LEONARD LUMBER REPORT: The dynamic of supply and demand guides most commodities markets

The Lumber Market:

The dynamic of supply and demand guides most commodities markets. Admittedly some do have a slight amount of emotion added to the trade. Not here. Lumber is different. Most of the trade is based on opinions, emotions, and rumors. Supply and demand factors are secondary. We all know it as a fact and have learned to trade the whole package. This last go-around in futures was a perfect example of the smooth-out cycle that many economists embrace. The thought is pricing smooths out over time. Not in a few hours. While I agree with the theory, I have never enjoyed it in lumber. You are never hedged in this market, and that lack of hedging allows for wide swings. Wide swings kill margins, and reduced margins bring in more caution. Today, everyone wishes for higher prices to bolster the bottom line. A $600 2×4 looks much better on the books than a $400 one. We are seeing a market in the greatest smoothing out period in its history after a run to $1700. It takes time and pain. What a western Canadian producer is at has little to do with the market. Times have changed.

We continue to seek a tighter supply environment to raise prices. This is year three of that strategy. At this pace, the mills could continue to hover around break-even indefinitely. How do we survive in this environment? With SYP and Euro not embracing the cutback strategy, the pool of wood is always available. They always look to sell their wood, which is negative. This leaves the battle between SPF and the marketplace.

There are always chances for a commodity to see sharply higher prices when not warranted. Today, lumber is one. At no time should emotions warrant higher prices when a market doesn’t have the dynamics, but they do.

The trend will be down in the next couple of months as housing stays flat, but prices will spike up and back. The market gives up $30 to $50. Don’t look to add more to it. Trade what it gives you.

Now for today:

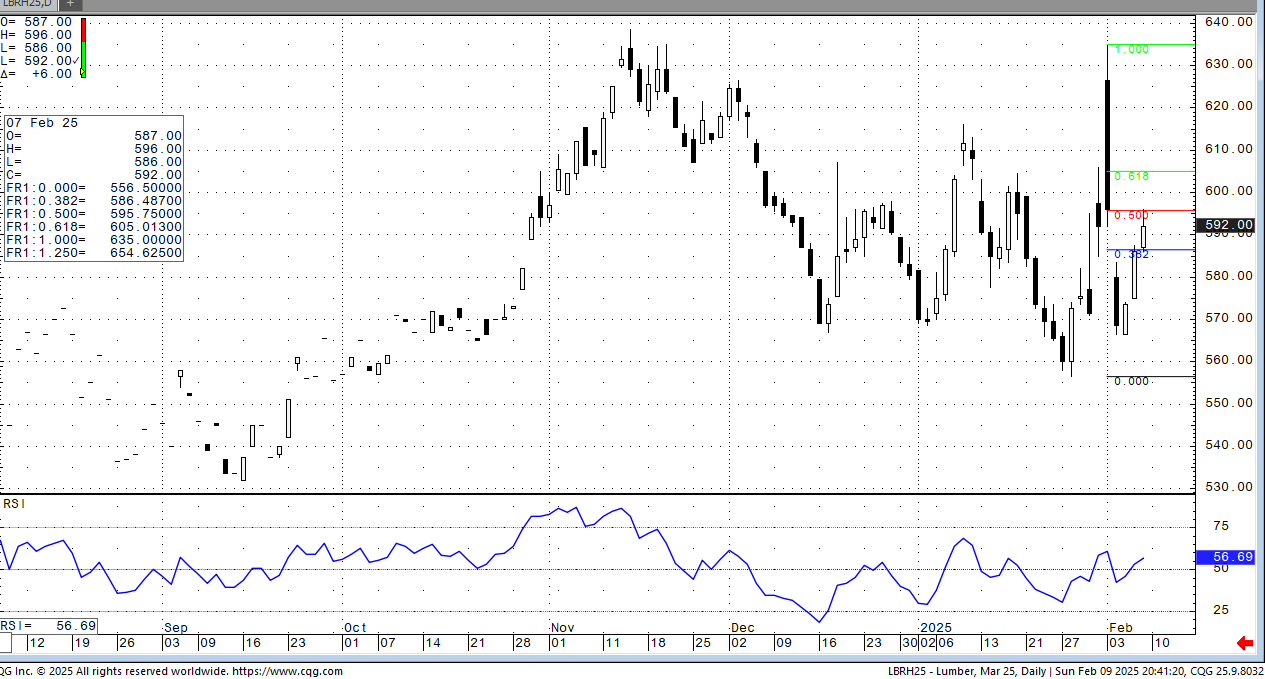

The futures market has recovered 50% of this move. 596.30 is 50%, and 61% is 605. Without the algo selling, we could see higher prices, but they will eventually appear. For the next few weeks, the mills will try to dig in. Owning cash today will show a profit.