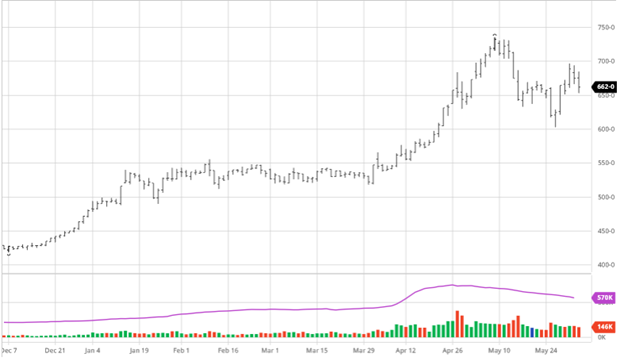

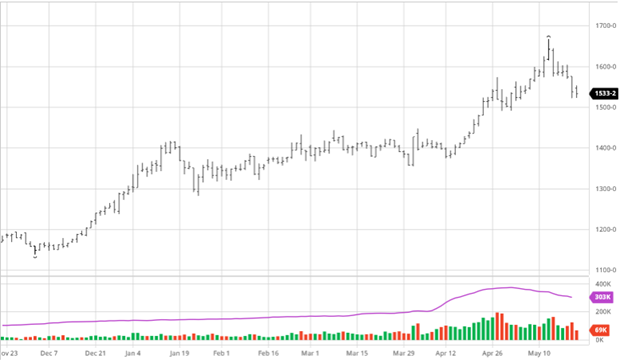

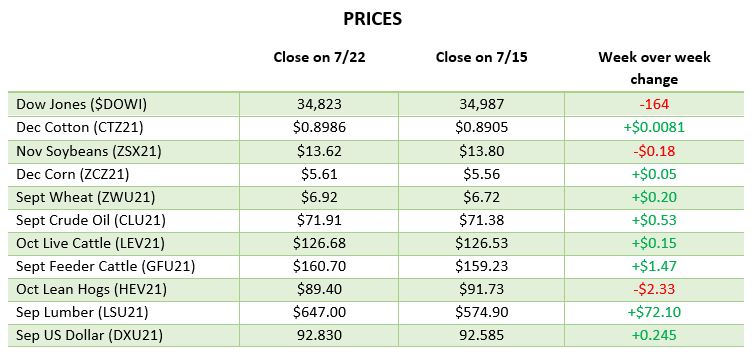

Corn made small gains early in the week only to fall short heading into the weekend as weakness continues to creep into the market with poor exports continuing and weather uncertainty. The hottest temperatures of the year for the plains and western corn belt are expected in the next few days with the only relief possibly coming past the 7 day forecast. As bad as things seem in the western corn belt, the eastern corn belt is having great weather, but will it be enough to offset those loses?

Brazil’s crop continues to get smaller, despite the USDA not making any major outlook changes, as they experience more freezing temperatures on their corn crop. China continues to sit on the sideline with no big purchases as they wait for lower prices before buying US corn. We know they will need to make purchases at some point but as we have seen in the past when there is no news from China prices tend to dip until they make a purchase so they will be quiet waiting for the right time to buy.

