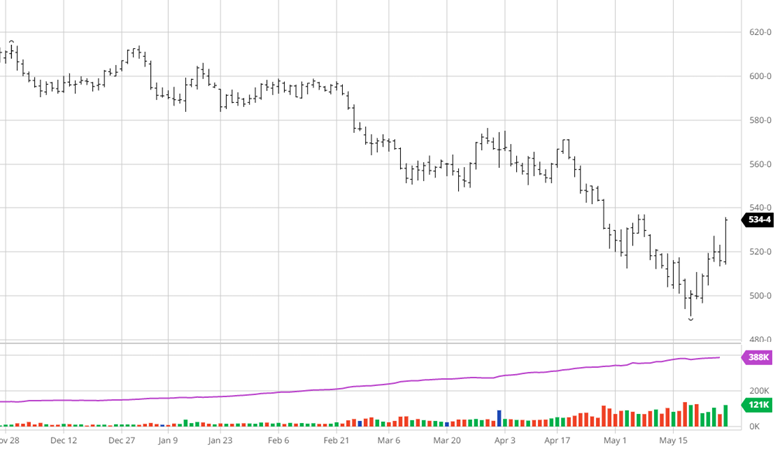

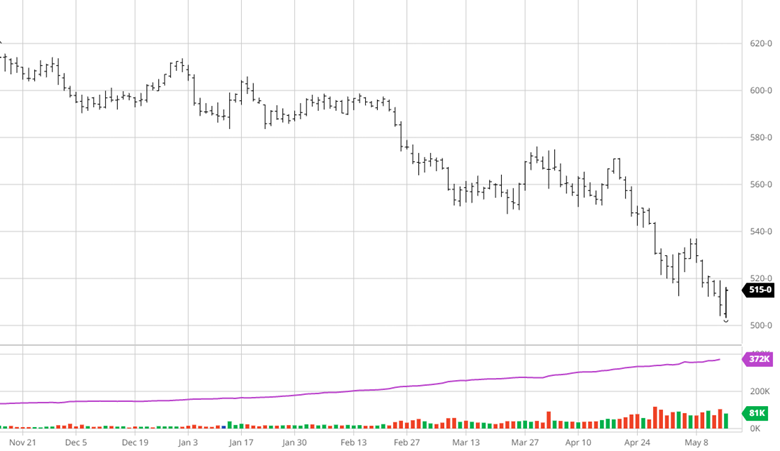

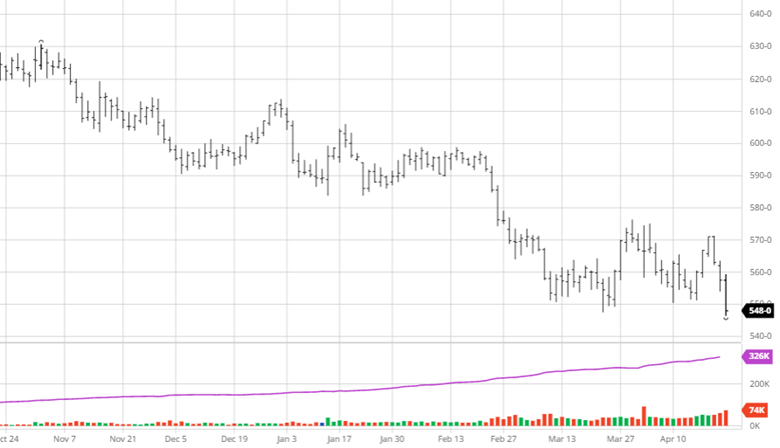

22/23 US Corn Stocks: 1.452 BBU (1.449 BBU Est)

22/23 US Corn Stocks: 1.452 BBU (1.449 BBU Est)

22/23 World Corn Stocks: 297.60 MMT (297.66 MMT Est)

23/24 US Ending Stocks: 2.257 BBU (2.254 BBU Est)

23/24 World Ending Stocks: 314.00 MMT (313.40 MMT Est)

22/23 Brazil/ARG Corn Prod: 167.00 MMT (166.67 Est)

