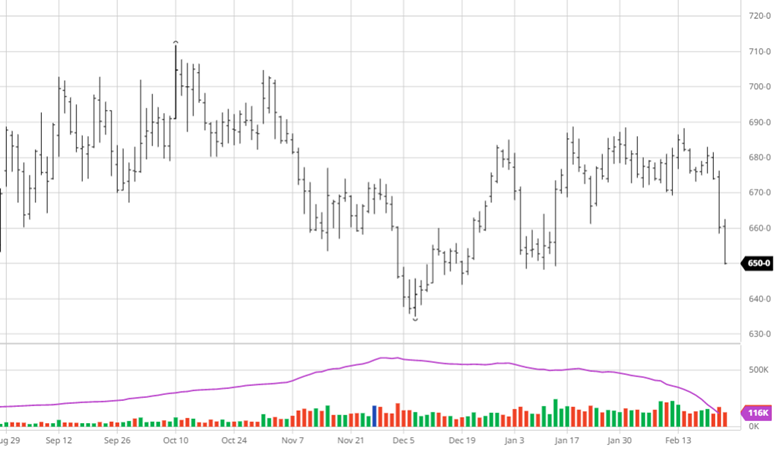

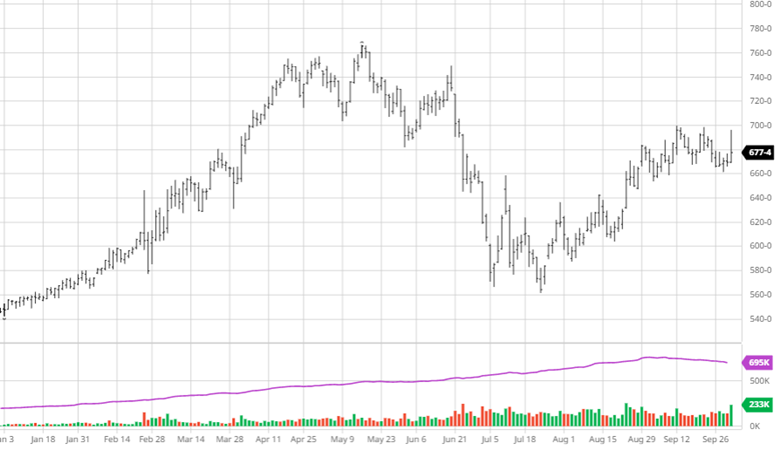

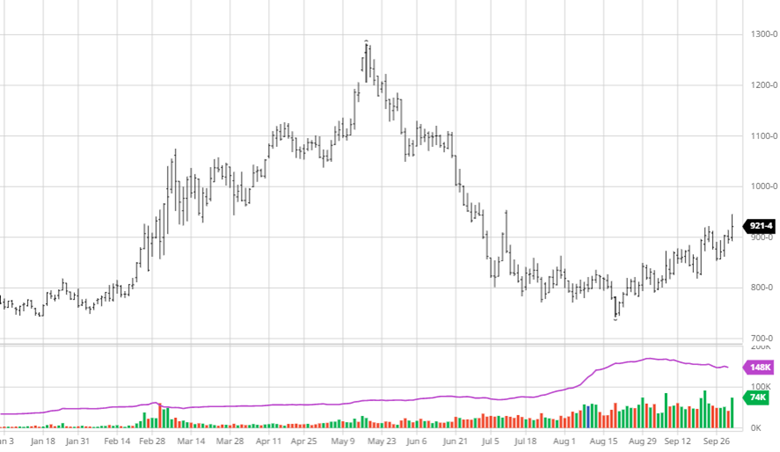

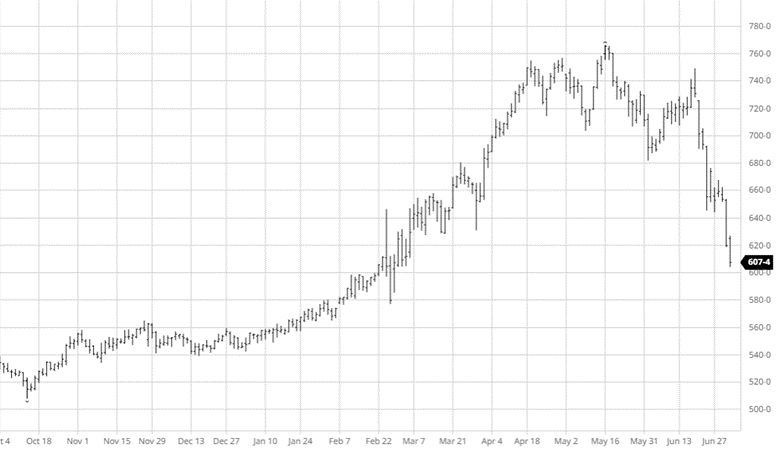

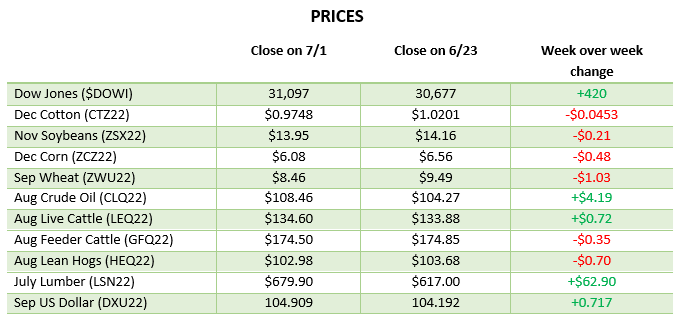

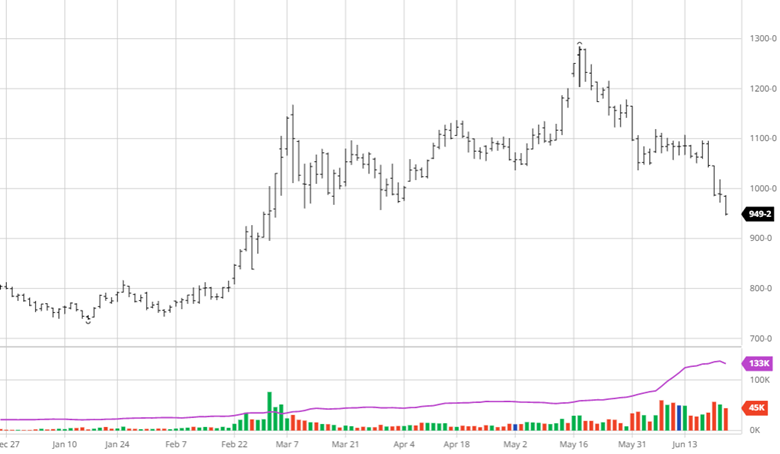

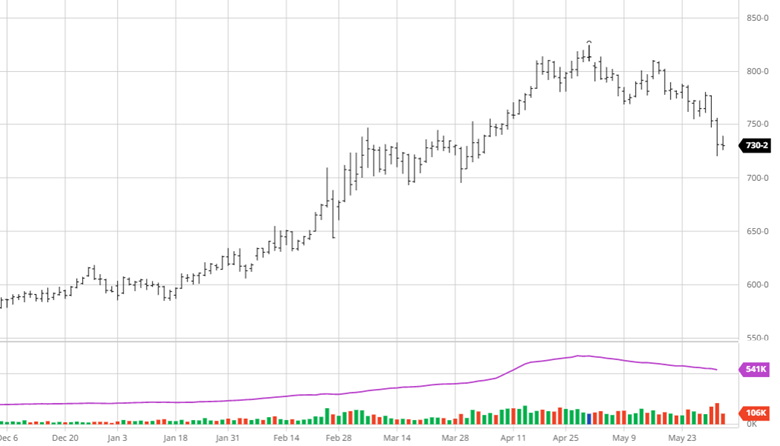

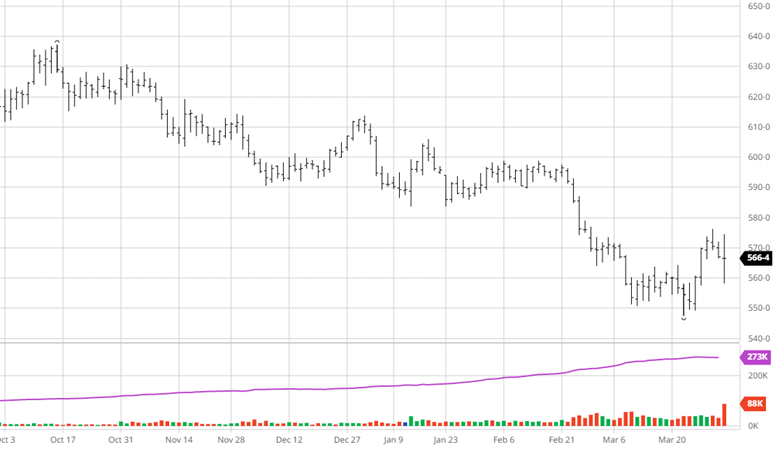

The USDA prospective plantings and quarterly stocks reports were released today, March 31st, with a mix of news. The report pegged this year’s crop at 92 million acres while the trade estimates were about 91 million. This led to a mixed trade as pre-report strength faded with futures ending mixed for the day. Current US weather conditions and the expectation of a slow start to planting could lead to this number falling, it is unlikely we will see a number higher than this the rest of the year, similar to last year. Corn stocks were lower than estimates by 69 million bushels and over 350 million bushels lower than last year.

