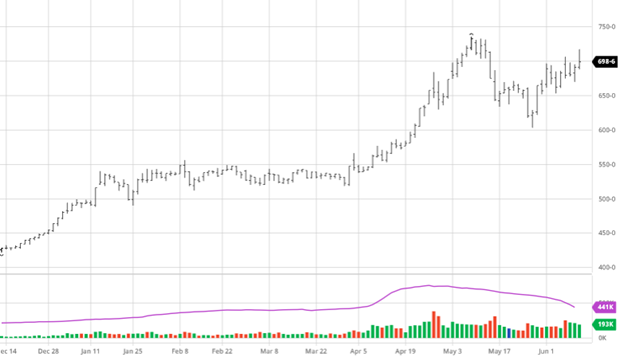

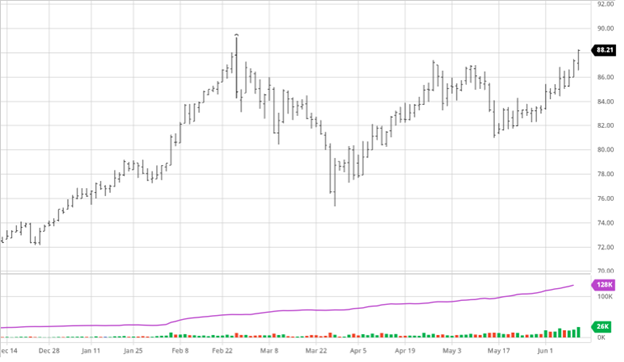

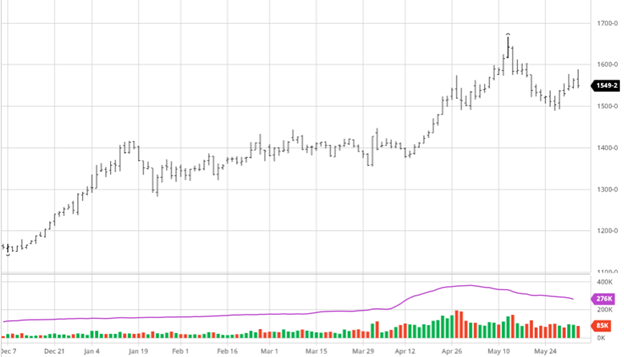

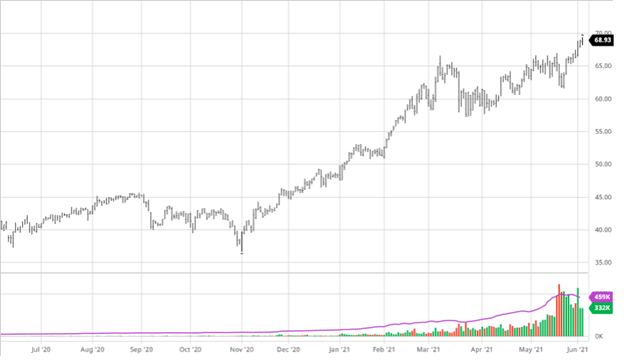

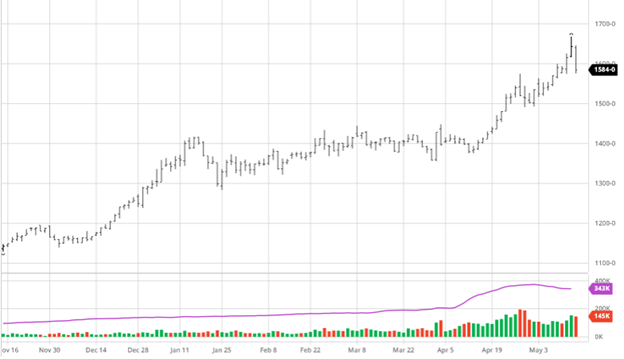

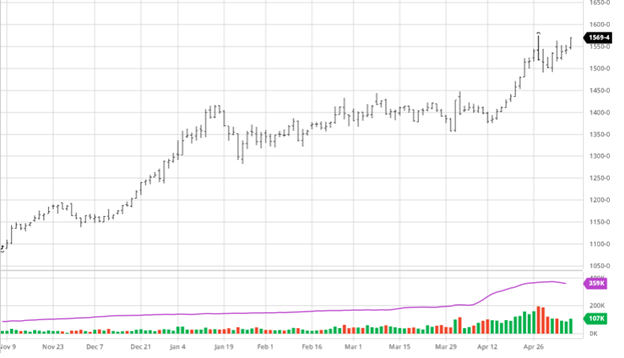

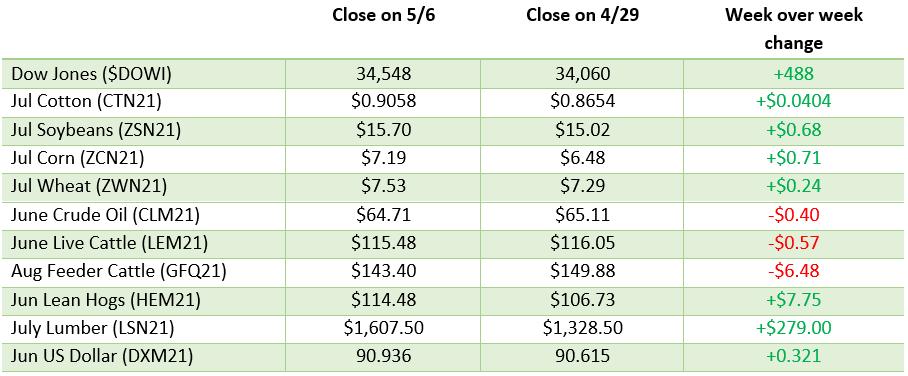

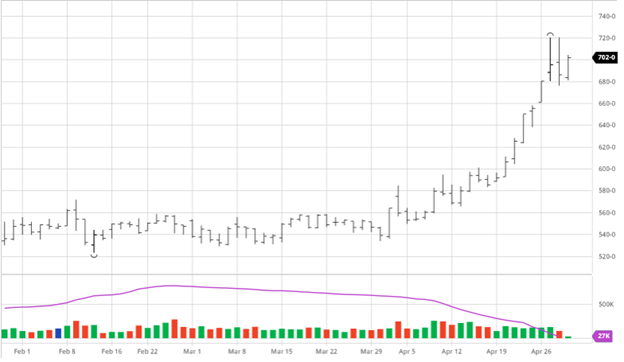

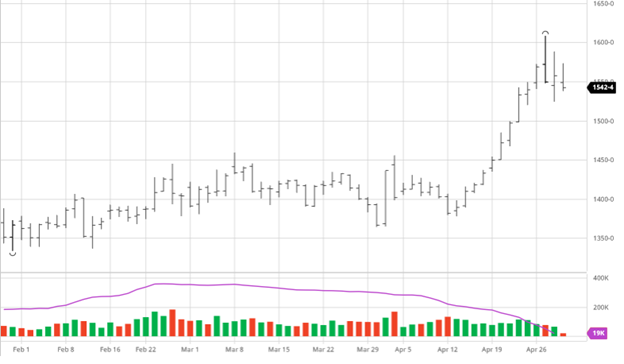

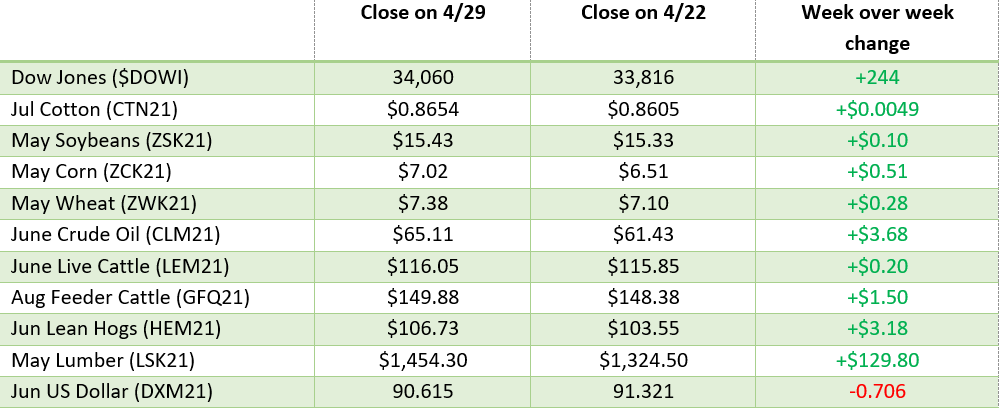

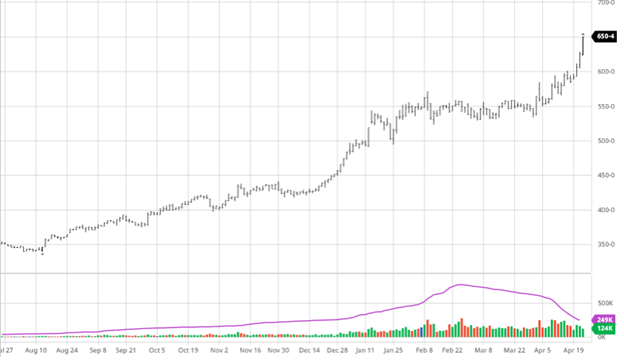

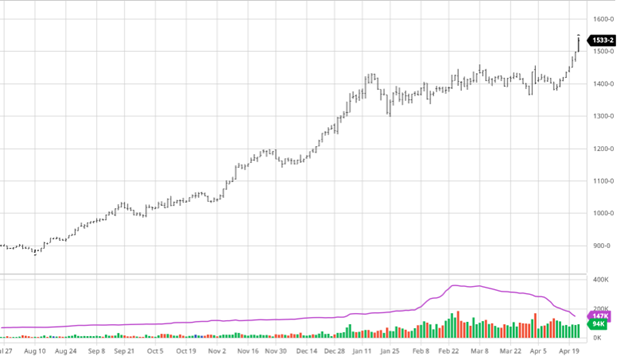

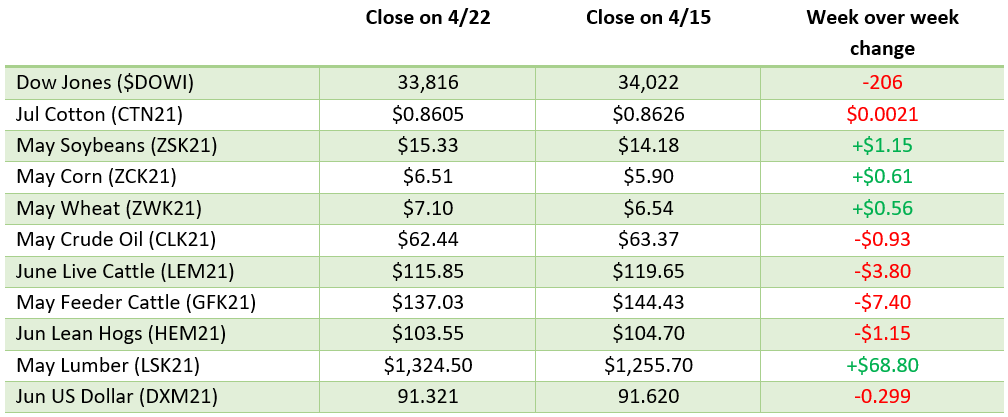

If you haven’t been watching one of the more esoteric futures market lately – Lumber – you’ve been missing a rather parabolic up market – up nearly 9% last week, 27% for the month, 78% for the year, and 280% over the past 12 months. Move aside dogecoin!