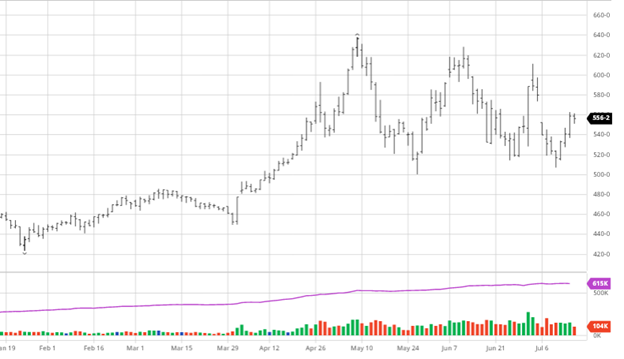

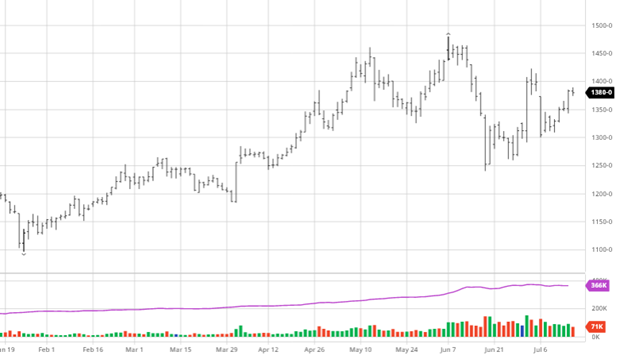

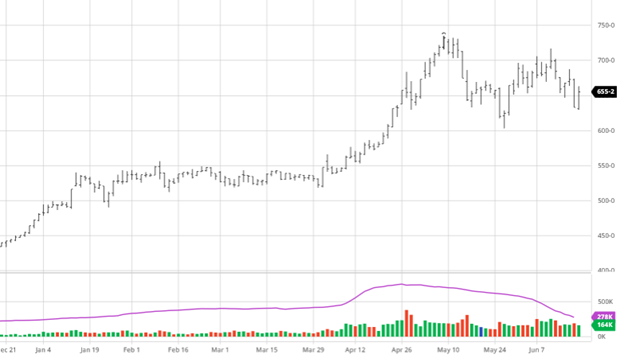

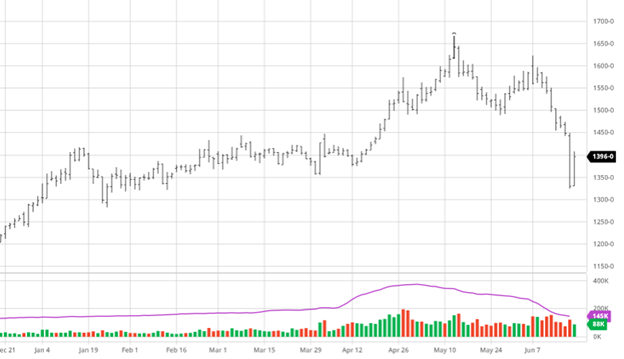

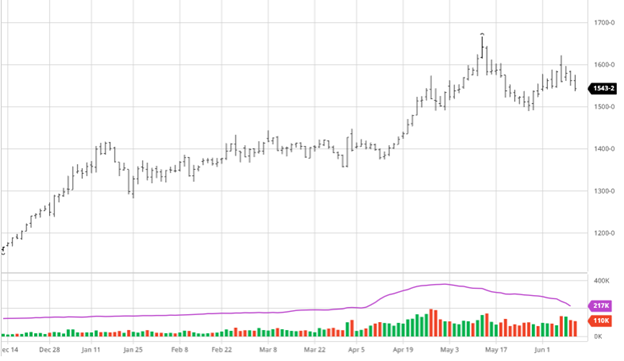

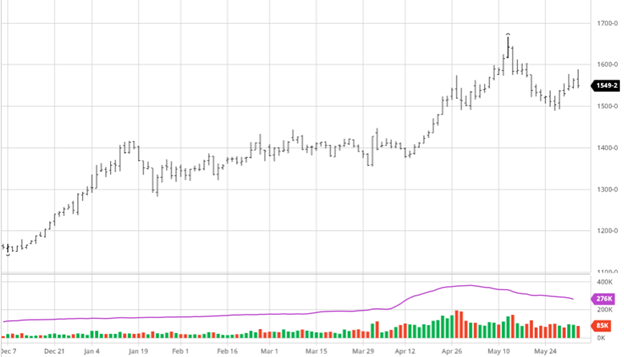

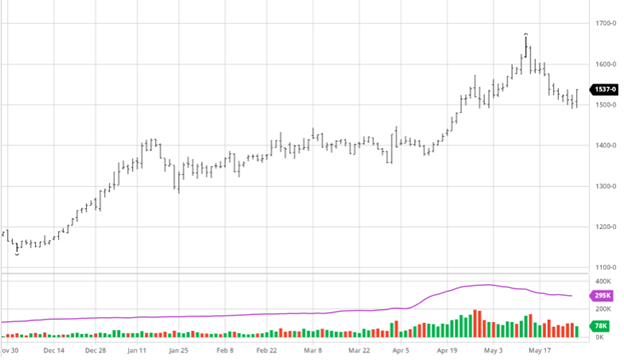

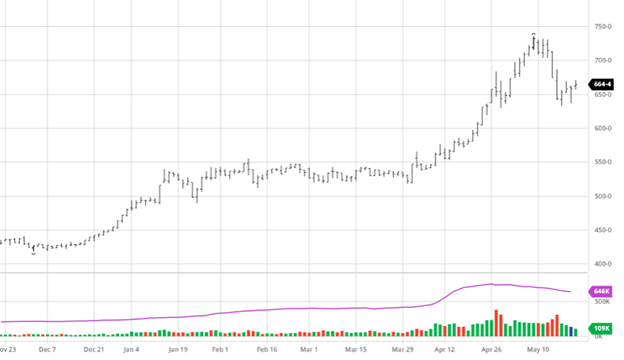

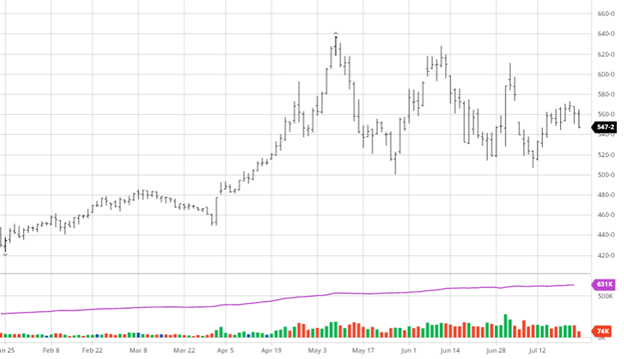

Via Barchart  Soybeans had a rough Thursday as the extended forecast offered a chance of help. We have to remember that extended, is just that – it’s NOT tomorrow – and just as help was added it can go back to hot and dry in one weather report. You’ll note in the chart below that beans have been trading mostly sideways since the start of May. This will probably continue unless some unforeseen news hits the markets or a major weather event/change in forecast happens. The next major report is the August 12th report which could be what finally gets us out of the range (whether to the upside or downside is TBD).

Soybeans had a rough Thursday as the extended forecast offered a chance of help. We have to remember that extended, is just that – it’s NOT tomorrow – and just as help was added it can go back to hot and dry in one weather report. You’ll note in the chart below that beans have been trading mostly sideways since the start of May. This will probably continue unless some unforeseen news hits the markets or a major weather event/change in forecast happens. The next major report is the August 12th report which could be what finally gets us out of the range (whether to the upside or downside is TBD).

The bean oil market has added volatility to beans as well as the Biden administration’s silence on their direction for the bio fuel industry. Their lack of action, one way or the other, is hurting beans and bean oil as producers remain with unanswered questions which leads to uneasiness (read volatility).

