The Lumber Market:

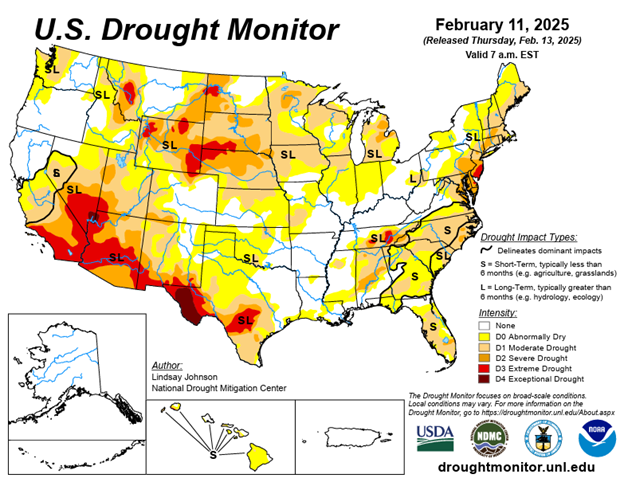

“Lumber, lumber, we don’t need no stinkin lumber.” Or is it, Badges? Trump is coming after the Canadian lumber industry with both barrels. The problem is the current Canadian government does not like or support the industry so who’s on their side? The biggest and very unintended consequence of all may not be sharply higher prices but a real slowdown in the US housing sector. It is already fighting just to stay flat. This may just send investors to other markets, thus reducing the dollars available in the housing sector. You cool the housing sector, and you will cool inflation. Again unintended.

This is one of those times where you plan for the worst and hope for the best. It is also a time when you could have $750 lumber and no customers.

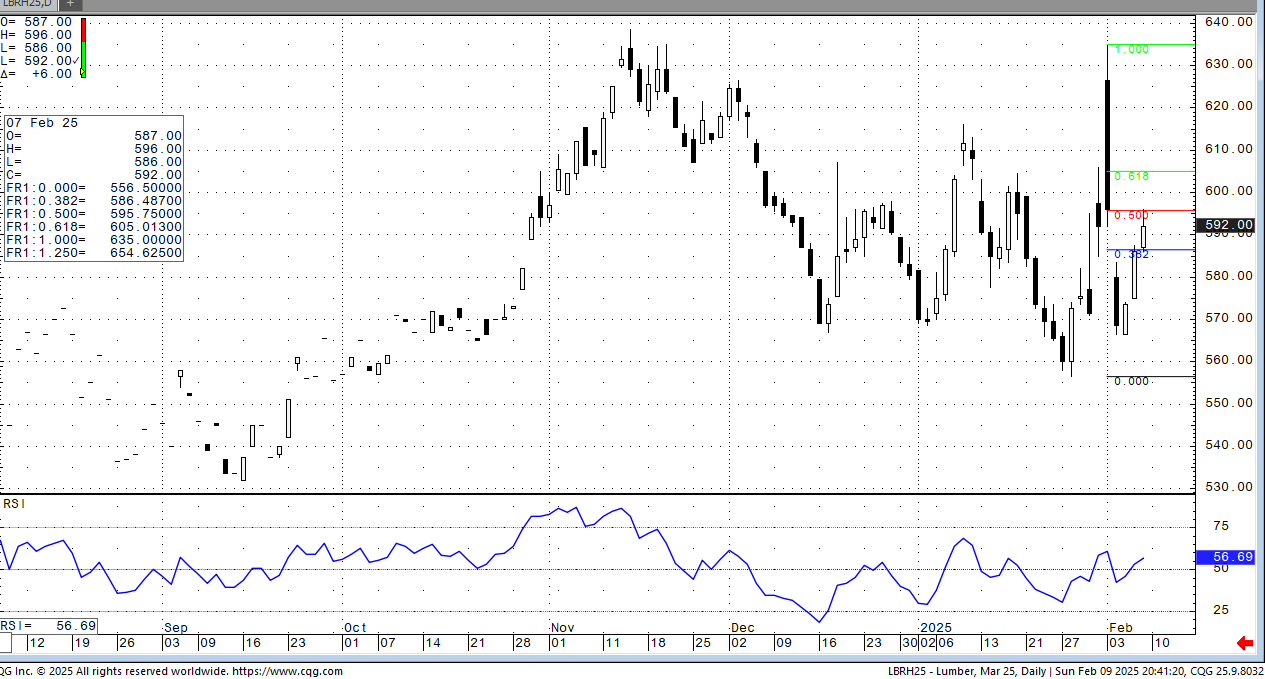

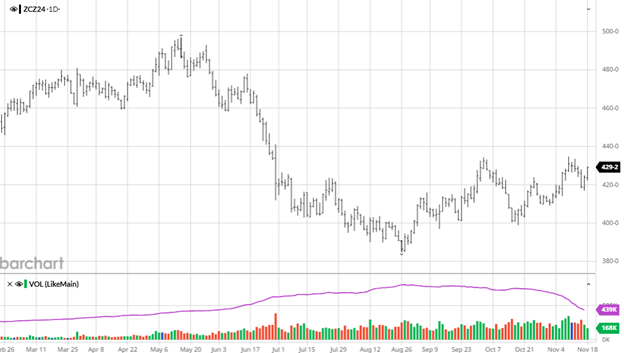

Technical:

I was dead nuts on last weekend stating that for the market to go higher it would need a sharp sell off. We saw that on Wednesday and keeping to new lumber style, it all happened in a few minutes. That’s how we roll these days. What I missed was the timing. I think we have to take a step back and consider that while the technical read tends to pan out, it now occurs in minutes not days or weeks. We have to project the move and have orders in to take advantage. Don’t freeze on winners. Manage the position based on what the cash market would offer you. More importantly, don’t freeze on losers. Get out.

Sticking with the boxing analogy…. “hit the one in the middle.”

Brian Leonard

bleonard@rcmam.com

312-761-2636