AG MARKET UPDATE: JUNE 4-11

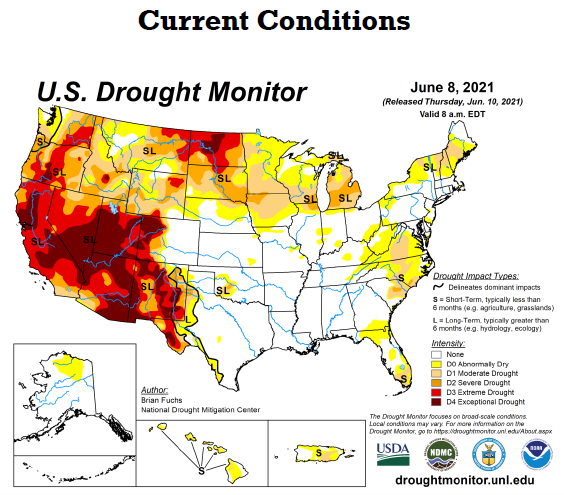

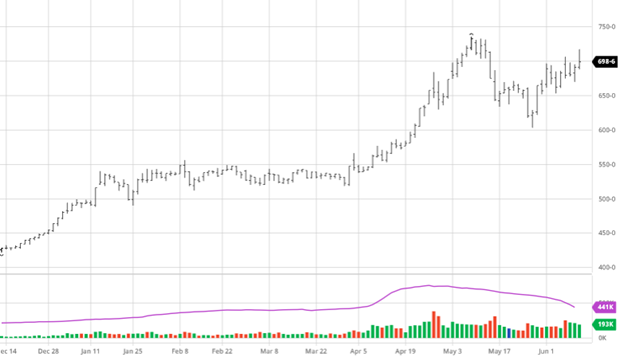

Corn had another good week that was made better following the bullish news in Thursday’s WASDE report. At the start of the week corn planting was seen as 91% complete with little progress being made from last week but at this point in the process limited progress is expected. The dryness in the Midwest and other areas of the corn belt can be seen in the drought monitor below. The USDA agreed with what many in the industry have been saying by reducing US and world ending stocks.

20/21 US ending stocks was adjusted down to 1.107 billion bushels from 1.257 in the May report while 21/22 ending stocks were adjusted down to 1.357 billion bushels from 1.507 in May. World ending stocks for 20/21 were lowered to 280.60 million tonnes from 283.53 while the 21/22 was also lowered to 289.41 million tonnes from 292.30. There is still a disconnect between the USDA and the public on what’s going on in South America and the size of their crop. Word on the street is that it has been shrinking as weather woes caused issues but the USDA does not have them down nearly as much in this report.

Now that growing season has started weather and specifically where it does and does not rain will be the main price driving factors. The upper Midwest is dry but the delta just got torrential rains this week and areas in Indiana and Ohio have been soaked too. The rain in the Dakotas and Iowa to end the week will help but still need rain over extended periods to get back to good growing conditions.

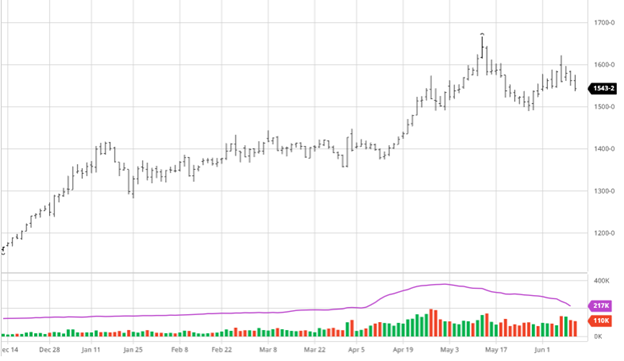

Soybeans slipped a bit on the week but are still hanging on inside the recent range. Bean news has been quiet as of late with no market specific news, unlike corn. Soybean planting was seen as 80% complete to start the week with some continued progress to be made. The USDA WASDE report was more bearish for beans than corn but markets responded well after.

The 20/21 US ending stocks were raised from 120 million bushels to 135 million and the 21/22 ending stocks were raised form 140 million to 155 million bushels respectively. These were both still within trade estimates so no major shock with the US or the world stocks. The 20/21 world ending stocks were raised from 86.55 million tonnes to 88 million and the 21/22 ending stocks were raised from 91.10 million to 92.55. Raising the stocks month over month is usually bearish and old crop took a hit while new crop rallied on the report.

Markets moved lower Friday with rain coming in some much needed areas heading into the weekend.

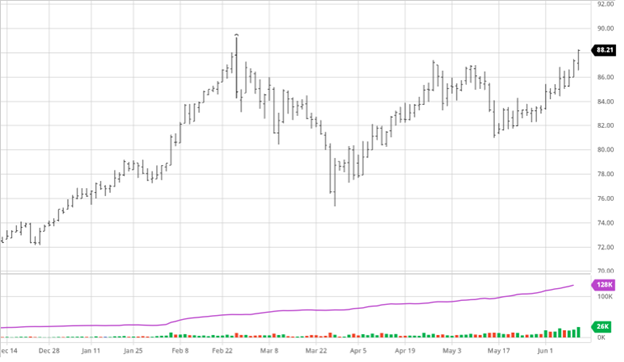

Cotton has seen modest gains this week after soaking rains and flooding in areas of the Delta. The WASDE report this week showed the expected directionally bullish revisions. There were no major surprises, but their numbers may be hinting at a continued decline in production going up against the rising levels of global consumption. The USDA projections for 21/22 show a 100,000 bale increase in exports from last month to 14.8 million bales. As exports continue to be strong for the 20/21 crop ending stocks were lowered 200,000 bales to 2.9 million ending stocks. Global ending stocks were lower as well with consumption rising.

Dow Jones

The Dow lost slightly on the week as news was slow with no major market news or movers. Covid openings continue as numbers continue to decline in the US while there are still problems around the world.

Lumber

Lumber prices have dipped recently but are still at very high levels historically. Check out our recent post about the lumber market and what all has been going on.

Podcast

Check out our recent podcast with Dr. Greg Willoughby: We’re talking with Greg in the new episode about being a “plant doctor”, weather patterns, GMO & organic produce, crop history, technical advances, level 201 education on agronomy, the agronomy equation, Helena Agri, soil biology, American v European agriculture, Greg’s early background in livestock, and the advancement of native plants to modern produce.

https://rcmagservices.com/the-hedged-edge/

US Drought Monitor

The map below shows current drought conditions and the continued problems in the upper Midwest. More drought conditions have crept into southern Iowa and parts of Nebraska in the last week. Heat over the next two weeks will be a problem in the Dakotas and western corn belt.