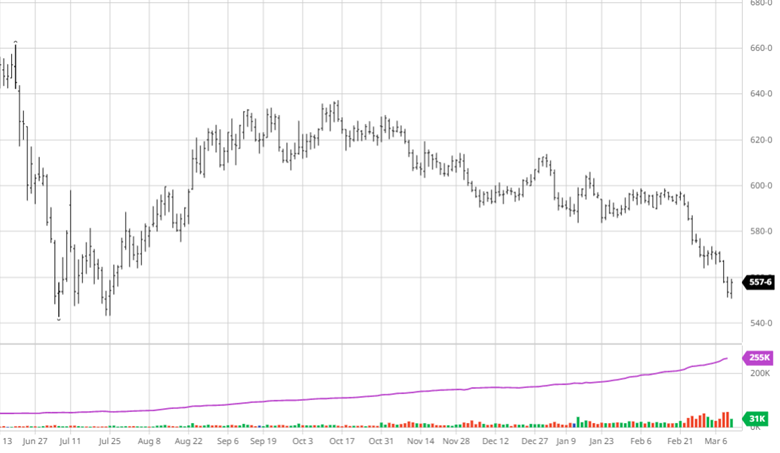

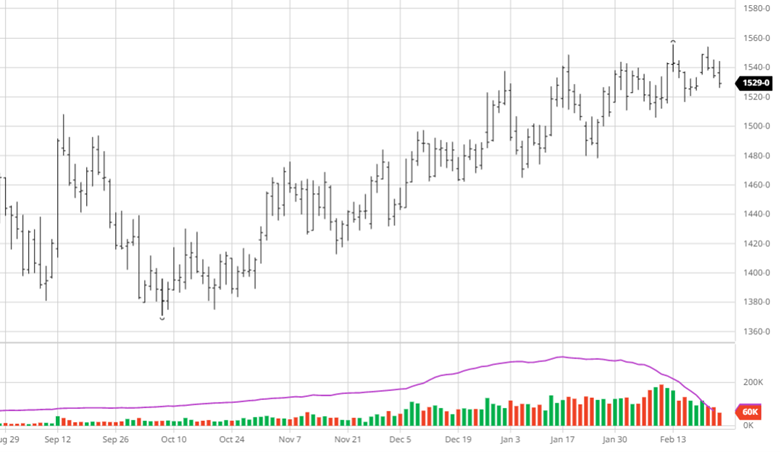

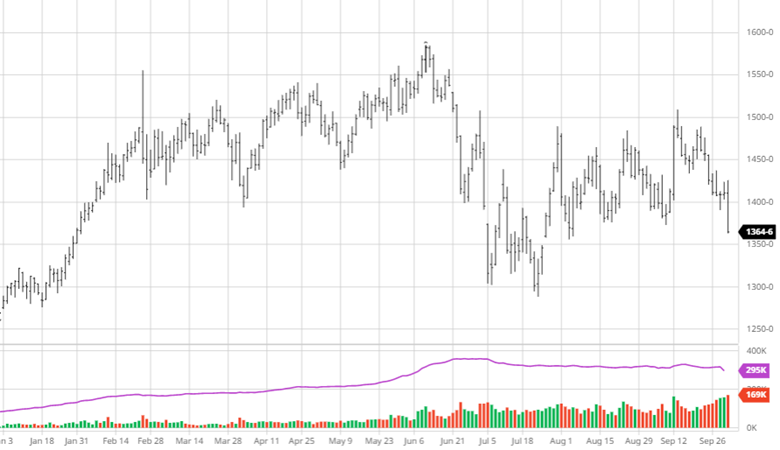

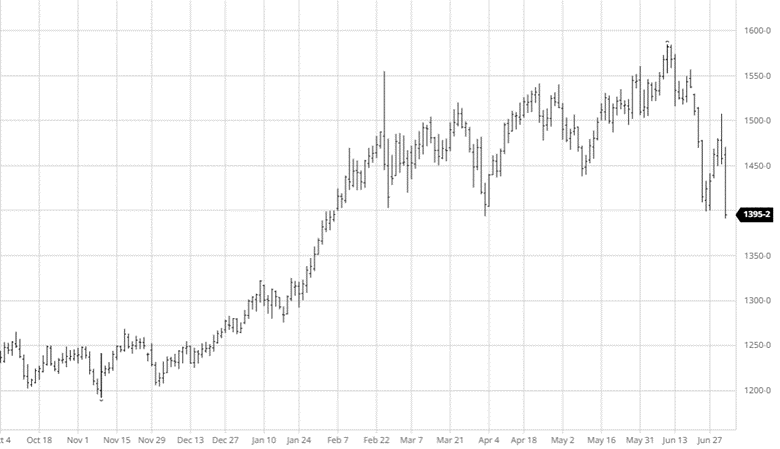

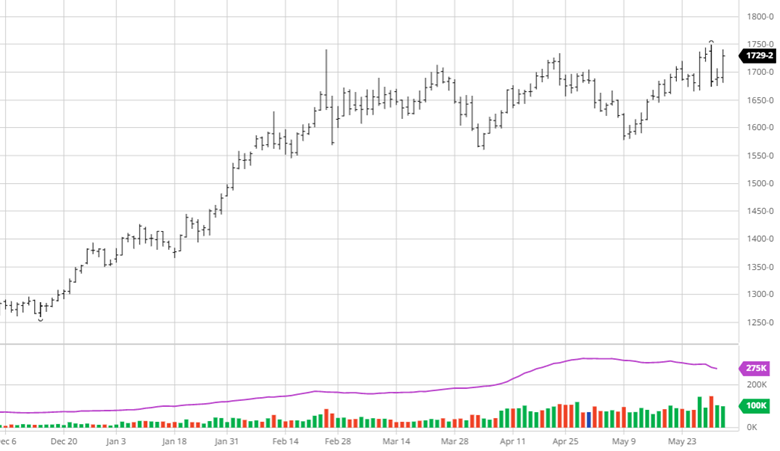

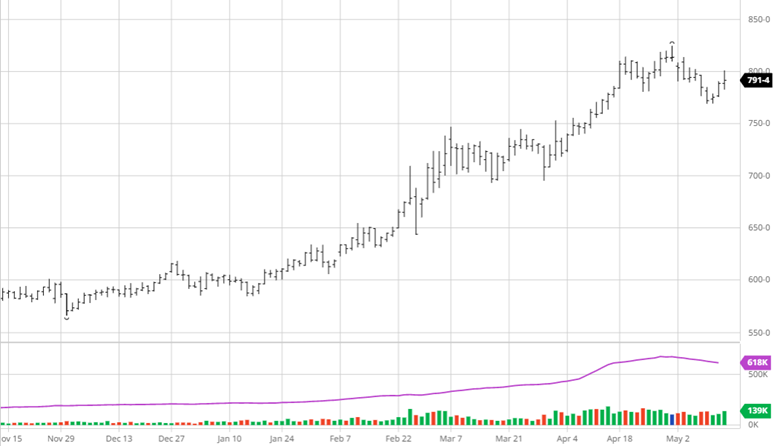

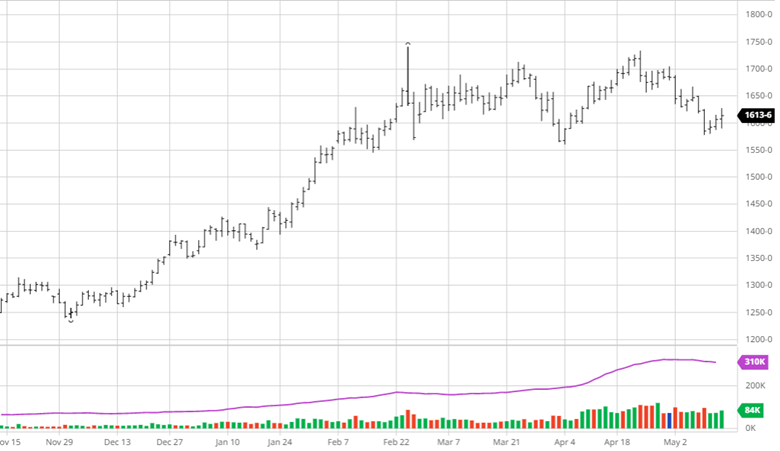

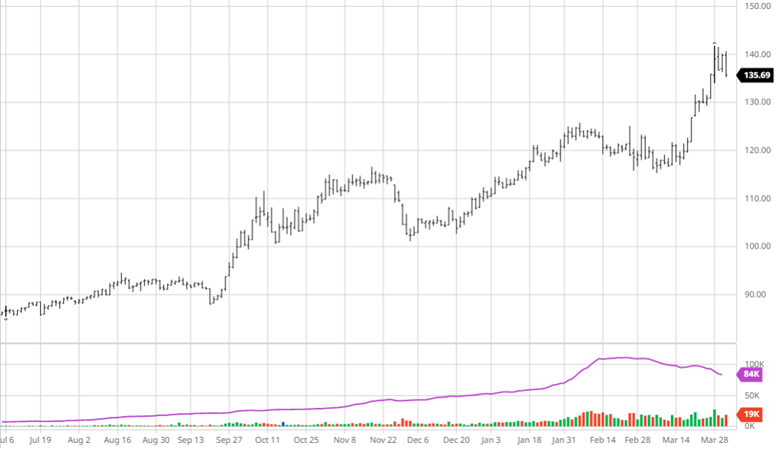

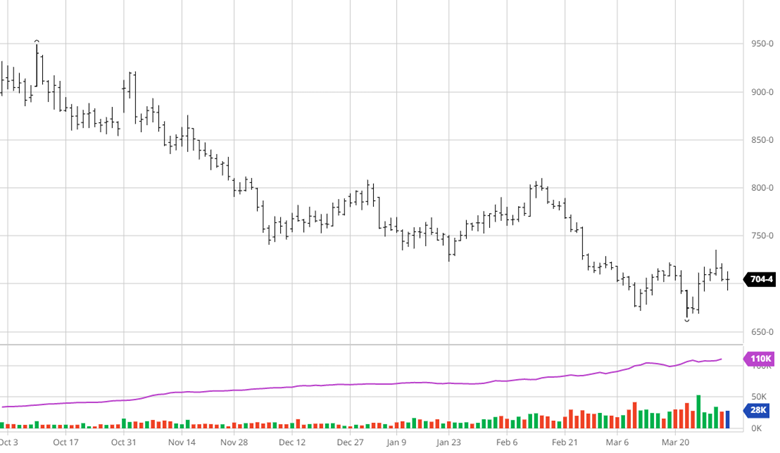

Soybeans received a boost from the report as with lower acreage and stocks than expected. The planted acreage number came in at 87.5 million acres, lower than the 88.24 million trade estimate. The quarterly stocks were 247 million bushels lower than a year ago, continuing to show the tightness on the balance sheet. South America still has some uncertainty around their crop, but we should get a better idea in the coming weeks. Both numbers from today’s report are seen as bullish for the market.

