With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

Contact Tim Webb [email protected]

Visit rcmwa.com for more information and be sure to follow them on Twitter and check them out on LinkedIn

________

________

Check out the complete Transcript from this week’s podcast below:

Stock market outlook and Tax savings strategies for 2023 with Tim Webb

Jeff Eizenberg 00:14

Welcome to the hedge edge by RCM AG services where we’re getting out of the field and onto the mic to bring you weekly market updates, commentary from commodity experts in monthly interviews with the biggest names in agribusiness. Welcome to the hedge edge and the first episode of 2023. As always, I’m your host Jeff Eisenberg. Today we’ll be taking a break from commodities and diving into the world of equities, interest rates, as well as tax savings and business planning strategies for the new year. Our guest today is Tim Webb. Tim is a close friend of our sister company, RCM Wealth Advisors, where he’s the Chief Investment Officer and managing partner. Tim has been working as a portfolio manager and advisor to families institutions, and agri businesses, implementing no nonsense financial planning strategies, and market investment disciplines to help clients build and maintain wealth and reach financial goals since 2003. Tim, welcome to the show.

Tim Webb 01:25

Thanks, Jeff, for having me. Appreciate it.

Jeff Eizenberg 01:29

Absolutely. Hey, last time we saw each other I think it was on the golf course. And correct me if I’m wrong, but pretty sure I was standing on a green that you drove Absolutely. Over the green went over.

Tim Webb 01:40

Yeah, I want to be clear on that it. It carried the green.

Jeff Eizenberg 01:47

Oh, is that possible? So you you grew up playing baseball. I mean, some people say golf and baseball don’t mix. But from what I see, it’s a perfect match.

Tim Webb 01:57

Well, you know, I, I’ve always been somewhat of a big hitter, I back and forth pretty much my entire career. And initially, it did not mix, I was having the banana slices all the way into the woods and all that other stuff. And if we’re talking advice here, I’m going to give two quick driving tips, I guess the first one would be try to transfer a little bit of weight to your front foot that helped me out a ton. And then really just kind of driving down into the ball and through it. And if you’re looking for power, the one thing that I’ve realized is that I do swing hard, that’s that’s neither here nor there. But where I generate my most power is because you’re in a small confined area, is you actually have to push down into the ground and up you have to figure out how to generate a lot of power from a very short period short area, right. So you can kind of drive my feet into the ground and then come up at the at the point of impact there. So Wow.

Jeff Eizenberg 02:55

So you’re not not only you know, offering financial advice, you’re also operating Golf Tips. Which one did people take you up on more frequently? I guess is the question.

Tim Webb 03:05

Well, the only benefit in golf I can do is with my drive. My short game is horrendous. So but ya know, it’s I enjoy it. I joined the league and over the past three years, so I’ve improved markedly my golf a little bit. So I get out maybe, I think maybe, you know, I try to get in 18 holes a week if I can. Yeah, so it’s nothing nothing great. I’m I’m I’m a mid 80s shooter. So don’t other than the dry. That’s all I can impart on this conversation. Okay, well,

Jeff Eizenberg 03:39

I’ll put you on my scrambled team for sure. Next, next time we play, but I do well, I do. Well, it scrambles. Yeah, on percent. Great. Well, yeah. So excited to have you here today. You know, we’ve been obviously working together in parallel for a long time now. And, you know, the markets. We’re going to talk about a little bit about the markets. And you know, before we jump into that, I think it might be helpful, just for anyone listening in just to give a little bit of your background. I mean, you you started our CM malt advisors over 10 years ago with with Bobby shorts, and you know, the CEO of RCM alternatives and in ag services. What What can you tell us about this journey? I mean, 10 years ago, you know, all we had to do is stick your money in the markets and we’re looking pretty good. 10 years later, but it’s different world now.

Tim Webb 04:28

Yeah. Well, especially in the in the overall wealth management space as a whole. So I started my career back in 2003. Started with a great regional firm, ag Edwards, and after about four years, four or five years in there, I remember going down to a meeting at their St. Louis campus with the CEO. And I won’t mention names with that but the CEO was asked and it was it was like around 2007 I guess right around there. was closed for Friends with the Gallatin family who had started ag Edwards. And I remember the question was, Hey, would you ever sell this firm? And he’s, you know, quote unquote, Over my dead body? Would I ever sell this firm? 11 days later he sold the firm. Right? So. So from there, you know, it went to, I think it was y cobia. At the time. I can’t remember offhand. I didn’t necessarily want to stay with with that firm. So I ended up transferring over to Smith Barney at the time, then you hit kind of the the 2008 financial crisis. Citibank broke the buck. Smith, Barney was kind of their crown jewel of, you know, assets for the bank at that point. It was, it was at that point, it seemed as if we were gonna be buying some other groups. I remember calling some of my friends on the street, like, oh, they were calling me. I said, I hear we’re buying you there. I got we here we’re buying you like okay. Eventually they, Morgan Stanley and Smith, Barney decided on a joint venture, which eventually turned into Morgan Stanley, long term, they were offering up some deals, I didn’t necessarily want to take any kind of deal from them. So at that point, in 2009, I opened up in independent office, went to the RIA model, right, so there was, you know, broker johrei, but it was through a local outfit. And that local outfit was eventually swallowed up by Charles Schwab. So that

Jeff Eizenberg 06:34

was an interesting time, because the RA model is so different than the traditional stock brokerage model, right? You’re really taking an entire look at someone’s financial plan, as opposed to what stock Can I pick? That’s going to me the next Tech tech, tech stock or something along those?

Tim Webb 06:51

Yeah, it totally true. And the biggest thing with that is, is really kind of becoming a fiduciary, right? So once you go to the gray model, it’s so much different than it was back when I started in 2003. When you go into the RA model, you’re sitting on the you’re sitting as a fiduciary to your clients, and you’re sitting on the same side of the table, right? You’re not making any Commission’s off of their business, you’re charging a fee for service and advice, adding value and and not necessarily pushing any product to any one person and or client, right. So the idea is what is best for that individual, that corporation, that that non for profit, that is going to help them and all those people that might be within that organization, and you push forward from that standpoint now, from an overall business, I couldn’t make that any better. Right? So, you know, there’s from the situation of having to say, Okay, well, what is best? How do we get a go the best? How do we go about getting our clients to that end goal. And that’s where the IRA model, in my opinion, the registered investment advisor model is best suited for the lion’s share of clients, and you’re starting to see even the big banks and all that stuff, trying to push their business more towards that arena.

