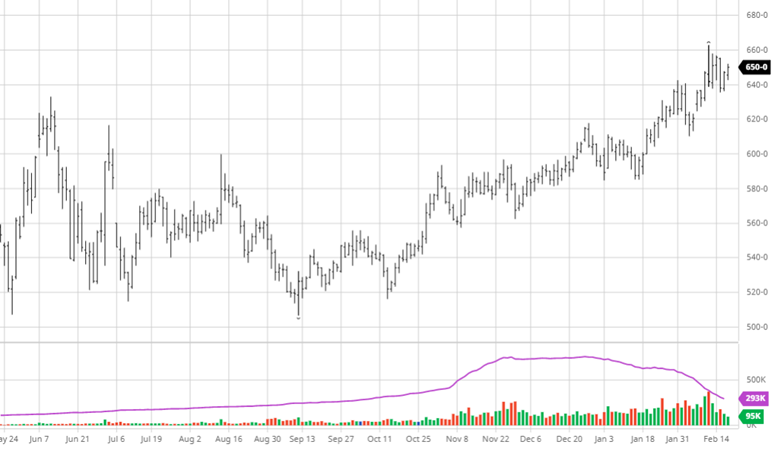

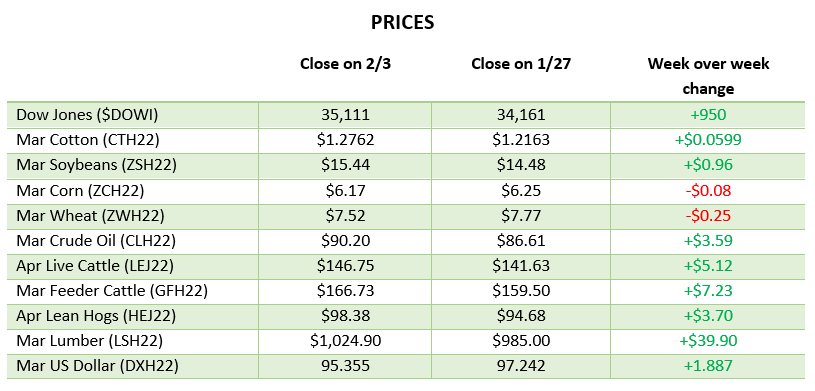

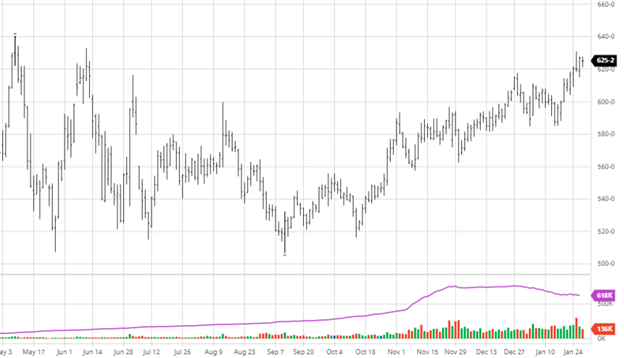

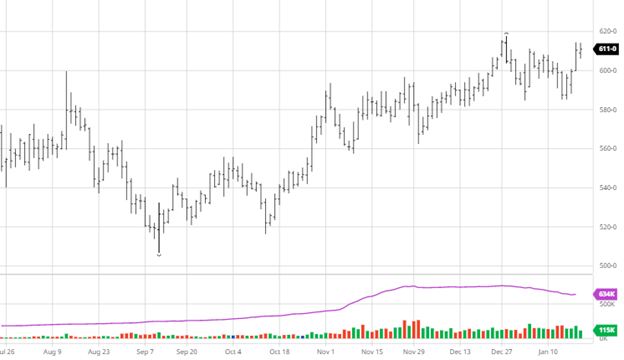

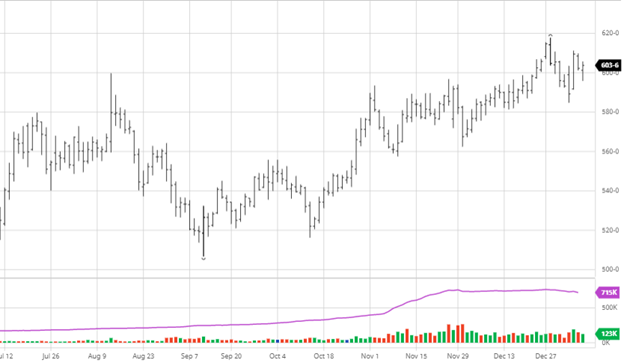

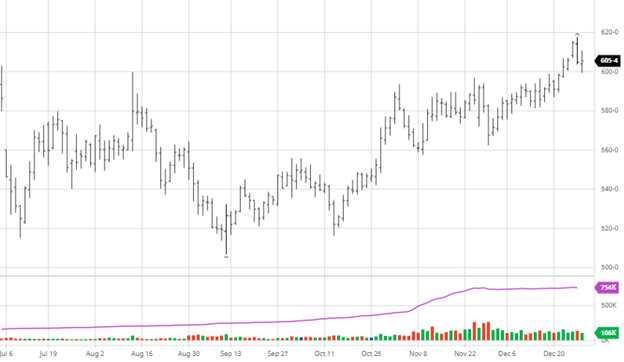

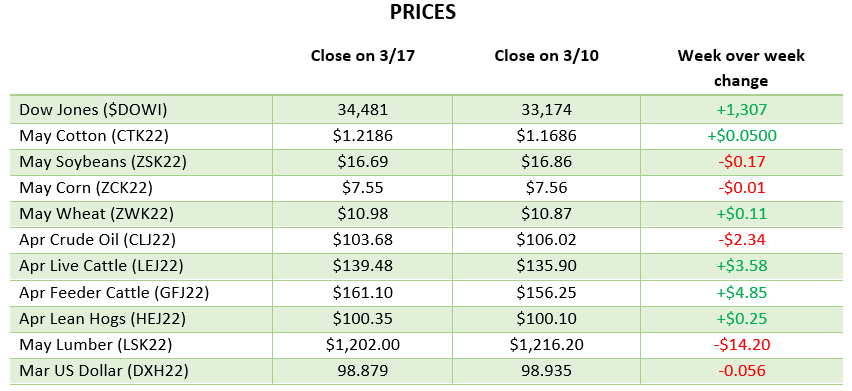

Corn was pretty flat on the week, but it did not lack volatility. The war in Ukraine and the constant news make for wild swings on unconfirmed reports such as peace talks and Russian demands. The volatility has caused many headaches, but the volume has decreased, showing that many traders are watching from the sideline and not trading volatile rumors that may or may not be true. The next month of weather will be important as some areas of the US are very dry and will need moisture heading into the spring. Corn export sales were above expectations this week, helping the bounce back Thursday.

