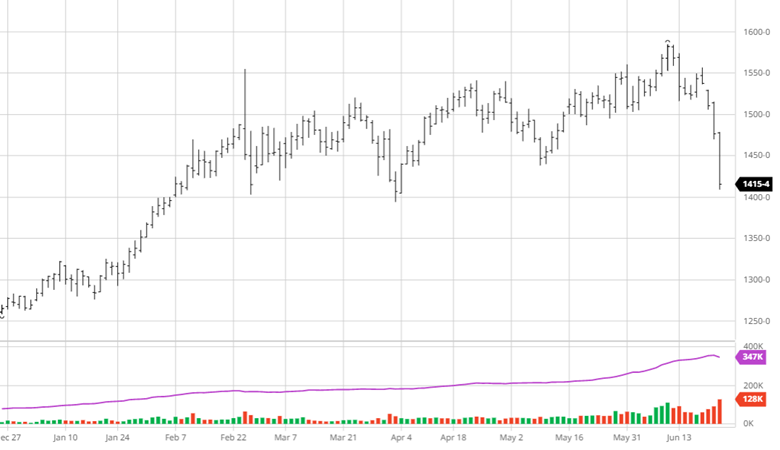

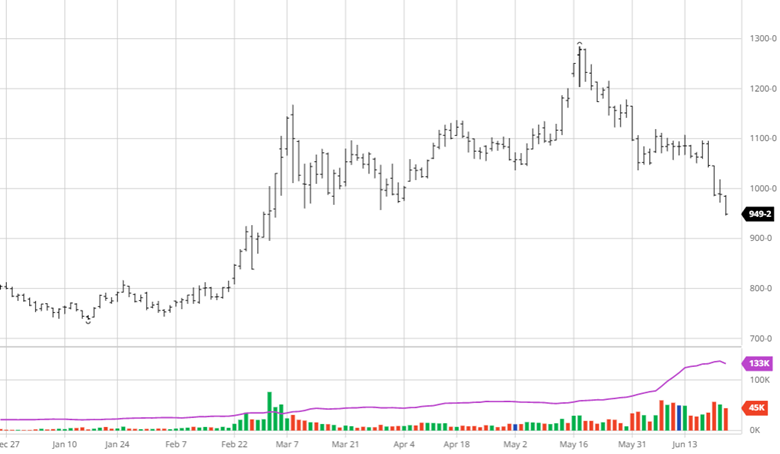

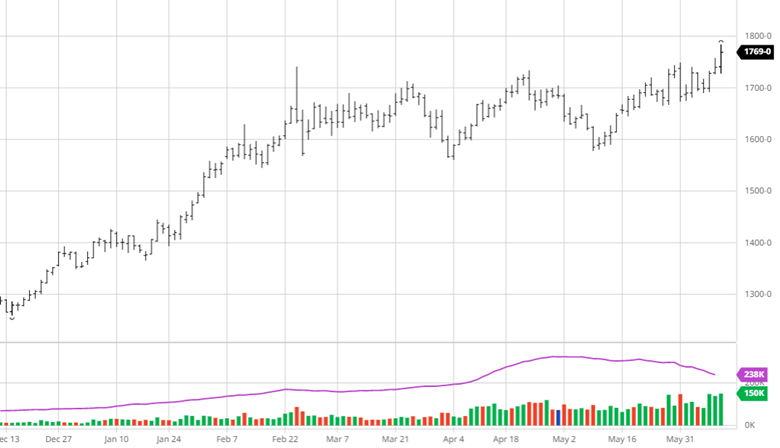

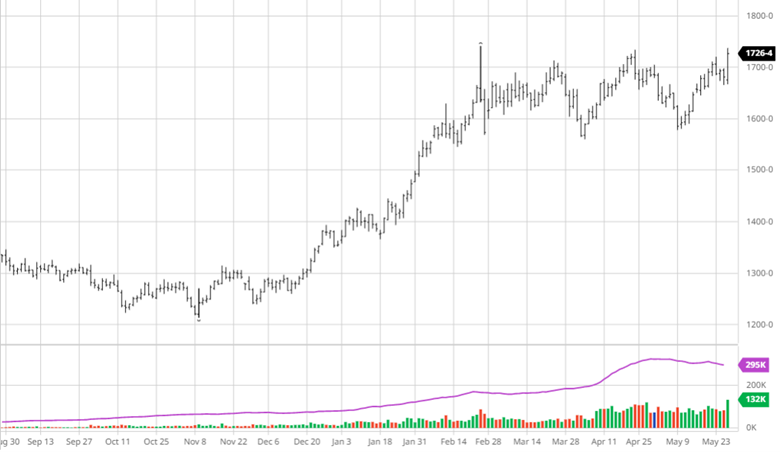

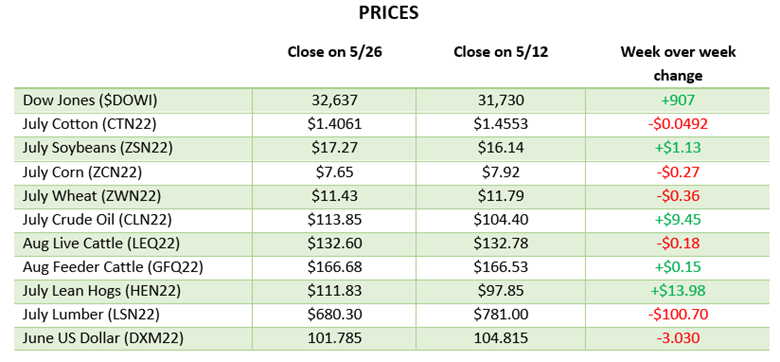

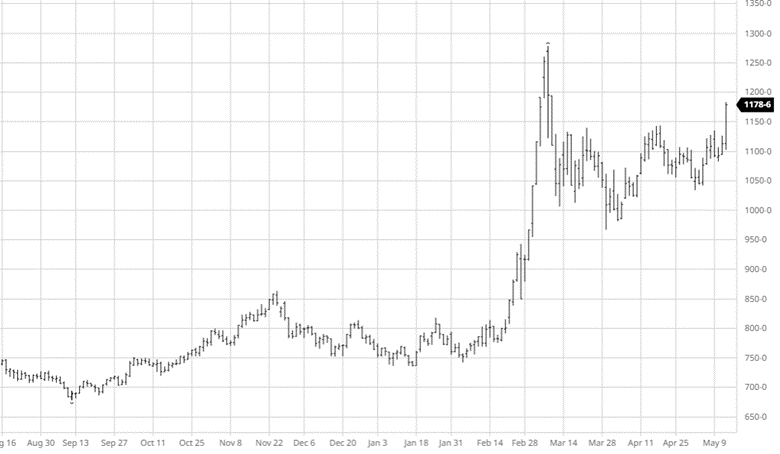

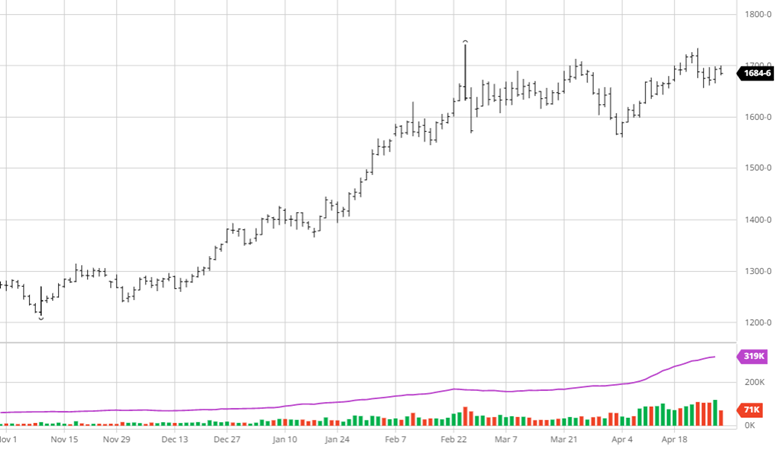

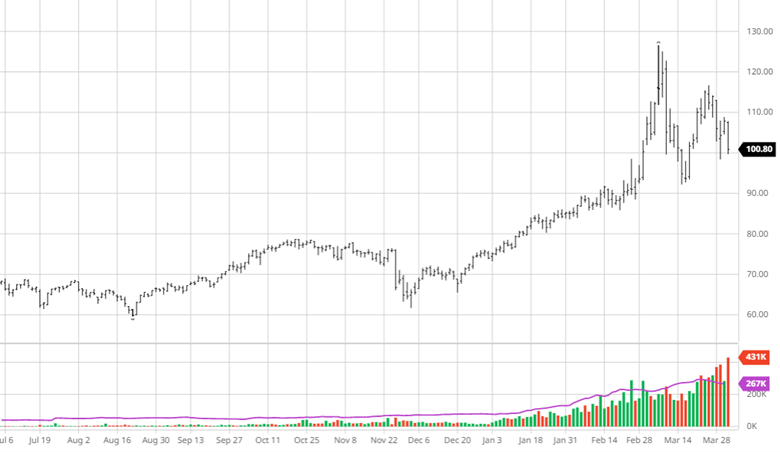

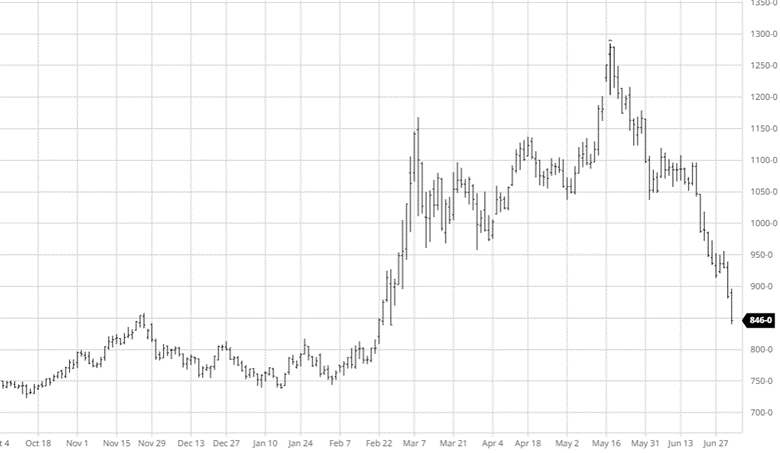

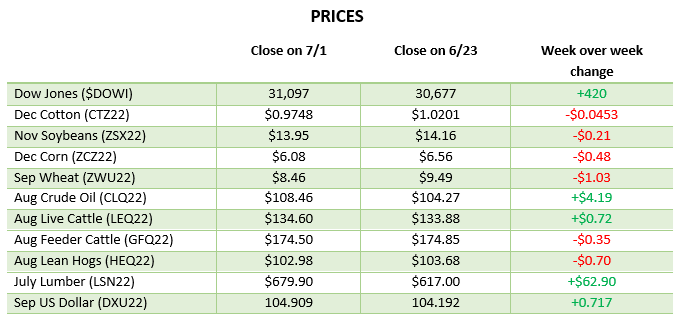

Corn reacted negatively to the Stocks and Acreage report this week despite there not being any surprises and the numbers coming out close to pre-report estimates. Planted acres came in at 89.921 million acres (89.861 million estimate) and June 1 stocks were 4.346 billion bushels (4.343 billion estimate). The bearish news is improving weather after the 4th of July with rains expected across most of the corn belt. The concern over the wet spring causing prevent plant acres in ND and MN does not appear to have come to fruition with high prices motivating farmers to get the crop in the ground. Trading resumes Tuesday morning after the long weekend so any change in weather or world news could lead to a volatile opening after another kick in the teeth on Friday.

