AG MARKET UPDATE: MARCH 31 – APRIL 12

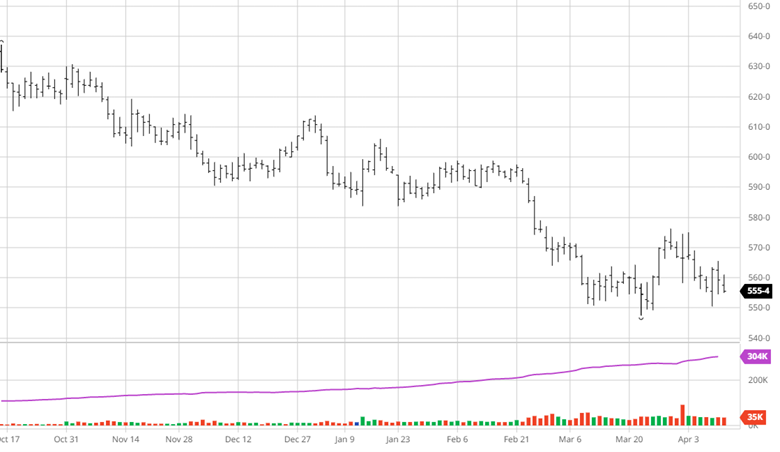

Corn has been down over the last week and half after the prospective plantings report and this week’s supply and demand report. The theme has been a lack of market moving news with little surprises in the reports. This week’s report was slightly higher than pre-report estimates for US and world ending stocks, but slightly below estimates for Argentina and Brazil’s production. The market did not react much either way to the report as the market continued to trade in its current range. Cash basis is rising and planting is rolling this week, expect this range bound trade to continue between the March 22nd low of $5.47 ½ and resistance at the 20 DMA at $5.61 until there is a catalyst to move it.

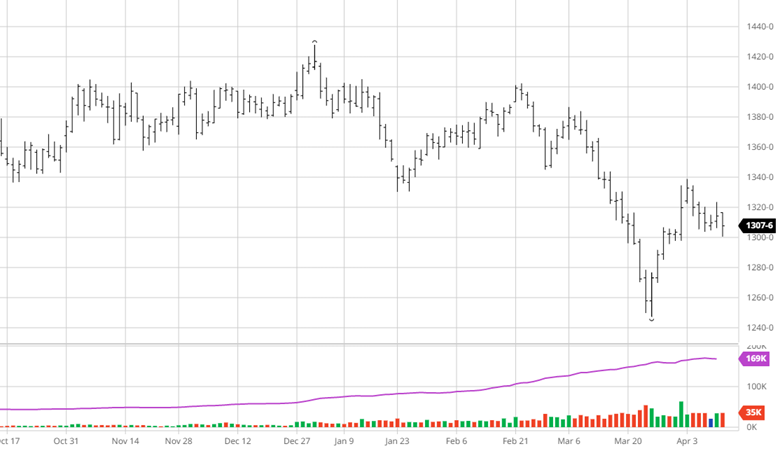

Soybeans had a similar week to corn as they traded lower off the post planting report bump. The demand for beans has picked up recently but US and world stocks came out higher than anticipated. Basis continues to improve for beans as well with South Americas crop continuing to get smaller. We continue to learn how bad the Argentine crop is with potential to be the smallest crop in the last 20 years. The recent sideways trend looks to continue for old crop as stocks remain tight with falling Brazilian prices keeping the market from moving higher.

Equity Markets

The DJIA moved higher this week while the S&P and Nasdaq sank as CPI came in .1% better than expected with year over year inflation sitting at 5%, core CPI was at 5.6%. It is still expected that the Fed will raise another 25 basis points next month, but the markets believe that will be the last rate hike this year. Q1 earnings kick off this week with several big banks, the guidance and response to the recent banking crisis will be the focus.

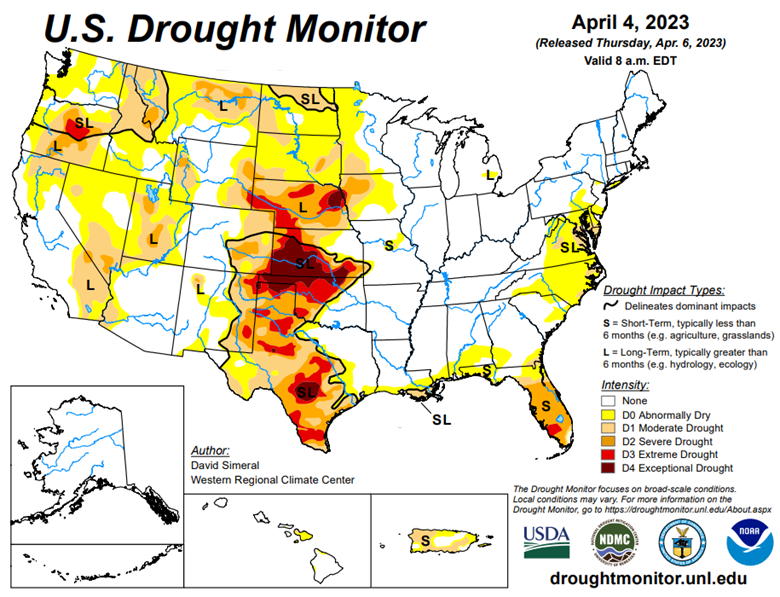

Drought Monitor

The eastern corn belt has gotten plenty of moisture, some too much, so far this winter with the western corn belt dry.

Podcast

With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].