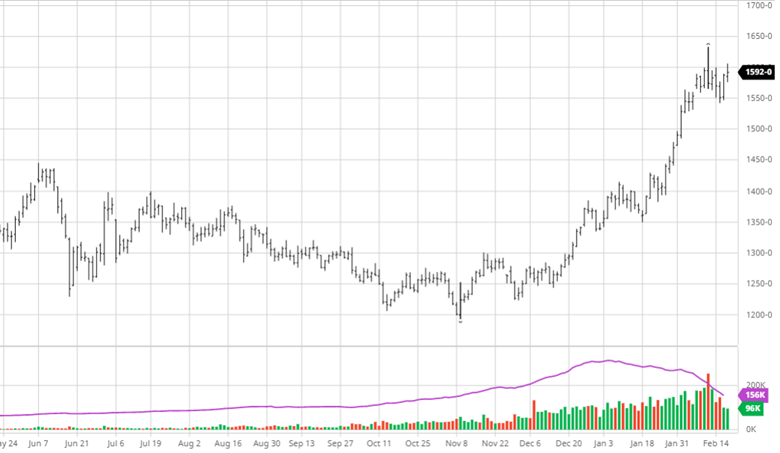

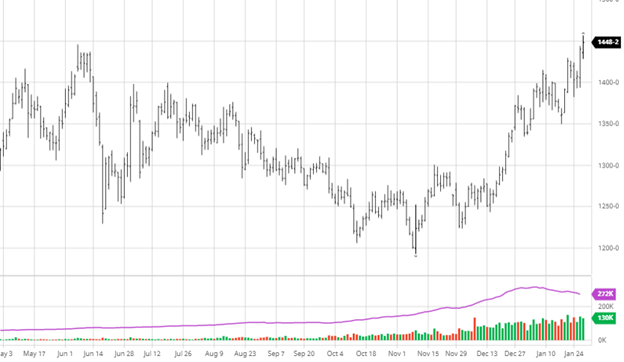

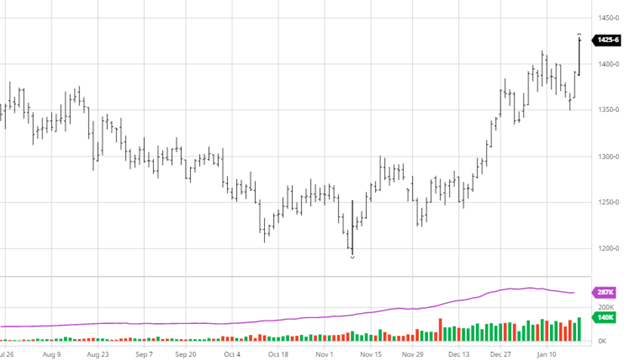

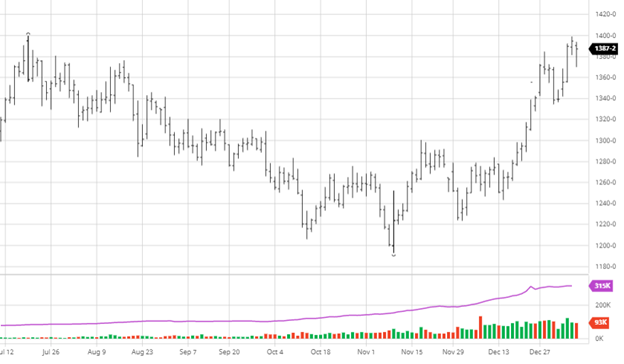

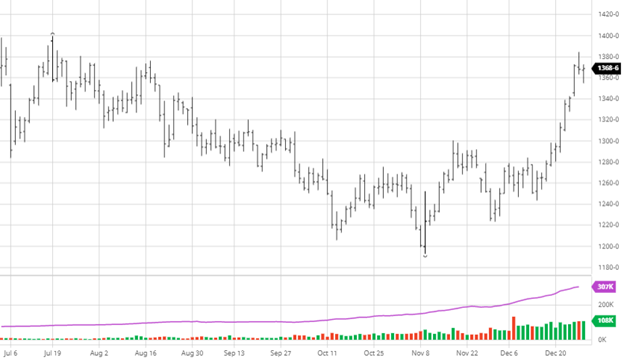

Soybeans fell on the week as the news affecting beans is not solely out of Ukraine. South America has had better weather conditions the last couple weeks and forecasted ahead. While the drought conditions did plenty of damage to the crop early on, the improved conditions are good but not great to help out. Bean exports were within expectations this week as beans have traded relatively flat the last couple of weeks.

