What are we to make of the on-again, off-again tariff threats and realities flying around markets these past several weeks? Will this crush American consumers, hurt American farmers, or be the panacea Trump hopes for? Well, history doesn’t repeat, but it rhymes, as they say… and we’ve seen this movie before.

The Previous Tariff Episode: A $13.2 Billion Lesson

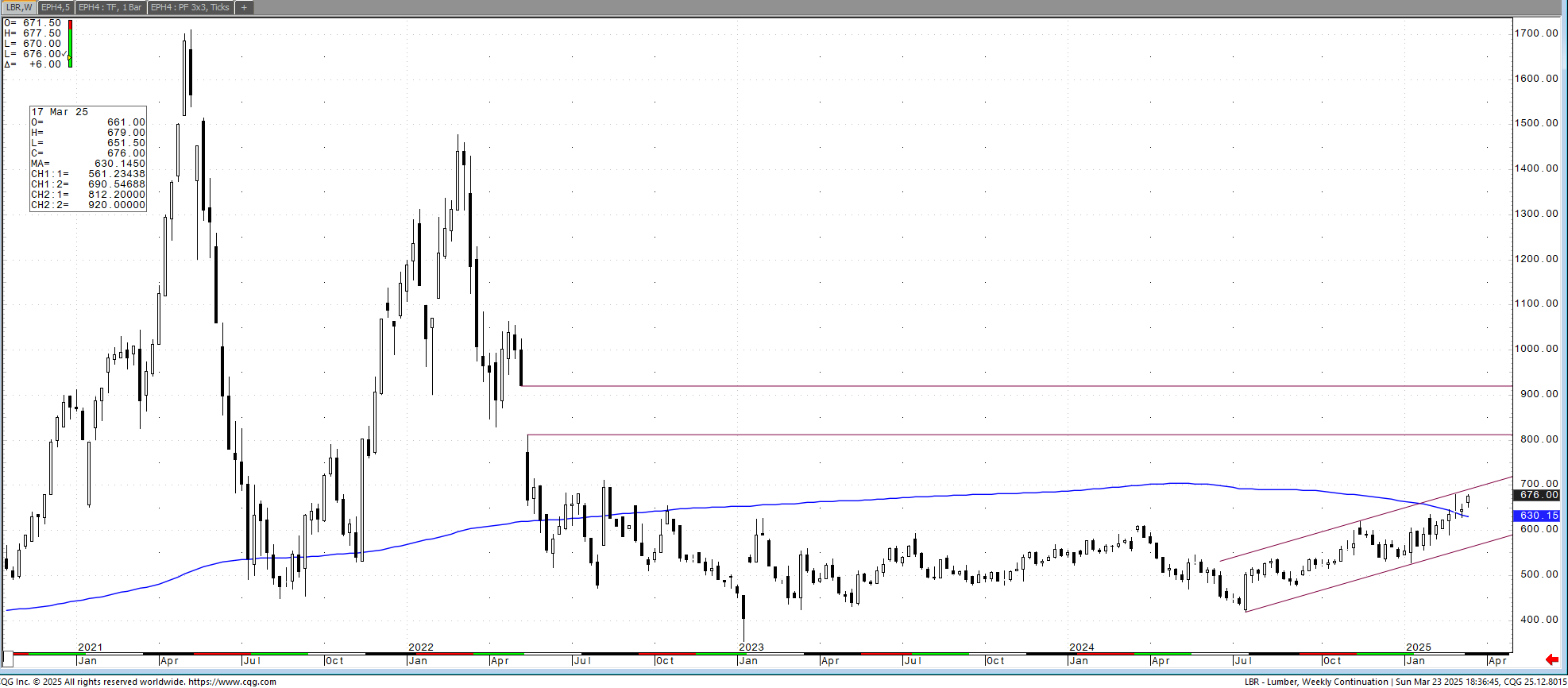

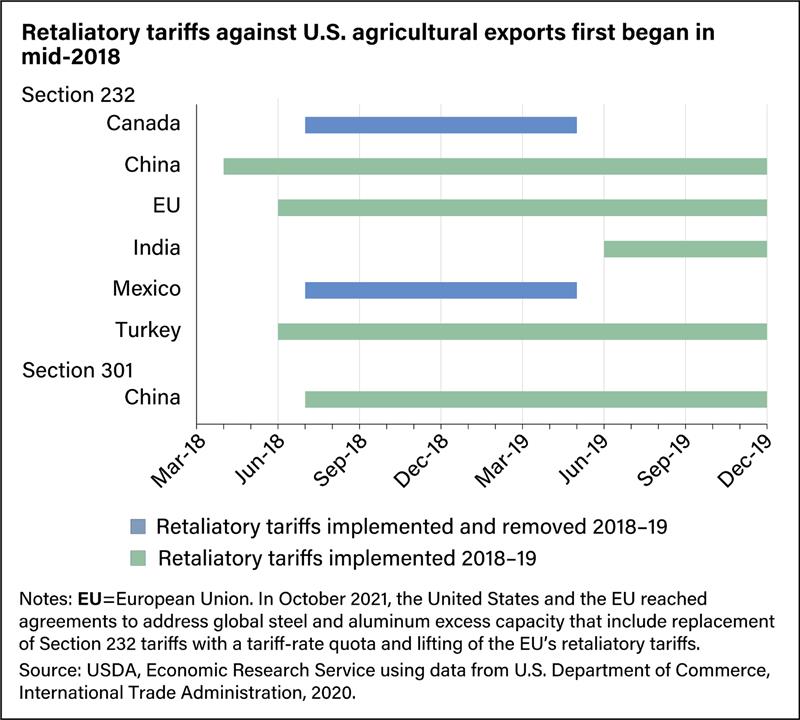

When trade tensions escalated during the previous Trump administration, grain markets felt the shockwaves immediately. The U.S. Department of Agriculture’s Economic Research Service (ERS) quantified these impacts in stark terms: retaliatory tariffs from six major trading partners cost U.S. agriculture $13.2 billion from mid-2018 through 2019. (source: https://www.ers.usda.gov/amber-waves/2022/march/retaliatory-tariffs-reduced-u-s-states-exports-of-agricultural-commodities)

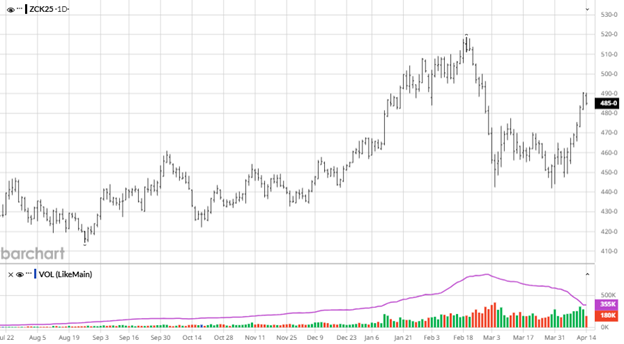

China’s implementation of a 25% tariff on corn, wheat, and cotton—along with tariffs on soybeans—was just the beginning. Mexico, Canada, the European Union, India, and Turkey all implemented their own countermeasures targeting American farm goods. The result? A perfect storm that destabilized agricultural markets across multiple sectors.

