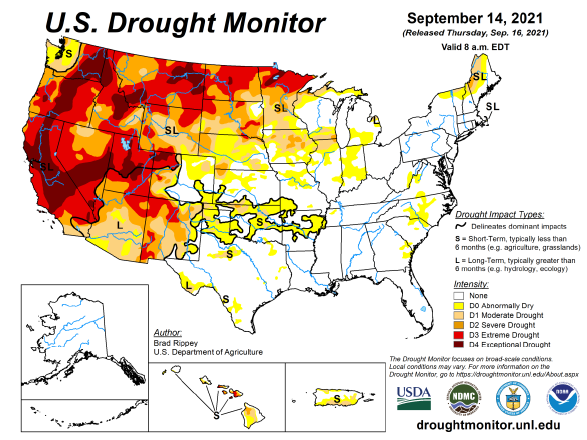

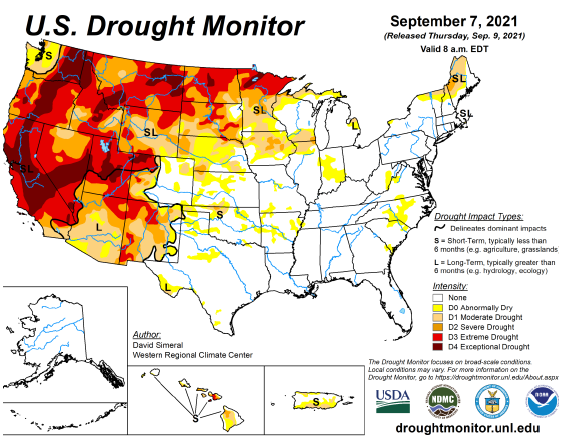

US Drought Monitor

The maps below show the US drought monitor and the comparison to it from a week ago. The dryness will allow harvest to start on time.

Via Barchart.com