Summary:

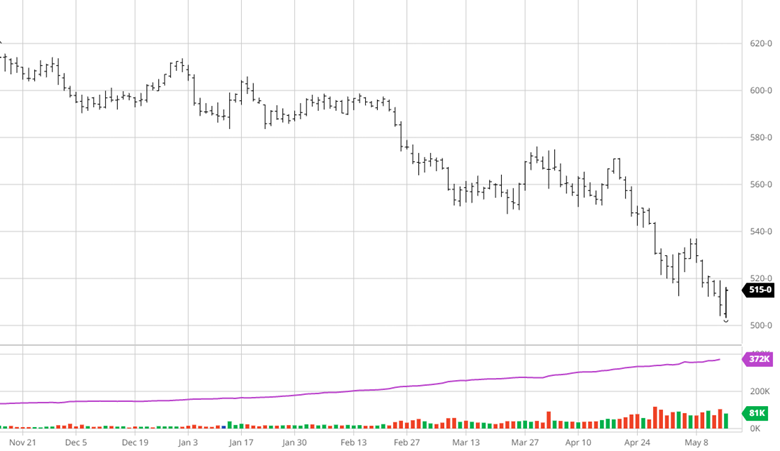

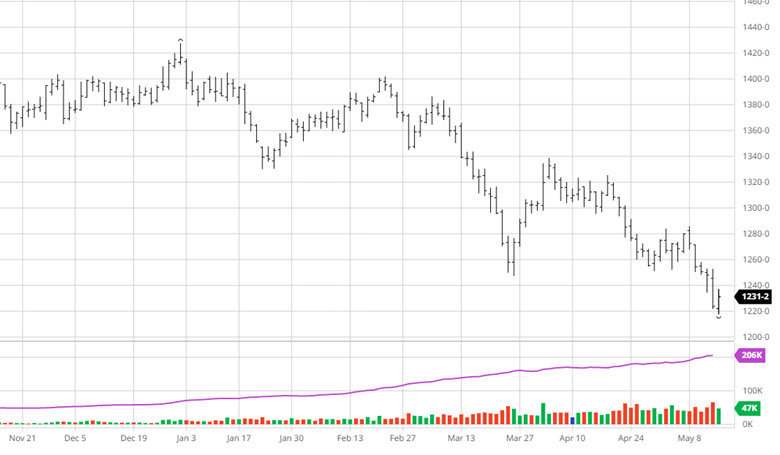

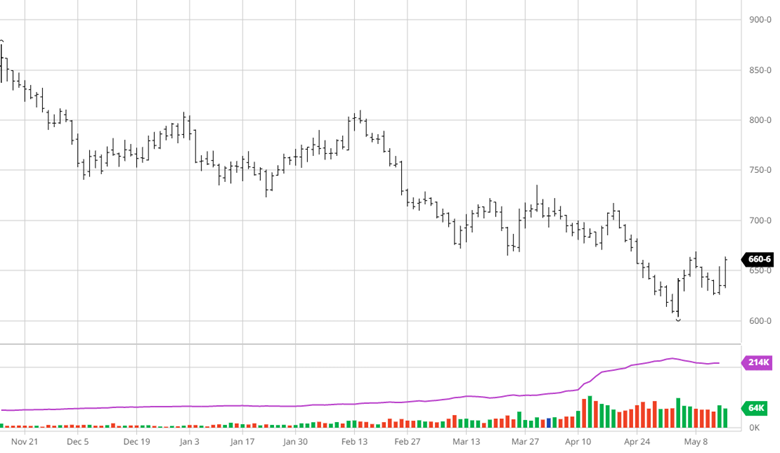

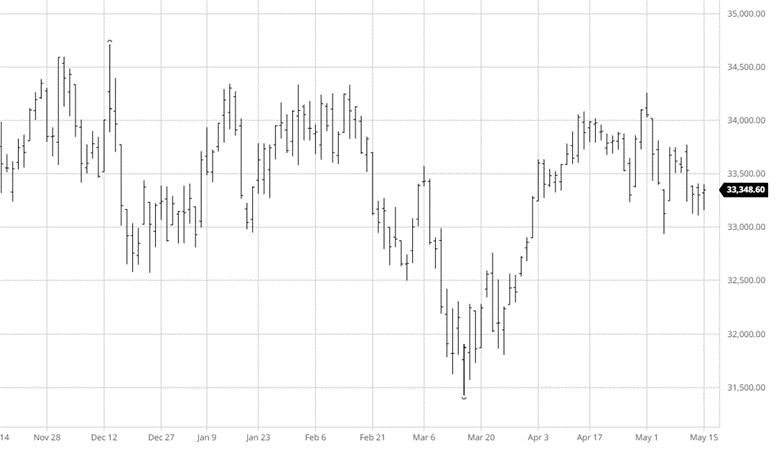

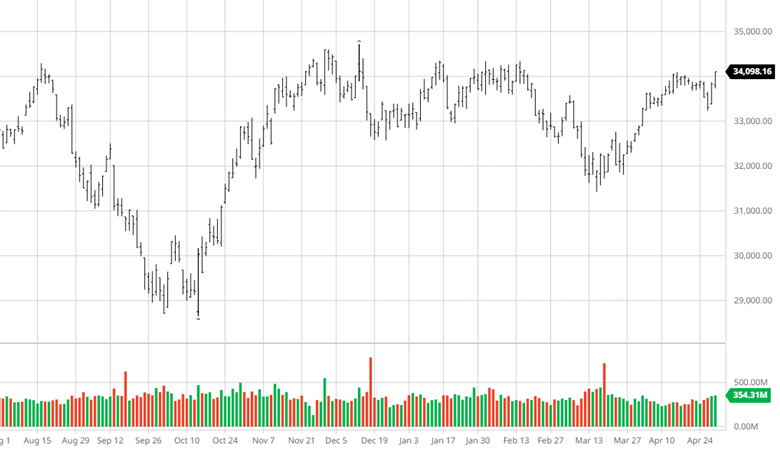

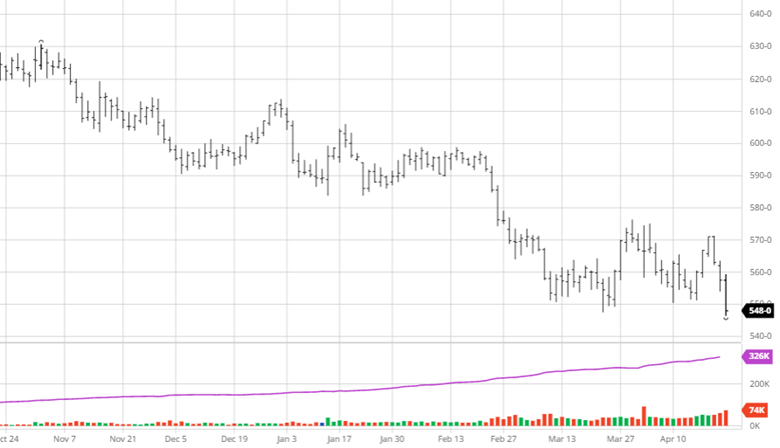

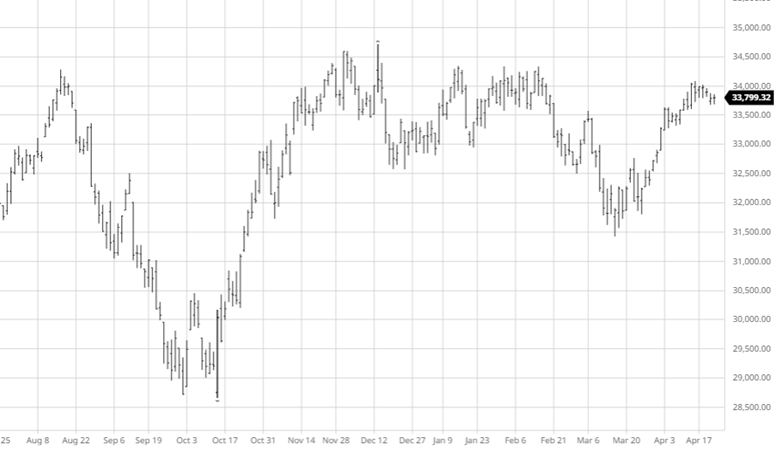

The futures market had a mixed week as Tuesday saw a good flush of longs followed by a Wednesday of profit-taking. By Friday the market saw a pickup in volume as the roll began. Having an active roll is key to a fluid contract. The market