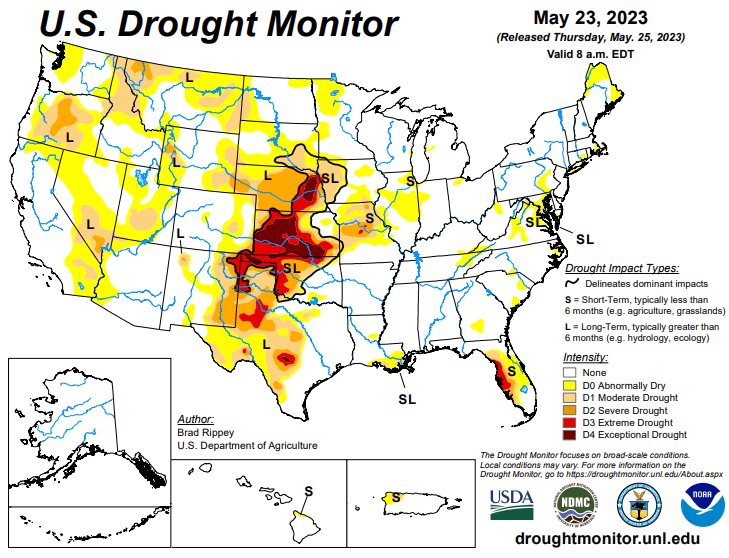

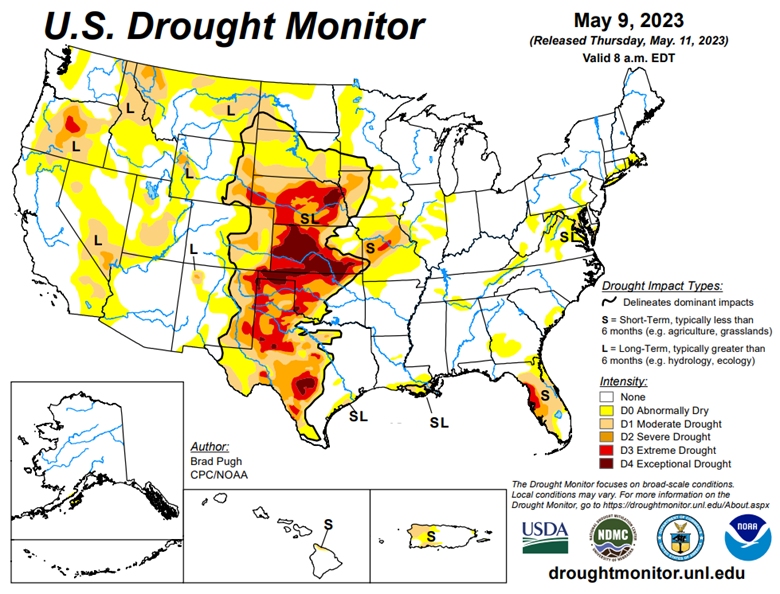

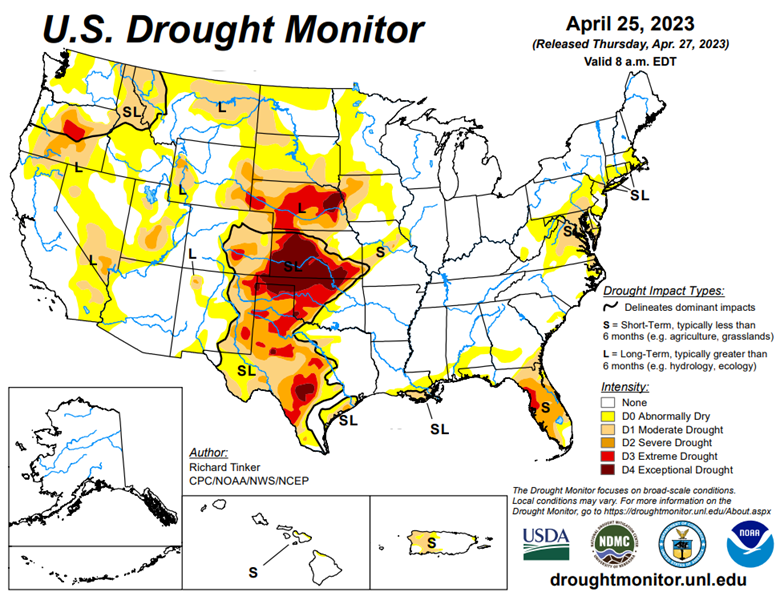

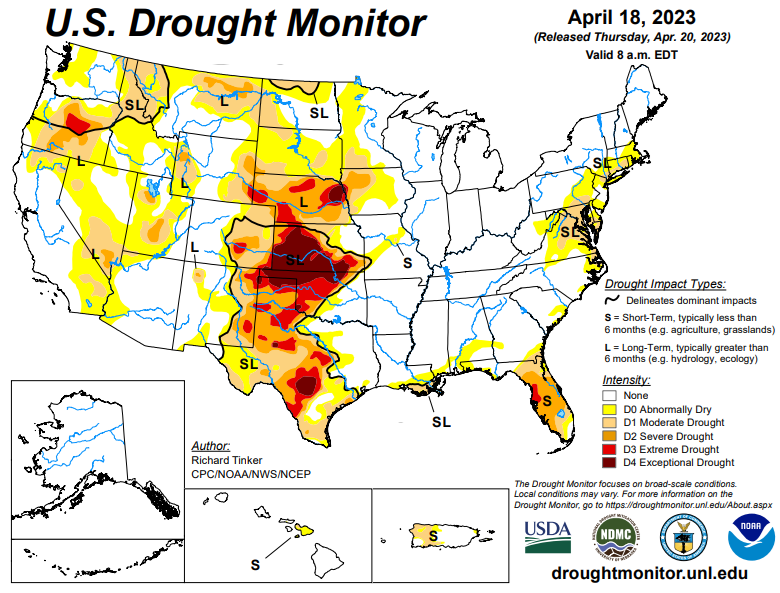

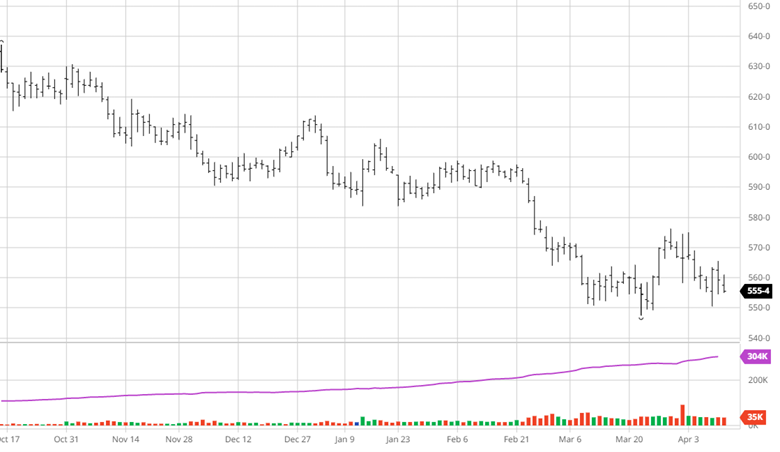

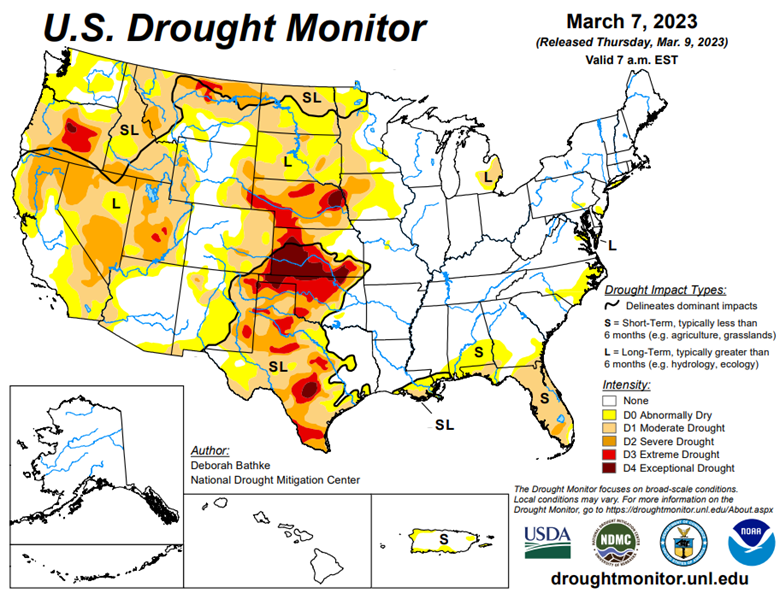

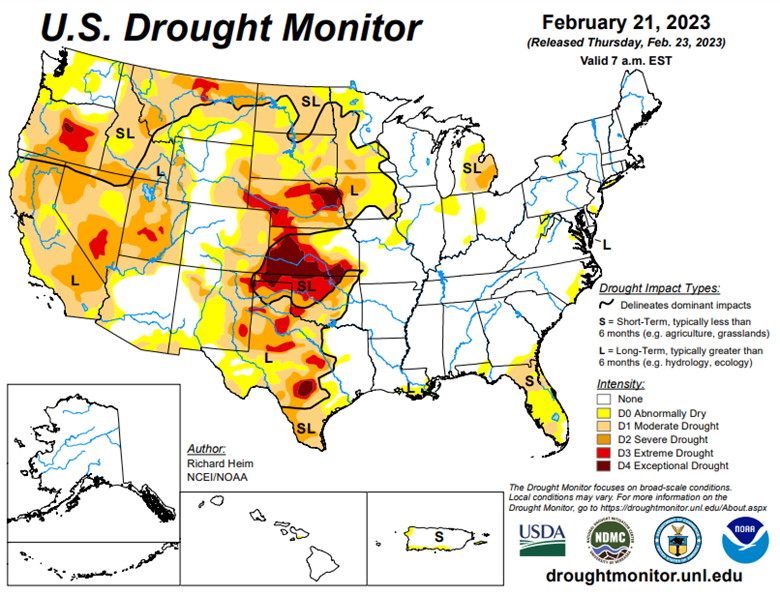

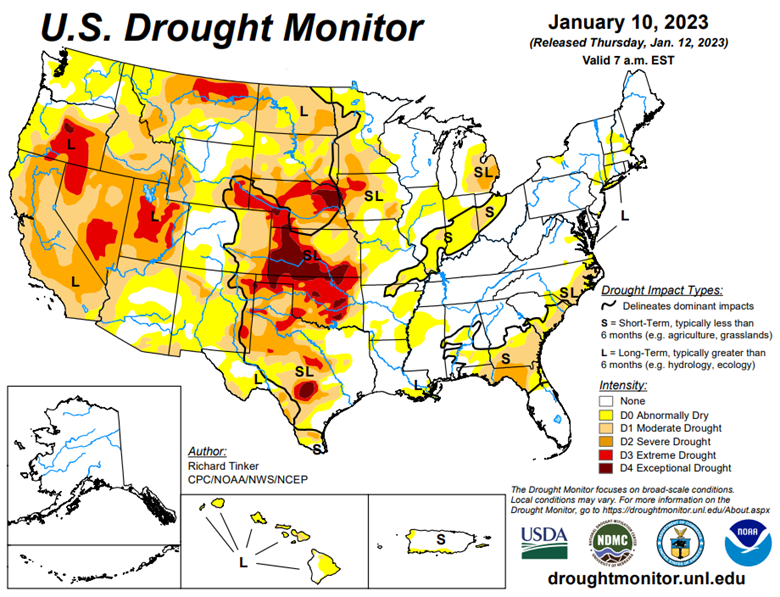

World corn stocks look to grow a lot year over year with expected economic slowdowns dragging on consumption. The USDA left production estimates