The ERS analysis reveals how unevenly these impacts were distributed. Midwestern states bore the brunt of the damage, with Iowa ($1.46 billion), Illinois ($1.41 billion), and Kansas ($955 million) suffering the largest annual losses.

Soybeans alone accounted for 71% of total losses—a staggering $9.4 billion hit primarily absorbed by Midwest farmers. Sorghum producers (particularly in Kansas and Texas) faced $854 million in losses, while pork producers took a $646 million hit.

The Bailout Response

To offset these losses, the first Trump administration implemented an unprecedented farm bailout program. Over the course of these two years, the total bailout for farmers reached approximately $28 billion. This included direct payments to farmers, as well as additional programs aimed at purchasing surplus agricultural products and finding new markets for U.S. agricultural goods.

So all good? Not really….Farmer’s would rather earn their dollars, not be given them, as evidenced by this farmer’s quote in a 2021 article::

“Ultimately, my bottom line looks about the same as it did pre-Trump trade war, but much of that ‘income’ came in the form of Trump’s bailout,” Scott Blubaugh, an Oklahoma-based farmer and president of the Oklahoma Farmers Union, told Yahoo Finance. “Those are subsidies that I wouldn’t have needed if the trade war hadn’t happened. I’m grateful for the dollars to keep my farm afloat, but I’d much rather earn those dollars than be given them. The trade wars limited my and other farmers’ ability to earn.”