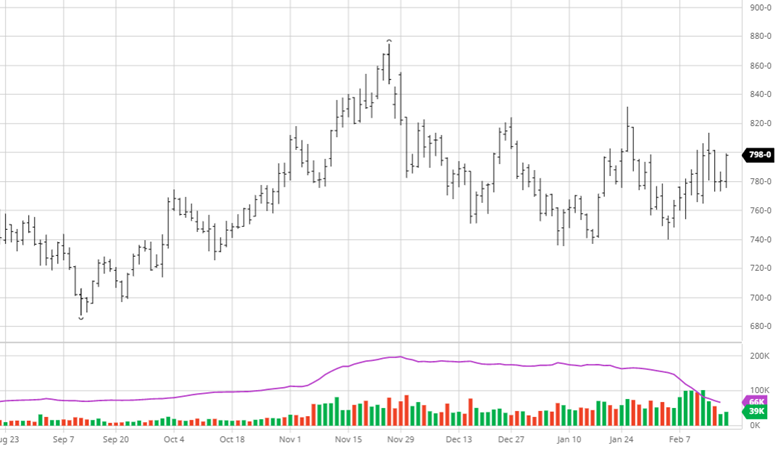

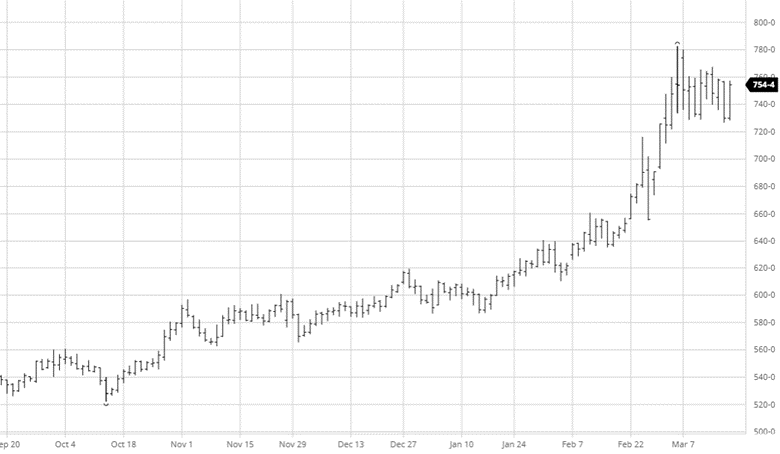

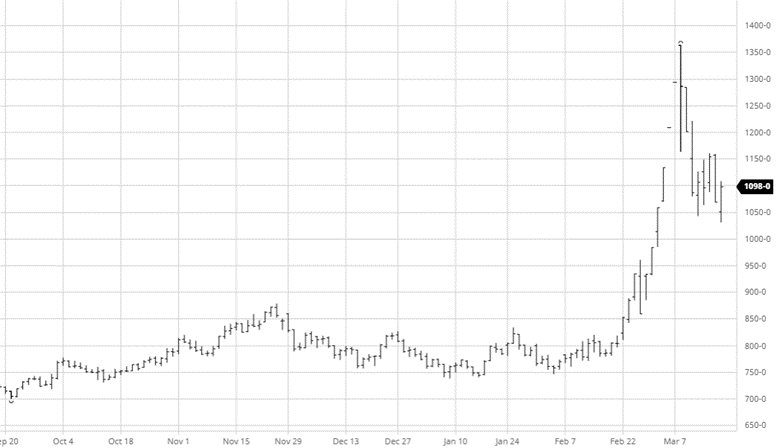

Wheat’s volatility continued this week as the war in Ukraine continued. Reports of peace/ceasefire talks have been in the news that seems to move markets whenever a new one is reported, but the volatility will continue until there is a resolution. There will still be massive fallout from this war as Ukraine’s infrastructure will be devastated, and sanctions on Russia will be large. Ukraine’s crop year drastically change, and it will be hard to get a full read on the damage until much later. Rain fell on some of the drier areas in the US that grow wheat, but the market did not seem to care. For now, the news will continue to be Ukraine and Russia.