unchanged, while this is not surprising for the June report, the weather will need to start helping or we should see a drop in next month’s report. The EU and GFS weather models continue to be inconsistent for the next two weeks. The USDA lowered Argentina’s production from last month but raised Brazil’s.

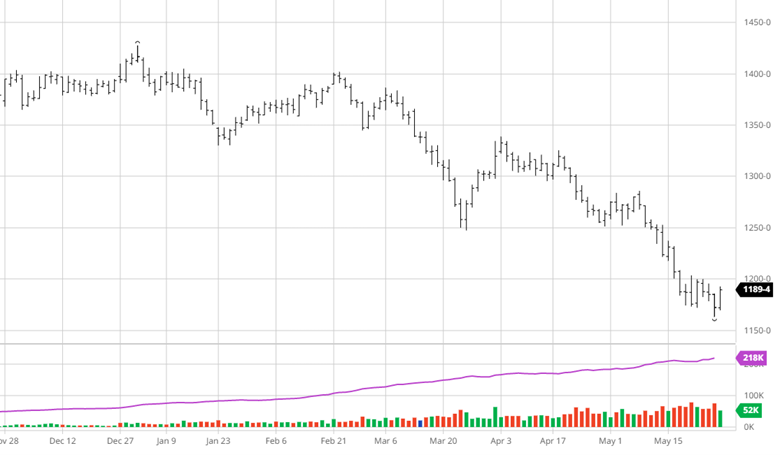

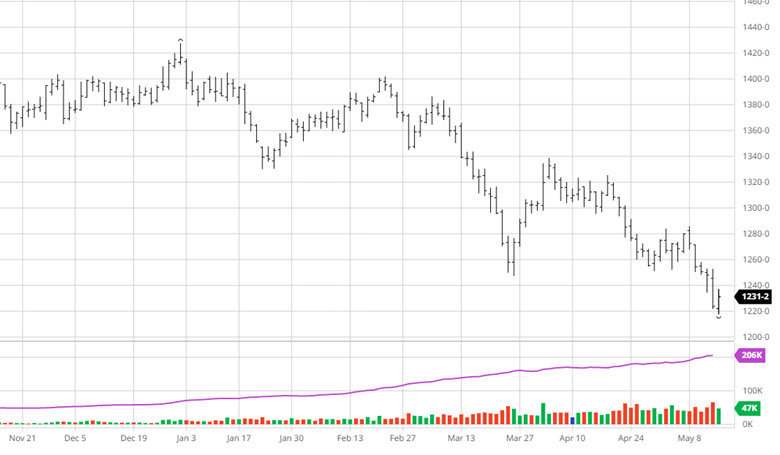

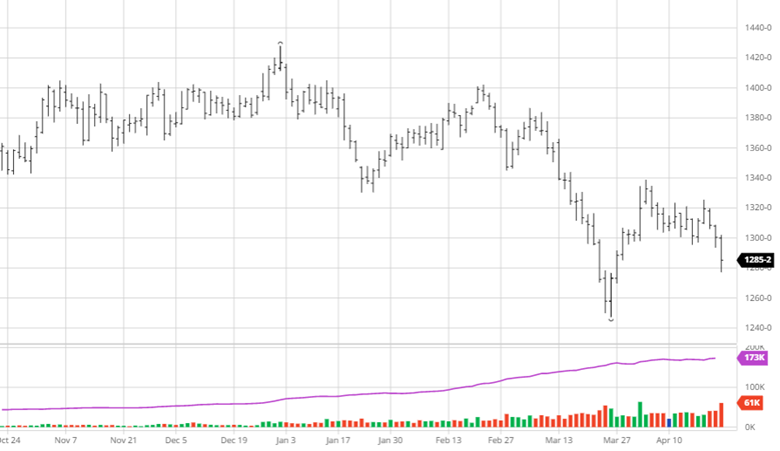

22/23 US Bean Stocks: 230 MBU (223 MBU Est)

