Crosswinds verse headwinds. I am starting to wonder if the story is of how we all walked 3 miles to school uphill both ways. We are getting to the point where we may just have to take the charts and data from 2020 to 2023 and put them off to the side. While it is reflective historically it may not be the true focal point today. If we push that information to the side, we can focus on today’s factors. All of which we have experienced in earlier cycles.

Positives:

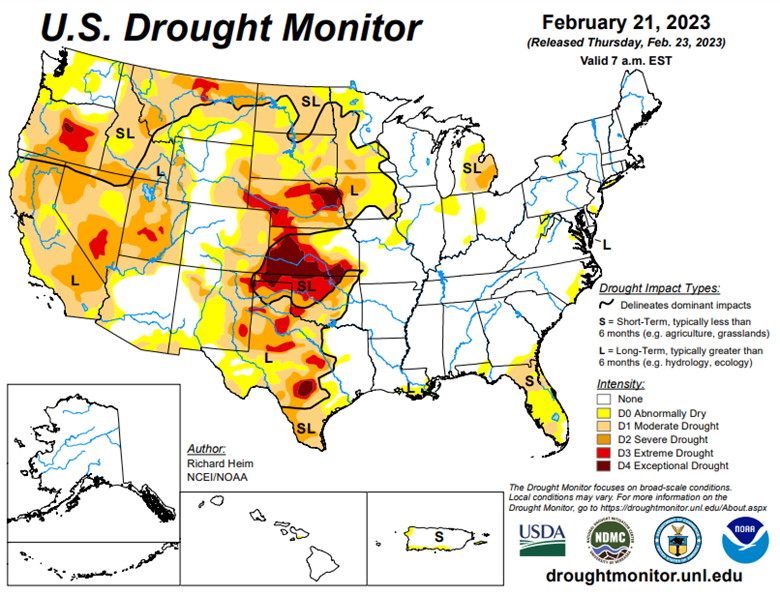

- The housing market is underbuilt.

- There has been a generational shift to owning a home.

- Labor is tight.

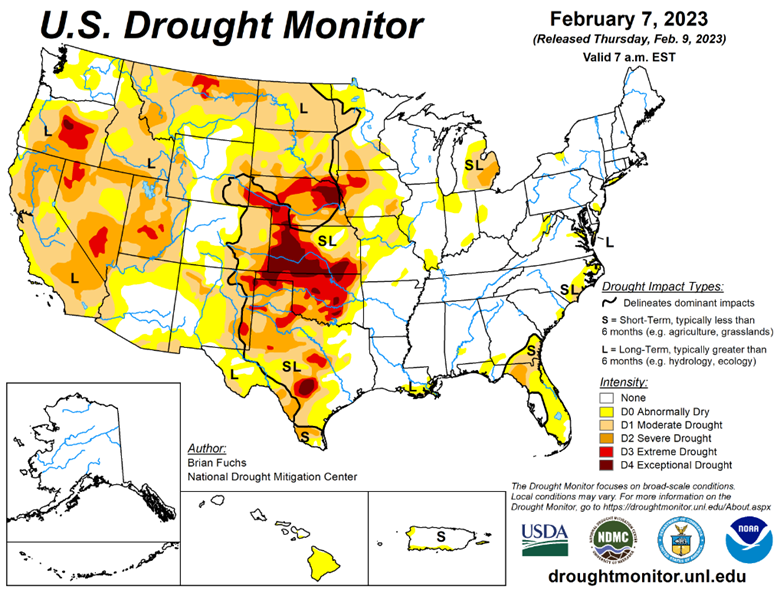

- Real log issues.

- Great overall employment.

Negatives:

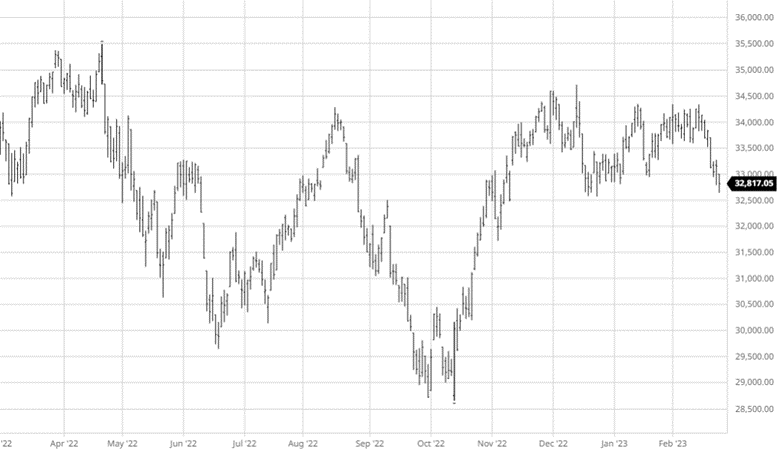

- The economic question.