Jeff Eizenberg 08:01

Yeah, listen, everybody is an expert at their business right at this stage in the game. And we want to let them stay experts at what they do and bring you in to piece together the the financial elements of it makes sense. And then also your global network, additional service providers or partnerships, allow for you to then also kind of be at the helm of some of these organizations, whether it’s a, you know, a farm, in an elevator, you know, somebody that’s touching in traditional agricultural businesses, or, you know, obviously, not inside our markets, but other types of companies and businesses that you work with elsewhere.

Tim Webb 08:42

It’s great point, one of the one of the main things to and where you can continue to drive value for your clients is trying to figure out ways that you can help their business in every aspect, right? So be it bringing specialty Farm Insurance to two different groups, bringing estate planning wills, getting, you know, essentially negotiating on behalf of your clients with these groups, going to different different outfits that may do those services and bringing some volume to them, so that you can bring the volume discounts back to your clientele, and say, Okay, well, here’s, here’s how, here’s what we’ve negotiated. This is, you know, these are the experts in these fields, and they’re gonna bring this to you, and it’s most likely going to be less costly than you would going out on your own right. So that that’s kind of the big thing and kind of bringing that full full suite of services to whatever client base we’re chatting with organization or otherwise, right.

Jeff Eizenberg 09:42

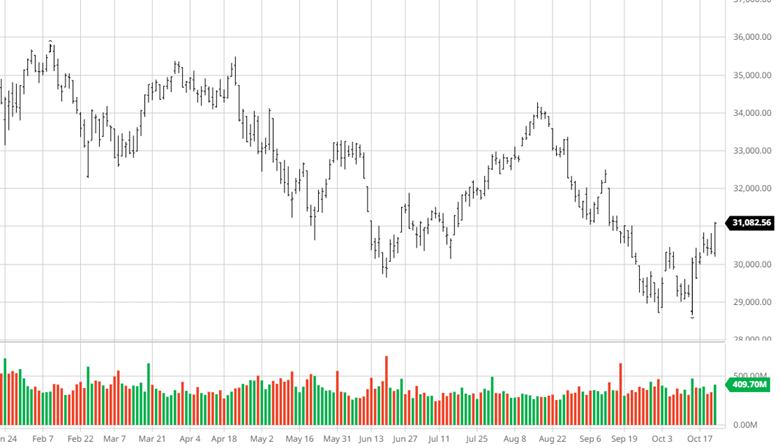

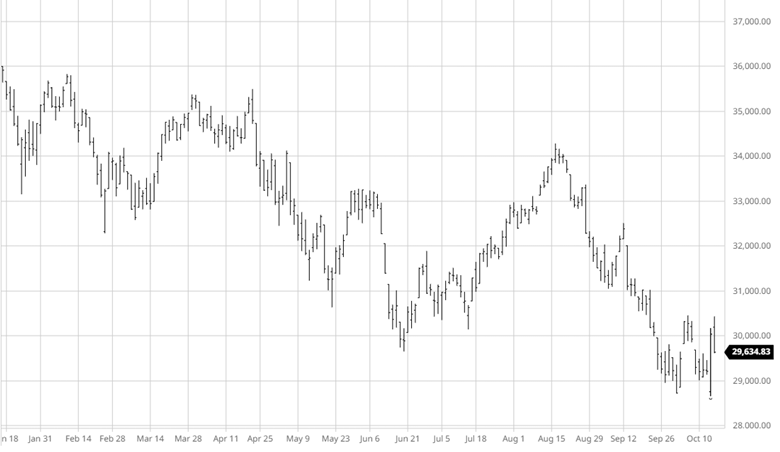

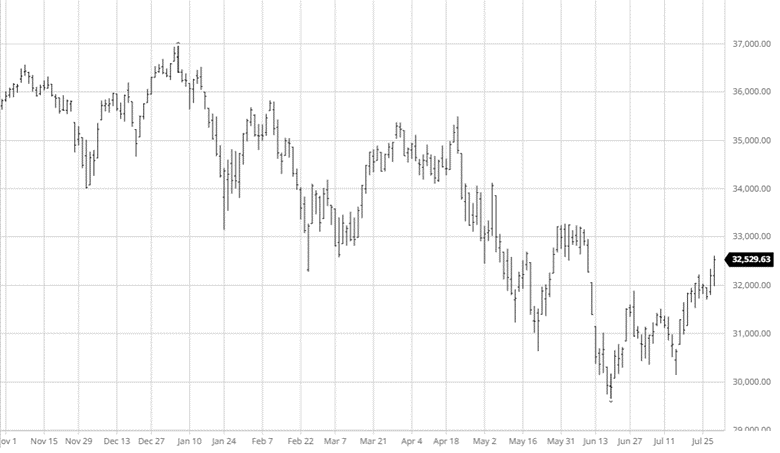

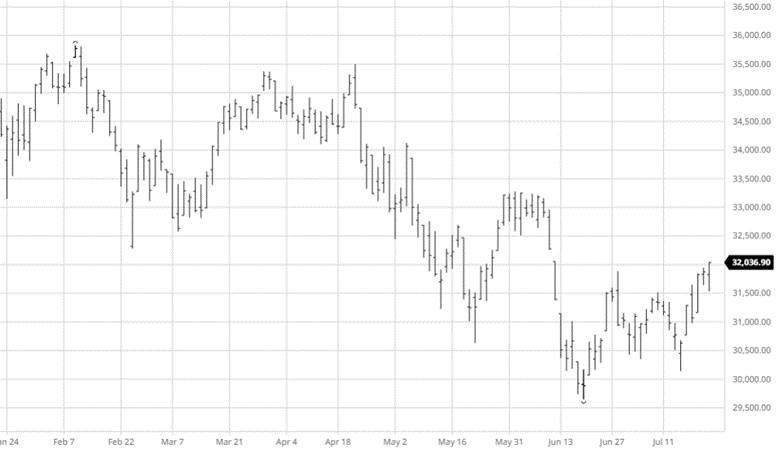

All right, well, we’ve got the elevator pitch down now. So let’s flip over to the important stuff. What is not that that doesn’t count, but people want to know and I do too. Where are we going with stocks, the stock market, and interest rates coming up here in the new year? Here we’re, you know, obviously market end of the year down terribly, almost as bad as 2008. And then you reference the 2003 period when you started. That was another terrible period. But you know, I guess the first question is, is there a beacon of hope? Or is it all doom and gloom here? What are you and your team looking at right now?

Tim Webb 10:21

Yeah. So you know, obviously, you know, the big in maybe you’ll have questions about this later. But the big thing that are on a lot of our client’s mind is, okay, is there a recession coming? Or I believe we already are in it. Some, some, some don’t.

Jeff Eizenberg 10:36

And I’ll tell you, my Costco bill, telling you we were going to be in recession, I can’t believe the prices, I’m going to hit the brakes and sending my wife to the store.