22/23 US Bean Stocks: 230 MBU (223 MBU Est)

22/23 World Bean Stocks: 101.30 MMT (100.55 MMT Est)

23/24 US Ending Stocks: 350 MBU (345 MBU Est)

23/24 World Ending Stocks: 123.30 MMT (121.99 MMT Est)

22/23 Brazil/ARG Bean Prod: 181.00 MMT (180.16 Est)

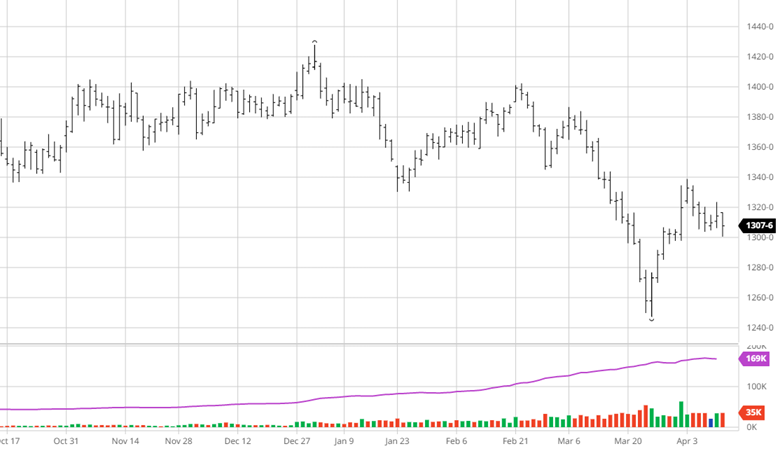

The USDA kept the US production the same while lowering exports, which leads to a big jump in US ending stocks. Crush margins should keep supporting beans, as weather is not a major factor, yet, to worry about. Like corn, the drop in Argentina’s bean crop was partially offset by Brazil’s gains.

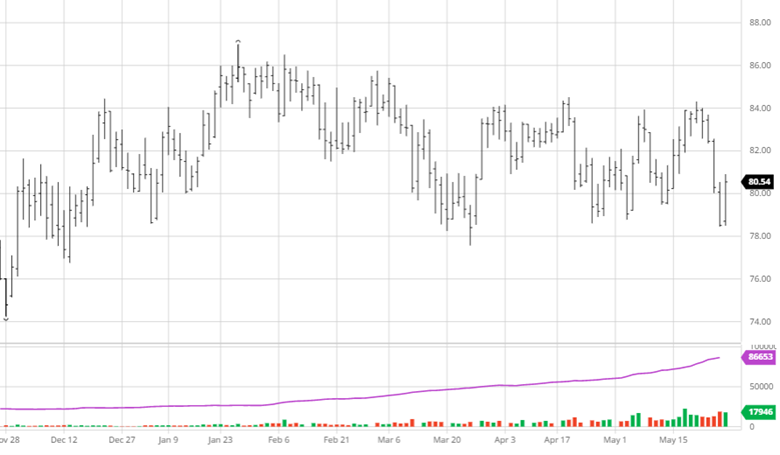

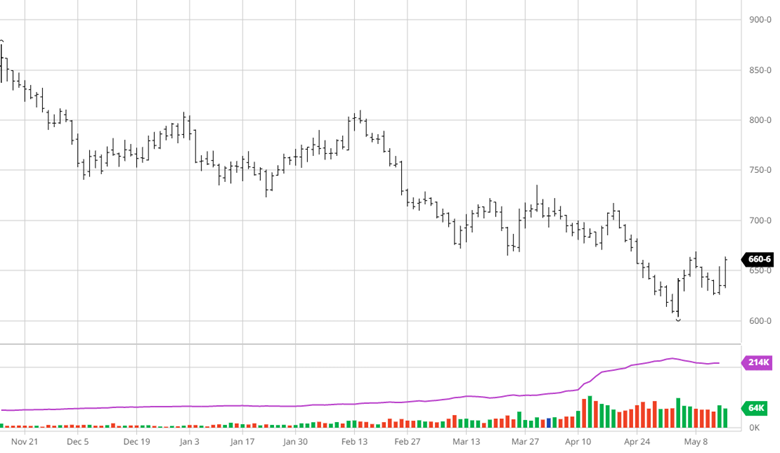

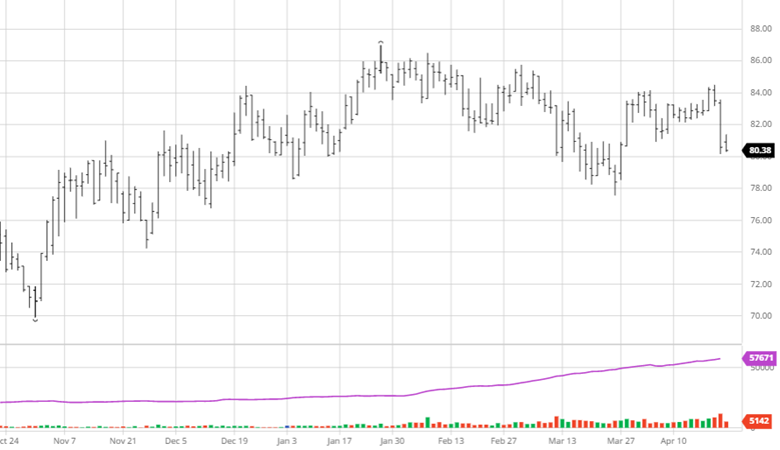

22/23 US Wheat Stocks: 598 MBU (606 MBU Est)

22/23 US Wheat Stocks: 598 MBU (606 MBU Est)

22/23 World Wheat Stocks: 266.70 MMT (266.58 MMT Est)

23/24 US Wheat Stocks: 562 MBU (569 MBU Est)

23/24 World Ending Stocks: 270.70 MMT (264.65 MMT Est)