is getting a little fatigued on the sell side. After over 16 sessions without a correction, the attitude has changed to “not short” from “not long.” This will leave only the algo and funds left to sell it. They won’t compete with themselves for long. Is this a bullish call? Nope, I just think that the headwinds out there for this industry are now defined. The negatives coming are expected and planned for. Without a surprise, the market is underbought.

Economic:

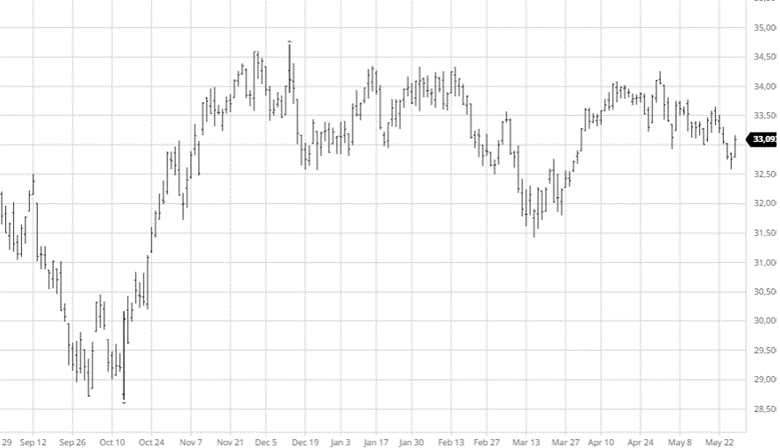

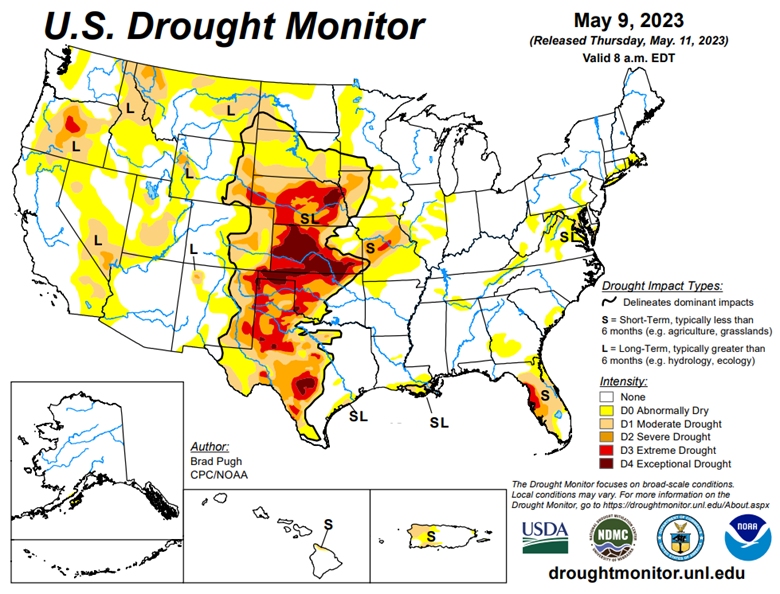

The overall economy expects higher unemployment and sticky high rates. Those are big negatives for this industry. The question becomes if the 80% break in prices from the 2022 highs was enough or not to offset those issues. The fact that we are in the middle of it with steady demand tells us that just maybe the underbuilt condition is a bigger factor in the demand equation. If so, demand will also remain sticky. My projection for a third quarter of less supply offsetting less demand may not play out with demand better.