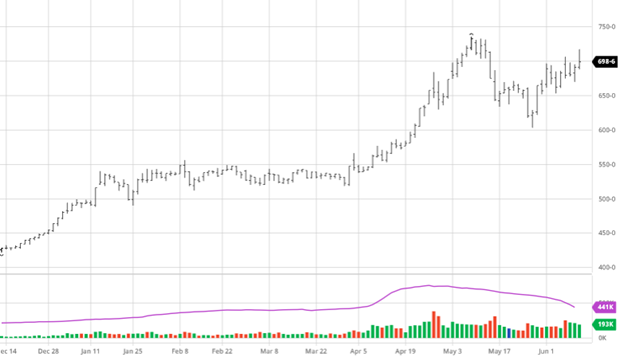

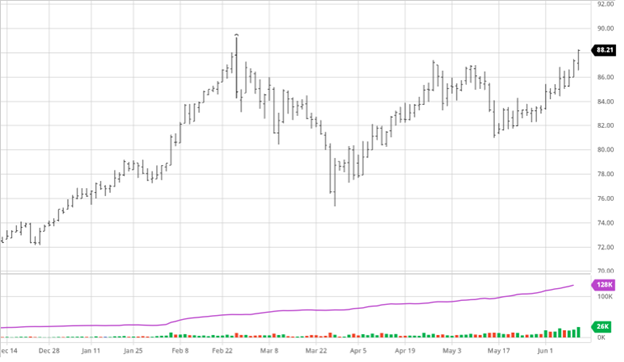

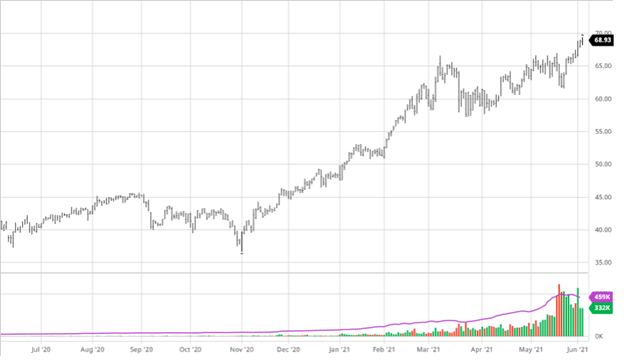

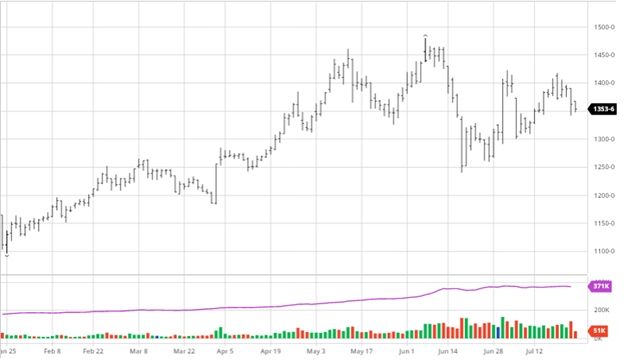

Dow Jones

The Dow lost on the week (Thursday-Thursday) following a large selloff on Monday followed by 3 straight days of gains. The market was trading positively into the week’s end as well getting back over 35,000 in intraday. The Delta variant worries seem to be biggest fear in the market right now as it spread dangerously throughout under vaccinated areas of the country threatening the continued reopening.

Podcast

Check out our recent podcast with Dr. Greg Willoughby: We’re talking with Greg in the new episode about being a “plant doctor”, weather patterns, GMO & organic produce, crop history, technical advances, level 201 education on agronomy, the agronomy equation, Helena Agri, soil biology, American v European agriculture, Greg’s early background in livestock, and the advancement of native plants to modern produce.