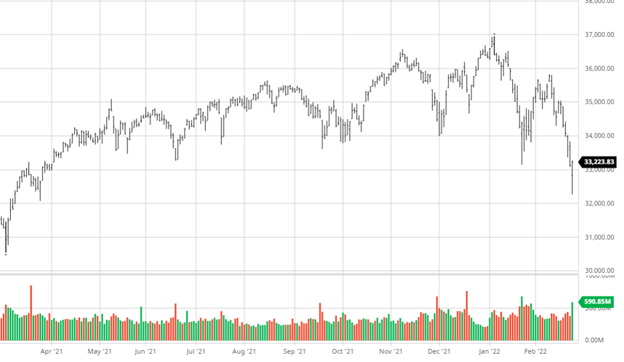

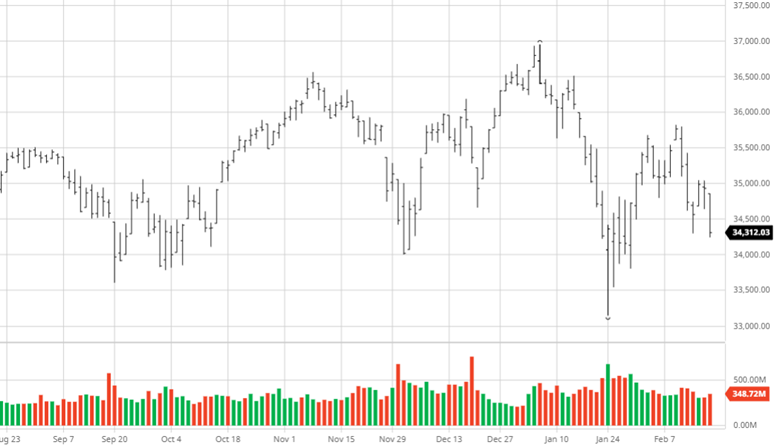

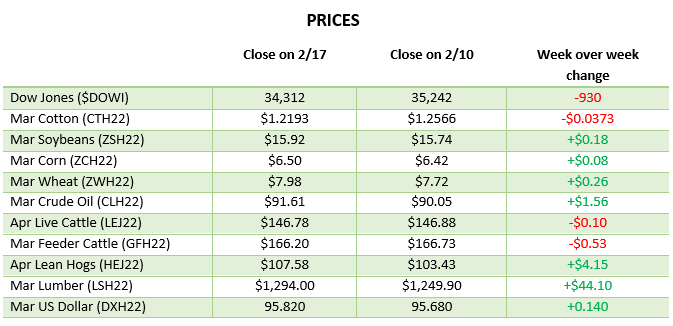

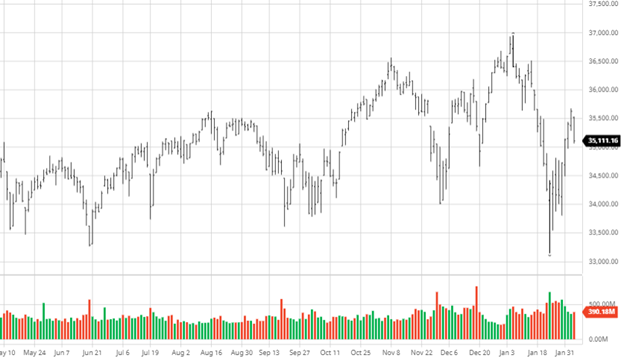

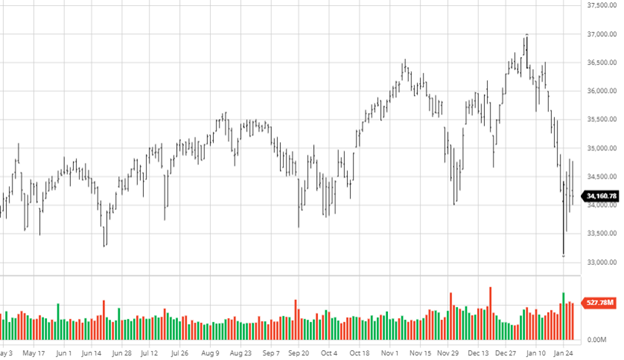

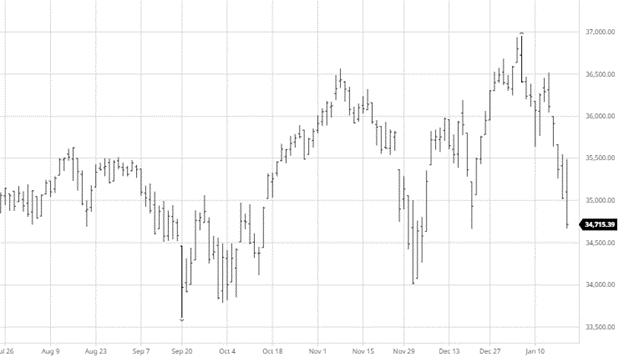

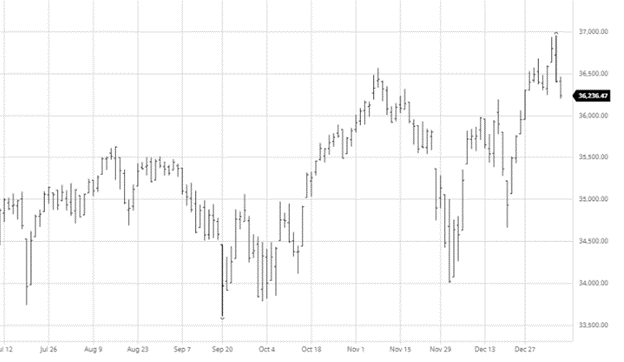

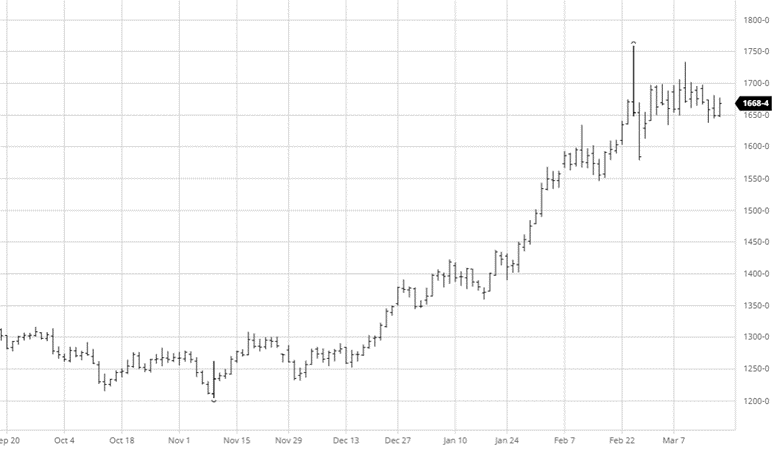

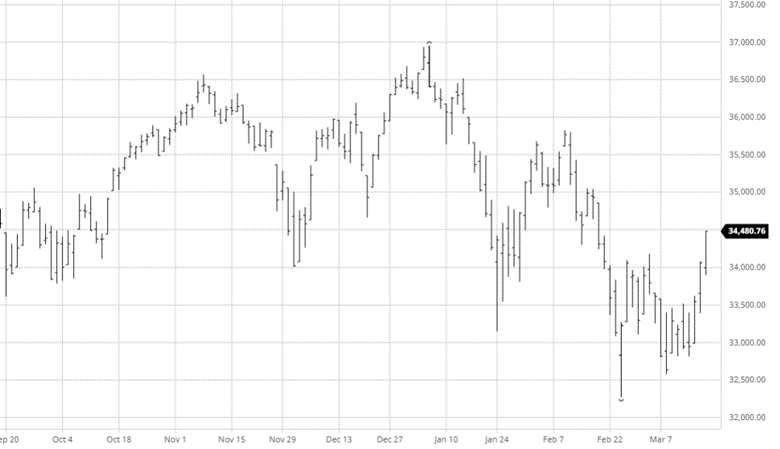

Dow Jones

The equity markets rallied this week as investors aren’t sure if we bottomed but felt the market had fallen enough to be an excellent area to get back in. The fed decided to raise rates for the first time since 2018 raising it a quarter of a point. They also announced to expect six more raises as the year goes on to fight inflation. The market had already priced this news in, and after a short dip down, markets finished the day after the news higher. China has had a new round of Covid lockdowns, which is something to watch.

Podcast

Tune in as biotech guru Dr. Channa S. Prakash discusses everything from Alabama football, genetics as one of the most extensive agricultural advancements, the most significant risk factors to feeding the world over the next 30-50 years, plus everything in between.

Why producing crop plants with a much gentler footprint on the natural resources will help feed the growing population. How 75% of the world’s patents in agriculture gene editing are coming from China. Understanding that trying to impose restrictions on our ability to grow food can be a considerable risk to agriculture. Listen to hear about these topics and more!