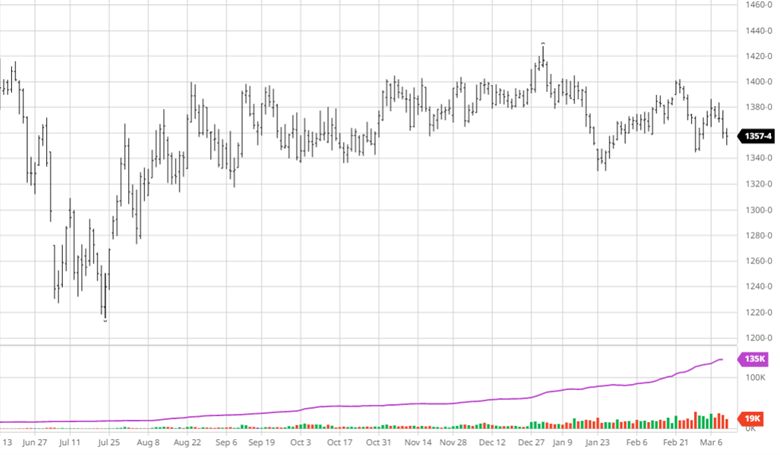

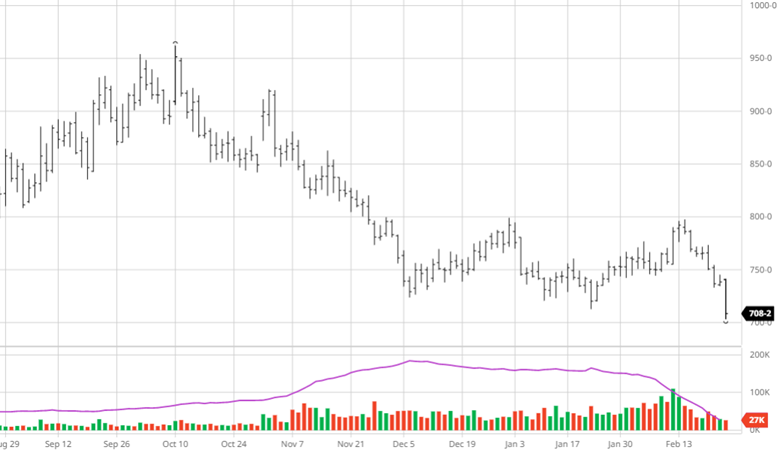

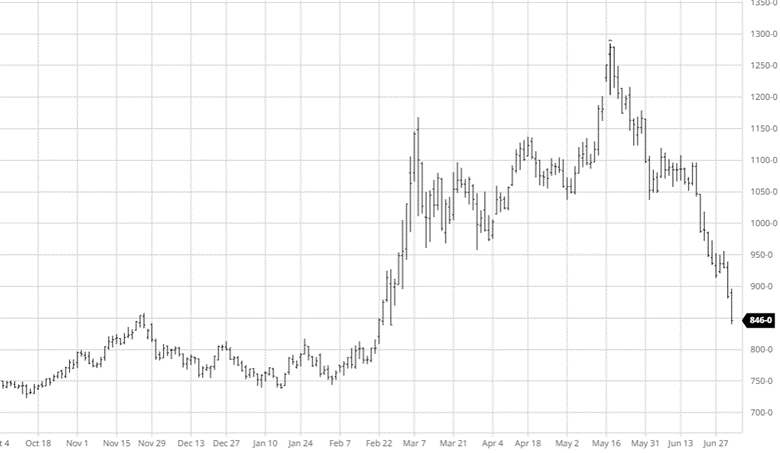

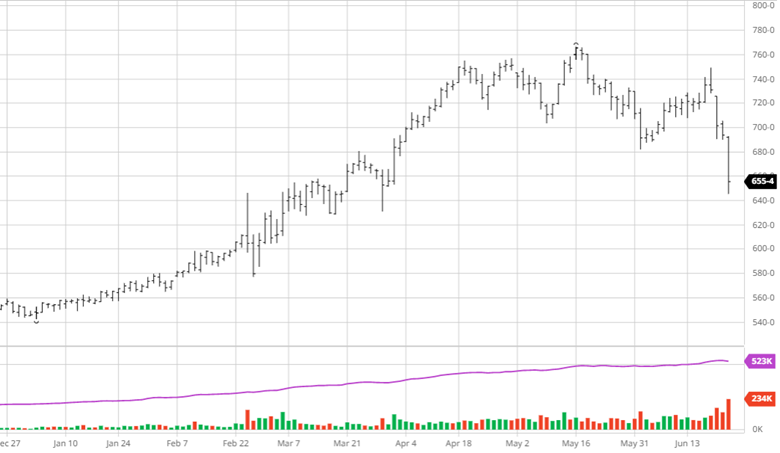

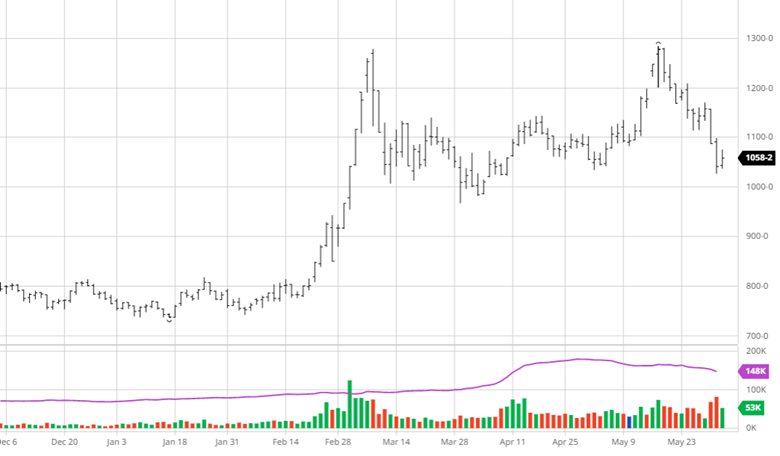

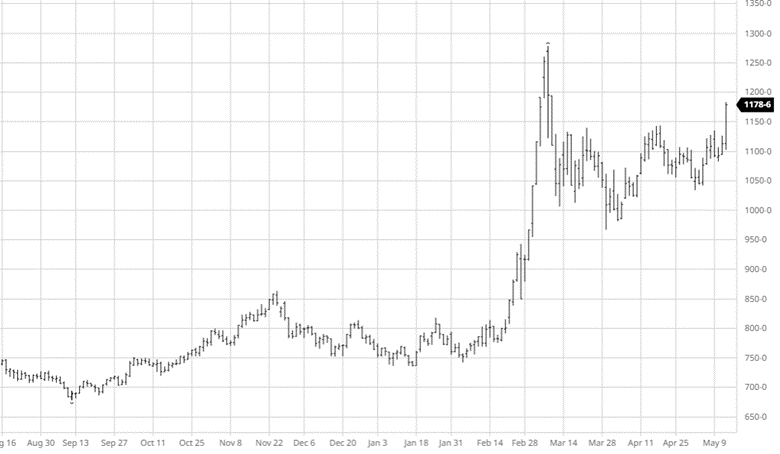

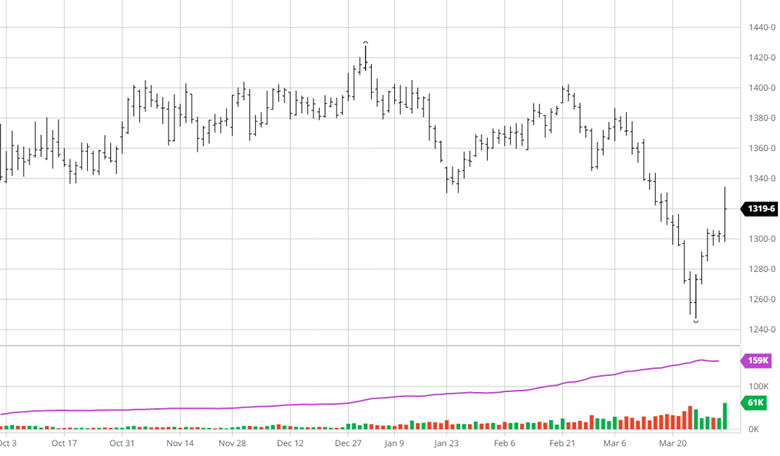

Wheat saw some bearish numbers with higher planted acreage and higher stocks than pre-report estimates. 49.9 million acres, 1 million over estimates, and 946 million bushels in stocks, 934 mbu estimate, were both bearish while the price did not overreact. Wheat will follow corn’s lead for now with many questions still surrounding the conditions in the southern plains and the Black Sea.

