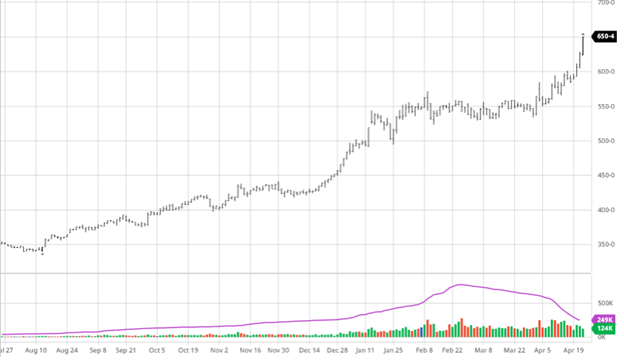

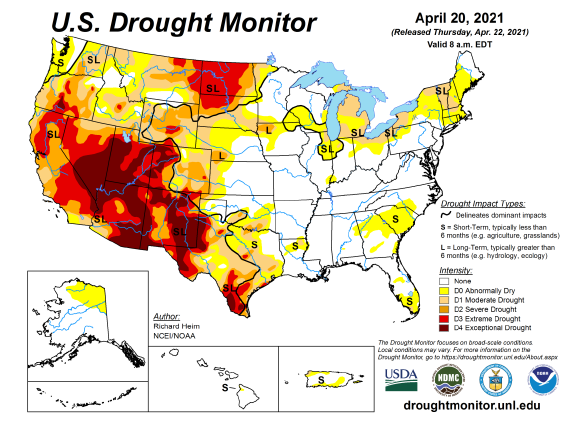

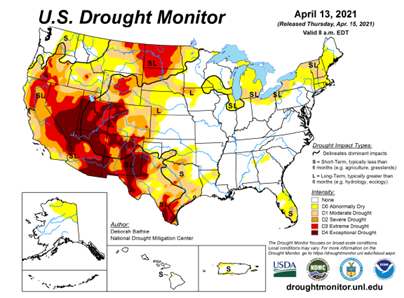

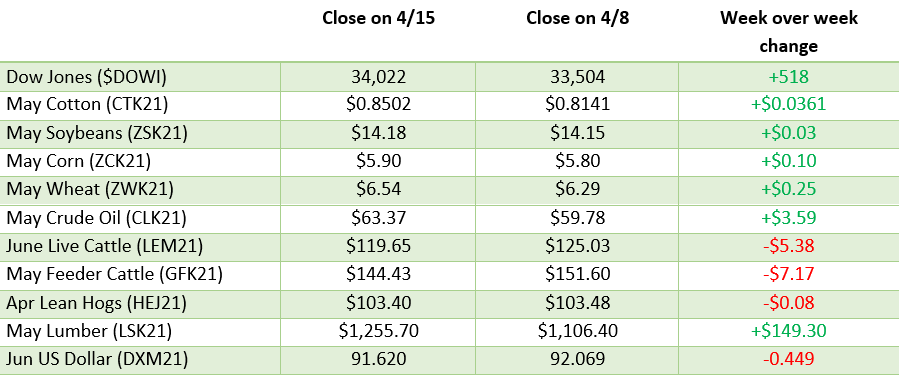

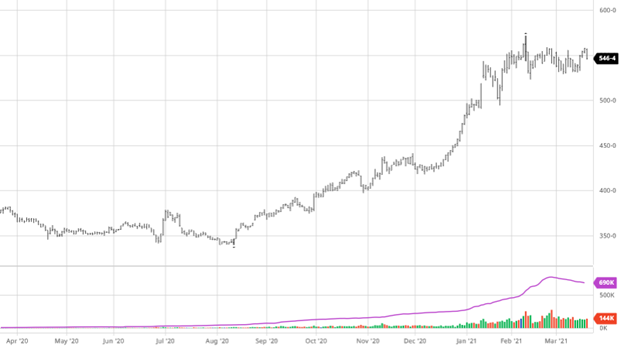

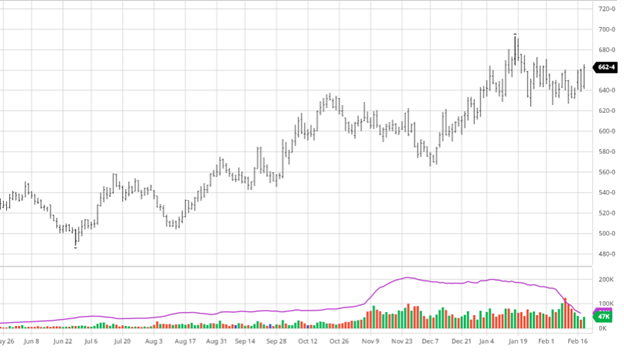

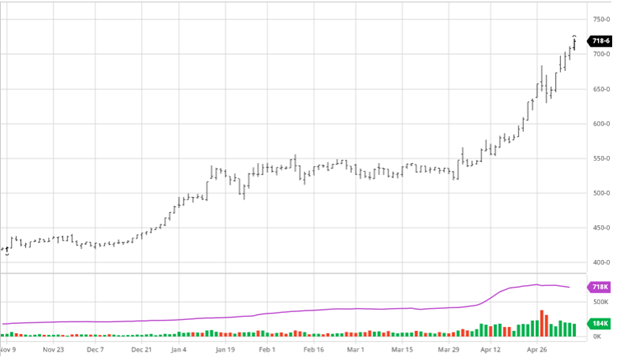

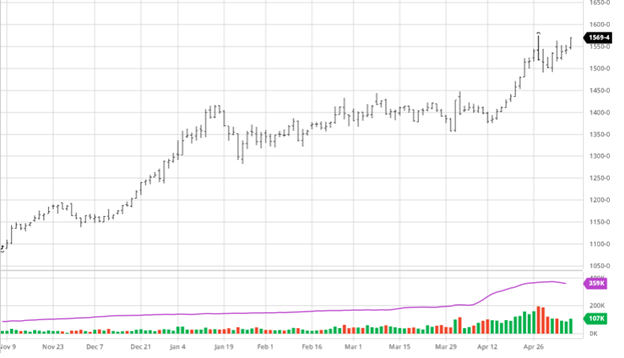

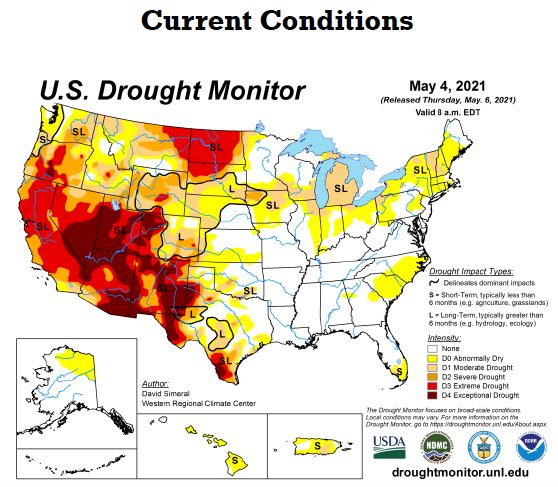

Corn continued it’s hot run this month with a great week in both old crop and new crop prices. As Brazil’s safrinha crop keeps facing a dry outlook, pressure is mounting on the US to produce a great crop to fulfill world demand. The US forecast is turning wetter for many major growing areas but remains cool for this time of year. The cool weather is not ideal for early growth, but the rain will be welcome in areas facing drought conditions (see map at bottom). There is a rumor of more Chinese interest in new crop which helped propel old crop to end the week. Despite poor exports this week, this news, along with South America’s troubles, have been the market moving news this week. The US corn crop is seen at 44% planted at the start of the week beginning May 3.