- Highest rates in years.

- Euro wood. It is a race to the bottom in the wholesale community.

- The home mortgage business sits with the community bank. They are becoming more restrictive.

The negative factors will smooth themselves out more quickly than the positives. Rates and the Euro wood will be less an issue by the third quarter. The economy on the other hand will take much longer to be defined and then to recover. That will be a hinderance to our market. On the positive side, if you build less houses you take care of the labor issue and keep the marketplace thin. That is the direction the home builders have headed towards.

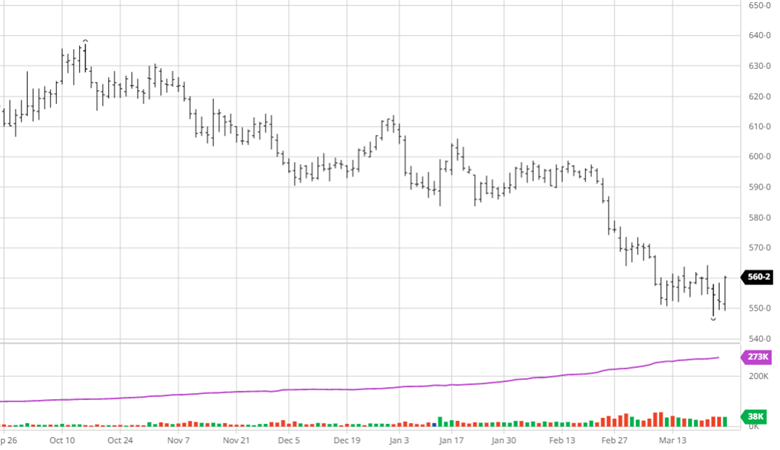

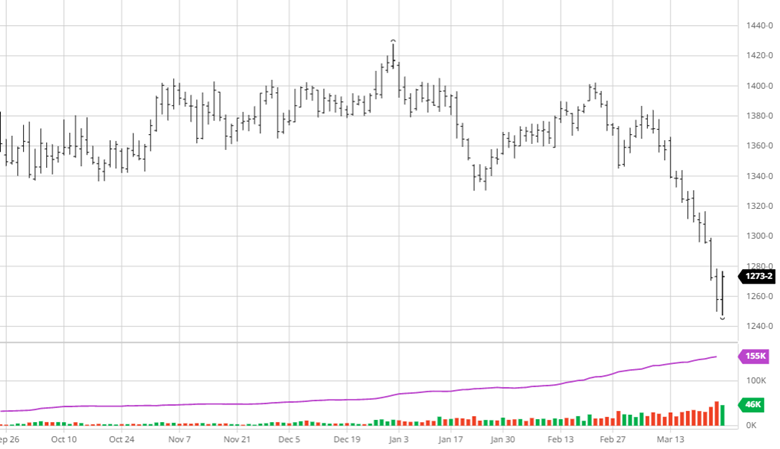

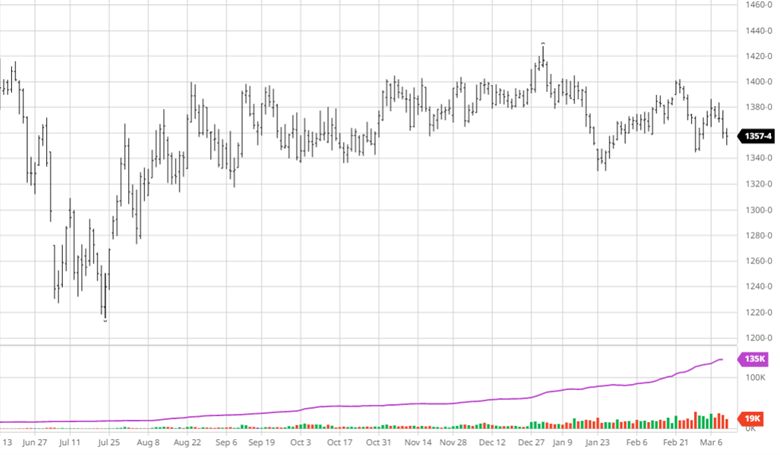

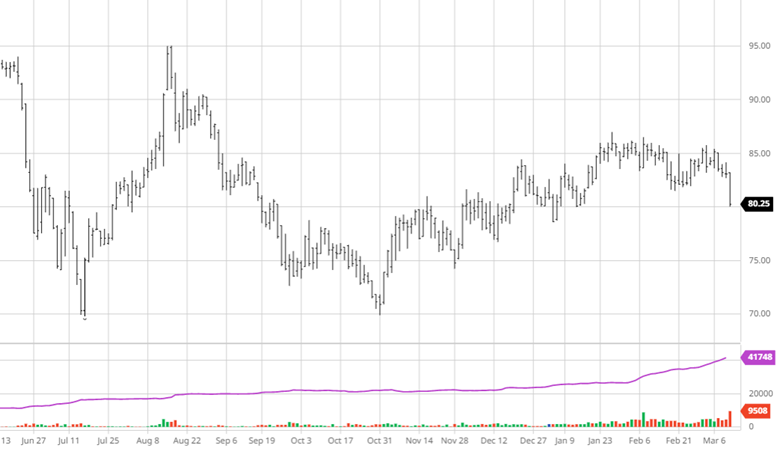

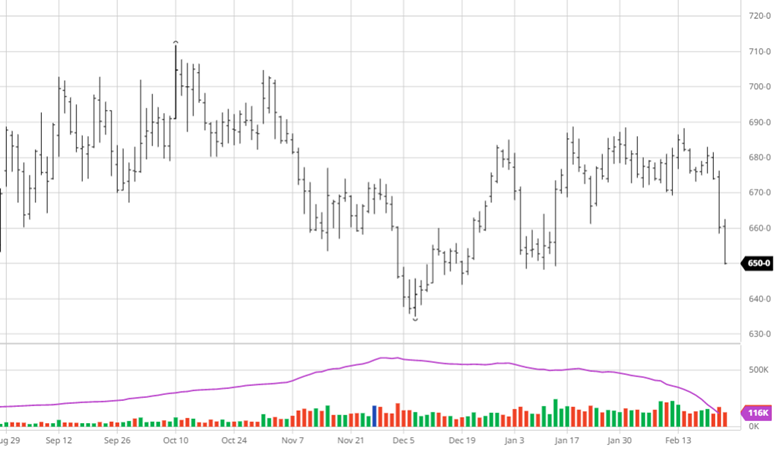

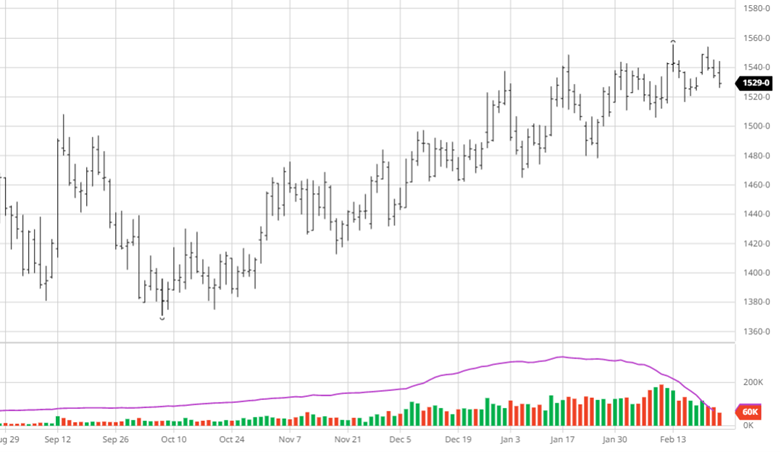

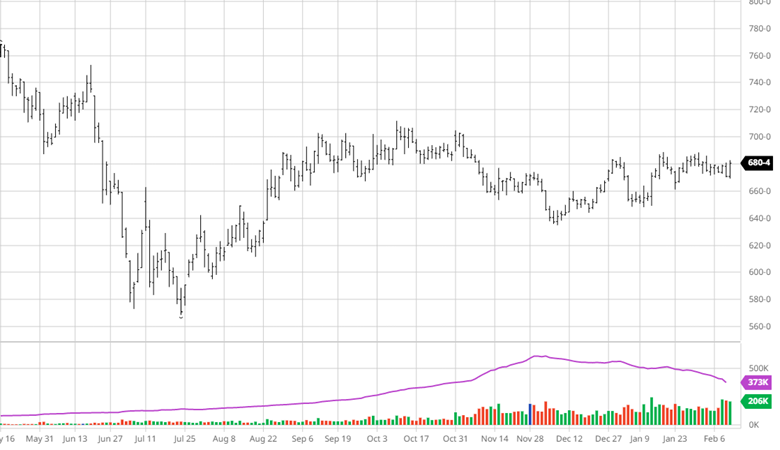

The question coming into 2023 remains the question today. What should the price of a 2×4 be with a 1.2 or 1.1 starts number? That cannot be answered until the Euro problem has cleared up. What I will say is this market has built a box around it. The first thought coming into the year was a muted 2023 trade. That shifted to a higher trade because of business. Now I am an afraid that it is boxed in. What I mean is that momentum will be created only to get hit from the existing factors. This will show up when inventories are light in a falling market and overbuying in a rising market. That is not a sideways trade. It is a trade that finds momentum and then stops abruptly. Opportunity is only available in the middle and lost when the push up or down is in place. It will break out and trade at a higher level eventually, but not anytime soon. For today, real inventories will be a value while the churn and burn crowd are in the liability zone. There is absolutely no reason not to hedge inventories when in this box and futures are a premium.

