What a year. The housing industry plowed through 2021 with record disruptions and record sales. Once a pipeline issue was resolved, another would pop up. We are coming into 2022 with a tight supply and high demand for this commodity. Big dollars continue to flow into the economy, and now a house has reappeared as a valuable asset. There is also roaring inflation which is a double-edged sword for this commodity.

The fact is the housing market is exceptional, and lumber prices are trending higher. The positives are firmly in place, while the negatives will need a dramatic economic shift to come into play. The black swan could be rates or inflation or a greater covid blitz. In any case, it would have to be dramatic. Let us dive into the key factors controlling this industry. Our gut instinct is to rehash the past, and we’ll attempt not to bring up the obvious.

2021 — Year in Review

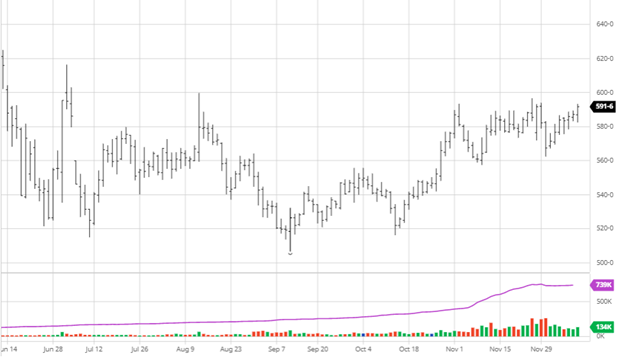

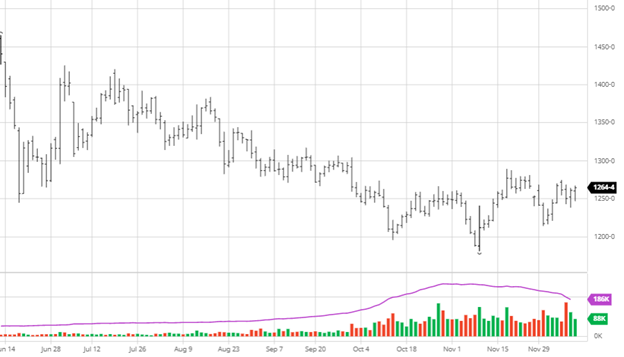

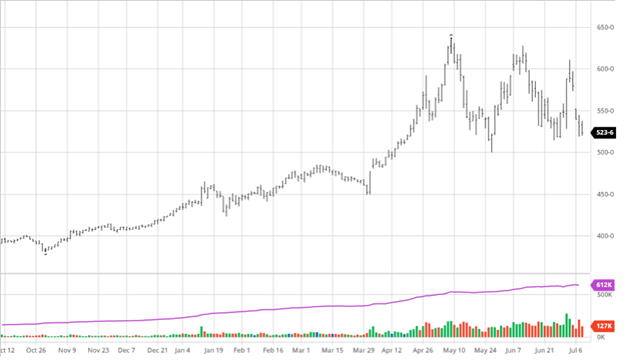

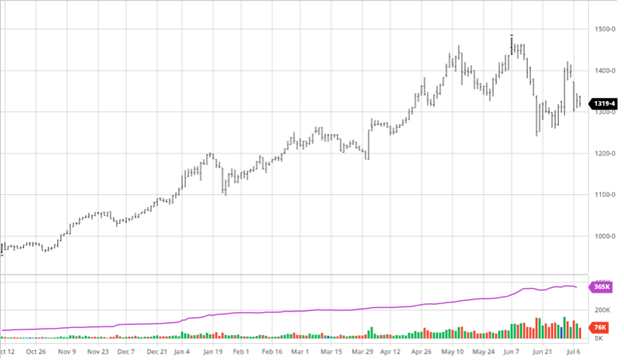

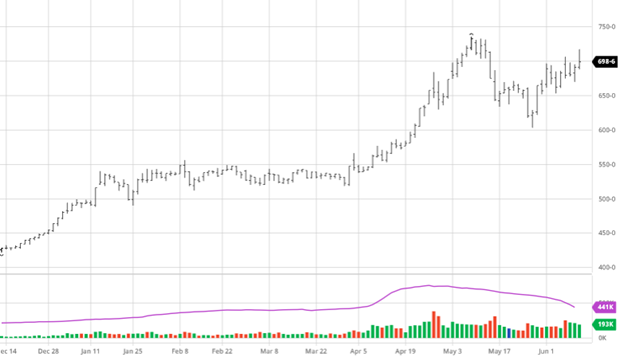

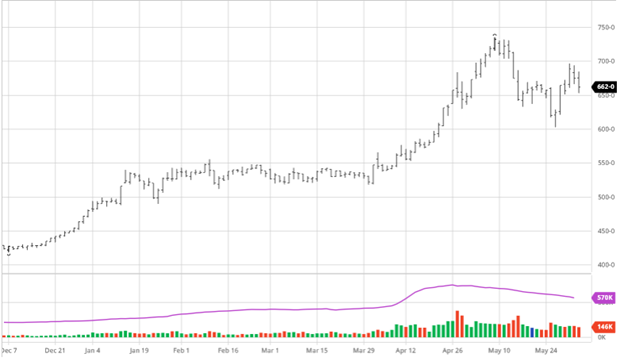

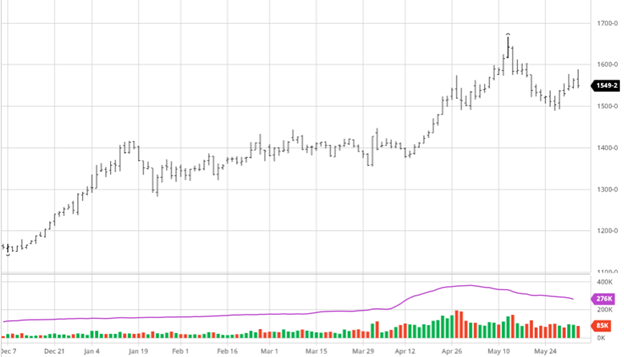

We came into 2021 at a futures price of $870. While we saw $1,000 the year before, this was much too high for the industry. The refusal to buy put an industry, seeing increasing volume in construction, critically underbought. From there, a panic ensued, and the market went parabolic.

The biggest takeaway from 2021 is that the trade was willing to pay unheard-of prices for wood and passed along the cost. No price level slows buying, and there is no longer too high. What higher prices do is generate a greater supply at a quicker pace. When there is a disruption in the chain, prices go straight up. Today we are either in the middle of that cycle or near the end.