Tim Webb 10:44

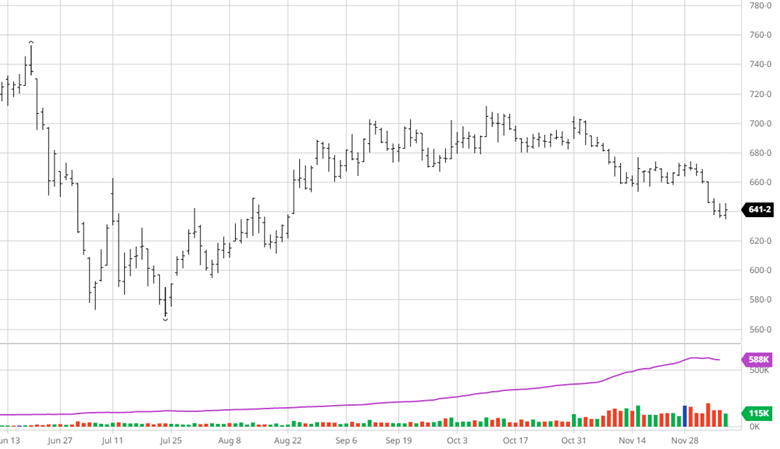

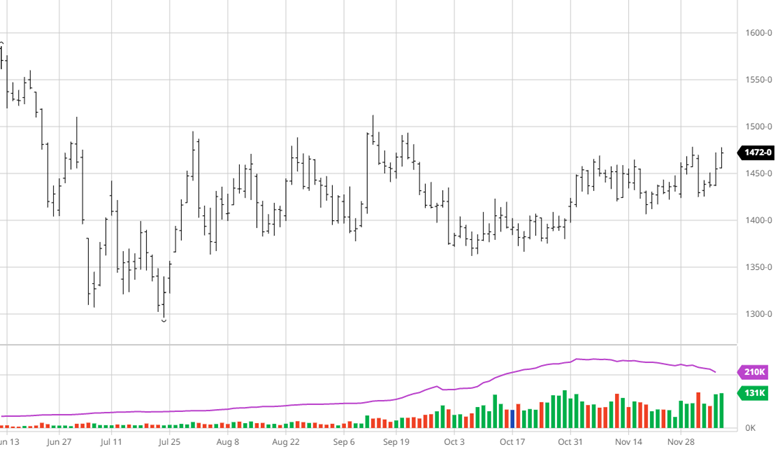

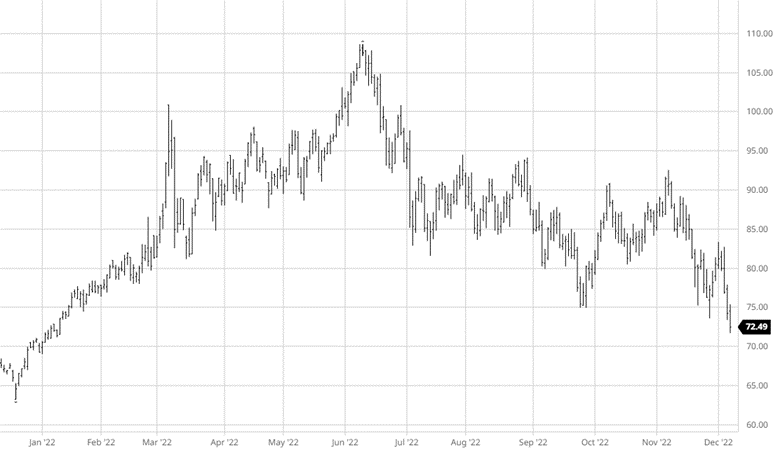

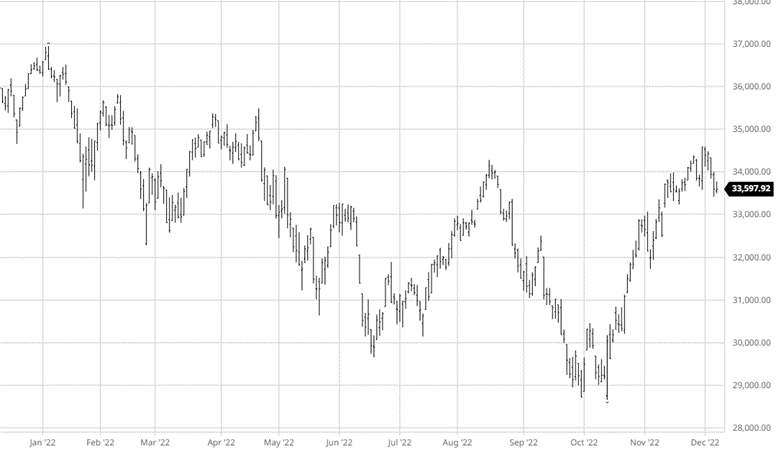

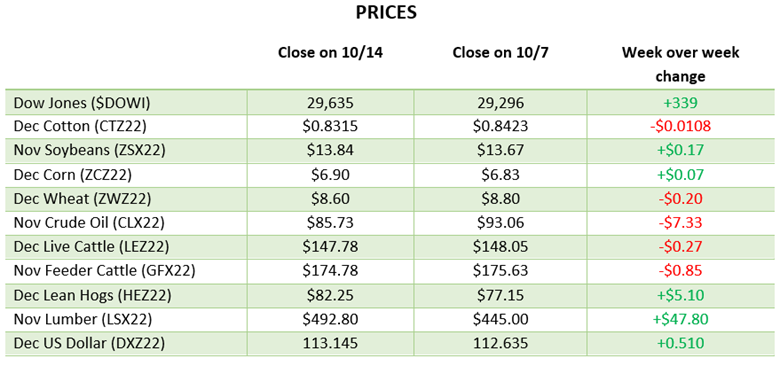

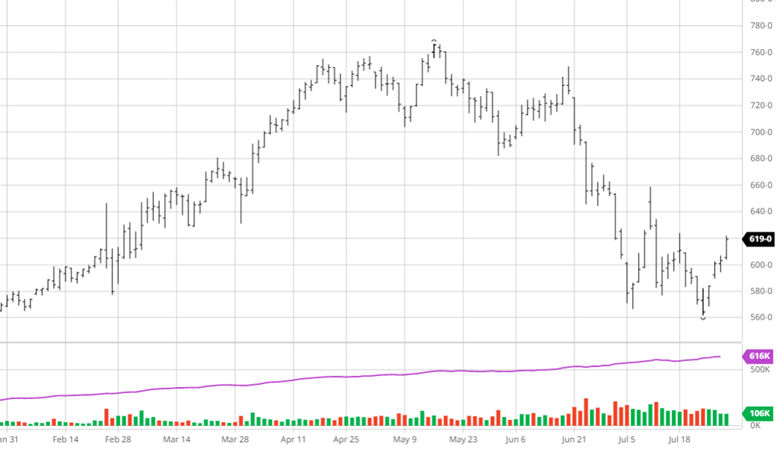

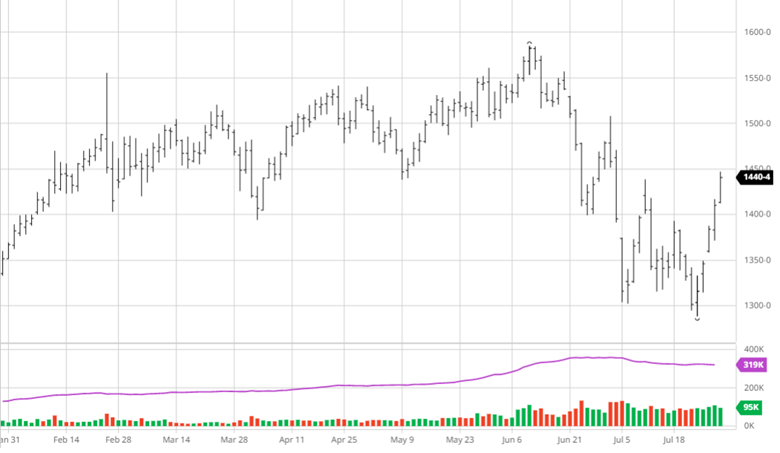

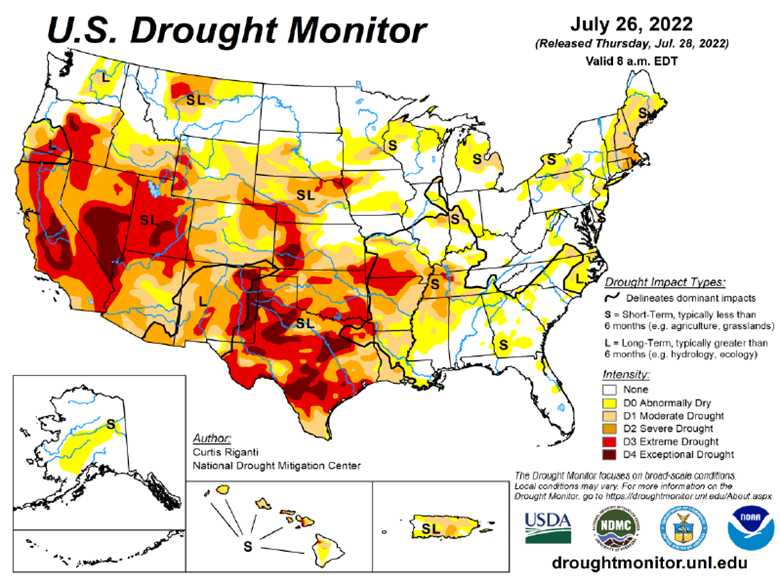

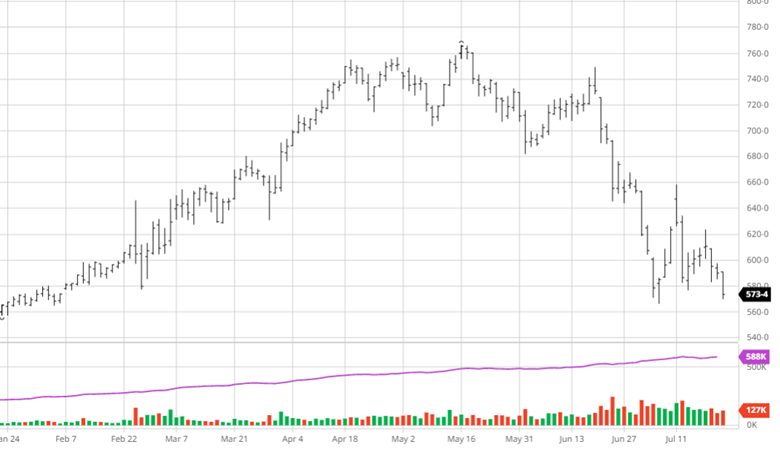

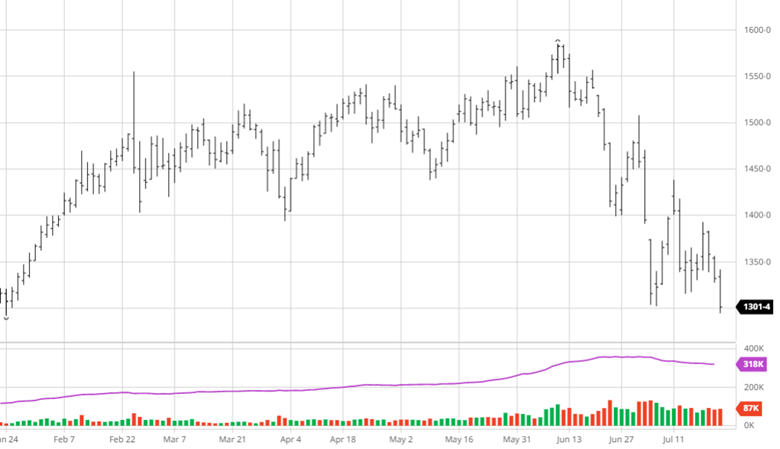

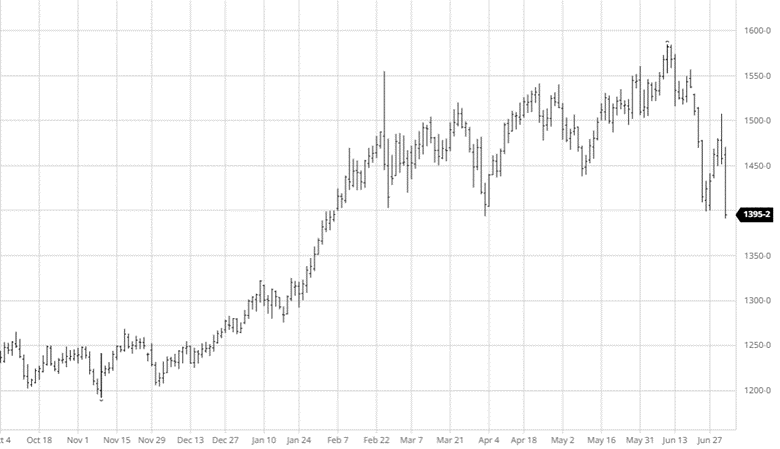

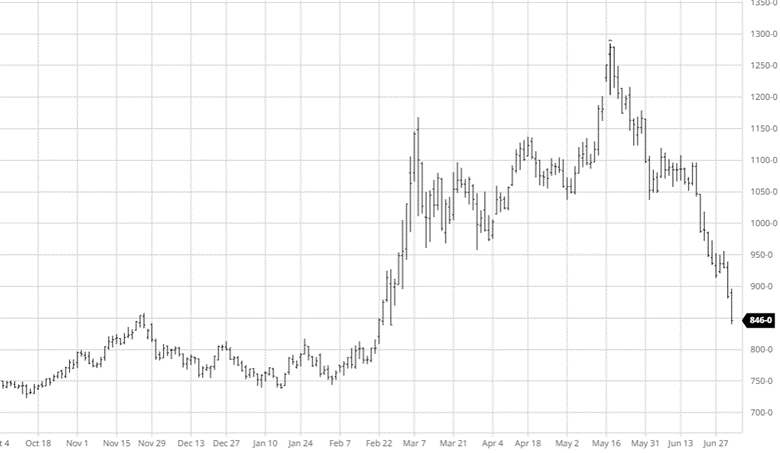

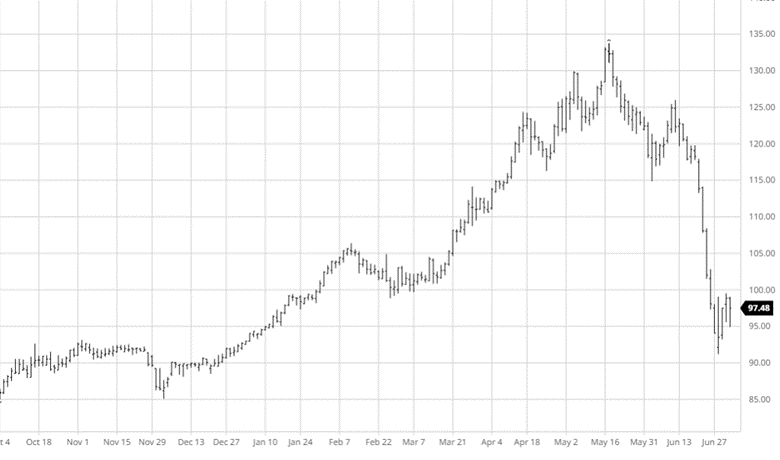

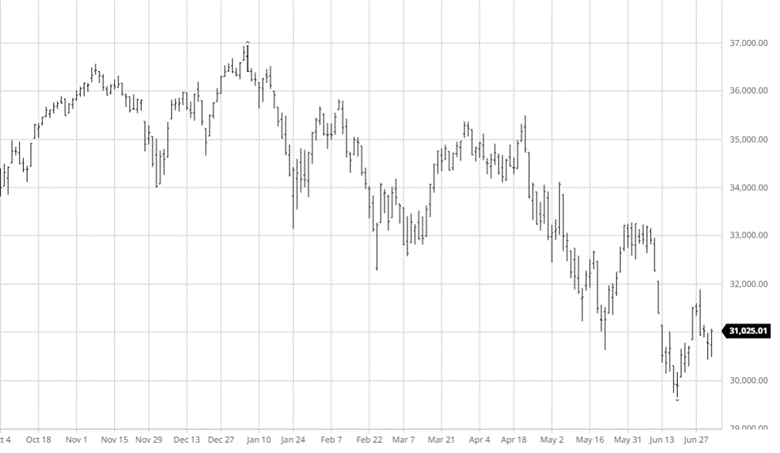

Yeah, yeah. Inflation. That’s obviously another big situation. And, we try to inform on that as well. But yeah, with respect to is there a recession kind of looming hovering over us? The answer, in our opinion, is yes. Right. So we’re kind of projecting it out probably for the second half of 23, which is where it looks most likely. Everybody who’s been in the markets understands that this past year, was it didn’t matter what you’re in, you could have been in stocks, bonds, Bitcoin, silver, gold, you know, it seemed like everything was, you know, really tracking backward. And in a lot of ways, in a typical recession, some of those things might have worked, you know, even in the corporate