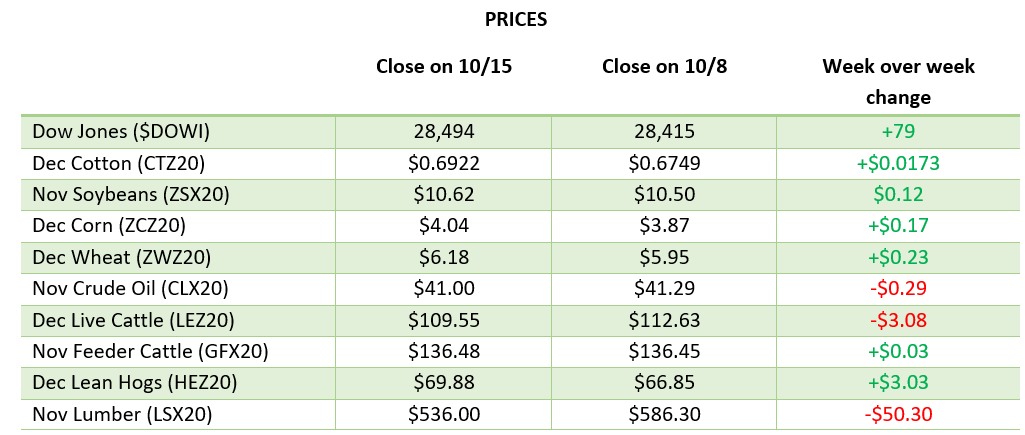

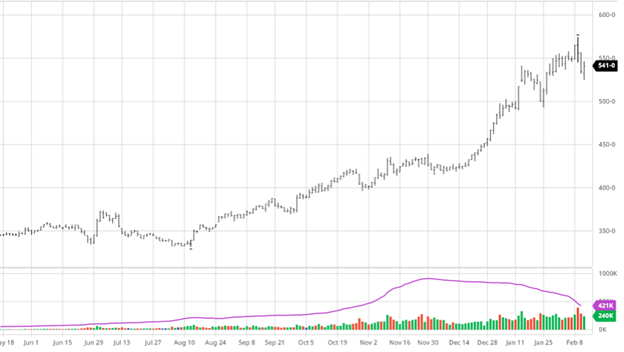

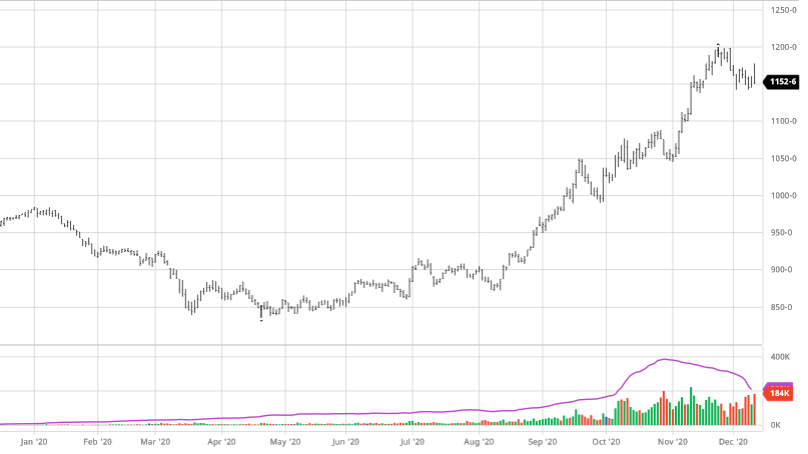

Corn was down a little on the week as there was not much news on either side. The USDA report came with a mixed bag of information as corn had minimal loses after it. The US corn stocks came in 11 MBU above estimates, but world numbers came in 12 MBU below making that news mostly a wash. They did not touch many numbers but did raise Chinese imports or corn by 16.5 mmt. Many experts still see 16.5 mmt on the lower end of imports and will probably end up being higher. Corn does not have quite the bullish news behind it of beans, but a sharp up move in beans will bring corn with it. Continue to keep an eye on exports to China and South American weather.

