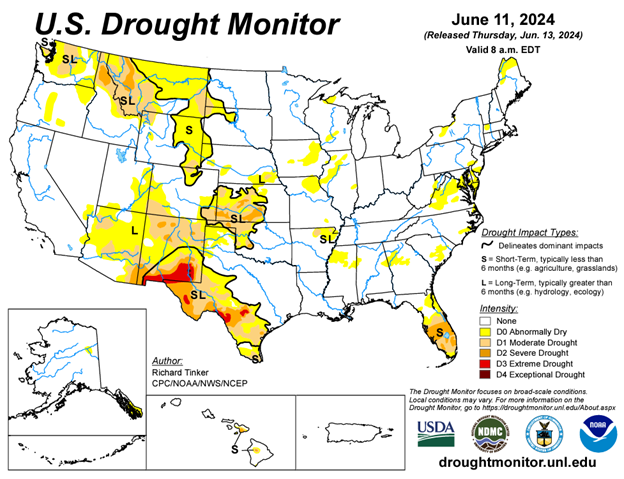

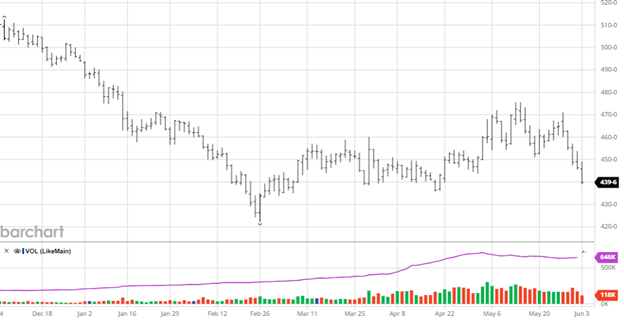

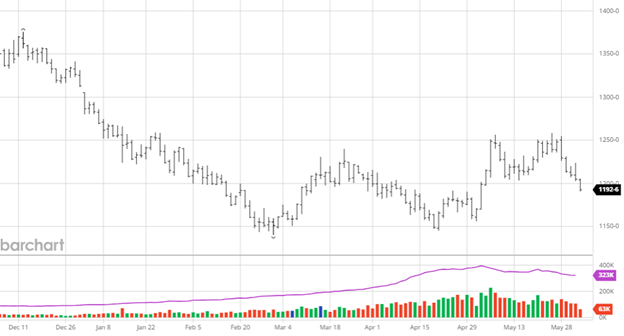

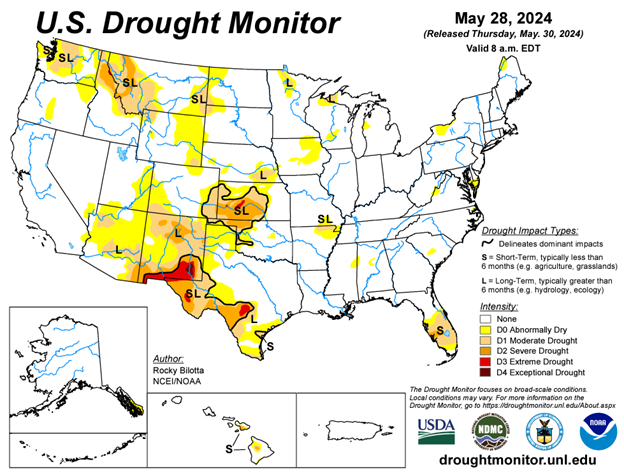

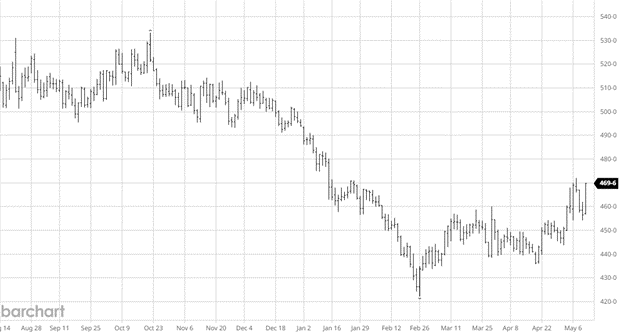

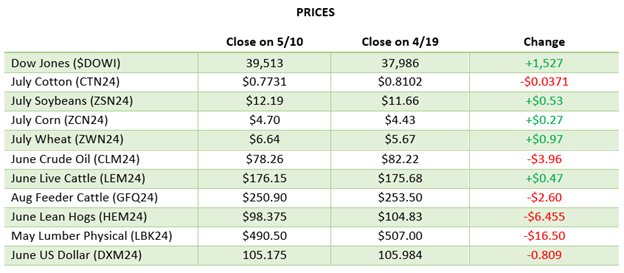

Futures are back. We have to say they are back when they can break $20 and then rally $25 in a matter of hours. This market is also so fragile that anything spooks it. Friday’s turnaround confirmed most opinions of the futures side of the market. The tailwinds caught up. The next read is how a perceived undersupplied market trade. Supply-driven markets are very volatile. We saw that on Wednesday and Thursday as futures retreated near $500. This week, I’m going to dig down into the fundamentals, the futures makeup, and the general psyche that’s pushing the market.