bond space, or those high grade corporates or, you know, mortgage-backed should have done a little bit better than they did. So everything kind of really took it on the chin, some of the numbers, you have

Jeff Eizenberg 11:33

to take a pause there and make a plug for the alternative side here, you know, following CTAs, fad had a great year, you know, double digits. So let’s not forget about where there can be potential is commodity since we’re on a commodity podcast. Remember, there was there were some positive numbers out there.

Tim Webb 11:55

No doubt. I’ve been seeing those numbers from you guys. And they are quite impressive. I would I would definitely agree with that. Yeah, so there, I mean, yes, there’s, as you know, there’s always someplace where you can kind of look, it was just more difficult and 22. Right. There was in, you know, to put it put it lightly, I guess, to really look back, you know, because they started raising interest rates so aggressively and above expectation, wait way beyond what they were predicting, right. Like at the beginning of 22? I believe they were kind of coming out saying, Yeah, we’re going to probably do employment looks good. We’re probably going to have 325 basis point rate hikes throughout the year of 22. Well,

Jeff Eizenberg 12:36

exactly. It just complete change, of course.

Tim Webb 12:39

Yeah, they did that in one month, right. So we’ve just seen this happen fast and furious. And the other big thing that we look at, and you know, what, everyone’s there’s a lot of froth still left in the markets, right. So, you know, from a standpoint of empty money supply, right. So they’ve, there has just been because of the pandemic and everything else like that there has been a flood of money that’s been put out there, be it through different government programs, things like that different bills that have passed, but there’s been a lot of money, and that has kind of pushed through the system and still has a way of working, it has some more time that it has to work its way through the system if you will. So now, you know, moving into 23, you can see the Federal Reserve kind of saying, Okay, well, we’re, we’re looking at some of these things we’re at we did just did a 50 basis point hike, some are projecting another 75 basis points. And one thing that we’re seeing a lot of is that, you know, if 22 is any indication, I don’t necessarily think the best place to look is what the Federal Reserve is kind of touting right now. Right? Of course, and

Jeff Eizenberg 13:49

dead wrong. I mean, why should we believe right?