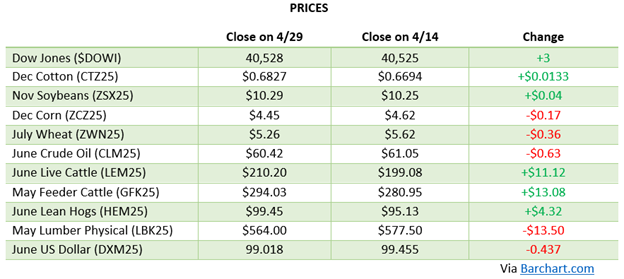

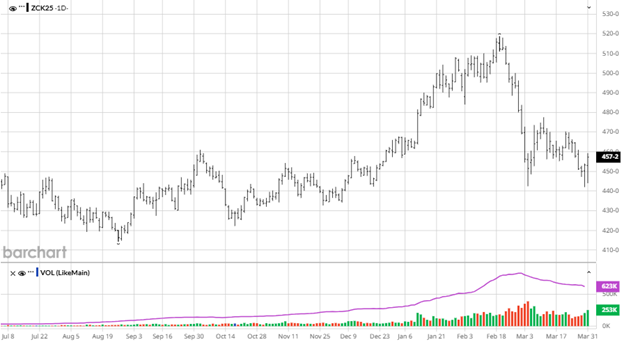

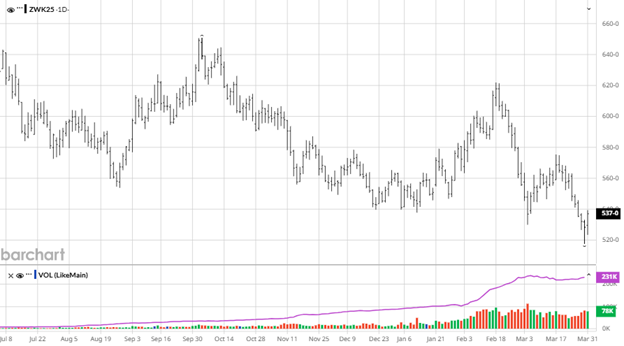

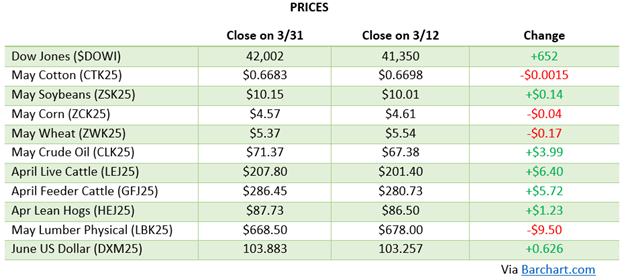

Market Volatility: Then and Now

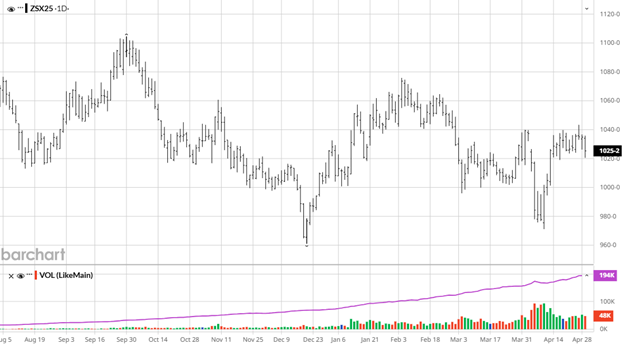

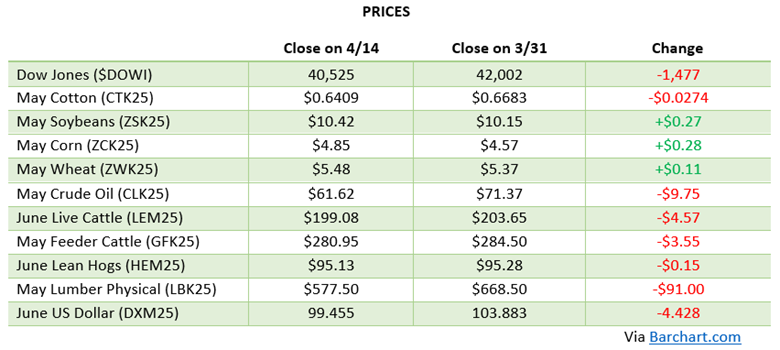

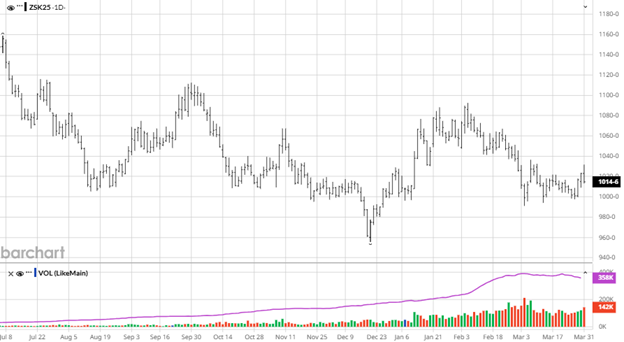

So with all of that as the backdrop, what were markets doing in reaction to the tariffs 7 years ago? The market reactions in 2018 were substantial. Soybean futures fell from about $10.25 in early 2018 down to $7.50 in late 2018 as tariffs took hold. Yet remarkably, prices rallied all the way up to $16.75 by 2021 as China eventually resumed their buying.

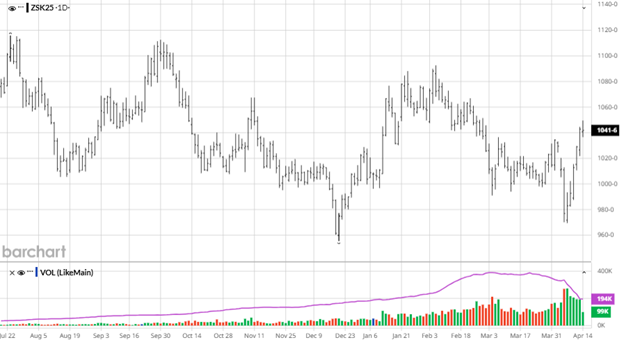

Today’s market has shown more resilience. Despite renewed tariff talk, soybean futures have moved from $10.40 at their yearly high to around $9.80 recently—a much more modest decline than the 27% drop we saw in 2018.

Why the difference? Farmers and markets appear to be weighing several factors:

- Experience with the previous tariff cycle has taught exporters to diversify markets more effectively

- Current global supply and demand fundamentals differ from 2018

- Markets may be pricing in the possibility of targeted bailouts similar to last time