2023 US All Wheat Production: 1.665 MBU (1.672 MBU Est)

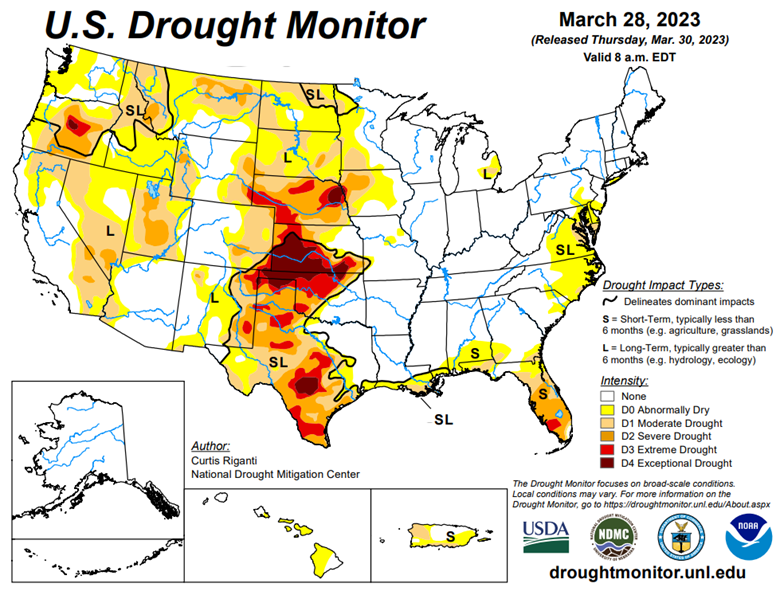

The USDA forecasted wheat world ending stocks to grow more than expected with higher stock in Russia, India Ukraine and the EU all revising higher. The US ending stocks were raised with a raise in US production as well. Wheat will continue to keep its eyes on the Black Sea, which as we have learned can be unpredictable.

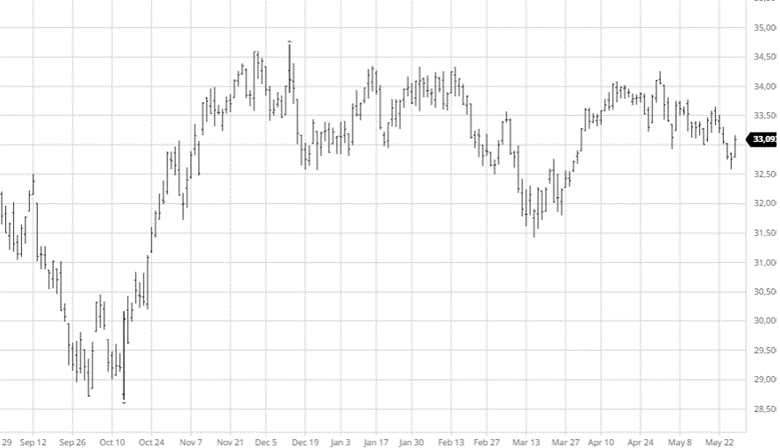

Overview:

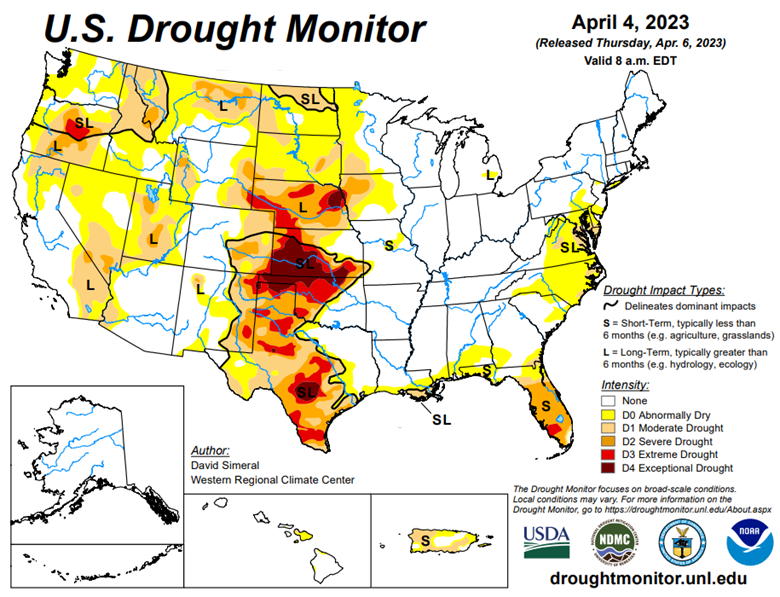

Business as usual with no big surprises in the June report as the USDA left US production estimates untouched. The USDA also left Chinese imports the same with 23 million tons or corn and 100 million tons of beans. The lack of any major news in the report was expected but the lack of any real bearish surprises was welcome. As it starts to heat up many areas will still be looking for rain, especially in the WCB that was lacking subsoil moisture to begin with. Forecasts will be the most watched thing moving forward as the inconsistencies in models does little to ameliorate any concerns.

