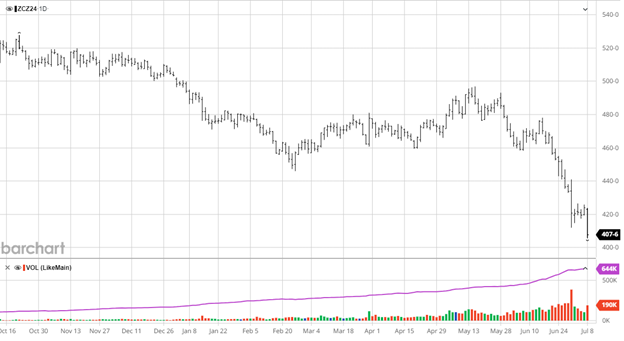

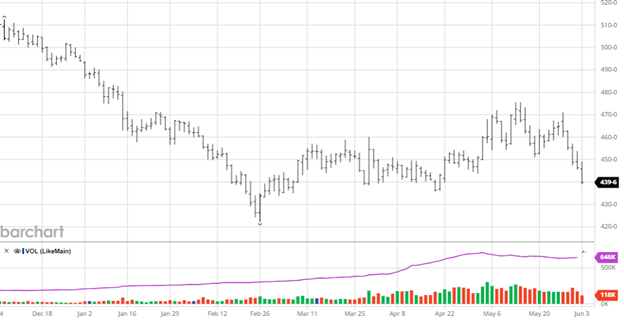

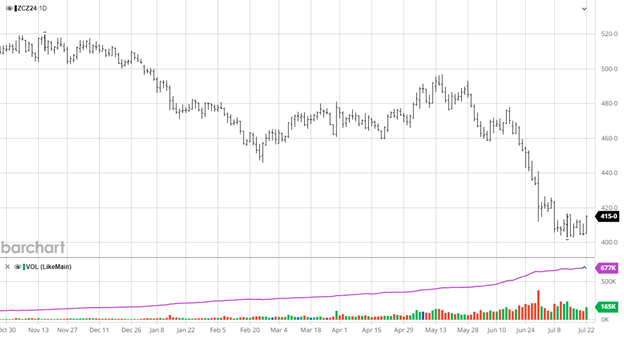

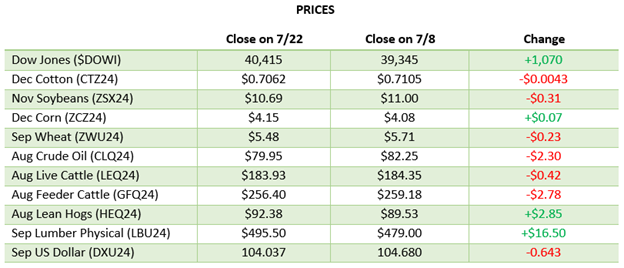

Corn has consolidated in the $4 to $4.20 range since July 8 even with the USDA report. The USDA did not release any major updates to production as they let expected US yield at 181 bu/ac but it did have lower ending stocks for the next 2 years with increased old crop exports and increased feed demand. This bullish news was not enough to put a fire behind corn as the US crop this year remains on record breaking pace with the great weather start to the year. The forecasts to start the week were adjusted for a warmer drier US starting this week than initially thought, lifting markets.

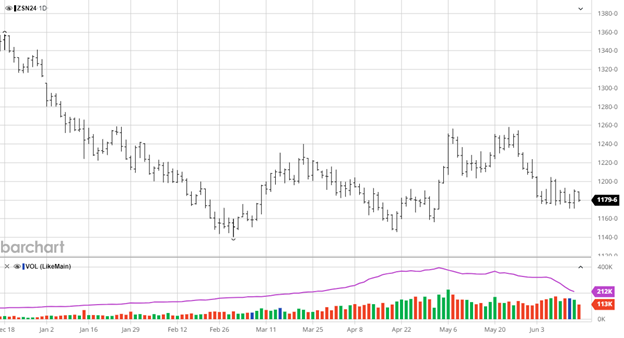

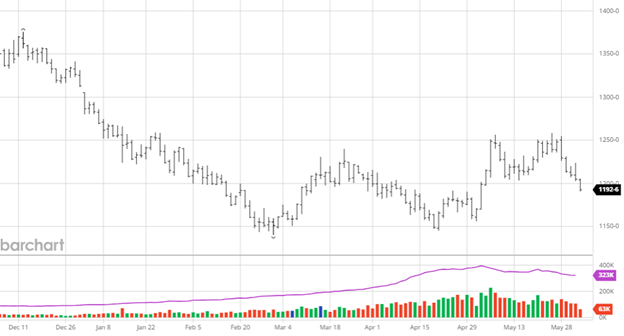

Beans seemed to find a near term bottom last week trading into the low $10.30 range. The sharp rally to start the week was a welcome sign with the largest up day for the Nov contract in at least the last 6 months. The USDA made minimal changes to soybeans in their update while adding demand to offset potentially record yields in the US. As we head into the back half of summer the bean market will trade on export demand from China and US weather.