- Export sales data suggests global buyers remain active despite the uncertainty

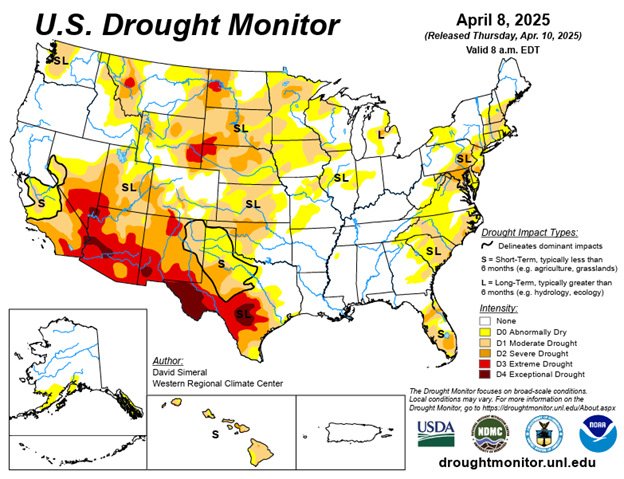

What Farmers Are Worried About

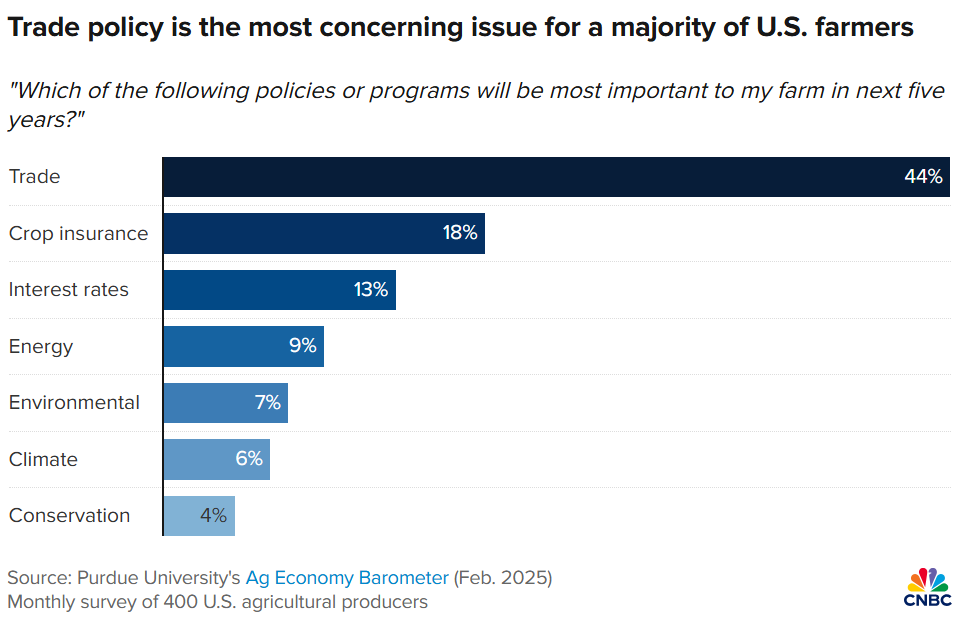

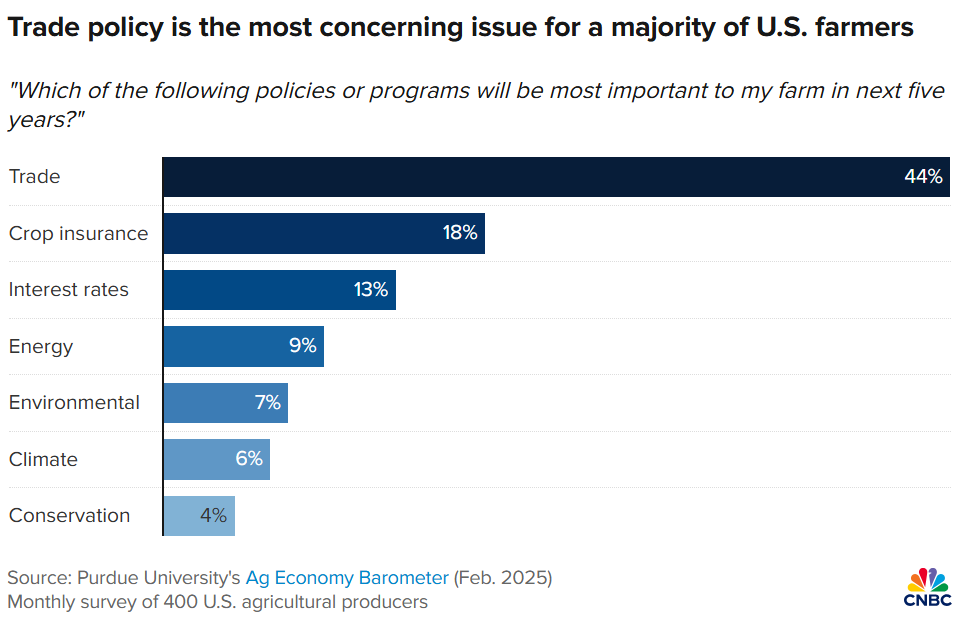

The farming community’s anxiety about trade policy is reaching critical levels. According to a this CNBC article, the latest Purdue University/CME Group Ag Economy Barometer shows nearly half of farmers surveyed believe a trade war leading to a significant decrease in U.S. agricultural exports is “likely” or “very likely.”

Caleb Ragland, a Kentucky soybean farmer and president of the American Soybean Association, expressed deep concern: His family farm, potentially entering its 10th generation with his sons, faces existential pressure from policies “completely out of our control” that can manipulate prices by “20%, 30%” while costs continue to rise. “Tariffs break trust,” Ragland noted, pointing out that “the U.S. has yet to fully recover its loss in market share of soybean exports to China,” despite China being the world’s largest buyer of the commodity. “It’s a lot harder to find new customers than it is to retain ones that you already have.”