Tim Webb 13:52

I agree. And the worst part of it all is, is the markets are trading based off of their, what they’re saying and all that other stuff. It’s not based off of fundamentals. It’s not based off of even, you know, tracking, it’s all based on what is the Federal Reserve going to do? What are they going to say? What are they going to project out? And that’s no, that’s, that’s not a good place to be overall. And I do think in 23, that’s that that narrative starts to change a little bit, right. So eventually, the markets do tend to always go back to okay, what’s the valuation that I’m at right now? Right, where, where is where can I find future growth and, and future prospects for different companies? And once we start getting back to the fundamentals, which we do believe will happen in 23, be it in the bond markets, be it in the stock markets? We do think we get back to some normalities where we’re going off of what you know, earnings because obviously, you’re going to have compression in earnings. You know, there’s going to that’s going to trickle through. That’s probably what’s going to trigger the recession that we think is forthcoming. On top of it, you’re gonna probably see that the Federal Reserve is going to kind of keep their Put on the gas a little bit. So you get closer to more of a 5% unemployment rate, versus staying at the three-and-a-half word that it’s technically quoted at right now. Right. So, you know, so there’s gonna be some of that coming off the system, which, you know, with respect to stocks, that we don’t necessarily think that’s the best growth environment. So for some of those cloud computing companies, some of those, you know, even even some of the big aggregate tech companies, they’re facing headwinds throughout that. So, you know, our goal is kind of looking at, okay, what dividend paying stocks value based stocks are we looking at, we know, there’s going to be some volatility that comes through here, you can utilize some option work with that utilizing covered calls. And we have something we call our triple income strategy where we’re doing different things to kind of generate synthetic Nan, we want to call it synthetically generate options, premiums to kind of get some of these, these dividend paying stocks at a better price, do a covered call or call spread on it on the back, and really kind of mitigate some of that volatility that, you know, we saw throughout 22. So we think that that strategy in 23 looks to be a little bit stronger than saying, okay, everything is dip back so bad in the tech space and the growth companies that it’s gotta be a good time to buy it.

Jeff Eizenberg 16:21

Is really, what if I could summarize what you’re saying there, at the end of the day, hope is not a strategy, right? And you you really have a view of where where things need to go? Or are potentially going and then being tactful in how to allocate? You know, really kind of falls on your shoulders a bit, I guess, you know, a question that comes to mind is, historically, people have been successful with passive investments, versus the active type of investment strategies. And I know, you and your company that you’ve mentioned, your, your strategy, you know, have had quite a bit of success on the on the being the tactful, or, you know, active side. Maybe just talk a little bit about that. Not too not too detailed. I mean, you’re talking to commodity traders. So, you know, we understand, you know, covered calls and options, strategies, but just high level what, what are some of the more active approach? You take?

Tim Webb 17:22

Yeah, yeah. And speak briefly on the past stuff. Yes, over the past 10 years, with easy money. It was kind of a point and shoot situation, right? You know, it was, if there’s 500 targets out there, and you hit a few of them yet, it’s gonna it’s gonna be fine, right like that. That’s that that’s what was good under easy monetary policy, obviously, it’s gotten a lot more difficult. Now that the volatility is ticked up. And also, that has come to kind of a screeching halt from an empty money supply aspect, right. So that, that in 22, right around October is pretty much gone, too. It’s still a little bit going on, but it’s pretty, pretty slow down substantially, right. So with respect to that, you know, the way the way that we look at it for 23 going going forward, you take a passive index, you know, let’s just say the s&p 500, a lot of times people say, You know what, I’m gonna put that in there. Okay, so just based off of what I said before, that’s a market cap weighted average, right? So that the biggest companies in the world are going to have the most amount of exposure in that s&p 500 font. Right? Right. So you’re gonna own all the apples, the Google’s the Facebook’s meta, if you will, all of those, that’s going to be comprised of about 35% of your portfolio between 30 and 35% of your portfolio based on market cap weight. And, you know, you’re technically moving more towards kind of a technology based portfolio with respect to that. And in our opinion, in this upcoming year, the value base is going to be more the healthcare sector, you know, a little bit maybe, you know, financials have been hurt a little bit, but, you know, those potentially could do okay, being that we’re in a, you know, somewhat of a an abundance type of atmosphere with the Federal Reserve type of thing. So the one the one strategy that we employ is obviously, we want reoccurring dividends that have consistently increased over time that we think that are going to continue to, you know, they’re not going to get hurt too bad throughout any kind of recession, because they’re kind of their built in businesses. They’re the steady growers, if you can get four to 6% in market return, and you got a two to 4% dividend, you’re looking at a six to 8% Return overall. And sometimes you just got to take what’s given to you in that particular time. Right, you know, question

Jeff Eizenberg 19:36

Question comes to mind right there. So with cash rates as high as they are now three to 5% it was cash-rich companies are the ones that you’re thinking about because ultimately they’re going to earn interest on money it’s an excess cash plus potentially thrown off profit from the from the best business actual revenues. Is that something that you’re thinking about?

Tim Webb 19:57

Absolutely. Cash is king right? You know, that’s, that’s Always the, you know, we do what’s called discounted cash flow analysis or discounted cash flow, you know, kind of reporting on companies. So we’re always looking okay, what’s the cash look like? What’s their ability to continue to pay those dividends? What’s their growth model? Because, you know, be it with inflation still at high levels, right? There are certain capital expenditures that different companies were paying for in the past, right. wage growth was kind of moving pretty, you know, up pretty quickly, because, you know, you had easy monetary policy, and that kind of trickled down through all the, through all the ranks or so yeah, definitely cash is going to be king our opinion 2023 typically always is. But you know, those high valuation stocks, while they may be cash rich, they’re still trading in multiples that are well beyond what we think that, you know, could continue in 23. There. So it’s just more of a conservative approach, right, just just for to start off the year. It’s not that we can’t pivot it, you know, because at some point, I don’t want to be all doom and gloom on this. I do think, at some point, there’s going to be a great buying opportunity, both in bonds, because those have retracted so much. And even in those growth stocks. I mean, I just I think the market is waiting, somewhat for an all clear sign. But I want to put that in perspective as well. Right. So we’ve just gone through 12 months of the market, you know, starting in January, the market just started tanking and 22 going down, going down. I’ve had a couple of pockets. We had about nine or 10 situations where the market tried to rally and failed throughout 2022. We do think that tends to continue into 23. A little bit. And but with that said, if we do go into recession, markets will be trying to get out don’t they’ll be the first things to recover, right? So typically, recessions lasts anywhere from two to 18 months as a whole. Right? That includes 2008 and blues back for the past 50 years. So, you know, we’re 12 months into kind of a retracement in, in equities. And we do think that, you know, I don’t think we’re gonna hit the long end of that 18 months, but I think for the first couple of quarters, I think it makes sense to play it safe. dividend payers, things like that. The other thing is I have not this is something that we’ve been doing, we’ve been kind of doing a laddered CD strategy. I haven’t bought CDs for DVDs.

Jeff Eizenberg 22:21

I mean, are you talking about the ones that we listened to on our old disk man? Or what does it say?