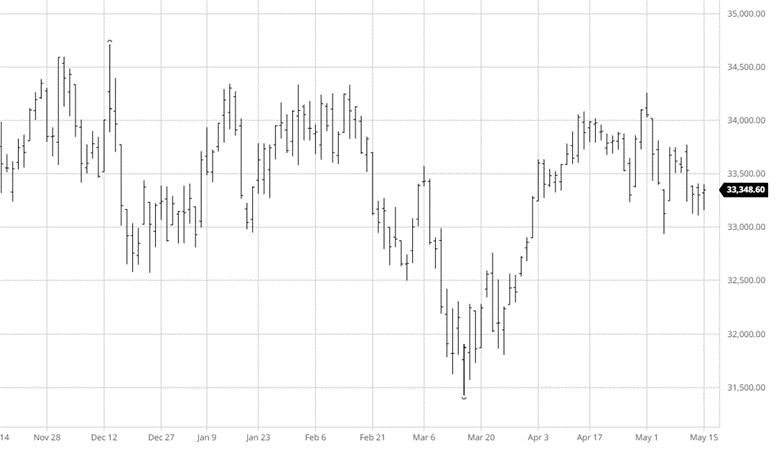

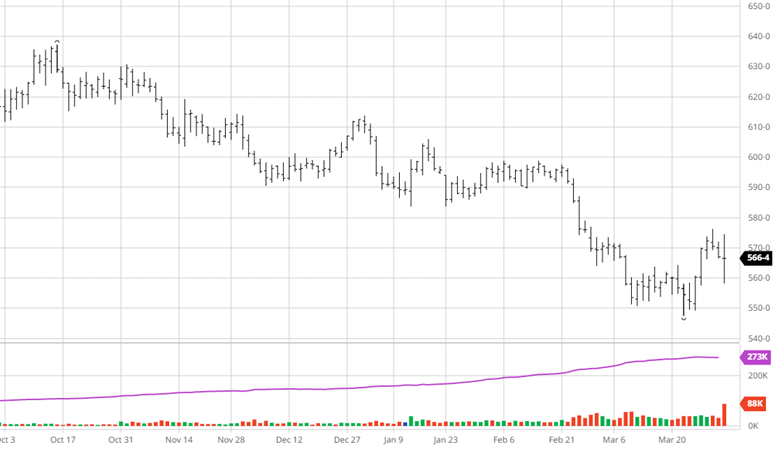

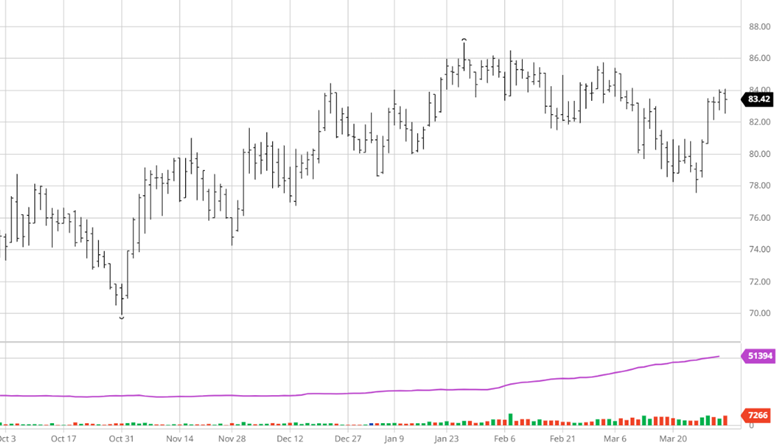

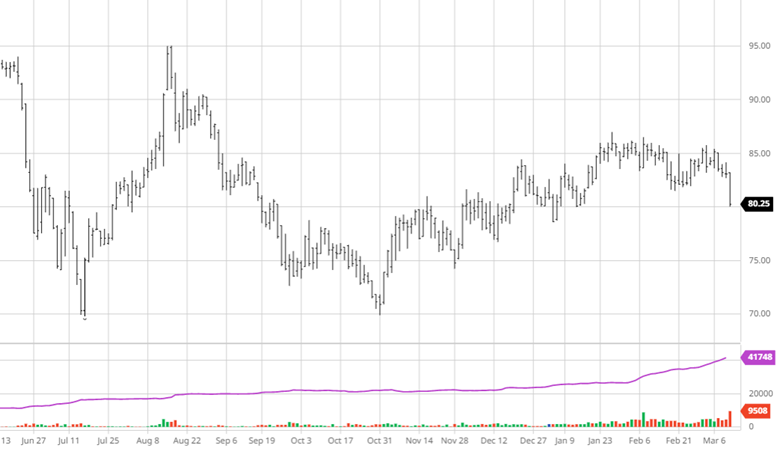

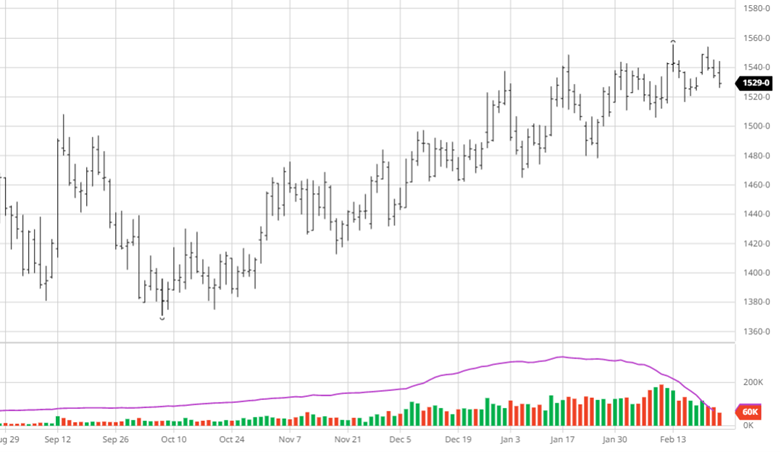

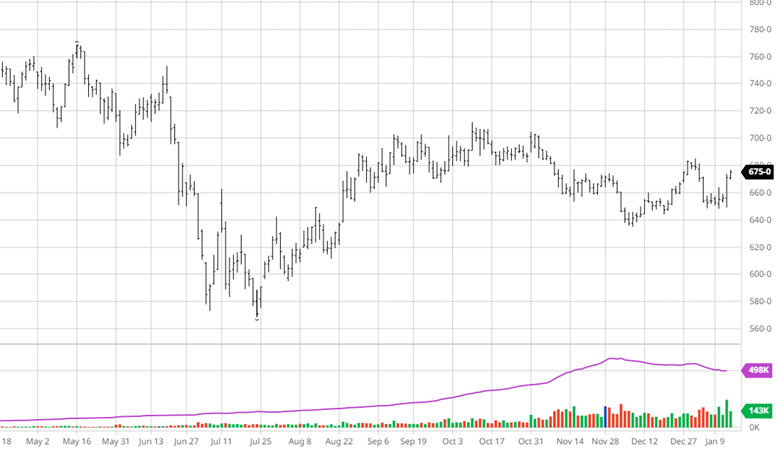

December 2023 – Corn