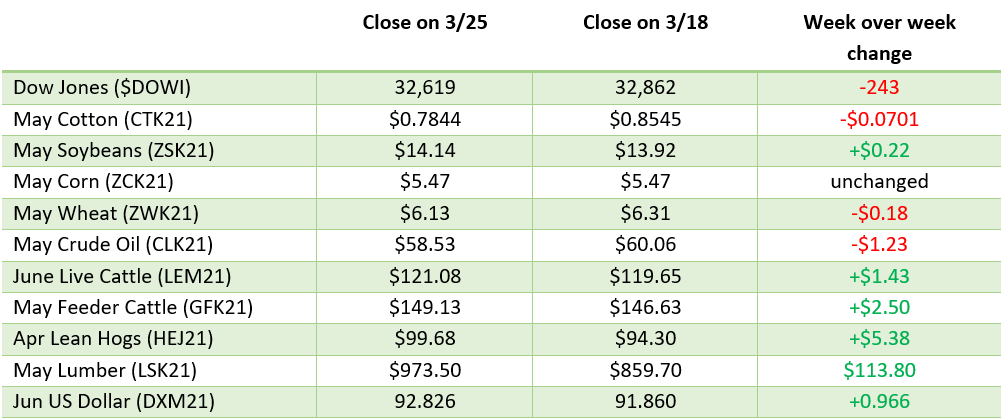

Soybeans followed Corn this week as they also saw strong gains. China’s ASF news has slowed as of late which is good for export expectations to China. The world demand has continued to be strong and helpful to prices in both South America and the US, while US beans remain competitive in the world market even at these levels. The recent wet and colder weather across much of the US is not expected to cause any issues for the soybean crop except maybe pushing planting back in some areas where farmers also must wait to plant corn. 25% of the US soybean crop is seen as being planted for the week beginning May 3.

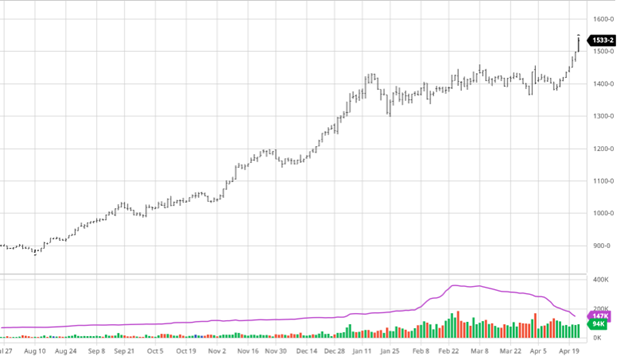

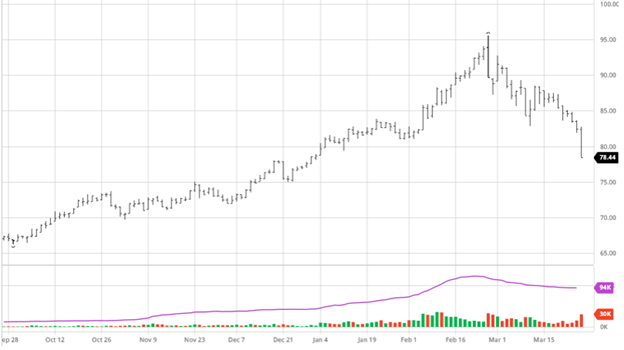

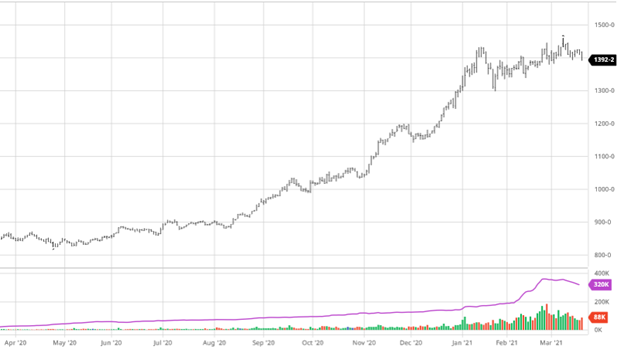

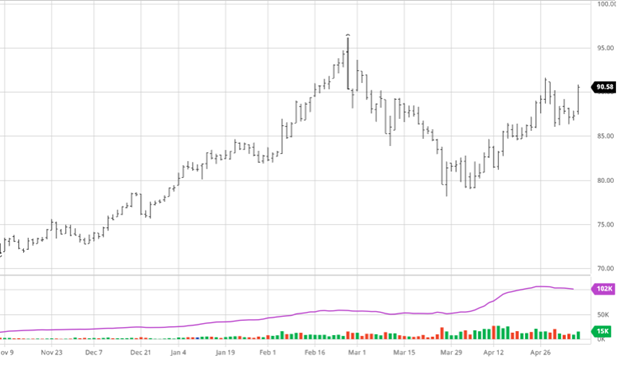

The big question right now: What is going on with cotton? Cotton has not enjoyed in the rally in 2021 that other commodities have. The demand has been there, but there are already worries about the 2021 cotton crop. Normally these are a recipe for higher prices, right? The fundamentals would agree as higher comparative prices for other commodities may take away some cotton acres by the end of planting season. The technical side has been cotton’s enemy as of late as they have not been able to make new contract highs, unlike the grains. The world shipping bottleneck does not appear to be getting any better and as the US continues to come out of lockdowns along with other countries demand will only make it worse. This problem needs to be solved sooner rather than later.