So how does a $300 commodity that regularly deals with events such as wildfires and sharply higher housing starts now come to be trading at almost $1300?

To answer that question, we checked in with our lumber expert Brian Leonard to get the inside scoop:

Unlike most other commodities, lumber is used in a product with a long decision-making process. Housing has a long timeline. While the production of a 2×4 is rather quick, the cycle from tree to house is much longer. And because of that abnormally long period of time, lumber futures have the possibility of overlapping economic cycles and seasons. With that amount of lead time available how did this commodity get so under-bought, so under-produced and so under-supplied to cause a 300% increase (!!!) from it’s typical price?

#1 is the effect on housing due to the increase in federal funding (or QE as we now call it). It is the way for the Fed and Treasury to shore up the economy which leads to the building of wealth and ease of access to funds at a low interest rate. In doing so, there can be a positive affect on the stock market, as we’ve seen – and in typical fashion, the housing market tends to increase in tandem with the stock market and the U.S. economy. In this case, history serves as an indicator in three occasions of this excessive capital spike in recent history. The first was the run in the late 1940’s after WWII, then in the mid 2000’s caused by a substantial drop in cold war funding in the 90’s and September 11th. Today the flood of funding has been caused by Covid, and the numerous stimulus packages and prevalence of low rates – which can generate excessive demand.