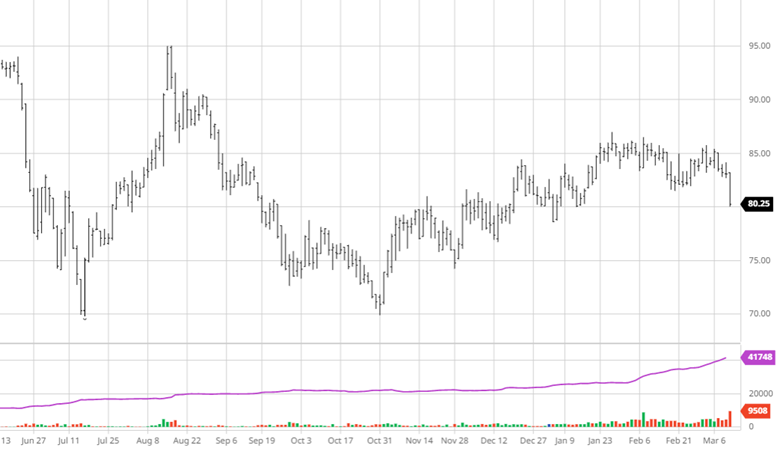

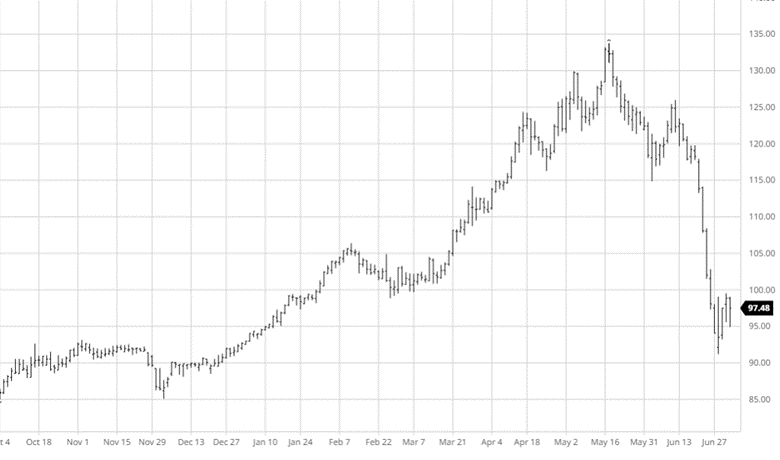

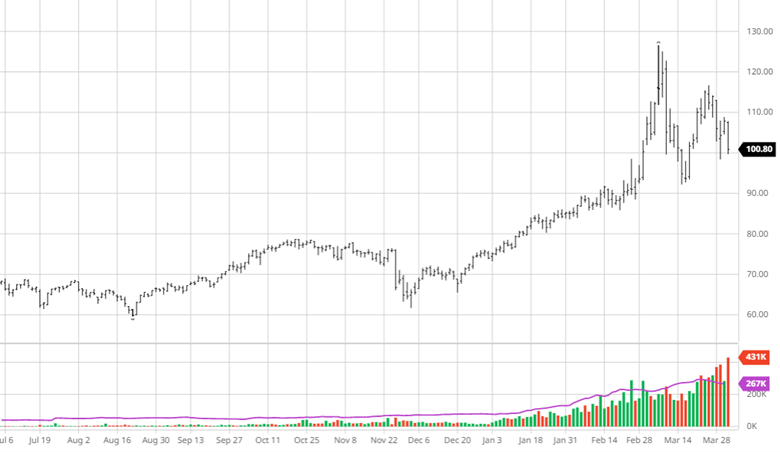

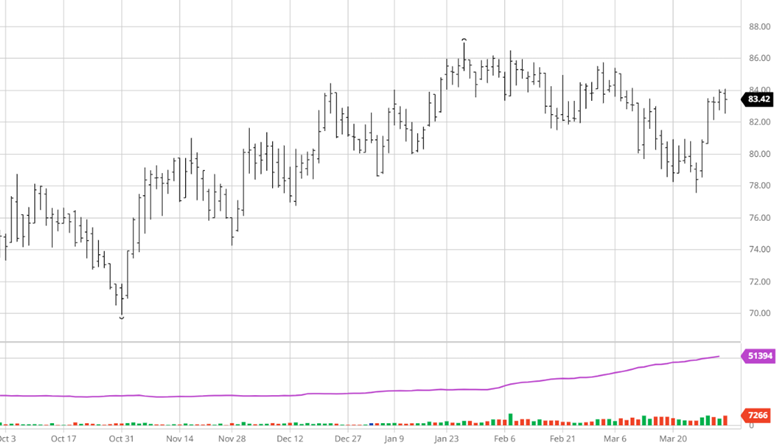

Cotton’s bounce this week back to over 83 cents was very welcome after a couple weeks of lower trade. The market did not have a major reaction to the report with planted acreage estimates coming in at 11.3 million acres vs the 11.2 million trade estimate. Speculative short covering helped cotton rally this week while spreads were also a lower than normal percent of the trade. The problem continues to remain of recession fears and how that affects companies purchases trying to weigh supply and demand.