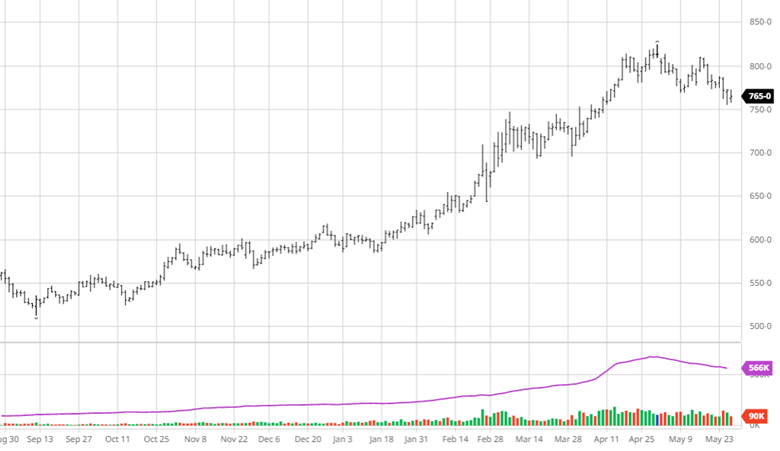

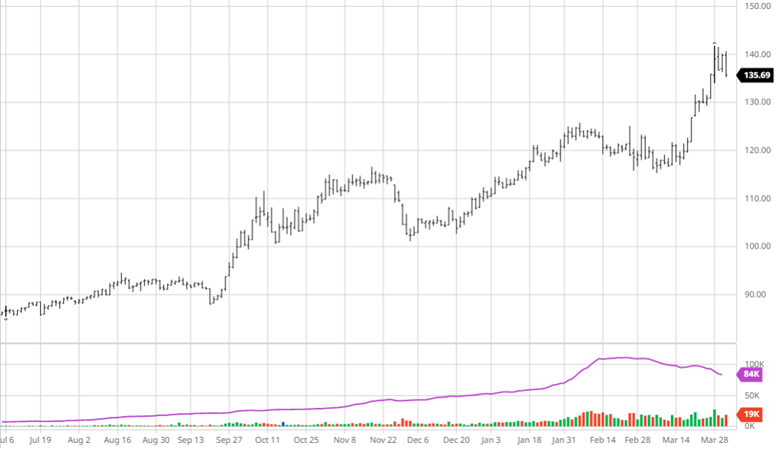

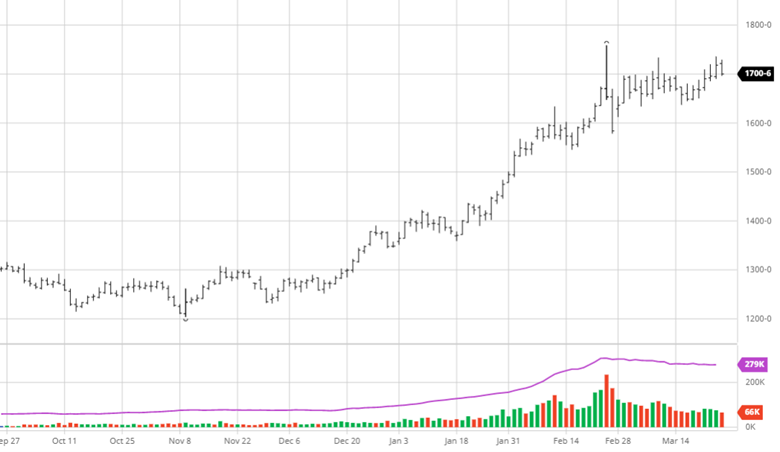

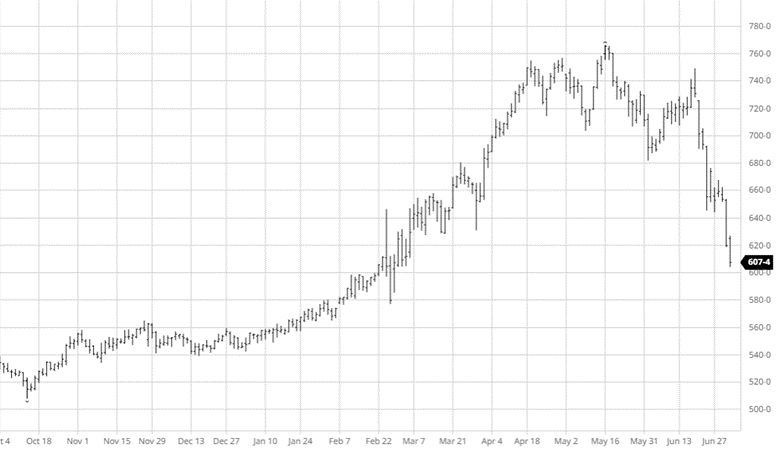

Soybeans had a good week making solid gains before dipping after the report and then getting crushed today (Friday). The bean planted acres was 88.325 million acres (90.446 million estimate) and June 1 stocks was 971 million bushels (965 estimate). The acres number was surprising as it came in 2.121 million acres below pre-report estimates. While the favorable weather for corn is also favorable to beans, they have a different story than corn to follow. Chinese demand needs to return to the market but 2+ million acres of production is a lot to be off by. The inability for Soybeans to break out higher following the report shows that they still have a fight ahead of them and that outside market risks likely have an impact on prices. Friday’s trade hit beans hard and the long weekend holds uncertainties.