Many would build a plan around the “bookends” of that year’s trade in the past. This is a critical drill for the industry in 2022. The need is to create a value area. We need to look at some of the economics out there to look at the value of this commodity.

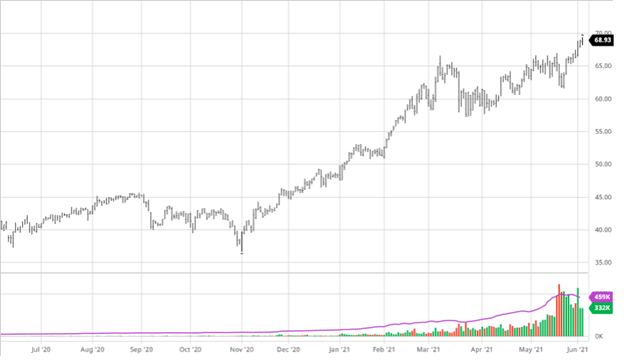

Housing starts average in 2021 was 1.586 million. The consensus is projecting a 1.6 number in 2022. That number could be far greater if there were the ability to build. As we said back in 2018, there is only so much capacity to go around. This year, many builders have chosen to scale back building plans so as not to get overextended. Others are adding numbers with lofty goals. Profitability drives their planning, and with the lack of availability still present, profits will stay high.

Where should value sit at 1.6 million starts?

The cost of production is skyrocketing in this industry as in all the rest. The last report showed wages up 9.2%. Yes, that is correct. That means the person who changes the oil in the logger’s truck to the people who do the final cleaning on the home before closing makes about 10% more. And that is if you can find a person to hire.

In the United States, the average monthly job offerings number is around 6 million — The December 1st number was 11 million. The stat that shows the mood of labor is the “quit” rate. This is usually a sub 1% number, and it was a whopping 3% in November. 3% of workings are quitting. These numbers are unsustainable, but many of these costs will not come off.

The best indicator today of the economic issue is the current inflation rate, and in November, it recorded 6.8% with an upward trajectory.