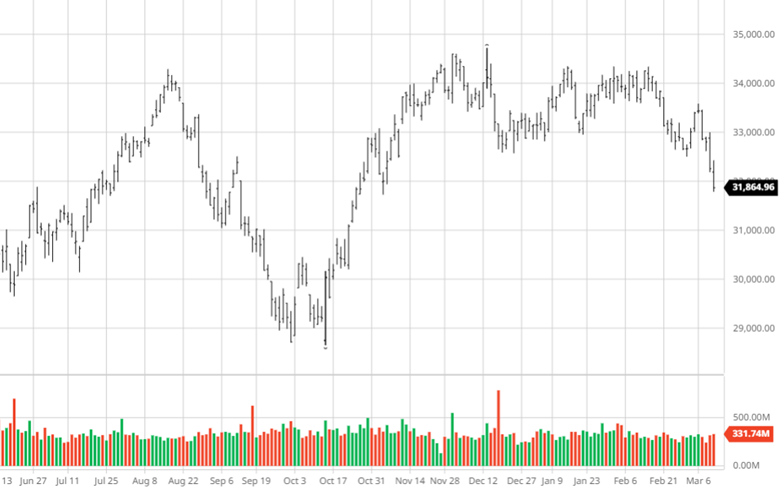

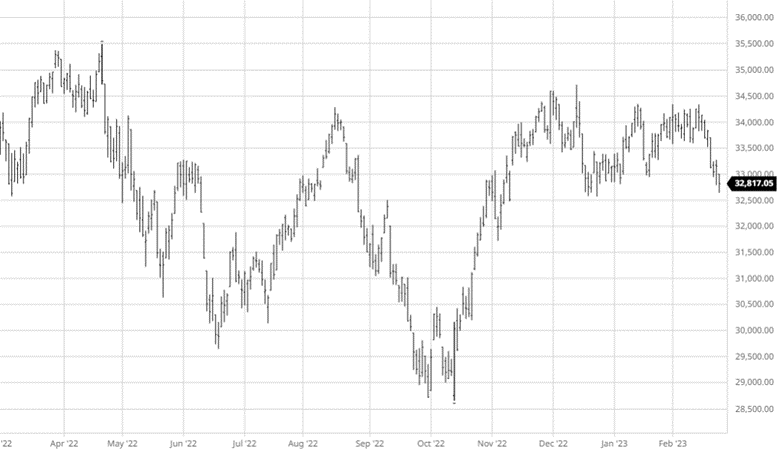

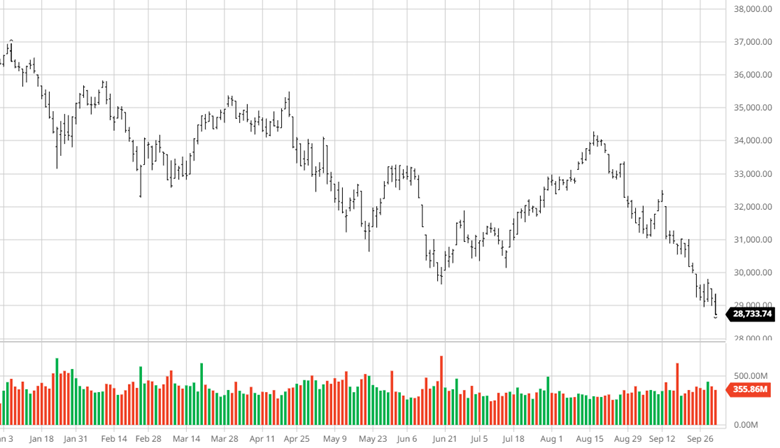

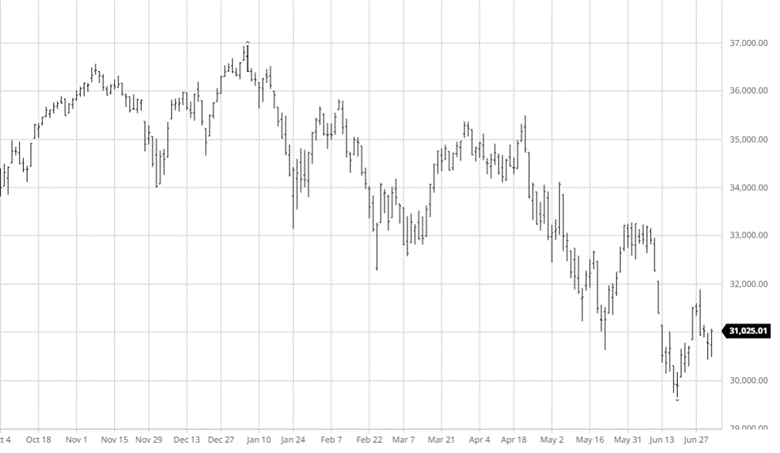

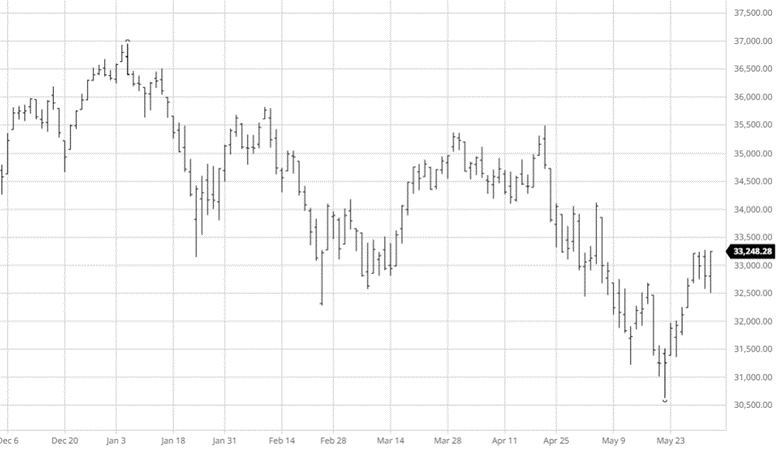

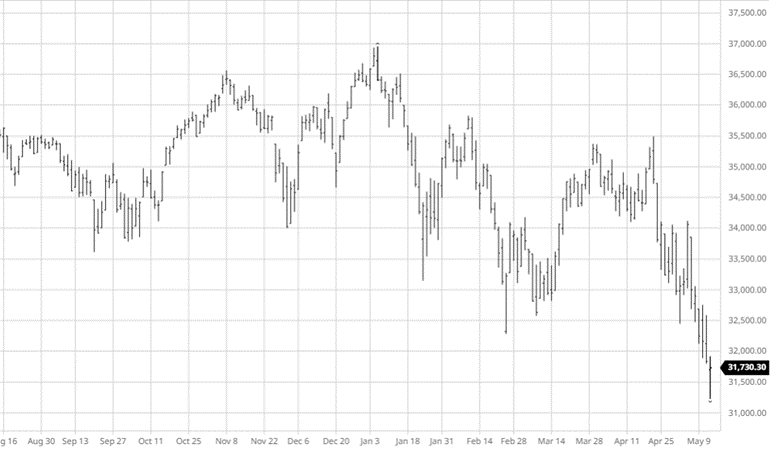

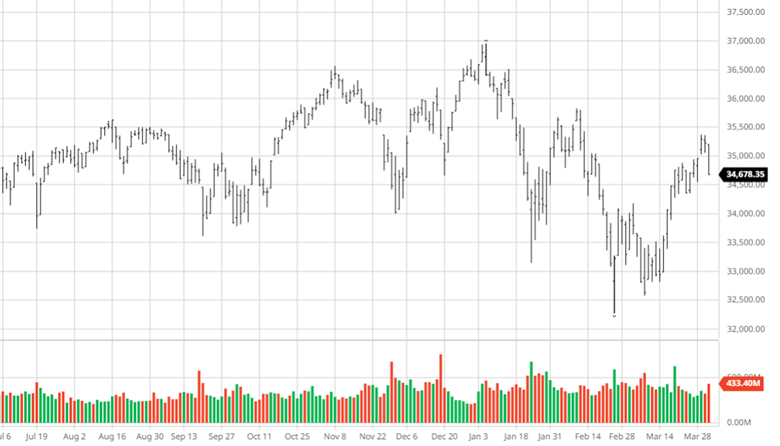

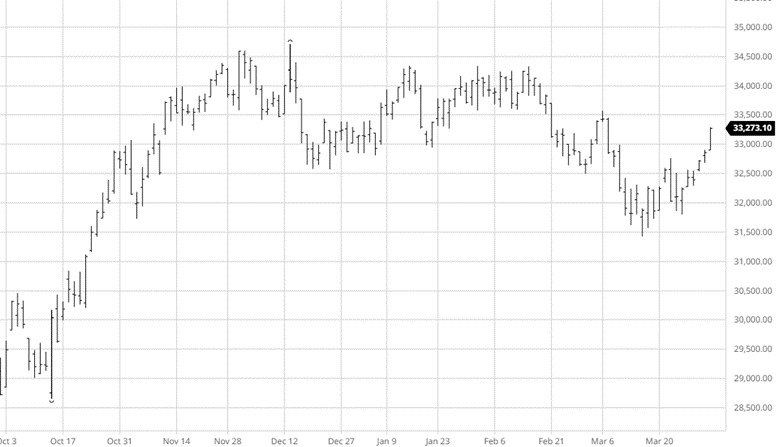

Equity Markets

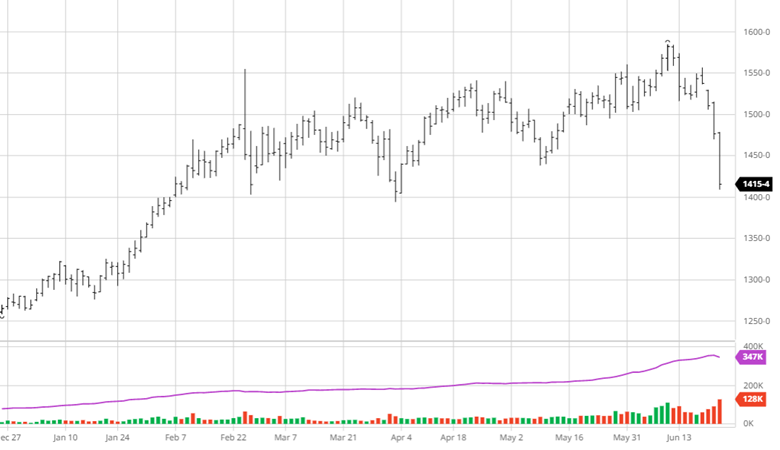

Equities had another good week as investors seem to believe the Fed will relax with rate hikes and the banking fears have calmed down along with an ease in inflation pressure as we slowly move lower. Tech companies would be the beneficiary of lowering rates by the end of the year but the Fed’s recent comments would indicate they have no intention to lower rates before the end of the year. There was strength in most sectors this week.