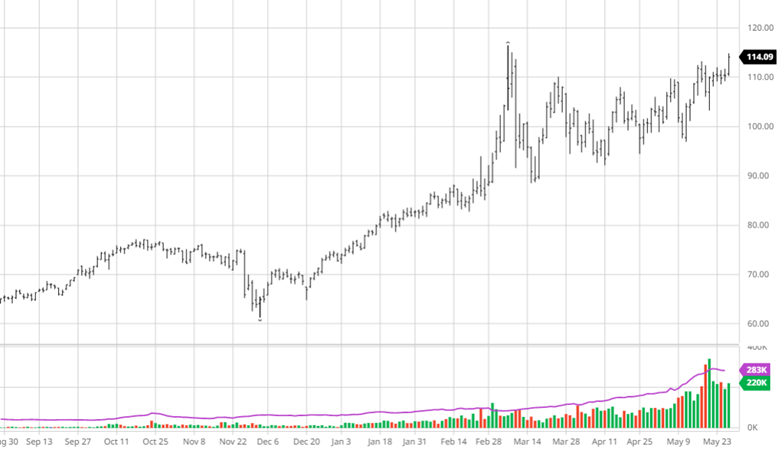

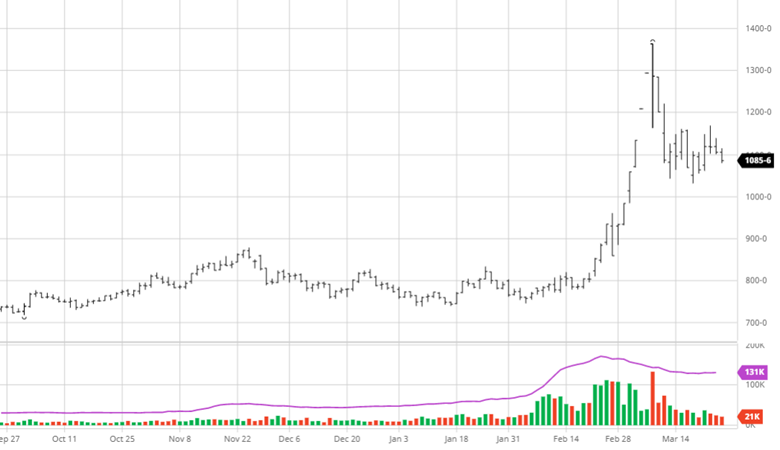

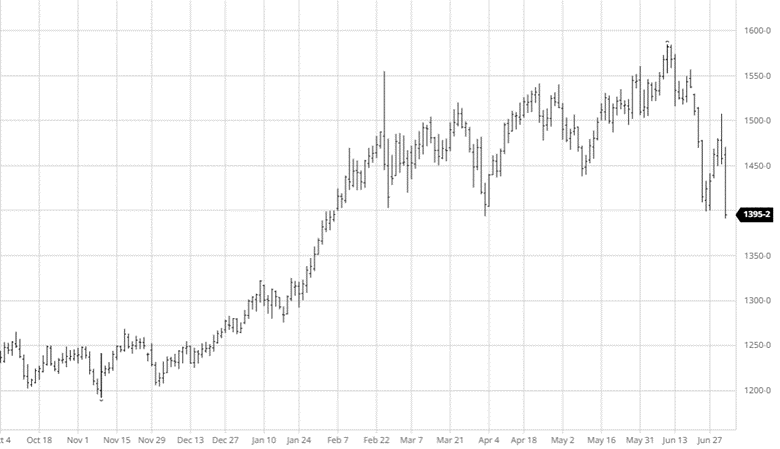

Wheat moved lower on the week pre-report and continued lower after it with no surprises only to get crushed on Friday. All wheat planted acres were 47.092 million acres (47.017 million estimate) and 660 million bushels in June 1st stocks (655 million estimate). After a tough Friday, wheat has plenty of non US weather related news to follow and any developments over the 4th of July weekend will be seen on Tuesday.