Technical:

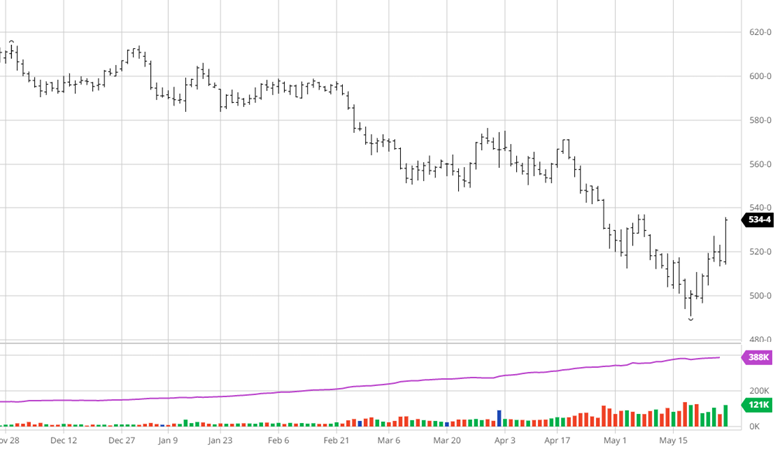

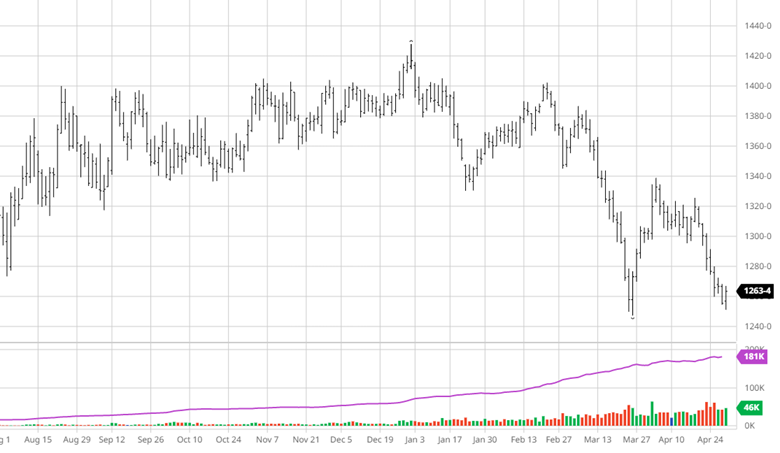

The resistance trendline is now at 499.50. The oscillators are calling for a correction. A rally back to the trendline would be expected. The issue is this elongated downtrend. It doesn’t create a comprehensive oversold condition. It gradually puts indicators overdone. Today nothing indicates caution should be used when basis trading. It continues to be a reliable tool to use.