https://rcmagservices.com/the-hedged-edge/

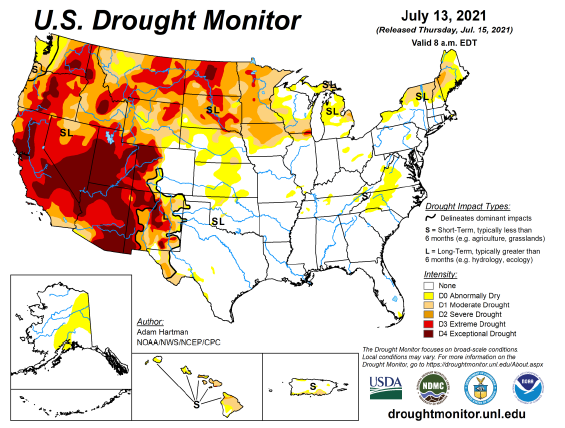

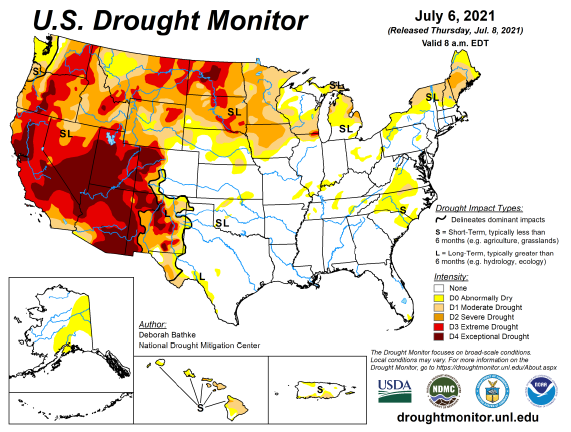

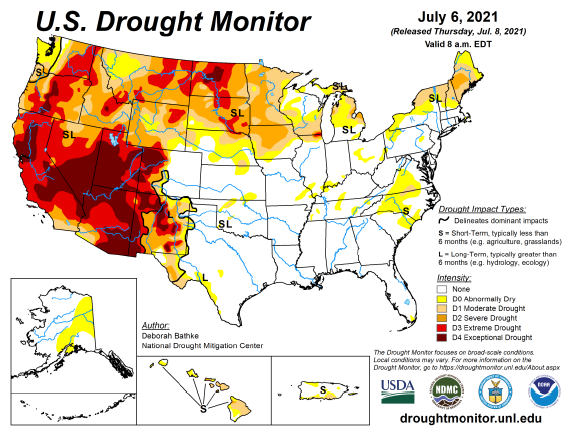

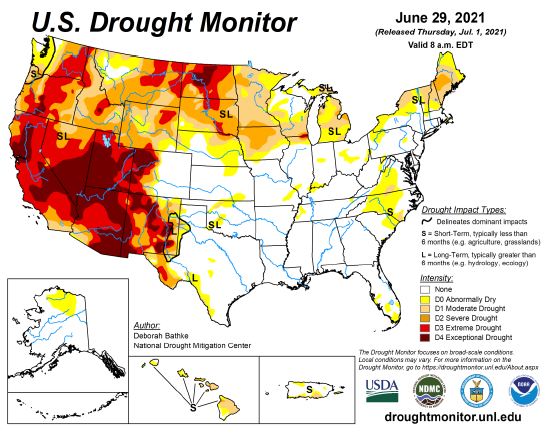

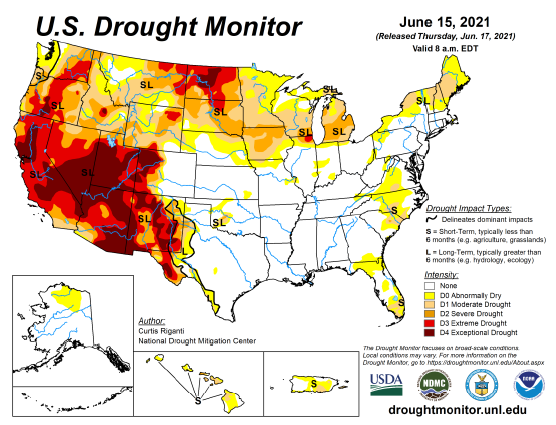

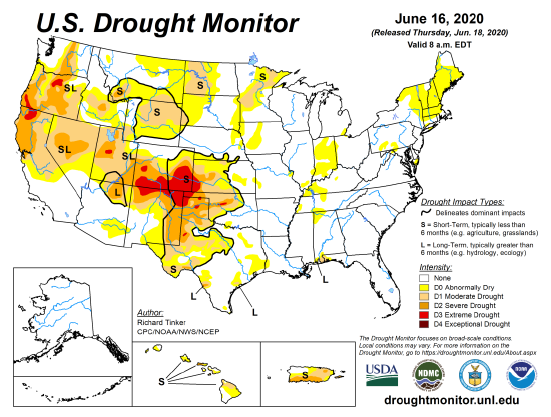

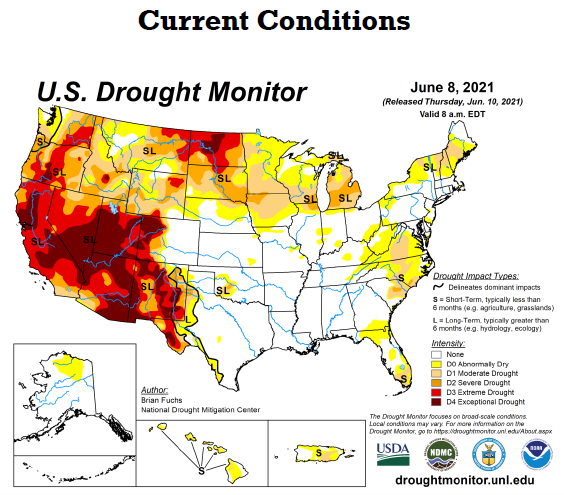

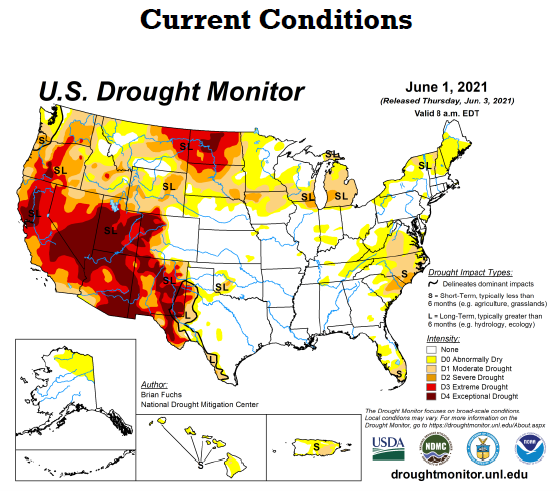

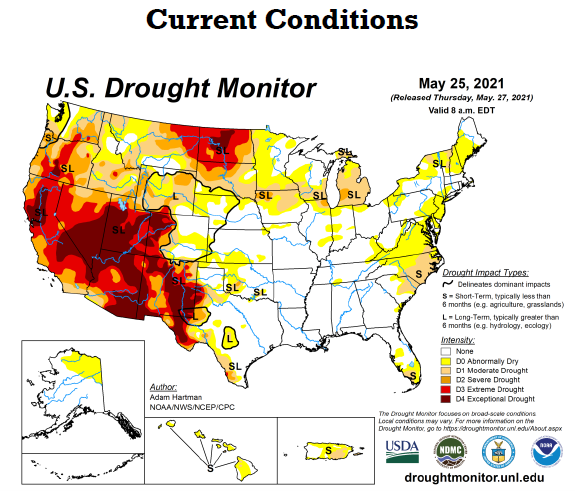

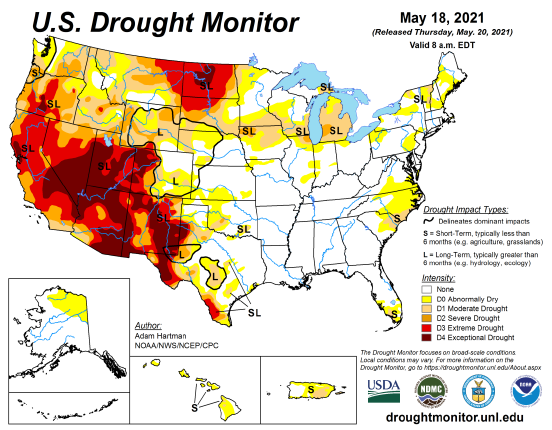