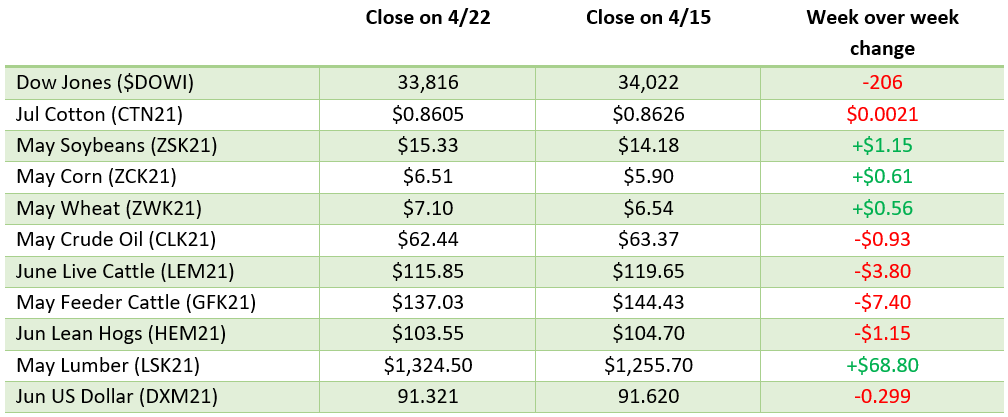

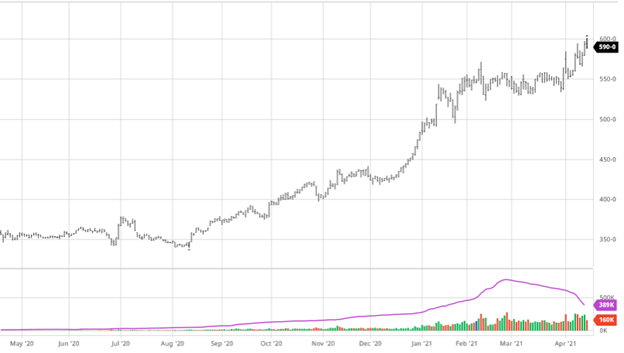

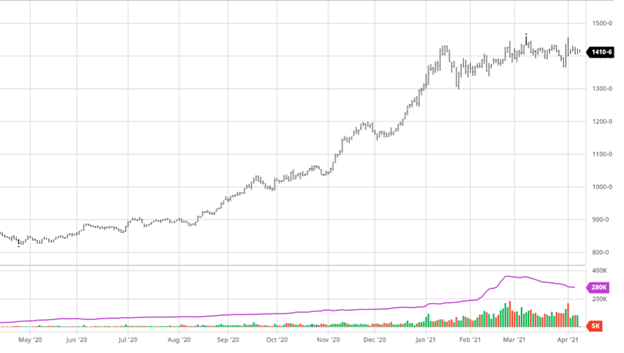

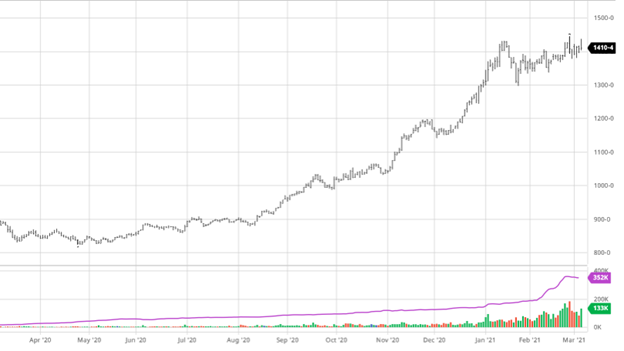

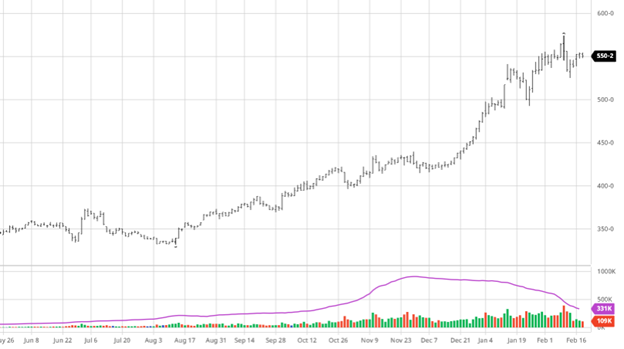

Dow Jones

The Dow was up this week while other indexes were mixed with the Nasdaq and Russel falling. As earnings continue to be reported many of the winners of the last year have posted strong quarters but it appears the momentum behind them have slowed as good earnings have sometimes been followed by selling.

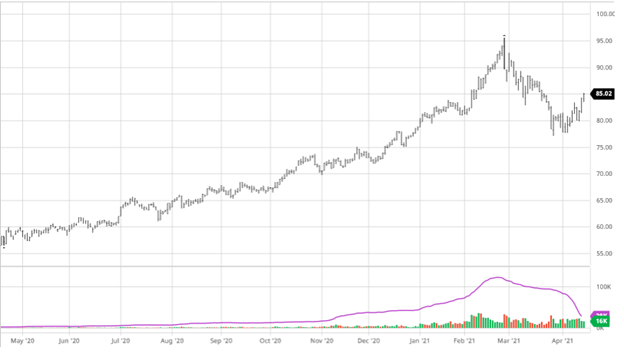

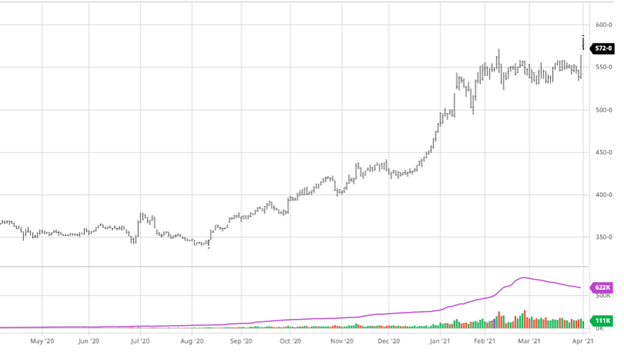

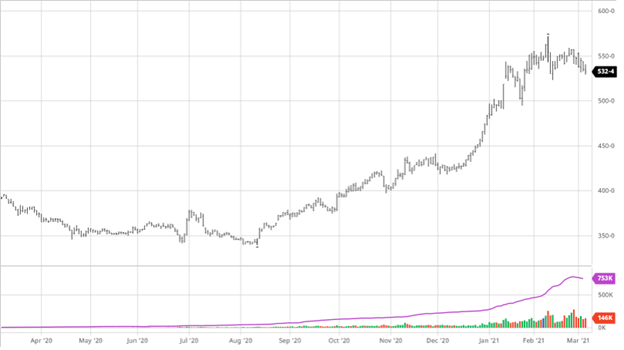

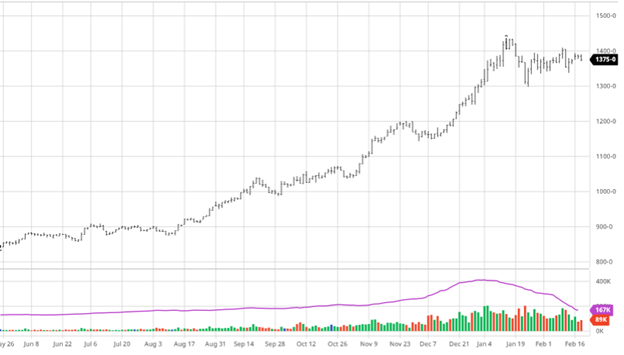

Lumber

Check out our recent post about the lumber market and what all has been going on.

Podcast

Check out or recent podcasts with guests Elaine Kub and Kyle Little. Elaine and Jeff discuss grain markets and trading grains while Kyle helps give insight into the Lumber markets and what has been going on.

Listen with Kyle:

Listen now with Elaine

CME

CME Group announced this week that it will not re-open its trading pits that were closed last March at the start of the pandemic. The Eurodollar Options pit will remain open. See the full press release here.

US Drought Monitor

The map below shows the current drought conditions throughout the US as planting continues across the country.