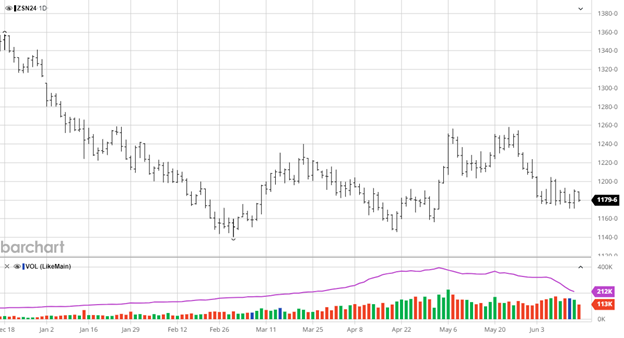

We know the trade came into 2024 bullish. Even by April, it was still a 50/50 mix. By June 1st. the buy-side of the industry had become fully entrenched. They were going to run inventories at a highly tight JIT model regardless of their business. This lack of exposure in the marketplace when the dynamics are moving quickly to a supply-driven market puts a floor in. In this industry, trading decisions are made over weeks and months while the market turns are in minutes. If a supply issue is built, this makeup will cause volatility. Another change was around June 1st. The reappearance of traders in the futures market, which had been gone for years, was very telling. a few never even traded the new contract. They tend to buy futures instead of cash when prices are very low. They don’t look at the premium. They are buying the market to protect against upside risk. This isn’t forward sales. It is hedging.

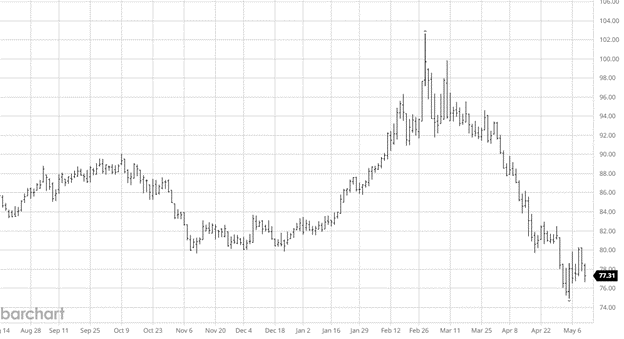

I want to make a quick point about the Fed. When Powell announced the possibility of the Fed having to increase rates, it had an immediate effect on us. All he had to do was announce the possibility of it occurring to shift the builder’s plans. Last week’s announcement of the possible half-point cut in September could motivate some builders. The reason why he is cutting could be disastrous to this sector. If the possibility of high unemployment is the reason, then this will be short-lived, but for now, there is excitement.

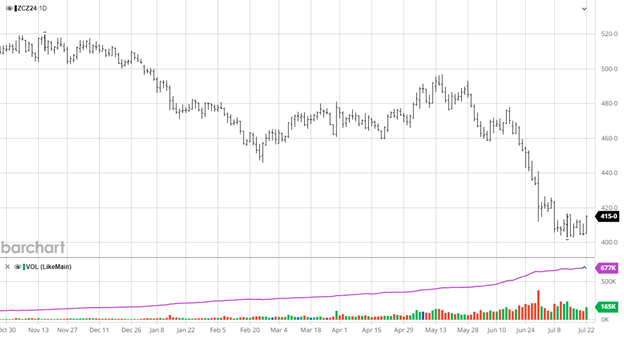

The futures trade is the primary driver of this market. I know it is supply and demand, but futures can push cash $100 higher or lower with little to no reason. There is a lot of confusion about who exactly the drivers are, so I will break it down. In 2024, the industry has been carrying a very long future position in an environment that isn’t conducive to forward pricing. I like to call these traders the “Texas Hedgers.” They are long cash and futures. That speculative position and upward bias added to the six-month selloff. The industry shorts tend to only position against a cash position. In most cases, they do not speculate. We have also seen in 2024 a very large holding of shorts by the funds. There is no question that the funds drive the futures market. They drive all markets. The problem with the funds is that they aren’t a barometer for the trend or price of the lumber cash market. They have numerous reasons to be in markets, from the US dollar to managing a long position in one market with a short position in another. What is a benefit to us is that it creates movement to where the futures price works for your overall risk management plan. A good example is today. No one will hedge at $500, leaving a large swatch of exposure. The industry hopes that the funds will run the market higher to bring hedging back into play. The final category is all others, where most of us fall. A group of these trades is very astute to the market. While having been very quiet over the past few years, these traders recognize a possible tipping point in futures and try to push the market through it. They set off panic. I wouldn’t be surprised if they have been trying to get some upside panic on this recent move. I left the algorithm trade out because they do not carry a position. Their design is to be flat at the end of the day. They are great for intraday turmoil. They also search for tipping points.

To sum up, this industry’s market cap has shrunk. The available profit dollars are limited, so a $10 swing can shift you from a profit to a loss. This makes the outside dynamics more critical now than ever. We are a “data desert.” The indicators for direction out of the futures are needed to determine the makeup and cash buying cycles. Both need to be front and center in any planning.

Technical:

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636