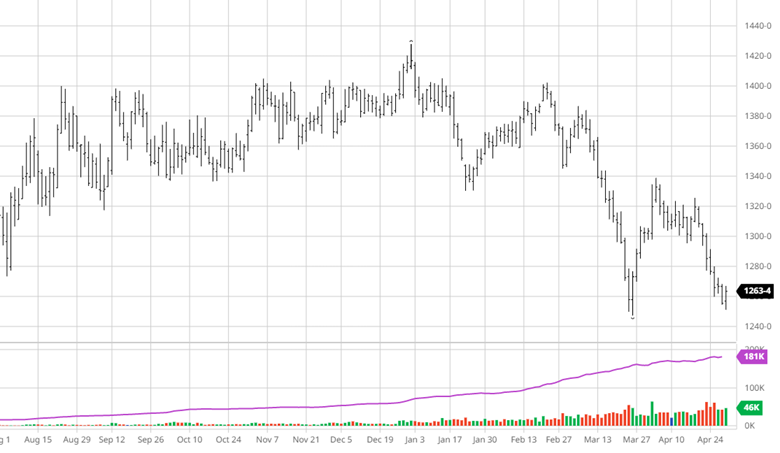

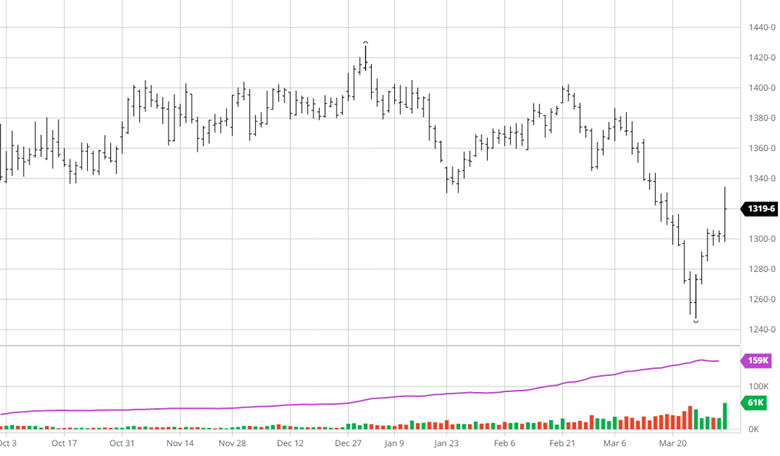

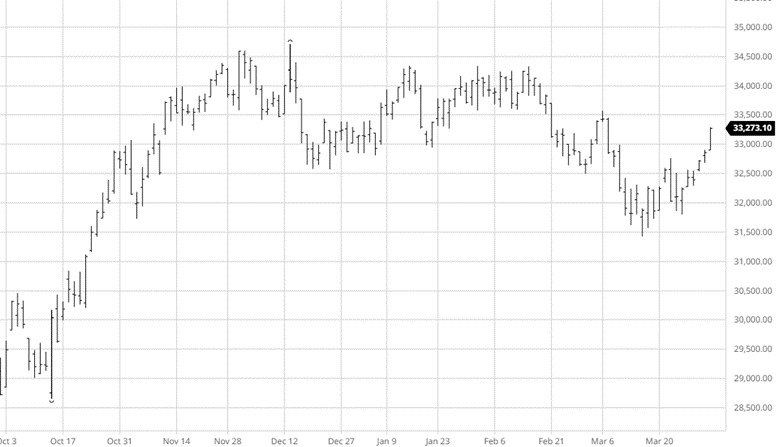

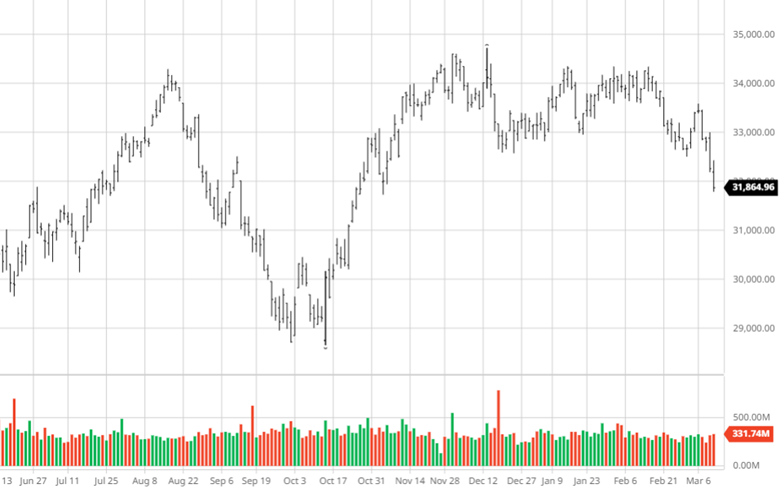

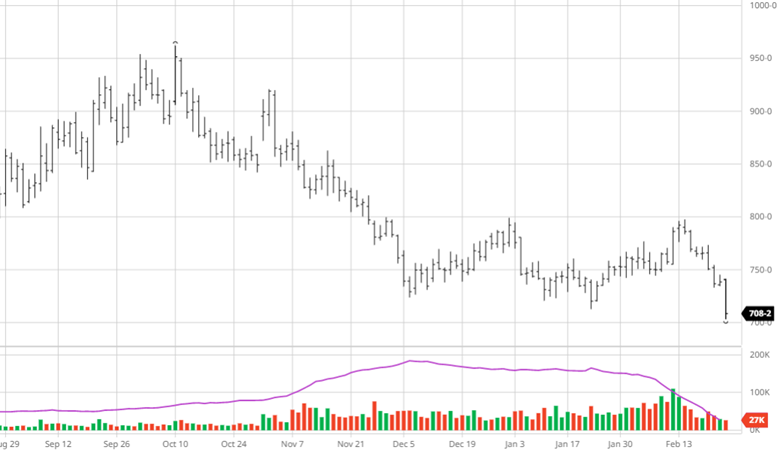

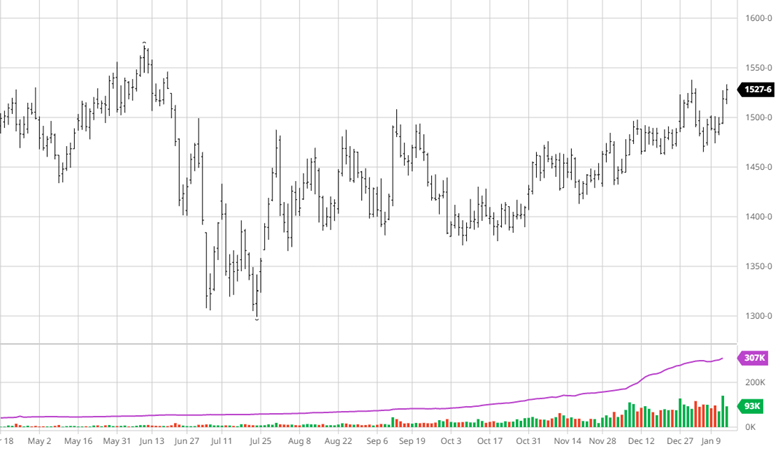

November 2023 – Beans

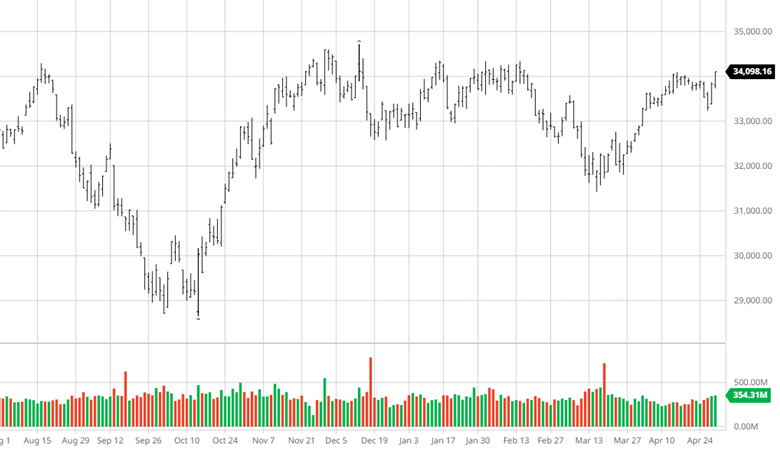