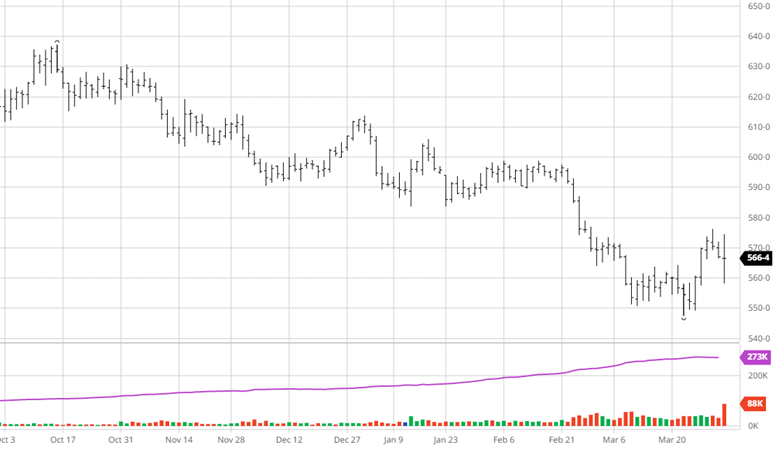

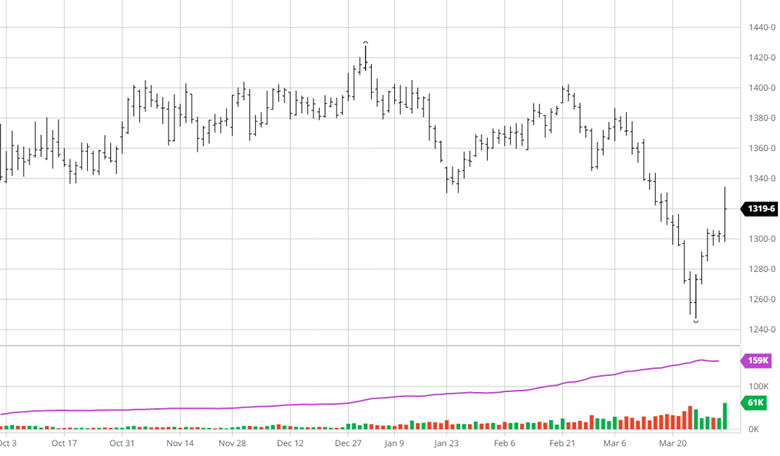

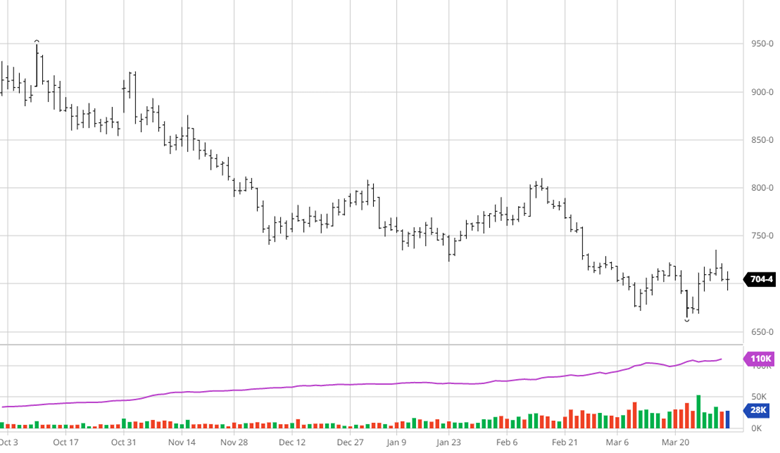

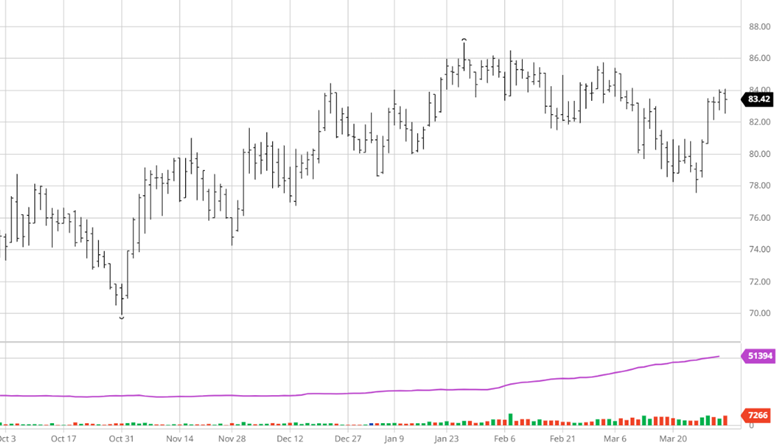

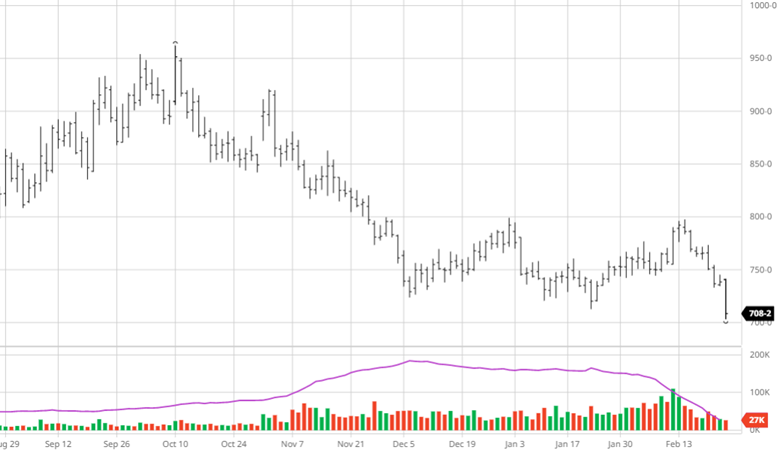

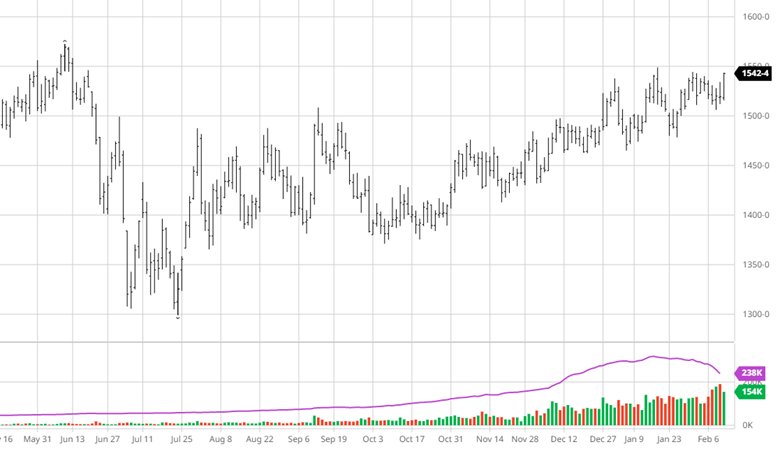

Lumber Futures Volume & Open Interest

CFTC Commitments of Traders Long Report

https://www.cftc.gov/dea/futures/other_lf.htm

Lumber & Wood Pulp Options

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636