Via Barchart

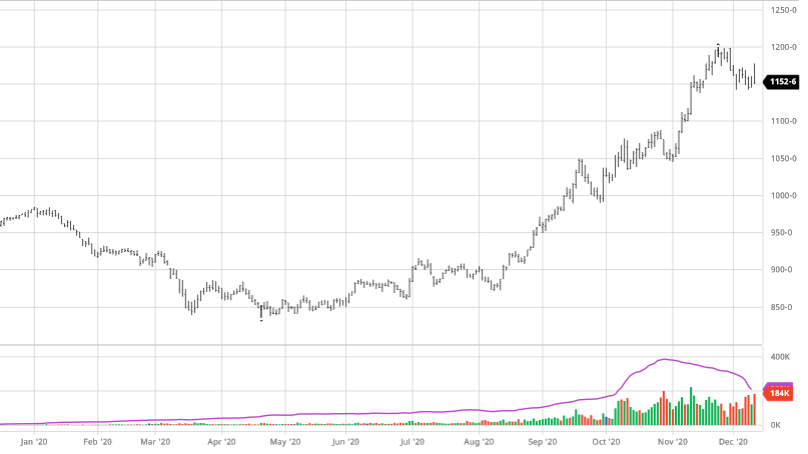

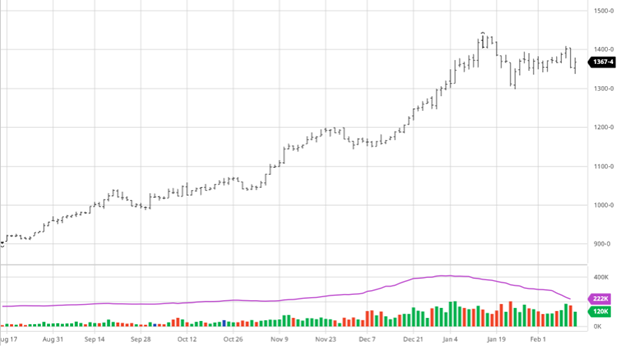

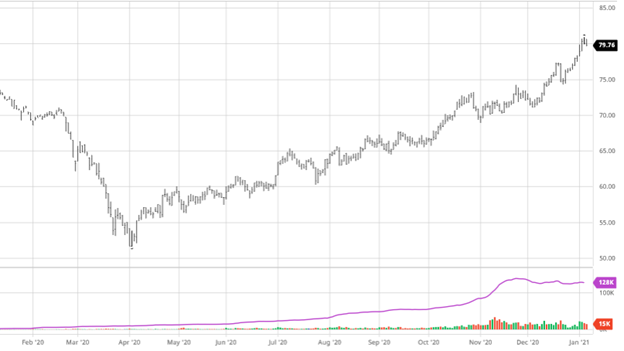

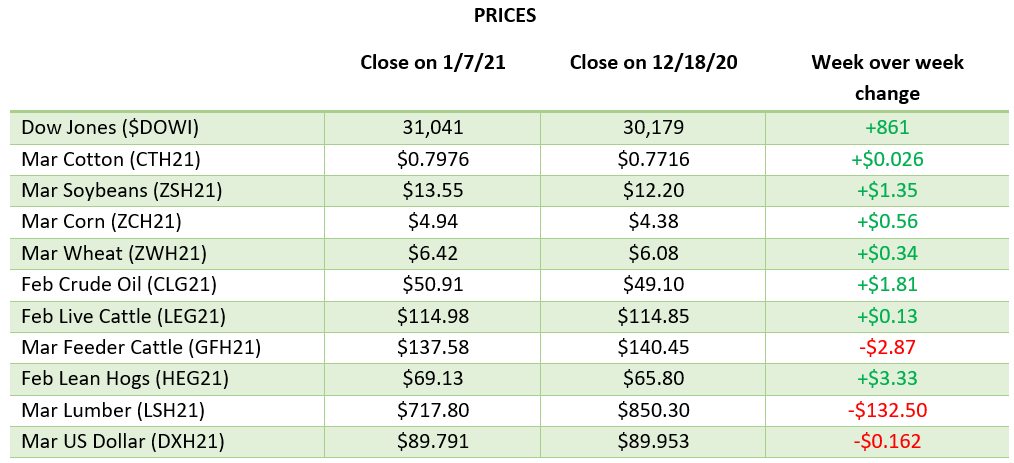

The USDA report for soybeans came as a mixed bag of news. The US ending stocks came in higher than expected but still lower than the Nov report (190 MBU in Nov vs 175 MBU Thurs vs 168 mil bu expected). Thursday saw a wide range of trading from 18 higher to 8 lower as you can see in the chart below, and settled down a few cents post report. The main focus will now shift to world demand and South American weather as we head towards the end of 2020. In a La Nina year, drought conditions and warm temperatures can cause issues although recently SA weather has gotten some relief. Any surprise sales will be welcome news as well to push prices higher, but if South America has a production problem that will be the biggest market mover going forward until the January USDA report. Many experts are still bullish bean prices heading into 2021. We stand on our suggestion of not storing beans into the 2021 planting season to take advantage of great prices and potentially look at re-ownership strategies if it fits your risk profile as we look ahead to 2021.