All this is a result of flooding the system with cash. That is flooding a system that was already building strength, and that was not the case in 2009 when the economy was headed lower. We must remember that many funds are circulating in a small economic space today. At this point, it will have to inflate itself out of the problem, which will end the housing run.

We talked earlier this year about how the housing market reacts to a cash-infused accelerating economy. With a better economy, expectations were for the first-time homebuyers to jump into the market after the “lost decade.” We have seen that increase, but more than expected went to the multi-sector. Under these dynamics, an increase in rates will not cause a slowdown in home buying. The norm has been about 38% of first-timers buying new homes, which is now closer to 20%. The troubling statistic is that the 38% group are investors. We do not need to review what happened the last time it was that high.

Projection:

Usually, most outlooks are a counter-trend analysis. Today we see only roses. This industry is highly complicated because of the various amounts of input at all levels. One factor could be bullish at one point and bearish at another. Today, we have numerous positive inputs that will lead to higher prices. At the same time, those factors have a shelf life. The tightness factors are slowing. Last year once those factors were finished, others crept into the equation. The next correction will indicate if that repeats or not. In the meantime, expect the 2021 swings again. It will also look remarkably familiar to the old-time seasonals that would make a top in the first quarter, do the sell in May and go away for the summer, followed by the fall buy starting the cycle all over again.

2022 will show owning lumber products will be a sound investment. Also, owning some type of downside risk management will soften the blow of the wide swings, especially when it is down. It is no longer a “time the buy” market; it is an opportunistic buy market.

About The Leonard Report

The Leonard Lumber Report is a new column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Before You Go…

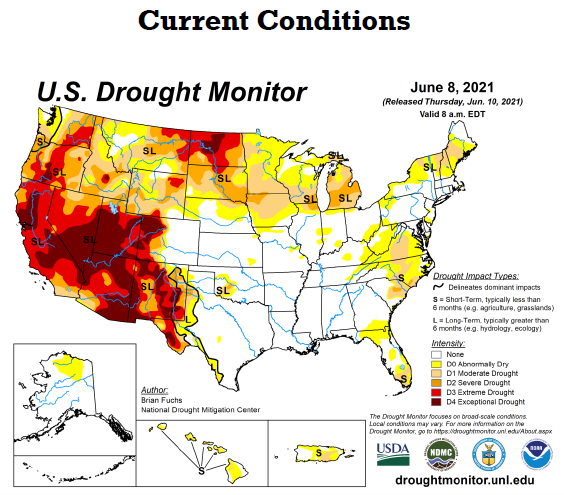

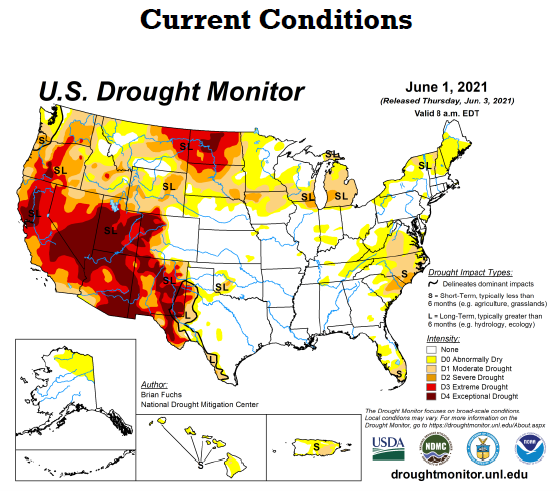

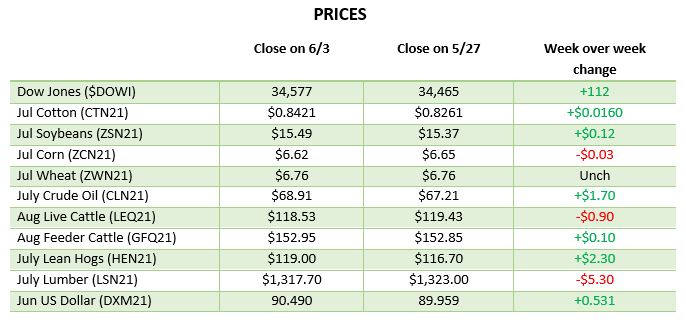

The 2021 U.S. grain crop has the potential to be one of the largest on record. Where did all the yield come from, what areas were the hardest hit, and why on God’s green earth are grain prices still so high?