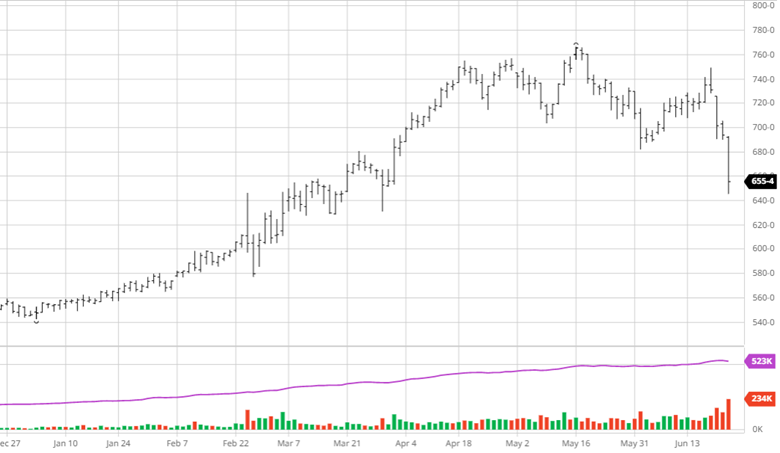

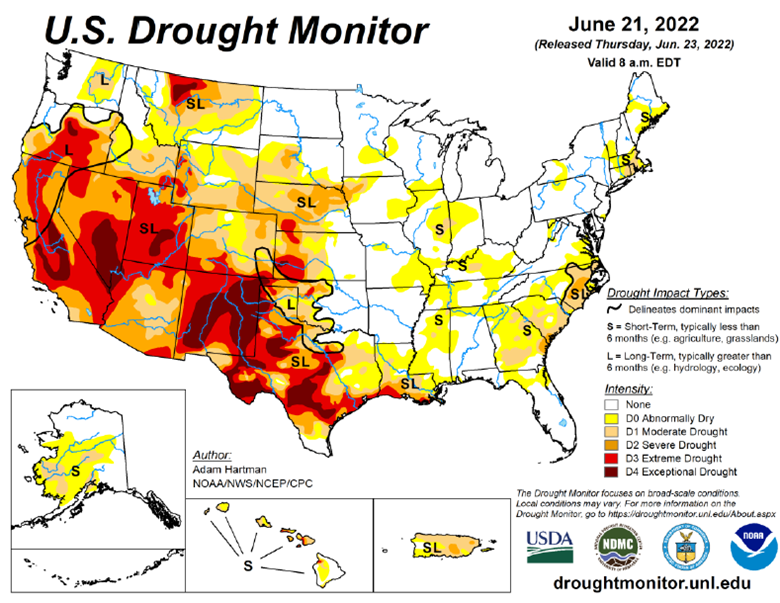

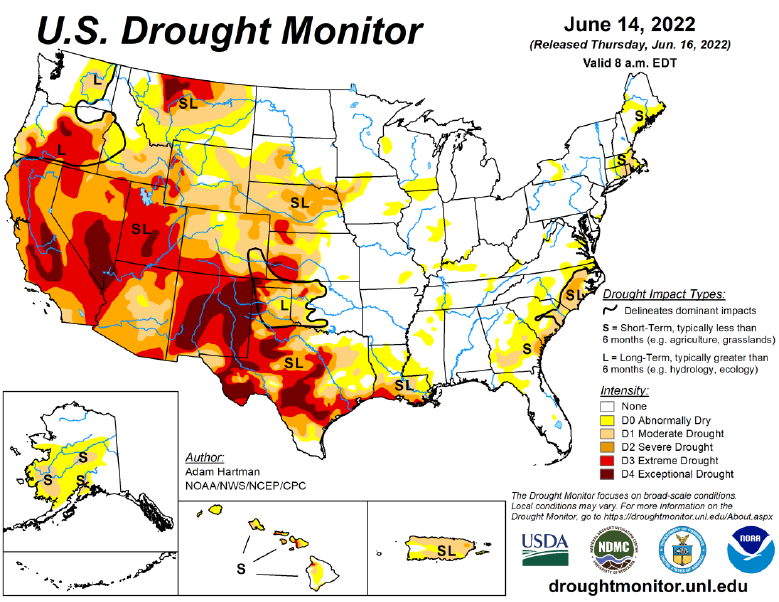

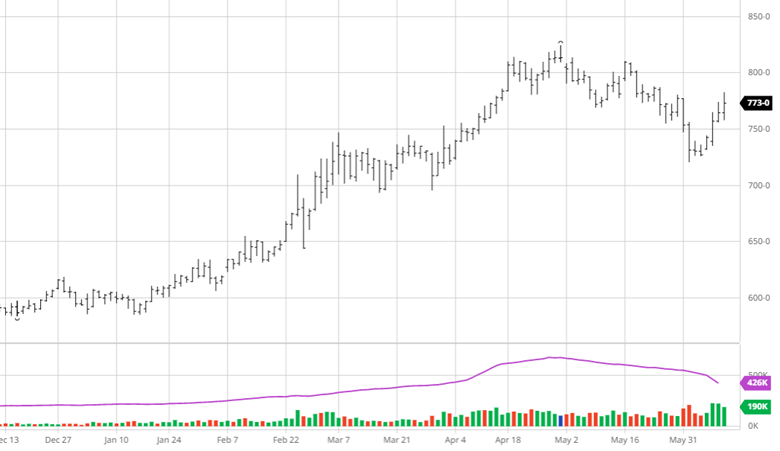

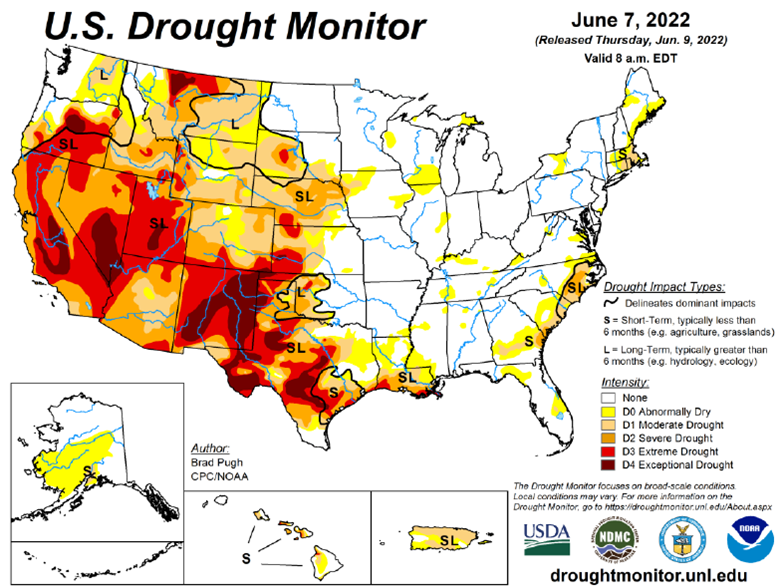

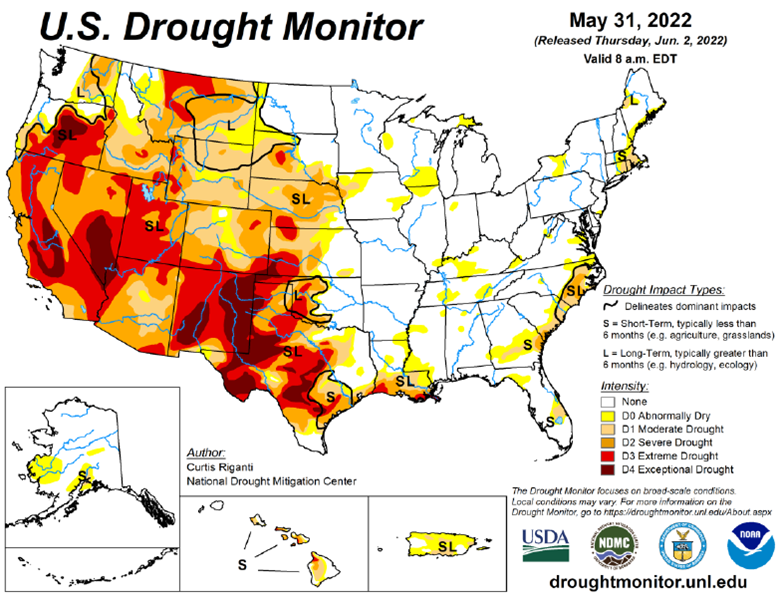

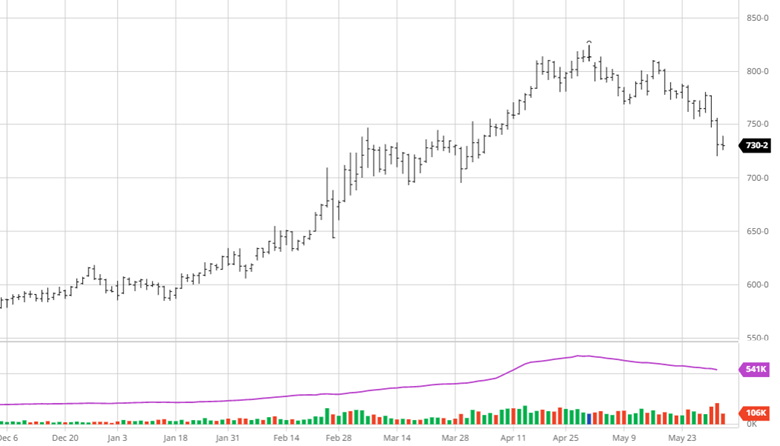

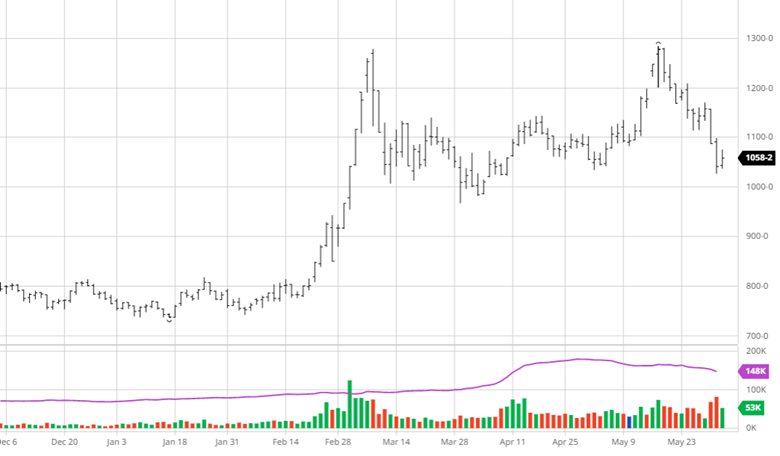

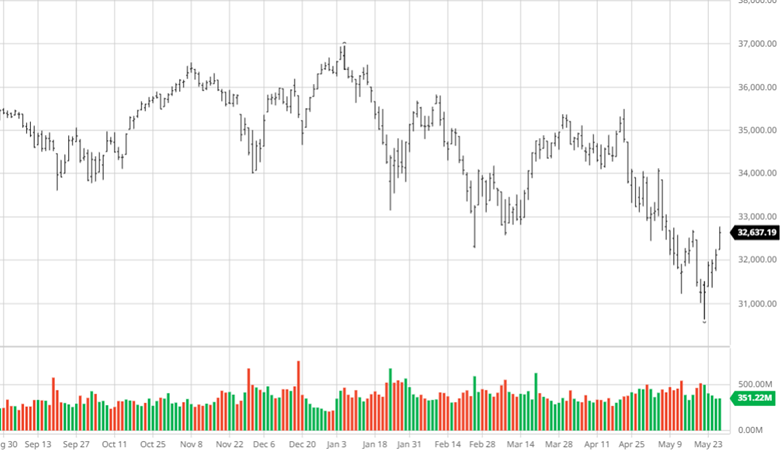

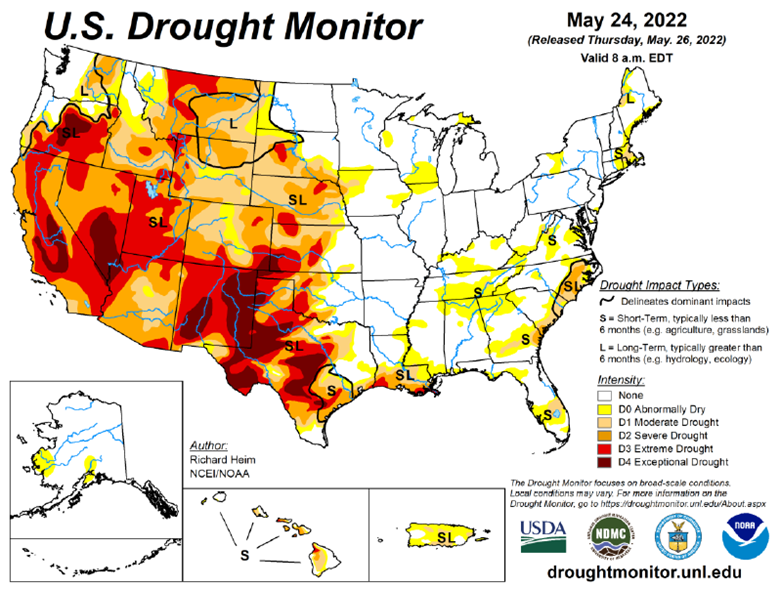