Tim Webb 22:29

Well, it just, you know, the appetite for risk right now is very, very low is what I would say with the base that we deal with, right? So that’s also if you look at it from the contrarian standpoint, too, that’s also an opportunity like you, you may want when things get it’s that old Warren Buffett, you know, saying is, you know, be greedy when others others are fearful, we’re starting to hit some peak fearful levels right now, which, from our standpoint, we look at that as an indicator of good times ahead a little bit, right. So when we come out of these, these types of recessions, you have the largest you have, you can look back, and you’re going to be looking at 45 to 50% returns, potentially out of these recessions and and not too short time after that. And stocks will typically run six to 12 months ahead of that recession actually being over, right. So I don’t want to get too fine with with the strategy saying, Okay, you got to do this. And you got to wait until you get an all clear sign. That might not be the case, right. So it’s a situation of we know where we’re at, we’re about 12 months into this retracement, we know potentially could last 18 months but went a little bit longer. Okay. Historically, now we’re passing some levels, we had a pandemic, that was pretty large and had a quite a bit of an effect. We’ve had easy monetary policy that they’re pulling back. Oh, and by the way, we got $32 trillion in debt at the government level.

Jeff Eizenberg 23:51

Let’s not forget about that. Oh, another 1.7 here at the end of the year, whatever the number is. Yeah,

Tim Webb 23:56

I saw it. I think that’ll probably pass but we’ll see. So yeah, and it’s just one of those things where it’s, it’s, you know, you want to play it safe a little bit. But as I was saying, with the laddering of the CDs, we’ve been doing that, but we’re doing short term, right? So you’re able to get, you know, on one month, you’re getting 4% type returns 4.2%. Now, it’s annualized, right? So but we’re kind of laddering that so that we’re doing it month by month on that. And then as the interest rates are being risen, sometimes the CDs rates are raised, rising and kind, but we also want that liquidity available to us so that if the markets do turn, we don’t think they’re going to turn on a dime. But we do want to have some availability with some of the capital to then be able to put that to work for our long term strategy, right? In these situations, what we’re going through right now, you have to you got to kind of battle in the short term, find your pockets get in there. And then you know, at some point, we want to get back to a long term strategy because we do believe more Kids are going to do fine over a long period of time. Historically, they always have, you know?

Jeff Eizenberg 25:10

Yeah, I can completely appreciate the long term view. And I think that kind of leads into the next section here, which is kind of transitioning away from what markets are doing, or doing or anticipated doing to, you know, really building a business, long term business, and the planning and structure around that, I think is super important. And, you know, making money in stock in the stock market, or in equities or bonds is one thing. But the other side is also extremely important. How about saving money in taxes or, you know, preparing your infrastructure and your business, to be able to pass it on to either, you know, other employees through employee benefit programs, Aesop’s other things like that, or succession planning, if you’re a small business, small farm, or even just a small business passing things along those ways. So if you could just maybe shift over a little bit, Tim, and I mean, there are many other strategies that people should be thinking about that outside of just where do I, you know, what stock? Do I buy? What, you know? How high is the stock market?

Tim Webb 26:18

Gonna go from here? Yeah, yeah, good point. So, you know, from a tax planning standpoint, you know, for our clients, businesses, organizations, farmers, we, that is something that we concentrate pretty heavily on. So we’re fair, you know, the corporate benefit space is something that we’re in and we look at it very heavily, and we bring that to our business owners as a great benefit

Jeff Eizenberg 26:38

large or small businesses are absolutely,

Tim Webb 26:41

yeah, it could be individual, individual owner only type 401 K’s right. And they didn’t realize that they could potentially get, you know, $67,000 off of their taxable wages, by setting something up for themselves themselves and their wife, whatever, your wife and husband opposite way. So just it’s one of those things that we really try to help from a financial planning standpoint. So we’re talking about market strategy, things like that. This is more under the financial planning wealth management portion of of our business. So in the corporate plan space, and or even just retirement space, right. As I mentioned, just previously, we’re $32 trillion in debt, what does that tell us? Right? It tells us at some point, tax rates are going to have to go up quite a bit to pay down our debt. So what do we do? Do we just sit here and wait for those rates to go up and continue doing what we’re doing? Or do we take advantage of some of those government, or, you know, the IRS places that allows us to put money away into a tax deferred vehicle, or an after tax deferred vehicle, ie what the Roth portion of things, and take advantage of what we can while we can build those balances up? So that in the future, because we all know, they’re kind of kicking this can down the road, at some point, you know, it’ll come home to roost, right, there’s gonna be a situation, what we try to plan for is we don’t want that situation to happen, right, as you’re going into retirement, and then oh, by the way, tax rates had just moved up, 10%, you’re gonna have to work another two years, even though you didn’t necessarily plan for it, you know, from that standpoint, right. So we’re trying to prepare our investors for the the likelihood or potential that tax rates could go up in the future. And one of those ways to do it for businesses and individuals is getting the proper retirement planning piece to your business or your individual aspect in place, and be prepared for the unknown. Right. So that that’s, that’s the big takeaway I would give.

Jeff Eizenberg 28:41

Yeah. And I think that, you know, a lot of people end up just putting a lot of trust in their accountants to tell them exactly what to do here. And I think that the accounting community does a great job giving advice, but at the end of the day, you know, you partner with accountants to help them be more successful in advising their clients. And I think that, you know, any accountants that are listening in here? It’s, yeah, let’s let’s all work together. Because at the end of the day, if, you know, all parties are swimming in the same direction, it’s going to be a lot faster boat, right?

Tim Webb 29:11

Yeah. No, no doubt, a lot of times. So that’s part of that financial planning process overall, is, you know, many times, you know, and I often say like, your money is your business. Right? It’s it’s unique, right? So

Jeff Eizenberg 29:26

you got like Jim Cramer does isn’t that his line? Your Money, Your business or something along those lines?