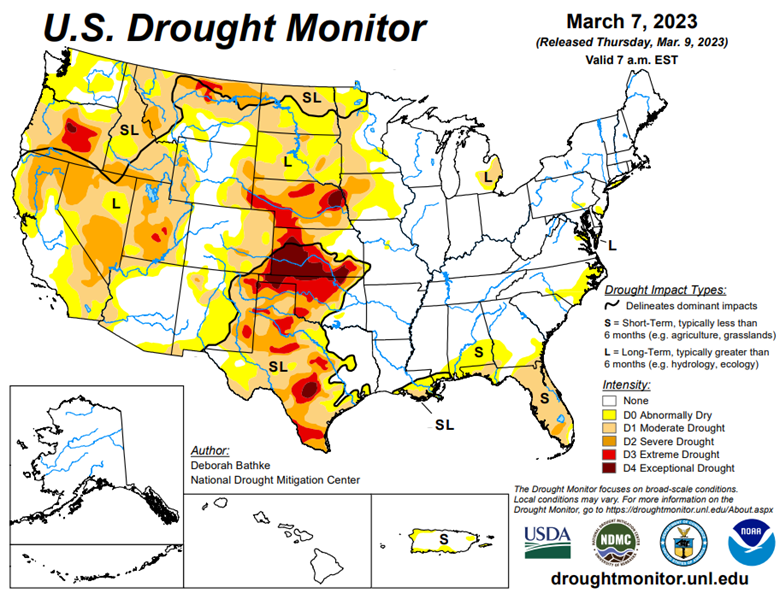

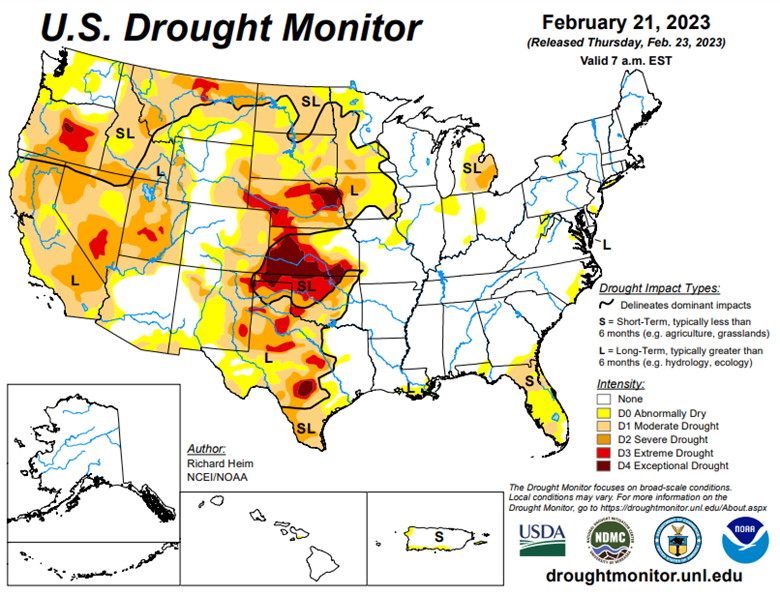

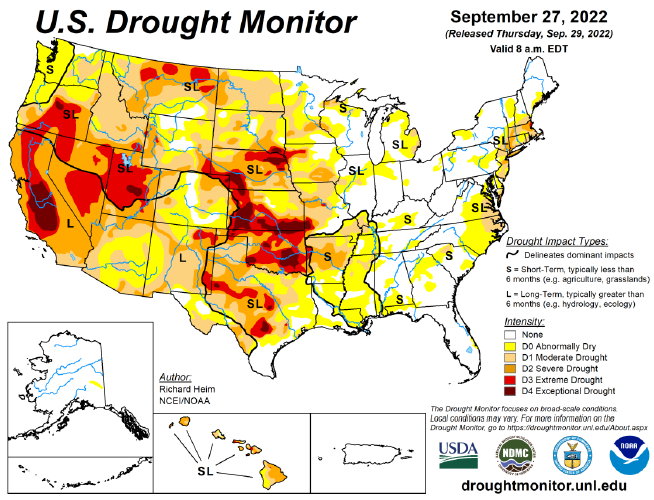

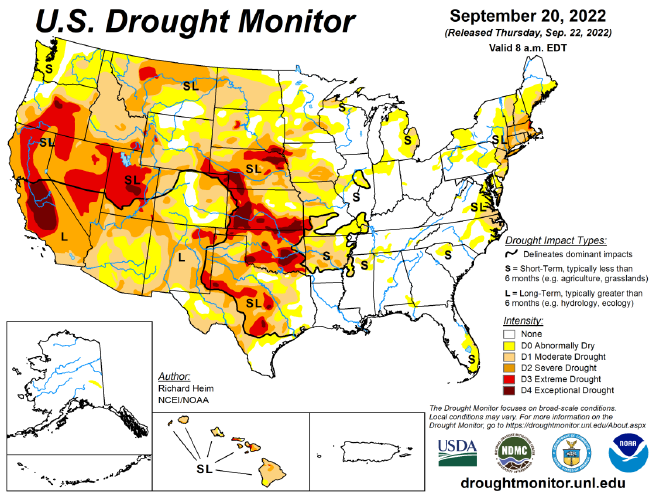

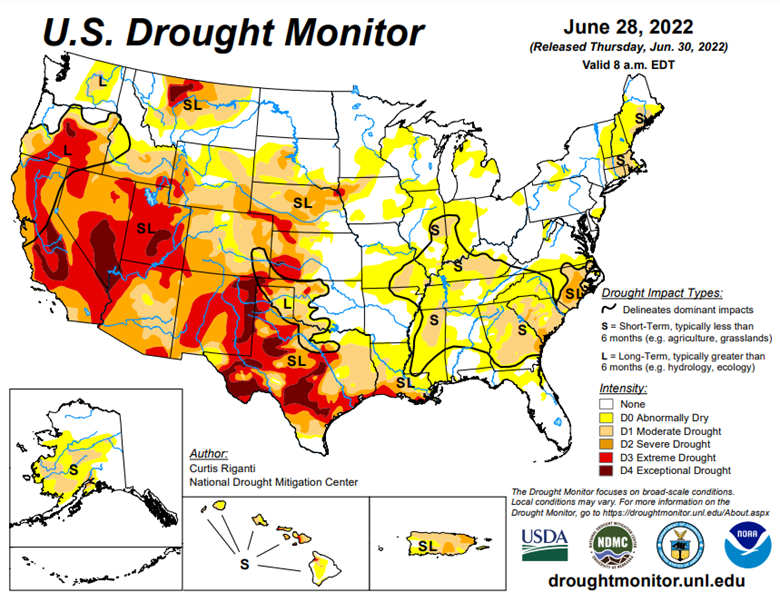

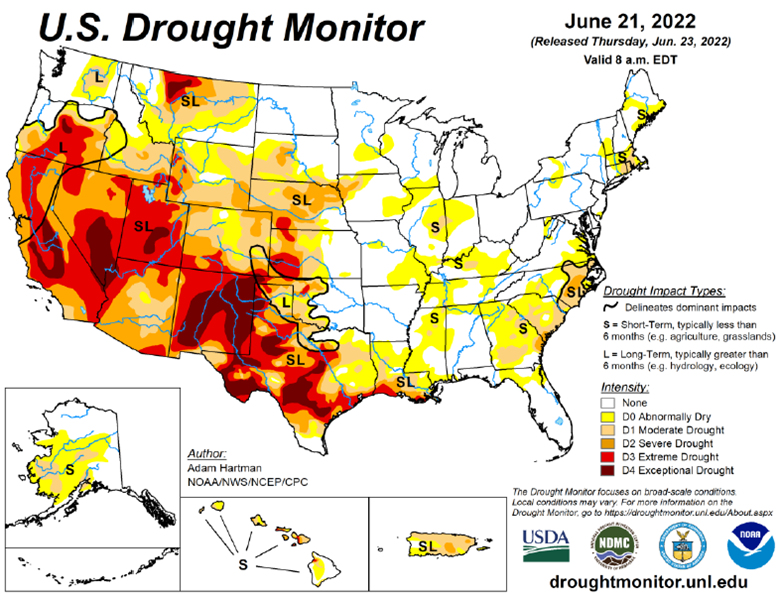

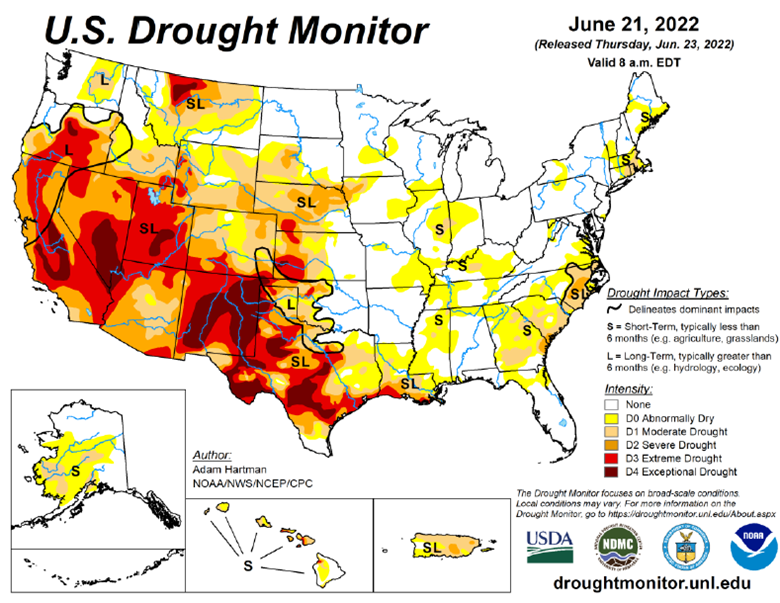

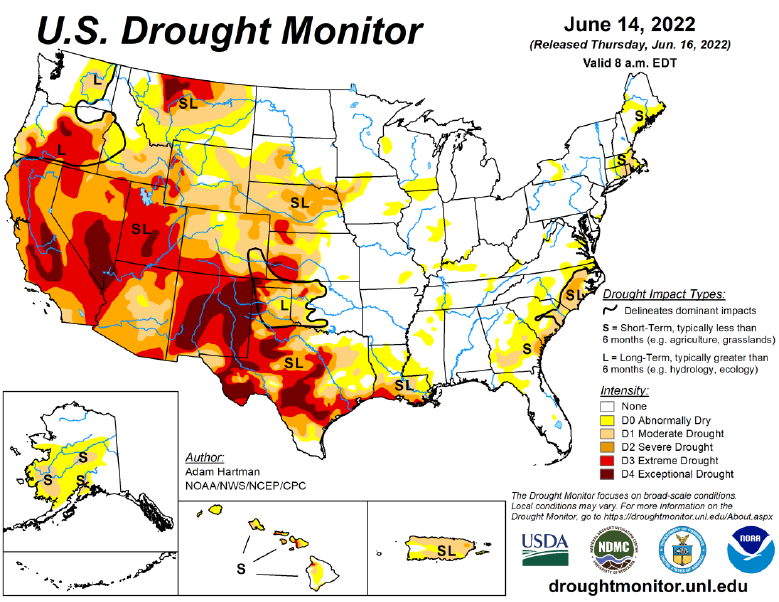

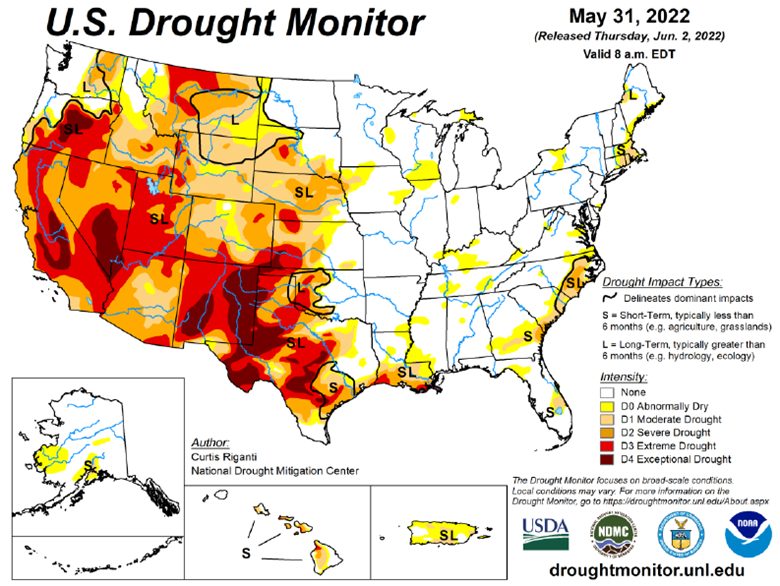