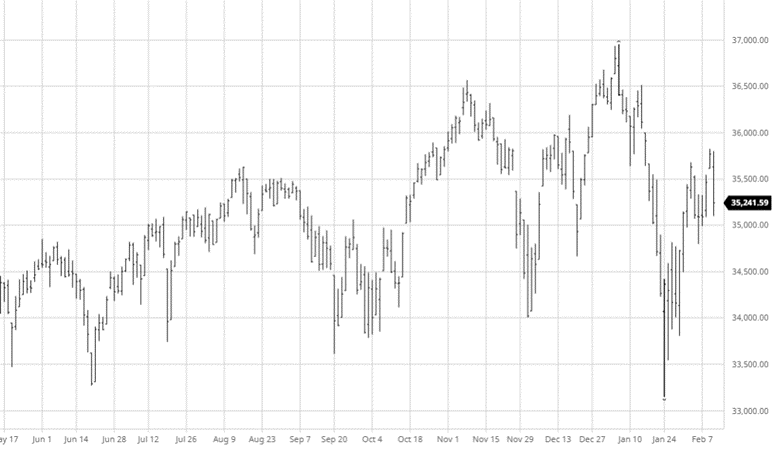

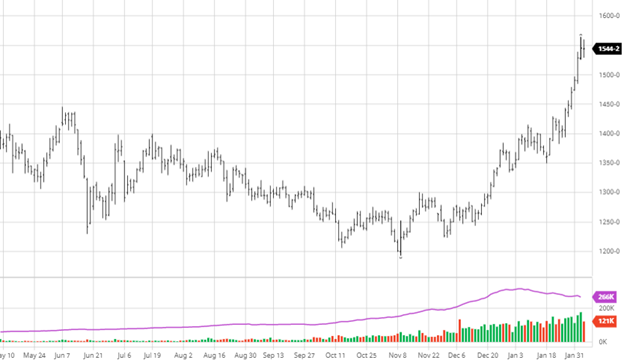

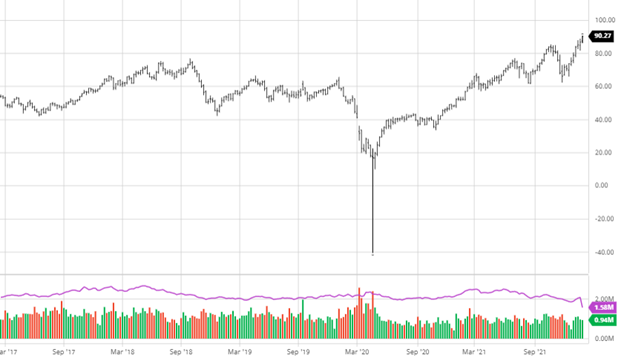

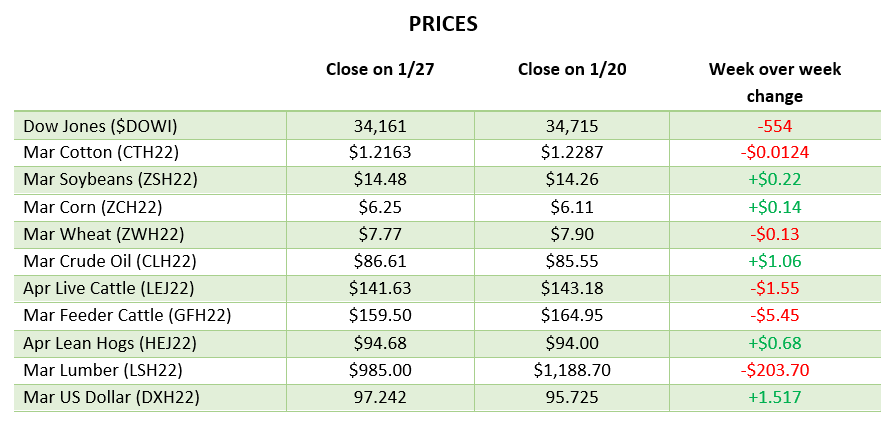

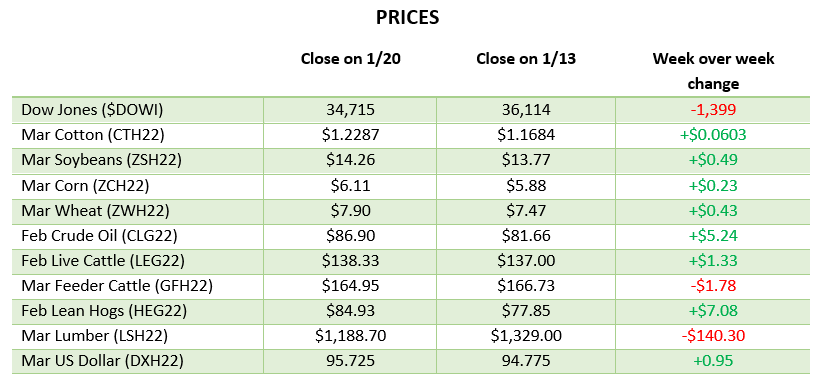

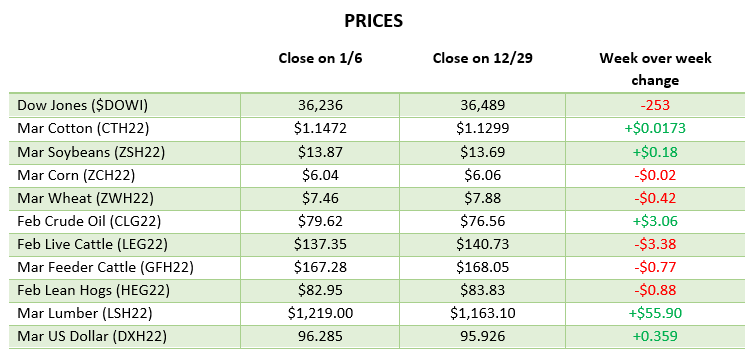

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.