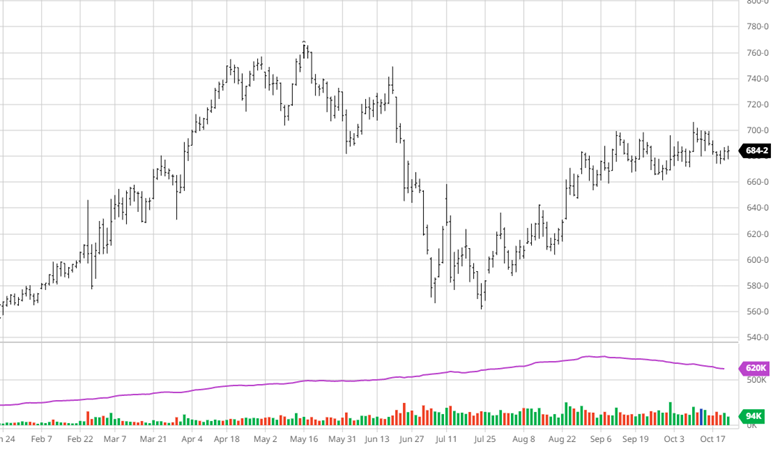

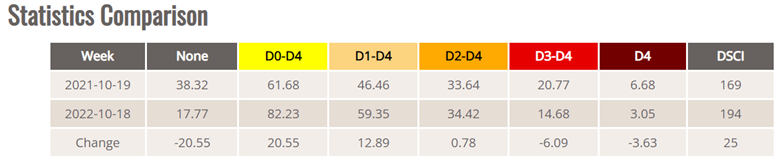

AG MARKET UPDATE: OCTOBER 14 – 21

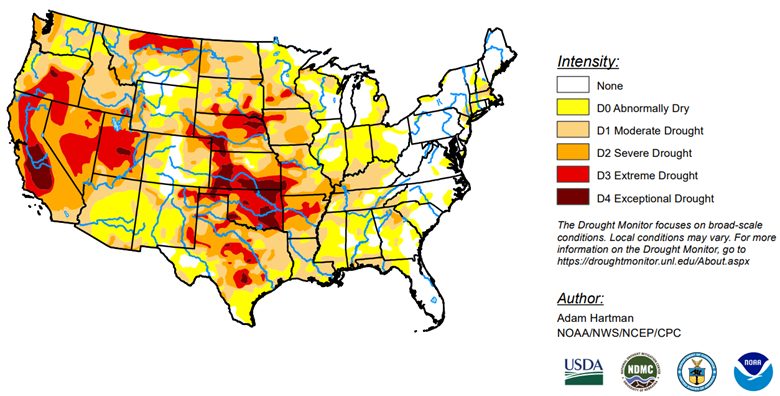

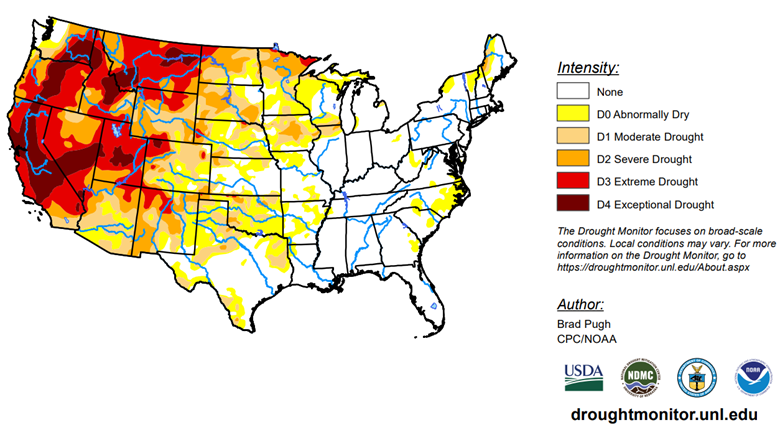

Corn had small losses on the week as harvest continues to roll on. The major ongoing story is the low river levels impacting barge travel along the Mississippi and other major water ways. This is having an impact on basis levels along with exports. Exports for the week were within estimates and ethanol output got back above 1 million barrels for the first time since early August. The exports will be the main factor to keep an eye on in the short term with no immediate relief expected for the Mississippi River with barges backed up and delays on both sides of the supply chain. The drought conditions compared to this time last year can be seen at the bottom, showing how much moisture is needed over the winter.