Via Barchart

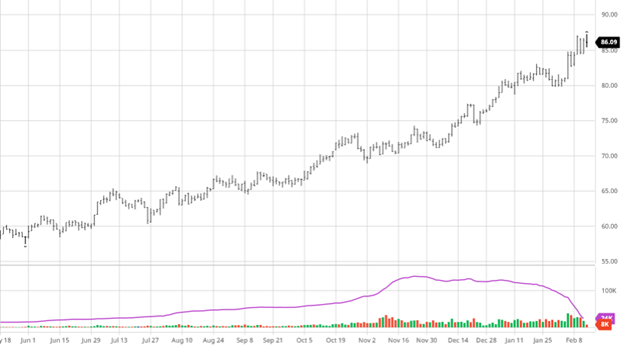

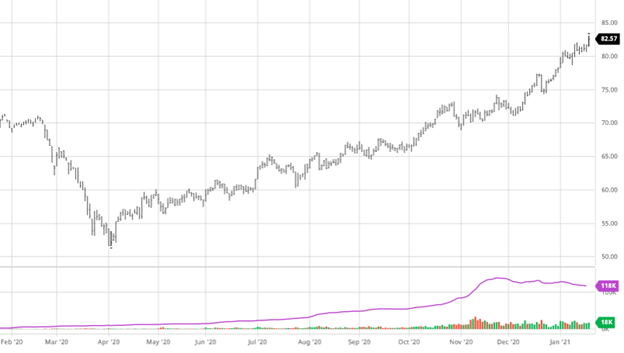

Cotton had a good week boosted on Thursday by the USDA report which provided some bullish news for cotton prices. It lowered production by 1.1 million bales (900,000 bales of which came from a reduction in Texas). Mill use was unchanged, but they raised exports 400,000 bales to 15 million as world consumption and US exports rise. Ending stocks were also 1.5 million bales lower to 5.7 million (or 33% of use). The USDA also lowered world ending stocks by 3.9 million bales expecting lower production and higher consumption. The 2.2 million bale decline in global production comes from the US reduction as well as 1 million bale reduction between India and Pakistan. China is also expected to import more cotton than the previous report. All of these are bullish news for cotton as well as continued drought conditions in west Texas that could cause problems come the spring if the conditions continue for too long. Another bullish factor looking to 2021 crop is with bean and corn prices where they are and cotton prices still trailing we could see acres used for cotton switch to beans or corn in areas where the soil allows. There is still a pandemic raging throughout the world with a second wave in full effect so consumption in the near future may be holding cotton prices back.

Via Barchart

Wheat had solid gains this week on Wednesday and Thursday after falling the previous trading days. The USDA report provided some bullish news with smaller supplies, higher exports, and lower ending stocks with no change to the domestic use. The 20/21 global wheat outlook is for larger supplies, increased consumption, higher exports, and reduced stocks. This probably comes on the heels of vaccines rolling out hopefully easing lockdowns as life gets back to normal throughout 2021.

Via Barchart

Dow Jones

The Dow has traded up and down over the last week making small gains as the market seems to have priced in the COVID vaccine being rolled out in the next week after FDA approval (hopefully) in the coming days. The approval of the vaccine and Operation Warp Speed going into effect could help support this runup of stocks into the new year, however, if Congress can’t get a stimulus bill together, we could see another pullback. There are still many questions about what a Biden presidency will look like for taxes and regulations coming to Wall Street at the start of 2021 as well.

Water Futures

The CME began trading water futures on Monday as yet another way for farmers to hedge their production if they use irrigation. Water will not require any physical delivery like other futures contracts. This will allow farmers to hedge against water scarcity or shortages that could hurt their crop. Read the entire article here.