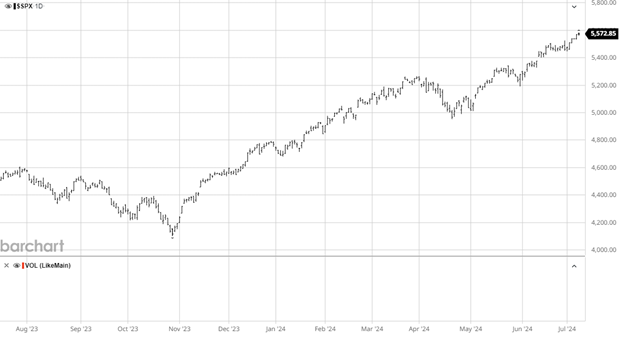

Equity Markets

The equity markets have shown volatility in July as several mega cap stocks that had been driving the market fell last week while small cap stocks saw their best week in years. The market is expecting rate cuts in September and the moves of last week appear to be repositioning within the market as funds space out their funds more away from the biggest stocks.

Other News

- President Joe Biden announced he would not seek reelection in November and put his support behind Kamala Harris to be the Democrats nominee. The DNC is in Chicago next week where unless a challenger pops up, she will become the nominee.

- An assassination attempt on former president and current GOP nominee Donald Trump occurred at a rally last week after a gunmen fired on him at the event hitting his ear and killing someone in attendance.

- The Ag markets will pay attention to the election as tariffs and trade wars (potentially from both candidates) are on the table.

- Cotton continues its weakness drifting lower as the US is trending towards a large crop at this point in the year with weak demand from the global market.

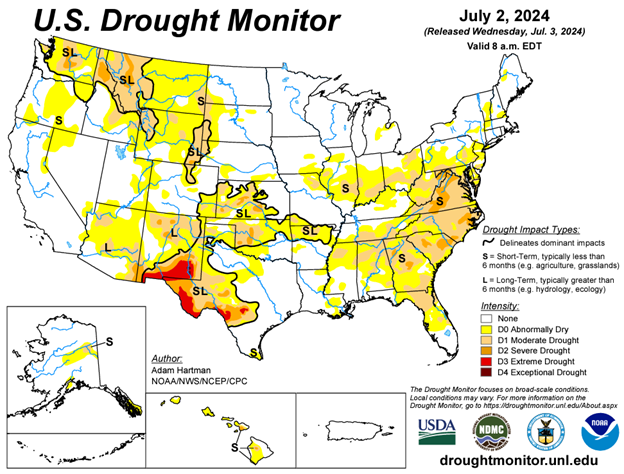

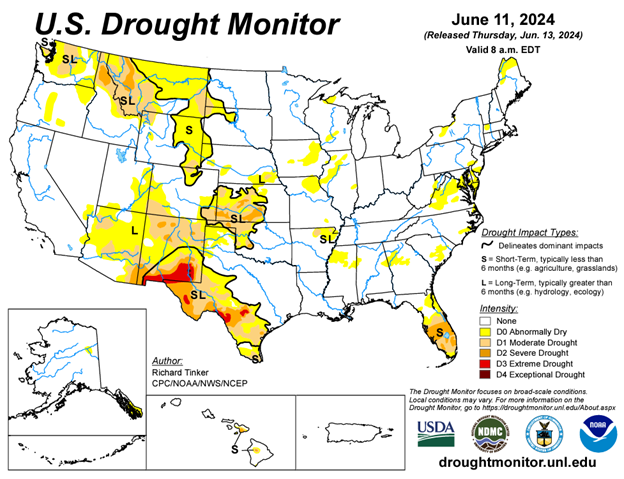

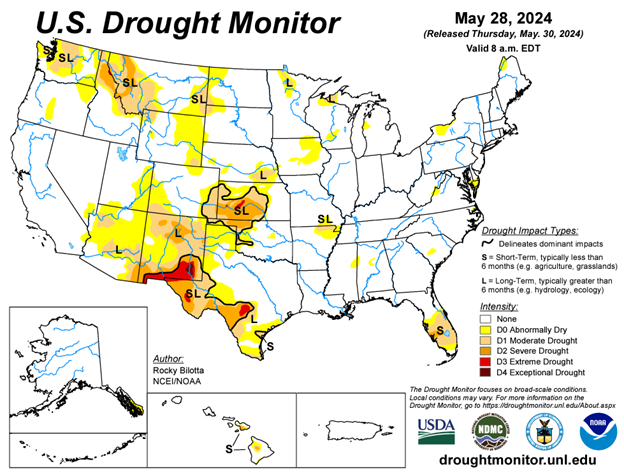

Drought Monitor

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.