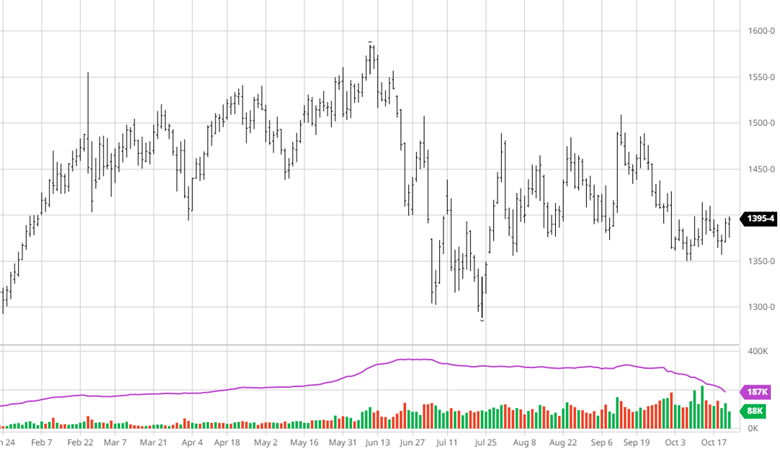

Beans made gains this week with China showing back up as buyers but still has a bearish outlook with South America expecting neutral weather. Harvest continues to roll on with 63% done and nothing slowing it down. As always, the US needs to sell their beans before Brazil gets closer to harvest, with a potentially record crop coming from Brazil this year. If China continues to buy and Brazil begins to have weather issues, we could see a rally, but the Mississippi river issues and other bearish problems may have the upper hand currently.

Beans made gains this week with China showing back up as buyers but still has a bearish outlook with South America expecting neutral weather. Harvest continues to roll on with 63% done and nothing slowing it down. As always, the US needs to sell their beans before Brazil gets closer to harvest, with a potentially record crop coming from Brazil this year. If China continues to buy and Brazil begins to have weather issues, we could see a rally, but the Mississippi river issues and other bearish problems may have the upper hand currently.

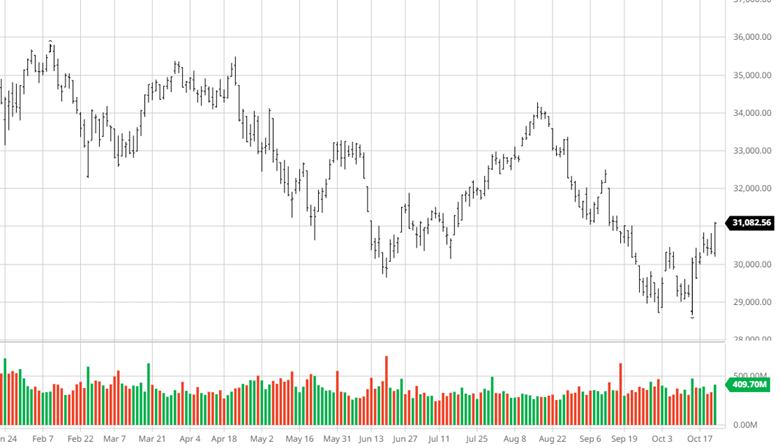

Equity Markets

The equity markets were positive again this week with mixed earnings and option expiration pushing markets higher. Next week’s earnings will be the most important and set the tone for the rest of the year with Apple, Microsoft, Google, Amazon, Exxon, Visa, Facebook, and many more. The guidance these company’s give will show where the largest companies in the world see the economy in the next 3-12 months. While this month’s trade has been encouraging, many investors think is just a pause before we move lower again, next week may give us a better idea. Mortgage rates topped 7% again this week as the housing market continues to face the fallout.

Drought Monitor

The drought monitor below shows where we stand compared to this time last year.

October 18, 2022 Valid 8 a.m. EDT (Released Thursday, Oct. 20, 2022)

October 19, 2021 Valid 8 a.m. EDT (Released Thursday, Oct. 21, 2021)

Podcast

Are the Fed’s hikes starting to dampen inflation? Oil, grains, and metals have all fallen from their highs. But the rarely spoken of Cotton market was one of the first to crack…falling from 1.58/lb to 0.95/lb in just a few short days. We’re digging into this sharp drop and just why and how Cotton is involved in seemingly everything with RCM’s very own cotton king, LOGIC advisors Ron Lawson.

In this episode, Ron is giving us the low down on how and why he believes it’s not Dr. Copper which acts as the global economic barometer, but how Cotton is the real Canary and leading indicator on global demand. In between those talks, we’re covering all things Cotton including crop insurance, irrigated vs dry land, the scam that was Pima and Egyptian Cotton, the process of cotton – which countries have it, which want it, ginning it, spinning it, dyeing it, global commodity merchant co’s pushing it around, and even micro-plastics, climate change, and how Cotton always flows to the cheapest labor source. Finally, we’re walking in some high Cotton putting Ron in the hot seat. Will we ever get the growth back? Tune in to get these critical hot takes — SEND IT!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].