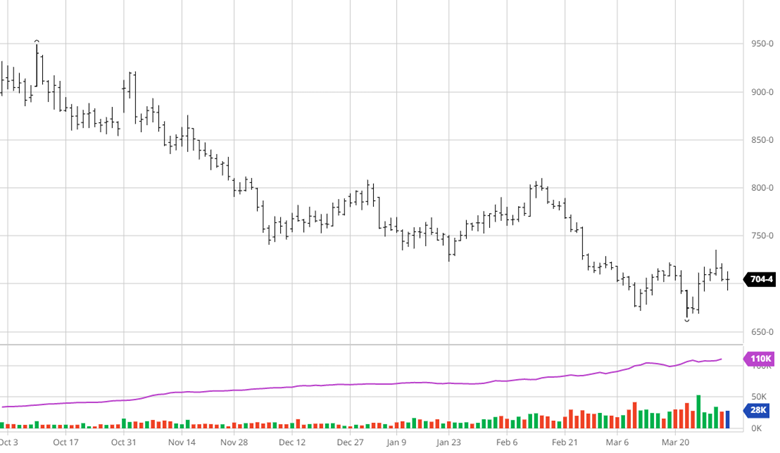

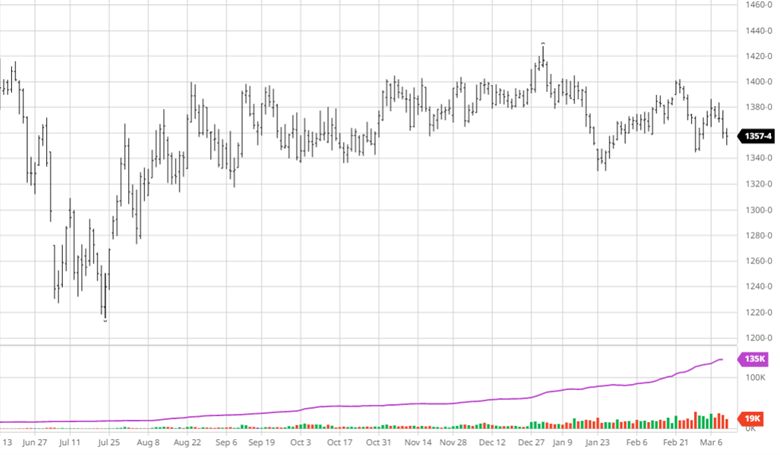

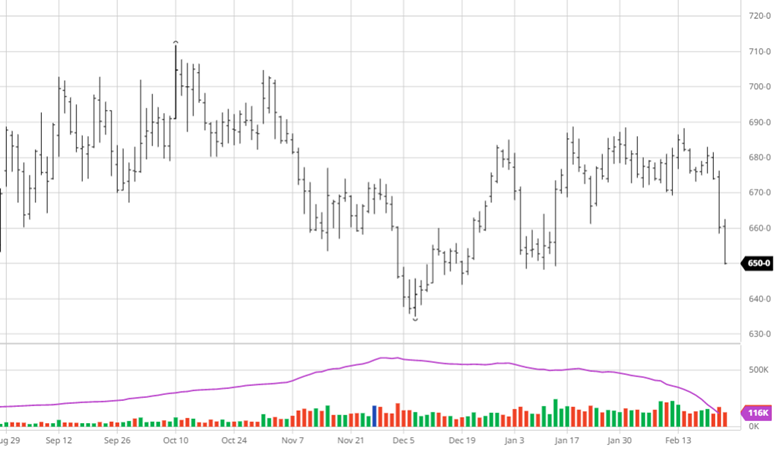

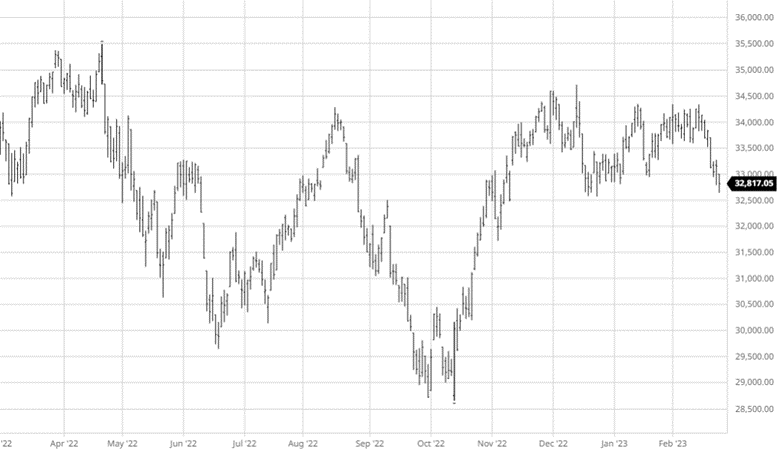

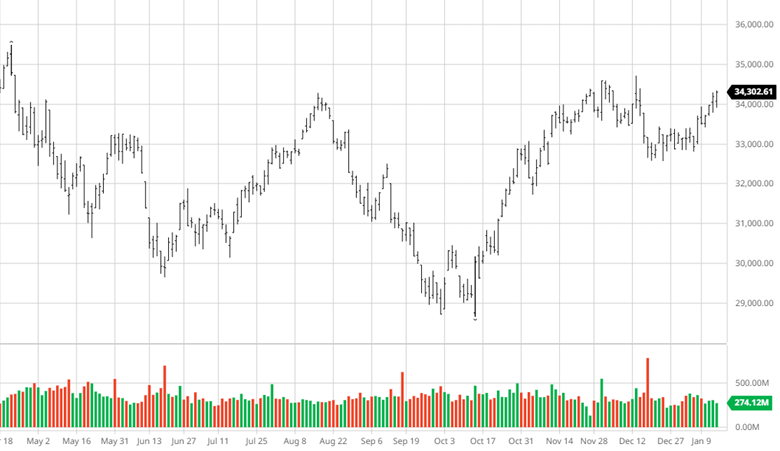

July 2023 – Wheat

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.