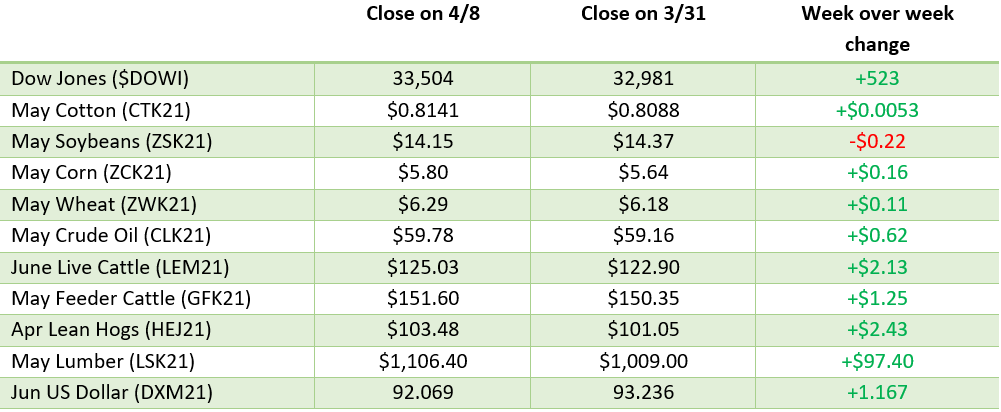

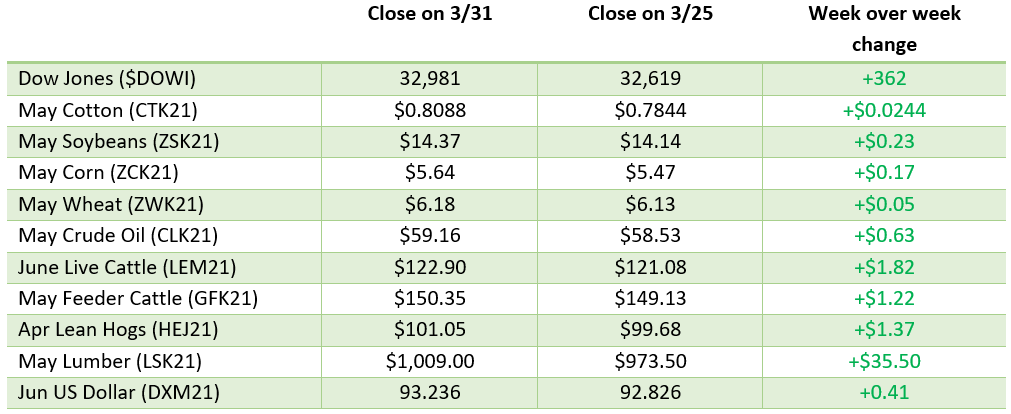

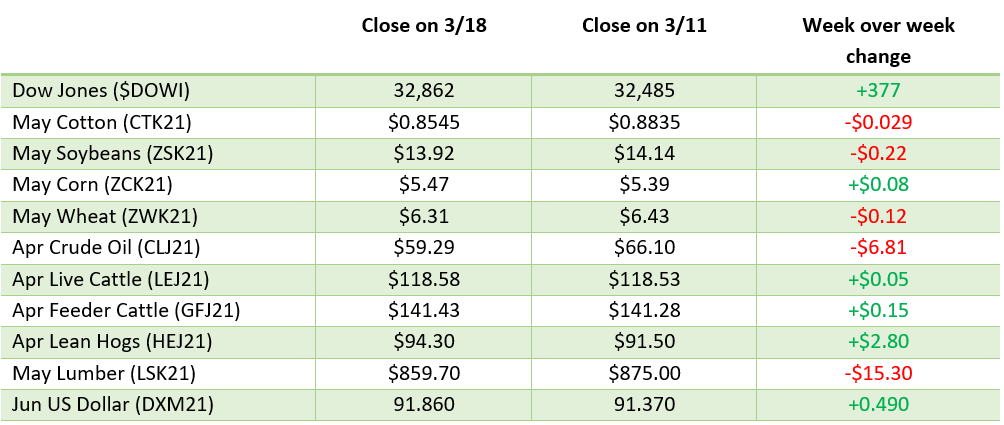