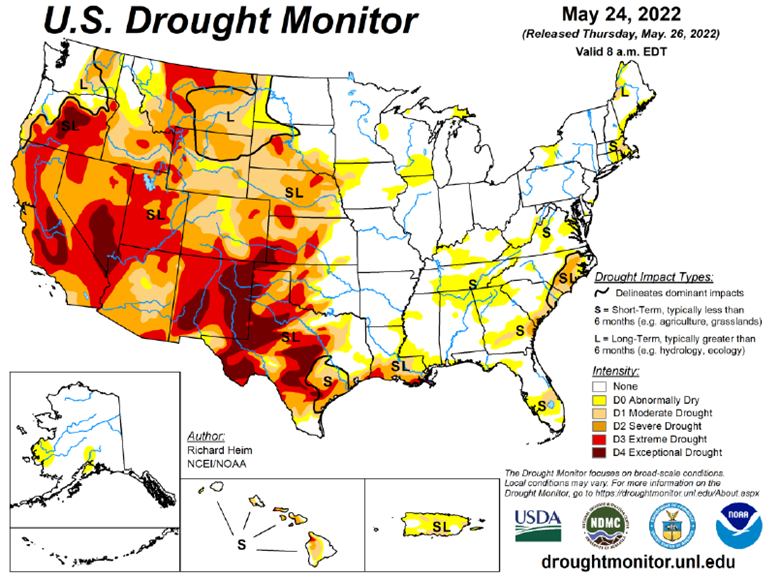

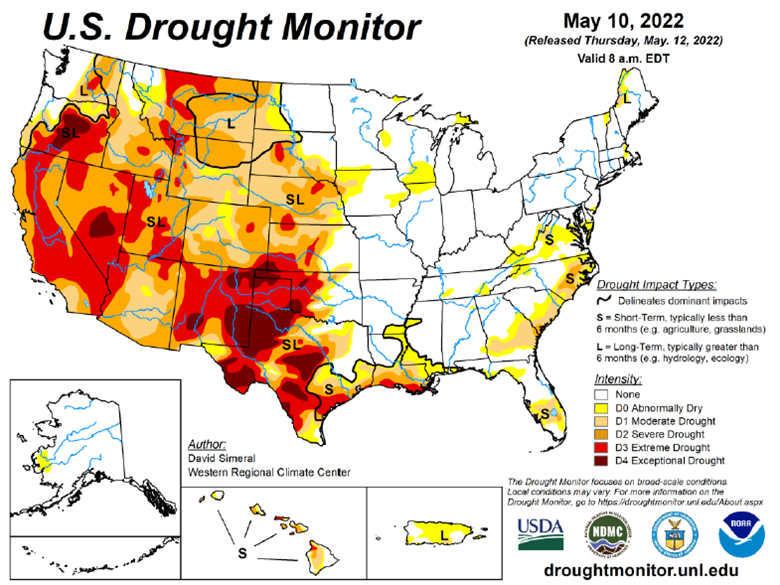

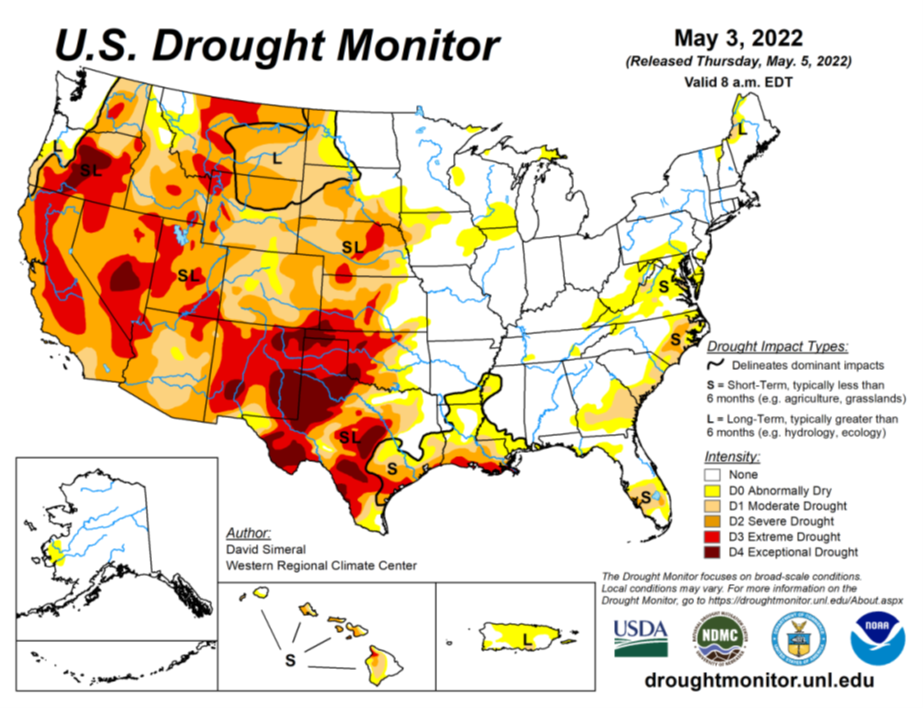

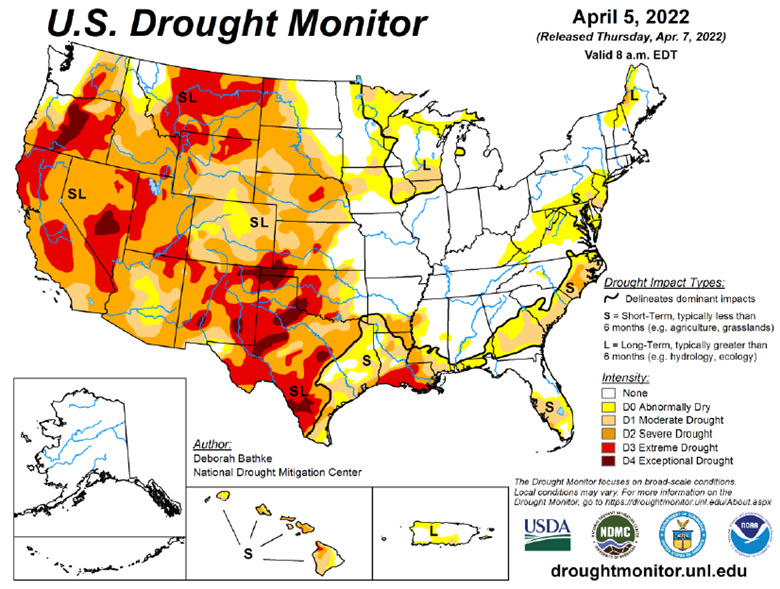

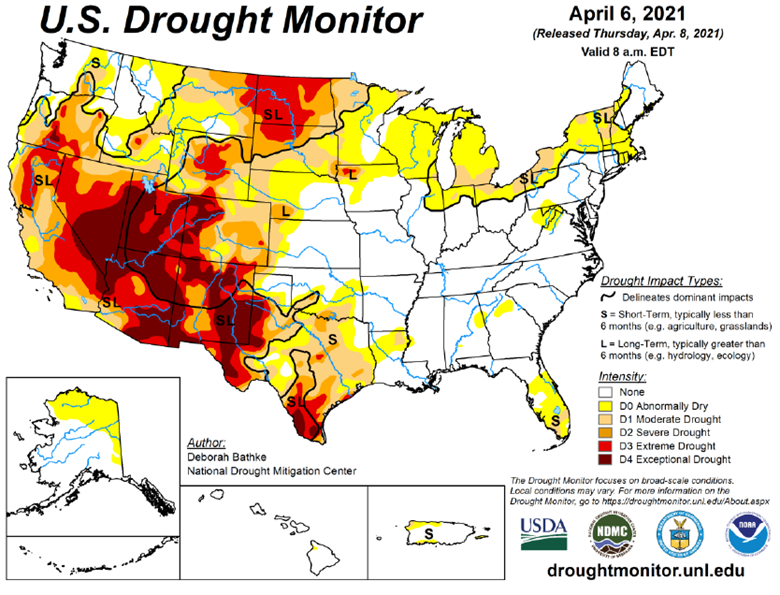

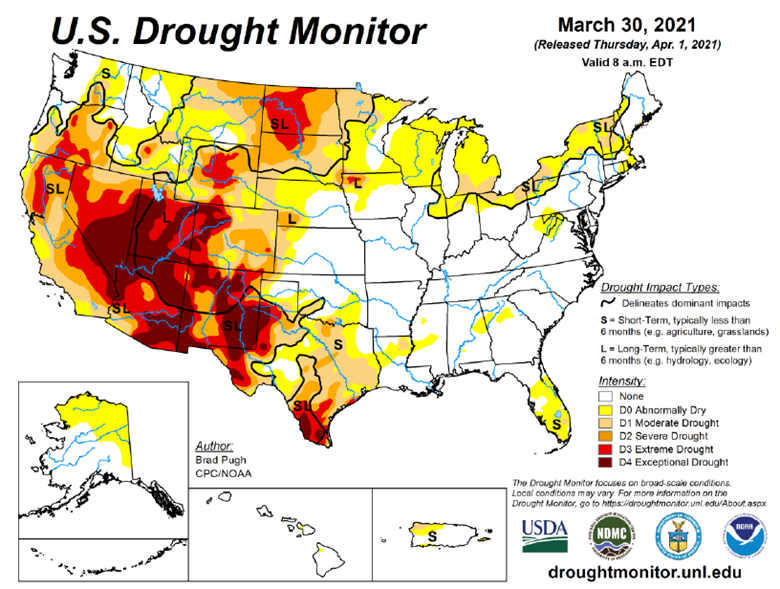

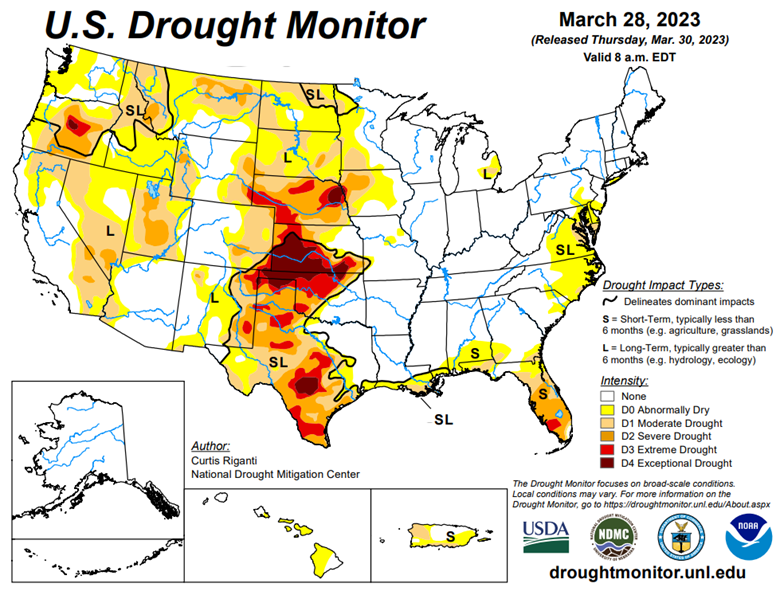

Drought Monitor

The eastern corn belt has gotten plenty of moisture, some too much, so far this winter with the western corn belt needing more heading into the spring.