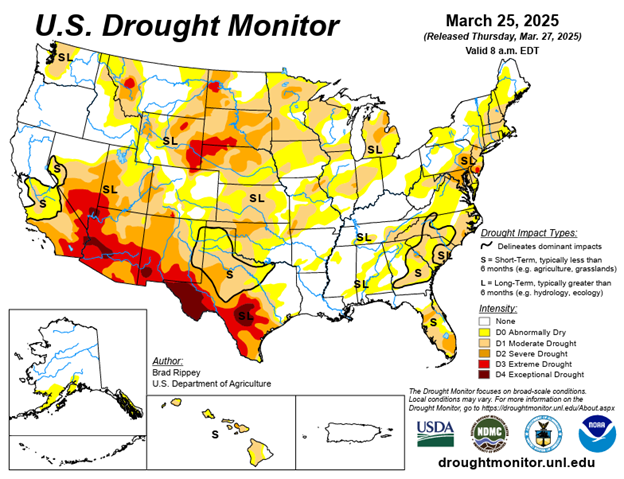

The timing couldn’t be worse. As Michael Langemeier, agricultural economist at Purdue University, explained, there was a 33% per acre drop in net return for soybeans and corn between mid-February and early March related to tariff concerns, coming when “2025 was not ending up to be an extremely profitable year before this.”

What has particularly alarmed agricultural economists is the shift in farmers’ policy priorities. “Usually when you ask a policy question, by far and away the most important policy is crop insurance,” Langemeier observed. “Crop insurance is right up there with apple pie and baseball… The fact that crop insurance was a distant second to trade policy speaks volumes.”

Looking Forward

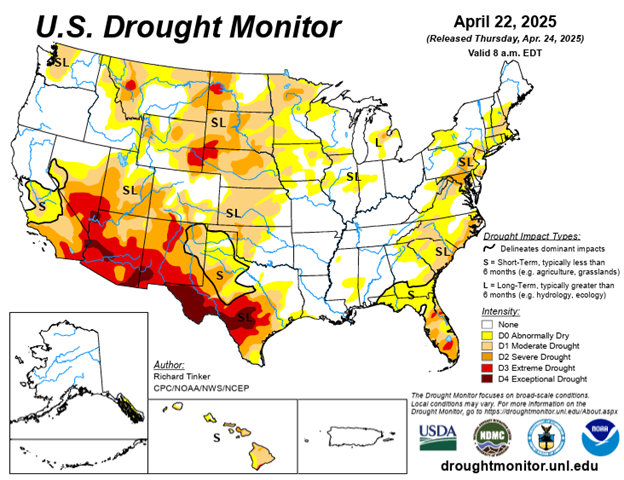

As tariff rhetoric intensifies in today’s political climate, the agricultural sector watches with informed caution. The ERS analysis provides a roadmap for understanding potential vulnerabilities—particularly for soybean, sorghum, and pork producers in the Midwest.

The lesson remains clear: in our interconnected global economy, trade policy decisions reverberate through commodity markets with remarkable speed and force. For investors and businesses alike, understanding this history isn’t merely academic—it’s essential for navigating whatever comes next.