Today what we have is one of the greatest economic “perfect storms” ever seen in a commodity; one that has been brewing for years. This current explosive market dates all the way back to 2006 when annualized average new housing unit starts hit a historic high of 2,273,000 (Census.gov) with close to 50% made up of second home buys and limited credit – we saw a top and the net result was a saturated housing market.

Note: (That was occurring at that time when the bug kill timber out of BC was peaking keeping production abnormally high.)

The oversaturation slowed building month over month and by the second half of 2007 the starts number fell below the teardown rate. For baseline, the teardown rate is considered between 850 and 1 million homes tore down or destroyed each year. Construction from mid-2007 to mid-2012 was less than teardown and was the longest period in history for such a low number of new homes built. The “great recession” of 2008 to 2010 was the biggest factor causing the depressed state of construction.

One of the lasting effects of the recession on the industry was an increase in permanent closing of producing mills in North America. While there were plans already in place because of shifting supplies and landscapes for timber etc….the recession seemed to ramp up the pace.

A second factor under the radar of economists was the effect the recession had on many families, especially future first-time home buyers. The ones we called the “lost generation” in housing which were those who graduated between 2008 and 2012. This group had difficulty finding a job that would earn enough to pay off their student debts let alone marry and buy a home. The housing market now lacked those first-time home buyers and there was a major shift to apartment living in the urban areas. Pubs and pups was the new mantra – marriage, kids, and house was no longer a goal of most.

The period from 2013 to 2018 saw a steady slow growth in housing led by the boom in multifamily. Single family construction was still lagging. 2018 showed the first signs of an imbalance between supply and demand in lumber causing a sharp run up in futures to a new historic high of $659. The previous all time high of $493.50 was made in 1993 and caused initially by the spotted owl issue. The 2018 run up had many other issues such as a tax duty, long commodity funds and an industry short. There was also a more aggressive embrace of just-in-time inventory management and these factors combined were setting a bullish tone Firms were set up to be under inventoried and forced to pay higher prices.

Today, the biggest factor changing the landscape was the Covid-effect. This market was likely heading higher due to the low housing supply (requiring more lumber demand) and going to see issues regardless, but the Covid reactions have multiplied them.

The biggest factors that have led up to this run up:

- A drawdown in production capacity of dimension lumber

- A low inventory of new single-family homes

- Historic lows in mortgage rates

- Historically high amounts of capital flowing into the system

- Greater wealth caused by a sharply higher stock market

- An unprecedent shift to single family homes

Adding Covid to the mix; we saw a stoppage of production at mills with only a marginal slowdown in construction. At the same time, we saw rail and trucking slow, and to this day rolling shutdowns at some mills and rail remain. Another issue affecting lumber prices is trucking and the lack of available drivers; we currently have the smallest pool of new drivers in recent history. T This shrinking pool has slowed or stopped any increase in available trucks as Covid has shifted many to Amazon.

Real Time Issues:

- Inability to increase production causing supply constraints

- Buyer paralysis either mentally or financially… financially could be a low credit line and over budget all because of a $160K train load of lumber.

- Unprecedented rush to single family homes with a yard (no more commuting, work from home effect?)

- Reduced distribution chain which points back to issue 2 above

So where is the relief? The relief from higher prices will only come from a slowdown in demand. That slowdown might be self-inflicted because of the lag in the building chain either because of the lack of OSB (Oriented Standard Board), appliances or a paint color. This will slowdown construction down and allow some of the froth to be lopped off the top. It will not decrease construction plans, but maybe just draw them out. The greater relief valve will be a slowdown in traffic going into the summer. The higher prices for homes and the longer time frame for construction will start to weigh on the market. But this also will only give temporary relief. A fundamental change in buyer sentiment needs to happen. In the meantime, if you cannot or will not build inventories, the marketplace will always be short. It is that simple.

– Brian V. Leonard

Brian Leonard is a 30+ year veteran in the commodities trading space. Brian began his career as an assistant in the Soybean pit in the early ‘80s, and moved on to wood products in 1994. Brian’s current role for RCM Ag Services is to serve as a Risk Analyst, specializing in the wood products sector. His customer base spans a large spectrum ranging from wood producers to home builders with all different types of risk management needs. Brian also assists with risk management within the currency and fuel sectors. Brian recently received an MA in Pastoral Studies at University of St. Mary of the Lake, and uses that to work with churches in low income neighborhoods in the Chicagoland area.