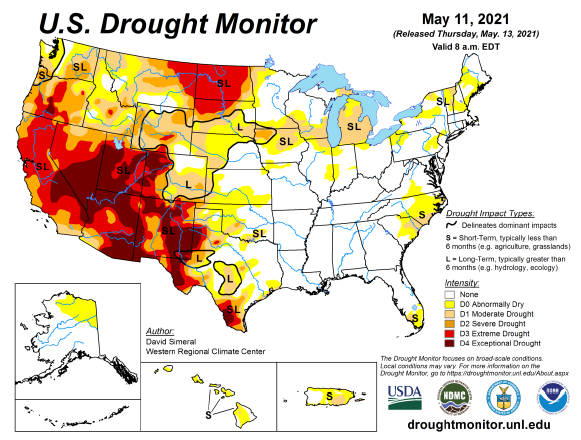

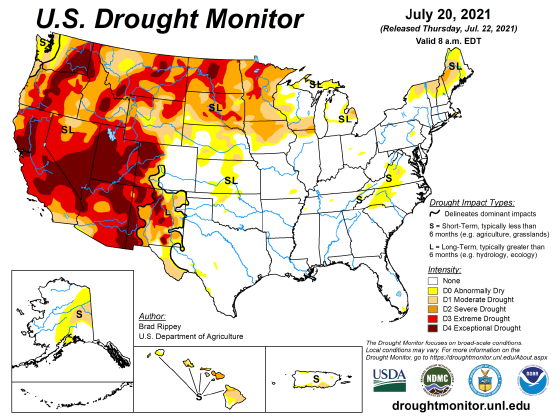

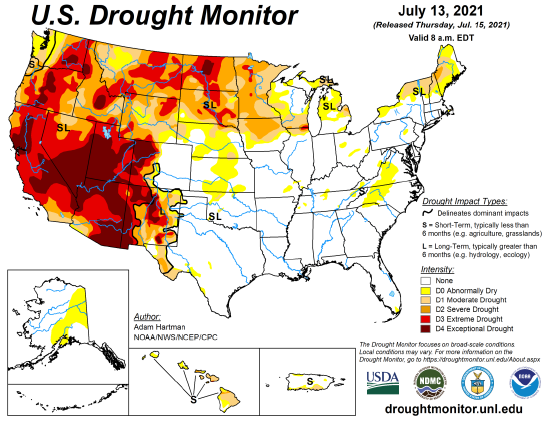

US Drought Monitor

The maps below show the current drought conditions in the US. The second map is last week’s so you can see how the areas that received rain improved or did not. The wild fires continue to rage in the west as smoke from them has carried all the way to Southeastern US.

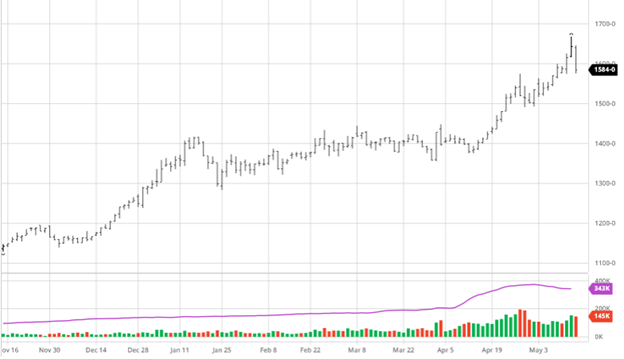

Via Barchart.com