The Lumber Market:

It was a tough week for the cash market as mills were forced to lower prices to get rid of excesses. Futures on the other hand, held value. It was a very slow volume week as the trade stayed on the sidelines. While this is normally a hard time to read the market, it is obviously much harder this year. A few keys to be watching:

-

I have been preaching about the high amount of inventory out in the field. Every week that number is reduced. A couple day run in cash could even things up and force the buyers back in. That remains to be seen, but there will be an uptick in usage.

-

I’m not a fan of the “underbuilt” hypothesis. There are too many dynamics that have to come into play to make it a factor. We saw them come into play during covid. When momentum to move increases we are far short of homes. What we have today is a two-pronged move being created. The first is once rates drop there will bring a ton of existing home inventory onto the market. That will create good sales but little anxiety. Once the trading of homes is completed, the market with feel the underbuilt condition.

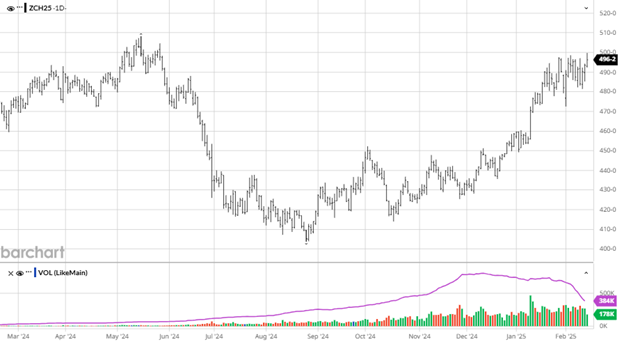

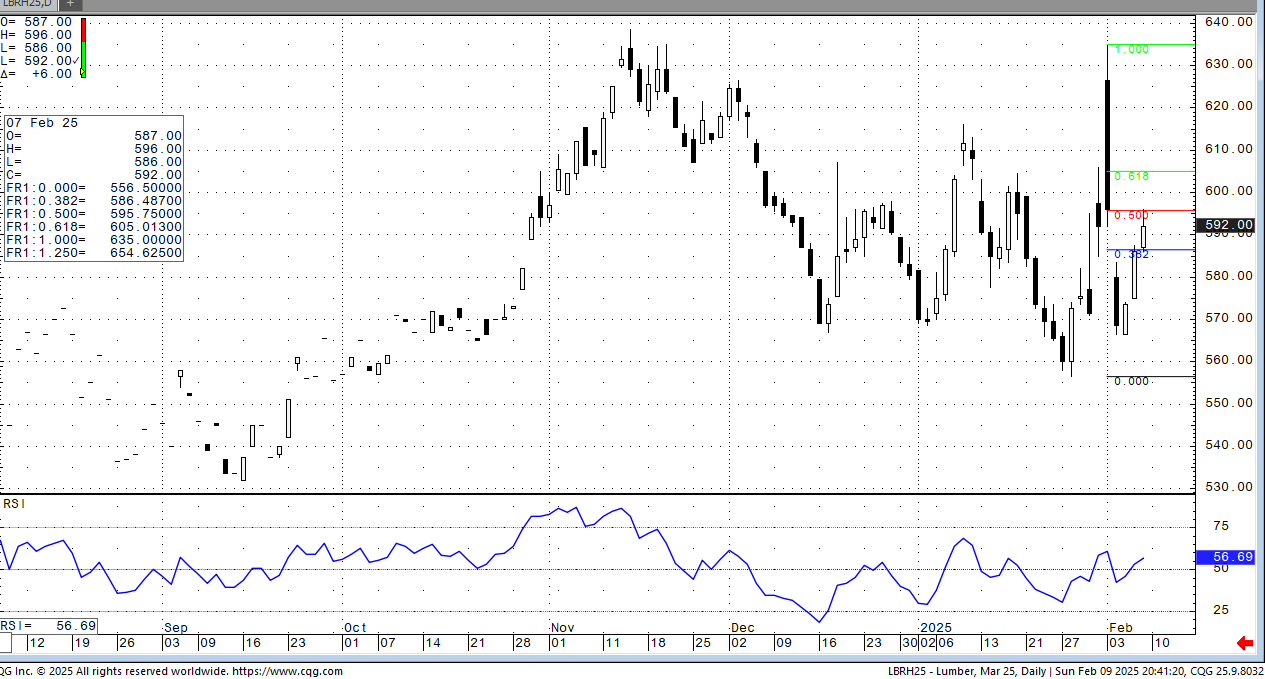

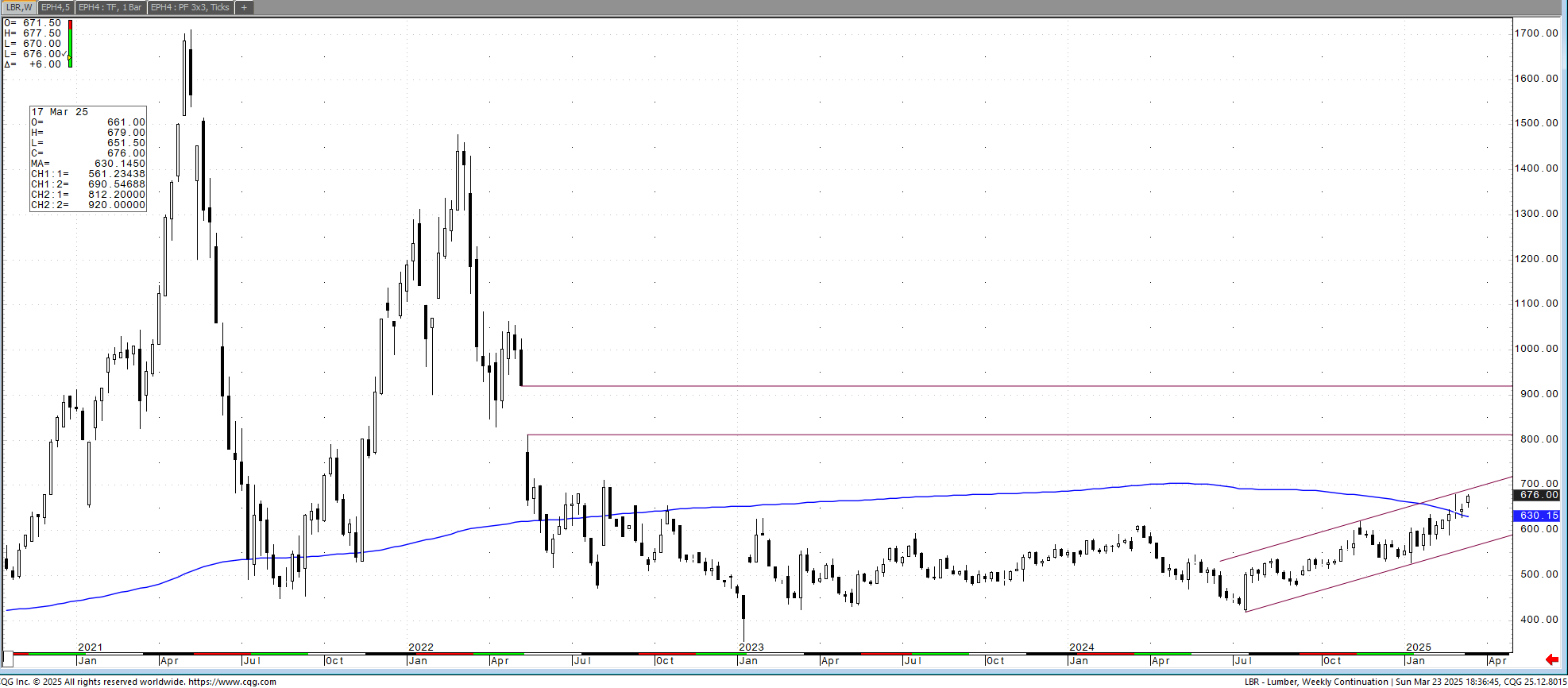

The market has been in an uptrend since last July. I will have a chart below to show the trend. It tells me that the mills can no longer produce at breakeven or at a loss. The housing demand is too great for that. I said that a few years ago so take it with a grain of salt. Economics are economics and housing leads. As of today, it is looking up. Tariffs and duties are all transitory. Stick to the fundamentals.

Technical:

I love the gap on the chart below at 812.20. I know it was the old contract, but the algo and funds don’t give a shit. The next few weeks are going to be very volatile. The market could shoot $50 in either direction for a while. What if the market ran up to $720 and then down to $620. Is your risk managed?

We are going into one the most confusing week of all of our careers. Remember things never change. We will all come out of this at some point when reality is defined. Don’t get caught up in it.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636