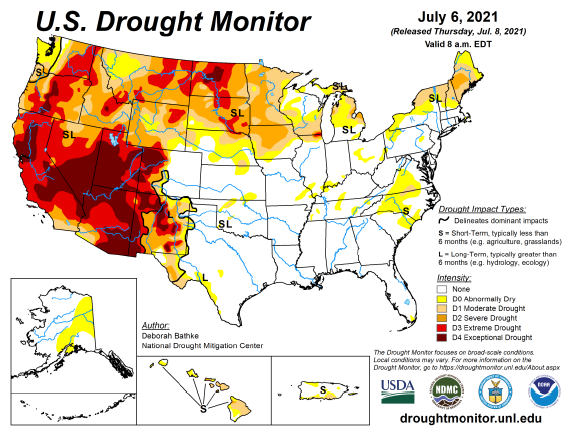

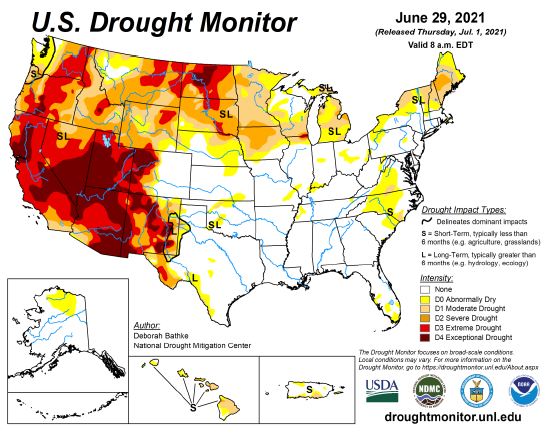

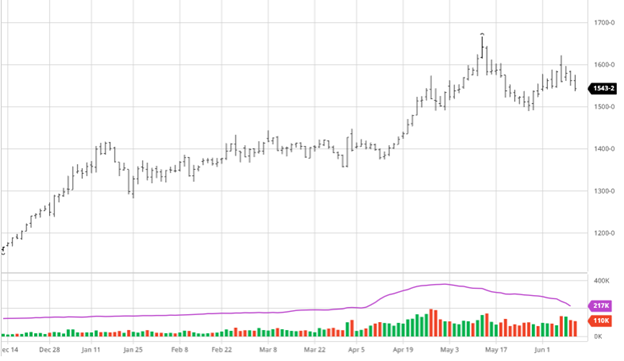

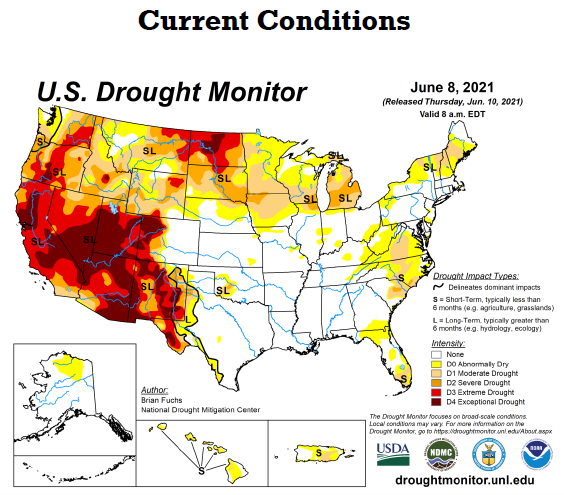

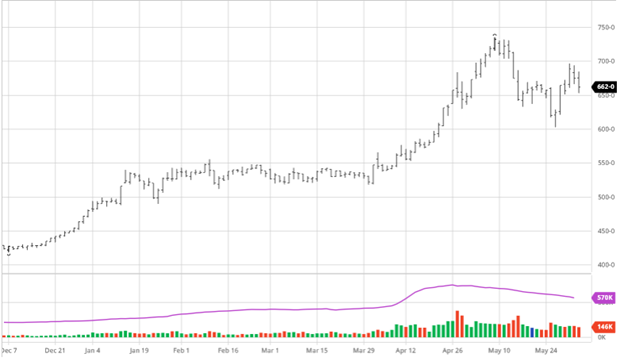

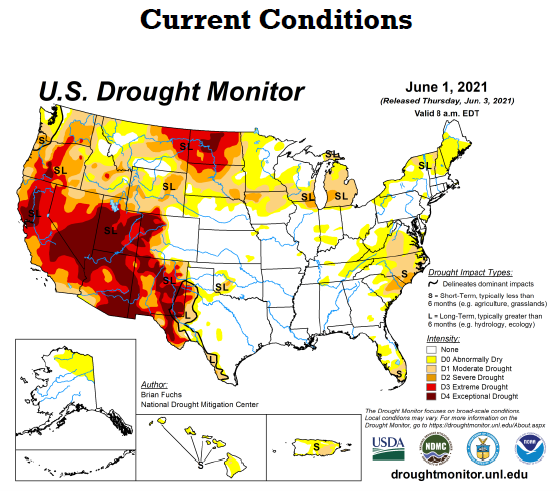

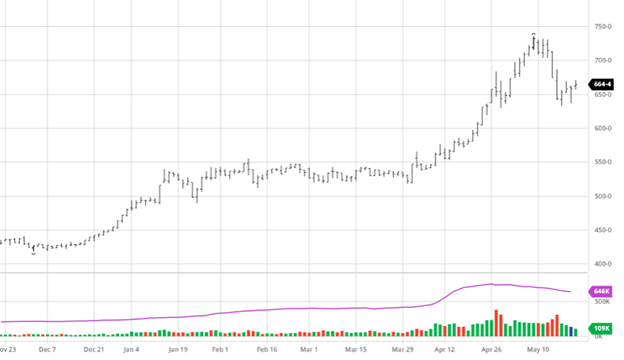

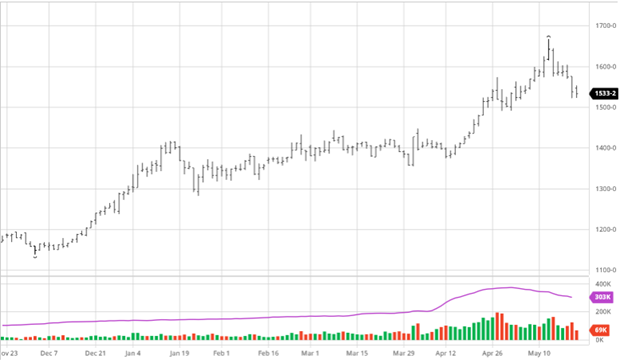

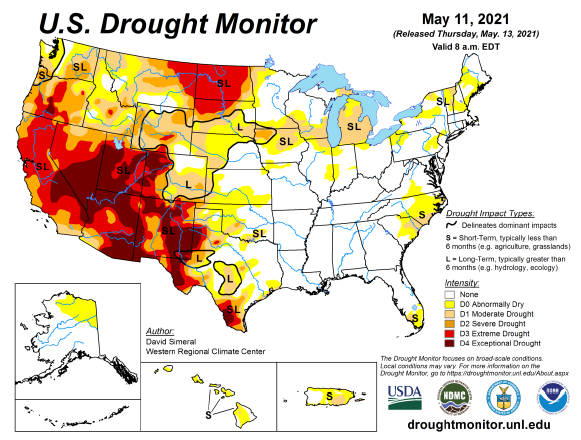

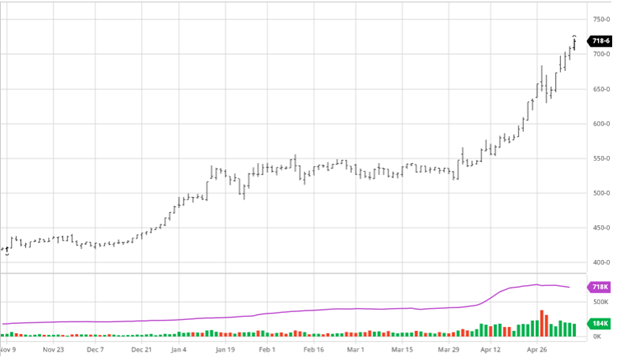

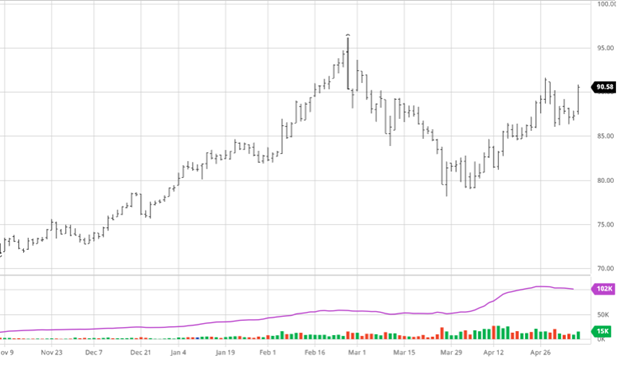

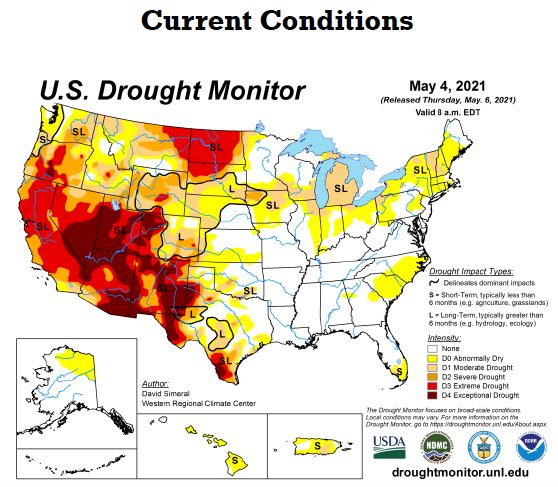

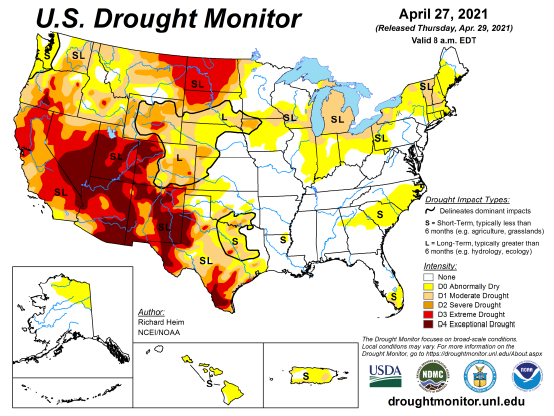

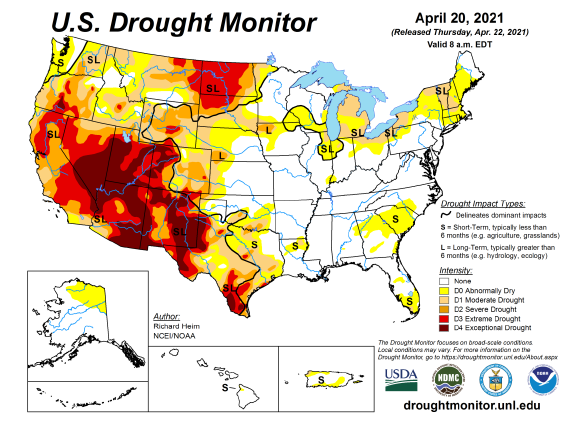

Soybeans, like corn, fell following the holiday weekend with huge losses on Tuesday to start the week. Weather remains the main focus of the markets as rains in the next week will help but forecasts have it followed by heat and dryness. Bean crop conditions this week were down 1% to 59% g/e. The soybean balance sheet does not have as much room for error as corn so any adverse soybean news will be bullish for the market. The long term up trend broke about 3 weeks ago but prices are still at a great level compared to what we were seeing this time last year. The report on Monday will help tell us what other news should be moving the market other than weather but headlines love to say it rained.

Soybeans, like corn, fell following the holiday weekend with huge losses on Tuesday to start the week. Weather remains the main focus of the markets as rains in the next week will help but forecasts have it followed by heat and dryness. Bean crop conditions this week were down 1% to 59% g/e. The soybean balance sheet does not have as much room for error as corn so any adverse soybean news will be bullish for the market. The long term up trend broke about 3 weeks ago but prices are still at a great level compared to what we were seeing this time last year. The report on Monday will help tell us what other news should be moving the market other than weather but headlines love to say it rained.