Recap:

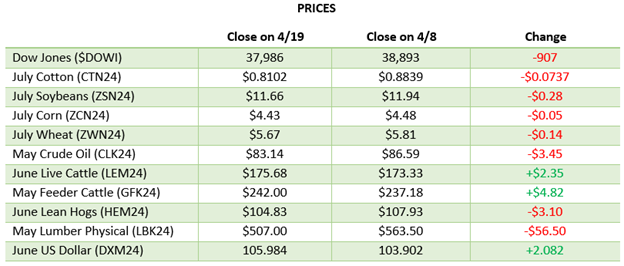

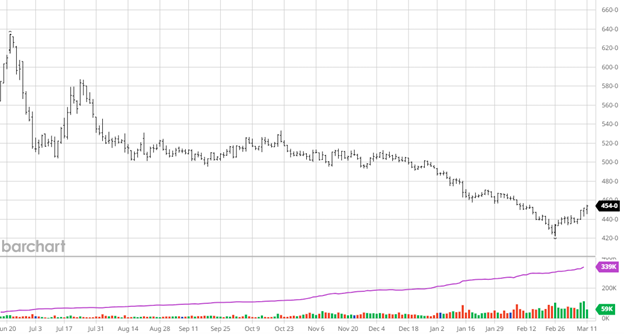

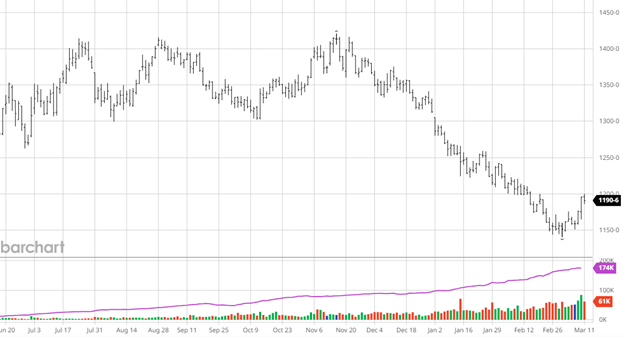

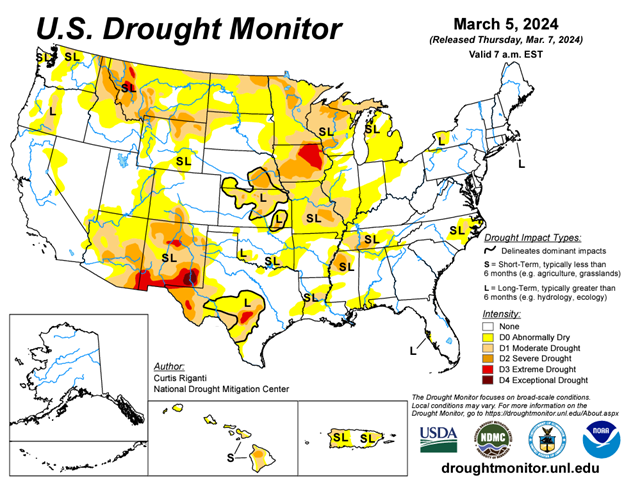

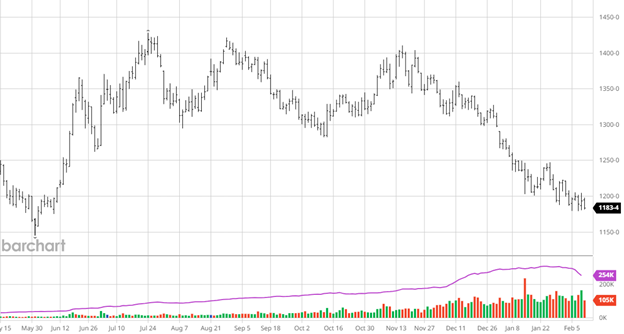

It was a better week for trading. The market seemed to drift into a bottoming formation, followed by a couple of good spike-up days and a new low for the move. We can call it a bottoming action, supportive, new low, or dead cat bounce. I heard all of them. What it did was cause the trade to be bullish one day and bearish the next. While the trade was highly volatile, the net for the week was only a $8 gain. What was different last week was that, for the first time, we had a few green shoots appear. From wholesalers covering shorts to mills holding prices, there was a better tone. We head into next week with a much more positive attitude.

While attitudes are better, most are very cautious. Prices have fallen far more than expected. Taking the cash market back into the $3’s should not have happened with all the shutdowns etc. The trade is now searching for the reason. Is there a more significant issue lurking out there? It’s hard to pin it on the market going too high, so it needed to go lower theory. I saw fear in the faces of some traders. They couldn’t sell a stick. We can’t blame the algo for that.

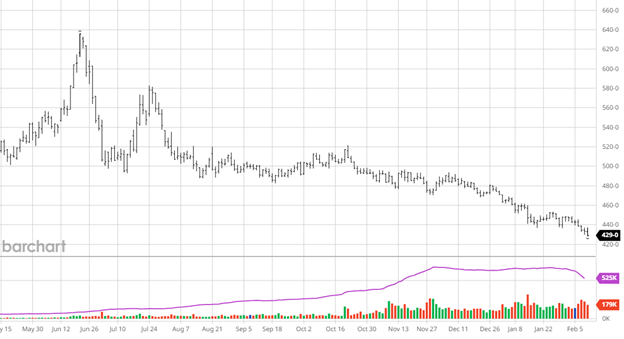

The industry is exiting shorts and getting long. Seeing them in a good flow instead of a battle is nice. This last trade report had short funds almost doubling their position while the long funds continued to exit. This report cuts off on Tuesday. I bet it shows the long fund numbers reversed and going higher on the next report. The trade at the end of the week had a fund tone to it.

Technical:

It’s harder to pull any green shoots out of the tech read, except it closed higher on Friday. This indicates that the battle down here isn’t over. The problem for the shorts is that the new volatility rallied futures $15 in a few trades. Your position can be upside down in a few minutes, not sessions. To summarize, the tech read calls for an ABC correction up, not a V bottom. The jury is still out.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636