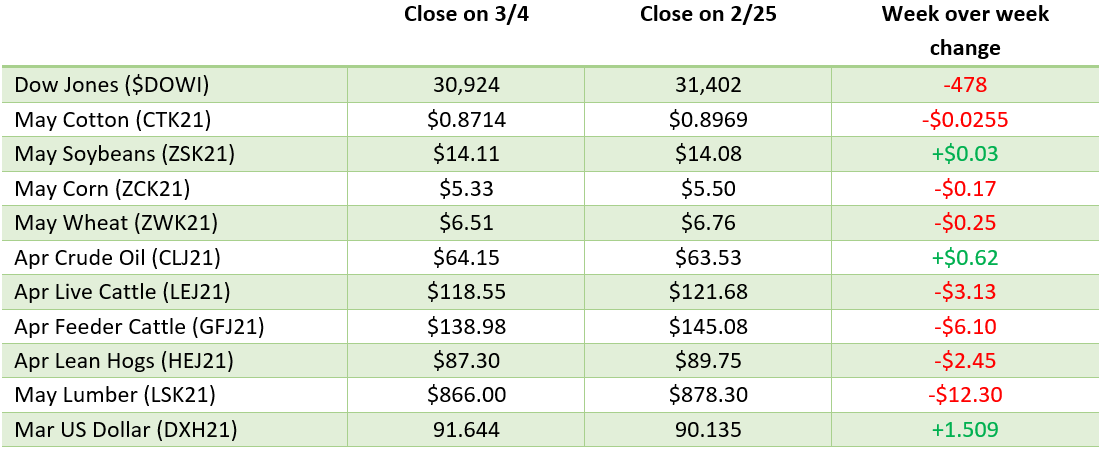

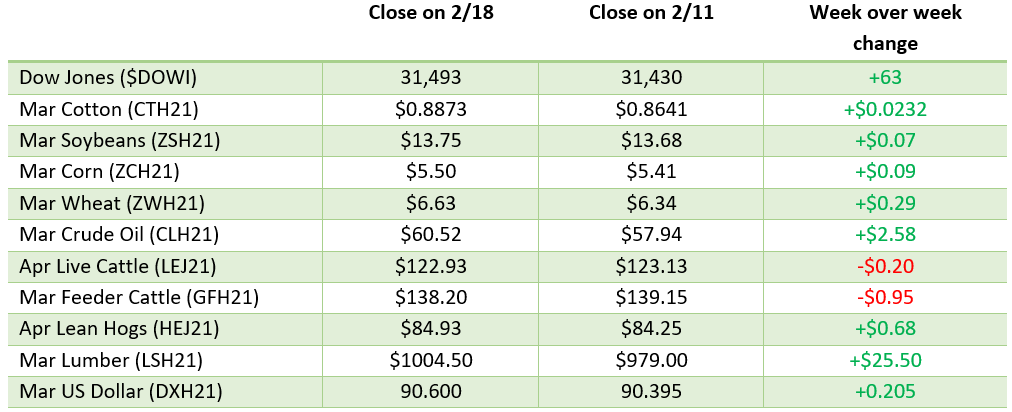

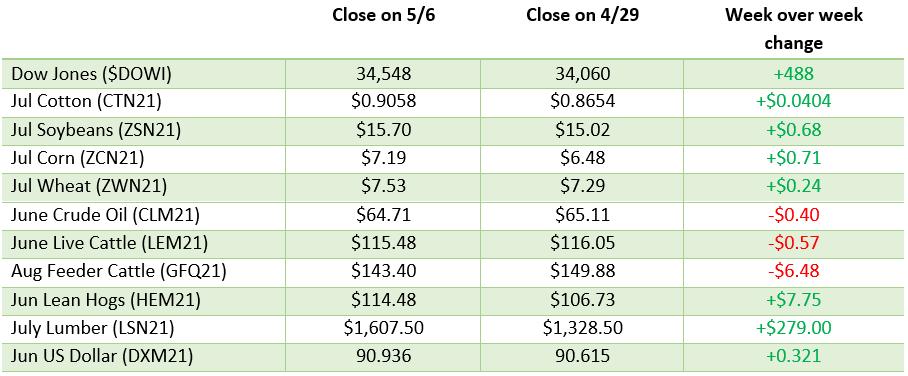

Weekly Prices

Via Barchart.com