Podcast

With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

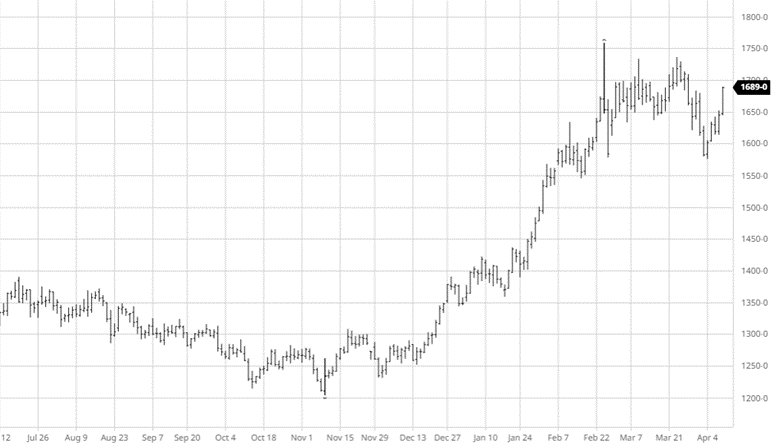

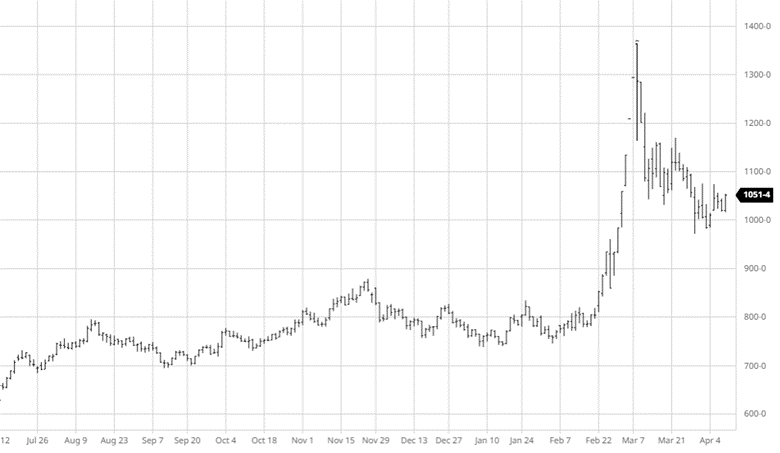

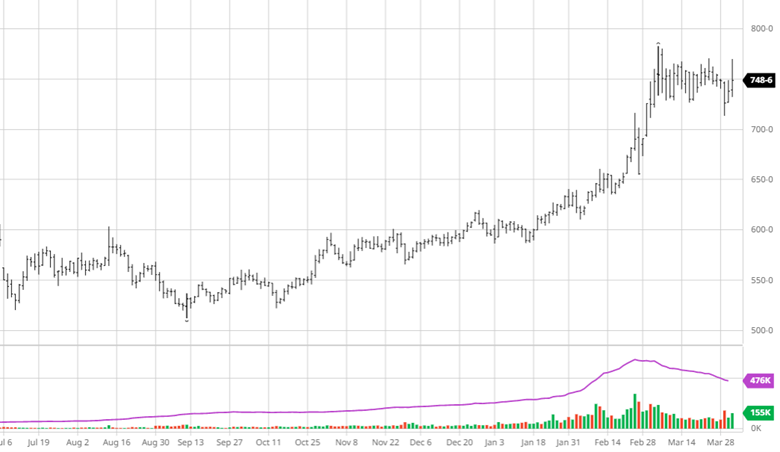

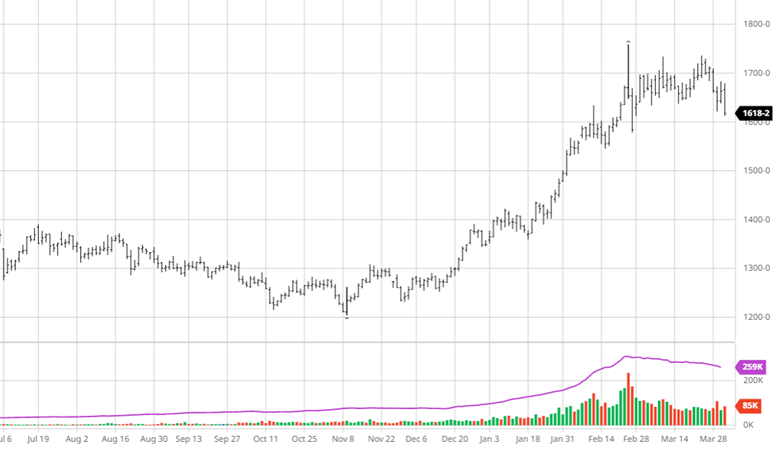

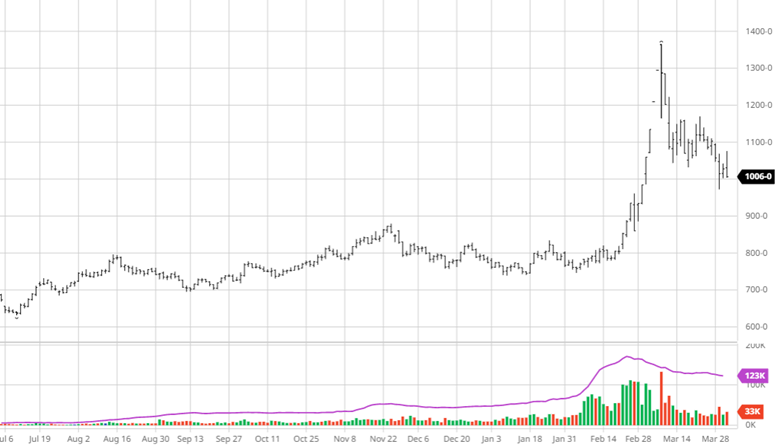

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].