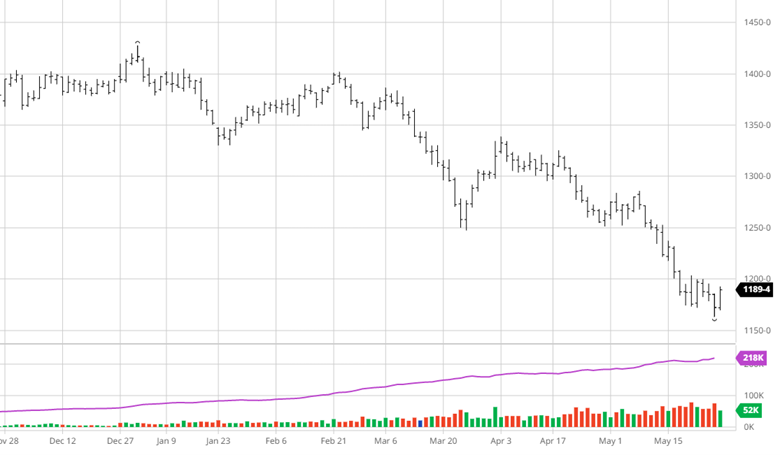

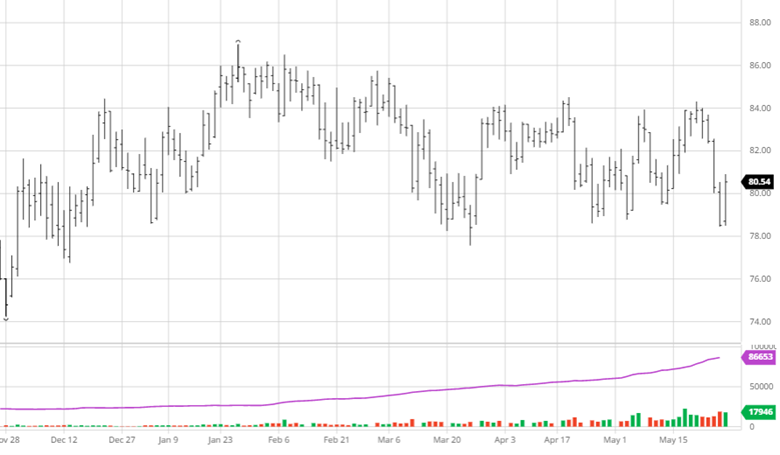

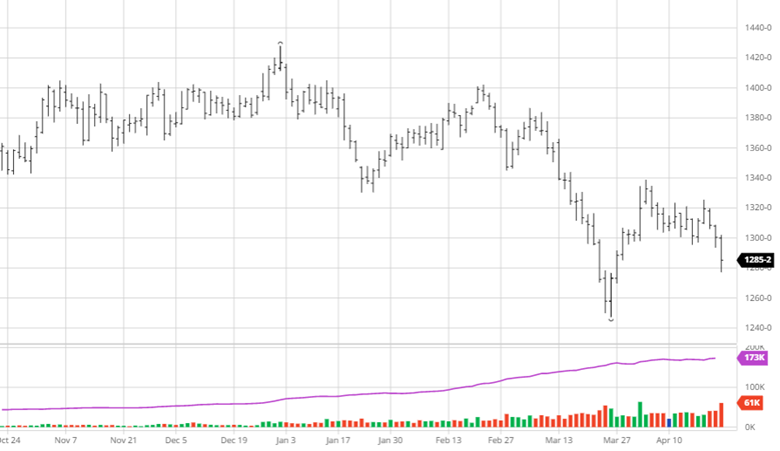

Lumber Futures Volume & Open Interest

CFTC Commitments of Traders Long Report

https://www.cftc.gov/dea/futures/other_lf.htm

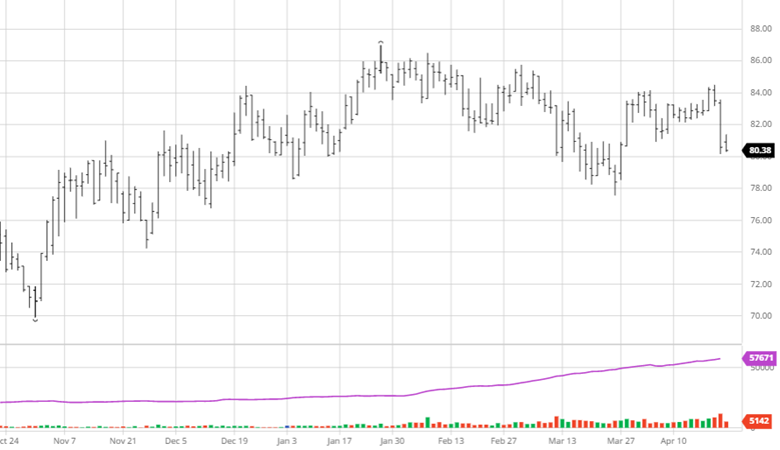

Lumber & Wood Pulp Options

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

312-761-2636