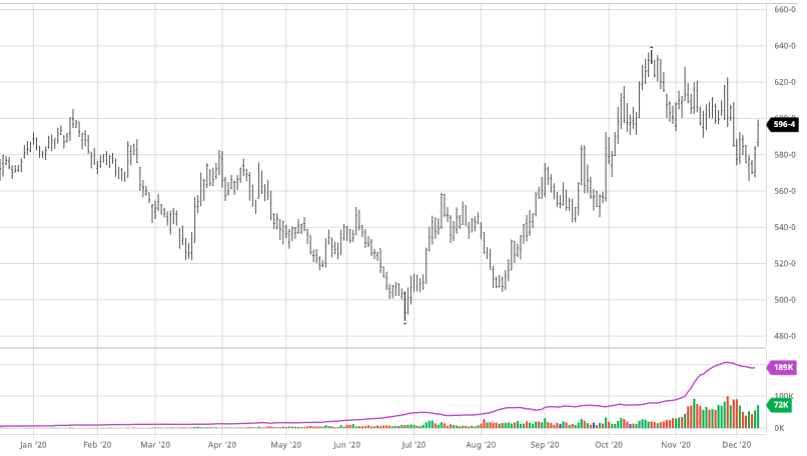

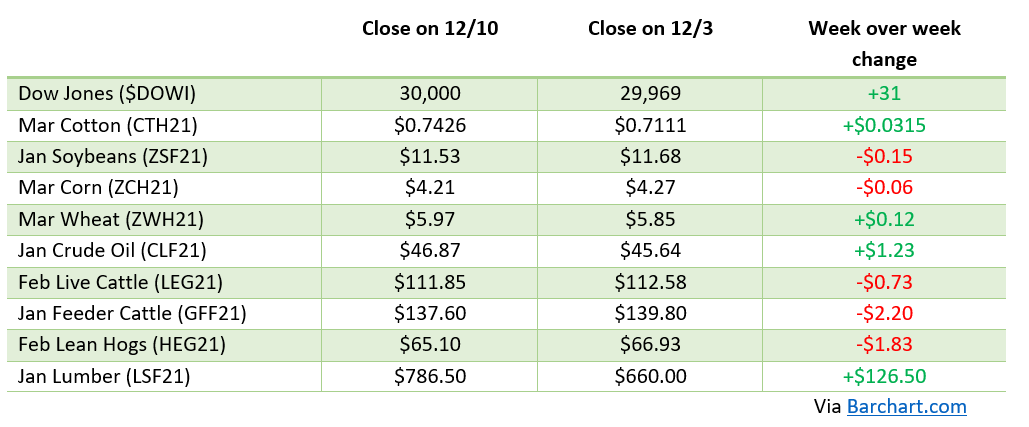

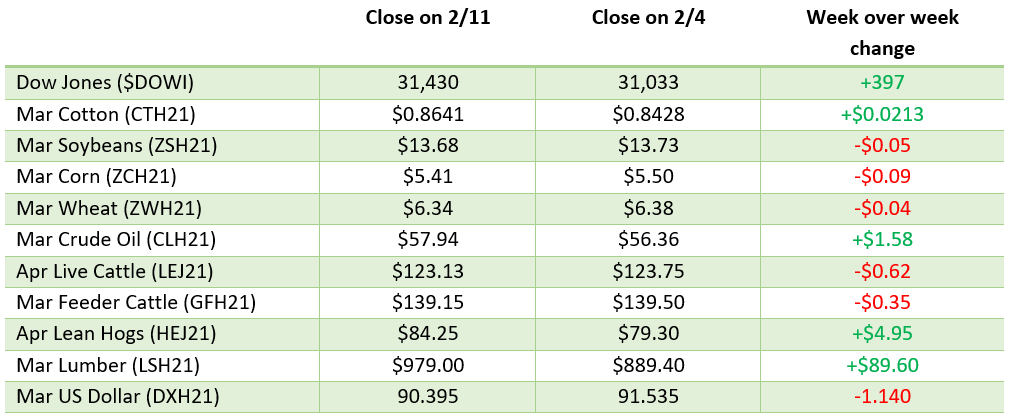

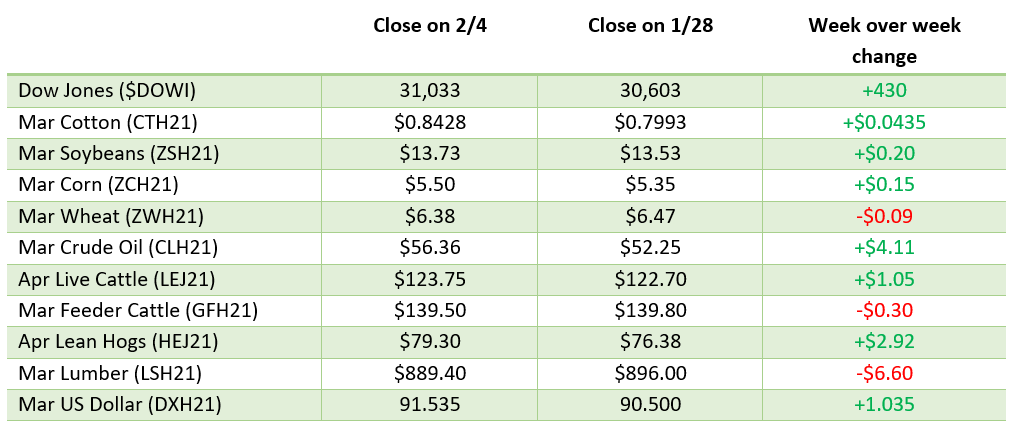