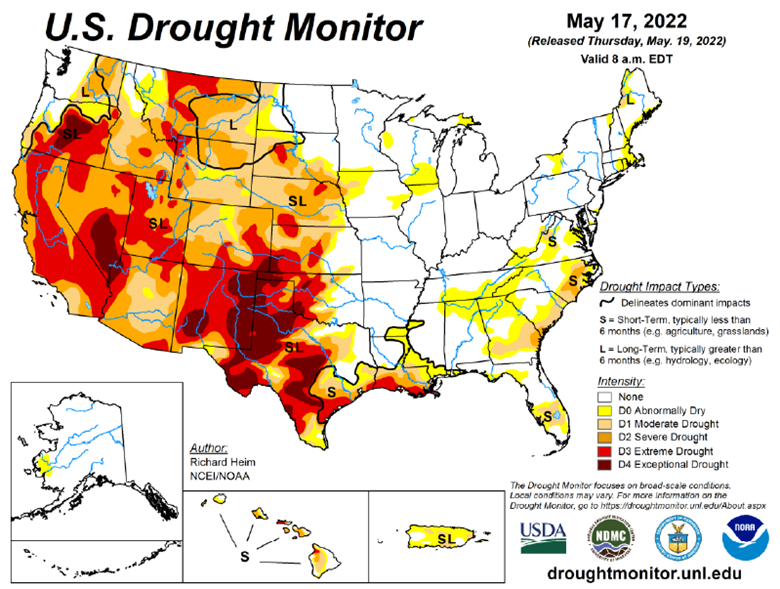

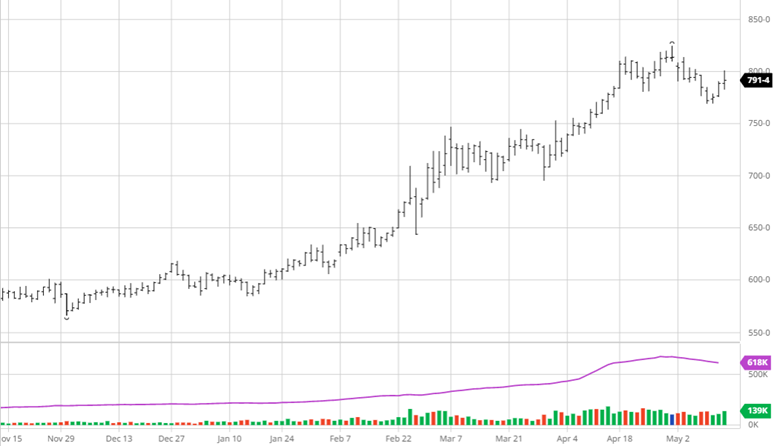

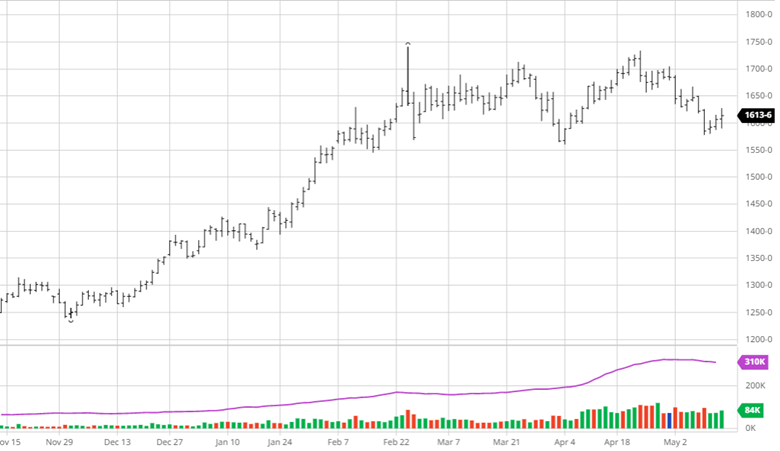

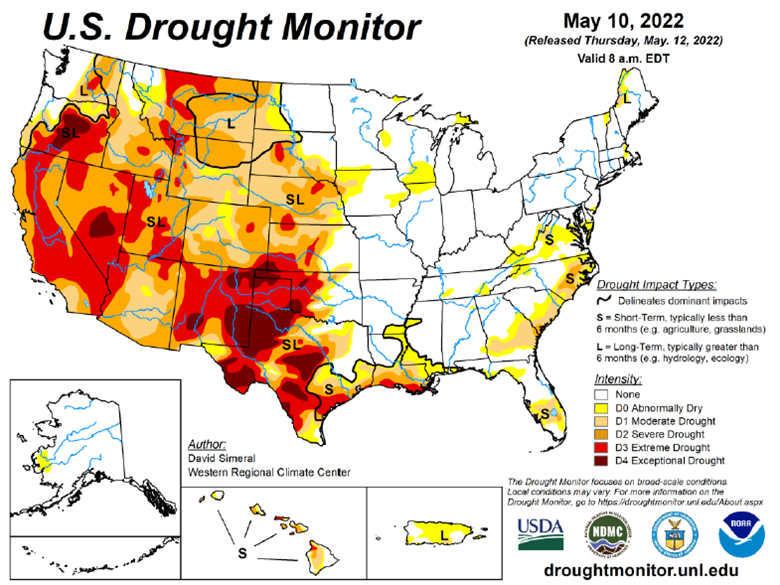

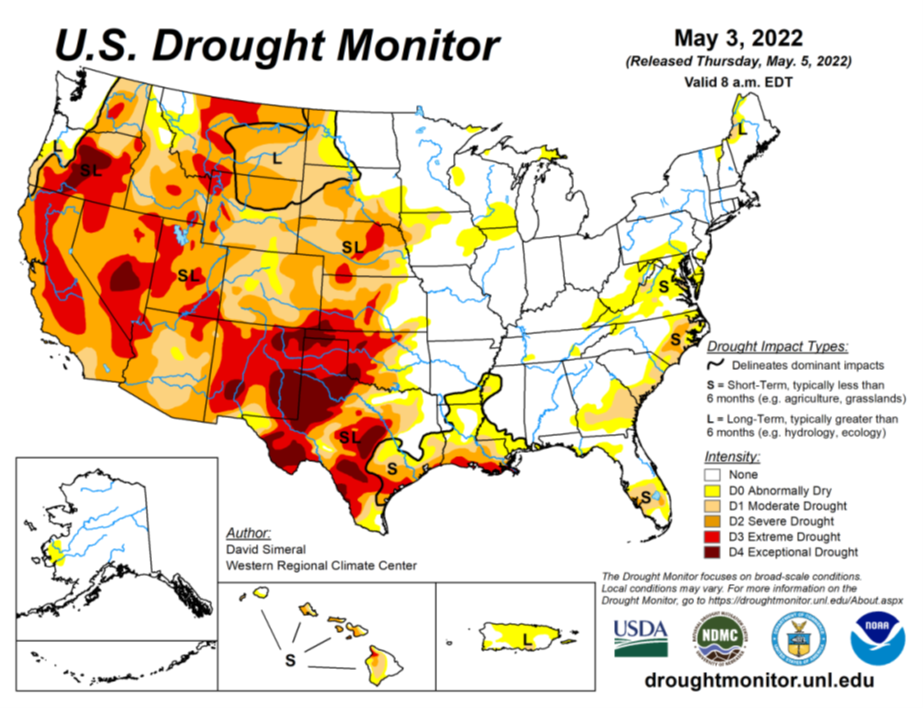

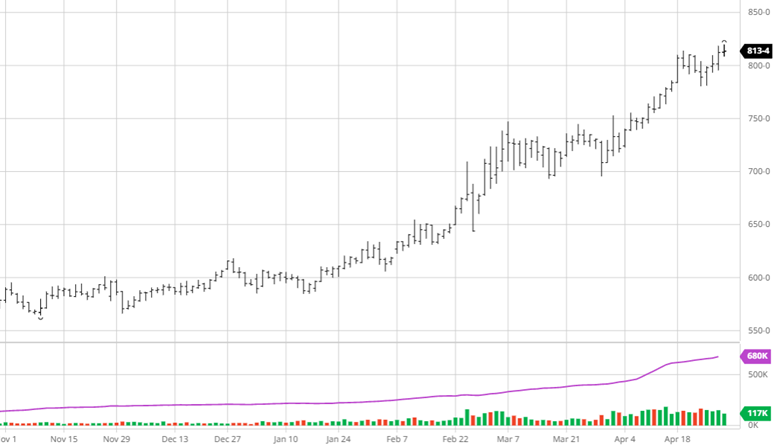

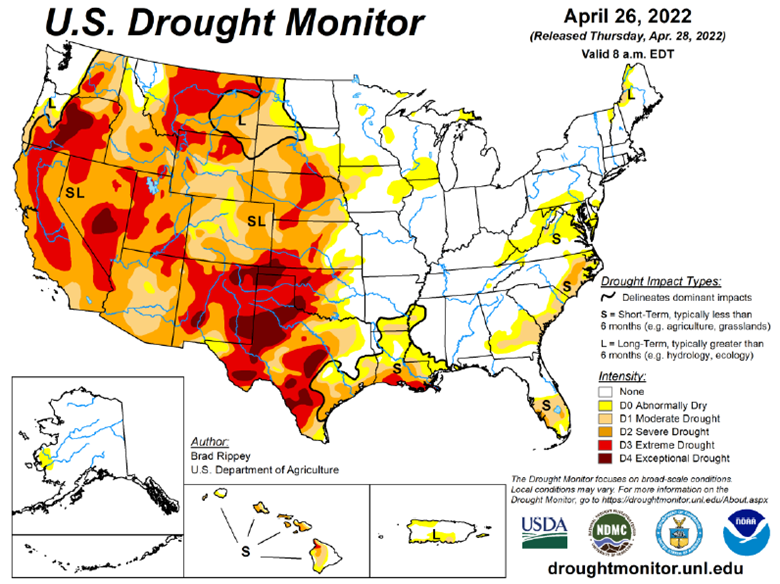

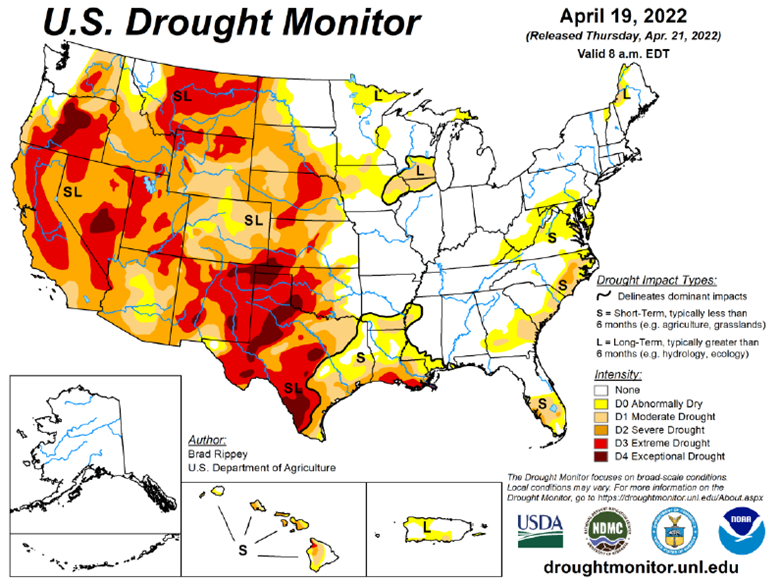

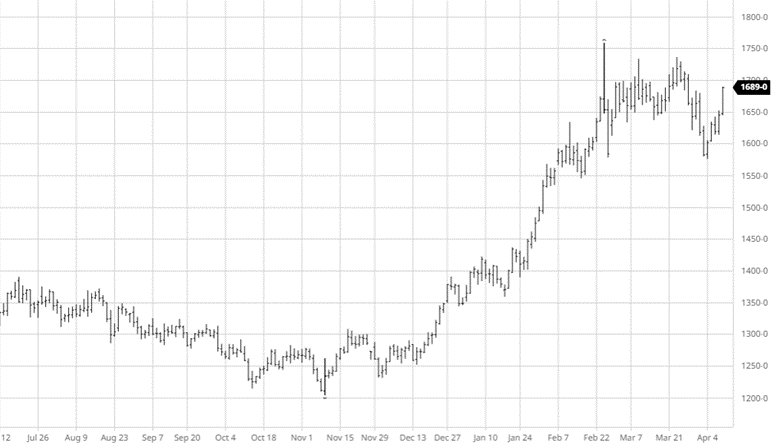

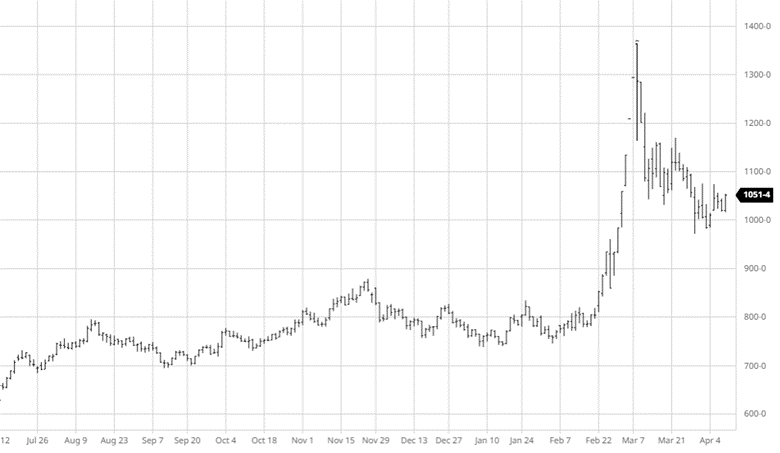

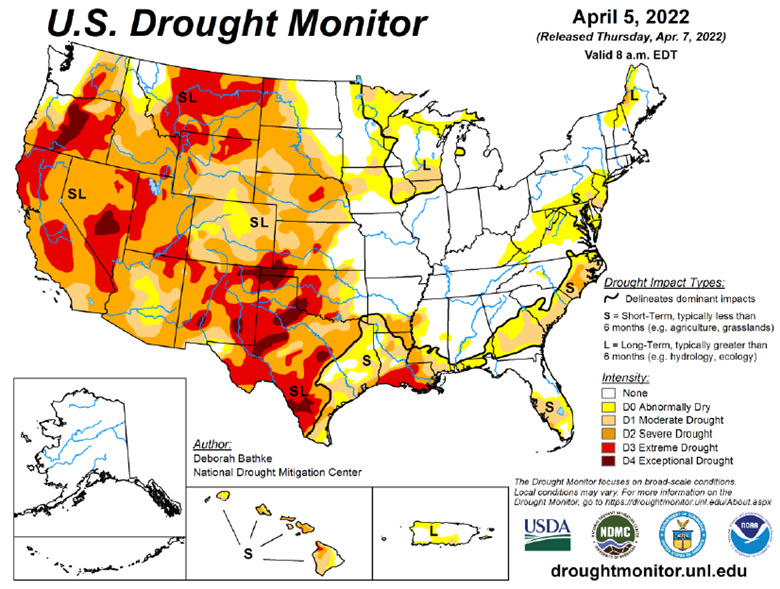