29:32

I don’t know. I don’t steal it from him. You know, you might. Yeah,

Tim Webb 29:37

well, yeah. If he said it, oh, I must have heard it passing. But I’ve been saying that for years. So but it but it remains true, right? So you have to run your money like your employee, right? So you’re putting your employee out into different markets, and if they’re not being productive, then they’re a non productive employee, and you need to get rid of that employee in in some sense, right. So um, And, and that’s also a taxes, right? So what a lot of times in the financial planning process, whether you have your own account that you love working with, or if you’re looking for one we have partnered with, with different firms in that regard that have a very sound track record of working in the financial planning process. But we oftentimes will do conference calls, you got to have your own management team and run your business, right? So we work with them and their accountants to say, Okay, well, here’s what we’re looking at. It could be Roth conversions throughout time, it could be okay, here’s where we’re at from a business standpoint, we need to figure out a way to get $150,000 off of the company books, how do we do that, from a proper retirement planning standpoint, things like that. So that when you start getting that out, you’re paying less taxes year over year, and that money is now growing for you versus going reverse back to the government. That’s, that’s that where that starts to bifurcate. And you get, okay, we’re going up this way, as opposed to paying that way, right. So and then all of a sudden, you continue to build on that. And then come retirement, diversifying your tax liabilities, be it through some Roth pieces, and like cash balance plans, then you can kind of have a situation where you’ve, you’ve also done proper tax planning, all the way through your accumulation phase. And when you get into your withdrawal phase, because we always kind of talk about there’s two phases to your retirement. Right now, if you’re not retired, you’re building your business, you’re building your individual net worth, and you’re accumulating the assets that you need to build so that you can retire a lot of times, you’ll work for 3035 years. And with the advent of new medicine, and a lot of new cool kind of technology coming in from stem cell and all that other stuff, people are going to be living longer, potentially, right. And you might be working for 35 years, and then in retirement for 30 years, right. So now, you’re not making that income, how do we? How do we account for that in the future, and that’s what we, that’s where that financial planning process comes in. We basically look at it year over year, figure out how to get you to that end goal so that you don’t have to go back to work when you’re 82. You’re like, wait a minute, I didn’t, I didn’t realize I should have done that.

Jeff Eizenberg 32:12

Are you question? Are you going to be able to hit the ball, as long as you are at 82?

Tim Webb 32:17

I’m going to try? I definitely, you know, every nowadays, because I swing so hard. It’s a couple Advil before the round. And if you go after, right, maybe

Jeff Eizenberg 32:28

something else help as well, you know,

Tim Webb 32:31

hey, you know, it’s one of those things, you know, gotta get, you know, maybe, maybe it’s something to ease the pain, if,

Jeff Eizenberg 32:38

you know, this is it. And I think in terms of easing the pain related to retirement planning, I think that what you guys are doing is phenomenal, you know, excited to be partnered with you guys in this project adventure to, you know, get this story out and message to more of our, you know, farming and agri businesses that are out there, you know, small, medium, large, I mean, at the end of the day, particularly in agriculture, the business has grown exponentially, you know, a small country elevators, now a mid sized country elevator, a, you know, a farm that was historically, you know, had revenues, a million, or $2 million is now, you know, for six or 8 million in revenue. And, you know, there’s a lot to manage. And, you know, there’s a lot of work that needs to go into making sure that these businesses, they used to be more family run, continue to be family run, and then grow pass on, and ultimately are successful for many generations to come. And that’s why I think that, you know, this discussion is super important today, and really wanted to have you on here, Tim, so

Tim Webb 33:52

I’m an Indiana guy, we have a great, we got a great farming community out here and everything like that. So yeah, we’re, you know, obviously land and everything is done very well. And, you know, what we’d like to do is we like to bring those services out to them, because a lot of times, you know, there’s not many alternatives in a specific area for them, where they can take advantage of, of a different perspective or something along those lines, there may be only two shops in their entire, you know, 30 square mile radius, and they don’t want to travel out, you know, so we go out to them, we sit down and chat with them and all that stuff. So it’s, you know, just want to let people know that they have options that they can choose from, and it’s more of a holistic approach, looking at the whole, the whole piece of the puzzle for you. So,

Jeff Eizenberg 34:39

yeah, this has been great, Tim, really appreciate this. I think what we’ll do is catch up with you here, maybe quarterly to see what’s going on with markets and you know, touch base on any new new updates related to these planning strategies, as well and you know, other you know, we have an office out in Kansas, you got the new office there in Crown Point, Indiana, like you said, I mean right there in foreign country and continue to grow. So congratulations on the business. You know, one last thing I’d like to ask here before the end of before we wrap up is, you know, first of all, you’ve kind of already given us your market prediction, you think that market is forward looking and likely to make a turn around here at some point. I’m not going to stick number on it for you but you know, it sounds to me like that’s that’s your your one point. And then second is you know, if you had to kind of go back you’re 21 year old body right after you graduated college. And you know, you’re gonna go out you’re gonna go play in the Major Leagues. It sounds like let’s say, let’s say that didn’t work out what what extreme sport would you find yourself interested in getting after?

Tim Webb 35:59

I would think I you know, and I’m currently looking into it as well even at my advanced by becoming more advanced age here. Rock climbing also in an odd way boxing so my father was the US the heavyweight Bengal bot Bengal Bowl champion at Notre Dame for two years running. So, you know, that would have been extreme I guess it’s kind of a fight sport that would have been something you know, kind of on those stressful days in the markets are down, you know, you know, a little boxing would have been okay, too. But yeah, I’m currently I’m looking into some rock climbing options for myself. Not a ton out here in Indiana overall.

Jeff Eizenberg 36:40

Yeah, I was gonna say probably not right in the heart of rock climbing area, but can certainly I guess I know what to get you next year for Christmas. I get your boxing boxing bag or heavy bag? Yeah, yeah. For the office, you could play ping pong. And then you know, the loser after you lose to the young bucks, you have to hit the bag.

Tim Webb 37:01

You know, they can’t beat me just so you know. I mean, it’s as hard as they try. It’s not gonna happen. So

Jeff Eizenberg 37:07

Well, Tim, really appreciate you coming on the show. How do people get in touch with you? What’s the best place to reach you? Yeah.

Tim Webb 37:14

So we’re at obviously, you see the RSC mag services. So we are our CM Wealth Advisors. So it’s RCM w a.com. So you can check us out there. And you know, our number and everything contact information, a lot of our groups listed on there as well, not all of our strategic partners. But a lot of our interior group is listed on that. So yeah, we’re happy to help in any way that we can. Big or small to your point, it doesn’t matter to us. You know, if you have questions, it’s a no obligation. We’re here to help. If you need some help, give us a call.

Jeff Eizenberg 37:47

That’s perfect. Yeah. And then tie in with the services piece. We can obviously all we could talk about both sides of the market at the same time. So

Tim Webb 37:56

we’re gonna come on in, right. There’s more to come on that for sure.

Jeff Eizenberg 37:59

So yeah, we’ll keep keep everybody posted. But all right, Tim. Well, thank you so much for your time. Super, super great to see you. Next time, we’ll get another round of golf in and catch up for a game of ping pong. But thanks again and enjoy the rest of your you know that your new year coming up?

Tim Webb 38:20

Absolutely. Thanks for having me. Appreciate it.

This transcript was compiled automatically via Otter.AI and as such may include typos and errors the artificial intelligence did not pick up correctly.