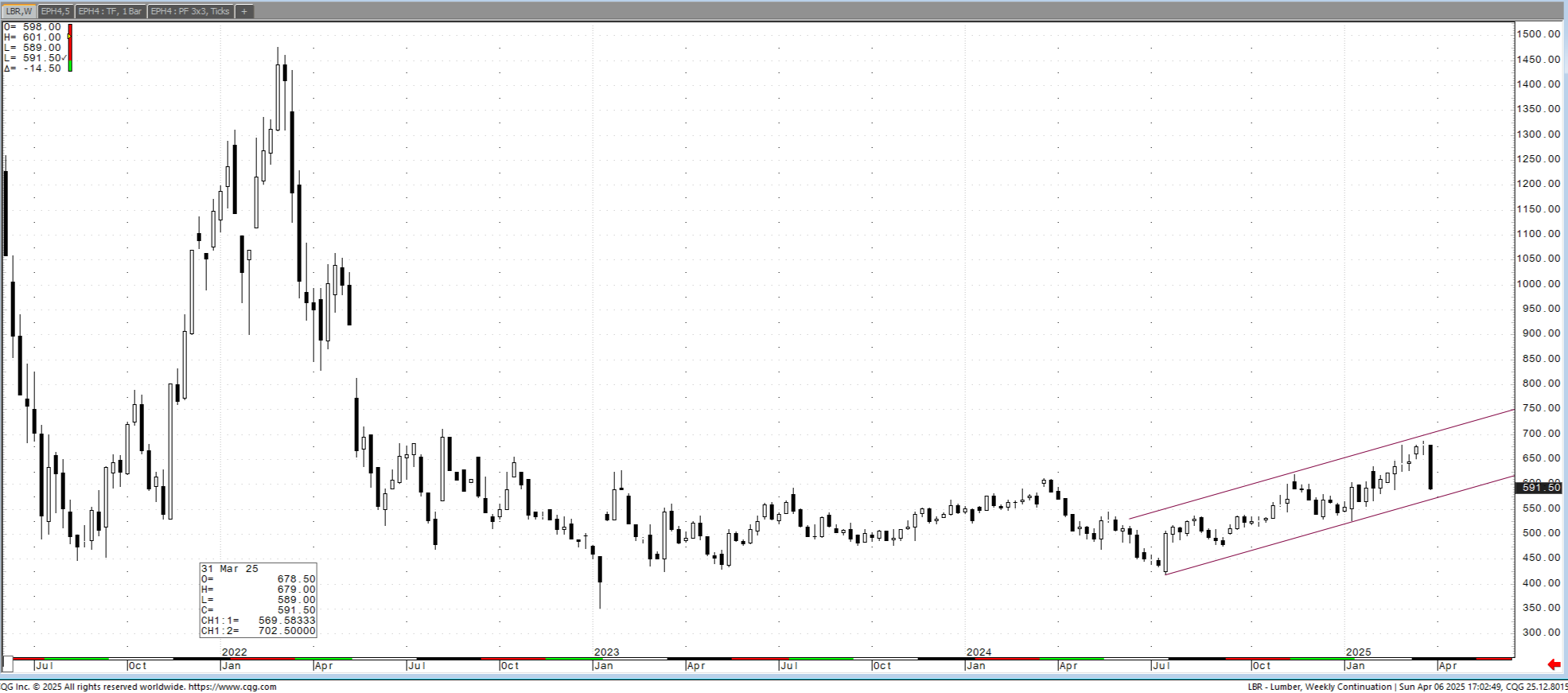

In this volatile environment, thoughtful risk management has never been more essential—not just for grain producers, but throughout the entire agricultural supply chain. Those who implement diversified marketing plans, maintain liquidity buffers, and secure flexible financing arrangements will be best positioned to navigate these uncertain waters. While no strategy can fully insulate against geopolitical shocks, a disciplined approach to risk management may be the difference between weathering the storm and becoming another casualty of trade policy crossfire.

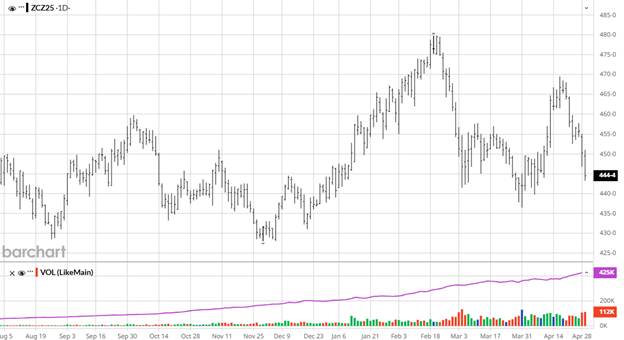

Soybeans have also faced sharp swings in the past two weeks, driven by global trade tensions, weather and repositioning. China’s retaliatory tariffs on US beans lead to a big drop in US exports, at the same time Brazil’s exports to China surged. Weather in some areas of Brazil has raised some concerns about a potential dip in yield but another record crop is still expected. Spec traders have started positioning a small long position after it has been beaten down so much they are hoping for a rally that could come with any US issues with planting or lower planted acres.

Soybeans have also faced sharp swings in the past two weeks, driven by global trade tensions, weather and repositioning. China’s retaliatory tariffs on US beans lead to a big drop in US exports, at the same time Brazil’s exports to China surged. Weather in some areas of Brazil has raised some concerns about a potential dip in yield but another record crop is still expected. Spec traders have started positioning a small long position after it has been beaten down so much they are hoping for a rally that could come with any US issues with planting or lower planted acres.