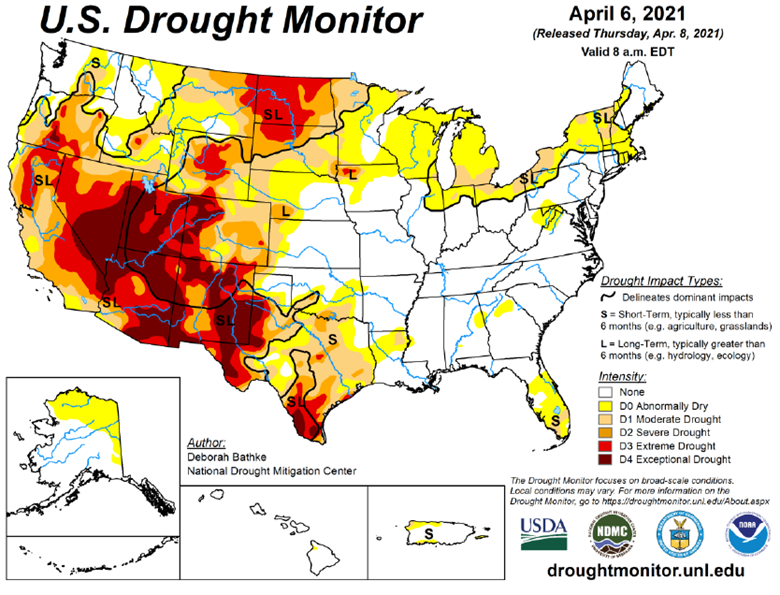

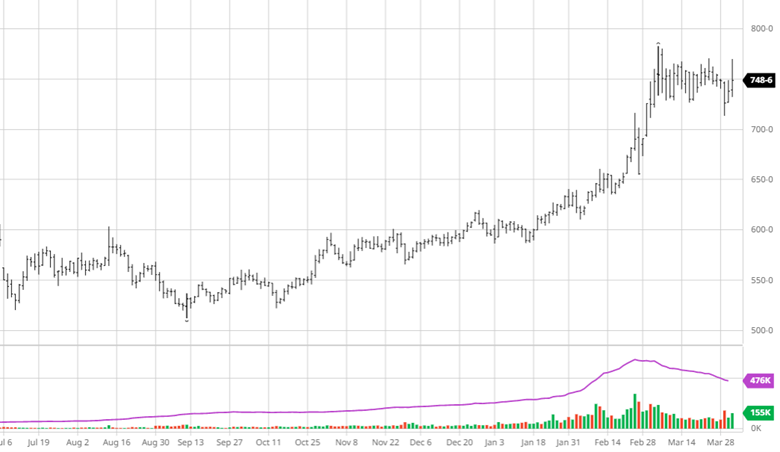

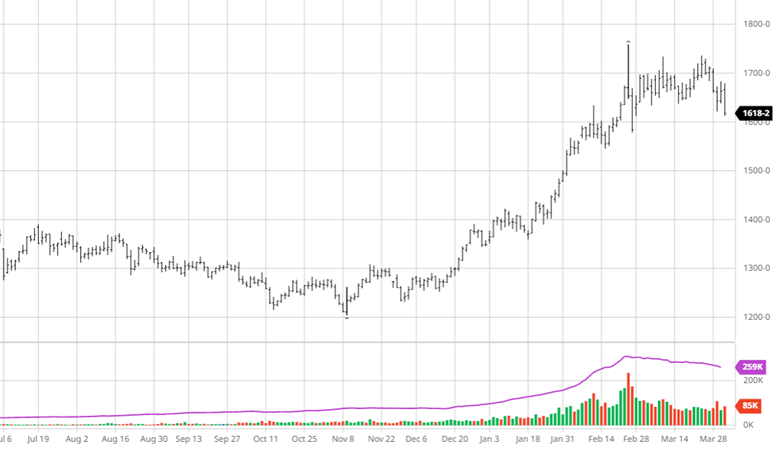

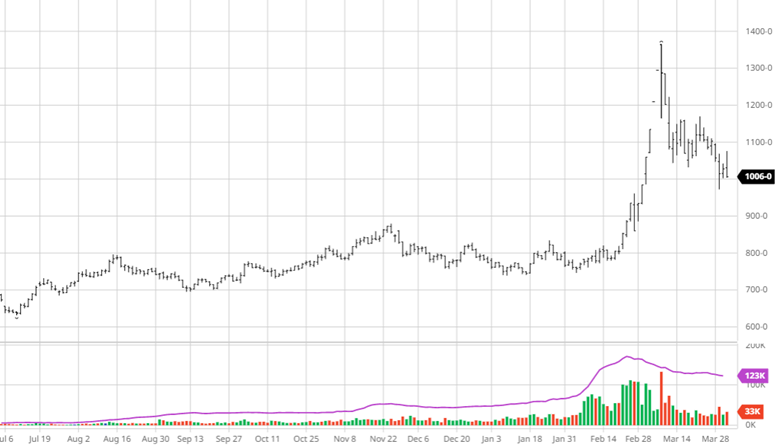

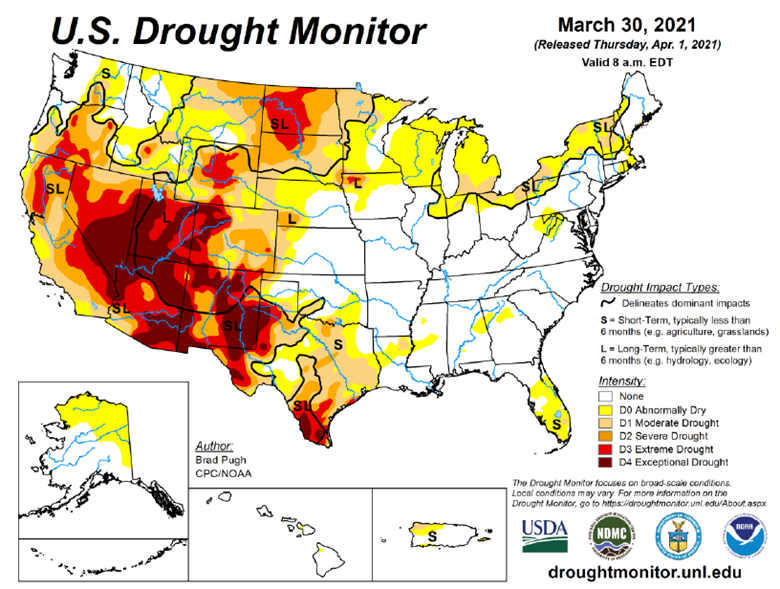

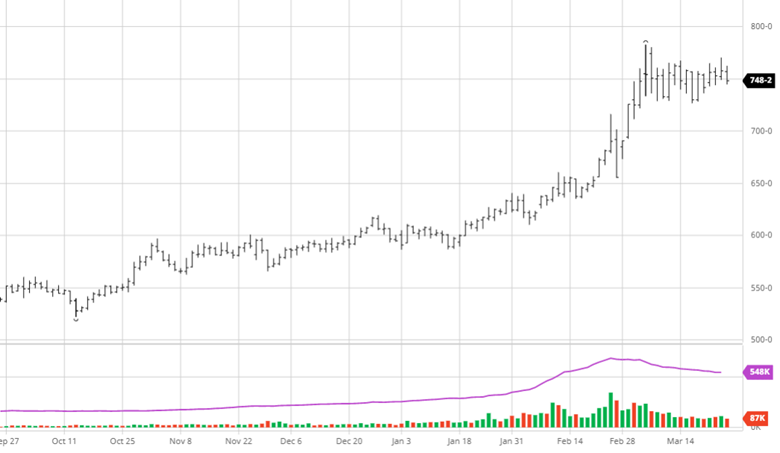

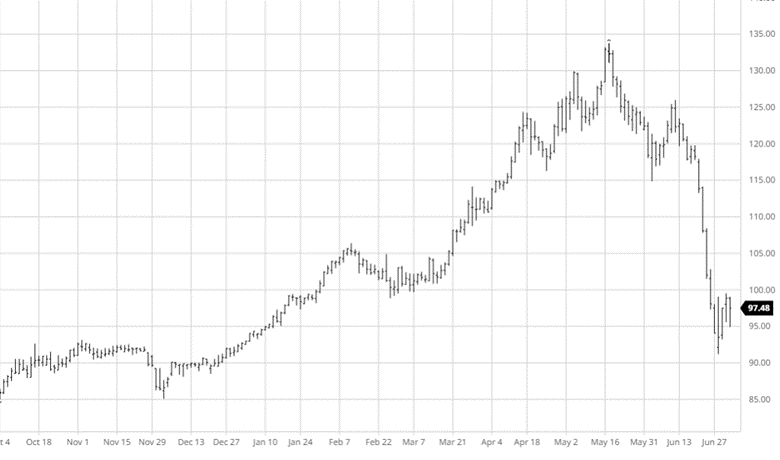

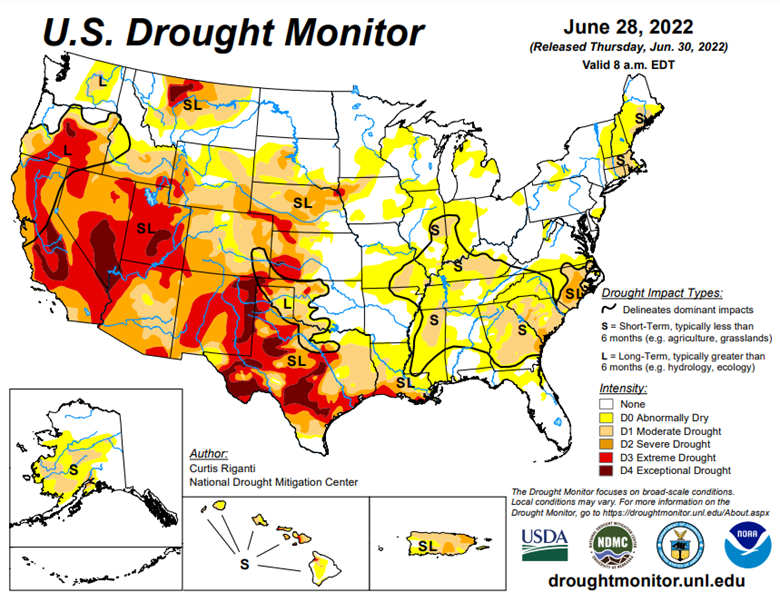

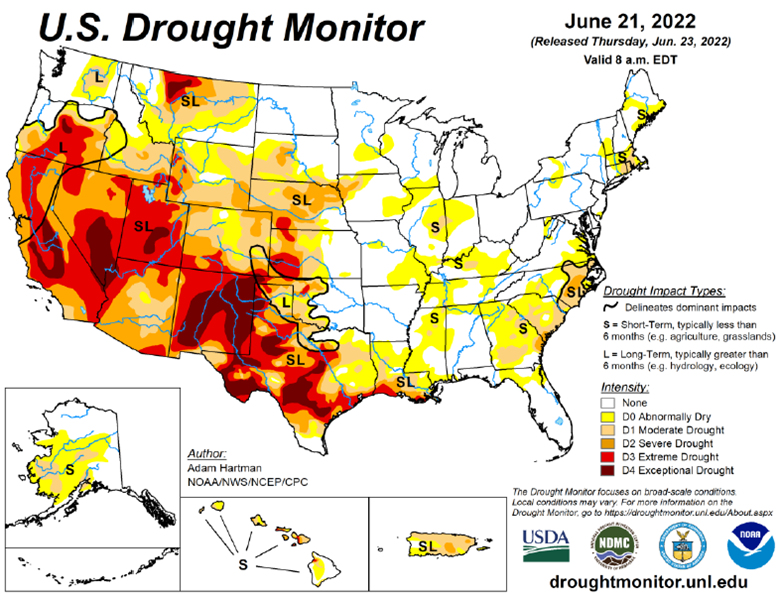

As you can see in the chart below cotton has had a rough 2 weeks. With demand expected to decrease with the possibility of a recession coming, this reaction is clear and puts fiber prices at the mercy of the economy’s future. The other side to this is that US production will likely be lower than expected with so much dryland in west Texas and other serious drought areas (see map below) expected to not produce a crop. Growers planted 12.5 million acres in 2022, up 11% from last year.