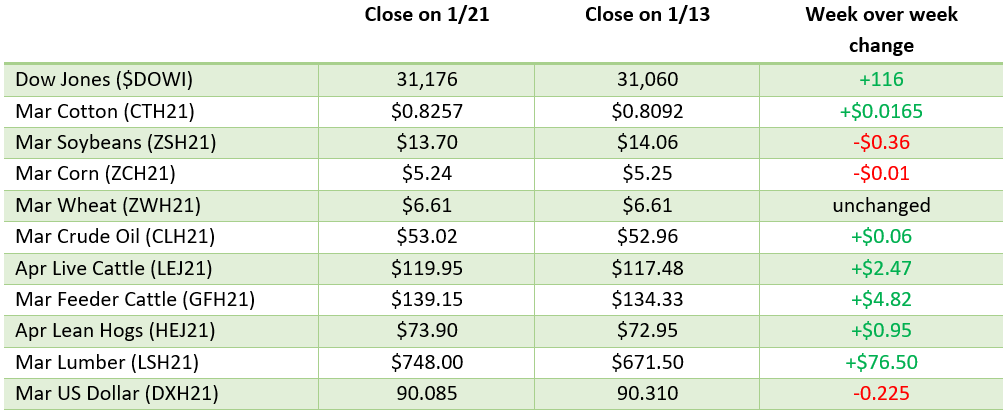

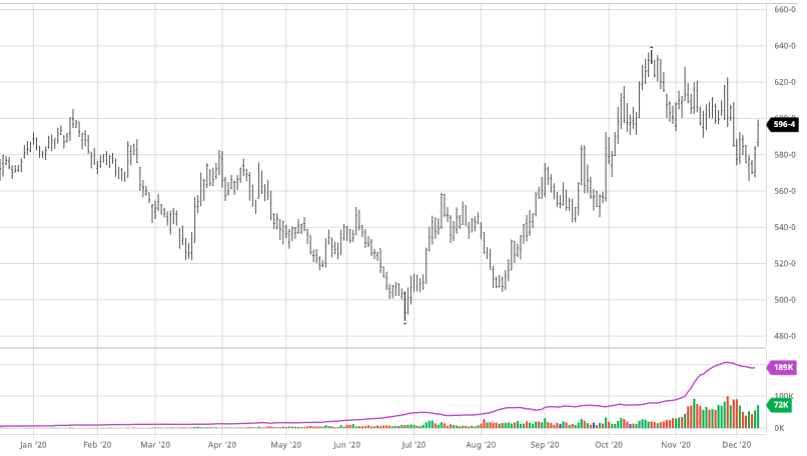

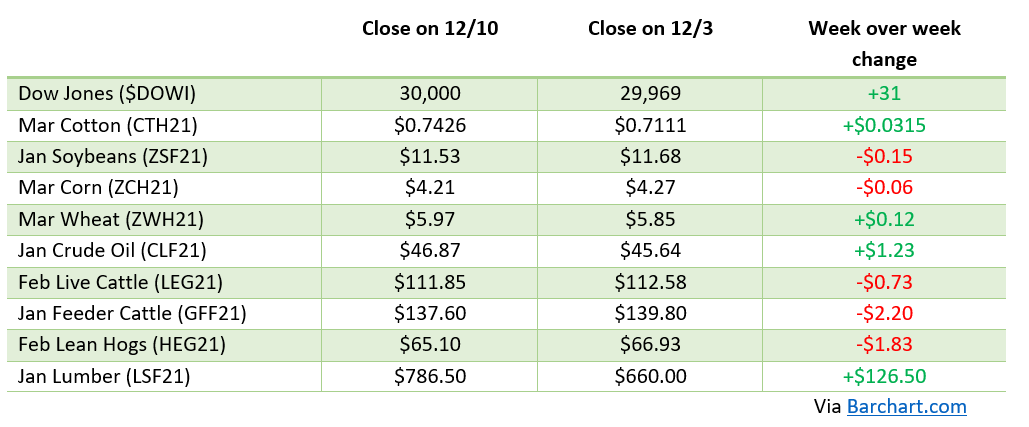

Weekly Prices

,

,

,

,