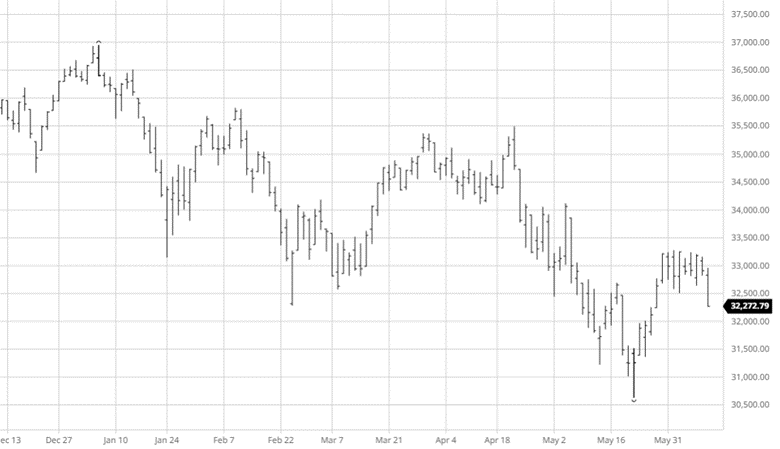

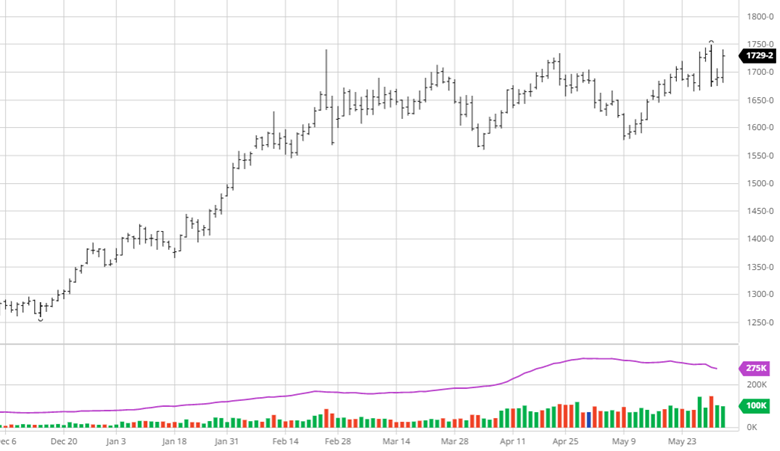

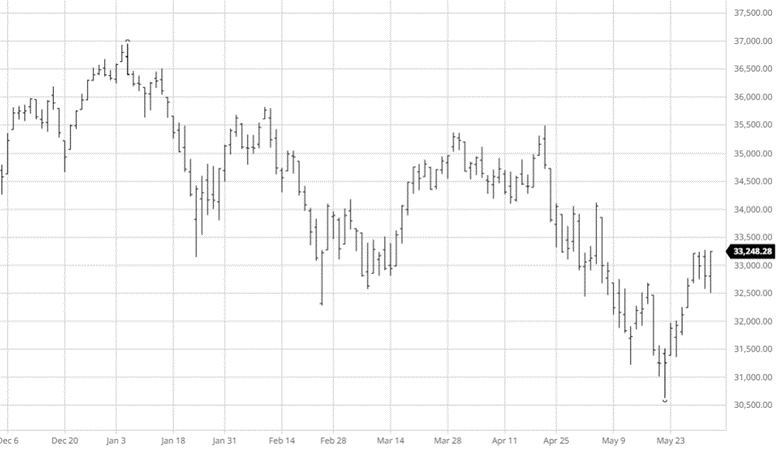

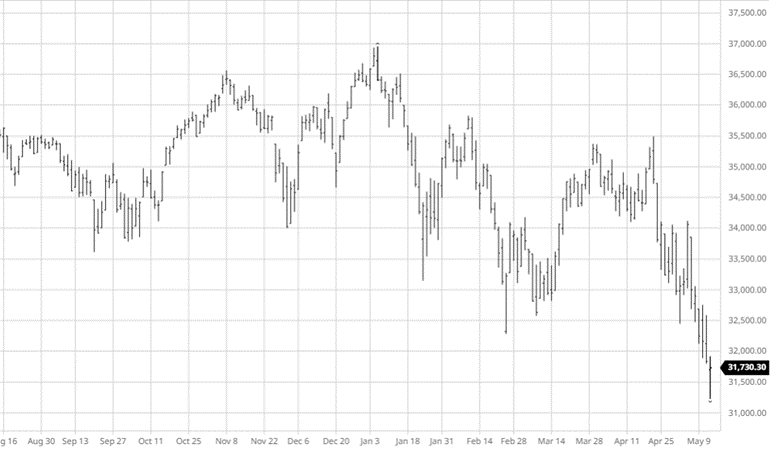

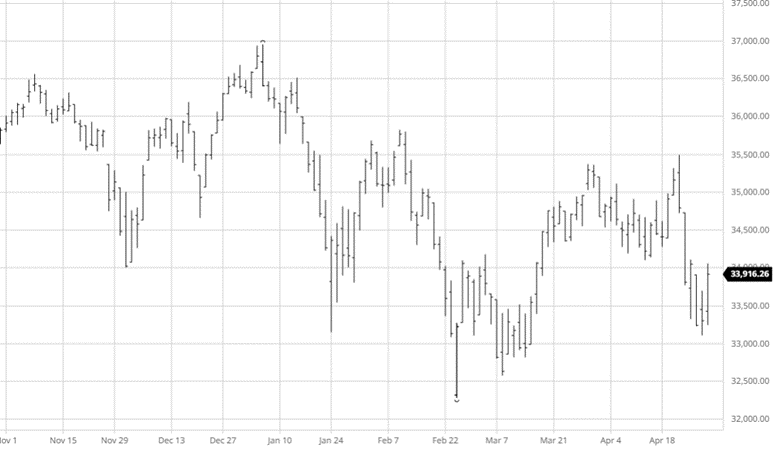

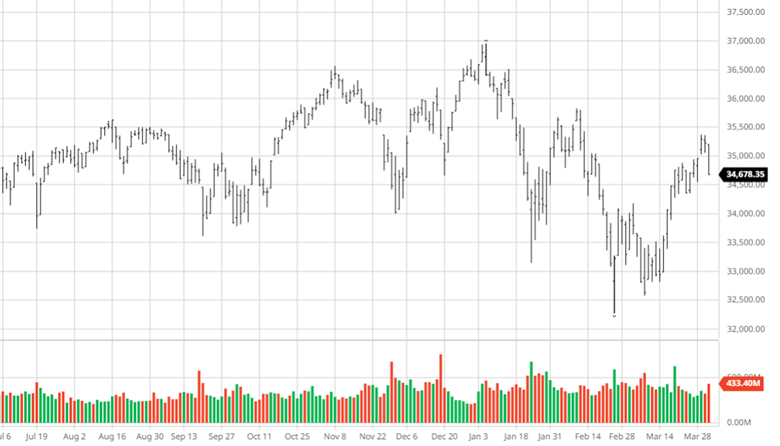

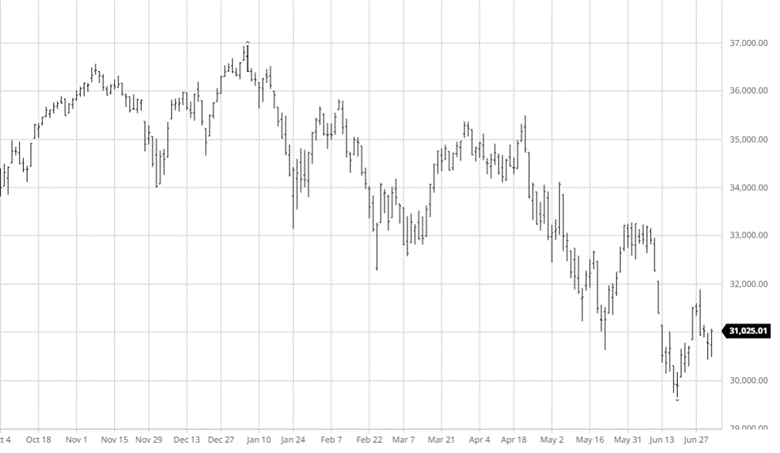

Equity Markets

The equity markets were relatively flat on the week after a few up and down days. The market headlines keep being “market rallies as fear of recession lessens” or “market falls as recession fears remain” so the market is still looking for guidance as it continues lower. July’s news will be similar to June with inflation and the Fed being the main drivers.

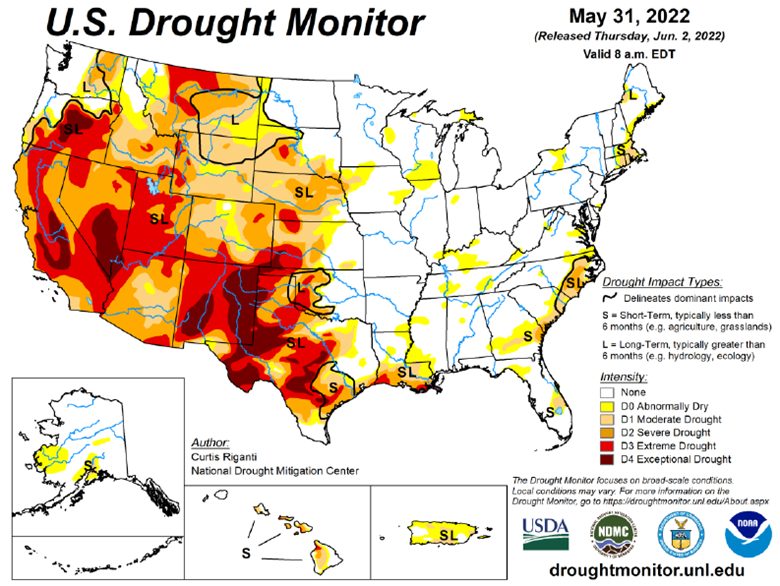

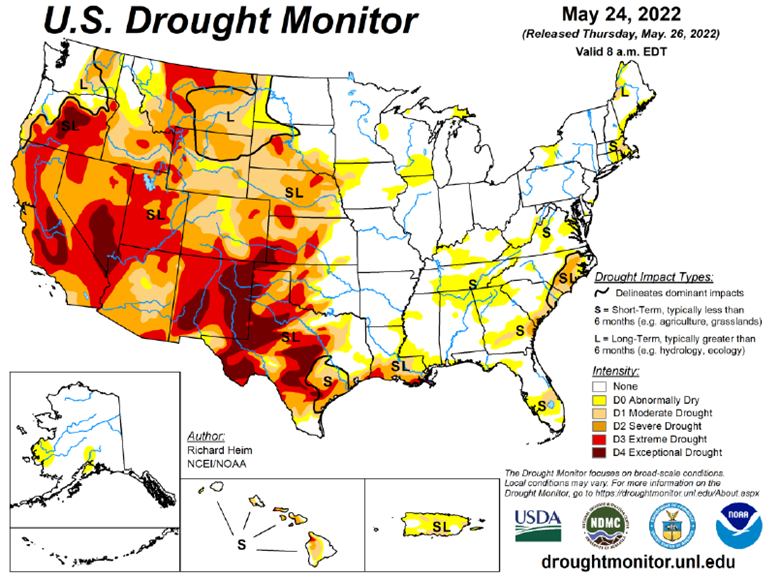

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

There is an agriculture tug of war happening across the nation, impacting America’s farmland. Fertilizer prices are continuously fluctuating, and it has us taking a page the “The Clash” should we stay, or should we go?! And we aren’t the only ones. Many farmers are asking their agronomist and chemical salespeople, “what will fertilizer cost me the rest of the season, and what are my options if I don’t want to go all-in on my typical fertilizer treatment plan?”

In this episode of the Hedged Edge, we are joined by a special guest who needs no introduction in his local circle, Dick Stiltz. Dick is a 50-year veteran of the fertilizer and chemical industry and is the current Agronomy Marketing Manager of Procurement fertilizer and crop protection at Prairieland FS, Inc in Jacksonville, IL. He is at the pulse of the current struggle and here to discuss the topic at hand.

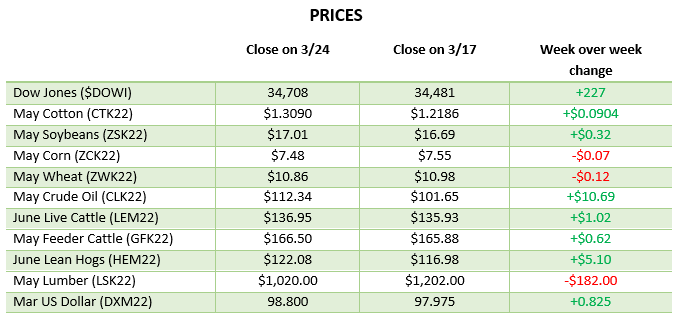

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.